Menards Bundle

How Does Menards Thrive in the Home Improvement Arena?

Menards, a privately-held powerhouse, has quietly built a retail empire, challenging industry giants. Founded in 1960, this Midwestern favorite has expanded to become the third-largest home improvement retailer in the U.S. with over 341 Menards SWOT Analysis. Its success lies in its unique approach to the market.

With approximately $15 billion in annual revenue in 2024, understanding how Menards works is crucial. This analysis explores the core operations of the Menards company, its value proposition, and its strategic moves. We'll examine how this privately-owned entity competes against publicly traded companies, offering insights into its business model and future prospects. Discover how Menards stores have become a household name.

What Are the Key Operations Driving Menards’s Success?

The core operations of the Menards company revolve around providing a wide array of products to both homeowners and professional contractors. This approach allows the company to cater to a broad customer base. The company's business model is built on offering a comprehensive selection of items, creating a 'one-stop shop' experience for its customers.

The value proposition of Menards centers on offering a diverse range of products at competitive prices. The company's strategic focus on efficient operations, including a robust supply chain and customer-friendly services, enhances the overall customer experience. By combining a broad product selection with a commitment to value, Menards aims to attract and retain a loyal customer base.

The company's operational strategy includes strategically located stores and distribution centers, ensuring wide market reach. As of May 2025, Menards operates 341 stores, primarily in the Midwest. This network supports efficient inventory management and product availability, crucial for its 'one-stop shop' model.

The primary offerings include lumber, roofing, building materials, hardware, tools, appliances, and home goods. The company also offers seasonal items, garden supplies, groceries, pet food, and automotive products. This diverse range supports the 'one-stop shop' concept.

The company uses strategically placed distribution centers and a 'hub-and-spoke' delivery system. Efficient logistics and inventory management minimize stockouts and transportation costs. Suppliers are required to use specific preferred carriers, often using a 'drop trailer' system.

Customers benefit from in-store services, pickup options, and a growing online presence via Menards.com, which offers over 375,000 items. The company provides a 'Pro Advantage' program for contractors. The stores are designed to be spacious and well-organized.

The company focuses on competitive pricing through bulk purchasing and internal manufacturing. This focus on value, combined with a diverse product range and a customer-friendly approach, translates into cost savings and convenience for its customers. The company's focus on value is a key differentiator.

The company's operational model is designed for efficiency and customer convenience. The strategic placement of stores and distribution centers ensures wide market reach. Efficient logistics and inventory management are critical for minimizing costs and enhancing customer satisfaction.

- Strategic store locations, primarily in the Midwest, maximizing market reach.

- A 'hub-and-spoke' delivery system originating from distribution centers.

- Emphasis on efficient logistics and inventory management to reduce costs.

- Supplier requirements for using preferred carriers, often with a 'drop trailer' system.

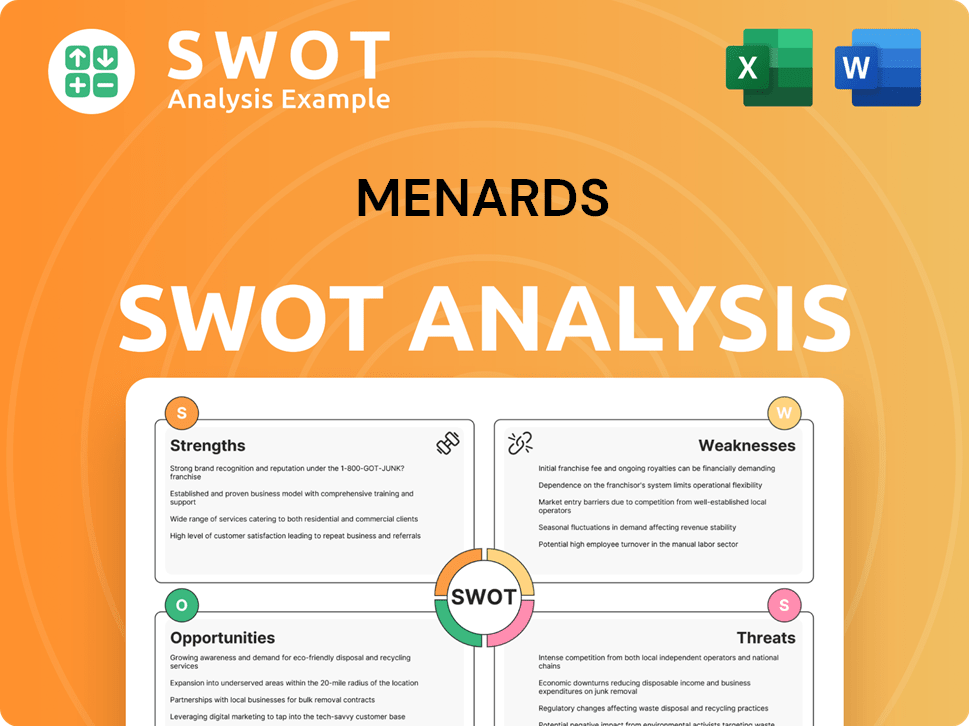

Menards SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Menards Make Money?

