Menards Bundle

How Does Menards Thrive in the Cutthroat Home Improvement Arena?

Menards, a powerhouse in the home improvement industry, has built a loyal customer base by offering a vast selection of products at competitive prices. Its strategic expansion across the Midwest highlights its significant impact on the retail sector. Understanding the Menards SWOT Analysis is crucial to grasping its competitive advantages.

This deep dive into the Menards competitive landscape will examine its key rivals, including Home Depot and Lowe's, providing a comprehensive market analysis. We'll explore Menards' strategy, from its pricing models to its unique store layouts, and how it maintains its market share against fierce retail competition. Furthermore, we will analyze Menards' financial performance compared to rivals, focusing on its regional market dominance and future growth projections within the home improvement industry.

Where Does Menards’ Stand in the Current Market?

In the realm of home improvement retail, Menards carves out a significant market position, particularly in the Midwestern United States. The company's core operations revolve around offering a comprehensive range of products, including lumber, hardware, appliances, and garden supplies. This diverse selection caters to a broad customer base, from DIY enthusiasts to professional contractors.

Menards' value proposition centers on competitive pricing and a wide product assortment. This strategy has helped it maintain a strong presence in the competitive home improvement industry. The company's focus on value, combined with its expansive store network, has solidified its position as a key player in the market.

Menards consistently ranks among the top home improvement retailers in the U.S. Although specific market share figures are not publicly available for this privately held company, its performance places it in direct competition with industry giants like The Home Depot and Lowe's. This competitive landscape is crucial for understanding Menards' strategic positioning.

The company's geographic presence is concentrated across 15 states, primarily in the Midwest. This regional focus allows for a deeper market penetration and brand recognition within its core areas of operation. Understanding Menards store locations and expansion plans is key to analyzing its market strategy.

Menards is a robust privately held entity, with estimated annual revenue of $13.4 billion in 2023. This financial strength allows the company to invest in its operations, expand its offerings, and maintain competitive pricing. Analyzing Menards financial performance compared to rivals provides insights into its competitive advantages.

Menards' strategy emphasizes value-oriented retail, focusing on competitive pricing and a broad selection of products. While it has embraced digital transformation, its core strategy remains rooted in its brick-and-mortar big-box format. This approach is designed to meet the needs of its diverse customer base.

The home improvement industry is highly competitive, with players like The Home Depot and Lowe's vying for market share. Menards' success hinges on its ability to maintain competitive pricing and a wide product selection. Further insights can be found in Growth Strategy of Menards.

- Menards' regional market dominance is particularly strong in the Midwest, where it often holds a leading position.

- The company's value-oriented approach appeals to a broad customer base, including DIY enthusiasts, contractors, and small businesses.

- Menards' online presence and e-commerce strategy are evolving to meet the changing demands of consumers.

- Analyzing Menards' advertising campaigns analysis can reveal how the company maintains its brand visibility.

