Lidl Stiftung & Co. KG Bundle

How Does Lidl Stiftung & Co. KG Dominate the Discount Grocery Scene?

The global grocery market is a battlefield, and Lidl Stiftung & Co. KG is a formidable general, constantly reshaping the Lidl Stiftung & Co. KG SWOT Analysis. Its expansion, particularly in the U.S., showcases its aggressive strategy against established giants. Understanding the Lidl competitive landscape is crucial for any investor or strategist looking to navigate the complexities of the grocery retail industry.

From its origins in Germany to its global presence, Lidl's journey offers a compelling case study in discount supermarket competition. This analysis will delve into Lidl competitors, evaluating its market share, financial performance, and strategic initiatives. Furthermore, we'll explore its expansion strategy, pricing models, and future growth prospects, providing a comprehensive Lidl market analysis to inform your investment decisions.

Where Does Lidl Stiftung & Co. KG’ Stand in the Current Market?

Lidl Stiftung & Co. KG holds a significant position in the global grocery retail industry, particularly within the discount segment. Its core operations focus on providing a wide array of food and non-food items, with a strong emphasis on private-label brands. This strategic approach allows for greater control over quality and pricing, which is a key component of its competitive strategy.

The company's value proposition centers on offering high-quality products at competitive prices, primarily targeting budget-conscious consumers. This model is supported by efficient supply chain management and a streamlined store format, which helps to keep operational costs low. Over time, Lidl has gradually evolved its offerings to include fresh produce, organic options, and an improved shopping experience, enhancing its appeal to a broader customer base.

The Schwarz Group, which includes Lidl, reported total revenues of 167.2 billion euros in fiscal year 2023, showcasing its substantial scale and influence. This financial strength allows Lidl to invest in expansion and maintain its competitive edge within the grocery retail industry. This financial performance is a critical factor in understanding the Revenue Streams & Business Model of Lidl Stiftung & Co. KG.

Lidl's market share varies by country, but its parent company's revenue of 167.2 billion euros in 2023 highlights its significant presence. This financial performance is crucial for understanding the company's competitive landscape.

Lidl has a robust presence across Europe, with over 12,000 stores. It has also been actively expanding in the United States since 2017, demonstrating its international market presence.

Lidl's product strategy emphasizes private-label brands, which constitute a significant portion of its offerings. This strategy allows for greater control over pricing and quality, contributing to its competitive advantage.

Lidl primarily targets budget-conscious consumers seeking high-quality products at competitive prices. It is also expanding its offerings to appeal to a broader customer base.

Lidl's market position is shaped by its discount model, private-label focus, and geographic expansion. The company competes within the grocery retail industry, facing competition from both discount supermarkets and conventional supermarkets.

- Lidl's main competitors include Aldi, Tesco, and other major grocery retailers.

- The company's expansion strategy involves opening new stores and gaining market share in various countries.

- Lidl's financial performance, with an 8.5% increase in 2023, reflects its ability to adapt and thrive in a competitive environment.

- The company is continuously working on its sustainability initiatives.

