Grupo Kuo Bundle

How is Grupo Kuo Navigating the Global Competitive Arena?

In today's volatile market, understanding the Grupo Kuo SWOT Analysis is crucial for investors and strategists alike. This Mexican industrial giant, Grupo Kuo, has evolved from a focused entity into a diversified powerhouse, making it a compelling case study in strategic adaptation. Its journey showcases resilience and foresight in a complex global landscape, demanding a deep dive into its competitive dynamics.

This Market Analysis will dissect the Competitive Landscape of Kuo Company, exploring its Market Share Analysis, and examining its Competitive Advantages of Grupo Kuo to provide a comprehensive Industry Overview. We'll also explore How does Grupo Kuo compete in the market, its strategic alliances, and the Future Outlook for Grupo Kuo's Competitive Position, offering insights for informed Business Strategy.

Where Does Grupo Kuo’ Stand in the Current Market?

Grupo Kuo maintains a substantial and diversified market position across its key business segments, including chemicals, automotive, food, and polymers. Its strategic approach and broad portfolio contribute to its strong standing in the competitive landscape. The company consistently ranks among the leading players in its core markets within Mexico and internationally.

The company's diverse operations span several industries, providing a degree of insulation against economic fluctuations. This diversification is a key element of its business strategy, allowing it to navigate market challenges more effectively. Grupo Kuo's ability to adapt and expand its global footprint has been central to its sustained success.

As of the first quarter of 2024, Grupo Kuo reported a net income of $281 million Mexican Pesos, which reflects its financial health amidst market fluctuations. This financial performance underscores the company's robust market position and its capacity to generate value across its diverse business segments. For a deeper dive into their expansion plans, consider reading about the Growth Strategy of Grupo Kuo.

Grupo Kuo holds a significant market share in its core segments. While specific figures fluctuate, the company consistently ranks among the top competitors in its primary markets. This strong market position is a result of its strategic diversification and global reach.

Grupo Kuo's geographic presence extends beyond Mexico, with manufacturing facilities and sales operations across North America, Europe, and Asia. This global footprint supports its competitive advantages and enhances its ability to serve international markets effectively.

The company's diverse product lines include synthetic rubber, plastics, processed foods, and automotive components. This diversified portfolio allows Grupo Kuo to cater to a wide range of customer segments. The variety in offerings helps to mitigate risks associated with economic downturns.

Grupo Kuo serves a broad range of customer segments, from large industrial clients to consumer markets. Its food division, which includes brands like Kekén in pork products, caters directly to consumers. This diverse customer base contributes to the company's stability.

Grupo Kuo's strengths lie in its diversified portfolio and global reach, which provide resilience against market volatility. The company’s strategic diversification and global presence contribute to its competitive advantages and long-term sustainability. The company's commitment to innovation and expansion has been key to its success.

- Diversified Business Segments: Reduces reliance on any single market.

- Global Manufacturing and Sales: Enhances market access and customer reach.

- Strong Financial Performance: Demonstrated by consistent profitability.

- Strategic Partnerships: Supports innovation and market expansion.

