Kohl's Bundle

How Does Kohl's Thrive in Today's Retail Landscape?

Kohl's, a familiar name in U.S. retail, has been adapting to the ever-changing consumer market. With a focus on family-oriented products, from apparel to home goods, Kohl's has built a significant presence with approximately 1,100 stores and a robust online platform. Despite facing challenges, including declining sales in recent years, Kohl's continues to evolve its Kohl's SWOT Analysis to stay competitive.

Understanding the intricacies of Kohl's business model is essential for anyone interested in the retail sector. This exploration will dissect How Kohl's works, examining its Kohl's operations, strategic initiatives, and the ways it generates revenue. We'll delve into Kohl's strategy, partnerships, and competitive advantages to provide a comprehensive overview of this retail giant's approach to navigating the modern market, including the importance of Kohl's structure in its operational success.

What Are the Key Operations Driving Kohl's ’s Success?

The core operations of Kohl's revolve around offering a wide array of products, including apparel, footwear, accessories, beauty items, and home goods, tailored to families and middle-income consumers. This strategy involves a mix of national brands, exclusive brands, and private label merchandise. In fiscal year 2024, the company introduced new private-label home goods collections, demonstrating its commitment to providing diverse offerings.

A robust supply chain is critical to Kohl's operations. Merchandise is primarily received at nine retail distribution centers and five e-fulfillment centers. These centers strategically ship products to approximately 1,100 physical stores via contract carriers. This operational setup supports both in-store and online sales, with e-commerce sales exceeding $4 billion in 2024.

Kohl's leverages its extensive store network for fulfilling online orders, offering in-store pickup, which gives it an edge over digital-only competitors. The company focuses on enhancing its omnichannel platform to deliver a seamless customer experience, including initiatives like self-serve buy online, pick up in store, and testing self-serve returns and check-out.

Kohl's operates as a department store retailer, focusing on apparel, footwear, accessories, beauty, and home products. The company's strategy includes a mix of national brands, exclusive brands, and private label merchandise. This approach targets middle-income families, offering value and convenience.

The company's operations rely on a robust supply chain, with merchandise flowing through distribution and e-fulfillment centers. Kohl's utilizes its physical stores to fulfill online orders, offering services like in-store pickup. This omnichannel approach enhances customer experience and drives sales.

Strategic partnerships, like the one with Sephora, boost sales and attract new customers. The collaboration with Sephora, which began in 2021, has significantly enhanced Kohl's beauty business, with Sephora at Kohl's sales exceeding $1.4 billion in 2023 and projected to surpass $2 billion by 2025.

Kohl's offers value pricing, a diverse product assortment, and convenient shopping options. The company's off-mall locations and loyalty program, with over 30 million members, contribute to its competitive advantage. These elements combine to create a compelling shopping experience for its target demographic.

Kohl's distinguishes itself through off-mall locations and an established loyalty program. This structure supports its ability to offer a mix of own-brand and national brands at competitive prices. The company's core capabilities translate into customer benefits.

- Value Pricing: Offering competitive prices on a wide range of products.

- Diverse Product Assortment: Providing a broad selection of merchandise to cater to various customer needs.

- Convenient Shopping Options: Offering both in-store and online shopping experiences, including in-store pickup.

- Strategic Partnerships: Collaborations like Sephora and Babies 'R' Us enhance product offerings and customer reach.

