Menards Bundle

Can Menards Sustain Its Impressive Growth Trajectory?

From humble beginnings to a retail powerhouse, Menards has carved a significant niche in the home improvement industry. This analysis delves into the Menards SWOT Analysis to understand the core strategies driving its success. We'll explore how the company has grown from a small lumber shop to a multi-billion dollar enterprise with over 340 stores.

This exploration of Menards' Menards SWOT Analysis will uncover their strategic initiatives, including expansion plans and online sales, assessing their impact on market share and financial performance. We'll also examine Menards' competitive advantages and future prospects within the dynamic home improvement sector, considering both challenges and opportunities. Understanding the Menards growth strategy is crucial for anyone interested in the company's long-term success.

How Is Menards Expanding Its Reach?

The Menards growth strategy centers on strategic expansion and diversification within the home improvement market. The company's approach involves both physical store growth and broadening its product offerings to cater to a wider customer base. This strategy is critical for maintaining its market share and ensuring long-term financial performance.

Menards' future prospects are closely tied to its ability to adapt to changing consumer preferences and economic conditions. The company's focus on providing a comprehensive shopping experience, including appliances, groceries, and pet supplies, positions it well to capture a larger share of customer spending. Furthermore, Menards' expansion plans into new geographical areas could significantly boost its revenue and overall market presence.

A thorough Menards company analysis reveals a business model built on competitive pricing, extensive product selection, and a commitment to customer service. These elements, combined with its expansion initiatives, are key drivers of its success. The company's ability to secure exclusive discounts from suppliers also contributes to its ability to offer competitive prices, a critical factor in attracting and retaining customers.

Menards' expansion strategy prioritizes growth within its established Midwestern footprint. As of October 2024, the company operates in 15 states, with a total of 341 stores and 4 distribution centers. The company is actively exploring opportunities to enter new states, such as Pennsylvania, and is considering locations like Monroe, Wisconsin, where it has owned land for over a decade.

Menards has expanded its product range beyond traditional building materials, tools, and hardware. Larger stores now include appliances, pet products, lawn and garden supplies, and groceries. This broad selection aims to provide a one-stop shopping experience, attracting a wider customer base and increasing the 'share of wallet' in existing markets.

Menards is known as a 'low price leader,' a key factor in attracting and retaining customers. The company maintains strong relationships with suppliers to secure exclusive discounts. These discounts enable Menards to offer competitive pricing, helping to keep operational costs in check and maintain its market position. This approach supports its long-term strategic goals.

Menards continues to open new stores annually, reinforcing its commitment to physical expansion. While a planned 200,000-square-foot store in South Strabane Township, Pennsylvania, was not on the 2024 construction schedule, the company has acquired land in southwestern Pennsylvania. This suggests potential future expansion into new states, demonstrating its long-term strategic goals.

Menards' expansion plans involve strategic geographical growth and diversification of its product offerings. These initiatives are designed to increase market share and enhance customer loyalty. The company's focus on competitive pricing and strong supplier relationships further supports its growth objectives.

- Geographical Expansion: Opening new stores in existing and new markets.

- Product Diversification: Expanding beyond traditional home improvement products to include appliances, groceries, and pet supplies.

- Competitive Pricing: Leveraging supplier relationships to offer low prices and maintain a competitive edge.

- Customer Experience: Providing a one-stop shopping experience to attract and retain customers.

