Grupo Kuo Bundle

Unveiling the Mechanics of Grupo Kuo: How Does It Thrive?

Grupo Kuo, a prominent Mexican conglomerate, casts a long shadow across the global industrial landscape. With a presence in over 70 countries and a workforce exceeding 23,000, understanding the inner workings of this Grupo Kuo SWOT Analysis is crucial. Its diversified portfolio, spanning consumer products, chemicals, and automotive components, makes it a fascinating case study for investors and analysts alike. Recent strategic moves, like the sale of its Aftermarket Business, further highlight the dynamic nature of the Kuo company.

This strategic divestment, announced in January 2025, underscores Grupo Kuo's commitment to optimizing its capital structure and strategic investments. By examining its core operations, revenue streams, and competitive advantages, we can gain a deeper understanding of this Mexican conglomerate's resilience and future prospects. This comprehensive analysis will provide valuable insights into the Grupo Kuo business model and its impact on the Mexican economy, making it a must-read for anyone interested in the Kuo company.

What Are the Key Operations Driving Grupo Kuo’s Success?

The core operations of Grupo Kuo, a prominent Kuo company, are structured around two primary segments: Consumer and Industrial. This Grupo Kuo business model allows for diversification and synergy across various sectors. The Consumer segment focuses on food production, while the Industrial segment encompasses chemicals and automotive components.

The Consumer segment includes pork meat production and processed foods, leveraging extensive agricultural processes and a robust distribution network. The Industrial segment is divided into chemicals and automotive units, manufacturing plastics, chemical applications, and automotive transmissions. These segments rely on complex manufacturing processes and strong relationships with various industries.

Grupo Kuo's operational approach is unique due to its integrated and diversified structure. This allows the company to capitalize on market opportunities and maintain resilience. The company's strategic focus on exports and efficient manufacturing contributes to its strong market position.

The Consumer segment primarily deals with pork meat production and processed foods. This involves agricultural processes, food processing, and a comprehensive distribution network. The segment's reach extends to both domestic and international markets, including significant exports to Japan, South Korea, and the U.S. The segment operates under brands like Keken, and also includes processed foods and beverages through its joint venture with Herdez Del Fuerte.

The Industrial segment is divided into chemicals and automotive units. The chemicals unit manufactures plastics and chemical applications. The automotive segment focuses on producing and selling transmissions and components under brands such as Tremec, Moresa, and TF Victor. This segment relies on precision manufacturing and advanced technology.

Grupo Kuo's value proposition centers on providing a wide range of essential products and market differentiation. This is achieved through efficient manufacturing, strategic joint ventures, and a broad distribution network. The company's ability to adapt and gain market share, as demonstrated by its chemical business, highlights its resilience.

Grupo Kuo benefits from a strong export focus, particularly in the pork meat segment, reducing reliance on a single geographic market. The company’s operational resilience and adaptability are key strengths. The company's strategic approach enhances its ability to navigate market challenges and capitalize on opportunities.

Grupo Kuo demonstrates several key strengths that contribute to its success. These include a diversified business model, a strong export focus, and efficient manufacturing capabilities. These strengths allow the company to maintain a competitive edge in the market.

- Diversified Business Model: Operates in both Consumer and Industrial segments, reducing risk.

- Strong Export Focus: Significant exports to various countries, including Japan and the U.S.

- Efficient Manufacturing: Focus on efficient processes and strategic joint ventures.

- Adaptability: Demonstrated ability to adapt to market changes and gain market share.