The Menards company primarily generates revenue through direct sales of a wide array of home improvement products and related goods. This strategy is supported by a diverse product range and various services, contributing to its robust financial performance. The company's approach combines physical stores with a growing digital platform to cater to both online and in-store shoppers.

In 2024, Menards' revenue reached approximately $15 billion. This substantial revenue stream is a result of effective monetization strategies, including a well-known rebate program and private-label brands. The company's strategic focus on product diversity and customer loyalty programs is key to its financial success.

A crucial aspect of How Menards works is its revenue generation through direct product sales. The company's diverse product categories contribute significantly to its total revenue. For instance, in 2024, building materials, including lumber and roofing, accounted for an approximate $7.5 billion in sales. Appliances and home goods contributed around $2.2 billion, while tools and hardware generated approximately $3.1 billion.

A notable monetization strategy employed by Menards is its robust rebate program, particularly the well-known 11% rebate offer. This program provides merchandise credit for future purchases and is a key driver of growth, with over 60% customer participation in 2024. These rebates incentivize repeat business and foster customer loyalty by offering perceived value and encouraging customers to consolidate their purchases at Menards.

- The Menards BIG Card further enhances this strategy by offering cardholders a 2% rebate on purchases and special financing options to encourage larger transactions.

- Beyond product sales, Menards also generates revenue through various services, including custom cabinetry and window installation.

- The company also leverages its private-label brands, such as Masterforce, Tuscany, Dakota, and Crestone, which offer cost-effective alternatives to national brands, allowing Menards to maintain competitive pricing while ensuring product quality.

- Menards' online sales also contribute to revenue, with menards.com generating US$1.295.8 billion in online revenue in 2024. This blended retail approach, combining physical stores with a growing digital platform, caters to both online and in-store shoppers, further diversifying revenue sources. For more details on the company's customer base, you can explore the Target Market of Menards.

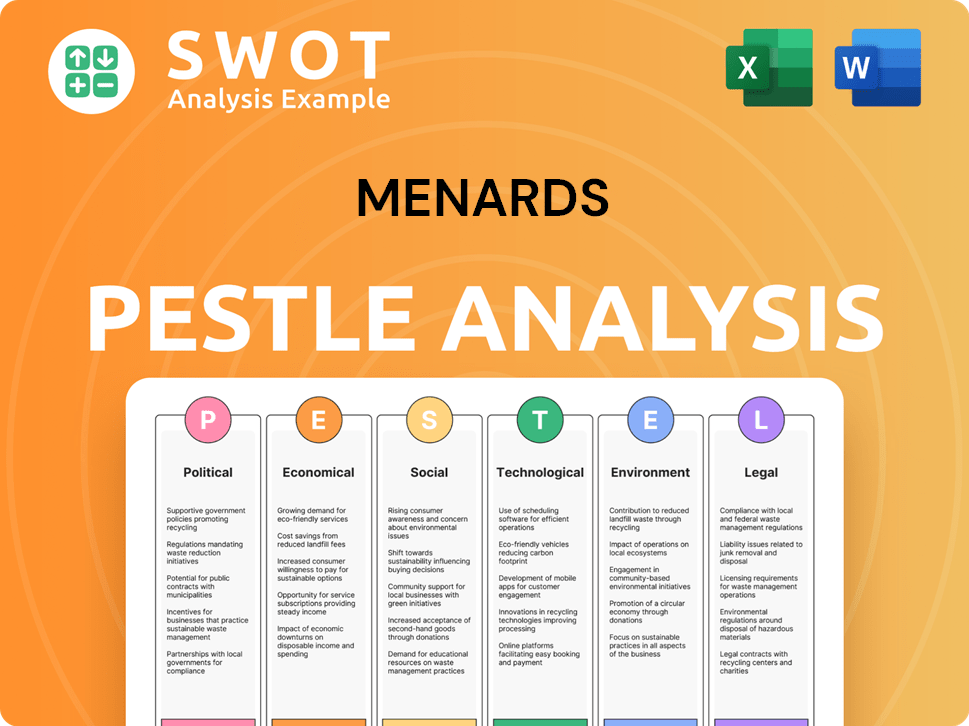

Menards PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Menards’s Business Model?

