Kohl's Bundle

Can Kohl's Thrive in Today's Retail Battleground?

The retail industry is a dynamic arena, constantly reshaped by technology and consumer trends. Kohl's, a long-standing player in the department store sector, faces significant challenges and opportunities. This analysis delves into the Kohl's SWOT Analysis, providing a comprehensive look at its competitive position.

Understanding the Kohl's competitive landscape is crucial for investors and strategists alike. We'll explore Kohl's competitors, dissect its market analysis, and evaluate its ability to maintain a competitive advantage amidst evolving consumer behaviors. From comparing Kohl's vs. Target comparison to examining Kohl's financial performance compared to competitors, this report provides actionable insights into Kohl's strategic positioning within the broader retail industry and its future prospects. We will also look at Kohl's market share analysis 2024 and Who are Kohl's main rivals.

Where Does Kohl's ’ Stand in the Current Market?

Kohl's operates within the department and discount retail sector, holding a significant market position. As of Q4 2024, the company held a 28.66% market share within the department and discount retail industry. Furthermore, it held a 1.09% market share within the broader retail sector. This places it as the second-largest traditional department store by sales, despite the overall decline in the department store channel.

The company's core offerings include apparel, footwear, accessories, beauty products, and home goods. With approximately 1,150 physical stores across 49 states, Kohl's has a broad geographic reach, with 80% of the U.S. population living within 15 miles of a store. This extensive network supports its value-conscious customer base and family-friendly retail environment.

Over time, Kohl's has strategically adapted its value proposition. A key move has been the partnership with Sephora, which is expected to generate $2 billion in sales by 2025. Additionally, the company is diversifying its product lines, including reintroducing categories like Babies R Us, to cater to a wider demographic. For a deeper understanding of the company's origins, you can read a Brief History of Kohl's .

Kohl's market share within the department and discount retail industry is significant. The company's position is influenced by the broader trends in the retail industry. Understanding these dynamics is crucial for assessing Kohl's competitive landscape.

Kohl's has implemented several strategic initiatives to maintain its market position. These include partnerships, such as the one with Sephora, and diversification of product offerings. These moves are designed to enhance customer appeal and drive sales growth.

In fiscal year 2024, Kohl's experienced a 7.2% decrease in net sales, totaling $15.4 billion. Operating margins have also decreased, indicating the need for strategic adjustments. These financial metrics reflect the challenges and opportunities within the retail industry.

Kohl's maintains a strong geographic presence with approximately 1,150 stores across 49 states. The company's widespread physical footprint is a key factor in its market position. This extensive network allows it to serve a broad customer base.

Kohl's faces several challenges in the competitive retail landscape. These challenges include declining sales per square foot and the need to adapt to changing consumer preferences. Understanding these challenges is crucial for assessing Kohl's future prospects.

- Declining sales per square foot over the past 15 years.

- Intense competition from both traditional department stores and discount retailers.

- Need for strategic adaptation to changing consumer preferences.

- Maintaining profitability in a challenging market environment.