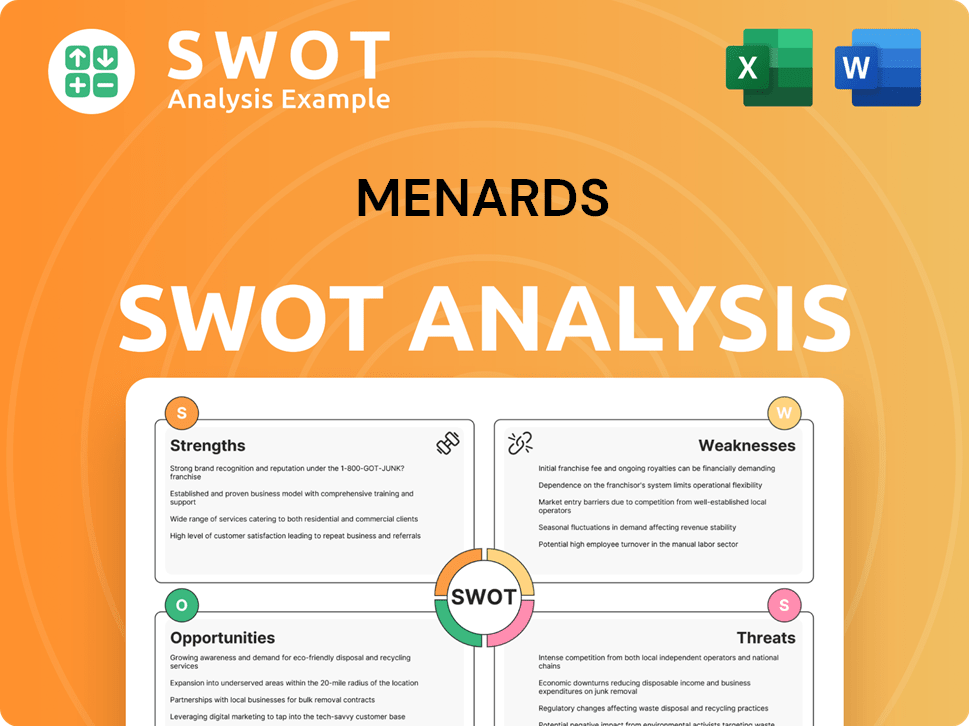

Menards SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Menards Invest in Innovation?

The innovation and technology strategy of Menards is crucial for its sustained growth and enhanced customer experience. While the privately-held company doesn't widely publicize specific R&D investments or the use of cutting-edge technologies like AI and IoT, its approach to digital transformation is evident through its online presence and operational efficiencies. This strategy is a key component of the overall Marketing Strategy of Menards, enabling the company to maintain a competitive edge in the home improvement industry.

Menards leverages technology to streamline operations and improve customer service. The company's focus on in-house manufacturing capabilities and its commitment to sustainability further highlight its strategic use of innovation beyond just consumer-facing technologies. These efforts are designed to support Menards' long-term strategic goals and address potential challenges in the dynamic retail environment.

Menards' commitment to innovation is also reflected in its customer service initiatives. The company offers design and project calculation programs, assisting customers with their home improvement projects. This focus on providing value-added services, combined with its digital and operational strategies, underscores Menards' approach to maintaining and growing its market share.

Menards' e-commerce platform, menards.com, plays a significant role in its growth. Launched in 2004, the website generated US$1295.8 million in revenue in 2024, mainly from the United States, with a small share from Canada.

In April 2025, menards.com recorded a revenue of $60,692,401. The website experienced nearly 30 million sessions, indicating a robust digital presence and a strong online sales strategy.

The online store features a wide array of products across various categories, including DIY, Electronics, and Furniture & Homeware. This comprehensive product offering supports Menards' expansion plans by catering to diverse customer needs.

Menards operates its own manufacturing facilities, a rarity in the retail industry. This vertical integration allows the company to maintain competitive pricing, which is a key component of its business model.

Menard Canada focuses on reducing its carbon footprint. This includes using fewer materials and resources and avoiding excess waste, reflecting the company's commitment to sustainability initiatives.

Menard USA has aimed to reduce its Scope 3 emissions. The company has already reduced these emissions by 23% since 2021, despite company growth, demonstrating its commitment to environmental responsibility.

Menards employs several key strategies to enhance its operational efficiency and customer experience. These strategies contribute to the company's ability to compete effectively in the home improvement market and support its long-term goals.

- E-commerce Platform: The menards.com platform provides a significant revenue stream and a strong digital presence.

- In-House Manufacturing: Vertical integration helps maintain low prices and control over product quality.

- Sustainability Practices: Initiatives like reducing carbon emissions and waste contribute to operational efficiency and positive brand perception.

- Customer Service Programs: Design and project calculation programs enhance customer satisfaction and loyalty.