The journey of the Menards company has been marked by significant milestones and strategic shifts that have shaped its operations and market position. Founded in 1960, the company initially focused on post-frame structures, later evolving into a prominent building materials outlet. This evolution reflects its adaptability and responsiveness to market demands.

Menards has consistently expanded its footprint, reaching a notable milestone with its 150th store around the year 2000. Strategic moves, such as establishing distribution centers in Ohio and Iowa in 2007, have enhanced its supply chain efficiency. As of May 2025, the company operates 341 stores across 15 states, demonstrating its continued growth and commitment to serving its customer base.

The company's ability to adapt to changing market dynamics, including the rise of e-commerce and technological advancements, is crucial for its continued success. Menards has embraced digital marketing and e-commerce, offering over 375,000 items on its website. In 2024, online revenue exceeded $1.2 billion, highlighting the importance of its digital presence.

Menards was founded in 1960, initially focusing on post-frame structures. The company expanded significantly, opening its 150th store by 2000. Strategic investments in distribution centers, such as those in Ohio and Iowa, have supported its growth.

The company has invested in e-commerce and digital marketing to adapt to market trends. Menards has expanded its product offerings and adopted smart home technology. These moves aim to enhance customer experience and maintain competitiveness.

Menards benefits from strong regional brand recognition and customer loyalty. The 'Save BIG Money' slogan and competitive pricing attract budget-conscious consumers. The 11% rebate program is a key differentiator, driving repeat business.

Menards faces challenges in adapting to market trends and technological shifts. The company has an opportunity to improve its e-commerce capabilities. Delays in construction projects indicate potential expansion challenges.

Menards' competitive advantages include strong brand recognition, economies of scale, and unique business practices. The company's strategy of offering competitive pricing and the 11% rebate program fosters customer loyalty. The company's private ownership allows for flexible decision-making, which is a key aspect of the Growth Strategy of Menards.

- Menards has a wide variety of products (SKUs), aiming to be a one-stop shop for customers.

- The company's efficient supply chain, including strategic distribution centers, contributes to cost control.

- Menards focuses on offering competitive pricing to attract budget-conscious consumers.

- The 11% rebate program is a significant differentiator, driving repeat business.

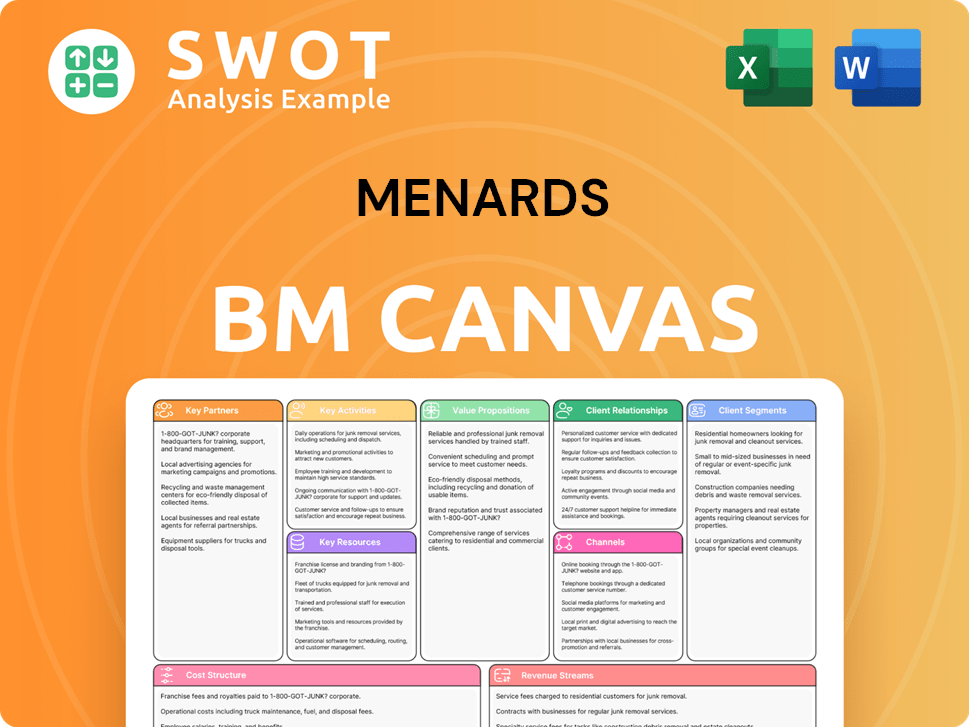

Menards Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Menards Positioning Itself for Continued Success?