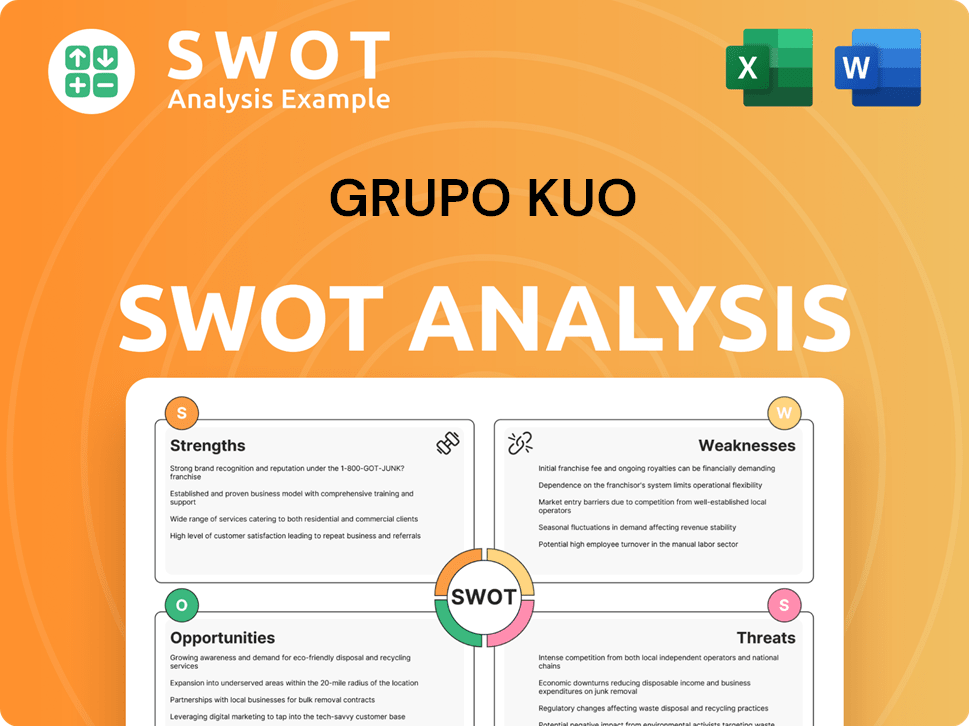

Grupo Kuo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Grupo Kuo Make Money?

Understanding the revenue streams and monetization strategies of Grupo Kuo is crucial for grasping its financial performance. The Kuo company generates revenue primarily through the sale of products within its Consumer and Industrial segments, showcasing a diversified approach to income generation. This strategy allows Grupo Kuo business to maintain a strong market presence and adapt to economic shifts.

As of the 12 months ended September 30, 2024, Grupo Kuo reported approximately MXN 37 billion in revenue. For the full year 2024, the company's annual revenue reached around $52 billion Mexican pesos (MXN). The first quarter of 2025 saw revenue climb to MXN 9.04 billion, a 10% increase compared to Q1 2024, demonstrating consistent growth.

The Consumer segment, primarily driven by the pork meat business, saw a 15.7% increase in revenue during Q4 2024, reaching MXN 8,285 million, due to increased sales prices and volume. The Industrial segment, encompassing chemicals and automotive, experienced a 9.5% revenue growth in Q4 2024, reaching MXN 5,236 million, mainly due to higher prices and volumes in chemical applications. Exports played a significant role, accounting for 52% of total revenue in Q4 2024.

Grupo Kuo employs several strategies to generate and optimize revenue. These include leveraging joint ventures and adapting to market dynamics. The company's ability to adjust prices and manage costs is also a key factor in its financial success. You can learn more about the target market of Grupo Kuo by reading this article: Target Market of Grupo Kuo.

- The Consumer segment's pork meat business is expected to increase exports up to 45% of total sales in 2025, focusing on markets like Japan, South Korea, and the U.S.

- The Industrial segment benefits from higher prices and volumes in chemical applications like adhesives, tires, and food packaging.

- The divestment of the Aftermarket Business in January 2025 for about $370 million is a strategic move to strengthen its capital structure, with proceeds going towards debt reduction and strategic investments.

- The transmissions segment experienced a 4.3% drop in revenue for 2024, with a projected growth of 5.7% for 2025.

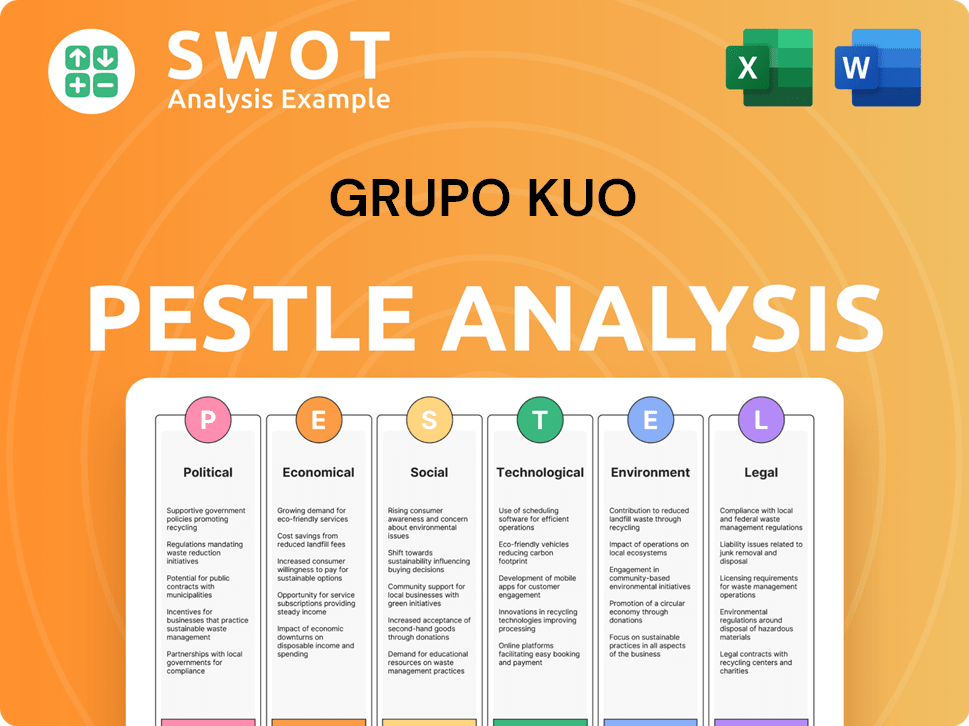

Grupo Kuo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Grupo Kuo’s Business Model?

