Grupo Kuo Bundle

Can Grupo Kuo Continue Its Ascent in the Global Market?

Grupo Kuo, a Mexican industrial powerhouse, has consistently reshaped its trajectory through strategic maneuvers across diverse sectors. From its humble beginnings in 1973, the company has evolved into a significant international player. This article delves into Grupo Kuo's ambitious Grupo Kuo SWOT Analysis and its future prospects, exploring how it plans to leverage strategic initiatives for sustained growth.

Understanding Grupo Kuo's growth strategy is crucial for investors and business strategists alike. The company's ability to adapt and innovate within the chemicals, automotive, food, and polymers industries showcases its resilience and forward-thinking approach. Analyzing Grupo Kuo's business performance, including its expansion plans and recent acquisitions, provides valuable insights into its potential for future success. Furthermore, a deep dive into Grupo Kuo's long-term strategy reveals its commitment to maintaining its market share and exploring new revenue streams.

How Is Grupo Kuo Expanding Its Reach?

The growth strategy of Grupo Kuo involves a multi-faceted approach, focusing on strategic acquisitions, geographical diversification, and enhancing its product portfolio. These initiatives are designed to strengthen its market position and capitalize on emerging opportunities in various sectors. The company's expansion plans are particularly evident in its automotive, chemical, and food segments, reflecting a commitment to sustainable growth and increased shareholder value.

In 2024, Grupo Kuo continued to pursue opportunities to expand its global footprint, especially in the automotive and chemical sectors. This includes entering new markets and forming strategic partnerships to leverage existing distribution networks and regulatory expertise. The company's investments are geared towards accessing new customer segments, enhancing technological capabilities, and maintaining a competitive edge in rapidly evolving industries. These efforts are supported by specific milestones tied to increased production capacities and market share gains targeted for late 2025.

A key aspect of Grupo Kuo's strategy involves expanding its pork production capacity and processing facilities through its subsidiary, Kekén. This expansion aims to increase export volumes to key markets like Japan and China. The company's commitment to diversifying its revenue streams beyond its traditional markets is evident in these investments. Furthermore, Grupo Kuo is continuously evaluating potential mergers and acquisitions that align with its core competencies and offer synergistic benefits, particularly in the specialty chemicals and polymer sectors. For a deeper dive into the company's financial structure, consider exploring Revenue Streams & Business Model of Grupo Kuo.

Dacomsa, Grupo Kuo's automotive components division, is targeting expansion in Asia and Europe to meet the growing demand for electric vehicle components. This includes strategic partnerships and direct market entry. The focus is on leveraging existing distribution networks and regulatory expertise to enhance market penetration and achieve growth.

Kekén, the food subsidiary, is increasing its pork production capacity and processing facilities. The goal is to boost export volumes to key markets like Japan and China. This expansion supports the rising global demand for protein and diversifies revenue streams.

Grupo Kuo continuously evaluates mergers and acquisitions in the specialty chemicals and polymer sectors. These moves aim to access new customer segments and enhance technological capabilities. The focus is on maintaining a competitive edge in rapidly evolving industries.

The company is actively pursuing geographical diversification, particularly in Asia and Europe. This involves direct market entry and strategic partnerships. The aim is to capitalize on growth opportunities and reduce reliance on traditional markets.

Grupo Kuo's expansion strategy is built on strategic acquisitions, geographical diversification, and enhancing its product portfolio. These initiatives are designed to strengthen its market position and capitalize on emerging opportunities. Specific milestones include increased production capacities and market share gains targeted for late 2025.

- Expansion in Automotive Components: Focusing on electric vehicle components and advanced materials in Asia and Europe.

- Food Sector Growth: Increasing pork production capacity and processing facilities to boost exports to key markets.

- Strategic Acquisitions: Evaluating mergers and acquisitions in specialty chemicals and polymer sectors.

- Geographical Diversification: Targeting new markets to reduce reliance on traditional markets.