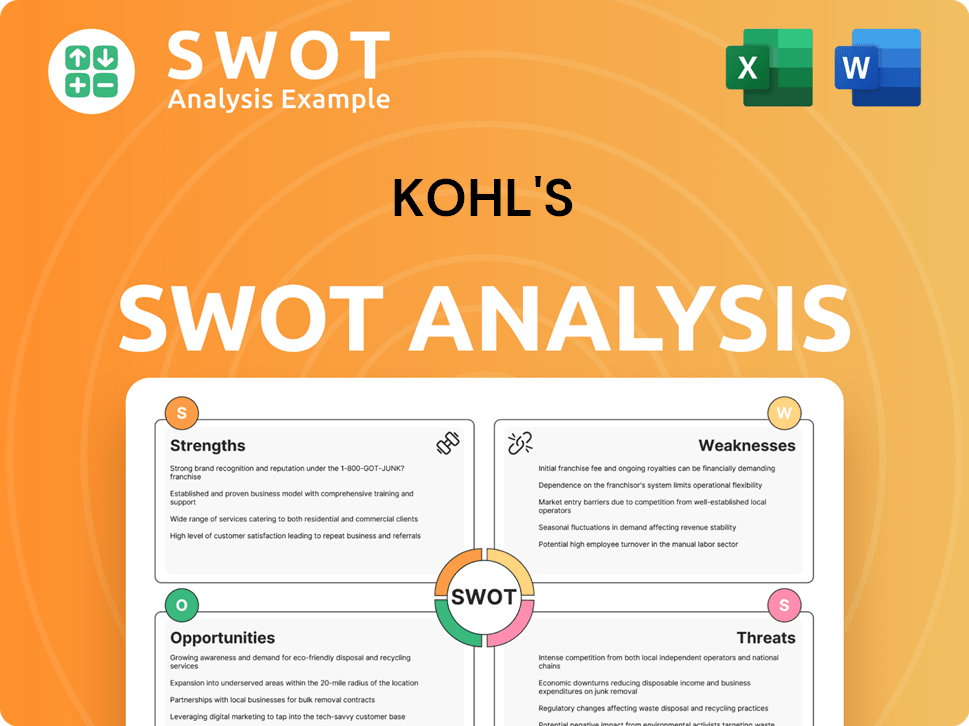

Kohl's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Kohl's ?

The Kohl's competitive landscape is complex, with the company facing both direct and indirect competition in the retail sector. Understanding Kohl's competitors is crucial for a comprehensive market analysis. This environment requires Kohl's to constantly adapt its strategies to maintain its market position.

Kohl's operates in a highly competitive retail market, and its financial performance is directly impacted by its ability to compete effectively. The company's recent performance, including a decline in sales over several quarters, highlights the pressures it faces from various competitors. This analysis will provide a detailed look at Kohl's key rivals and the competitive dynamics at play.

The retail industry is dynamic, and Kohl's must navigate a landscape shaped by established players and emerging trends. The following sections will delve into the specifics of Kohl's competitors, providing insights into their strategies and market positions. This will help to understand the challenges and opportunities Kohl's faces in maintaining its competitive advantage.

Direct competitors include traditional department stores and discount retailers that offer similar products and target demographics. These rivals compete primarily on price, brand offerings, and in-store experiences. These companies directly impact Kohl's market share and financial performance.

Indirect competitors consist of online retailers, discounters, and other retail formats that offer alternative shopping experiences. These competitors challenge Kohl's by offering different value propositions, such as convenience, lower prices, or a wider selection of products. The rise of e-commerce has significantly impacted Kohl's sales.

Analyzing market share data provides a clear picture of the competitive landscape. Key players like Macy's, Walmart, and Target hold significant portions of the retail market. Understanding these market share dynamics is crucial for Kohl's strategic planning and competitive positioning.

Kohl's has implemented strategic responses to address competitive pressures, including partnerships and store initiatives. These moves aim to enhance offerings, drive traffic, and improve the overall customer experience. These strategies are essential for adapting to changing market conditions.

The growth of e-commerce has transformed the retail industry, with online sales posing a significant challenge to traditional brick-and-mortar stores. The ability to compete effectively in the digital space is critical for Kohl's long-term success. Online apparel sales reached $31.9 billion for Amazon in 2023.

New and emerging players, including individual sellers and small businesses on platforms like Etsy, further fragment the competitive landscape. These smaller entities often offer unique products and personalized shopping experiences, adding to the complexity of the market. This diversification impacts Kohl's ability to capture market share.

Kohl's faces competition from a variety of retailers, each with distinct strengths and strategies. A detailed analysis of these competitors is crucial for understanding the competitive landscape and Kohl's position within it. This analysis will help to assess the competitive advantage of Kohl's.

- Macy's Inc.: Held a 40.65% market share as of Q4 2024. It is a direct competitor, primarily competing on brand offerings and in-store experience.

- Burlington Stores Inc.: Held 19.04% market share as of Q4 2024. This discount retailer attracts budget-conscious shoppers, posing a challenge to Kohl's pricing strategy.

- Dillard's Inc.: Captured 11.64% market share as of Q4 2024. This department store competes with Kohl's on price and product selection.

- Walmart Inc.: Held 43.68% market share in the retail sector as of Q4 2024. A major player that competes with Kohl's across various product categories, particularly in apparel and home goods.

