Larsen & Toubro Bundle

Who Really Owns Larsen & Toubro?

Unraveling the Larsen & Toubro SWOT Analysis reveals more than just its strengths; understanding its ownership is key to grasping its strategic moves. From its humble beginnings in 1938, L&T has transformed into a global powerhouse. But who exactly calls the shots at this Indian multinational conglomerate?

Knowing the Larsen & Toubro ownership structure provides crucial insights into its governance and future trajectory. With a diverse portfolio spanning infrastructure, technology, and defense, L&T group’s ownership is a complex web of stakeholders. This deep dive will explore the evolution of L&T company owner and identify the key players shaping its destiny, offering a comprehensive view of who owns L&T.

Who Founded Larsen & Toubro?

The story of Larsen & Toubro's ownership begins with its founders, Henning Holck-Larsen and Søren Kristian Toubro. These two Danish engineers established the company in 1938 in Bombay (now Mumbai), India. Their initial focus was representing a Danish dairy equipment manufacturer.

The onset of World War II significantly influenced the company's direction. Trade restrictions during the war pushed Larsen and Toubro to shift from representing other companies to providing engineering services. This shift included ship repair and fabrication, which became crucial during the war years.

In 1940, the company's first major project involved constructing a soda ash plant for the Tata Group. This achievement helped to build their reputation. Later, in 1945, they partnered with the U.S.-based Caterpillar Tractor Company for marketing earth-moving equipment. The formal incorporation of Larsen & Toubro Private Ltd. occurred in 1946, and the company transitioned to a public limited company by 1950.

Founded in 1938 by Henning Holck-Larsen and Søren Kristian Toubro in Bombay, India.

Initially represented a Danish dairy equipment manufacturer.

Shifted to engineering work and services, including ship repair, due to trade blockades.

Secured its first major order to build a soda ash plant for the Tata Group in 1940.

Entered into an agreement with Caterpillar Tractor Company in 1945.

Formally incorporated as Larsen & Toubro Private Ltd. in 1946 and became a public limited company in 1950.

The shift from a private partnership to a public company in 1950 marked a significant change in the ownership structure of Larsen & Toubro. While specific equity splits for the founders are not publicly available, the transition indicates a move from concentrated founder ownership to a broader base of L&T shareholders. Søren Kristian Toubro retired from active management in 1962, and Henning Holck-Larsen retired as chairman in 1978. The L&T group has since evolved, with current ownership reflecting a diverse mix of institutional and individual investors. Understanding the Larsen & Toubro ownership structure is key to grasping its history and future direction.

- Early ownership was primarily held by the founders.

- The move to a public company broadened the shareholder base.

- The founders retired from active roles over time.

- The current ownership structure includes institutional and individual investors.

Larsen & Toubro SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Larsen & Toubro’s Ownership Changed Over Time?

The ownership of Larsen & Toubro (L&T) has transformed significantly since its public listing in 1950. Initially led by its founders, the company has evolved into a widely diversified public shareholding structure. As of March 31, 2025, there is no predominant promoter stake, indicating a shift towards institutional and retail investors.

The evolution of L&T's ownership structure reflects its growth and adaptation in the market. This transition highlights a move towards a more dispersed ownership model, with various institutional and individual investors holding significant stakes. This shift has been accompanied by strategic decisions, such as divesting non-core assets to maximize shareholder value, as seen with the April 2024 divestment of L&T Infrastructure Development Projects Limited.

| Stakeholder | Shareholding as of March 31, 2025 | Shareholding as of December 2024 |

