Lidl Stiftung & Co. KG Bundle

Can Lidl Stiftung & Co. KG Continue Its Retail Revolution?

From a small German wholesaler to a global retail powerhouse, Lidl Stiftung & Co. KG has redefined the grocery landscape with its commitment to value. This report explores the Lidl Stiftung & Co. KG SWOT Analysis, examining its remarkable journey and its innovative approach to the retail industry. Discover how Lidl plans to navigate future challenges and capitalize on emerging opportunities in the competitive grocery market.

Lidl's remarkable growth, fueled by its discount model and strategic market expansion, offers valuable insights into retail industry trends. This analysis will provide a comprehensive overview of Lidl's growth strategy, its future prospects, and its ability to maintain and enhance its market share in Europe and beyond. Understanding Lidl's competitive advantages, including its supply chain management and customer loyalty programs, is key to predicting its long-term business goals and impact on local communities.

How Is Lidl Stiftung & Co. KG Expanding Its Reach?

The expansion initiatives of Lidl Stiftung & Co. KG are central to its Lidl growth strategy and future prospects. The company is aggressively pursuing growth across its core markets and venturing into new territories. This expansion is supported by significant investments in infrastructure and logistics, demonstrating a long-term commitment to growth.

Lidl's approach involves a combination of organic growth through new store openings, strategic investments in distribution networks, and a focus on product category expansion. These efforts are designed to strengthen its market position and capitalize on evolving retail industry trends. This strategy is crucial for maintaining its competitive edge in the grocery market.

The company's expansion plans are ambitious and data-driven, reflecting a clear vision for the future. Through these initiatives, Lidl aims to increase its market share and solidify its presence in key regions. This is part of its broader strategy to become a leading player in the global retail landscape.

In the UK, Lidl plans to operate 1,100 stores by the end of 2025, with the goal of opening 'hundreds' of new stores. The company is committed to opening between 50 and 60 stores annually. This expansion is supported by investments in infrastructure, including the opening of a large warehouse in Luton in September 2023.

Internationally, Lidl is investing heavily in its European store and distribution network, with plans to launch in new markets. In Spain, Lidl plans to open 50 new stores in 2025. The U.S. market includes over 180 stores across nine states and Washington, D.C., focusing on expansion within existing markets.

Significant infrastructure investments are crucial to support the expansion. In Spain, Lidl is investing in logistics, including a €16 million warehouse in Constantí and a new center in Catalonia worth approximately €140 million. In early 2024, Lidl sought £91.1 million from investors to construct new stores in the UK.

Lidl is also focused on product category expansion. The company aims to increase its volume of fiber-rich foods sold by 20% by 2026 and ensure wholegrains represent 25% of total grains sold by 2030. This demonstrates a commitment to broadening its product offerings alongside geographical growth.

Lidl's expansion strategy involves aggressive store openings, significant infrastructure investments, and product category diversification. These initiatives are designed to strengthen its market position and capitalize on retail industry trends. Understanding the Target Market of Lidl Stiftung & Co. KG is key to appreciating these strategies.

- Aggressive store opening plans in the UK and internationally.

- Significant investments in logistics and distribution networks.

- Focus on expanding product categories, such as fiber-rich foods and wholegrains.

- Seeking investment to construct new stores and expand operations.

