Kofola Bundle

Can Kofola Continue to Thrive in the Competitive Beverage Market?

Kofola ČeskoSlovensko a.s. has strategically navigated the beverage industry, notably through acquisitions like its recent move to fully own General Plastic, a key packaging supplier. This forward-thinking approach highlights Kofola's commitment to vertical integration and operational efficiency. From its origins in Czechoslovakia to its current dominance in Central and Eastern Europe, Kofola's journey is a testament to its adaptability and strategic vision.

To fully understand Kofola's trajectory, this analysis delves into its Kofola SWOT Analysis, exploring its Kofola growth strategy and Kofola future prospects. We will examine its Kofola company analysis, including its Kofola market share and Kofola business model, while also considering the broader Kofola beverage industry trends and challenges. This exploration will provide insights into Kofola expansion plans in Europe, Kofola sustainability initiatives, and other key factors driving its success.

How Is Kofola Expanding Its Reach?

The growth strategy of Kofola ČeskoSlovensko is centered on expanding its market presence and product offerings, primarily within Central and Eastern Europe. This involves a mix of organic growth, strategic acquisitions, and product innovation to capture a larger share of the beverage market. The company's focus on sustainability and consumer preferences also plays a crucial role in its expansion plans, ensuring it remains competitive and relevant in the evolving beverage industry.

Kofola's future prospects are promising, driven by its strategic initiatives and adaptability to market trends. The company's ability to integrate acquisitions, such as the 2024 purchase of General Plastic, and its focus on the healthy beverage segment position it well for continued growth. By leveraging its strong brand recognition and exploring new distribution channels, Kofola aims to strengthen its market position and capitalize on emerging opportunities.

The Mission, Vision & Core Values of Kofola reflect its commitment to sustainable practices and consumer-centric innovation. This approach is critical for navigating the competitive landscape and achieving long-term success. Kofola's ongoing investments in production capabilities and brand development suggest a proactive approach to future growth, potentially through strategic alliances or further M&A activities in neighboring regions.

Kofola's expansion strategy includes strategic acquisitions to strengthen its market position. The acquisition of General Plastic in 2024 is a prime example, enhancing supply chain control and cost-efficiency. These acquisitions are crucial for driving Kofola's growth strategy and expanding its market share within the beverage industry.

Kofola is exploring opportunities within the healthy beverage segment, aligning with consumer preferences for natural and less sugary options. This includes potential new product launches within existing brands like Rajec and Kofola. These initiatives are part of Kofola's product innovation strategies to meet evolving consumer trends and preferences.

The company aims to leverage its strong brand recognition to enter new product categories or distribution channels. This could involve partnerships with other beverage companies or expanding its direct-to-consumer capabilities. These efforts are designed to diversify Kofola's revenue growth drivers and strengthen its competitive position.

Kofola's emphasis on sustainability, such as increasing the share of recycled PET in its packaging, plays a role in its expansion. This appeals to environmentally conscious consumers and aligns with stricter European regulations. These initiatives are integral to Kofola's long-term business strategy and brand positioning and marketing efforts.

Kofola's expansion strategy is multi-faceted, focusing on acquisitions, product innovation, and sustainability to drive growth. These initiatives are designed to strengthen its market position and capitalize on emerging opportunities within the beverage industry. The company's financial performance review indicates a commitment to these strategic goals.

- Strategic Acquisitions: Acquiring companies to enhance market reach and product portfolios.

- Product Innovation: Launching new products and variations to meet evolving consumer preferences.

- Sustainability: Implementing sustainable practices to appeal to environmentally conscious consumers.

- Market Expansion: Exploring new distribution channels and product categories.

