Lidl Stiftung & Co. KG Bundle

Decoding Lidl Stiftung & Co. KG: How Does It Thrive?

Lidl Stiftung & Co. KG, a global retail giant, operates over 12,000 stores, primarily in Europe and the United States. This discount supermarket chain has captured the attention of millions with its commitment to offering quality products at competitive prices. But how does this model actually work, and what makes Lidl a force to be reckoned with in the competitive retail landscape?

This exploration into the Lidl Stiftung & Co. KG SWOT Analysis will unravel the secrets behind the Lidl business model. We'll dissect Lidl's operations, from its efficient supply chain to its strategic market penetration, offering insights for investors, customers, and industry observers alike. Understanding the Lidl company's approach is crucial for anyone seeking to understand the evolving dynamics of the retail sector and its impact on the global market.

What Are the Key Operations Driving Lidl Stiftung & Co. KG’s Success?

The core operations of the Lidl Stiftung & Co. KG company are centered around its network of discount supermarkets. The Lidl company offers a wide range of food and non-food products. This caters to a broad customer base seeking everyday essentials and occasional special buys. Its business model focuses on providing high-quality items at competitive prices.

The value proposition of Lidl is built on delivering high-quality goods at significantly competitive prices. This is primarily achieved through a strong emphasis on private-label brands, which constitute a substantial portion of its offerings. Lidl's operational efficiency is key to its success. The company focuses on streamlined processes to maintain low costs and pass savings on to customers.

Lidl's operational processes are designed for efficiency. This includes streamlined sourcing, with a focus on direct relationships with producers to reduce costs and ensure quality control. The company's logistics and supply chain management are highly optimized, minimizing warehousing needs and transportation costs. Sales channels are predominantly its physical stores, designed for quick and easy shopping experiences. Customer service is integrated into store operations, with staff trained to assist shoppers efficiently. These core capabilities translate directly into customer benefits through lower prices and a consistent shopping experience, differentiating Lidl in the crowded retail landscape.

Lidl's supply chain is a key element of its operations. This efficiency helps in reducing costs and maintaining product quality. Direct sourcing and optimized logistics are central to this strategy.

The design of Lidl stores focuses on a quick and easy shopping experience. Stores are typically standardized to streamline operations. This approach contributes to the overall efficiency of the business.

Lidl offers a curated selection of products, including both food and non-food items. A significant portion of the products are private-label brands. This helps in controlling costs and maintaining quality.

Customer service is an integral part of Lidl's store operations. Staff are trained to assist customers efficiently. This focus helps in creating a positive shopping experience.

Lidl's operational strategy includes several key components. These elements contribute to its success in the retail industry. The company's focus on efficiency and value is evident in its operations.

- Efficient supply chain management.

- Standardized store layouts.

- Emphasis on private-label brands.

- Customer-centric service.

