Kohl's Bundle

Can Kohl's Reclaim Retail Dominance?

In today's dynamic retail landscape, Kohl's Corporation is actively reshaping its Kohl's SWOT Analysis to secure its future. Founded in 1962, Kohl's has evolved from a local grocery store to a major department store chain. This evolution highlights the critical need for strategic planning to ensure sustained relevance and profitability.

As the retail industry trends shift, understanding Kohl's growth strategy and future prospects is crucial for investors and analysts. Kohl's company analysis reveals a focus on exclusive brands and private label merchandise, aiming to differentiate itself in a competitive market. Examining its expansion plans, technological advancements, and financial projections will provide insights into its ability to navigate challenges and capitalize on opportunities, including its omnichannel strategy and impact of inflation on sales.

How Is Kohl's Expanding Its Reach?

The expansion initiatives of the company are central to its growth strategy, focusing on optimizing its physical presence, enhancing its digital capabilities, and forging strategic partnerships. This multifaceted approach aims to capture new customer segments, improve customer engagement, and strengthen its competitive position within the evolving retail landscape. The company's strategic moves are designed to adapt to retail industry trends and maintain a strong market presence.

A key component of this strategy involves the 'Sephora at ' partnership, which has been a significant driver of growth. This collaboration brings Sephora mini-shops into stores, attracting a younger, beauty-focused demographic and increasing foot traffic. In addition to the Sephora partnership, the company is rightsizing its store formats and investing in its omnichannel capabilities to meet changing consumer demands. These initiatives are crucial for the company's Kohl's future prospects.

The company's focus on Kohl's growth strategy is evident in its strategic investments and partnerships. By integrating online and in-store experiences and refining its product assortment, the company aims to enhance customer engagement. These efforts are designed to drive Kohl's financial performance and ensure long-term sustainability in the retail sector. The company's approach reflects a commitment to adapting to retail industry trends and maintaining a strong market presence.

The 'Sephora at ' partnership is a cornerstone of the company's expansion strategy. By the end of fiscal year 2023, there were 900 Sephora locations within stores, with plans to have Sephora shops in all 1,100+ stores by 2025. This initiative is designed to diversify revenue streams and attract a younger demographic.

The company is rightsizing its store formats, including opening smaller stores in new markets. This allows for more targeted and efficient expansion. These smaller formats are designed to improve operational efficiency and adapt to local market demands, contributing to Kohl's company analysis.

The company is investing in its omnichannel capabilities to seamlessly integrate online and in-store experiences. This includes improving buy online, pick up in-store (BOPIS) and curbside pickup options. These enhancements aim to increase customer convenience and drive sales, aligning with Kohl's omnichannel strategy.

The company is continuously refining its product assortment by introducing new brands and categories. This includes expanding its active and casual wear selections to cater to evolving consumer preferences. These efforts aim to boost Kohl's profitability and revenue by attracting a wider customer base.

The company's expansion initiatives are designed to adapt to Kohl's competitive landscape and capitalize on Kohl's partnerships and collaborations. The Sephora partnership is a prime example of how the company is diversifying its offerings to attract new customers. The company's strategy also includes rightsizing stores and enhancing omnichannel capabilities.

- The Sephora partnership is expected to significantly contribute to revenue growth.

- Smaller store formats allow for more efficient expansion in new markets.

- Enhanced omnichannel capabilities improve customer convenience and drive sales.

- Continuous refinement of product assortment caters to evolving consumer preferences.

For a deeper understanding of the company's business model and revenue streams, consider reading Revenue Streams & Business Model of Kohl's . The company's expansion strategy, including the Sephora partnership and omnichannel enhancements, is aimed at improving customer engagement. These efforts are designed to ensure long-term sustainability and growth in the competitive retail market. The company's ability to adapt to retail industry trends and execute its expansion plans will be critical for its future success.

