Menards Bundle

Who Shops at Menards?

Understanding the "who" behind Menards' success is key to grasping its market dominance. Menards, a leading home improvement retailer, has cultivated a loyal customer base. This analysis delves into the specifics of Menards' customer demographics and target market.

From its humble beginnings in 1958, Menards has evolved into a retail giant, and its customer profile has expanded significantly. To truly understand Menards' position in the market, we must examine its Menards SWOT Analysis, customer base, and the strategies it employs to attract and retain its ideal customer. This exploration will reveal valuable insights into Menards' market analysis and how it caters to the needs and wants of its diverse clientele, including detailed information on Menards customer demographics.

Who Are Menards’s Main Customers?

Understanding the customer demographics and Menards target market is crucial for analyzing its business strategy. The company primarily focuses on three key customer segments: homeowners, contractors, and small businesses. This approach allows the company to cater to a broad customer base, ensuring a steady flow of revenue.

The business model of the company is largely business-to-consumer (B2C) for homeowners and business-to-business (B2B) for contractors and small businesses. This dual approach enables it to capture a significant share of the home improvement market. By focusing on both individual consumers and professional clients, the company maximizes its market reach and sales potential.

The Menards customer profile reveals a diverse group of individuals and businesses, each with unique needs and preferences. The company's ability to meet these varied demands is a key factor in its success and market position.

Homeowners represent a significant portion of the company's customer base, driven by the increasing popularity of DIY projects. In 2024, the home improvement market was projected to reach $513 billion, with DIY projects constituting a substantial portion. Younger homeowners, particularly those aged 18-34, are increasingly leading home improvement investments, with 36% planning to increase their budgets in 2025, compared to 17% of homeowners aged 55 and older. This demographic often tackles homes requiring more renovation, allocating higher budgets for improvements.

Contractors form another core demographic, relying on the company for lumber, building materials, and other essential supplies. The U.S. construction and contractor industry is poised for growth, with projections of 4.5% growth in 2024 and steady demand in institutional construction, with spending expected to increase by 4% in 2025. This segment often prioritizes product availability, competitive pricing, and bulk purchasing options.

Small businesses, including local contractors and independent retailers, also benefit from the company's wide range of products and competitive pricing. These businesses often seek cost-effective solutions for their operational needs, making the company a valuable resource. The company's focus on value and extensive product variety remains a consistent draw for its diverse customer base.

The company's approximate $15 billion in annual sales in 2024 reflects its strong market position. Over time, the company has likely adapted its offerings and marketing to cater to the evolving needs of these segments, for instance, by expanding its online presence and product listings to over 375,000 items, catering to both online and in-store shoppers. For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of Menards.

The Menards customer base is diverse, but some common traits define the ideal customer. These customers are typically homeowners, contractors, and small business owners looking for quality products at competitive prices. They value convenience, a wide selection of items, and a positive shopping experience.

- Homeowners seeking DIY project supplies and home improvement materials.

- Contractors requiring bulk purchases of building materials and tools.

- Small business owners looking for cost-effective solutions for their operational needs.

- Customers who appreciate a wide variety of products and competitive pricing.