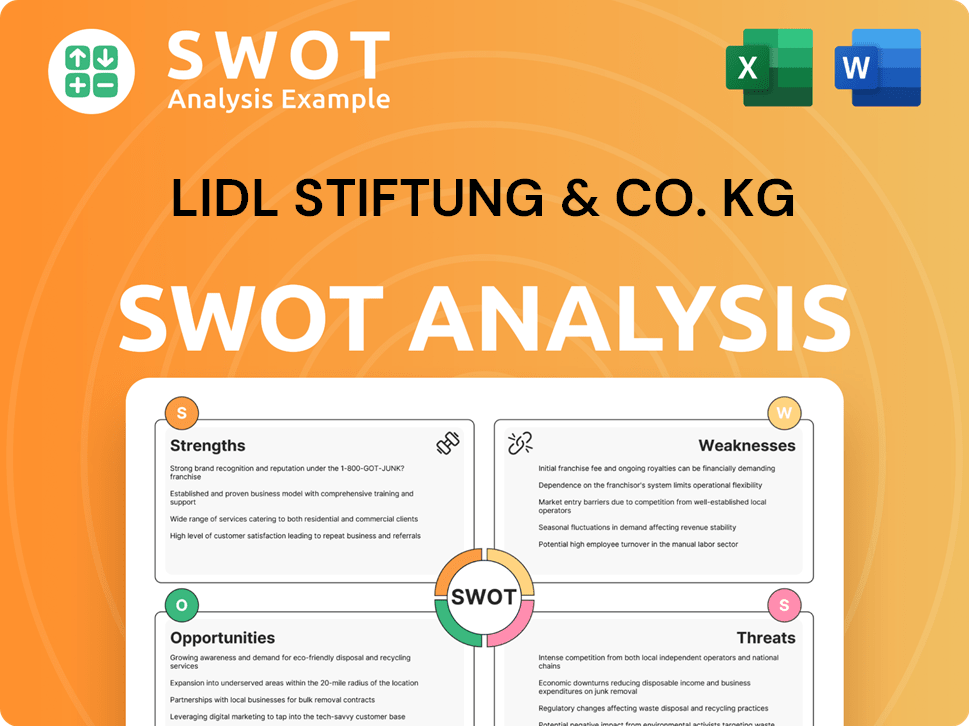

Lidl Stiftung & Co. KG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Lidl Stiftung & Co. KG?

The Lidl competitive landscape is characterized by intense competition from both direct discount rivals and established supermarket chains. Understanding the dynamics of these competitors is crucial for Lidl Stiftung & Co. KG to maintain its market position and drive future growth. This analysis provides a detailed look at the key players challenging Lidl in various markets.

Lidl's market analysis reveals a strategic focus on offering low prices through a lean business model, similar to its main competitors. This strategy, however, places it in direct competition with both discount supermarkets and conventional grocery stores, each with unique strengths and competitive advantages. The grocery retail industry is highly competitive, with constant shifts in consumer preferences and market dynamics.

Lidl's main competitors in Europe and globally can be divided into several categories, each posing distinct challenges. The primary category includes direct discount rivals, while the secondary category involves traditional supermarket chains. Furthermore, the rise of online grocery services adds another layer of competition, influencing Lidl's strategies.

Aldi is Lidl's most significant direct competitor globally, particularly in markets like the UK, where they collectively held a significant market share of 17% as of early 2024. Both companies focus on private labels and efficient supply chains to offer low prices. The competition between Lidl and Aldi is marked by price wars and aggressive store expansion strategies.

In Europe, Lidl faces competition from major supermarket chains such as Carrefour, Tesco, Auchan, and Rewe. These competitors often have larger store formats and broader product assortments, leveraging brand loyalty and wider service offerings. In the United States, Lidl competes with Walmart, Kroger, and Albertsons.

The rise of online grocery delivery services and quick commerce platforms indirectly challenges Lidl by offering convenience that may outweigh price savings for some consumers. Mergers and alliances among traditional players, like Ahold Delhaize, further consolidate market power, impacting Lidl's expansion opportunities. The competitive battles increasingly involve fresh produce quality and store aesthetics.

Walmart, with its immense purchasing power and vast store network, presents a formidable challenge to Lidl through its 'everyday low prices' strategy. Walmart's scale allows it to offer competitive pricing and a wide range of products, making it a significant competitor in the US market.

Tesco in the UK has responded to the discounter threat by introducing its own value lines and price matching schemes. This strategy aims to compete directly with Lidl and Aldi on price, maintaining its market share against the growing presence of discount supermarkets.

Online grocery services and quick commerce platforms challenge Lidl by offering convenience that may outweigh price savings for some consumers. These services provide an alternative shopping experience, impacting Lidl's market share and requiring strategic adjustments.

To succeed in this competitive environment, Lidl must continually adapt its strategies. This includes focusing on price competitiveness, improving product quality, enhancing store aesthetics, and innovating rapidly. Understanding the strengths and weaknesses of Lidl competitors is crucial for effective strategic planning.

- Pricing Strategy Analysis: Lidl's pricing strategy must remain competitive to attract and retain customers.

- Private Label Product Strategy: Lidl's private label products are a key differentiator, offering value and quality.

- Supply Chain Management: Efficient supply chain management is essential for cost control and product availability.

- Store Format and Design: Modern and appealing store formats can enhance the shopping experience.

- Customer Satisfaction Ratings: Maintaining high customer satisfaction is critical for brand loyalty.