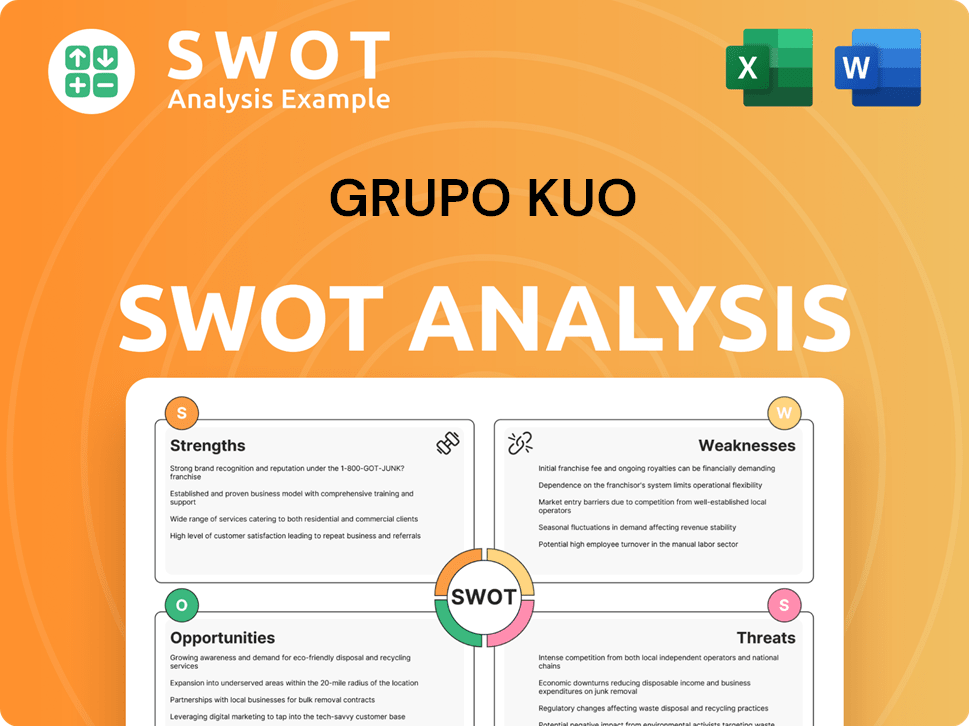

Grupo Kuo SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Grupo Kuo Invest in Innovation?

Innovation and technology are central to the Grupo Kuo's growth strategy. The company heavily invests in research and development across its diverse business units. These efforts are crucial for staying competitive and meeting evolving market demands.

The company focuses R&D on new materials, improving production processes, and enhancing product performance. This approach allows Grupo Kuo to create differentiated products and improve operational efficiency. Their commitment to innovation is a key driver of their long-term success.

Sustainability is a significant focus, particularly in the polymer division. Grupo Kuo is actively developing bio-based plastics and recycled content solutions. New product lines are expected to be introduced in 2025, reflecting the company's commitment to environmentally friendly materials.

Grupo Kuo allocates a significant portion of its resources to R&D. These investments support the development of innovative products and processes. The company's R&D spending is a key indicator of its commitment to long-term growth.

Digital transformation is a core element of Grupo Kuo's strategy. The company implements advanced analytics and artificial intelligence (AI) in its manufacturing operations. This enhances efficiency and quality control.

Grupo Kuo utilizes IoT sensors for real-time monitoring of production lines. Predictive maintenance algorithms minimize downtime. These technologies contribute to operational excellence and cost savings.

Innovation in the automotive sector focuses on lightweight materials and advanced composites for electric vehicles. The company aims to secure new contracts with major automakers. This supports their expansion plans.

Grupo Kuo consistently pursues patents for novel products and processes. This solidifies its position as a leader in its industries. Patents directly contribute to its long-term growth objectives.

Grupo Kuo collaborates with leading universities and research institutions. These partnerships facilitate the development of cutting-edge technologies. This collaborative approach enhances its innovation capabilities.

Grupo Kuo's technology initiatives are designed to drive both product innovation and operational efficiency. These initiatives support the company's long-term strategic goals, ensuring it remains competitive in its core markets. These efforts are crucial for the company's future outlook.

- Development of bio-based plastics and recycled content solutions.

- Implementation of AI and advanced analytics in manufacturing.

- Use of IoT sensors and predictive maintenance algorithms.

- Focus on lightweight materials for electric vehicles.

