Kohl's Bundle

Who Really Calls the Shots at Kohl's?

Unraveling the mystery of Kohl's SWOT Analysis and understanding its ownership is key to grasping its future in the ever-changing retail world. Knowing who owns Kohl's company reveals the forces that drive its strategic decisions, from product offerings to expansion plans. This knowledge is essential for anyone looking to understand the dynamics of this major player in the retail sector.

The evolution of Kohl's corporation from a family-run grocery store to a publicly traded entity provides a fascinating case study in business transformation. Exploring Kohl's ownership structure helps investors and analysts understand the influences shaping its path. This analysis will examine Who owns Kohl's, including its Kohl's parent company, major shareholders, and the impact of Kohl's executives on its trajectory, offering a comprehensive view of its corporate landscape.

Who Founded Kohl's ?

The story of the department store begins in 1962 with its founder, Maxwell Kohl. He started the company as a grocery store in Brookfield, Wisconsin. The initial ownership of the company was held entirely by the Kohl family.

During its early years, the company operated as a family-owned enterprise. Maxwell Kohl and his family were the sole proprietors. They guided its transformation from a grocery business into a department store. There were no external investors during this initial phase. Ownership was concentrated within the Kohl family.

Early internal family agreements, such as vesting schedules or buy-sell clauses, were not subject to public disclosure. The family's vision of providing value and convenience to families allowed for swift, unified decision-making. The Kohl family maintained full ownership until the company's acquisition by BATUS Inc. in 1972.

Maxwell Kohl founded the company in 1962. It began as a grocery store in Brookfield, Wisconsin.

The Kohl family held all the shares in the early years. There were no external investors.

The company was run as a family business. The focus was on building a department store.

In 1972, BATUS Inc. acquired the company. This marked a significant shift in ownership.

The founding team aimed to provide value and convenience. This was reflected in their concentrated ownership.

Internal family arrangements were not publicly disclosed. These included things like vesting schedules.

The company's history started with a family-focused approach. This allowed for quick decision-making. The company's ownership structure evolved over time. For more insights, you can read the Growth Strategy of Kohl's .

Here are some key takeaways about the company's early ownership:

- Founded in 1962 by Maxwell Kohl as a grocery store.

- Initially, the Kohl family held complete ownership.

- The company transitioned from a grocery to a department store under family leadership.

- No external investors were involved during the early years.

- BATUS Inc. acquired the company in 1972, changing the ownership structure.

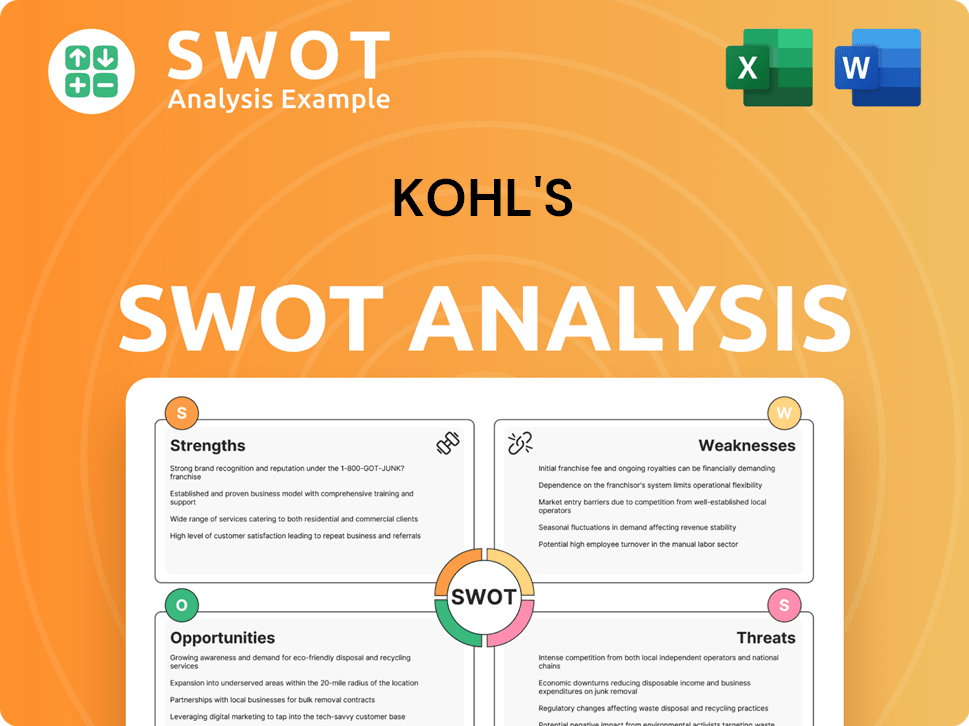

Kohl's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Kohl's ’s Ownership Changed Over Time?

