Larsen & Toubro Bundle

How Does Larsen & Toubro Dominate the Competitive Landscape?

Larsen & Toubro (L&T) stands as a titan in India's infrastructure and industrial sectors, but how does it fare in the cutthroat global market? This exploration dives deep into the Larsen & Toubro SWOT Analysis and the competitive dynamics shaping its future. Understanding the Competitive Landscape is crucial for investors, analysts, and strategists alike.

This detailed Industry Analysis will dissect L&T's Market Share, pinpoint its key rivals, and examine its Business Strategy to navigate the complex challenges. We'll explore crucial questions such as "Who are the main rivals of Larsen & Toubro?" and "How does L&T compare to its peers?" to provide actionable insights for informed decision-making. Analyzing L&T's competitive environment in infrastructure is essential for understanding its long-term growth prospects.

Where Does Larsen & Toubro’ Stand in the Current Market?

Larsen & Toubro (L&T) holds a prominent position in India's infrastructure and engineering sectors. The company is a leading player in large-scale Engineering, Procurement, and Construction (EPC) projects, particularly in infrastructure, power, and heavy engineering. Target Market of Larsen & Toubro reveals that L&T Construction, a major arm of the company, is a key participant in significant national infrastructure projects, underscoring its strong market presence.

L&T's core operations span various critical sectors. These include infrastructure (roads, railways, metros, airports, ports, and water treatment), heavy engineering (defense, aerospace, and nuclear power), and power (thermal and gas-based power plants). Furthermore, L&T Technology Services and Mindtree (post-merger) represent its substantial presence in technology services, catering to a global clientele. The company's diverse portfolio and integrated capabilities are key differentiators in the competitive landscape.

As of March 31, 2024, L&T's order book stood at a robust ₹4,76,000 crore, demonstrating strong future revenue visibility and market demand for its services. This substantial order book highlights its strong competitive position and client trust. L&T's financial health remains strong, with a consolidated revenue of ₹2,21,113 crore for the fiscal year ended March 31, 2024, representing a year-on-year growth of 17%.

L&T consistently ranks as a dominant force in India's infrastructure and engineering sectors. While specific market share figures vary across its diverse operations, the company's influence is undeniable in large-scale EPC projects. Its strong market position is supported by a substantial order book and robust financial performance.

L&T operates across several key business segments, including infrastructure, heavy engineering, power, and technology services. Each segment contributes significantly to the company's overall revenue and market presence. The company's diversified portfolio helps mitigate risks and capitalize on various market opportunities.

While India remains L&T's core market, the company has a significant international presence. It has a substantial footprint in the Middle East, Africa, and Southeast Asia. International operations contribute substantially to its overall revenue and growth.

L&T's competitive advantages include its integrated capabilities, technical expertise, and strong financial position. The company excels in complex, large-scale, and high-value projects. Strategic diversification and digital transformation also contribute to its competitive edge.

L&T's competitive strategy focuses on leveraging its core strengths in engineering and construction. The company emphasizes innovation, digital transformation, and diversification to maintain its market leadership. L&T continues to invest in technology and expand its service offerings to meet evolving market demands.

- Focus on large-scale EPC projects.

- Strategic diversification into technology-driven solutions.

- Strong emphasis on digital transformation across operations.

- Expansion of international operations to drive growth.

Larsen & Toubro SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Larsen & Toubro?

The competitive landscape for Larsen & Toubro (L&T) is multifaceted, encompassing various sectors where it operates. Understanding the Larsen & Toubro competitive landscape is crucial for investors and strategists alike, as it directly impacts the company's market share and financial performance. This analysis involves a deep dive into the key competitors across different business segments, assessing their strengths, weaknesses, and strategic positioning.

L&T's diverse portfolio means it faces competition from a broad spectrum of companies, ranging from domestic giants to international players. The competitive dynamics are constantly evolving, influenced by factors such as project bidding, technological advancements, and strategic alliances. An in-depth industry analysis is essential to understand the competitive pressures and opportunities that shape L&T's business strategy.

Larsen & Toubro's operations span several key sectors, each with its own set of competitors. Understanding these competitive dynamics is vital for assessing L&T's market position and future growth prospects. For a deeper understanding of the company's origins, you can read more in this Brief History of Larsen & Toubro.

In the infrastructure and construction sector, L&T's primary competitors in India include Tata Projects, Shapoorji Pallonji Group, and Afcons Infrastructure. These companies compete on project bids, execution speed, and specialized capabilities. Competition is particularly intense in urban infrastructure projects like metro rail and smart city developments.