|---|---|---|

| Mutual Funds | 19.94% | 19.68% |

| Insurance Companies | 19.84% | Data not available |

| Foreign Portfolio Investors (FPIs) | 19.80% | 20.83% |

| Individual Retail Investors | 18.88% | Data not available |

| L&T Employees Trust and other trusts | 14.33% | Data not available |

| Other Domestic Institutional Investors (DIIs) | 3.17% | Data not available |

The major shareholders of Larsen & Toubro include a diverse group of institutional and individual investors. Mutual funds hold a significant portion, with 19.94% of shares as of March 31, 2025, an increase from 19.68% in December 2024. Insurance companies, including Life Insurance Corporation of India (LIC) with a 13.25% stake, also hold a substantial 19.84%. Foreign Portfolio Investors (FPIs) held 19.80%, a decrease from 20.83% in December 2024. Individual retail investors account for 18.88%. The L&T Employees Trust and other trusts collectively hold 14.33%, with the L&T Employees Trust being the largest public shareholder. Other Domestic Institutional Investors (DIIs) hold 3.17%. Overall DII holdings increased to 42.71% in March 2025, up from 41.57% in December 2024.

The ownership of L&T is widely distributed, with no single dominant shareholder.

- Mutual funds, insurance companies, and FPIs are major institutional investors.

- Individual retail investors hold a significant stake.

- The company focuses on maximizing shareholder value through strategic decisions.

- Learn more about the Marketing Strategy of Larsen & Toubro.

Larsen & Toubro PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Larsen & Toubro’s Board?

The corporate governance of Larsen & Toubro (L&T) is structured around a professionally managed model. The Executive Committee, led by S. N. Subrahmanyan as Chairman & Managing Director, oversees various business verticals and group companies. A. M. Naik holds the position of Chairman Emeritus. The Board of Directors plays a key role in the company's governance, ensuring strategic oversight and direction.

As of March 2025, the Board approved the appointment of Mr. Subramanian Sarma as Deputy Managing Director & President, effective April 2, 2025, until February 3, 2028, subject to shareholder approval. Mr. Subramanian Narayan was appointed as Company Secretary and Compliance Officer effective May 10, 2025. Mr. Siddhartha Mohanty was appointed as Nominee Director of LIC with effect from May 28, 2024. These appointments reflect the company's commitment to strong leadership and governance.

| Director | Position | Date of Appointment |

|---|---|---|

| S. N. Subrahmanyan | Chairman & Managing Director | - |

| A. M. Naik | Chairman Emeritus | - |

| Subramanian Sarma | Deputy Managing Director & President | April 2, 2025 |

| Subramanian Narayan | Company Secretary and Compliance Officer | May 10, 2025 |

| Siddhartha Mohanty | Nominee Director of LIC | May 28, 2024 |

The voting structure of L&T follows a one-share-one-vote principle, common for publicly traded companies. The ownership is diversified, with significant stakes held by mutual funds, insurance companies, and foreign portfolio investors. This structure contributes to a balanced distribution of voting power among L&T shareholders, aligning with the company's focus on maximizing shareholder value. To understand the broader Growth Strategy of Larsen & Toubro, it's important to consider its ownership structure and the influence of its key stakeholders.

Larsen & Toubro is a publicly traded company with a diversified ownership base.

- The company operates under a one-share-one-vote system.

- Major shareholders include mutual funds, insurance companies, and foreign portfolio investors.

- The Board of Directors plays a crucial role in governance.

- The leadership team is focused on maximizing shareholder value.

Larsen & Toubro Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Larsen & Toubro’s Ownership Landscape?

Over the past few years, several significant developments and ownership trends have reshaped the landscape of Larsen & Toubro (L&T). As of March 31, 2025, the company's ownership structure reflects a shift toward institutional investors and strategic adjustments. Notably, there is no promoter holding in L&T, indicating a professionally managed entity.

The ownership profile of L&T has seen notable changes. Institutional investors hold a significant portion of the company's shares. Mutual funds increased their holdings from 19.68% in December 2024 to 19.94% by March 2025. Foreign Institutional Investors (FIIs) decreased their holdings from 20.83% in December 2024 to 19.80% in March 2025. Overall, domestic institutional investors (DIIs) holdings increased to 42.71% in March 2025 from 41.57% in December 2024. These shifts highlight the evolving dynamics of L&T's shareholder base and its appeal to different types of investors.

| Metric | December 2024 | March 2025 |

|---|---|---|

| Mutual Funds | 19.68% | 19.94% |

| FIIs | 20.83% | 19.80% |

| DIIs | 41.57% | 42.71% |

L&T continues to strategically divest non-core assets. For example, the company completed the divestment of its entire shareholding in L&T Infrastructure Development Projects Limited on April 10, 2024. In December 2024, L&T acquired a 15% stake in E2E Networks, a cloud services company, with the intention to acquire an additional 6% by May 30, 2025, totaling 21% ownership. These strategic moves highlight L&T's focus on core growth areas and enhancing shareholder value. You can find more details on the company's ownership and strategic direction in this informative article about Larsen & Toubro ownership.