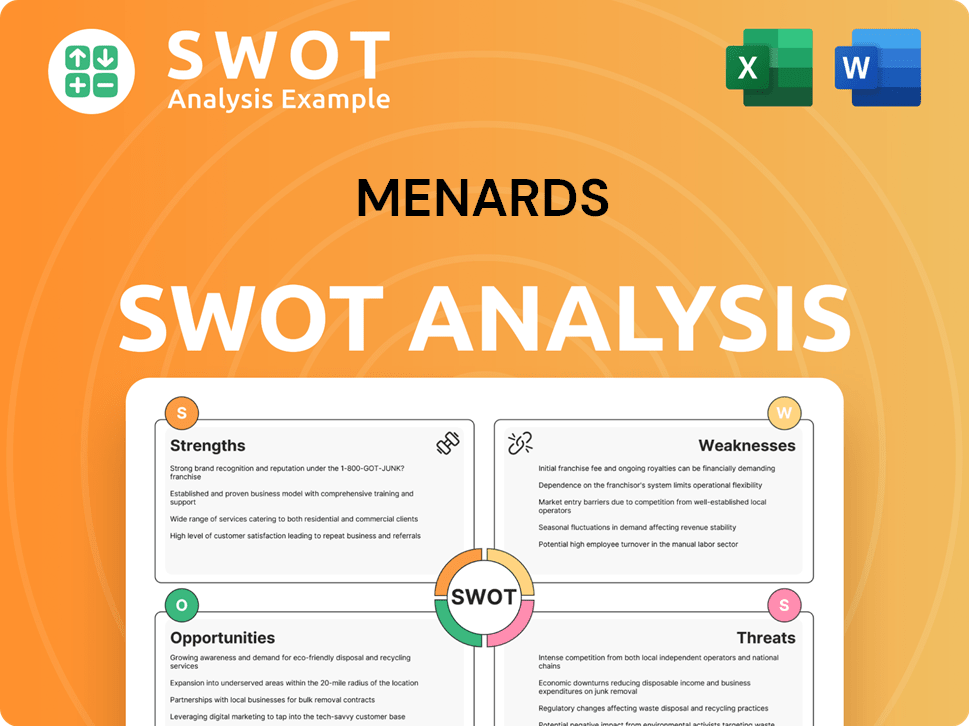

Menards SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Menards’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business. For the company, this involves catering to a diverse customer base with varying needs, preferences, and purchasing behaviors. The company's strategies are designed to meet these needs, focusing on value, convenience, and a wide product selection.

The company's customer base is driven by a combination of practical, psychological, and aspirational needs. Customers seek value and competitive pricing, which the company addresses through frequent sales and its rebate program. This approach, along with a focus on convenience and variety, shapes the company's customer profile and market strategies.

The company's customers are primarily motivated by the desire for value and competitive pricing. The company effectively addresses this need through its rebate program and frequent sales, which are key drivers of customer loyalty and sales volume. This focus on affordability and deals appeals directly to cost-conscious consumers.

The company's pricing strategy is a key factor, with sales increasing by 7% in 2024, directly appealing to cost-conscious consumers. The 11% rebate program is a significant driver of customer loyalty, with over 60% customer participation in 2024.

Customers actively seek deals through weekly ads and circulars, both in print and online, which drive store traffic. The company's omnichannel approach, with Menards.com offering over 375,000 items, blends digital ease with physical store access.

The extensive product range, including building materials, hardware, appliances, and groceries, makes the company a 'one-stop shop'. The company's focus on quality craftsmanship and customer satisfaction also plays a key role.

The shift towards omnichannel retailing is evident, with the website offering a vast selection. Retailers with strong omnichannel strategies saw a 15% increase in customer engagement in 2024, highlighting the importance of this approach.

The company addresses the need for affordable home improvement solutions and a wide array of products in one location. The company also adapts to market trends, such as the demand for sustainable products.

Loyalty is heavily influenced by savings from rebates and the BIG Card, which offers a 2% rebate and financing options. Approximately 30% of customers utilized financing in 2024.

The company’s customer base is diverse, with varied needs and preferences. The company's ability to meet these needs is crucial for its success. The company's focus on value, convenience, and a wide product selection is key to its market strategy. For a deeper understanding of the company's history and evolution, check out this Brief History of Menards.

- Value and Pricing: Customers prioritize competitive pricing, addressed through the rebate program and frequent sales.

- Convenience and Variety: The extensive product range and omnichannel approach cater to customer needs for convenience.

- Addressing Pain Points: The company provides affordable solutions and a wide array of products, adapting to market trends.

- Loyalty Programs: The BIG Card and rebates drive customer loyalty.