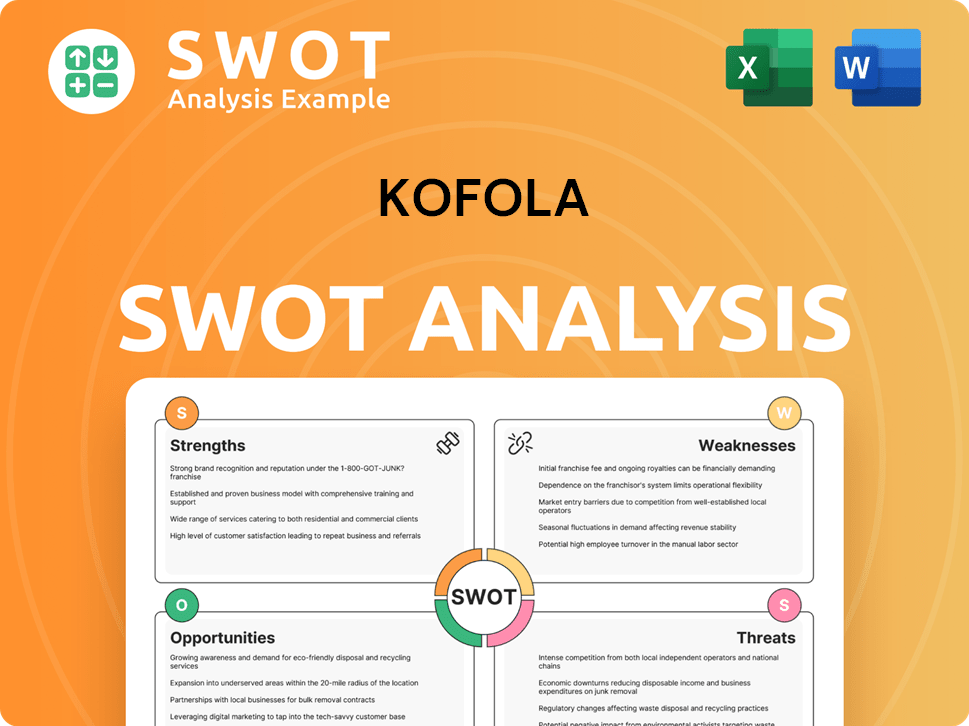

Kofola SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kofola Invest in Innovation?

The innovation and technology strategy of the company, a key element of its Kofola growth strategy, focuses on product development, digital transformation, and sustainable practices. This approach is designed to meet evolving consumer demands and maintain a competitive edge within the beverage industry.

The company's commitment to innovation is evident in its research and development investments. These investments aim to broaden its beverage portfolio, with a focus on healthier alternatives and functional beverages. This strategy is crucial for aligning with current consumer trends and preferences.

Digital transformation plays a significant role in optimizing the company's operations. This includes enhancing supply chain and distribution networks through data analytics and automation. Although specific details about advanced technologies like AI or IoT are not widely publicized, the company's dedication to operational excellence suggests it is exploring these tools to improve production, inventory management, and customer engagement.

The company continuously develops new products to meet changing consumer tastes. This includes beverages with natural ingredients and reduced sugar content. These efforts contribute to the company's Kofola future prospects.

The company invests in digital technologies to streamline its operations. This includes supply chain optimization and automation. These improvements are aimed at enhancing efficiency and responsiveness.

The company emphasizes sustainability through the use of recycled PET in packaging. This focus on eco-friendly practices is a key part of its strategy. This also helps in building brand positioning and marketing.

The company allocates resources to research and development to drive innovation. This includes expanding its beverage portfolio with healthier options. These investments support long-term growth.

The company is committed to achieving operational excellence through various initiatives. This includes exploring advanced technologies to improve production processes. This approach helps in maintaining a competitive edge.

The company is increasing the use of recycled PET in its packaging. This effort aligns with environmental responsibility. This also helps in meeting the growing demand for sustainable products.

A significant aspect of the company's innovation strategy involves sustainability. The company actively works to increase the use of recycled PET in its packaging, aiming for a higher percentage of recycled materials in its bottles. This commitment to eco-friendly practices not only aligns with environmental responsibility but also addresses the growing consumer demand for sustainable products. This focus contributes to brand loyalty and helps in Kofola market share.

The company's approach to innovation and technology includes several key strategies aimed at driving growth and meeting market demands. These initiatives are crucial for the company's Kofola company analysis and long-term success.

- Product Development: The company focuses on expanding its beverage portfolio with a focus on natural ingredients and reduced sugar content. This includes brands like Rajec and Vinea, which are positioned as healthier alternatives.

- Digital Transformation: The company invests in optimizing its supply chain and distribution networks through data analytics and automation. This enhances efficiency and responsiveness to market demands.

- Sustainability: The company is increasing the use of recycled PET in its packaging. This aligns with environmental responsibility and addresses consumer demand for eco-friendly products.