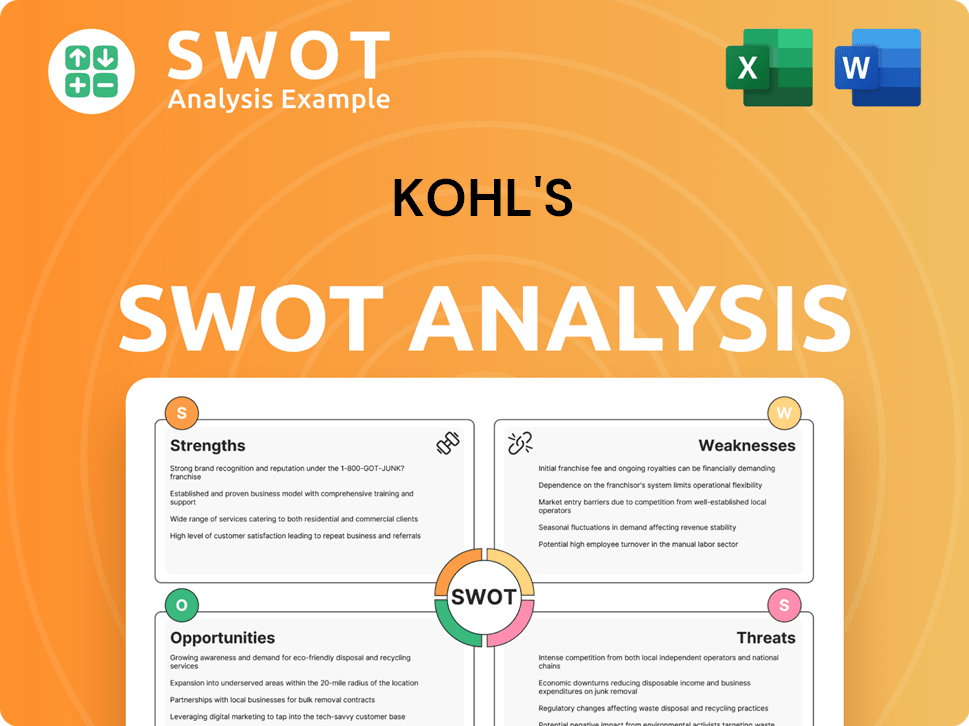

Kohl's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kohl's Invest in Innovation?

The retail sector is constantly evolving, with consumer expectations and technological advancements driving significant changes. To stay competitive, companies like are heavily investing in innovation and technology. This focus is crucial for adapting to changing market dynamics and ensuring long-term growth.

Understanding and responding to customer needs is at the heart of any successful growth strategy. This involves leveraging data to personalize the shopping experience and streamline operations. The goal is to create a seamless and engaging experience across all touchpoints, from online platforms to physical stores.

The company's approach to innovation and technology centers on enhancing customer experience, improving operational efficiency, and promoting sustainability. These efforts are key to navigating the complexities of the retail industry and achieving sustainable growth. A deeper dive into these areas reveals the specific strategies and initiatives driving the company's transformation. For a detailed look at the company's ownership structure, you can refer to Owners & Shareholders of Kohl's .

A core component of the company's strategy is digital transformation, with a strong emphasis on its e-commerce platform and mobile app. This includes continuous improvements to the user interface, search functionality, and overall online shopping experience. The goal is to provide a seamless and personalized shopping journey for customers.

The company utilizes data analytics and artificial intelligence (AI) to gain insights into customer preferences and behaviors. This data-driven approach helps optimize inventory management, personalize marketing efforts, and enhance product recommendations. AI is used to improve search results and provide a more tailored shopping experience.

The 'Sephora at ' partnership involves significant technological integration. This collaboration aims to create a cohesive customer experience across both brands' digital ecosystems. This integration allows for a more unified approach to customer engagement and service.

Investments in automation within the supply chain and logistics are aimed at improving efficiency and reducing delivery times. This includes the implementation of automated fulfillment centers to streamline order processing. These improvements are critical for meeting the demands of e-commerce and enhancing customer satisfaction.

The company is committed to sustainability, leveraging technology to achieve its environmental goals. This includes optimizing energy consumption in stores and distribution centers, and exploring more sustainable materials for private label products. These initiatives reflect a broader commitment to corporate social responsibility.

While specific patents or industry awards related to recent technological breakthroughs are not widely publicized, the company's continuous investment in its digital infrastructure and strategic partnerships demonstrates its commitment to leveraging technology. This focus is essential for meeting evolving consumer expectations and maintaining a competitive edge in the retail sector.

The company's investments in technology are designed to create a more engaging and efficient shopping experience. These efforts are aimed at improving customer satisfaction, streamlining operations, and driving long-term growth. The integration of AI, data analytics, and automation is central to this strategy.

- E-commerce Enhancements: The company continues to refine its e-commerce platform and mobile app. This includes improvements to the user interface, search functionality, and overall online shopping experience.

- AI-Driven Personalization: AI is used to enhance product recommendations and personalize marketing efforts. This data-driven approach helps to better understand customer preferences and tailor the shopping experience.