In heavy engineering and defense, L&T competes with Bharat Heavy Electricals Limited (BHEL) and global engineering firms. The defense sector sees competition with both private and government-owned entities for lucrative contracts. These contracts often require advanced technological capabilities and adherence to strict specifications.

L&T Technology Services and Mindtree (formerly L&T Infotech) compete with major IT services companies like Tata Consultancy Services (TCS), Infosys, Wipro, and HCLTech. These companies compete on digital transformation expertise, industry-specific solutions, and global delivery models. The competitive landscape includes niche players in renewable energy EPC and advanced manufacturing.

L&T's market share varies across its business segments. In infrastructure, L&T often competes with Tata Projects and Shapoorji Pallonji for large-scale projects. In IT services, L&T faces established players like TCS and Infosys. The ability to secure and execute projects efficiently is key to maintaining and growing market share.

L&T's competitive advantages include its diversified portfolio, strong project execution capabilities, and brand reputation. Its ability to handle large and complex projects gives it an edge. However, competitors often leverage regional strengths or technological partnerships to gain an advantage in specific projects.

Mergers and alliances continually reshape the competitive dynamics, especially in the IT services sector. These strategic moves lead to larger, more integrated competitors. These alliances can also provide access to new technologies and markets, influencing the overall competitive landscape.

Competitive challenges for Larsen & Toubro include intense price competition, especially in infrastructure projects. The need to continually invest in new technologies and talent is crucial. Maintaining project execution efficiency and managing costs are also critical factors.

- Price Competition: Intense bidding wars on infrastructure projects.

- Technological Advancements: Keeping pace with digital transformation and new technologies.

- Talent Acquisition: Attracting and retaining skilled professionals.

- Project Execution: Ensuring timely and efficient project delivery.

Larsen & Toubro PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Larsen & Toubro a Competitive Edge Over Its Rivals?

Analyzing the Larsen & Toubro (L&T) competitive landscape involves understanding its core strengths and how they stack up against its rivals. L&T has built a solid reputation over the years, establishing itself as a major player in various sectors. A deep dive into its competitive advantages reveals the strategies and capabilities that have helped it maintain its market position.

L&T's success is significantly influenced by its ability to execute large, complex projects. The company's expertise extends across diverse sectors, including infrastructure, energy, and defense. This diverse portfolio allows it to tap into various market opportunities and mitigate risks. The company's financial health also plays a crucial role, providing the resources needed for large-scale projects and strategic investments.

Understanding the competitive advantages of L&T is crucial for anyone looking at the Larsen & Toubro competitors analysis. It provides insights into the company's strategic positioning and its ability to compete effectively in the market. The following sections will delve deeper into the key factors that contribute to L&T's competitive edge.

L&T excels in executing large, complex Engineering, Procurement, and Construction (EPC) projects. This capability is a significant barrier to entry for many competitors. The company's expertise in managing complex projects across diverse sectors, such as infrastructure and energy, is a key differentiator. This is a critical factor in the L&T market position in construction.

L&T possesses proprietary technologies and deep engineering expertise. This allows it to undertake projects that are beyond the capabilities of many competitors. The company's focus on research and development supports its technological advancements. This technological edge is crucial for L&T's competitive strategy analysis.

L&T's strong brand reputation and customer loyalty are significant advantages. The company's reputation for quality and reliability fosters strong relationships with clients. This often leads to repeat business and preferred bidder status. This contributes to L&T's ability to maintain and grow its market share.

L&T benefits from substantial economies of scale, particularly in procurement and project management. This allows it to optimize costs and offer competitive pricing. Efficient cost management is essential for profitability and competitiveness. This is a key factor in L&T's financial performance compared to competitors.

L&T leverages several key advantages to maintain its market position. These include its extensive experience, integrated capabilities, and robust financial health. These factors collectively set L&T apart from its rivals, allowing it to secure and execute complex projects efficiently.

- Extensive Experience: Decades of experience in diverse sectors.

- Integrated Capabilities: EPC capabilities across various sectors.

- Robust Financial Health: Provides resources for large-scale projects.

- Strong Brand Reputation: Fosters customer loyalty and repeat business.

- Economies of Scale: Enables cost optimization and competitive pricing.

Larsen & Toubro Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Larsen & Toubro’s Competitive Landscape?

The competitive landscape for L&T is shaped by evolving industry trends, presenting both challenges and opportunities. These dynamics require strategic adaptability to maintain and enhance its market position. Understanding these factors is crucial for evaluating Larsen & Toubro's future prospects and its ability to sustain growth in a competitive environment. This includes assessing its L&T market position in construction and its overall Larsen & Toubro industry overview.