Institutional investors, including mutual funds and FIIs, hold a substantial portion of L&T's shares, reflecting its appeal to institutional investors. Domestic institutional investors (DIIs) increased their holdings to 42.71% by March 2025.

L&T strategically divests non-core assets and invests in growth areas. The acquisition of a stake in E2E Networks is a key example, aligning with the company's focus on cloud services and digital transformation.

While professionally managed, leadership transitions are ongoing. S. N. Subrahmanyan took charge as Chairman and Managing Director, and there have been changes in leadership within subsidiaries like LTIMindtree.

L&T's strategic moves reflect broader industry trends, including a focus on digital transformation, investments in emerging technologies like green hydrogen, and increased institutional ownership.

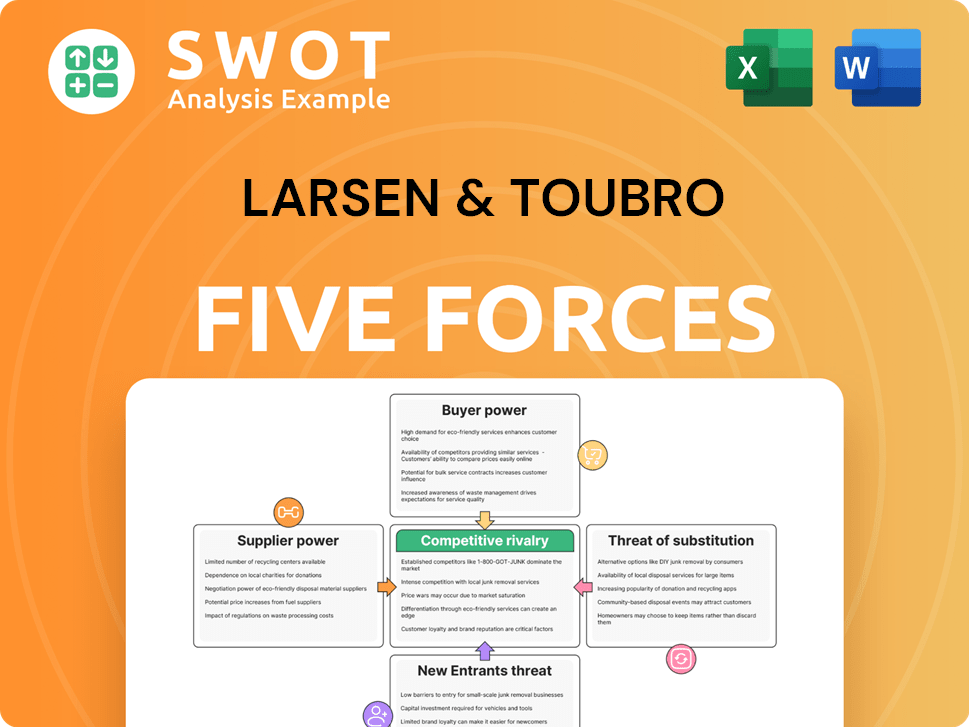

Larsen & Toubro Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Larsen & Toubro Company?

- What is Competitive Landscape of Larsen & Toubro Company?

- What is Growth Strategy and Future Prospects of Larsen & Toubro Company?

- How Does Larsen & Toubro Company Work?

- What is Sales and Marketing Strategy of Larsen & Toubro Company?

- What is Brief History of Larsen & Toubro Company?

- What is Customer Demographics and Target Market of Larsen & Toubro Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.