Larsen & Toubro Bundle

Can Larsen & Toubro Continue Its Ascent?

Larsen & Toubro (L&T), a titan of the Indian industrial landscape, boasts a rich history and a dynamic Larsen & Toubro SWOT Analysis that has fueled its remarkable growth. From its inception representing Danish dairy equipment manufacturers to its current status as a global EPC powerhouse, L&T's journey is a testament to strategic adaptability. This report dives deep into the

Understanding the

How Is Larsen & Toubro Expanding Its Reach?

The growth strategy of Larsen & Toubro (L&T) is heavily reliant on its expansion initiatives. These include entering new markets, diversifying its product offerings, and strategic mergers and acquisitions. This approach is designed to strengthen its market position and enhance its overall financial performance.

L&T's focus on international markets is a key component of its growth strategy. The company is actively pursuing opportunities in various regions, particularly in the Middle East, to capitalize on infrastructure development projects. This strategic direction supports its goal of sustained growth and increased market share.

The company's growth strategy is further supported by diversification into emerging sectors and strategic investments. These initiatives aim to position L&T for long-term success in a dynamic market environment.

L&T is significantly increasing its presence in international markets. For FY24-25, 58% of its order inflows came from international projects. This represents a 17.8% increase compared to the previous fiscal year. The Middle East remains a crucial region, with substantial investments in both physical and digital infrastructure.

L&T is expanding into high-growth sectors such as green energy and technology. The company commissioned 4.3 GWp of solar capacity in FY2024-25, bringing its total renewable energy portfolio to 26.9 GWp. Additionally, L&T is involved in the production of equipment for renewable diesel, biofuels, and emission control technologies. This Marketing Strategy of Larsen & Toubro is a key element of its expansion plans.

L&T has made strategic moves in the technology sector, acquiring a 15% stake in E2E Networks in November 2024. A secondary acquisition of 6% is expected by May 2025. L&T Semiconductor Technologies aims to be India's first fabless semiconductor firm, targeting the design of 15 products by 2027 with an investment of over US$300 million.

L&T plans significant expansion in the defense sector, aiming for a multi-billion dollar business. The company is targeting a 20% market share in the nuclear power segment, driven by government initiatives to modernize the military. This expansion is part of L&T's broader strategy to capitalize on growth opportunities in the defense industry.

L&T's expansion strategy focuses on international growth, diversification into high-growth sectors, and strategic acquisitions. These initiatives are designed to drive future growth and enhance its market position. The company is also investing in renewable energy and technology to capitalize on emerging market trends.

- Increased international order inflows.

- Significant investments in renewable energy projects.

- Strategic acquisitions in the technology sector.

- Expansion plans in the defense sector.

Larsen & Toubro SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Larsen & Toubro Invest in Innovation?

L&T, a leading player in the infrastructure and engineering sectors, heavily relies on technology and innovation to fuel its sustained growth. The company's approach is comprehensive, integrating digital solutions across its diverse business verticals to enhance efficiency and drive expansion. This commitment is reflected in its significant investments in research and development, which are crucial for its long-term success.

The company's focus on innovation is evident in its strategic investments and the development of advanced technologies. L&T's digital transformation initiatives, including the implementation of AI, IoT, and automation, are designed to streamline operations and improve project outcomes. These efforts are critical for maintaining a competitive edge in the dynamic market landscape.

L&T's commitment to innovation is evident in its R&D investments, with approximately 2.6% of its revenue allocated to research and development. This strategic allocation underscores the company's focus on staying at the forefront of technological advancements. The company's digital transformation program successfully reduced project lifecycle times by approximately 20%.

L&T integrates AI, IoT, and automation across its business verticals. This includes projects like the 'LIFT' project, which streamlined logistics and supply chains. These initiatives aim to reduce project lifecycle times and improve overall efficiency.

L&T develops AI-driven solutions tailored for sectors like healthcare, telecommunications, and construction. These solutions enhance operational efficiency and provide a competitive edge. This approach is critical for Larsen & Toubro's brief history and future growth.

LTTS, a subsidiary of L&T, is a leader in Engineering R&D, operating in over 25 countries. LTTS secured an $80 million digital engineering transformation deal in the sustainability segment in January 2025. LTTS also acquired Intelliswift in November 2024 for $110 million.

L&T is actively involved in green infrastructure, developing 15.6 million sq.ft. of green-certified building space in FY 2024-25. The company aims to halve the carbon footprint of its own operations by 2030, using 2018 as the baseline.

L&T has committed to investing ₹1,000 crore in renewable energy projects by 2025. The company aims to generate 500 MW of solar power. The use of alternative energy sources accounted for 30% of total energy consumption.

L&T reduced its carbon footprint by 25% in 2023 compared to the previous year. This reduction was achieved through the use of alternative energy sources. These efforts are part of L&T's broader sustainability strategy.