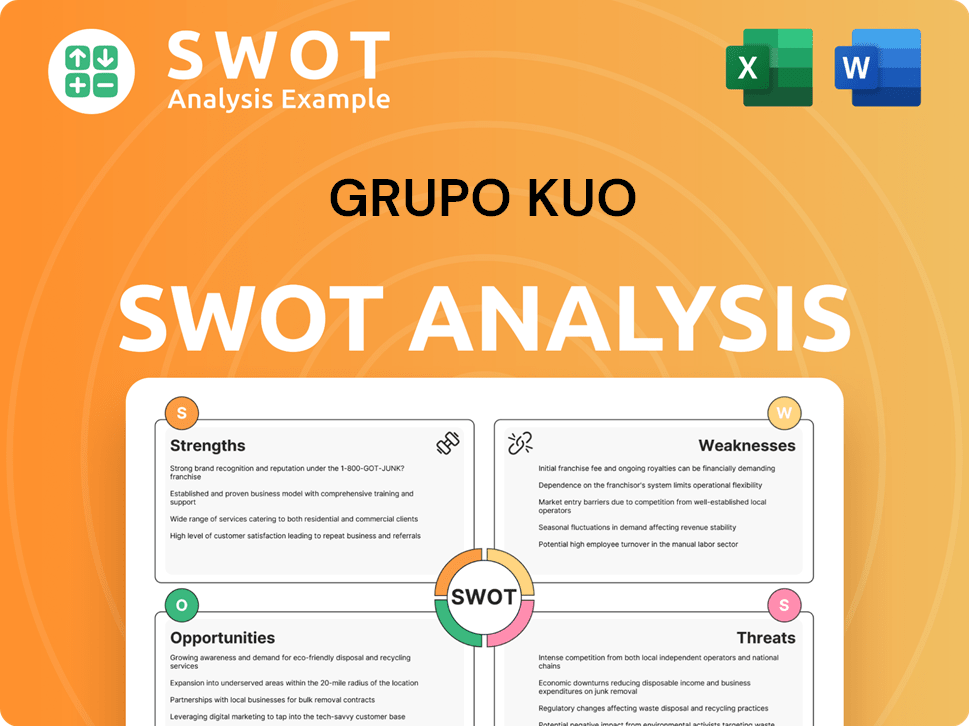

Grupo Kuo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Grupo Kuo?

The Grupo Kuo faces a complex competitive landscape due to its diversified business segments. Its operations span chemicals, automotive components, and food production, each with distinct rivals and market dynamics. Understanding these competitive pressures is crucial for assessing Grupo Kuo's strategic positioning and growth potential.

A thorough market analysis reveals that Kuo Company navigates a challenging environment, requiring constant adaptation to maintain and enhance its market share. The company's ability to innovate, manage costs, and build strong customer relationships are key factors in its ongoing success. This overview provides insights into the key players and strategies shaping Grupo Kuo's competitive environment.

The competitive environment for Grupo Kuo varies significantly across its sectors. In chemicals, it contends with global giants, while in automotive components, it faces established industry leaders. The food sector presents a mix of large conglomerates and regional players. The following sections provide a detailed look at the key competitors in each of these areas.

In the chemical sector, Grupo Kuo, specifically through its Dynasol and Resirene divisions, competes with major international players. These competitors often have substantial resources for research and development and wider product ranges. The competition focuses on technological innovation and global market reach.

Within the automotive industry, Grupo Kuo's Tremec subsidiary faces competition from global manufacturers of transmission and driveline components. These competitors have strong relationships with major automotive manufacturers. Technological leadership and cost-effectiveness are crucial in this sector.

In the food sector, particularly in pork production and processed meats, Grupo Kuo's Kekén brand competes with large, integrated food companies. These rivals compete on brand recognition, distribution networks, and pricing strategies. Emerging local and regional players also present challenges.

Mergers and alliances constantly reshape the competitive dynamics across all sectors. Grupo Kuo must remain agile and adaptable to these changes. Strategic partnerships can be key to maintaining a competitive edge.

Technological advancements play a significant role in the competitive landscape. Competitors invest heavily in R&D to improve product quality and efficiency. Grupo Kuo must also prioritize innovation to stay competitive.

Market dynamics are constantly evolving, influenced by economic trends and consumer preferences. Grupo Kuo needs to monitor these changes closely. Understanding these trends is crucial for making informed strategic decisions.

The chemical sector sees Grupo Kuo facing off against companies like Trinseo, Synthos, and Asahi Kasei. These firms have vast resources and global reach. In the automotive sector, ZF Friedrichshafen, Aisin Seiki, and Magna International are key rivals. These companies have strong OEM relationships and extensive engineering capabilities. In the food sector, Grupo Kuo's Kekén brand competes with large, integrated food companies both domestically and internationally.

- Trinseo: A major player in synthetic rubber and plastics, competes with Dynasol. In 2023, Trinseo reported revenues of approximately $3.7 billion.

- ZF Friedrichshafen: A global leader in automotive technology, competes with Tremec. ZF's sales for 2023 were over €46.6 billion.

- Major Food Conglomerates: These companies compete with Kekén in the food sector. Specific financial data varies, but these companies often have multi-billion dollar revenues.