L&T faces potential threats like intense price competition and project delays. However, it also has growth opportunities in emerging markets and product innovations. Strategic partnerships are key to accessing new markets and technologies. Digital transformation and sustainable solutions are key parts of L&T's strategy. The company's ability to navigate these elements will determine its long-term success. For a deeper dive into Larsen & Toubro's business model, consider reading Revenue Streams & Business Model of Larsen & Toubro.

Digital construction, including BIM and AI, is a significant trend. Regulatory changes regarding environmental norms and infrastructure development are also crucial. The push towards renewable energy offers opportunities. These factors influence L&T's strategic direction.

Intense price competition, especially from Asian players, poses a threat. Project delays due to land acquisition and regulatory hurdles are also challenges. Shifts in government spending priorities could impact the order book. These challenges require proactive risk management.

Growth in emerging markets, particularly in developing nations, offers significant potential. Product innovations in modular construction and smart grids provide avenues for diversification. Strategic partnerships can help access new markets and technologies. These opportunities can boost L&T's growth.

L&T is deploying digital transformation and sustainable solutions strategies. Strengthening its international footprint is another key focus. These strategies aim to ensure resilience and capitalize on opportunities. This will help in maintaining a strong L&T's competitive environment in infrastructure.

L&T has a strong presence in infrastructure, power, and defense. Its competitive advantages include a diversified portfolio and strong execution capabilities. The company focuses on innovation and strategic partnerships. This positions L&T well against its Larsen & Toubro competitors analysis.

- Focus on digital transformation and sustainable solutions.

- Expansion in emerging markets.

- Strategic partnerships to access new technologies.

- Continuous investment in workforce upskilling.

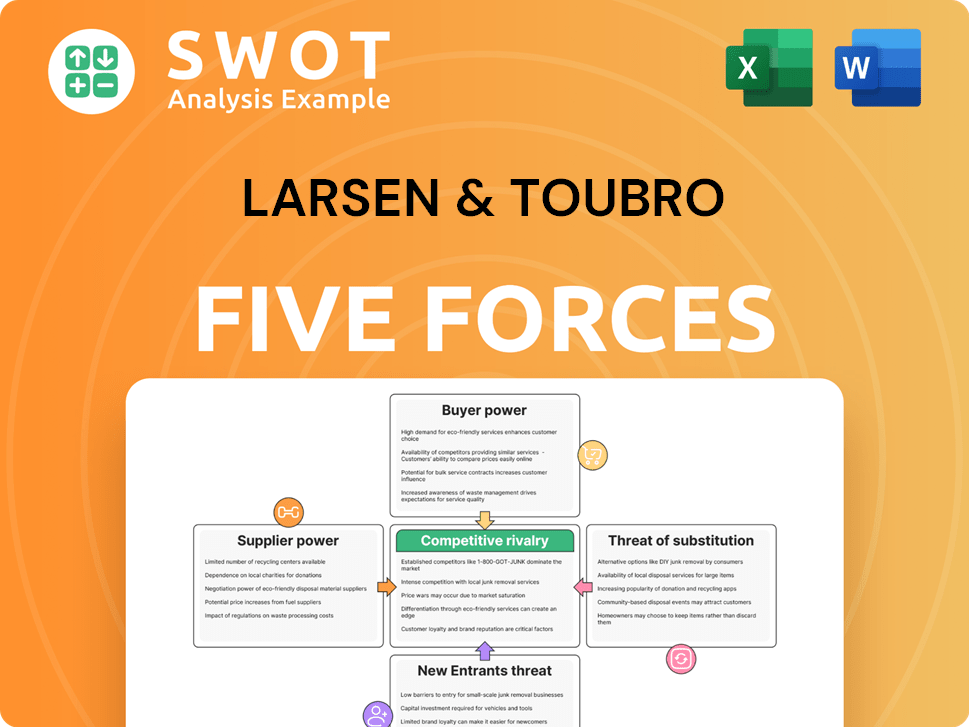

Larsen & Toubro Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Larsen & Toubro Company?

- What is Growth Strategy and Future Prospects of Larsen & Toubro Company?

- How Does Larsen & Toubro Company Work?

- What is Sales and Marketing Strategy of Larsen & Toubro Company?

- What is Brief History of Larsen & Toubro Company?

- Who Owns Larsen & Toubro Company?

- What is Customer Demographics and Target Market of Larsen & Toubro Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.