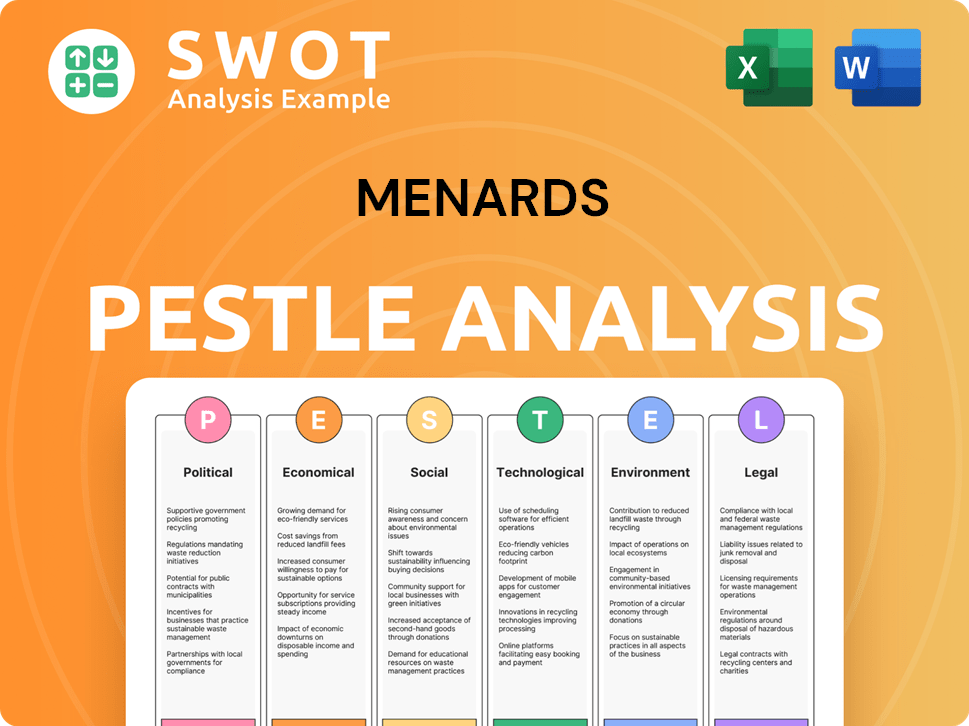

Menards PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Menards operate?

The geographical market presence of Menards is primarily concentrated in the Midwestern United States. As of May 2025, the company operates a total of 341 stores across 15 states. This strategic focus allows for strong brand recognition and customer loyalty within its operating regions.

These states include Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Nebraska, North Dakota, Ohio, South Dakota, West Virginia, Wisconsin, and Wyoming. This regional approach enables effective competition and a strong physical presence, which are key factors in attracting and retaining customers. The company's store placement emphasizes accessibility, which is a critical factor in driving customer traffic.

While Menards' focus remains regional, this limited geographic presence can also be a constraint on its overall growth potential compared to national retailers like Home Depot and Lowe's. However, the company's strategic store placement is key to its market reach and customer traffic within its operating regions, emphasizing accessibility and physical presence. There are no explicit details available on differences in customer demographics, preferences, or buying power across these specific Midwestern regions, nor how Menards localizes its offerings beyond general product availability.

The home improvement market is projected to reach $575 billion by 2027. This presents opportunities for geographical expansion for Menards. Such expansion could unlock higher revenue streams, potentially achieving a 10-15% annual growth.

Menards reported approximately $15 billion in revenue for 2024. This demonstrates its solid market position within its operating states. This financial performance highlights the company's strong presence in the Midwestern market.

Menards' strong regional presence allows it to effectively target its customer base. This strategic focus has enabled the company to build a loyal customer base and establish a strong brand reputation. The company's focus on the Midwest provides a stable foundation for its operations.