L&T's technological strategy is focused on integrating digital solutions, developing AI-driven applications, and investing in sustainable practices. These initiatives are designed to drive growth and enhance operational efficiency across various sectors. The company's commitment to R&D and strategic acquisitions further strengthens its position in the market.

- Digital Transformation: Implementing AI, IoT, and automation to streamline operations.

- AI-Driven Solutions: Developing tailored solutions for healthcare, telecommunications, and construction.

- Sustainability: Investing in green infrastructure and renewable energy projects.

- R&D Investments: Allocating a significant portion of revenue to research and development.

- Strategic Acquisitions: Expanding capabilities through acquisitions like Intelliswift.

Larsen & Toubro PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Larsen & Toubro’s Growth Forecast?

Analyzing the financial outlook of Larsen & Toubro (L&T) reveals a strong trajectory for future expansion. The company's performance in fiscal year 2024-25 showcases significant growth across various financial metrics, supported by a robust order book and effective capital management. This positive trend indicates promising L&T future prospects and a solid foundation for sustained success in the coming years.

L&T's strategic focus on order inflows and revenue generation is evident in its financial results. The company's ability to secure large projects and execute them efficiently contributes to its financial stability. This approach, combined with a commitment to shareholder value, positions L&T favorably in a competitive market. Understanding the financial dynamics is crucial for assessing L&T growth strategy.

The company's strong financial performance is a key indicator of its potential for future growth. Factors such as revenue growth, profitability, and order book size are all critical in evaluating the company's outlook. The following sections provide a detailed overview of L&T's financial performance and its implications for future growth.

L&T reported a consolidated Profit After Tax (PAT) of ₹15,037 crore for the fiscal year ending March 31, 2025, marking a 15% increase year-on-year. This growth demonstrates the company's improved profitability and effective cost management.

Consolidated revenue from operations increased by 16% year-on-year to ₹2,55,734 crore. This significant revenue growth reflects the company's strong performance and successful project execution across its diverse business segments.

In Q4 FY25 alone, PAT surged by 25% year-on-year to ₹5,497 crore, with revenue increasing by 11% to ₹74,392 crore. This strong performance in the final quarter underscores the company's ability to sustain growth momentum.

L&T achieved record order inflows of ₹356,631 crore at the group level in FY2024-25, representing an 18% year-on-year growth. This strong order inflow indicates robust demand for the company's services and projects.

The consolidated order book as of March 31, 2025, stood at ₹579,137 crore, reflecting a 22% growth over March 2024. International orders constituted a healthy 46% of the total, showcasing the company's global presence.

The company's operating margins stood at 9.6% in FY2025, demonstrating efficient project execution and cost management. This margin reflects the company's ability to maintain profitability in a competitive market.

L&T's liquidity position remains strong, with free cash balances and liquid investments of approximately ₹50,195 crore as of March 31, 2025, at a consolidated level. This strong liquidity provides financial flexibility.

The company declared a final dividend of ₹34 per equity share for the financial year 2024-25. Total debt as of April 1, 2025, was ₹132,409 crore, while cash and cash equivalents stood at ₹22,965 crore.

L&T's management is focused on timely execution of its large order book, preservation of liquidity, and optimum use of capital to enhance shareholder returns. The company's strong financial performance, robust order book, and strategic initiatives position it well for future growth.

- Order Book: The substantial order book provides significant revenue visibility, ensuring a steady stream of projects.

- Liquidity Management: Maintaining a strong liquidity position enables the company to navigate economic uncertainties and invest in future opportunities.

- Shareholder Returns: The declaration of dividends reflects the company's commitment to delivering value to its shareholders.

- Strategic Partnerships: L&T's partnerships and collaborations are crucial for its L&T expansion plans and strategies.

For a deeper understanding of the competitive landscape, you can explore the Competitors Landscape of Larsen & Toubro. This analysis provides valuable insights into the market dynamics and the company's position within it. Examining these factors is essential for a comprehensive L&T market analysis.

Larsen & Toubro Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Larsen & Toubro’s Growth?

The growth strategy and future prospects of Larsen & Toubro (L&T) are subject to several potential risks and obstacles. These challenges span market competition, regulatory changes, geopolitical instability, supply chain vulnerabilities, and the rapid pace of technological disruption. Understanding these risks is crucial for assessing the long-term viability of L&T's business model and its ability to deliver sustainable growth.

L&T faces significant competition from both domestic and international players in the engineering and construction industry. Fluctuations in operating profit margins indicate potential operational challenges that the company must navigate. The company's substantial international business also exposes it to global economic and geopolitical uncertainties, which can impact cross-border trade and investment flows.

Furthermore, the increasing reliance on fixed-price contracts, particularly in overseas projects, makes L&T's operating profitability vulnerable to cost escalations. The company's ability to manage these risks effectively will be critical to achieving its growth objectives. For a deeper dive into the company's target market, consider reading the article: Target Market of Larsen & Toubro.