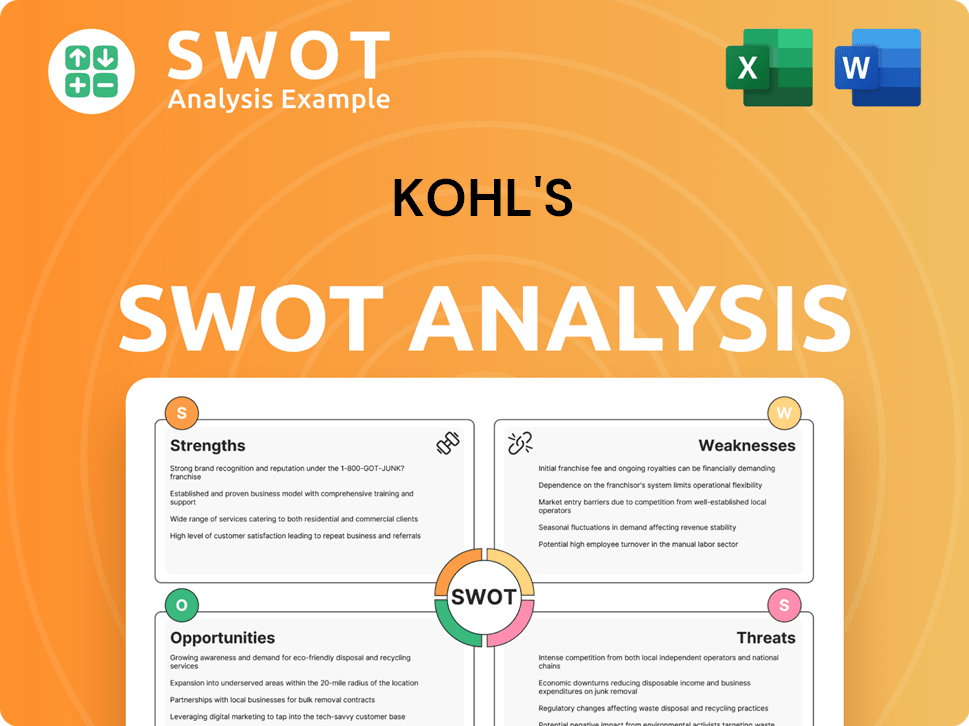

Kohl's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kohl's Make Money?

Understanding the revenue streams and monetization strategies is key to grasping how the business operates. The core of the business model revolves around selling a diverse range of products, including apparel, footwear, accessories, beauty items, and home goods. Strategic partnerships and digital sales are increasingly significant drivers of revenue for the business.

The company's financial performance reflects the evolving retail landscape. Net sales in fiscal year 2023 were $16.6 billion, but decreased by 3.4% year-over-year. The fourth quarter of fiscal year 2023 saw a 1.1% decrease in net sales, totaling $5.7 billion. For fiscal year 2024, net sales declined 7.2% to $15.4 billion.

The company's operations and strategy are evolving to adapt to market changes. This includes leveraging partnerships and expanding digital sales channels. To learn more about the company's journey, explore the Brief History of Kohl's .

The company employs several strategies to generate revenue and maximize profitability. A significant portion of revenue comes from product sales across various categories. Partnerships and private label brands also contribute substantially to the company's financial performance.

- Product Sales: The primary revenue source comes from selling apparel, footwear, accessories, beauty products, and home goods.

- Sephora Partnership: The partnership with Sephora is a major revenue driver. In 2023, Sephora at the company generated over $1.4 billion in sales, a 90% increase year-over-year, and is projected to exceed $2 billion by 2025. In Q3 2024, beauty sales increased by 15% year-over-year due to the Sephora store-in-store initiative.

- Babies 'R' Us Partnership: Another emerging revenue stream is the partnership with Babies 'R' Us. The company anticipates this partnership will generate 'more than $2 billion in sales' over the next few years.

- Private Label Brands: The company also monetizes through its private label brands, which typically have higher gross margins. New collections like Miryana and Mingle & Co. were launched in 2025.

- Digital Sales: E-commerce is a crucial component, with online sales reaching over $4 billion in 2024, accounting for approximately 30% of total sales. In fiscal year 2023, e-commerce represented 29% of annual sales.

- Retail Media Network: The company is developing a retail media network to monetize its large customer base of roughly 65 million active customers and over 30 million loyalty members.

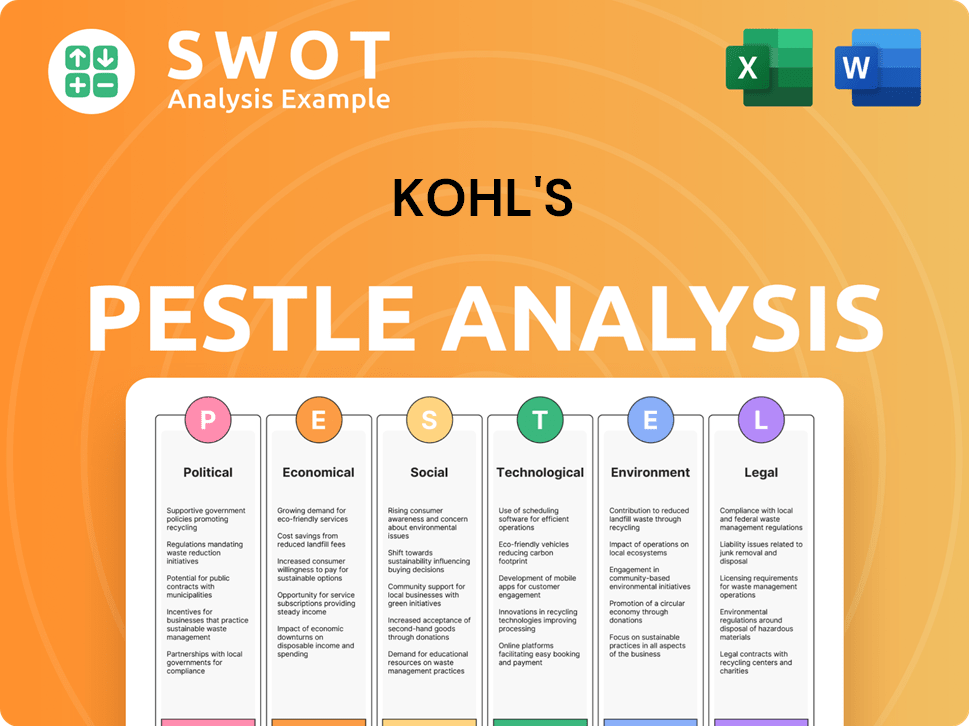

Kohl's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kohl's ’s Business Model?