The ownership structure of the company, now known as Kohl's Corporation, has seen significant changes over time. Initially, the Kohl family directly owned the company until its acquisition by BATUS Inc., a U.S. subsidiary of British American Tobacco, in 1972. This marked a pivotal shift away from family ownership. The company then transitioned to private ownership again in 1986 through a management buyout that included The May Department Stores Company. The most transformative event was the Initial Public Offering (IPO) in 1992, which opened the company to public investors by listing its shares on the New York Stock Exchange.

The shift from private to public ownership has significantly influenced the company's strategies, emphasizing shareholder value, financial transparency, and responsiveness to market pressures. The company's evolution reflects broader trends in the retail sector, where ownership structures often adapt to changing market dynamics and financial opportunities. The IPO in 1992 was a key step in the company's growth, enabling access to capital and a wider investor base, which has shaped its corporate governance and strategic decisions over the years.

| Event | Year | Impact on Ownership |

|---|---|---|

| Acquisition by BATUS Inc. | 1972 | Ended direct Kohl family ownership. |

| Management Buyout | 1986 | Took the company private again. |

| Initial Public Offering (IPO) | 1992 | Made the company publicly traded on the NYSE. |

As of early 2025, the company (NYSE: KSS) is a publicly traded entity with a diversified ownership structure. Major stakeholders include institutional investors, mutual funds, and index funds. For example, in the first quarter of 2025, significant institutional holders such as Vanguard Group Inc., BlackRock Inc., and State Street Corp. held substantial percentages of the outstanding shares. Vanguard Group Inc. held approximately 11.2%, BlackRock Inc. held around 9.8%, and State Street Corp. held roughly 4.5% as of March 31, 2025. Individual insiders, including board members and executives, hold a comparatively smaller portion of the total shares. Understanding the ownership structure is crucial for investors and stakeholders looking to assess the company's strategic direction and financial health. For more insights, consider exploring the Marketing Strategy of Kohl's .

The company is currently a publicly traded company. Major stakeholders include institutional investors like Vanguard and BlackRock.

- The IPO in 1992 was a major turning point.

- Institutional investors hold a significant portion of the shares.

- Individual insiders hold a smaller percentage.

- Ownership structure impacts strategic decisions.

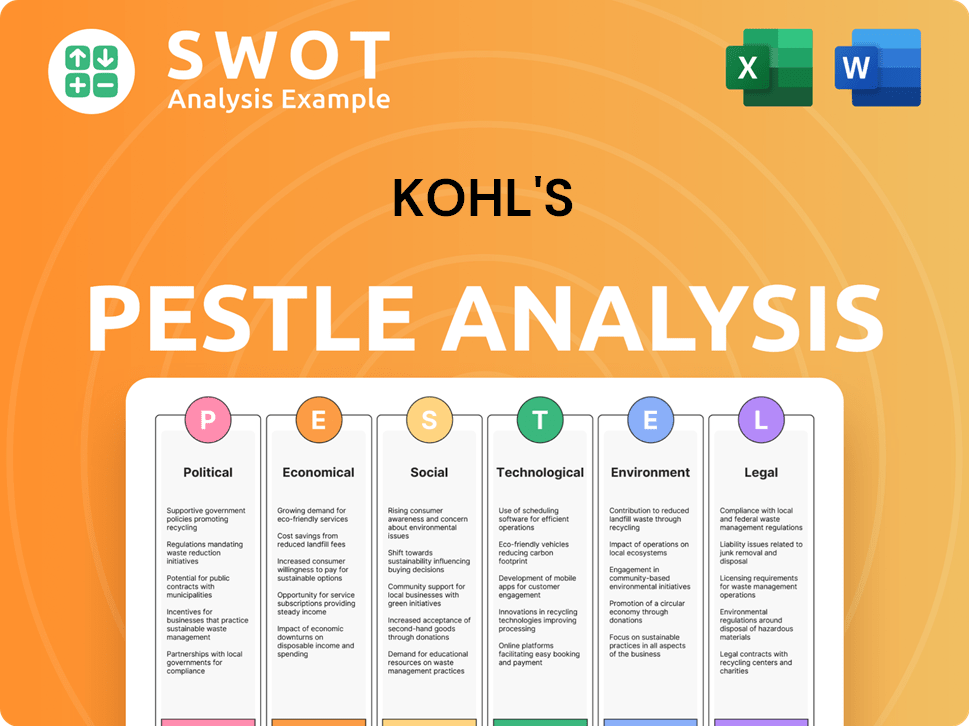

Kohl's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Kohl's ’s Board?