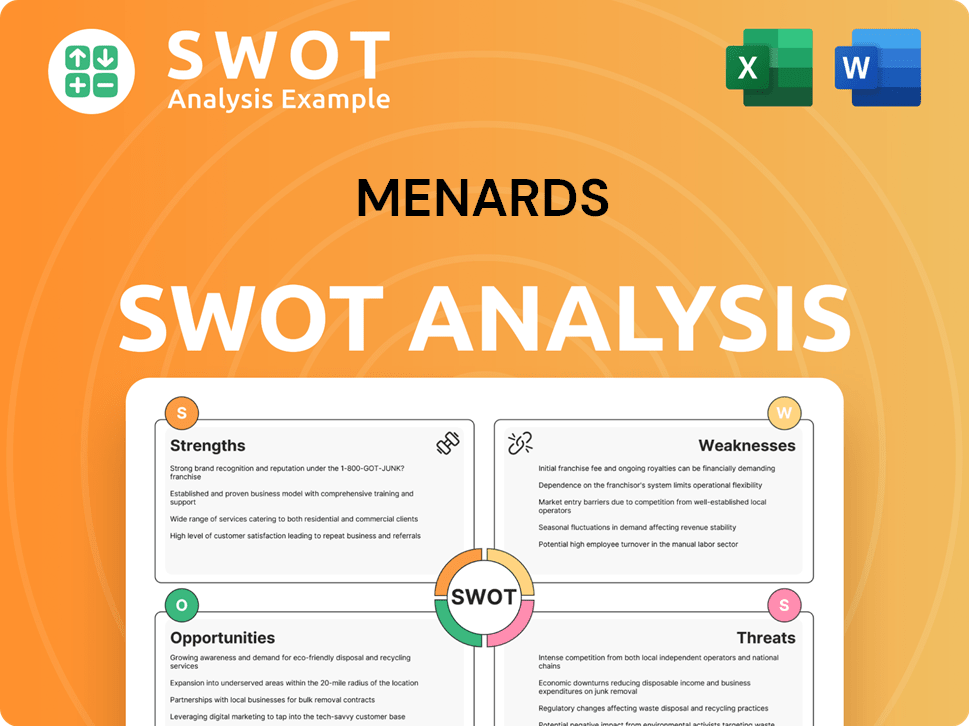

Menards SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Menards?

The competitive landscape for Menards in the home improvement industry is shaped by a diverse array of rivals. This analysis explores the key competitors, their strategies, and how they challenge Menards' market position. Understanding these dynamics is crucial for evaluating Menards' future prospects and strategic initiatives.

Menards' market analysis reveals a competitive environment influenced by both direct and indirect competitors. The home improvement industry is dynamic, with companies constantly adapting to changing consumer preferences, technological advancements, and economic conditions. This competitive intensity necessitates continuous innovation and strategic adjustments to maintain or enhance market share.

Menards faces substantial competition from several key players in the home improvement market. These competitors employ various strategies, including pricing, product assortment, and customer service, to gain market share.

The Home Depot is a primary competitor, boasting a vast national footprint and significant market capitalization. In 2024, The Home Depot reported net sales of approximately $152.7 billion. Its extensive product range and strong focus on professional customers pose a direct challenge to Menards.

Lowe's is another major competitor, known for its product variety and customer service focus. Lowe's generated revenues of around $86.3 billion in fiscal year 2024. It targets both DIY and professional customers, similar to Menards.

Regional hardware chains, such as Ace Hardware and True Value, offer localized competition. These chains often focus on personalized service and niche product offerings to differentiate themselves. Ace Hardware, for example, operates through a cooperative model, allowing for localized decision-making and community engagement.

Local lumber yards and building material suppliers provide specialized competition. These businesses often cater to specific needs, such as construction materials or custom services, and may have strong relationships with local contractors. They offer a more focused product selection compared to the larger home improvement stores.

General merchandise retailers like Walmart and Target indirectly compete by offering home improvement goods. These retailers often compete on price and convenience, leveraging their extensive supply chains and online platforms. Walmart's e-commerce sales continue to grow, increasing the competition in this sector.

E-commerce giants, particularly Amazon, pose an indirect threat. Amazon offers a wide array of home improvement products, often at competitive prices, with convenient delivery options. This has led to a shift in consumer purchasing habits, with more customers buying online. Amazon's net sales in 2024 were over $575 billion.

Menards' strategy involves a combination of competitive pricing, extensive product selection, and a focus on customer service. The company's advertising campaigns often highlight its value proposition, emphasizing lower prices and a wide range of products. Menards' market share is significant in the Midwestern United States, where it has a strong presence.

- Pricing Strategy: Menards frequently employs promotional pricing and offers rebates to attract customers.

- Product Assortment: The company provides a vast selection of products, including building materials, appliances, and home décor.

- Customer Service: Menards focuses on providing good customer service to build customer loyalty.

- Regional Focus: Menards has a strong presence in the Midwest, where it has established a loyal customer base.