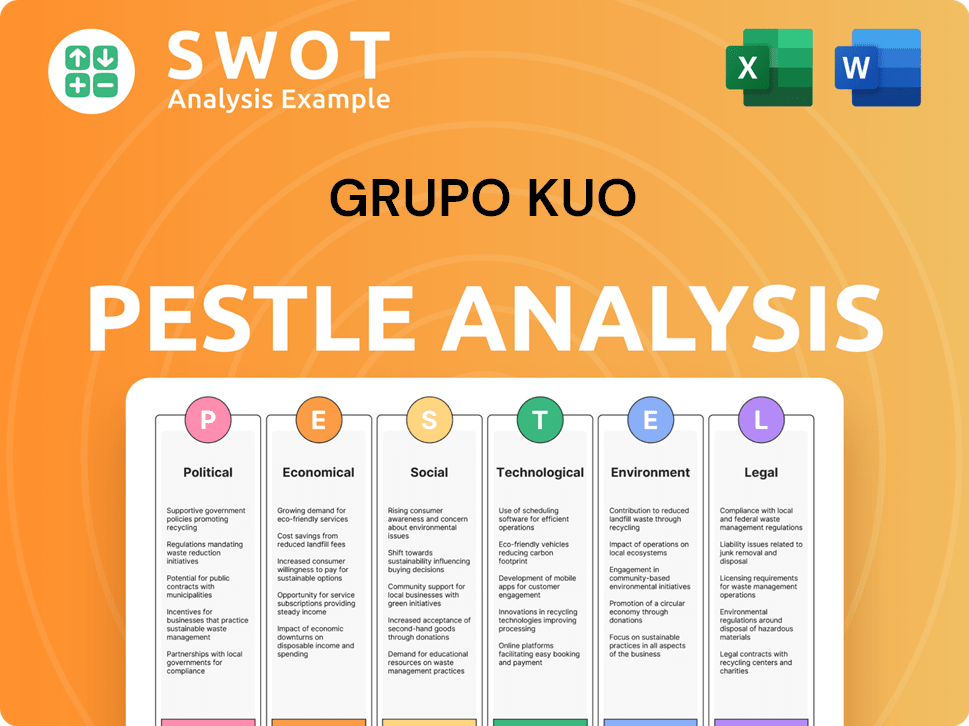

Grupo Kuo PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Grupo Kuo’s Growth Forecast?

The financial outlook for Grupo Kuo reflects a strategic emphasis on sustained expansion and profitability across its varied business segments. Recent financial reports and analyst projections for 2024 and 2025 suggest continued revenue growth, driven by strategic initiatives within its automotive, food, and chemical divisions. This growth trajectory is a key component of the Brief History of Grupo Kuo, highlighting its evolution and strategic shifts over time.

For the full year 2024, Grupo Kuo anticipates a revenue increase of approximately 8-10% compared to 2023. This increase is supported by operational efficiencies and a favorable product mix. The company aims to maintain an EBITDA margin in the range of 12-14%, underscoring its commitment to robust operational performance and financial discipline. This performance is crucial for understanding Grupo Kuo's financial health.

Investment levels are expected to remain strong, with capital expenditures primarily focused on capacity expansion in its food division (Kekén) and technological advancements in its chemical and automotive businesses. Grupo Kuo's long-term financial objectives include strengthening its balance sheet, optimizing its debt structure, and generating consistent free cash flow to support future growth and shareholder returns. These objectives are integral to Grupo Kuo's long term strategy.

Grupo Kuo projects a revenue increase of approximately 8-10% for 2024. This growth is driven by expansion initiatives in its automotive, food, and chemical segments. The company's strategic initiatives are designed to enhance its overall financial performance.

The company aims to maintain an EBITDA margin in the range of 12-14%. This target reflects a commitment to strong operational performance and financial management. Achieving this margin is key to Grupo Kuo's financial health.

Capital expenditures will focus on capacity expansion in the food division (Kekén) and technological upgrades in the chemical and automotive businesses. These investments are crucial for supporting future growth and innovation. These investments are key to Grupo Kuo's expansion plans.

Long-term financial goals include strengthening the balance sheet, optimizing debt, and generating consistent free cash flow. These goals are designed to support future growth and shareholder returns. These goals are integral to Grupo Kuo's strategic initiatives.

Grupo Kuo's revenue streams are diversified across its automotive, food, and chemical segments. The automotive segment includes the production and sale of auto parts. The food segment focuses on pork production (Kekén). The chemical segment involves the manufacturing and distribution of various chemical products.