- Research and Development: The company continuously invests in R&D to drive innovation and meet changing consumer preferences.

- Operational Excellence: The company explores the use of advanced technologies to improve production processes, inventory management, and customer engagement.

For further insights into the company's target market, consider reading this article on the Target Market of Kofola.

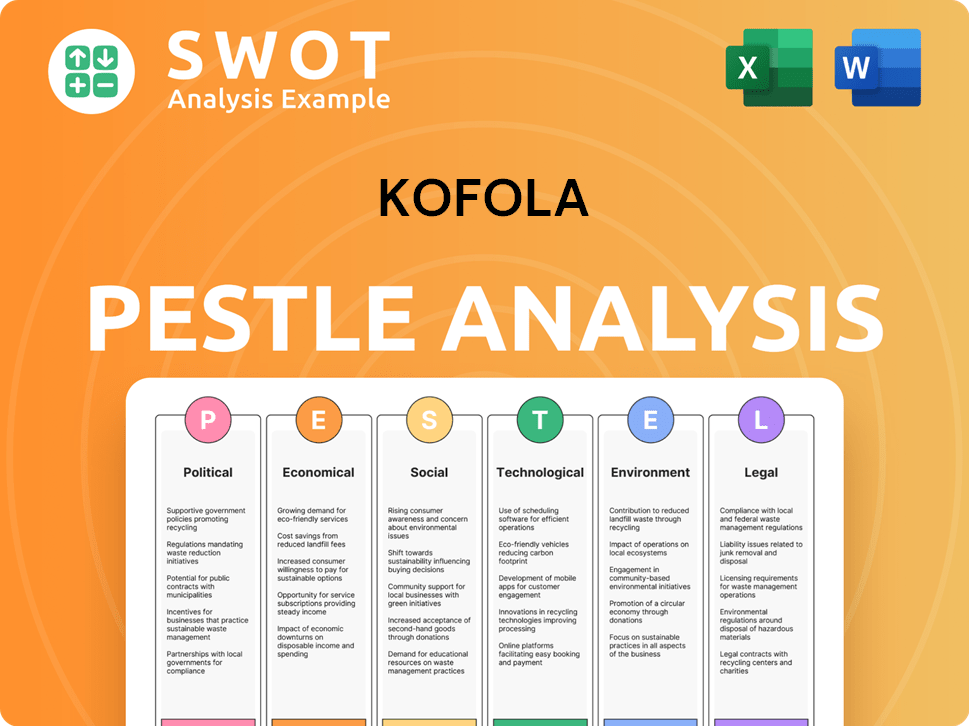

Kofola PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kofola’s Growth Forecast?

The financial outlook for Kofola ČeskoSlovensko is positive, driven by solid revenue growth and strategic investments. The company's proactive approach to market dynamics and operational efficiency supports its financial targets. This outlook reflects a strategic focus on sustainable growth and market consolidation within Central and Eastern Europe, which is key to its long-term success.

In the first quarter of 2024, Kofola reported significant growth, with sales increasing by 11.2% to CZK 1.69 billion. This strong start to the year suggests positive momentum. The company's strategic acquisitions, such as the full acquisition of General Plastic, are expected to contribute positively to its financial performance by enhancing cost control and supply chain resilience.

For 2024, Kofola anticipates EBITDA to be in the range of CZK 1.55 billion to CZK 1.65 billion. This projection shows confidence in its market strategies and operational efficiency. Kofola's financial ambitions are further supported by its consistent dividend policy, which signals financial stability and a commitment to shareholder returns. For more insights, you can explore the Competitors Landscape of Kofola.

Kofola's revenue growth is primarily driven by organic expansion and strategic acquisitions. The company focuses on product innovation and effective brand positioning to capture market share. These strategies are key to maintaining and increasing revenue streams, contributing to Kofola's overall financial performance.

Kofola is focused on consolidating its market position within Central and Eastern Europe. This involves strategic acquisitions and partnerships to strengthen its market share. These moves help Kofola navigate the competitive landscape and achieve sustainable growth.

The company's consistent dividend policy reflects its financial stability and commitment to shareholder returns. Kofola's balanced approach to growth, combining organic expansion with strategic M&A activities, supports healthy profit margins and prudent investment levels. This strategy helps to ensure long-term financial health.