Kohl's has undertaken significant strategic shifts to navigate the evolving retail landscape. A key move was the partnership with Sephora in 2021, which has significantly boosted its beauty segment. Furthermore, the company announced a collaboration with Babies 'R' Us in 2024, aiming for substantial sales growth.

The company's strategic focus includes enhancing customer experience, streamlining value strategies, and managing inventory and expenses. These efforts are designed to revitalize stores and improve operational efficiency. In response to market challenges, Kohl's is also adapting its approach to e-commerce and in-store experiences.

Understanding Competitors Landscape of Kohl's is crucial for appreciating its position in the retail sector. The company's competitive advantages, including its brand recognition and extensive store network, are key to its ongoing strategies.

The Sephora partnership, launched in 2021, is projected to achieve $2 billion in sales by 2025. The Babies 'R' Us collaboration, initiated in 2024, is set to introduce 200 shop-in-shops. These partnerships represent major strategic moves to enhance Kohl's business model and customer appeal.

Kohl's is focused on improving customer experience and value strategies. The company is streamlining operations, which includes closing underperforming stores. In fiscal year 2024, net sales declined by 7.2% to $15.4 billion, prompting the company to implement these strategic changes.

Kohl's benefits from its brand strength and off-mall locations. The loyalty program has over 30 million members, enhancing customer retention. Private label programs and brand partnerships differentiate the company from competitors.

The company is increasing personalization in e-commerce and using social commerce. Kohl's is also exploring virtual shopping experiences and shortening lead times with manufacturers. These initiatives aim to capture current trends swiftly, especially in apparel.

Kohl's retail operations are focused on adapting to market changes and enhancing customer engagement. The company's strategy involves a combination of partnerships, store optimization, and digital enhancements to drive growth. The company's structure is evolving to meet the demands of the retail landscape.

- The Sephora partnership is a key element of Kohl's strategy, aiming to attract new customers.

- The Babies 'R' Us collaboration is expected to contribute significantly to future sales.

- The company is streamlining operations by closing underperforming stores, as announced in 2025.

- Kohl's is investing in e-commerce and virtual shopping experiences to stay competitive.

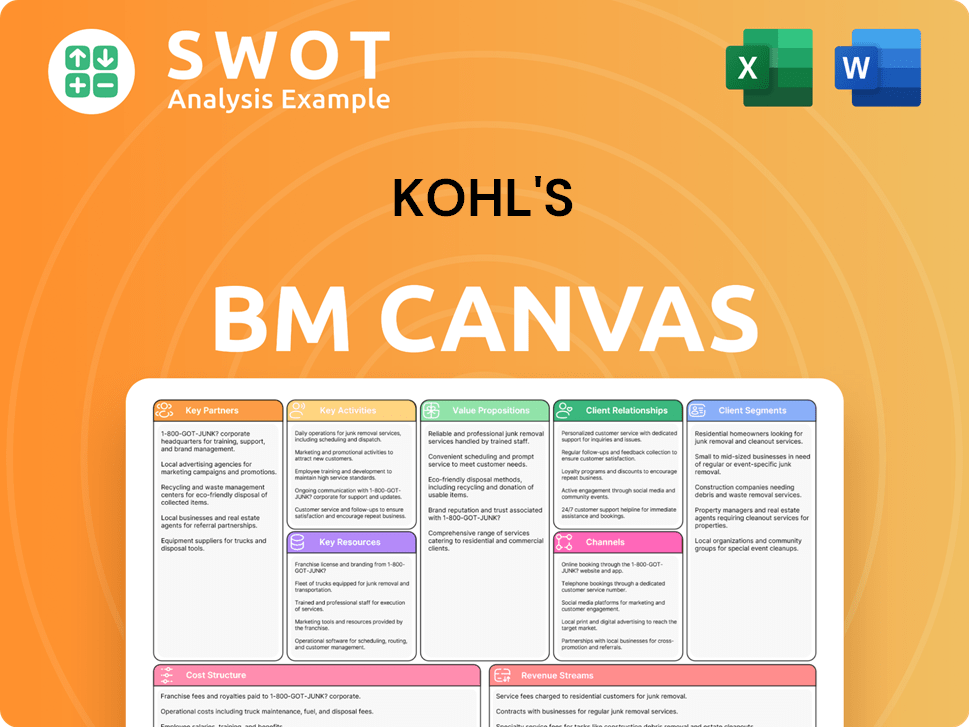

Kohl's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kohl's Positioning Itself for Continued Success?