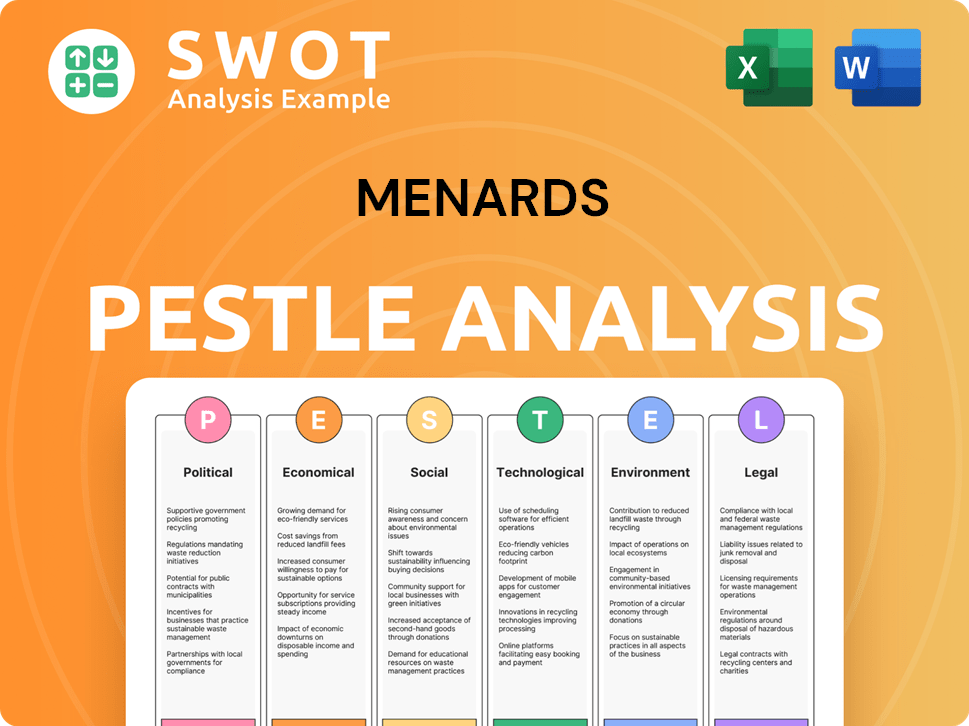

Menards PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Menards a Competitive Edge Over Its Rivals?

The competitive landscape for Menards is shaped by its distinctive advantages, allowing it to stand out in the home improvement industry. Its strategy emphasizes value and competitive pricing, frequently using a rebate program to foster customer loyalty. This approach, coupled with efficient supply chain management and large-volume purchasing, enables Menards to offer products at prices that are often difficult for competitors to match. This is a key element in the Marketing Strategy of Menards.

Menards also benefits from its extensive inventory, which often surpasses that of some competitors in certain product categories. This creates a one-stop-shop experience for a wide range of home improvement needs, from lumber and building materials to appliances and decor. Additionally, Menards' private ownership provides flexibility in strategic decision-making and a long-term investment horizon, free from the pressures of quarterly reporting.

The company's established brand equity and customer loyalty, particularly within the Midwestern states, also serve as significant advantages. Many customers in these regions have a long-standing relationship with Menards, valuing its product assortment and pricing. These advantages have evolved over time, with Menards consistently refining its operational efficiencies and leveraging its deep understanding of the Midwestern market.

Menards' focus on value is a primary competitive advantage. The rebate program, a key element of its pricing strategy, encourages repeat business and customer loyalty. This strategy, combined with efficient supply chain management, allows Menards to offer competitive prices.

Menards offers a wide range of products, often exceeding the selection of some competitors. This extensive inventory provides a one-stop-shop experience for customers. The broad product selection caters to a variety of home improvement needs, enhancing customer convenience.

Being privately owned allows Menards to make strategic decisions without the pressure of quarterly earnings reports. This ownership structure enables a long-term investment horizon. It allows for investments in infrastructure and expansion without immediate shareholder scrutiny.

Menards has built strong brand equity, particularly in the Midwestern states. Customer loyalty is a significant advantage, with many customers having long-standing relationships with the company. This loyalty is based on product assortment and pricing.