The evolution of Grupo Kuo, a prominent Mexican conglomerate, showcases a series of strategic moves and key milestones. These actions have significantly shaped its operational structure and financial outcomes. A recent and pivotal development includes the divestiture of its Aftermarket Business to Frasle Mobility, finalized in January 2025.

This strategic maneuver, valued at approximately $370 million, aims to streamline Kuo company's portfolio. It also strengthens its financial position through debt reduction and lessens its exposure to the volatile auto suppliers sector. Grupo Kuo business has demonstrated resilience and adaptability in various sectors, including chemicals and consumer goods, contributing to its competitive edge.

Operationally, Grupo Kuo continues to adapt to market dynamics. The company's diversified approach across consumer, chemical, and automotive sectors provides a natural hedge against industry-specific fluctuations, supporting its long-term sustainability and growth.

The divestiture of the Aftermarket Business to Frasle Mobility in January 2025 for $370 million. This strategic move is aimed at optimizing the company's portfolio. The company's focus is on debt prepayment and reducing exposure to the volatile auto suppliers industry.

Expansion in the pork meat segment with MXN 1.6 billion in capital expenditures planned for 2025. This investment includes new farms and processing plants. The company continually adapts to market trends, such as the electrification strategy under review in its industrial sector.

Diversified business model across consumer, chemical, and automotive sectors. Strong presence in over 70 countries and significant export revenues, with 48% of total revenue as of September 30, 2024. Focus on value-added applications in its chemical businesses and strong product demand in Asia for its pork meat.

Chemicals business showed resilience in 2024, driven by higher volumes and prices. The pork meat business saw a 102% increase in EBITDA during Q3 2024 compared to Q3 2023. This increase was fueled by operational efficiencies and favorable price and cost dynamics.

Grupo Kuo benefits from its diversified business model, which includes consumer, chemical, and automotive sectors. This diversification helps to mitigate risks associated with industry-specific fluctuations. The company’s global presence and strategic focus on value-added products further enhance its competitive position in the market.

- Diversified business model across consumer, chemical, and automotive sectors.

- Strong presence in over 70 countries and significant export revenues.

- Focus on value-added applications in its chemical businesses.

- Strong product demand in Asia for its pork meat.

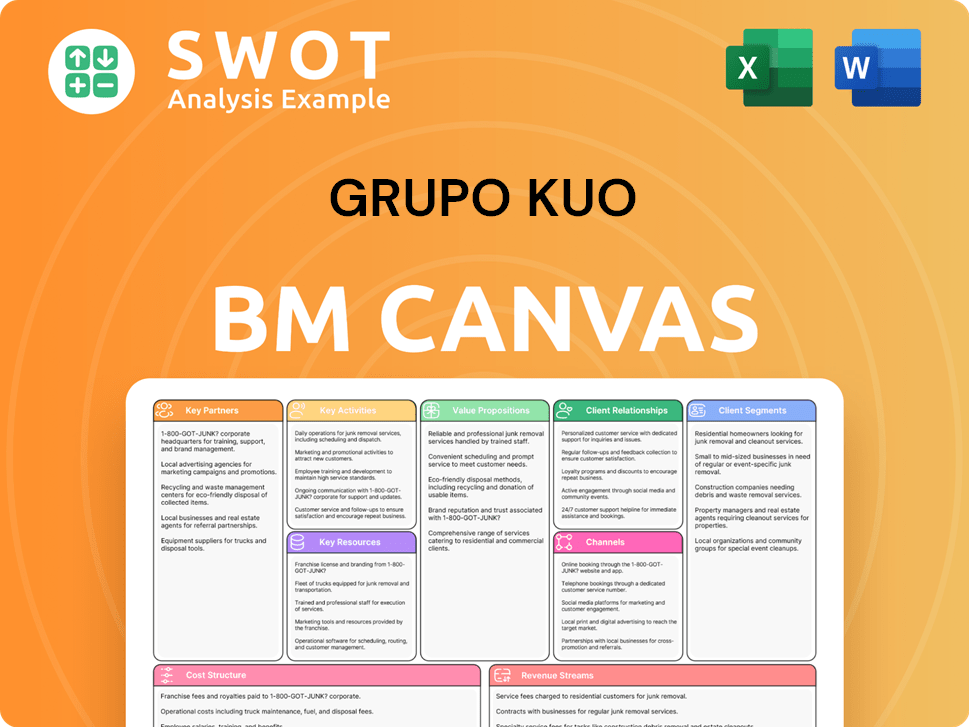

Grupo Kuo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Grupo Kuo Positioning Itself for Continued Success?