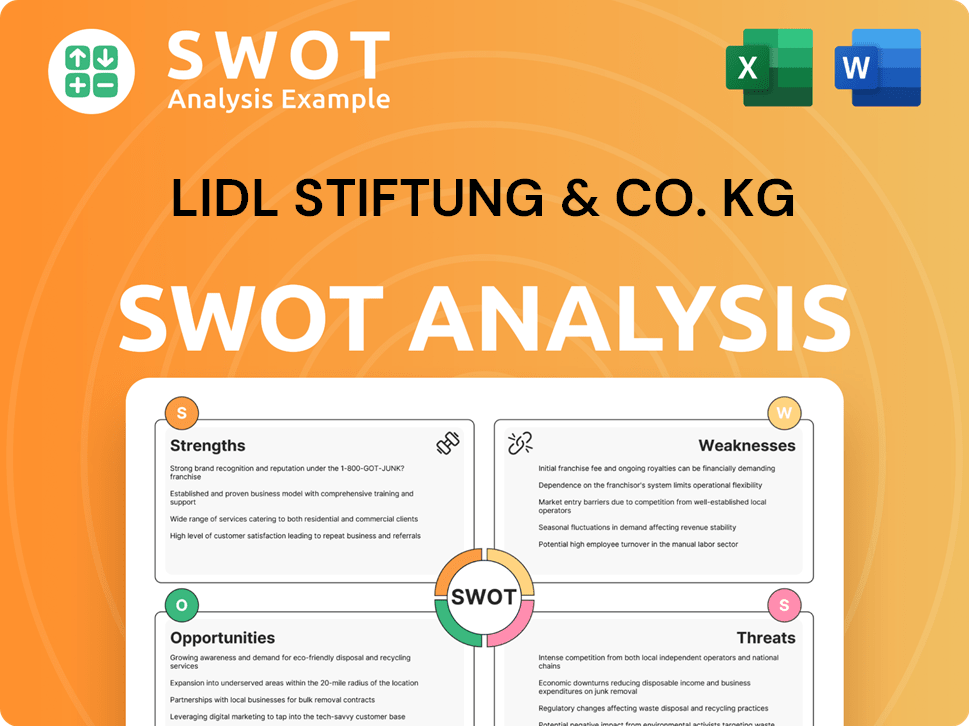

Lidl Stiftung & Co. KG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Lidl Stiftung & Co. KG Make Money?

The Lidl Stiftung & Co. KG, a prominent player in the discount supermarket sector, generates revenue primarily through the sale of goods in its stores. This encompasses a wide array of products, from food items to non-food merchandise, all contributing to its financial performance. Understanding the revenue streams and monetization strategies of the Lidl company is crucial for grasping its operational dynamics and market position.

The Lidl business model focuses on high-volume sales and low profit margins, leveraging economies of scale to maintain competitive pricing. This approach, combined with strategic sourcing and efficient operations, allows the company to offer attractive prices to consumers. The company's success is rooted in its ability to effectively manage costs and maximize sales volume.

A significant portion of Lidl's revenue comes from direct sales of goods to consumers through its extensive network of stores. While specific figures for 2024-2025 are not publicly available for Lidl Stiftung & Co. KG, the Schwarz Group, Lidl's parent company, reported €167.2 billion in sales for the 2023 financial year. This demonstrates the substantial revenue generated by the company.

Lidl operations are heavily influenced by its monetization strategies. These strategies are designed to maximize profitability while maintaining low prices for consumers. The company's approach includes a strong emphasis on private-label brands and dynamic pricing.

- Private-Label Brands: Lidl heavily relies on private-label brands, which offer higher profit margins compared to national brands. This strategy allows Lidl to control the entire supply chain, from sourcing to sale, reducing costs and increasing profitability.

- Dynamic Pricing: The company employs dynamic pricing strategies, including weekly special offers and limited-time non-food items, to drive foot traffic and encourage impulse purchases.

- Product Range Expansion: Lidl consistently expands its product range and introduces new private labels to capture a larger share of consumer spending.

- Regional Variations: Revenue mix can vary by region, influenced by local consumer preferences and market maturity.

For more insights into the company's background, you can explore the Brief History of Lidl Stiftung & Co. KG.