- Supply Chain Optimization: Investments in automated fulfillment centers and logistics aim to improve efficiency and reduce shipping times. This is critical for meeting the demands of e-commerce.

- Sustainability Initiatives: Technology is used to optimize energy consumption in stores and distribution centers. The company is also exploring more sustainable materials for its private label products.

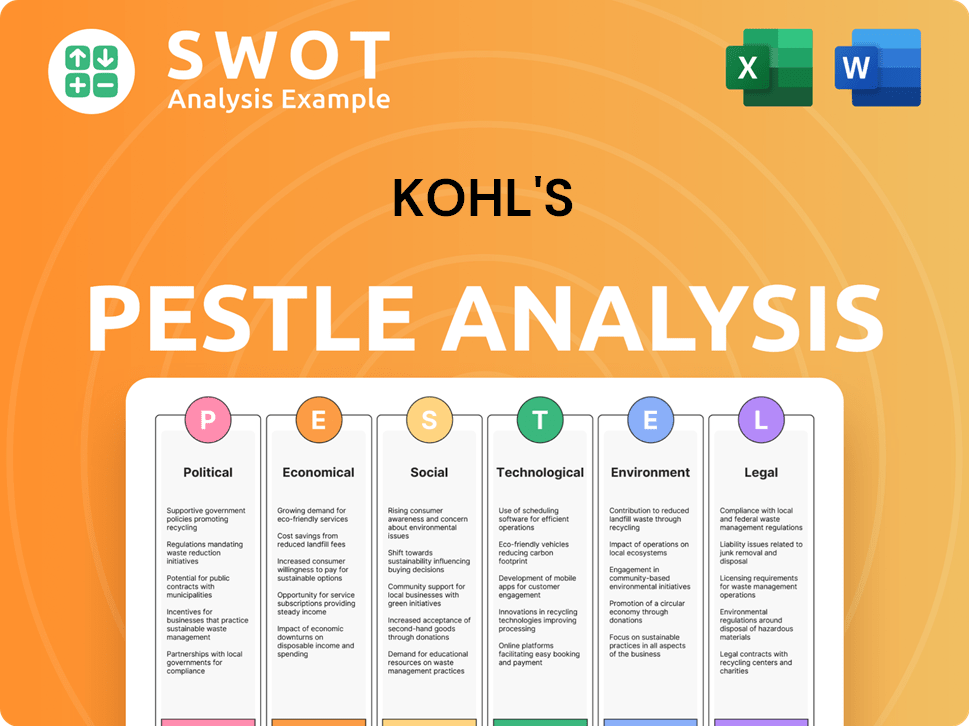

Kohl's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kohl's ’s Growth Forecast?

The financial outlook for the company is shaped by strategic initiatives aimed at stabilizing revenue and improving profitability. The company's performance in fiscal year 2023 showed net sales of $17.46 billion, reflecting a 2.7% decrease compared to the prior year. Diluted earnings per share (EPS) for fiscal year 2023 were reported at $2.85, indicating the company's financial position amidst industry challenges.

Looking ahead, the company anticipates net sales for fiscal year 2024 to range from a 1% decrease to a 1% increase. Projections for diluted EPS are between $2.10 and $2.70. These forecasts highlight a cautious approach, emphasizing the impact of strategic initiatives in a dynamic retail environment. This outlook reflects the company's efforts to navigate evolving retail industry trends and adapt its business model.

A key component of the anticipated financial improvement is the continued expansion and performance of the 'Sephora at ' partnership. This collaboration is expected to positively influence sales and customer traffic, with Sephora at on track to be a $2 billion business by 2025. The company's strategy also focuses on effective inventory management and optimizing its expense structure to enhance profit margins. For more insights into the company's core values and mission, you can explore Mission, Vision & Core Values of Kohl's .

In fiscal year 2023, net sales were $17.46 billion, a decrease of 2.7% year-over-year. Diluted earnings per share (EPS) were $2.85, reflecting the company's profitability amidst market pressures. This financial performance is a key indicator of the company's ability to navigate the retail landscape.

For fiscal year 2024, the company anticipates net sales to range from a 1% decrease to a 1% increase. Diluted EPS is projected to be between $2.10 and $2.70. These projections reflect the company's cautious approach to the evolving retail environment.

The 'Sephora at ' partnership is expected to significantly boost sales and customer traffic. It is projected to become a $2 billion business by 2025. This collaboration is a key element of the company's growth strategy.