The investment portfolio is primarily focused on capacity expansion and technological upgrades. Capital expenditures are strategically allocated to maximize returns and support long-term growth. These investments are critical for Grupo Kuo's future outlook.

Grupo Kuo is committed to sustainability efforts across its operations. These efforts include environmental initiatives and responsible business practices. Sustainability is a key aspect of Grupo Kuo's overall strategy.

The company operates in the automotive, food, and chemical industries, each with its own dynamics and competitive landscape. Market analysis informs strategic decisions and helps in adapting to industry trends. Understanding the industry is crucial for Grupo Kuo's performance.

Grupo Kuo may consider strategic acquisitions to expand its market presence and diversify its portfolio. Any acquisitions will be carefully evaluated to ensure they align with the company's strategic goals. Acquisitions are part of Grupo Kuo's growth strategy.

The long-term strategy focuses on sustainable growth, profitability, and shareholder value creation. This involves prudent capital allocation, operational excellence, and strategic investments. Grupo Kuo's long term strategy is designed for sustained success.

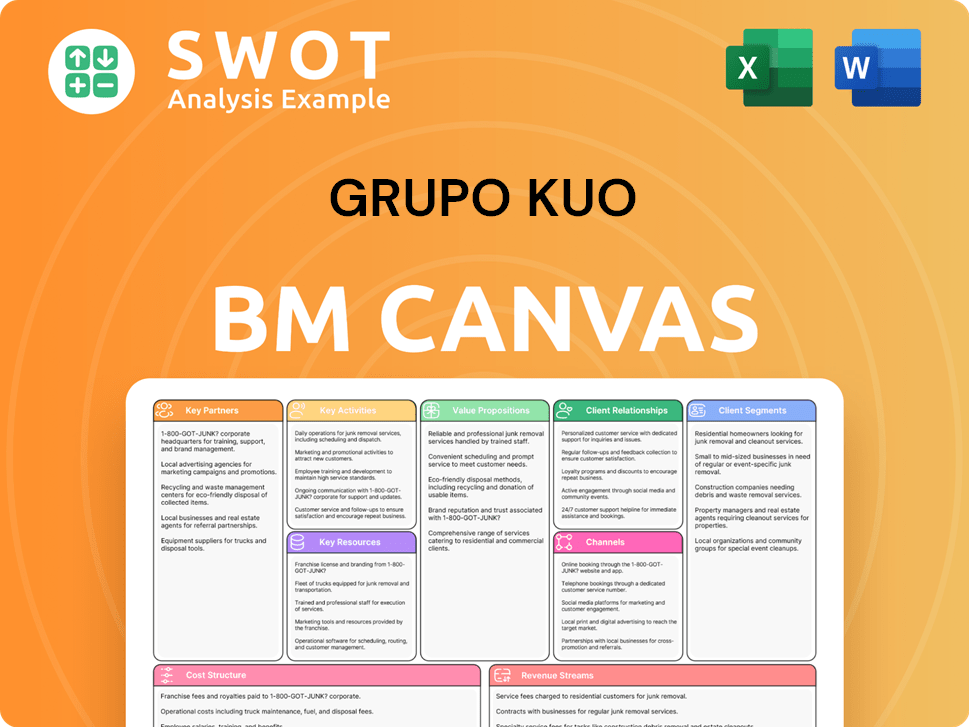

Grupo Kuo Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Grupo Kuo’s Growth?

Evaluating the potential risks and obstacles is crucial for understanding the future of Grupo Kuo. The company's Growth Strategy and overall success are influenced by various external and internal factors. These factors can create challenges that need careful management to ensure sustained Grupo Kuo Future growth.

Grupo Kuo Business operations face several strategic and operational risks. The competitive landscape, regulatory changes, supply chain vulnerabilities, and technological disruptions are potential obstacles that require proactive strategies. Addressing these challenges is essential for maintaining Grupo Kuo Performance and achieving its strategic objectives.

Market competition presents a significant challenge for Grupo Kuo, especially in the chemical and automotive components sectors. The presence of numerous global players intensifies the pressure to innovate and maintain market share. Furthermore, regulatory changes, such as stricter emissions standards, could increase compliance costs and restrict market access. For example, the automotive industry is experiencing rapid technological advancements, and Grupo Kuo Investments must adapt to new standards.

The chemical and automotive components sectors are highly competitive, with numerous global players. This intense competition necessitates continuous innovation and efficiency improvements. Maintaining a competitive edge requires strategic investments and a focus on operational excellence.