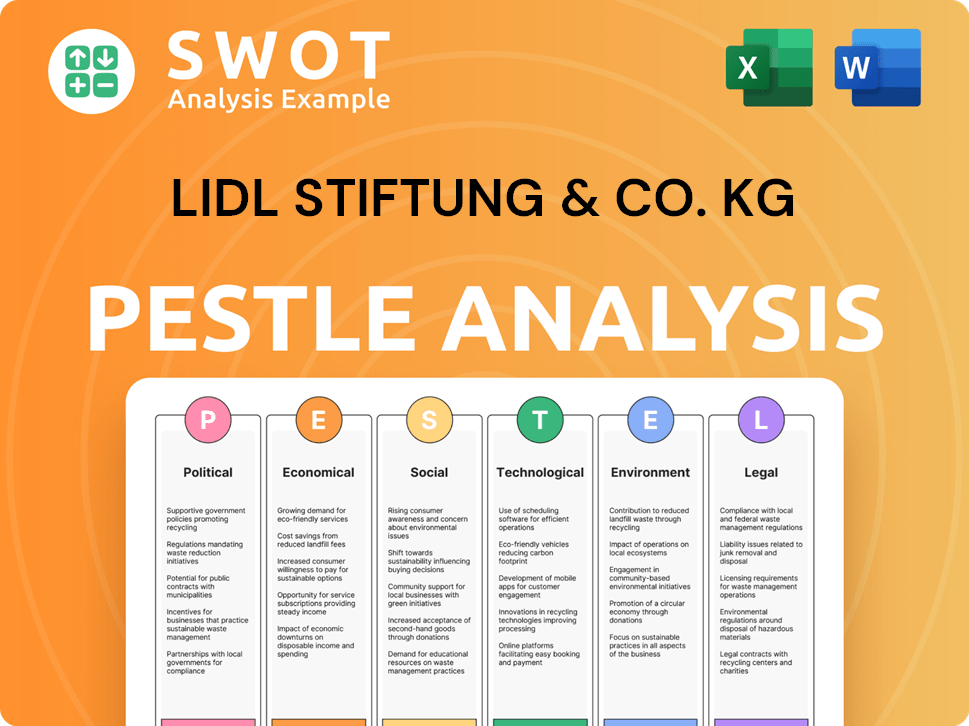

Lidl Stiftung & Co. KG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Lidl Stiftung & Co. KG’s Business Model?

The journey of Lidl Stiftung & Co. KG has been marked by significant milestones and strategic moves that have solidified its position as a global retail powerhouse. A pivotal strategic move has been its aggressive international expansion, particularly its entry into the U.S. market in 2017, which signaled its ambition beyond Europe. The company has continually invested in optimizing its supply chain and logistics, a core operational strength that contributes significantly to its cost efficiency.

Challenges have included intense competition from established retailers and adapting to diverse regulatory environments across different countries. Lidl has responded by consistently refining its private-label strategy, investing in store modernization, and emphasizing its commitment to sustainability, for instance, by focusing on sustainable sourcing and waste reduction. This commitment is part of a broader strategy to ensure long-term viability and appeal to environmentally conscious consumers.

Lidl's competitive advantages are multifaceted. Its brand strength is built on a reputation for value and quality. Operational efficiency, driven by its streamlined supply chain and lean store model, allows it to offer highly competitive prices. The extensive range of private-label brands provides both cost advantages and unique product offerings that differentiate it from competitors. Furthermore, its economies of scale, stemming from its vast store network and purchasing power, enable favorable supplier agreements.

Lidl's expansion into the U.S. market in 2017 was a significant milestone, marking a major step in its global strategy. The opening of its first store in the U.S. was a strategic move to tap into a new consumer base. By 2023, Lidl had expanded its presence across several states, demonstrating its commitment to growth.

Lidl has consistently focused on optimizing its supply chain and logistics to maintain cost efficiency. This includes strategic investments in distribution centers and transportation networks. The company also emphasizes its private-label strategy, offering a wide range of products under its own brands to control costs and differentiate itself from competitors.

Lidl's competitive advantage stems from its brand reputation for value and quality, supported by its operational efficiency. Its streamlined supply chain and lean store model allow it to offer competitive prices. The extensive range of private-label brands provides both cost advantages and unique product offerings.

Lidl continues to adapt to new trends by integrating more digital solutions, such as its Lidl Plus app, which offers personalized discounts and digital receipts. This enhances the customer experience and fosters loyalty. The company also focuses on sustainability initiatives, including sustainable sourcing and waste reduction, to appeal to environmentally conscious consumers.

Lidl's business model is centered around offering high-quality products at competitive prices, supported by efficient operations and strategic expansion. The company focuses on a limited assortment of products, with a strong emphasis on private-label brands. This strategy allows for cost savings and greater control over product quality.