- Aisin Seiki: Another key competitor in the automotive sector. Aisin's consolidated revenue for fiscal year 2023 was approximately ¥4.7 trillion.

- Synthos: A significant player in the chemical industry, particularly in the production of synthetic rubber. In 2023, Synthos reported revenues of around €1.7 billion.

For additional insights, consider reading about the Growth Strategy of Grupo Kuo.

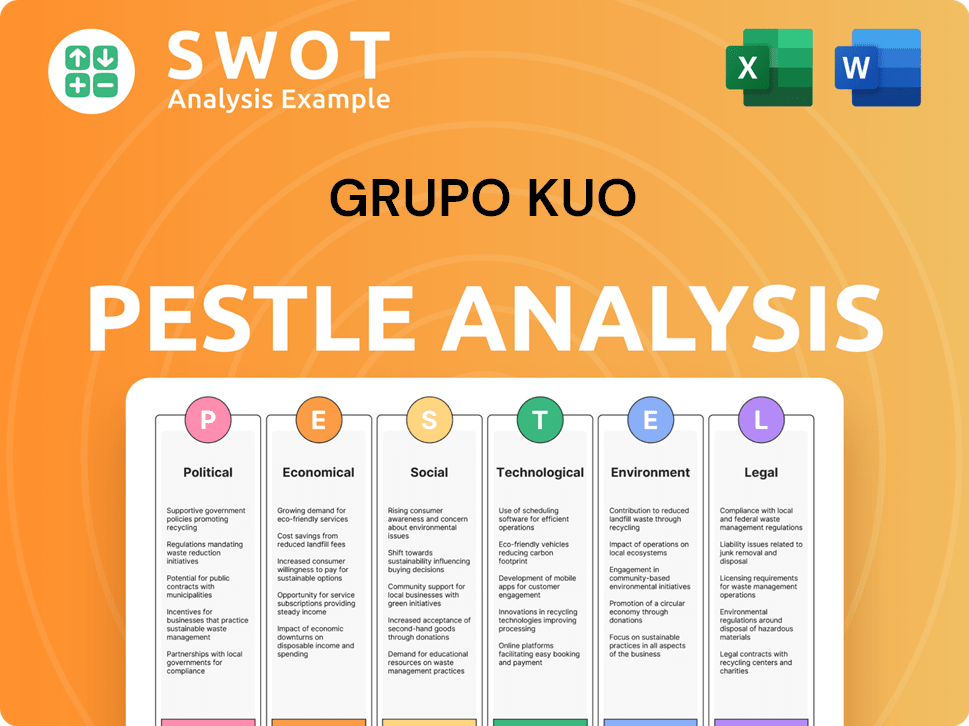

Grupo Kuo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Grupo Kuo a Competitive Edge Over Its Rivals?

The competitive landscape of Grupo Kuo is shaped by its diversified business model, which spans chemicals, automotive, and food sectors. This diversification provides a strategic advantage, allowing the company to mitigate risks associated with economic fluctuations in any single industry. This approach enhances resilience and provides opportunities for cross-segment learning and resource allocation, a key element in its business strategy.

In the automotive sector, Grupo Kuo's subsidiary, Tremec, holds a significant competitive edge through its expertise in high-performance torque transfer solutions. The company's focus on innovation and its ability to meet the evolving demands of the automotive industry, particularly for more efficient and advanced systems, allows it to maintain strong relationships with leading global OEMs. This is supported by proprietary technologies and a strong reputation for quality and reliability, contributing to its market share.

Within the chemical and polymer segments, Grupo Kuo benefits from specialized production processes and a focus on niche markets for synthetic rubber and resins. Its ability to produce advanced materials for various industrial applications provides a competitive edge, often backed by patents and a deep understanding of customer needs. In the food sector, the company leverages its integrated supply chain, from farming to processing and distribution, ensuring quality control and cost efficiencies, which contribute to its brand equity and customer loyalty, particularly with its Kekén brand.

Grupo Kuo's diversified structure across chemicals, automotive, and food sectors reduces risk. This diversification enables the company to navigate economic cycles more effectively. It also allows for cross-segment synergies and resource optimization, enhancing overall performance.