Kofola's strategic investments, such as the full acquisition of General Plastic, are designed to enhance cost control and supply chain resilience. These investments are crucial for improving operational efficiency and supporting future growth initiatives. The company's focus on sustainable practices also plays a significant role.

For 2024, Kofola projects EBITDA to be between CZK 1.55 billion and CZK 1.65 billion, demonstrating confidence in its operational efficiency and market strategies. This projection is a key indicator of the company's financial health and its ability to achieve its growth targets. This financial performance review highlights Kofola's strong position.

Kofola's long-term financial goals are focused on sustainable growth and market consolidation. The company aims to balance organic expansion with strategic acquisitions. This approach is designed to maintain healthy profit margins and support future initiatives, ensuring long-term success in the beverage industry.

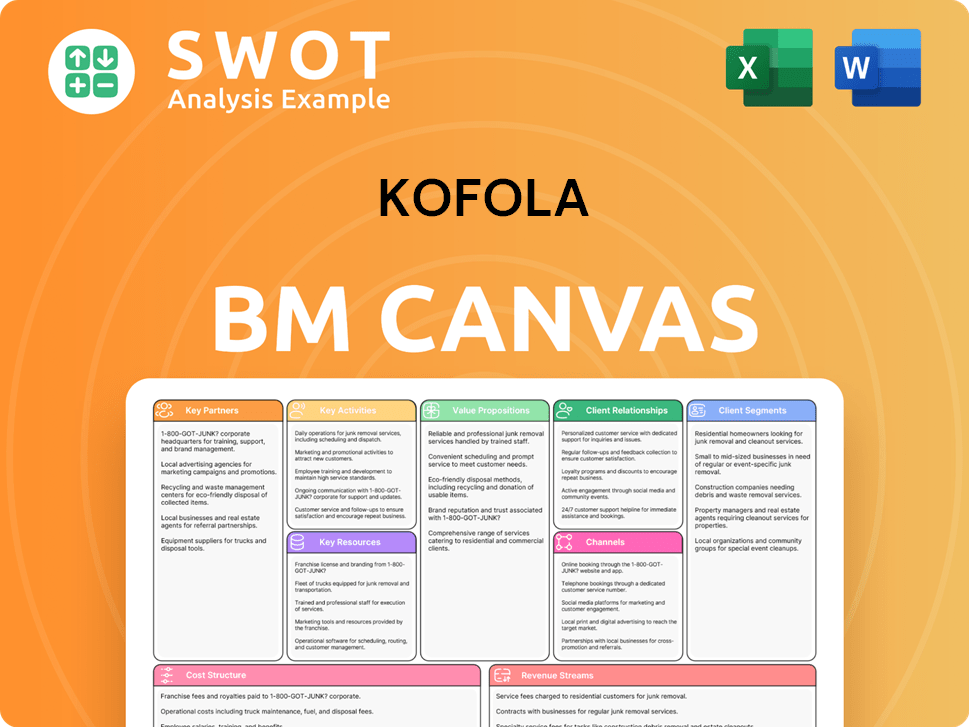

Kofola Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kofola’s Growth?

The path to growth for Kofola ČeskoSlovensko is not without its challenges. The company faces several potential risks and obstacles that could impact its strategic goals. Understanding these challenges is crucial for assessing the Revenue Streams & Business Model of Kofola and its future prospects.

Market competition, regulatory changes, and supply chain vulnerabilities are key areas of concern. These factors can influence Kofola's financial performance and its ability to maintain and grow its market share. The dynamic nature of the beverage industry requires continuous adaptation and proactive risk management.

Technological disruption also presents a risk, necessitating that Kofola stay ahead of the curve in production and distribution. The company's ability to mitigate these risks will be critical to its long-term success and continued expansion plans in Europe.

The beverage industry in Central and Eastern Europe is highly competitive, with numerous international and local players. This intense competition can lead to pricing pressures, affecting profitability and requiring continuous investment in marketing and product innovation. Maintaining Kofola's market share against established and emerging brands is a constant challenge.

Stricter regulations related to sugar content, packaging waste, and advertising can increase costs and necessitate product reformulation. Compliance with environmental regulations, such as those concerning PET recycling, requires significant investment. Adapting to these changes is crucial for the Kofola growth strategy.