As a major department store chain in the U.S., Kohl's operates around 1,100 stores. The company faces stiff competition from online retailers, discount stores, and others. Declining sales over the past decade and pressure on market share highlight the challenges faced by Kohl's.

Key risks include a tough economic climate affecting middle-income shoppers, tariff impacts on imported goods, and leadership changes. The shift to store-based fulfillment could pose challenges. Inventory levels, despite lower sales, indicate supply-demand issues. To learn more about the ownership structure, you can read this article: Owners & Shareholders of Kohl's .

Kohl's holds a significant position as a department store chain in the U.S., with a large store network. However, the retail landscape is highly competitive, with numerous players vying for market share. The company's market share faces pressure from various competitors, including online retailers and discount stores.

The company faces several risks, including a challenging macroeconomic environment impacting consumer spending. Tariff risks on imported merchandise also pose a threat. Leadership changes and the shift to store-based fulfillment introduce additional operational challenges. Increased inventory levels despite lower sales signal supply chain issues.

Kohl's is focusing on a turnaround strategy, including rebuilding its brands, simplifying promotions, and enhancing the customer experience. The Sephora partnership and Babies 'R' Us are vital for growth. The company plans to invest in e-commerce, store remodeling, and new small-format stores.

Key initiatives include a curated assortment, emphasizing value and quality, and improving the omnichannel platform. The company aims to enhance inventory management and reduce expenses. Kohl's anticipates a challenging 2025, forecasting a sales decline and plans to cut costs and reduce debt.

For 2025, Kohl's anticipates a net sales decline between 5% and 7%, with comparable sales down 4% to 6%. The company plans capital investments between $400 million and $425 million. The future depends on executing strategic initiatives and adapting to the evolving retail landscape.

- Focus on rebuilding proprietary brands.

- Enhance the omnichannel customer experience.

- Expand Sephora presence to all stores by 2025.

- Improve inventory management and reduce expenses.

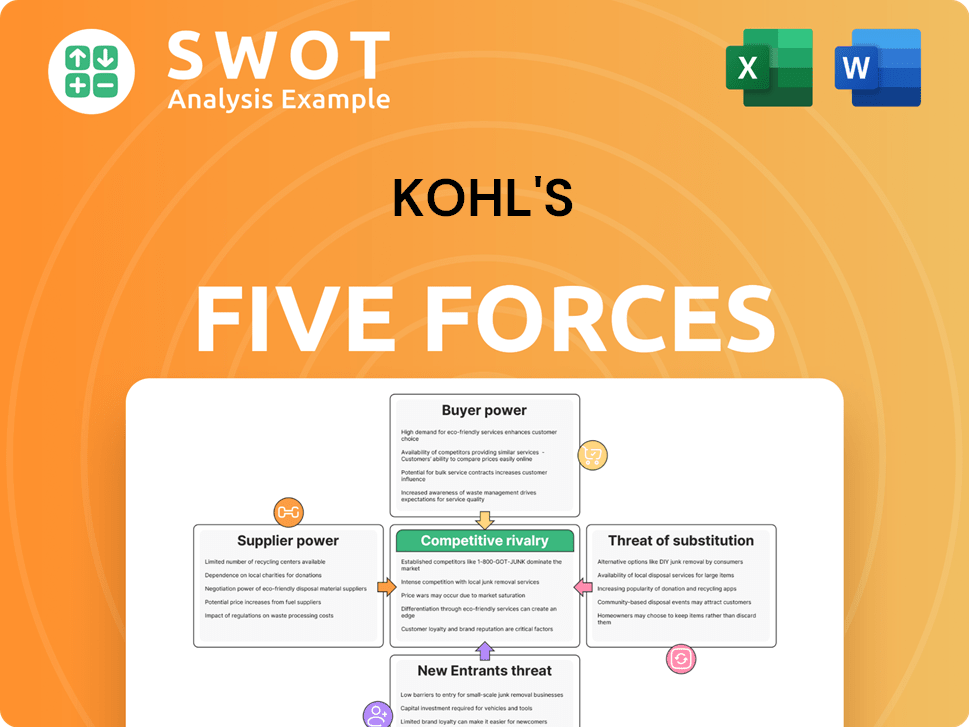

Kohl's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kohl's Company?

- What is Competitive Landscape of Kohl's Company?

- What is Growth Strategy and Future Prospects of Kohl's Company?

- What is Sales and Marketing Strategy of Kohl's Company?

- What is Brief History of Kohl's Company?

- Who Owns Kohl's Company?

- What is Customer Demographics and Target Market of Kohl's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.