The Kuo company holds a significant position within Mexico and globally, operating in over 70 countries. Its diverse business model spans consumer goods, chemicals, and automotive sectors, providing a degree of stability. The Grupo Kuo business is a leading player in the pork meat industry in Mexico and a major exporter.

However, Grupo Kuo faces several challenges, including volatile raw material prices and currency fluctuations. Competition in the chemical sector and higher labor costs are also significant factors. Despite these risks, the company is focused on strategic initiatives to boost profitability and maintain its market position.

The Grupo Kuo business maintains a strong presence in Mexico and globally. Its diversified portfolio across consumer, chemical, and automotive sectors helps to stabilize its market position. For instance, the pork meat segment is a leader in Mexico and a significant exporter.

Risks include volatility in raw material prices, especially for grains and soy paste. Fluctuations in foreign exchange rates also pose a risk. Softer demand in the transmission business and intense competition in the chemical sector are other key challenges.

The company expects 12.6% revenue growth in 2025. Strategic initiatives include expanding the pork meat segment and focusing on operational efficiencies. The sale of the Aftermarket Business is expected to improve credit metrics.

The company aims to maintain EBITDA margins above 10% and a weighted debt to EBITDA around 2.5x. Capital expenditures are planned for 2025, mainly to expand capacity in the pork meat segment. The company's focus is on sustaining financial performance.

The Kuo company is focused on strategic initiatives to sustain and expand profitability. These initiatives include capacity expansion and operational efficiencies. The company is also focused on strategic portfolio optimization.

- Expansion of the pork meat segment.

- Focus on operational efficiencies.

- Strategic portfolio optimization.

- Improvement of credit metrics through asset sales.

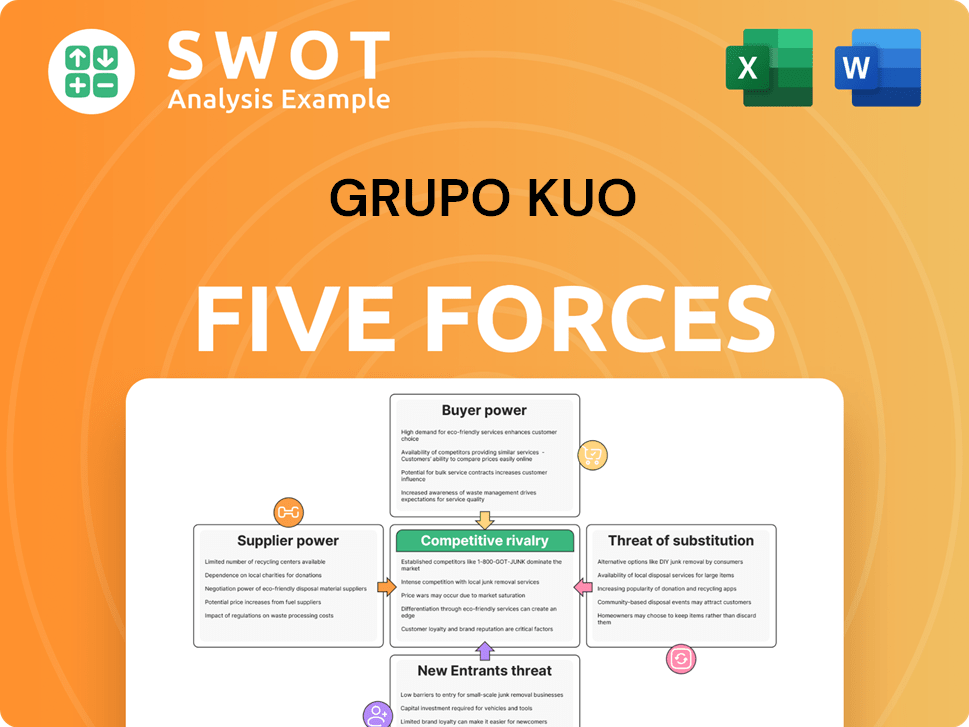

Grupo Kuo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grupo Kuo Company?

- What is Competitive Landscape of Grupo Kuo Company?

- What is Growth Strategy and Future Prospects of Grupo Kuo Company?

- What is Sales and Marketing Strategy of Grupo Kuo Company?

- What is Brief History of Grupo Kuo Company?

- Who Owns Grupo Kuo Company?

- What is Customer Demographics and Target Market of Grupo Kuo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.