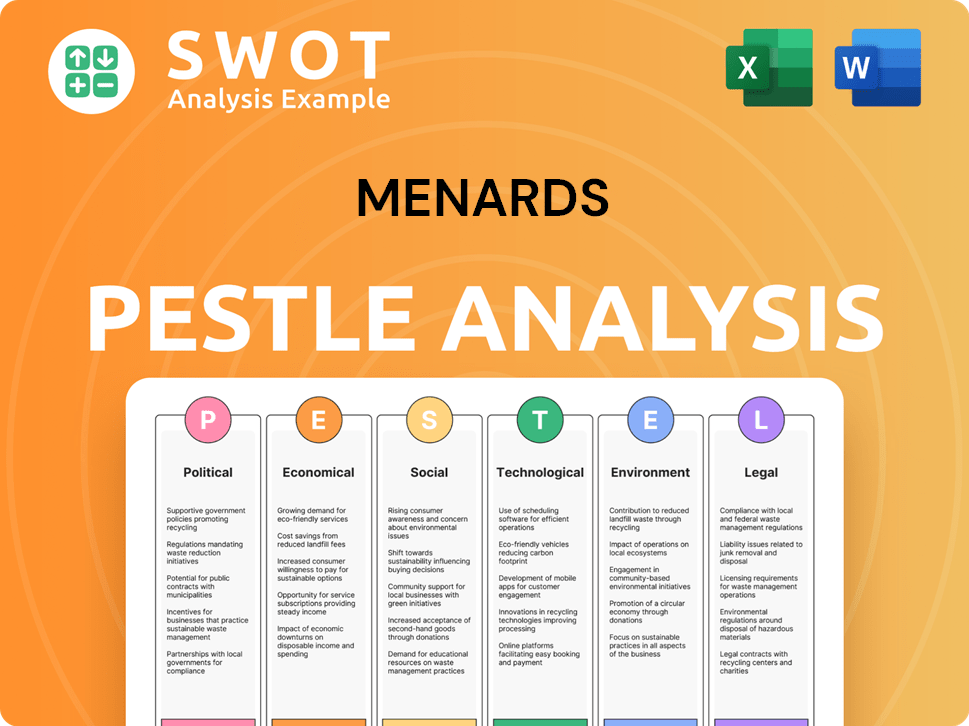

Menards PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Menards’s Growth Forecast?

Analyzing the financial outlook for Menards requires considering its private status, which limits the availability of detailed financial disclosures. However, available data and industry reports offer insights into its financial health and growth trajectory. The company has demonstrated consistent revenue generation and strategic financial management.

In 2024, Menards reported annual revenue of $10.0 billion, marking a peak revenue year for the company. Furthermore, Forbes reported Menards' revenue as $13 billion as of November 2024, indicating strong financial performance. The company's e-commerce operations also contribute significantly, with menards.com generating US$1295.8 million in net sales in 2024.

These figures provide a snapshot of Menards' financial strength and its ability to maintain a strong market position. The company's focus on the 'low price leader' strategy, supported by exclusive supplier discounts, suggests a commitment to cost efficiency and competitive pricing, which are key elements of its financial strategy.

Menards' annual revenue reached $10.0 billion in 2024, according to company reports. Forbes also reported a higher revenue of $13 billion as of November 2024, showcasing strong financial performance. This revenue reflects the company's robust sales and market presence.

Menards' e-commerce sales through menards.com amounted to US$1295.8 million in 2024. This indicates a significant online presence and contribution to overall revenue. The company's online strategy supports its broader growth plans.

Menards has a revenue per employee ratio of approximately $222,222, based on its 45,000 employees. This ratio reflects the company's operational efficiency and productivity. The company's strategic financial management contributes to this efficiency.

Menards reportedly secures exclusive discounts from suppliers, leading to cost savings of 10-15% on various product categories. This strategy supports its 'low price leader' position and enhances its competitive advantage. These discounts are a key part of the Mission, Vision & Core Values of Menards.

While specific financial targets are not publicly available, the consistent revenue and expansion suggest a stable financial outlook for Menards. The company's Menards growth strategy appears focused on sustained profitability within its established market, supported by its strong financial performance and strategic cost management. The Menards future prospects are promising, given its solid financial base and expansion plans. Understanding the Menards company analysis is crucial to assess its potential.