Capital expenditures for fiscal year 2024 are estimated to be between $500 million and $550 million. These investments primarily support the Sephora partnership and ongoing technology upgrades. This spending is crucial for long-term investment potential.

The company's financial strategy centers on leveraging key partnerships and operational efficiencies to achieve sustainable growth and enhance shareholder value. This includes managing inventory levels effectively and optimizing the expense structure. These strategies are designed to address the challenges facing the company.

- Focus on the Sephora partnership.

- Effective inventory management.

- Optimizing expense structure.

- Technology investments.

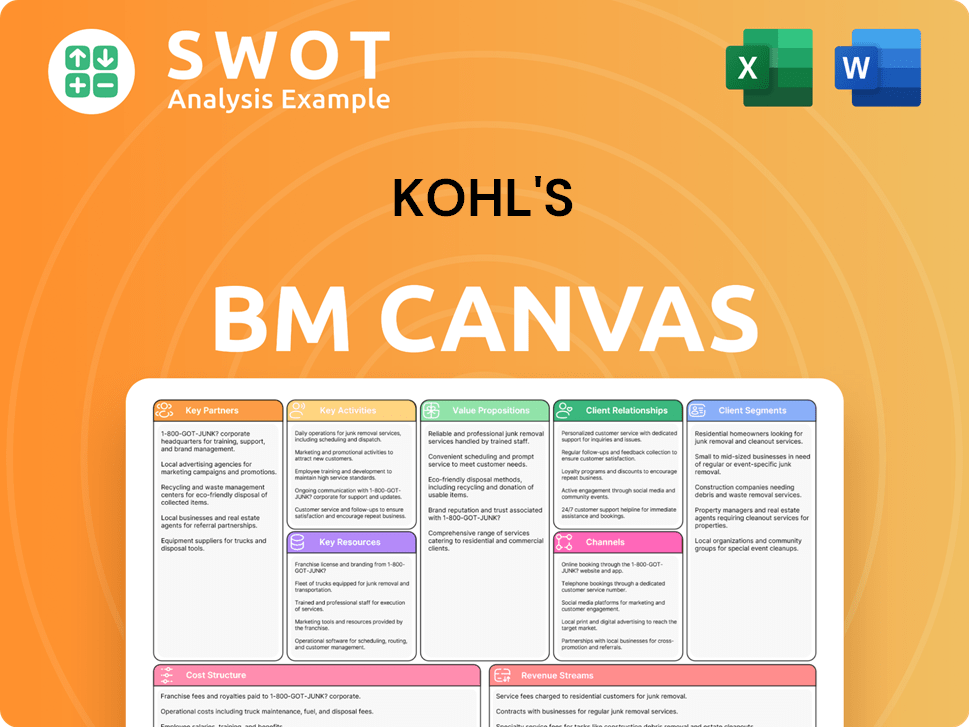

Kohl's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kohl's ’s Growth?

The future of Kohl's growth strategy faces several potential risks and obstacles that could impact its Kohl's future prospects. These challenges range from intense competition within the retail industry to internal operational issues. Understanding these risks is crucial for assessing Kohl's company analysis and its long-term investment potential.

One of the primary obstacles is the highly competitive retail landscape. Kohl's must contend with e-commerce giants, discount retailers, and other department stores, all vying for market share. This environment can lead to pricing pressures, reduced profit margins, and the need for continuous adaptation to changing consumer preferences. The company's ability to maintain and grow its customer base hinges on successfully navigating these challenges.

Supply chain vulnerabilities also pose a significant risk. Disruptions due to geopolitical events, natural disasters, or logistical issues can lead to inventory shortages, increased costs, and delayed product availability. This can directly affect sales and customer satisfaction, requiring robust risk management strategies and agile responses. Furthermore, technological advancements and the company's ability to keep pace with innovations in retail technology are also critical.

The retail sector is fiercely competitive, with e-commerce giants and discount retailers constantly vying for market share. This competitive environment puts pressure on pricing and profit margins. Adapting to changing consumer behaviors is essential for survival and growth.

Geopolitical events, natural disasters, and logistical issues can lead to inventory shortages and increased costs. These disruptions can directly impact sales and customer satisfaction. Robust risk management and agile responses are crucial.

Keeping pace with rapid advancements in retail technology is essential for maintaining a competitive edge. This includes AI-driven personalization and seamless digital payment systems. Failure to adapt can lead to a loss of market share.