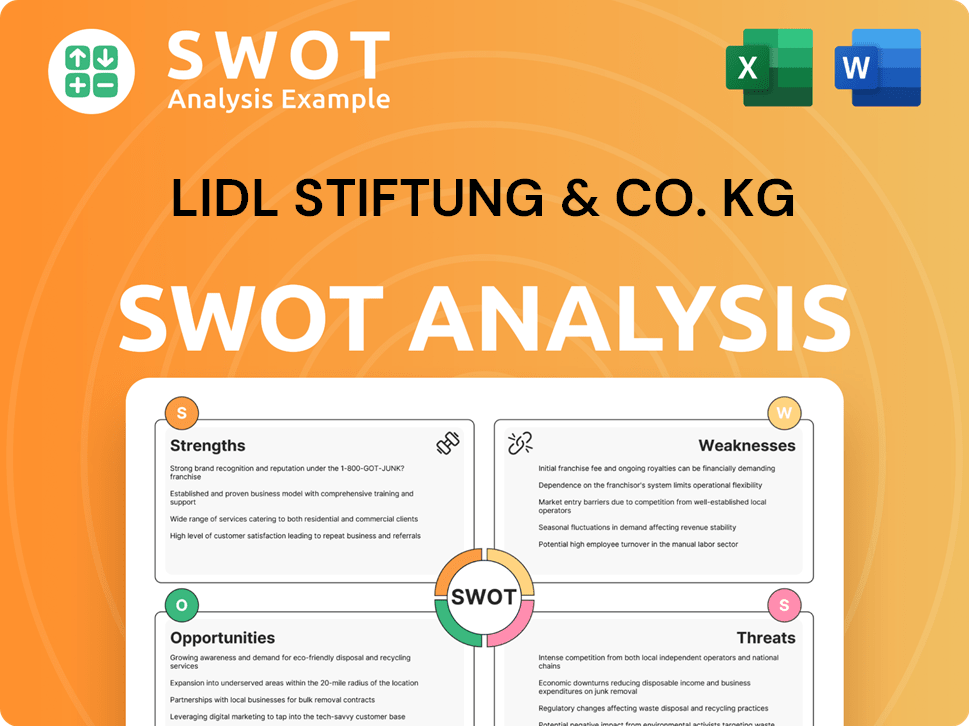

Lidl Stiftung & Co. KG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lidl Stiftung & Co. KG Invest in Innovation?

Lidl Stiftung & Co. KG's growth strategy heavily relies on innovation and technology to enhance efficiency and customer experience. This approach is crucial for maintaining its competitive edge in the retail industry, especially as grocery market expansion continues. The company focuses on leveraging technology to streamline operations and adapt to changing consumer behaviors.

The company's technology investments support its physical expansion program, focusing on speed, efficiency, and cost-cutting. By digitizing core processes and upgrading store infrastructure, Lidl aims to improve its customer offering and maintain its strong market position. This strategic focus is essential for navigating the dynamic retail landscape and meeting evolving customer expectations.

Lidl's future prospects are closely tied to its ability to integrate technology effectively and drive innovation across its operations. The company's commitment to sustainability and product innovation further enhances its long-term growth potential, ensuring it remains relevant and competitive in the grocery market.

Lidl is investing in the digitization of core processes. This includes rota planning, ordering, and warehouse automation. These efforts aim to improve operational efficiency and reduce costs.

As part of store upgrades, Lidl invests in new infrastructure and equipment. This includes larger, more energy-efficient chillers. These improvements enhance the customer experience and support sustainability goals.

Lidl is enhancing its customer-facing technologies. The Lidl Plus mobile rewards app offers both personalized and non-personalized discounts. Lidl UK also launched on TikTok Shop to engage younger consumers.

A large-scale digital transformation project with SAP's ERP solution was terminated after an investment of over €1 billion. This was due to technical and management challenges. Lidl has reverted to legacy systems.

The Schwarz Group, Lidl's parent company, is investing an additional €200 million into its online business in 2024. The goal is to better connect online with physical stores. This aims to stimulate parallel growth.

Lidl is committed to sustainability and product innovation. By mid-2025, it will remove all packaging designs deemed attractive to children. This goes beyond new UK legislation.

Lidl's commitment to innovation extends to its sustainability initiatives and product development. The company is focusing on reducing carbon emissions and increasing sales of healthy products, with a goal of at least 85% of sales from healthy and healthier products by 2025. Furthermore, Lidl is working to promote more sustainable alternatives in its product assortment and reduce the procurement of critical raw materials, aiming to make its procurement more sustainable by the end of 2025. For more insights into how the company approaches its market strategies, consider reading about the Marketing Strategy of Lidl Stiftung & Co. KG.

Lidl's innovation and technology strategy includes several key initiatives and goals.

- Digitization of core processes to improve efficiency.

- Investment in customer-facing technologies, such as the Lidl Plus app.

- Focus on sustainability, including removing child-attractive packaging.

- Commitment to increasing sales of healthy products to at least 85% by 2025.

- Investment in online business to enhance the connection between online and physical stores.