Changes in environmental regulations and international trade policies can significantly impact Grupo Kuo. Compliance costs may increase, and market access could be restricted, affecting profitability. Adapting to these changes requires proactive risk management and strategic planning.

Disruptions in the supply chain can affect the availability and cost of raw materials. This can impact production schedules and profit margins. Diversifying suppliers and implementing robust risk management strategies are crucial for mitigating these risks.

Technological advancements can render existing products or processes obsolete. Grupo Kuo must invest in research and development and adapt quickly to stay competitive. Failure to innovate could lead to a loss of market share and reduced profitability.

Economic downturns and fluctuations in currency exchange rates can impact Grupo Kuo. These economic factors can affect both demand and production costs. Diversification and financial hedging can help to mitigate these risks.

Geopolitical instability and trade disputes can affect Grupo Kuo's international operations. These risks require careful monitoring and strategic adjustments. Diversifying markets and supply chains can reduce exposure to specific geopolitical risks.

Grupo Kuo addresses these risks through a diversified business portfolio, reducing dependence on any single sector. The company employs robust risk management frameworks, including scenario planning and contingency measures. Furthermore, by fostering strong supplier relationships and continuously monitoring global market dynamics, Grupo Kuo aims to mitigate potential negative impacts.

To navigate these challenges, Grupo Kuo must focus on several key areas. Investing in research and development will be critical to ensure that its products and processes remain competitive. Additionally, strengthening supply chain resilience through diversification and strategic partnerships will be vital. For more insights, consider reading about the Target Market of Grupo Kuo.

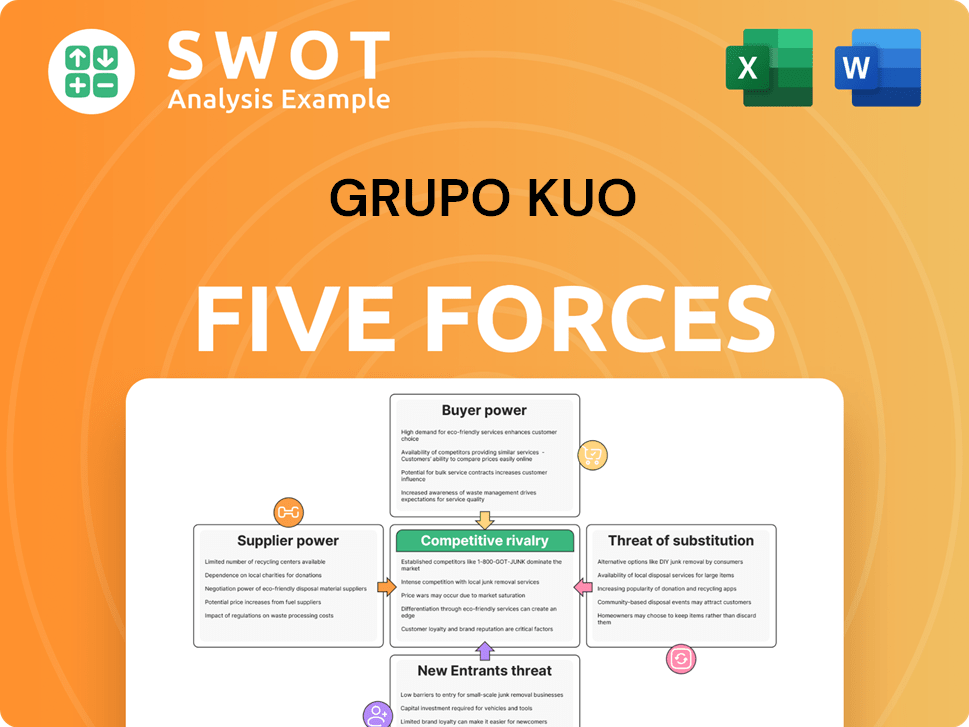

Grupo Kuo Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Grupo Kuo Company?

- What is Competitive Landscape of Grupo Kuo Company?

- How Does Grupo Kuo Company Work?

- What is Sales and Marketing Strategy of Grupo Kuo Company?

- What is Brief History of Grupo Kuo Company?

- Who Owns Grupo Kuo Company?

- What is Customer Demographics and Target Market of Grupo Kuo Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.