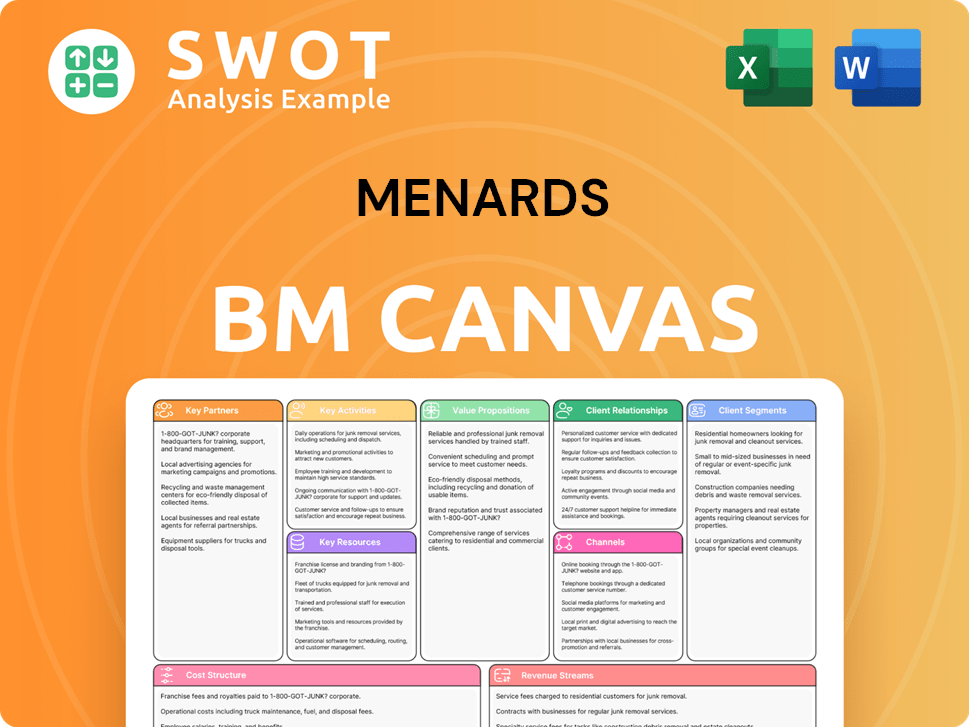

Menards Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Menards Win & Keep Customers?

Customer acquisition and retention strategies are crucial for the success of any business, and the strategies employed by the company are no exception. The company leverages a multifaceted approach, focusing on value, promotions, and an omnichannel presence to attract and retain its customer base. This comprehensive strategy has helped the company maintain a strong market position and foster customer loyalty.

A key element of the acquisition strategy involves competitive pricing. The company often undercuts competitors like Home Depot, which helped boost sales by 7% in 2024. This pricing strategy is particularly effective in attracting cost-conscious consumers. Marketing efforts include traditional advertising, such as TV commercials, with an estimated advertising expenditure of $300 million in 2024. Weekly ads and circulars, distributed in print and online, are also vital for showcasing deals and driving store traffic.

For customer retention, the company relies heavily on its rebate programs, most notably the 11% rebate. This program provides customers with merchandise credit for future purchases, incentivizing repeat business. The Menards BIG Card is another key tool, offering cardholders a 2% rebate on all purchases and special financing options for larger purchases, with approximately 30% of customers utilizing financing in 2024. These initiatives encourage repeat shopping and boost transaction values, contributing to the company's strong customer retention rates.

The company's strategy often involves undercutting competitors like Home Depot. This has been a significant factor in attracting price-sensitive customers. This competitive pricing strategy helped boost sales by 7% in 2024, demonstrating its effectiveness in acquiring new customers.

Weekly ads and circulars, both in print and online, are essential for promoting deals and driving store traffic. The company's advertising expenditure was approximately $300 million in 2024. These promotions are directly correlated with increased revenue.

The 11% rebate program provides merchandise credit for future purchases, encouraging repeat business. Over 60% customer participation in the rebate program significantly contributed to sales growth in 2024. This is a core component of their retention strategy.

The Menards BIG Card offers cardholders a 2% rebate on all purchases and special financing options. Approximately 30% of customers utilized financing in 2024. This card encourages repeat shopping and boosts transaction values.

The company also uses an omnichannel strategy, combining the convenience of online shopping with physical store access. Menards.com offers over 375,000 items and services like in-store pickup. This approach contributed to a 15% increase in customer engagement for retailers with strong omnichannel strategies in 2024. While specific CRM details are not publicly available, the emphasis on personalization and customer segmentation is recognized as a powerful retention strategy in the broader market. Initiatives like 'Ray's List' for in-store clearance items also aim to drive foot traffic and boost sales. Changes in strategy over time include increased frequency of the 11% rebate sales, sometimes as often as every two weeks in recent years. These strategies collectively aim to foster customer loyalty and increase lifetime value. To learn more about the company's broader strategies, consider exploring the Growth Strategy of Menards.