- Costco Wholesale Corp.: Held 17.80% market share in the retail sector. Costco competes with Kohl's on a range of products, offering value through bulk purchases and membership benefits.

- Target Corporation: Held 7.14% market share in the retail sector. Target competes with Kohl's on a variety of fronts, including apparel, home goods, and customer experience.

- TJX (TJ Maxx, Marshalls, HomeGoods): These discounters attract budget-conscious shoppers, posing a significant challenge to Kohl's.

- Amazon: The online giant has siphoned apparel sales from department stores. Online apparel sales reached $31.9 billion in 2023.

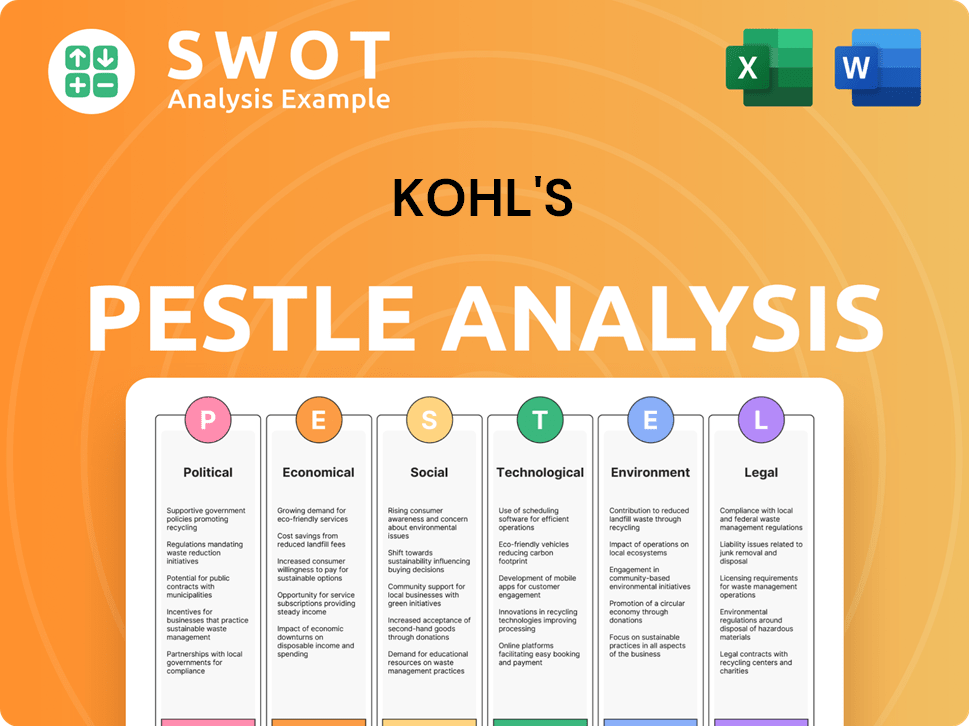

Kohl's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Kohl's a Competitive Edge Over Its Rivals?

Analyzing the Kohl's competitive landscape reveals a retailer navigating a dynamic market. Its strategic moves and competitive advantages are crucial for understanding its position within the retail industry. This analysis considers factors such as physical presence, brand equity, strategic partnerships, and financial performance relative to its Kohl's competitors.

Kohl's market analysis indicates a focus on convenience and customer loyalty as key differentiators. The company's ability to adapt and form partnerships, such as the Sephora collaboration, is essential for maintaining its relevance. Understanding these elements provides insight into how Kohl's aims to compete in a challenging environment.

Kohl's maintains several competitive advantages, though sustainability faces scrutiny in the evolving retail sector. A key strength is its extensive physical footprint, with over 1,100 stores located primarily off-mall, making them convenient and accessible to a large portion of the American population. This off-mall positioning differentiates it from some department stores competitors.

Kohl's operates over 1,100 stores, primarily in off-mall locations. This widespread presence offers convenience and accessibility, differentiating it from competitors. The off-mall strategy allows it to target a broader customer base and reduce direct competition with enclosed mall-based retailers.

Kohl's benefits from brand recognition and a strong customer loyalty program. The program includes 'Kohl's Cash' and Kohl's Rewards, which drive customer retention. With approximately 30 million active members, this program has historically contributed to positive comparable sales.