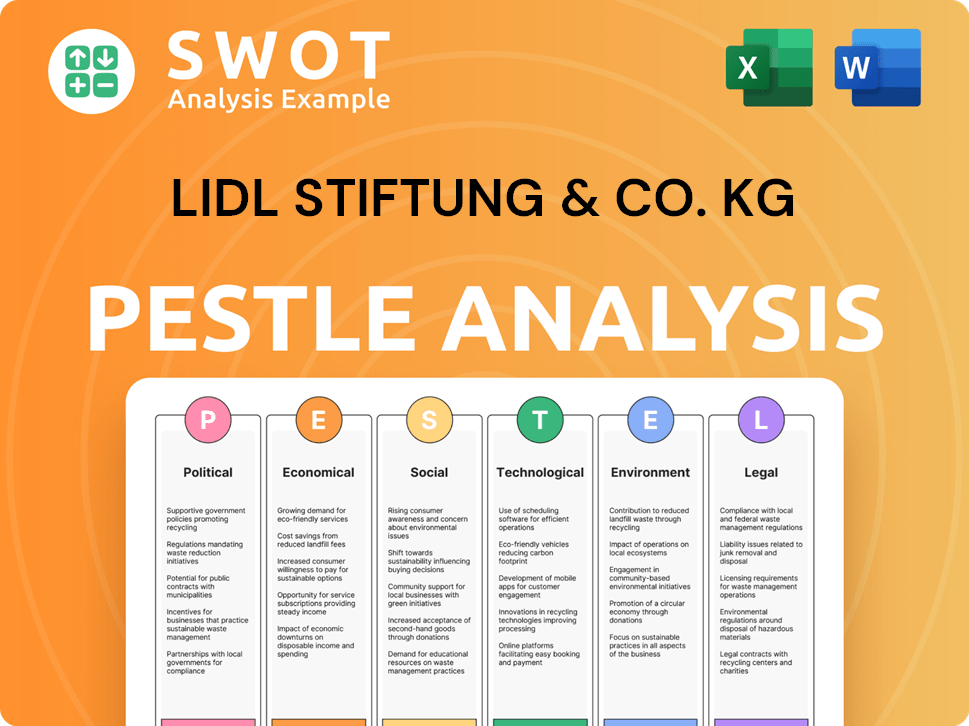

Lidl Stiftung & Co. KG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Lidl Stiftung & Co. KG’s Growth Forecast?

The financial outlook for Lidl Stiftung & Co. KG is robust, fueled by consistent revenue growth and strategic investments. The Schwarz Group, Lidl's parent company, reported an 8.5% increase in revenue for the fiscal year ending February 29, 2024 (FY2023), reaching €167.2 billion. This growth underscores the effectiveness of Lidl's Lidl growth strategy and its ability to capture market share.

Lidl's store sales significantly contributed to this positive performance, with a 9.4% year-on-year increase to €125.5 billion. This expansion is a key indicator of Lidl future prospects and its continued success in the retail industry. The company's focus on value and expansion is clearly paying off, driving substantial gains in both revenue and market presence.

The UK market provides a compelling example of Lidl's financial success. Revenue in the UK for the year to February 29, 2024, surged by 16.9% year-on-year to £10.87 billion (approximately €13.2 billion). Pre-tax profits also saw a significant recovery, reaching £43.6 million, a substantial improvement from the prior year's loss. This positive trend highlights the effectiveness of Lidl's company analysis and its ability to adapt to local market conditions.

For FY2023, the Schwarz Group reported an 8.5% increase in revenue, reaching €167.2 billion. This growth demonstrates the company's strong financial performance and its ability to capitalize on retail industry trends.

Lidl's store sales grew by 9.4% year-on-year to €125.5 billion. This increase is a key indicator of Lidl's market expansion and success in the grocery market expansion.

In the UK, Lidl's revenue increased by 16.9% year-on-year to £10.87 billion, with pre-tax profits reaching £43.6 million. This demonstrates the effectiveness of Lidl's strategies in a competitive market.

Investments in fixed assets for the core business amounted to approximately €8 billion in fiscal year 2023. This investment supports Lidl's expansion, store modernization, and supply chain improvements.

Lidl's financial performance is marked by significant growth and strategic investments, positioning it favorably within the competitive retail landscape. The Schwarz Group's overall revenue increase and Lidl's store sales growth demonstrate a strong trajectory.

- Revenue Growth: Schwarz Group revenue increased by 8.5% to €167.2 billion in FY2023.