As of early 2025, the Board of Directors for the Kohl's corporation oversees the company's operations, representing various stakeholder interests. The board typically includes independent directors and those with connections to major shareholders or management. Independent directors are often chosen to ensure unbiased oversight. The board, as of April 2025, includes individuals with extensive experience in retail, finance, and corporate governance, with many being independent.

The company operates on a one-share-one-vote principle for its common stock, with no dual-class share structure or special voting arrangements that would grant outsized control to specific entities. This structure ensures that all shareholders have equal voting rights, reflecting a commitment to fair governance. Recent proxy battles and activist investor campaigns have significantly influenced decision-making and board composition, highlighting the importance of shareholder engagement.

| Board Member | Role | Affiliation (as of April 2025) |

|---|---|---|

| Tom Kingsbury | Chief Executive Officer | Kohl's |

| Peter Boneparth | Lead Independent Director | Independent |

| Michael B. Strouse | Director | Independent |

In 2022 and early 2023, activist investors like Macellum Capital Management and Ancora Holdings pushed for strategic changes, including a sale of the company or significant board refreshment. While a sale did not occur, these campaigns led to changes in board membership and influenced the company's strategic direction. This included efforts to improve profitability and enhance shareholder value, demonstrating the impact of shareholder action and the board's responsiveness. For more information on the company's strategic direction, see Growth Strategy of Kohl's .

The Board of Directors plays a crucial role in the governance of Kohl's company, with a mix of independent directors and those with ties to major shareholders or management.

- Kohl's ownership structure generally follows a one-share-one-vote principle.

- Activist investor campaigns have influenced board composition and strategic direction.

- The board's composition reflects the company's commitment to shareholder value.

- The board's responsiveness to shareholder concerns is a key feature of its governance.

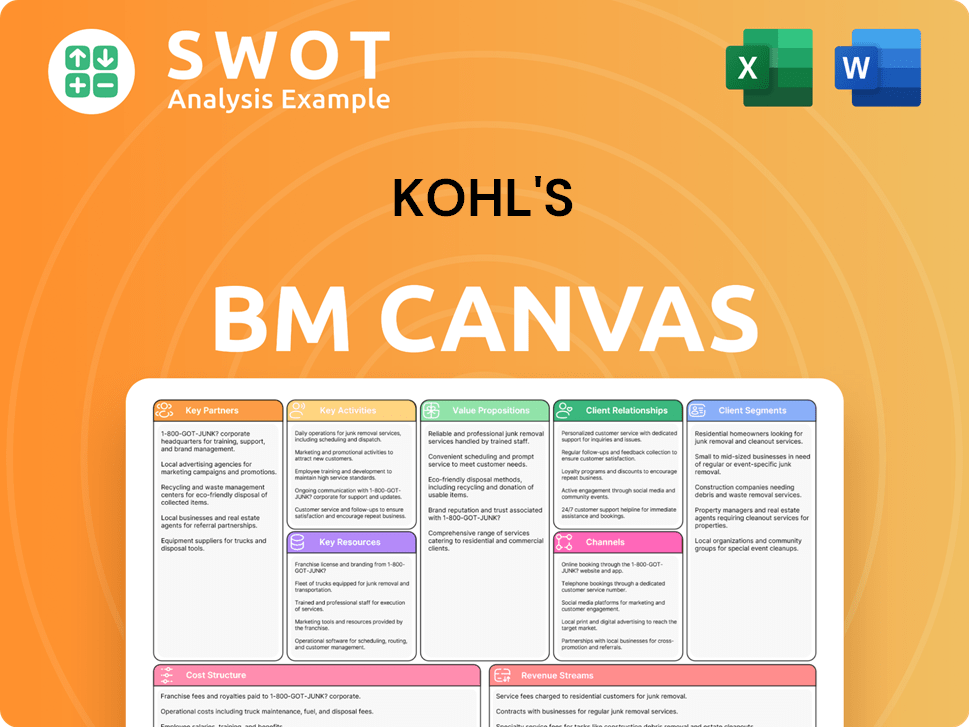

Kohl's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Kohl's ’s Ownership Landscape?