The collaboration with Sephora is a key differentiator, projected to be a $2 billion business by 2025. The partnership with Amazon for returns increases foot traffic. These partnerships demonstrate Kohl's willingness to innovate and find new ways to drive traffic and growth.

Kohl's has a significant e-commerce presence, with around 30% of total sales online. Physical stores serve as fulfillment hubs, with about 40% of online orders fulfilled directly through them, enabling faster delivery and convenient pickup. This omnichannel approach enhances customer experience.

Kohl's competitive strategy relies on several key strengths that differentiate it from Kohl's main rivals. These include a large physical footprint, a robust customer loyalty program, and strategic partnerships. These elements are crucial for Kohl's to maintain its market position and drive growth, as discussed in a recent article about the company here.

- Extensive store network providing accessibility.

- Loyalty programs that encourage repeat purchases.

- Strategic partnerships that attract new customers.

- Omnichannel capabilities for seamless shopping experiences.

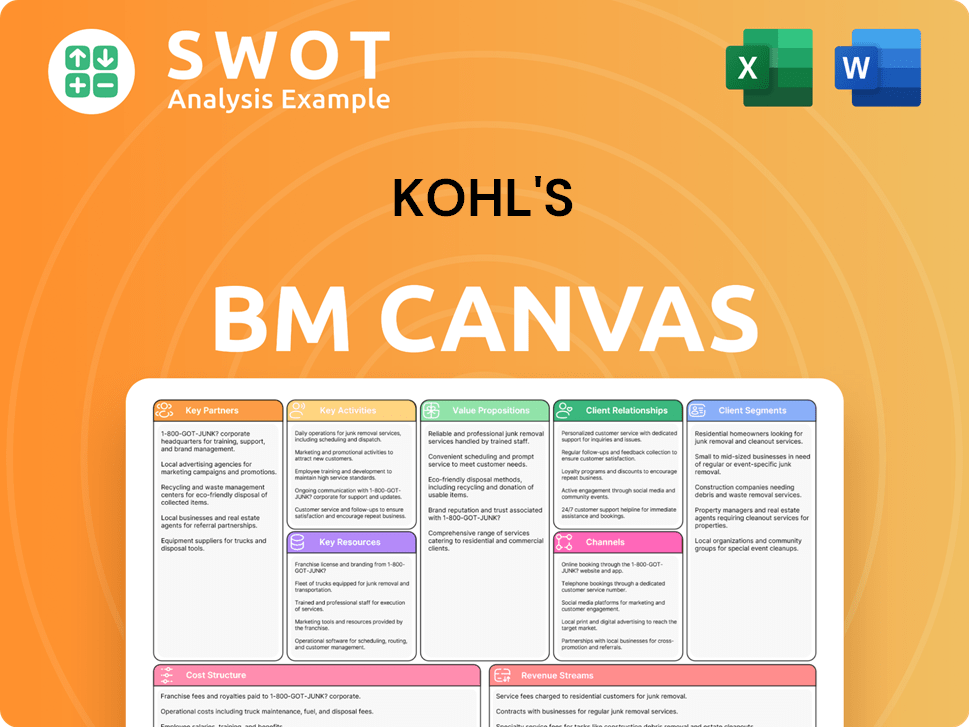

Kohl's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Kohl's ’s Competitive Landscape?

The retail industry in 2025 is experiencing significant shifts driven by technology, consumer preferences, and economic pressures. For companies like Kohl's, understanding the evolving landscape is crucial for maintaining a competitive position. This involves adapting to technological advancements, meeting changing consumer demands, and navigating a complex risk environment.

The future outlook for Kohl's hinges on its ability to adapt and innovate. The company faces challenges such as declining sales and increased competition, but also has opportunities to leverage strategic initiatives and partnerships. Focusing on customer-centric strategies and building resilient supply chains will be essential for success in the dynamic retail market.

Technological advancements, especially in AI, are driving operational efficiencies. Retailers are expected to invest in automation and data analytics for optimized pricing and supply chains. Enhanced omnichannel platforms and personalized customer experiences are becoming essential for boosting customer loyalty.