Acquiring and retaining top talent in a competitive labor market can be a challenge. Efficient execution of strategic initiatives depends on skilled employees. Effective human resource management is essential.

Rising inflation and evolving regulatory landscapes present ongoing challenges. These factors can impact consumer spending and operational costs. Proactive financial planning and adaptability are essential.

The shift towards online shopping and experiential retail requires continuous adaptation of the omnichannel strategy. In-store experiences must evolve to remain relevant. A focus on customer experience is key.

Internally, resource constraints, including talent acquisition and retention, can hinder strategic execution. The company's ability to navigate these risks through diversification of its product offerings, robust risk management, and scenario planning is critical. For example, Kohl's has been focusing on its omnichannel strategy. In early 2024, Kohl's reported a net sales decrease of 3.6% compared to the same period in the previous year, indicating ongoing challenges in a dynamic market. The company's response to these challenges, as highlighted in a Brief History of Kohl's , includes efforts to adapt to changing consumer behaviors and market trends. Furthermore, the company's strategic agility and ability to adapt to emerging risks, such as increasing inflation and evolving regulatory landscapes, will continue to shape its future trajectory.

In 2024, Kohl's faces economic headwinds, including rising inflation, which impacts consumer spending and operational costs. The company's financial performance is closely tied to its ability to manage these economic factors effectively. Strategic initiatives and cost management are critical.

The competitive landscape includes e-commerce giants, discount retailers, and other department stores. Kohl's must differentiate itself through unique offerings and excellent customer service. Market share depends on effective competitive strategies.

The company's business model is undergoing continuous adaptation to address challenges in the retail sector. The omnichannel strategy, including online and in-store experiences, is a key focus area. Adaptability and innovation are essential.

The company's expansion plans in 2024 involve strategic initiatives to strengthen its market position. New store openings and collaborations are part of the growth strategy. Successful execution of expansion plans is essential.

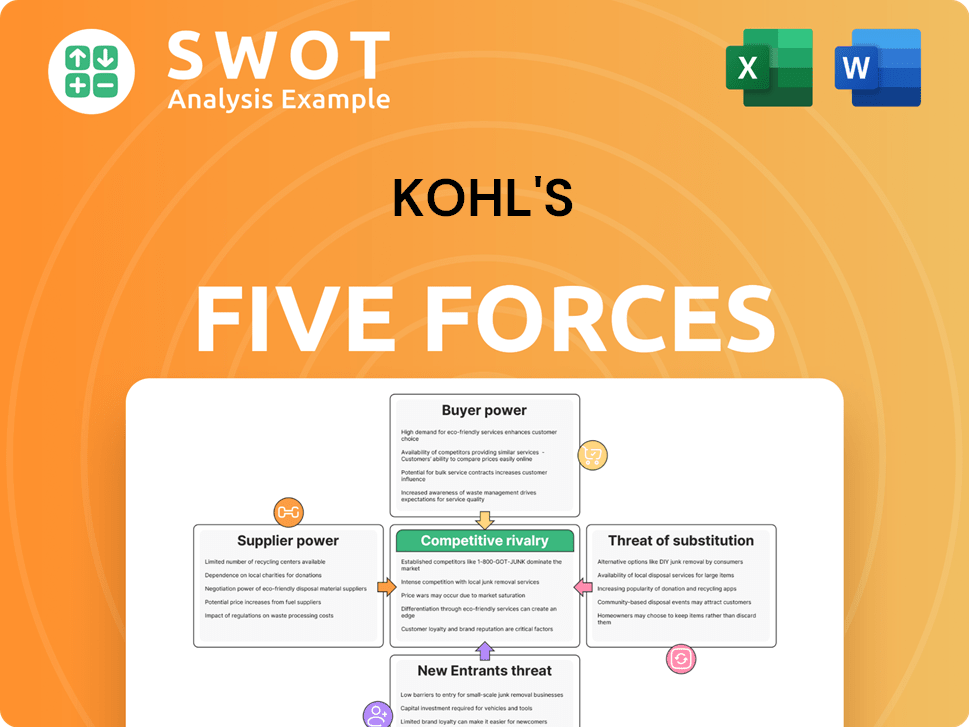

Kohl's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kohl's Company?

- What is Competitive Landscape of Kohl's Company?

- How Does Kohl's Company Work?

- What is Sales and Marketing Strategy of Kohl's Company?

- What is Brief History of Kohl's Company?

- Who Owns Kohl's Company?

- What is Customer Demographics and Target Market of Kohl's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.