Menards' competitive advantages are multifaceted, encompassing pricing strategies, extensive product offerings, and a unique ownership structure. These elements contribute to its strong market position and customer loyalty. The company's ability to adapt to market changes and maintain operational efficiency is crucial.

- Value-Driven Pricing: Menards' rebate programs and efficient supply chain allow it to offer competitive prices, attracting budget-conscious customers.

- Broad Product Selection: Extensive inventory, including lumber, building materials, appliances, and decor, positions Menards as a one-stop shop.

- Strategic Flexibility: Private ownership enables long-term investments and strategic decision-making without the constraints of public markets.

- Strong Regional Presence: High brand recognition and customer loyalty in the Midwestern states provide a significant competitive edge.

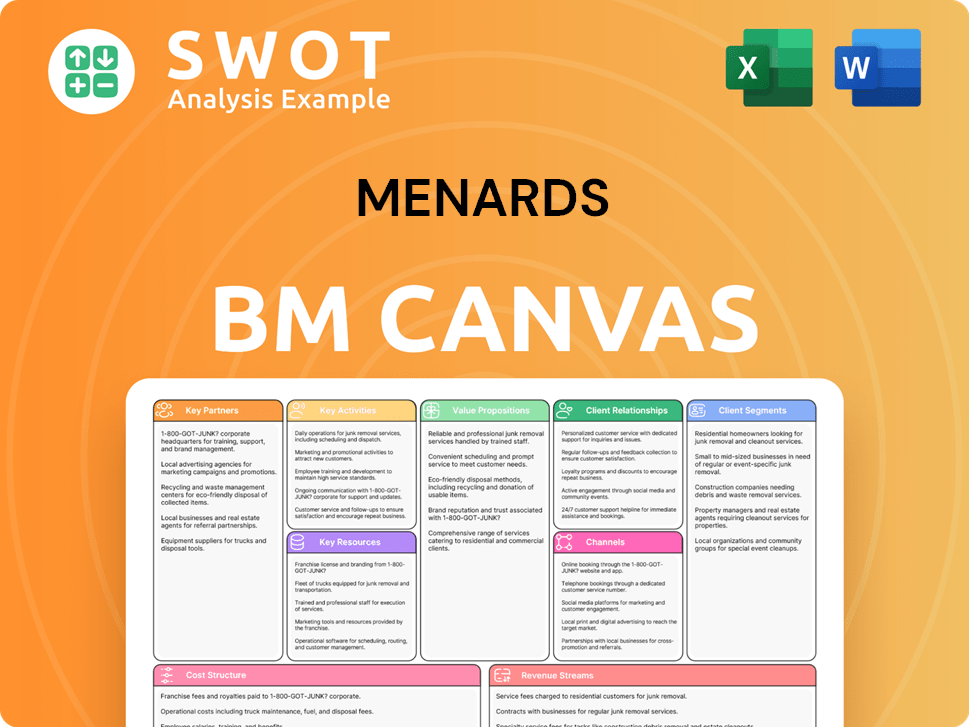

Menards Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Menards’s Competitive Landscape?

The home improvement industry is experiencing dynamic shifts that significantly impact companies like Menards. These changes present both challenges and opportunities, requiring strategic adaptation to maintain and grow market share. Understanding the Menards competitive landscape involves analyzing industry trends, anticipating future disruptions, and identifying potential growth areas to ensure long-term success.

The Menards market analysis reveals the importance of adapting to evolving consumer preferences and technological advancements. The company must navigate regulatory changes, consumer demands for sustainable products, and the rise of e-commerce to stay competitive. A proactive approach to these factors is crucial for maintaining Menards' position within the home improvement industry.

Key trends shaping the home improvement industry include the growth of e-commerce, the increasing demand for sustainable products, and the integration of smart home technologies. These trends necessitate investments in digital infrastructure, enhanced customer engagement, and the expansion of eco-friendly product lines. The focus on personalized shopping experiences also drives the need for data-driven marketing strategies.