The company consistently undercuts competitors to attract price-sensitive customers. This strategy, coupled with effective marketing, has been instrumental in driving sales and expanding the customer base. This approach directly targets the "Menards customer profile" by appealing to their value-driven preferences.

The company utilizes both traditional advertising, such as TV commercials, and digital platforms to reach its target market. Weekly ads and circulars highlight deals and drive store traffic, a key aspect of their "Menards market analysis." Advertising expenditure was approximately $300 million in 2024.

The 11% rebate program and the Menards BIG Card are central to retaining customers. These programs offer incentives for repeat purchases and encourage customer loyalty, directly influencing "Menards customer spending habits." The BIG Card also provides financing options.

The company's omnichannel strategy combines online shopping with physical store access. This approach enhances customer convenience and drives foot traffic. This strategy has contributed to a 15% increase in customer engagement in 2024.

Initiatives like 'Ray's List' for in-store clearance items and the frequent 11% rebate sales aim to enhance customer loyalty. These efforts are designed to increase customer lifetime value. This approach directly targets the "Menards customer base" by providing ongoing value.

While specific details on CRM systems are not publicly detailed, the emphasis on personalization and customer segmentation is recognized as a powerful retention strategy. This approach is a key element in understanding "Menards customer demographics" and tailoring offerings.

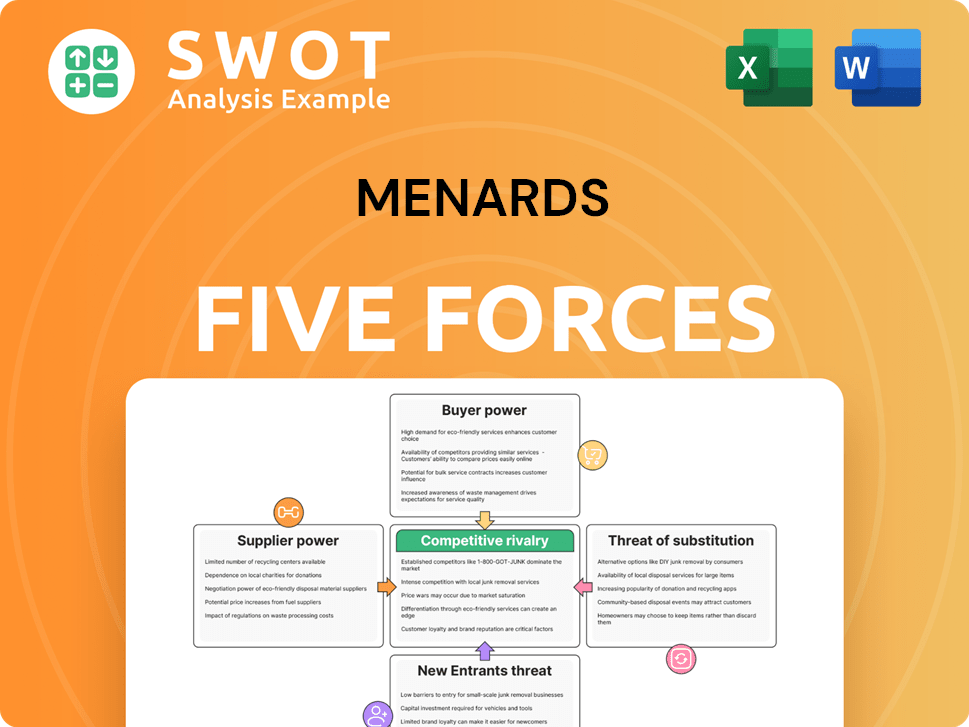

Menards Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Menards Company?

- What is Competitive Landscape of Menards Company?

- What is Growth Strategy and Future Prospects of Menards Company?

- How Does Menards Company Work?

- What is Sales and Marketing Strategy of Menards Company?

- What is Brief History of Menards Company?

- Who Owns Menards Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.