- Global Expansion: The company has expanded its operations across Europe, the United States, and other international markets, with a focus on strategic market entries.

- Supply Chain Optimization: Lidl invests heavily in its supply chain to ensure efficient distribution and minimize costs, which is crucial for maintaining competitive pricing.

- Private-Label Focus: The company's emphasis on private-label brands allows it to control costs and offer unique products, enhancing its competitive advantage.

- Digital Integration: Lidl is integrating digital solutions, such as the Lidl Plus app, to improve customer experience and foster loyalty.

For a deeper understanding of the company's growth strategy, consider reading the article on Growth Strategy of Lidl Stiftung & Co. KG.

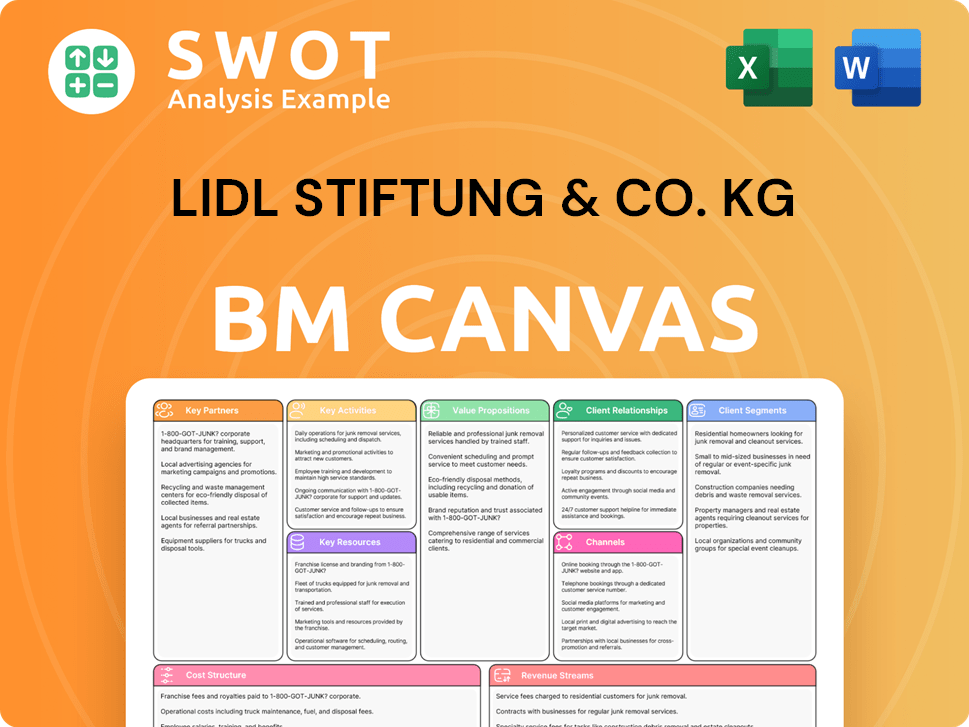

Lidl Stiftung & Co. KG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Lidl Stiftung & Co. KG Positioning Itself for Continued Success?

The Lidl Stiftung & Co. KG maintains a robust industry position, particularly within the discount retail sector. The company competes directly with major players like Aldi, leveraging a business model focused on efficiency and low prices. Its global presence continues to expand, driven by a value proposition that resonates with consumers seeking quality products at affordable prices. For example, the Schwarz Group, Lidl's parent company, reported sales of €167.2 billion for the 2023 financial year, demonstrating significant market share.

However, Lidl faces several challenges. Intense price competition from other discount retailers can squeeze profit margins. Supply chain disruptions, changing consumer preferences, and evolving regulatory landscapes also pose risks. To maintain its competitive edge and ensure sustained growth, Lidl is focused on strategic initiatives. These include enhancing its digital presence, optimizing its store network, and further developing its sustainable practices, as highlighted in the Growth Strategy of Lidl Stiftung & Co. KG.