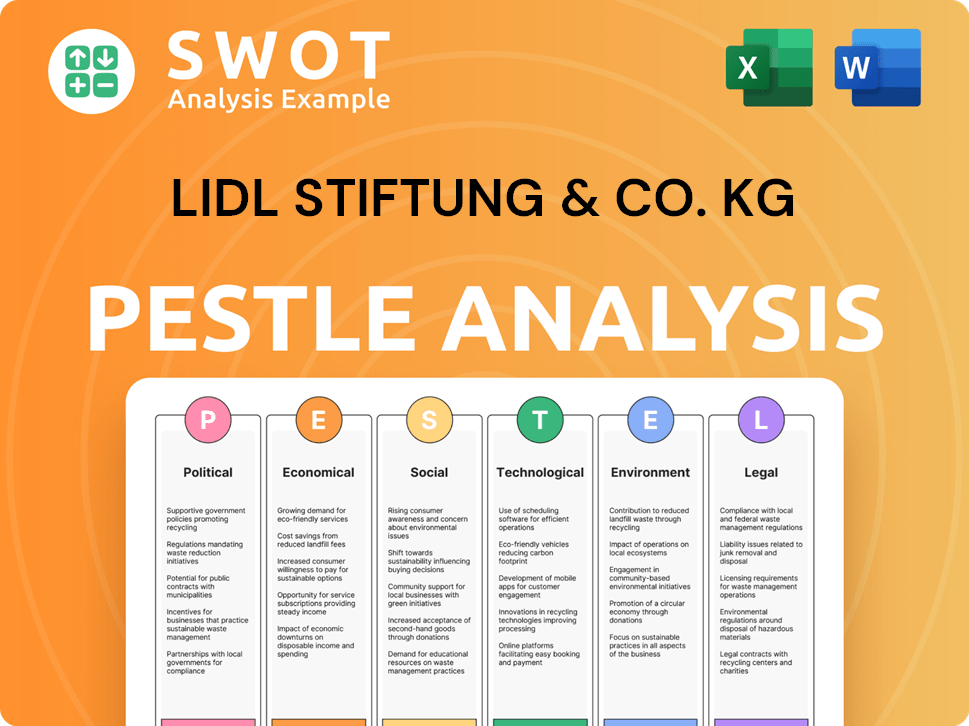

Lidl Stiftung & Co. KG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Lidl Stiftung & Co. KG a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of Lidl Stiftung & Co. KG involves a deep dive into its competitive advantages within the grocery retail industry. The company, operating primarily as a discount supermarket, has carved out a significant market share through strategic moves and operational efficiencies. Analyzing the Lidl competitive landscape reveals a business model focused on low prices, private-label products, and a streamlined shopping experience.

Key milestones for Lidl include its expansion across Europe and into the United States, showcasing its adaptability to different market conditions. Strategic moves such as investing in store aesthetics and expanding fresh produce offerings have enhanced its appeal beyond its initial value-driven proposition. These efforts have solidified its competitive edge, particularly against traditional supermarkets, by offering a compelling combination of price and quality. The company's focus on private-label brands, which constitute a substantial portion of its product range, allows it to control costs, maintain quality, and avoid national brand markups, further contributing to its competitive pricing.

Lidl's competitive advantages are multifaceted, encompassing operational efficiency, private-label strategy, and strategic expansion. Its highly efficient supply chain and lean operating model enable it to offer significantly lower prices than many traditional supermarkets. This efficiency is driven by a focused product assortment, simpler store layouts, and optimized logistics, allowing Lidl to minimize overheads and pass savings onto consumers. The company's ability to maintain low prices while offering a reasonable range of products is a key differentiator in the discount supermarket competition.

Lidl's operational efficiency is a core strength. This is achieved through a streamlined supply chain, optimized store layouts, and a focus on private-label brands. These factors allow Lidl to minimize overhead and offer competitive prices.

The company's emphasis on private-label brands allows for greater control over costs and quality. This strategy enables Lidl to avoid the markups associated with national brands, contributing to its value proposition. Private-label products often represent a significant portion of the product range.

Lidl's strategic expansion, particularly across Europe and into the United States, demonstrates its adaptability and growth potential. This expansion is supported by a strong distribution network and economies of scale.