Consumers are increasingly value-oriented, prioritizing discounts and longevity in their purchases. Generation Alpha, with its estimated $28 billion spending power by 2025, will significantly influence online engagement. Adaptations in offerings, marketing, and engagement strategies are necessary to meet these new demands.

Kohl's faces declining sales and increased competition from online retailers and discounters. The company experienced declining sales for eight consecutive quarters, and its operating margins have dropped. Increased regulation, such as a new credit card late fee ruling, could affect credit card revenues.

Strategic initiatives include offering a curated assortment and enhancing its omnichannel platform. The Sephora partnership remains a key growth driver, with beauty sales expected to exceed $2 billion by 2025. Diversifying product offerings and strengthening partnerships can attract new customers.

The Kohl's competitive landscape is shaped by various factors, including the rise of online retailers and discounters, changing consumer preferences, and economic conditions. A detailed Kohl's market analysis reveals that the company must adapt to stay competitive. Understanding Kohl's competitors is key to formulating effective strategies. For further insights into the company's ownership and financial structure, see the article Owners & Shareholders of Kohl's .

Kohl's plans to reestablish itself as a value and quality leader, focusing on customer-centric innovations. Expanding its physical presence with new, smaller stores and enhancing its online reach are key. The company is simplifying its pricing strategy for clarity.

- Comparable beauty sales rose 13% in Q4 fiscal 2024.

- The Sephora partnership is projected to generate over $2 billion in sales by 2025.

- Focus on value pricing across core categories to eliminate customer confusion.

- Emphasis on building resilient supply chains and adapting to market changes.

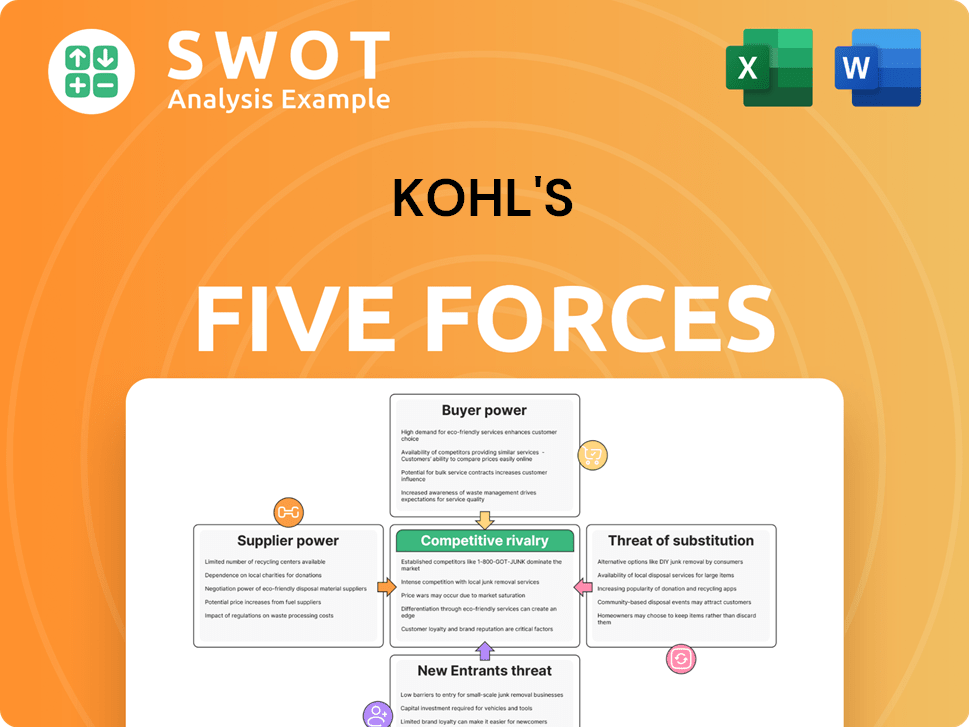

Kohl's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kohl's Company?

- What is Growth Strategy and Future Prospects of Kohl's Company?

- How Does Kohl's Company Work?

- What is Sales and Marketing Strategy of Kohl's Company?

- What is Brief History of Kohl's Company?

- Who Owns Kohl's Company?

- What is Customer Demographics and Target Market of Kohl's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.