Tremec's expertise in high-performance torque transfer solutions is a key differentiator. The company's focus on innovation and advanced systems allows it to maintain strong OEM relationships. This technological edge is supported by proprietary technologies and a strong reputation.

The food sector benefits from an integrated supply chain, ensuring quality and efficiency. This model supports brand equity and customer loyalty, particularly with the Kekén brand. This integrated approach enhances cost control and product consistency.

Strategic investments and acquisitions have enhanced Grupo Kuo's competitive position. The company leverages these advantages in product development and market expansion. Strategic partnerships further boost its market reach and technological capabilities.

Grupo Kuo's competitive advantages are rooted in its diversified business model, technological expertise, and established market presence. The company's ability to navigate economic cycles and its focus on innovation are crucial. The company's focus on operational excellence and strategic partnerships further strengthens its position.

- Diversification across chemicals, automotive, and food sectors.

- Technological leadership in torque transfer solutions through Tremec.

- Integrated supply chain in the food sector, enhancing cost efficiencies.

- Strategic investments and acquisitions to expand market reach.

The company's sustained investment in research and development across its divisions ensures that its product offerings remain competitive and relevant to market demands. These advantages have evolved over time through strategic investments, acquisitions, and a focus on operational excellence, allowing Grupo Kuo to leverage them in product development, market expansion, and strategic partnerships. For more details on how Grupo Kuo operates, you can read about the Revenue Streams & Business Model of Grupo Kuo.

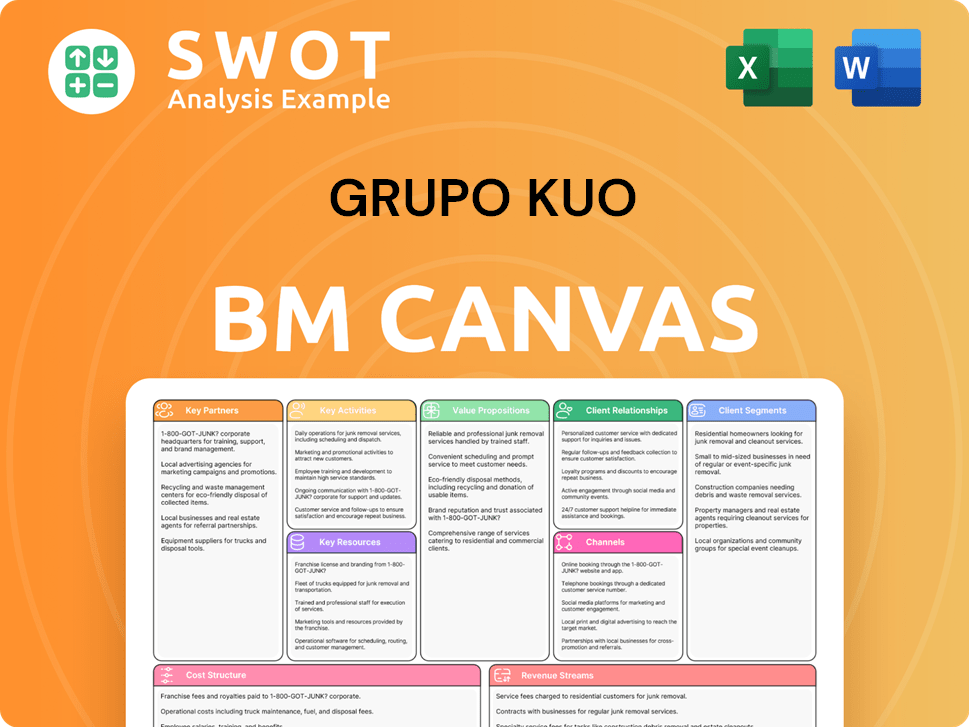

Grupo Kuo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Grupo Kuo’s Competitive Landscape?

The competitive landscape for Grupo Kuo is shaped by significant industry trends, including technological advancements, regulatory changes, and global economic shifts. These factors influence its diverse business segments, such as automotive, chemicals, and food. The company's ability to adapt to these changes and capitalize on emerging opportunities is critical for maintaining its market position.