Lidl has built brand equity associated with value and quality, fostering customer loyalty. Investments in improving the shopping experience, such as offering fresh produce and a more pleasant store environment, enhance customer perception beyond just price. This is evident in its marketing, which increasingly highlights quality alongside value.

Lidl's competitive advantages are rooted in its operational efficiency, private-label strategy, and strategic expansion. These advantages enable the company to offer lower prices, maintain quality, and expand its market presence. The company's extensive distribution network across Europe, with over 12,000 stores, provides strong market penetration and economies of scale in purchasing and logistics. The company's revenue in 2023 was approximately €114.8 billion.

- Operational Efficiency: Streamlined supply chain and lean operating model.

- Private-Label Focus: Controls costs and maintains quality.

- Strategic Expansion: Growing presence across Europe and beyond.

- Brand Recognition: Strong brand equity in established markets.

- Customer Experience: Investments in fresh produce and store aesthetics.

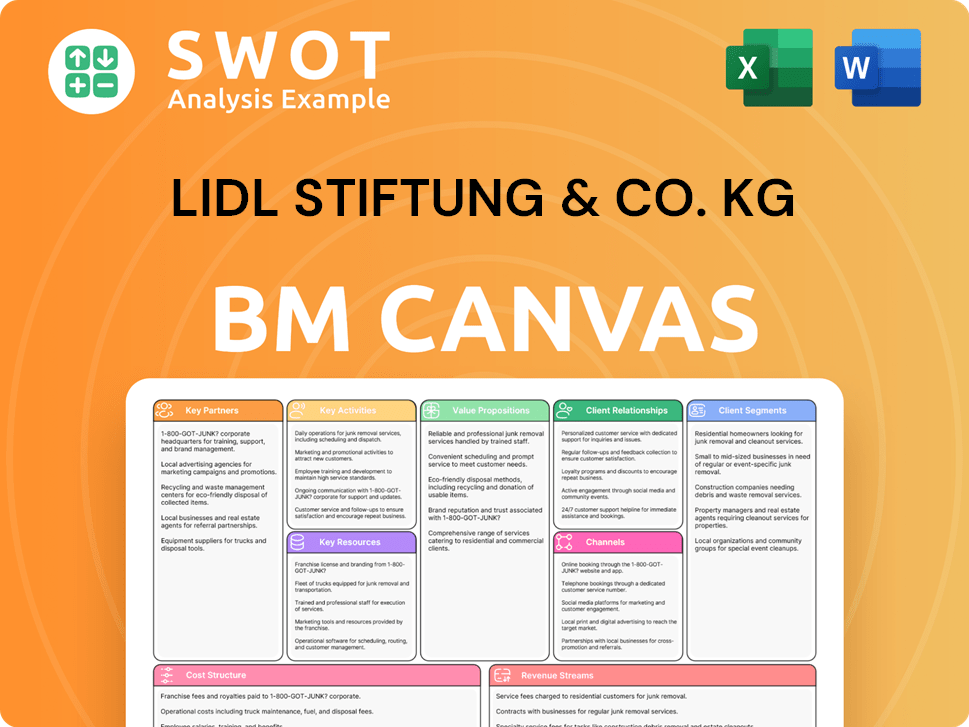

Lidl Stiftung & Co. KG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Lidl Stiftung & Co. KG’s Competitive Landscape?

The grocery retail industry is experiencing dynamic shifts, presenting both challenges and opportunities for Lidl Stiftung & Co. KG. Key trends include the rise of online grocery shopping, the increasing demand for sustainable products, and evolving regulatory landscapes. These factors require strategic adaptation to maintain and enhance Lidl's competitive position.

The competitive landscape is evolving, with potential disruptions from market consolidation, tech-driven startups, and shifts in consumer preferences. Lidl's ability to navigate these changes will be crucial for its future success. Understanding these trends is essential for a comprehensive Lidl market analysis.

The industry is seeing a surge in online grocery sales and home delivery, impacting traditional discounters. Consumers increasingly seek sustainable and ethically sourced products, influencing supply chain adjustments. Regulatory changes related to environmental impact and labor practices are also becoming more significant.

Lidl faces challenges from intensified price competition and the potential for traditional supermarkets to enhance their value propositions. Declining demand in certain product categories and the need to integrate technology more deeply into the customer experience also pose challenges. Further consolidation in the retail sector could create larger, more powerful competitors.