Fluctuations in raw material prices, such as sugar and PET resin, and disruptions in logistics can impact production costs and product availability. The acquisition of General Plastic aims to mitigate some of these risks by internalizing packaging production. Efficient supply chain management is vital.

Emergence of new production methods or distribution models could pose a risk if Kofola is slow to adopt them. Investing in technology and innovation is essential to remain competitive. The company must continuously evaluate and adopt new technologies to stay ahead. This impacts Kofola's future prospects.

Economic downturns or changes in consumer spending habits can impact demand for non-alcoholic beverages. Inflation and changes in currency exchange rates can also affect profitability. Kofola must remain adaptable to changing economic conditions. This impacts the Kofola company analysis.

Changes in consumer preferences, such as a shift towards healthier options or demand for sustainable products, require continuous product innovation. Kofola must adapt its product portfolio to meet evolving consumer needs. Understanding Kofola consumer trends and preferences is essential.

Kofola mitigates risks through a diversified product portfolio, continuous market analysis, and a focus on sustainable practices. The company's proactive approach to sustainability, including increasing the use of recycled PET, demonstrates its preparation for emerging environmental regulations. Diversifying its product offerings helps Kofola manage risks associated with consumer preferences and market fluctuations.

Kofola's history of navigating market shifts and economic fluctuations suggests a robust risk management framework. The company's ability to adapt to changing conditions and maintain profitability indicates effective strategies. Ongoing vigilance and adaptability are essential in the dynamic beverage industry, ensuring long-term sustainability and growth. This helps in Kofola's long-term business strategy.

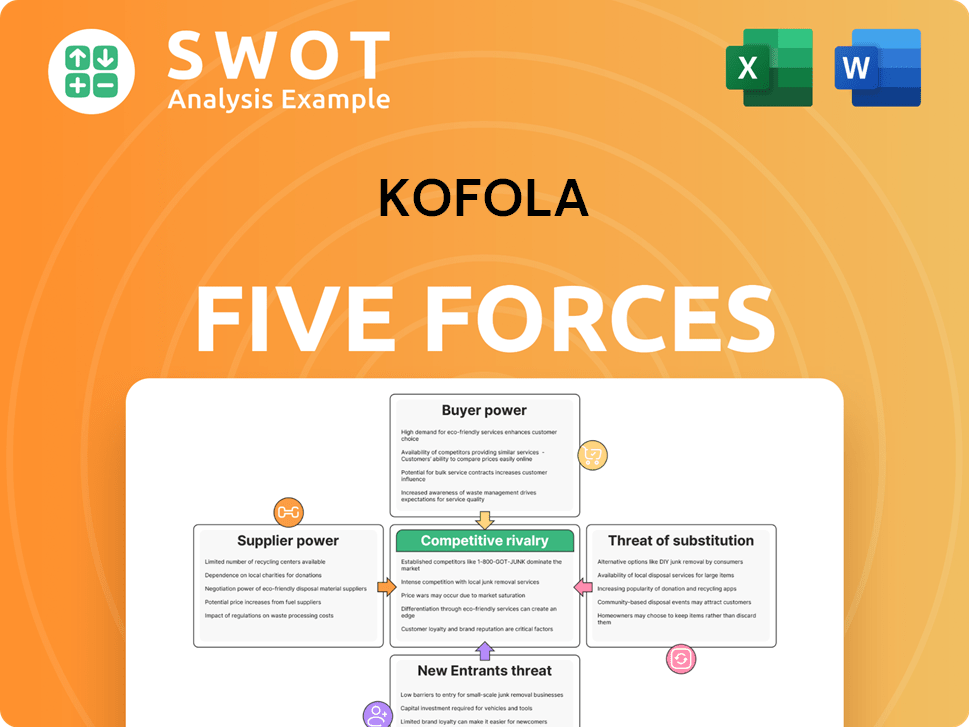

Kofola Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kofola Company?

- What is Competitive Landscape of Kofola Company?

- How Does Kofola Company Work?

- What is Sales and Marketing Strategy of Kofola Company?

- What is Brief History of Kofola Company?

- Who Owns Kofola Company?

- What is Customer Demographics and Target Market of Kofola Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.