- Store Sales: Lidl's store sales rose by 9.4% year-on-year to €125.5 billion.

- UK Performance: Revenue in the UK increased by 16.9% to £10.87 billion, with pre-tax profits of £43.6 million.

- Investments: Approximately €8 billion invested in fixed assets for core business in FY2023.

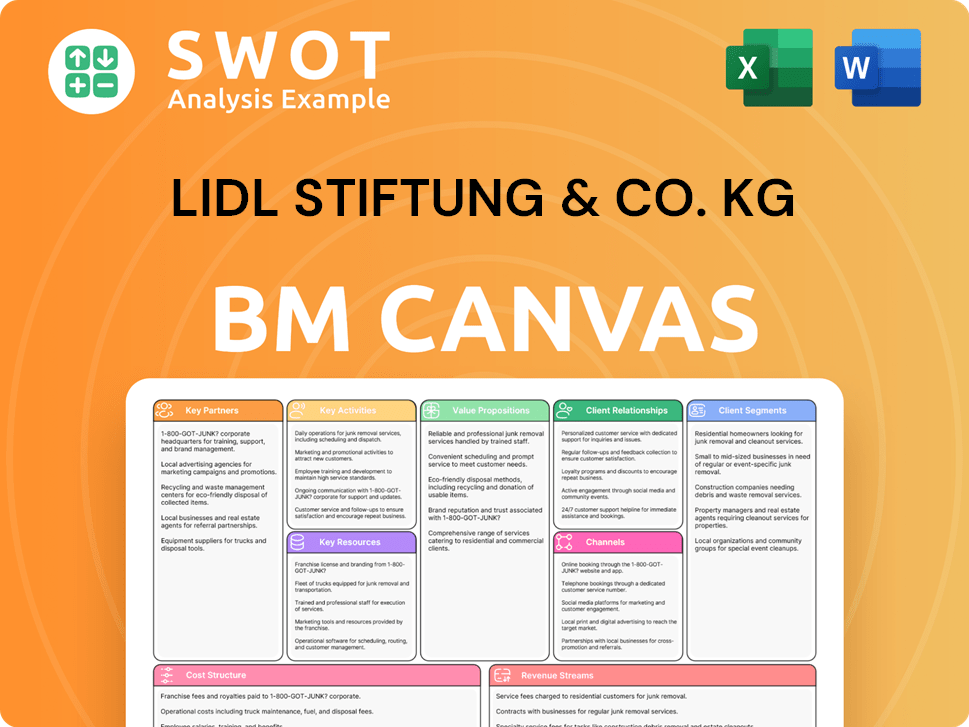

Lidl Stiftung & Co. KG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Lidl Stiftung & Co. KG’s Growth?

The success of Lidl Stiftung & Co. KG, and its Lidl growth strategy, is not without potential pitfalls. Several factors could impede its expansion and profitability. Understanding these risks is crucial for a comprehensive Lidl company analysis and assessing its Lidl future prospects.

Intense competition, supply chain vulnerabilities, and challenges in new markets present significant obstacles. The company must navigate these complexities to maintain its growth trajectory and achieve its Lidl's long-term business goals. These risks can impact Lidl's financial performance analysis.

One of the primary threats is intense competition in the retail sector. Rival discounters, particularly like Aldi, constantly challenge Lidl's market share. This competition often leads to price wars, which can squeeze profit margins. In 2024, Lidl responded to the competitive pressure by announcing its 'largest price reduction in its history' on over 500 items, with discounts up to 35% in some regions. This aggressive strategy, while aimed at attracting customers, could impact profitability.

Regulatory changes also pose a risk. Legislation, such as the UK's restrictions on advertising less healthy products to children, forces Lidl to adapt its product offerings and marketing strategies. Lidl proactively removed attractive packaging designs from these products by mid-2025, which has implications for Lidl's product innovation and development.

Supply chain vulnerabilities are another significant concern. Lidl's intricate supply chain, essential for its private-label products, is susceptible to external shocks like climate change, geopolitical shifts, and trade restrictions. These factors can lead to price increases and supply outages, as seen in 2021, when the company experienced severe supply chain challenges, resulting in depleted shelves. The article Revenue Streams & Business Model of Lidl Stiftung & Co. KG provides additional insights into Lidl's operations.