L&T competes with domestic rivals like Tata Projects and Reliance Infrastructure, as well as global competitors. The engineering and construction sector is highly competitive, impacting profit margins. The company must continuously innovate and improve efficiency to maintain a competitive edge in the L&T business landscape.

Geopolitical instability and regulatory changes pose external risks to L&T's operations. Uncertainties in policy and geopolitical tensions can affect cross-border trade and investment. L&T’s international business, which constitutes a significant portion of its group revenue, is particularly sensitive to these global dynamics.

Supply chain vulnerabilities and the rapid pace of technological change are major concerns. Continuous investment in R&D and digital initiatives is essential. The company must adapt to technological disruptions to remain competitive and maintain its L&T growth strategy.

A higher proportion of fixed-price contracts, especially in overseas projects, exposes L&T to cost escalations. Managing these contracts effectively is crucial for maintaining profitability. The company must implement robust cost control measures to mitigate these risks.

Fluctuating operating profit margins highlight potential operational challenges. L&T must optimize project execution and improve efficiency to ensure consistent profitability. Streamlining operations and enhancing project management capabilities are critical for L&T's future prospects.

L&T has a robust risk management framework to identify and mitigate potential risks. The company classifies risks as operational, tactical, and strategic. Diversification and a strong balance sheet are key indicators of long-term value creation potential. L&T's strategic partnerships also play a crucial role in its expansion plans and strategies.

L&T focuses on timely project execution and preserving liquidity to manage risks effectively. The company emphasizes optimizing capital utilization and engaging in scenario planning. L&T's diversification strategy, including its presence in various sectors, helps mitigate risks. The company's strong balance sheet and robust order book also contribute to its resilience.

Global economic conditions and geopolitical events significantly impact L&T's international business. Rising policy uncertainties and geopolitical tensions can affect trade, investment, costs, and productivity. The company must continuously monitor and adapt to these external factors to protect its financial performance and future outlook. The company's strategic partnerships and growth are also influenced by these dynamics.

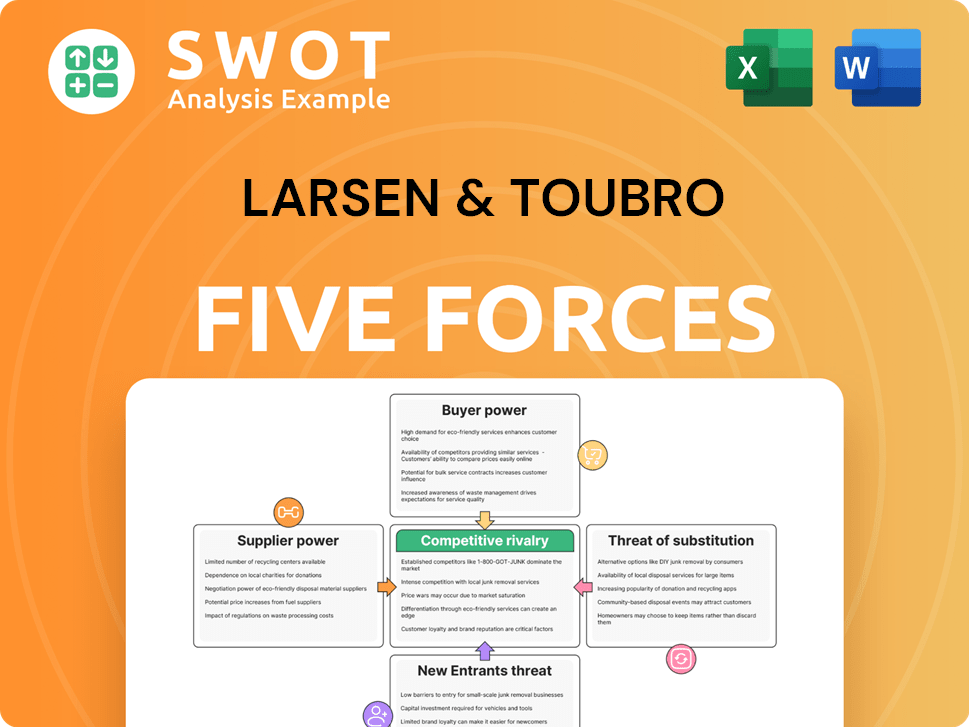

Larsen & Toubro Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Larsen & Toubro Company?

- What is Competitive Landscape of Larsen & Toubro Company?

- How Does Larsen & Toubro Company Work?

- What is Sales and Marketing Strategy of Larsen & Toubro Company?

- What is Brief History of Larsen & Toubro Company?

- Who Owns Larsen & Toubro Company?

- What is Customer Demographics and Target Market of Larsen & Toubro Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.