The Menards company holds a prominent position in the home improvement retail sector. As of May 2025, it ranks as the third-largest player in the United States, operating 341 stores primarily in the Midwest. This regional dominance is a key characteristic of how Menards works, setting it apart from its national competitors.

A 2024 study highlighted Menards' strong customer satisfaction, particularly in value for money, store cleanliness, and product variety. The study showed that Menards captures a leading 77% of customers' repeat purchases, exceeding both Lowe's and Home Depot. This underscores its robust market presence and customer loyalty, especially among DIY enthusiasts, which is central to the Menards business model.

Menards is the third-largest home improvement retailer in the U.S., with a strong presence in the Midwest. It competes with industry giants like Home Depot and Lowe's. The company's primary focus is on providing a wide variety of products at competitive prices, which contributes to its strong market position.

Limited geographic presence poses a challenge, making it vulnerable to regional economic downturns. Intense competition from larger, nationwide retailers like Home Depot and Lowe's also presents a constant challenge. Furthermore, keeping up with e-commerce capabilities and changing consumer preferences remains a significant risk.

Menards plans to expand into new markets and enhance its online presence. The company is investing in technology to improve customer experience and capitalize on the growing DIY market. By focusing on its strengths, Menards aims to sustain and expand its profitability in the evolving retail landscape.

Expansion into surrounding states is planned to capture new markets. There is a strong emphasis on improving the online shopping experience, including the mobile app and e-commerce platform. Investment in AI and AR technologies is also expected to improve customer experience. The company aims to leverage the expanding DIY market, predicted to reach $513 billion in 2024.

The home improvement market is competitive, with significant growth potential. Menards is focused on strategic initiatives to maintain its market position and drive expansion. The company's approach involves leveraging its core strengths to adapt to changing consumer needs and market trends.

- Expansion into new states is a key strategy for growth.

- Enhancing the online shopping experience is a priority.

- Investment in technology is aimed at improving customer service.

- The company is well-positioned to benefit from the growing DIY market.

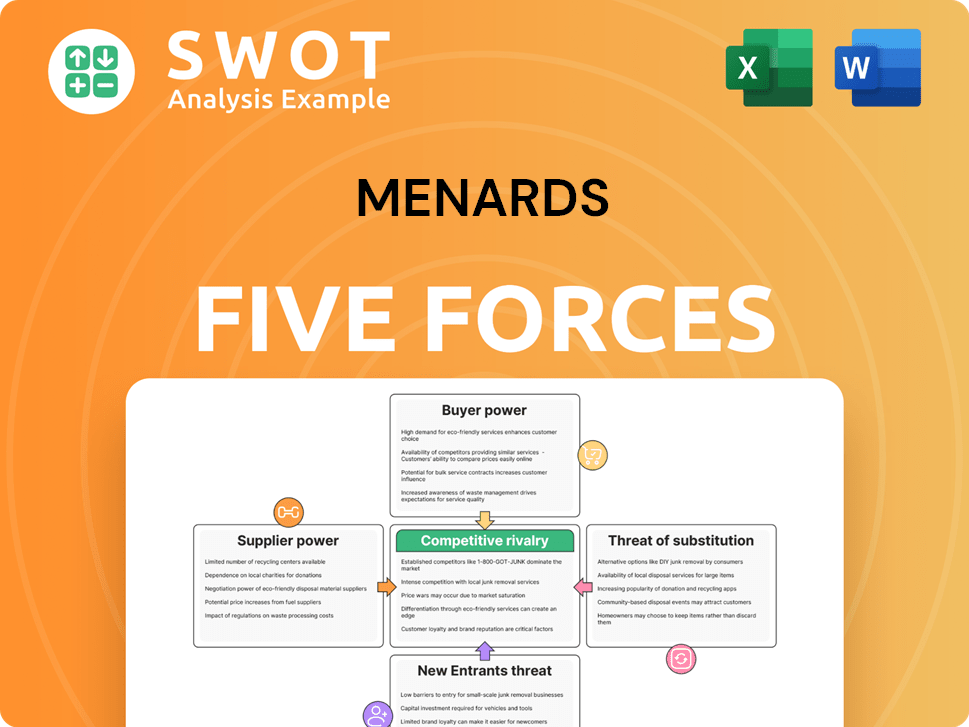

Menards Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Menards Company?

- What is Competitive Landscape of Menards Company?

- What is Growth Strategy and Future Prospects of Menards Company?

- What is Sales and Marketing Strategy of Menards Company?

- What is Brief History of Menards Company?

- Who Owns Menards Company?

- What is Customer Demographics and Target Market of Menards Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.