Expansion outside of Europe presents its own set of difficulties. The company faces fierce competition, established market competitors, and differing consumer purchasing patterns, particularly in the United States. Lidl is working to build brand trust and loyalty in the U.S., focusing on its value proposition and private label offerings. These challenges can impact Lidl's international market strategies.

Maintaining product quality and customer service while pursuing cost-cutting strategies is an ongoing challenge. Balancing these priorities is crucial for retaining customer loyalty and maintaining a positive brand image. This is also related to Lidl's customer loyalty programs.

Geopolitical risks can lead to significant business decisions. For instance, Lidl decided to withdraw from Myanmar by the end of 2024 due to the worsening political situation, highlighting its assessment of human rights due diligence risks in its supply chain. This decision showcases how external factors can influence Lidl's sustainable business practices.

Lidl's investment in technology is also a key area. The company continuously assesses and implements countermeasures to mitigate supply chain risks. This includes investments in technology and data analytics to improve efficiency and resilience. These technological advancements are crucial for Lidl's online grocery strategy and overall operational effectiveness.

The retail sector is highly competitive, with established players and new entrants constantly vying for market share. Lidl's success depends on its ability to differentiate itself through pricing, product offerings, and customer experience. This requires continuous innovation and adaptation to retail industry trends.

Effective Lidl's supply chain management is crucial for maintaining product availability and controlling costs. Disruptions, whether from natural disasters, geopolitical events, or other unforeseen circumstances, can significantly impact operations. The company must have robust risk management strategies and contingency plans in place.

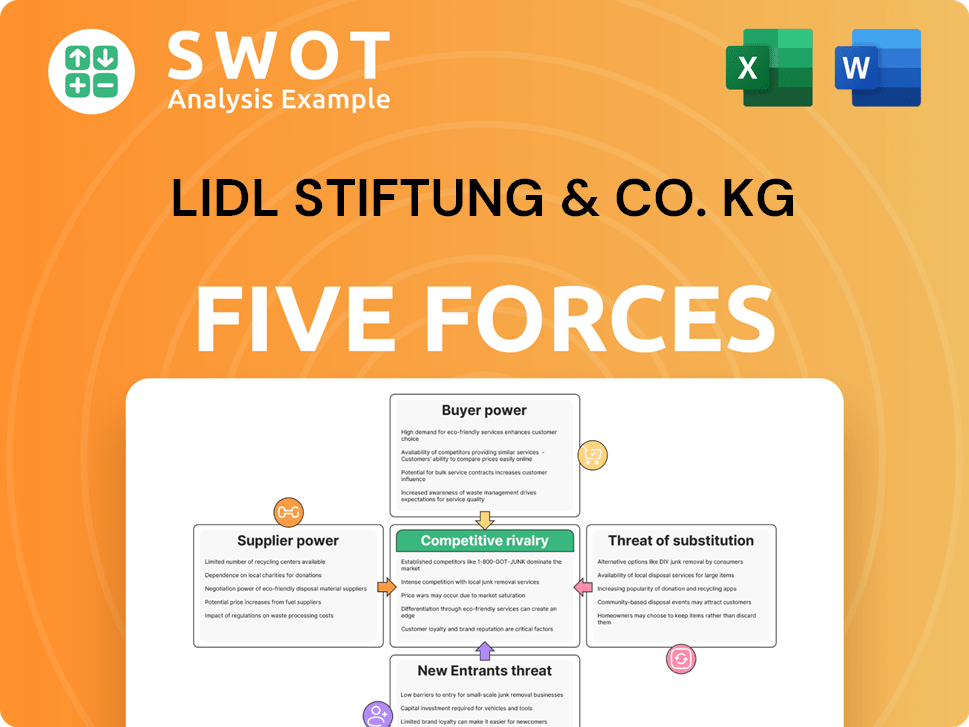

Lidl Stiftung & Co. KG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lidl Stiftung & Co. KG Company?

- What is Competitive Landscape of Lidl Stiftung & Co. KG Company?

- How Does Lidl Stiftung & Co. KG Company Work?

- What is Sales and Marketing Strategy of Lidl Stiftung & Co. KG Company?

- What is Brief History of Lidl Stiftung & Co. KG Company?

- Who Owns Lidl Stiftung & Co. KG Company?

- What is Customer Demographics and Target Market of Lidl Stiftung & Co. KG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.