Lidl is a key player in the discount retail sector, competing with Aldi and others. Its focus on value and efficiency drives its market share growth. The company's global expansion strategy targets both established and emerging markets.

Intense price competition and supply chain disruptions pose significant challenges. Changing consumer preferences and regulatory changes also impact operations. Adapting to these factors is crucial for sustained profitability.

Lidl's future involves continued expansion and technological advancements. The company aims to enhance operational efficiency and improve customer experience. Sustainability and digital innovation are key strategic priorities.

Lidl focuses on enhancing its digital presence and optimizing its store network. The company also develops sustainable practices. These initiatives are designed to drive long-term growth and customer loyalty.

The company's ability to navigate price wars and supply chain issues is critical. Adapting to consumer demand for sustainable and locally sourced products is also essential. The strategic initiatives aimed at digital transformation and operational efficiency will be key drivers of future success.

- Market Expansion: Targeting high-growth markets for store openings.

- Technological Integration: Leveraging technology to enhance efficiency.

- Sustainability: Focusing on sustainable practices to meet consumer demand.

- Customer Experience: Improving customer experience through digital channels.

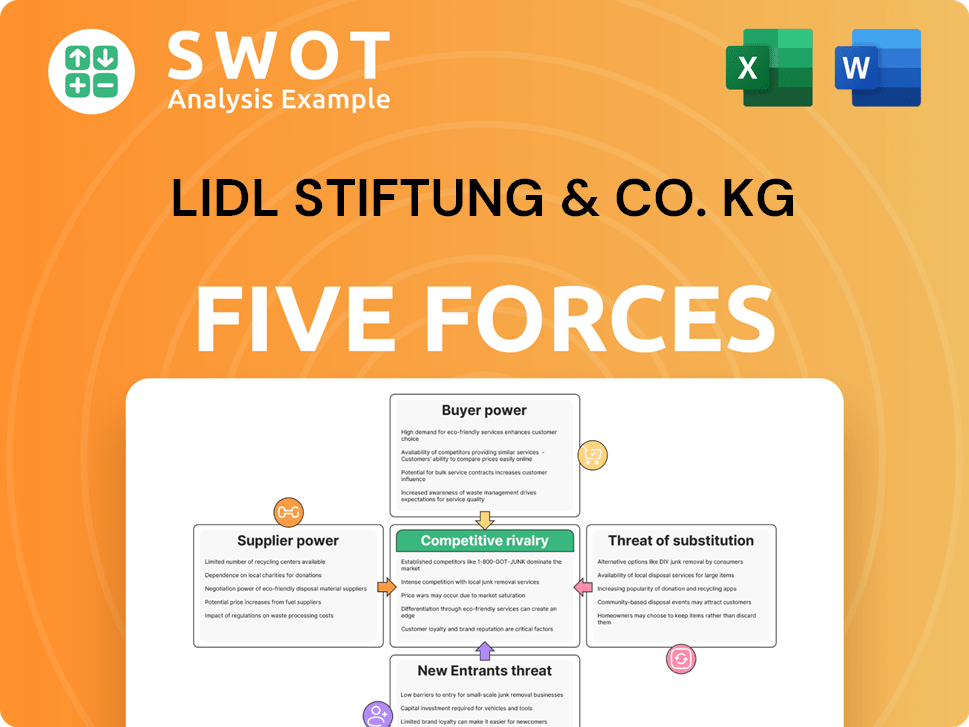

Lidl Stiftung & Co. KG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Lidl Stiftung & Co. KG Company?

- What is Competitive Landscape of Lidl Stiftung & Co. KG Company?

- What is Growth Strategy and Future Prospects of Lidl Stiftung & Co. KG Company?

- What is Sales and Marketing Strategy of Lidl Stiftung & Co. KG Company?

- What is Brief History of Lidl Stiftung & Co. KG Company?

- Who Owns Lidl Stiftung & Co. KG Company?

- What is Customer Demographics and Target Market of Lidl Stiftung & Co. KG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.