Risks include fluctuating raw material costs, supply chain disruptions, and evolving consumer preferences. The company's Q1 2024 results showed a decrease in operating income due to higher raw material costs, highlighting the impact of these challenges. The future outlook depends on Grupo Kuo's strategic responses, including innovation, partnerships, and market expansion, to navigate challenges and leverage growth opportunities.

Technological advancements, especially in automation and advanced materials, are driving innovation across all sectors. The automotive industry's shift to electric vehicles (EVs) and autonomous driving presents both challenges and opportunities for

Regulatory changes, like stricter emissions standards and new chemical regulations, require significant R&D investments. Global economic shifts, including inflationary pressures and supply chain disruptions, impact raw material costs and logistics. Consumer preferences are evolving, with increasing demand for healthier and sustainably sourced food products.

The increasing adoption of EVs provides an opportunity to develop next-generation e-driveline solutions. Growing demand for specialized polymers in healthcare and electronics offers avenues for expansion in the chemical sector. Emerging markets continue to present opportunities for market penetration and increased sales across all segments.

Grupo Kuo is likely to focus on strategic partnerships, targeted acquisitions, and continuous innovation. The company aims to remain resilient and capitalize on opportunities, further solidifying its competitive position. This approach is crucial for navigating the evolving global landscape and ensuring long-term success.

The competitive landscape for

- Technological Innovation: Automation, digitalization, and advanced materials are key drivers.

- Regulatory Environment: Stricter emissions standards and new chemical regulations impact operations.

- Economic Shifts: Inflation and supply chain disruptions affect costs and logistics.

- Consumer Preferences: Demand for healthier and sustainable products influences strategy.

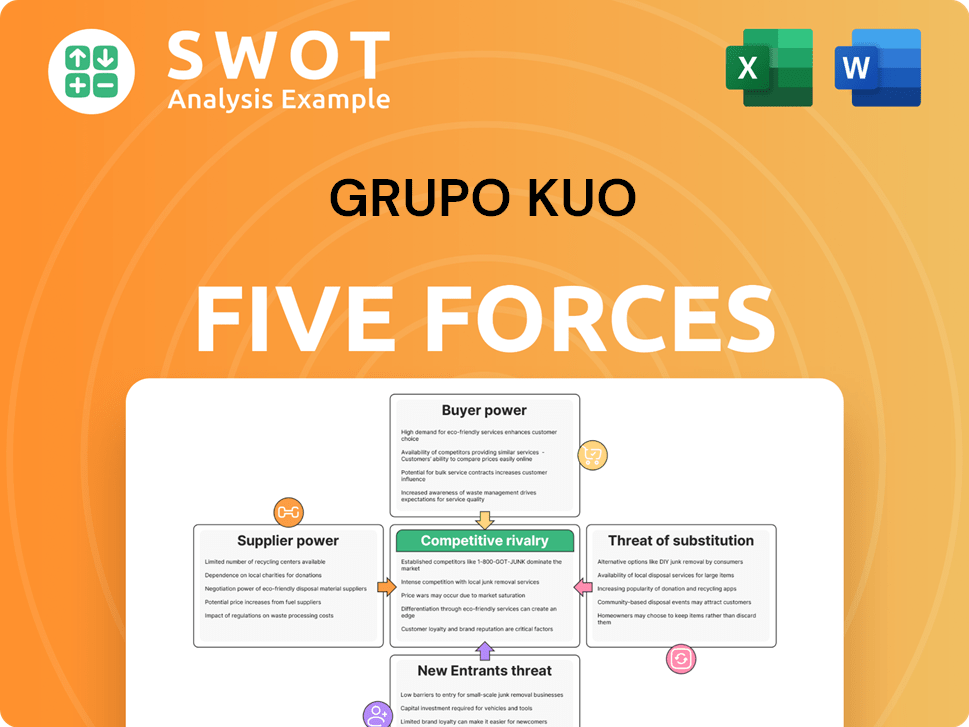

Grupo Kuo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grupo Kuo Company?

- What is Growth Strategy and Future Prospects of Grupo Kuo Company?

- How Does Grupo Kuo Company Work?

- What is Sales and Marketing Strategy of Grupo Kuo Company?

- What is Brief History of Grupo Kuo Company?

- Who Owns Grupo Kuo Company?

- What is Customer Demographics and Target Market of Grupo Kuo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.