Over the past few years (2022-2025), the ownership of Kohl's has seen significant activity, primarily driven by activist investor involvement and discussions regarding the company's strategic direction. The ownership structure hasn't fundamentally changed through major mergers or acquisitions. Instead, Kohl's has focused on returning value to shareholders via share buyback programs. For instance, share repurchase authorizations were announced in late 2023 and early 2024, demonstrating a commitment to boosting shareholder returns amid market fluctuations. Leadership changes, including new executive appointments, have impacted operational strategies but haven't directly altered the ownership percentages of major stakeholders. The company's stock symbol is KSS, and it is a publicly traded company.

Industry trends, such as increased institutional ownership and the influence of activist investors, continue to shape Kohl's. Institutional investors remain dominant, wielding considerable governance power through their voting rights. Activist investors have pushed the company to consider strategic alternatives, including potential sales or operational overhauls, though these efforts haven't resulted in a change of control. Public statements from Kohl's management and analysts often emphasize the company's dedication to long-term shareholder value, profitability improvement, and adapting to the changing retail environment. While there have been no definitive announcements regarding privatization or significant shifts in public listing, the company remains under investor scrutiny, with stakeholders seeking improved financial performance and strategic clarity. To get a better understanding of the competitive landscape, you can read about the Competitors Landscape of Kohl's .

| Metric | Data | Source/Date |

|---|---|---|

| Stock Symbol | KSS | Various Financial Websites |

| Is a publicly traded company | Yes | Various Financial Websites |

| Share Repurchase Authorizations | Announced in late 2023 and early 2024 | Company Statements |

Institutional investors continue to be a major part of Kohl's ownership structure, influencing governance and strategic decisions. Their significant voting power allows them to shape the company's direction and hold management accountable for performance.

Activist investors have pressured Kohl's to consider strategic alternatives, including sales or operational changes. This pressure indicates the desire for improved financial performance and strategic clarity in a challenging retail environment.

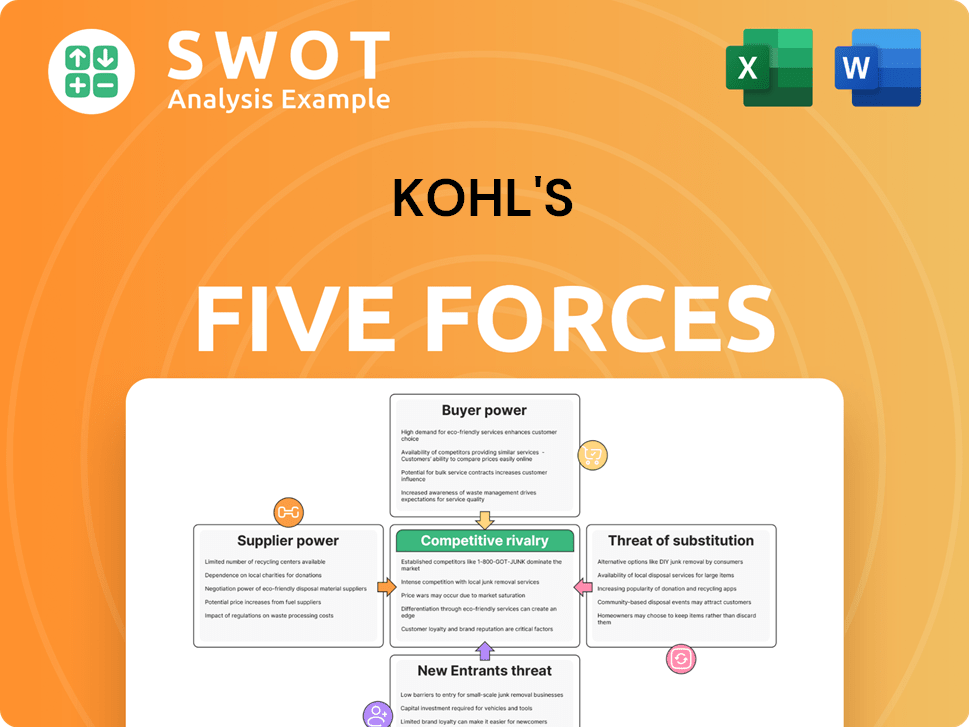

Kohl's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kohl's Company?

- What is Competitive Landscape of Kohl's Company?

- What is Growth Strategy and Future Prospects of Kohl's Company?

- How Does Kohl's Company Work?

- What is Sales and Marketing Strategy of Kohl's Company?

- What is Brief History of Kohl's Company?

- What is Customer Demographics and Target Market of Kohl's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.