Significant growth opportunities exist in emerging markets where the discount model is less mature. Product innovations, such as ready meals and plant-based options, can expand market appeal. Strategic partnerships, particularly in technology, can enhance logistics and customer engagement. Exploring these avenues is key for Lidl's expansion.

Lidl is likely to evolve towards a hybrid model, balancing its core discount principles with investments in digital capabilities and premium offerings. This approach aims to capture new growth avenues and maintain resilience. This involves strategic decisions to stay competitive in the discount supermarket competition.

The Lidl competitive landscape is shaped by several key players. The discount grocery market is highly competitive, with rivals like Aldi, and other regional and international players. Lidl's ability to maintain its cost-efficiency while adapting to changing consumer demands is crucial. For a deeper dive, explore the Growth Strategy of Lidl Stiftung & Co. KG.

- Online Grocery Expansion: Lidl is expanding its online presence, though it lags behind some competitors. In 2024, online grocery sales are projected to increase by approximately 10-15% in key markets.

- Sustainable Products: The demand for sustainable products is rising. Lidl is increasing its offerings of organic and ethically sourced products. The market for sustainable groceries is expected to grow by about 12% annually.

- Market Consolidation: The retail sector is consolidating, with larger players gaining market share. Mergers and acquisitions are changing the competitive dynamics.

- Emerging Markets: Lidl is focusing on expansion in emerging markets, where the discount model is gaining traction. Growth rates in these markets are significantly higher, often exceeding 10% annually.

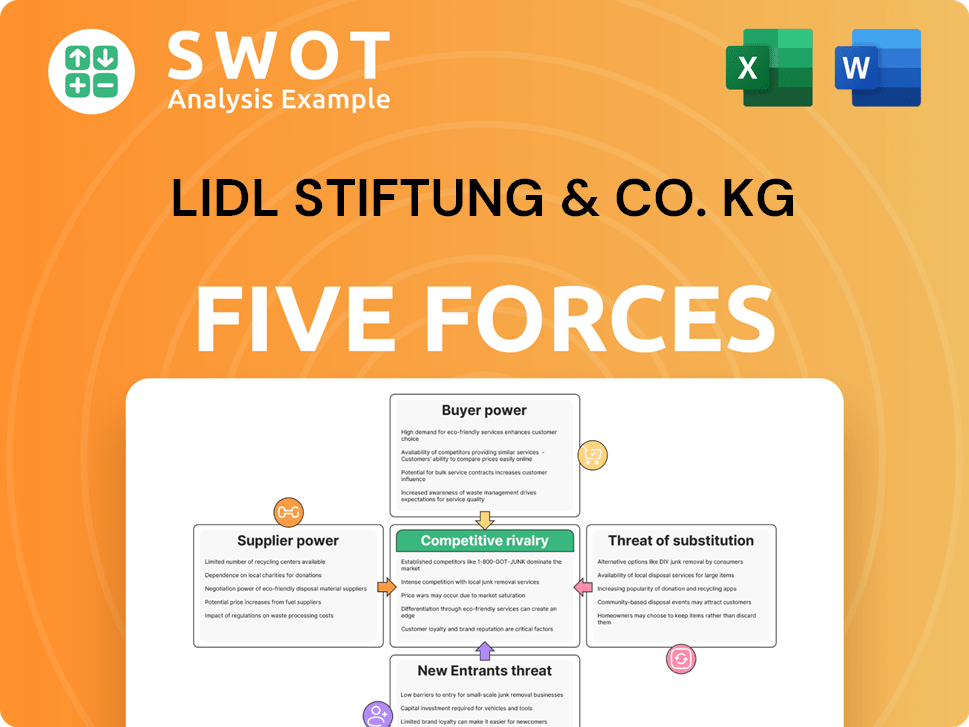

Lidl Stiftung & Co. KG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lidl Stiftung & Co. KG Company?

- What is Growth Strategy and Future Prospects of Lidl Stiftung & Co. KG Company?

- How Does Lidl Stiftung & Co. KG Company Work?

- What is Sales and Marketing Strategy of Lidl Stiftung & Co. KG Company?

- What is Brief History of Lidl Stiftung & Co. KG Company?

- Who Owns Lidl Stiftung & Co. KG Company?

- What is Customer Demographics and Target Market of Lidl Stiftung & Co. KG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.