Potential challenges for Menards include the rise of direct-to-consumer brands, which could bypass traditional retail channels, and the impact of economic downturns on the housing market. Increased interest rates and aggressive expansion by competitors like Home Depot and Lowe's also pose threats. Regulatory changes and evolving labor practices add further complexity to the operational environment.

Growth opportunities for Menards exist in emerging markets, particularly in regions with increasing homeownership rates. Product innovations related to energy efficiency, smart home integration, and sustainable building materials present significant potential. Strategic partnerships with contractors and developers could unlock new revenue streams and enhance customer value.

To maintain its competitive edge, Menards must continue to invest in its supply chain, digital capabilities, and customer service. Focusing on its core value proposition of offering a wide selection of products at competitive prices remains crucial. Adaptations to Menards strategy will be essential to remain resilient in a dynamic market. Read more about the Growth Strategy of Menards.

Menards competitors, including Home Depot and Lowe's, are constantly evolving their strategies, making it essential for Menards to stay agile. The company's ability to adapt to these changes and capitalize on emerging trends will determine its future success. Understanding these factors is crucial for effective Menards market analysis and strategic planning.

- Focus on e-commerce and omnichannel integration to meet evolving customer expectations.

- Explore strategic partnerships to expand product offerings and reach new customer segments.

- Invest in sustainable practices and products to align with consumer preferences and regulatory requirements.

- Continuously monitor market trends and competitor activities to inform strategic decisions.

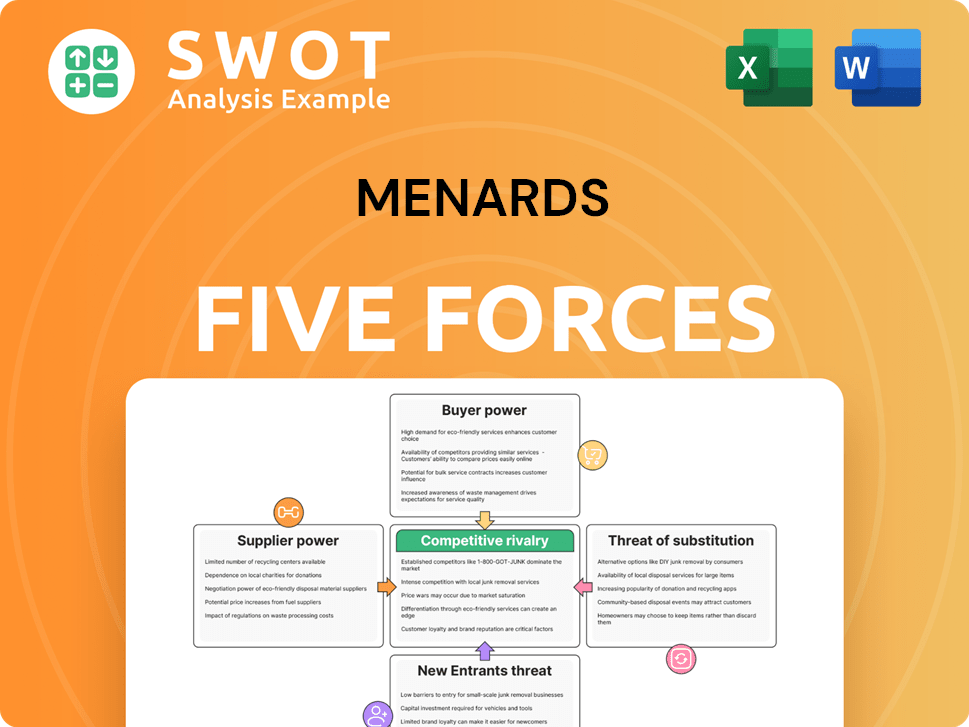

Menards Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Menards Company?

- What is Growth Strategy and Future Prospects of Menards Company?

- How Does Menards Company Work?

- What is Sales and Marketing Strategy of Menards Company?

- What is Brief History of Menards Company?

- Who Owns Menards Company?

- What is Customer Demographics and Target Market of Menards Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.