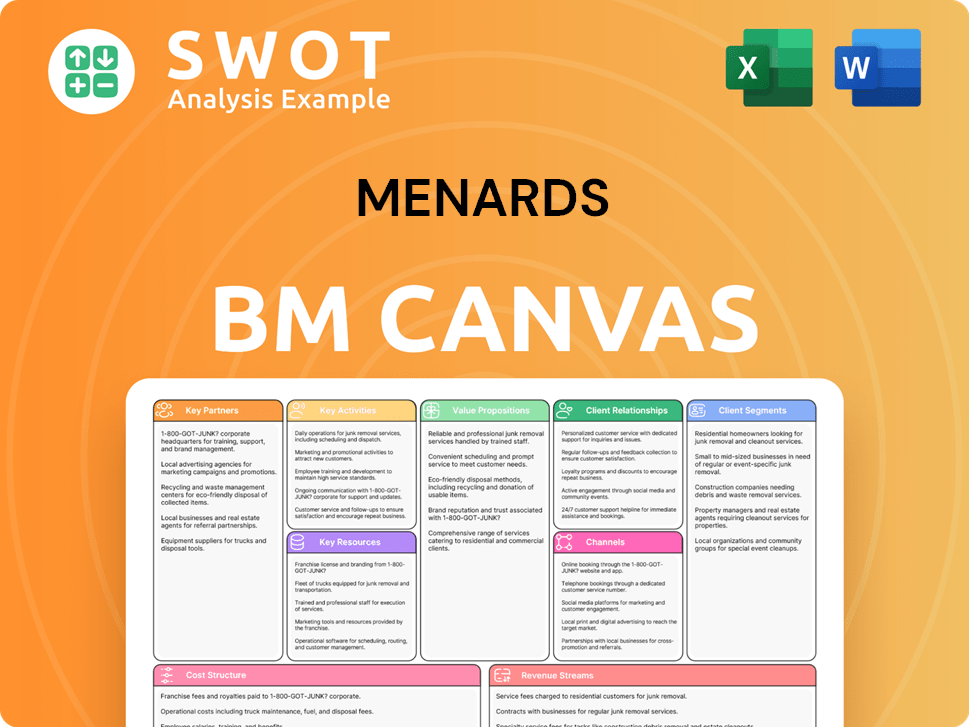

Menards Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Menards’s Growth?

The Menards company analysis reveals several potential risks and obstacles that could hinder its growth strategy. These challenges range from intense competition within the home improvement retail sector to external economic factors influencing expansion plans. Addressing these risks is crucial for maintaining and improving Menards' future prospects.

The home improvement market is highly competitive, with established players holding significant market shares. Regulatory changes and supply chain vulnerabilities also pose potential challenges. Furthermore, internal resource constraints and the need for continuous technological adaptation add to the complexities Menards faces.

Menards' expansion plans are sensitive to economic conditions and local approvals, as evidenced by project delays. Understanding and proactively managing these risks will be vital for the company's long-term success and financial performance.

The home improvement retail industry is fiercely competitive, with major players like Home Depot and Lowe's dominating the market. Home Depot holds approximately a 24% market share, while Lowe's has around 20%. Menards, despite being a strong regional player, has a national market share of about 3% as of 2020.

Regulatory changes and economic conditions can significantly impact business operations and construction projects. Ongoing discussions and amendments to various regulations could affect Menards' expansion plans. Economic factors also influence project timelines and approvals.

Supply chain vulnerabilities, though mitigated by Menards' vast inventory and supplier relationships, pose a risk. Challenges may arise, especially for specialized materials where supplier pools are limited. This could lead to delays and increased costs, impacting the company's financial performance.

Continuous digital transformation and adaptation to new technologies are essential for maintaining a competitive edge. The adoption of technologies like AI and IoT is crucial. Failure to keep pace with technological advancements could hinder Menards' ability to attract customers and streamline operations.

Internal resource constraints, such as the availability of skilled labor and efficient management of stores and distribution centers, can affect expansion. Delays in construction projects, like those in South Strabane Township, PA, and Granger Township, OH, demonstrate the impact of these constraints on the company's growth strategy.

Maintaining customer loyalty is vital in the competitive home improvement industry. Menards' value-for-dollar proposition is a key factor, with a 58.1% top box score in a 2024 study. This focus on value helps Menards compete effectively against larger rivals and maintain its market share.

Menards has a national market share of approximately 3% as of 2020, but leads in unit share in its active DMAs with 16% in 2020. This regional strength is a key component of its overall growth strategy. The company's ability to maintain and grow its market share depends on its ability to navigate the competitive landscape and address potential challenges.

Planned construction projects have faced delays due to economic conditions and local approvals. For example, projects in South Strabane Township, PA, and Granger Township, OH, have been affected. These delays highlight the sensitivity of Menards' expansion plans to external factors and internal resource constraints. Addressing these challenges is essential for successful expansion.

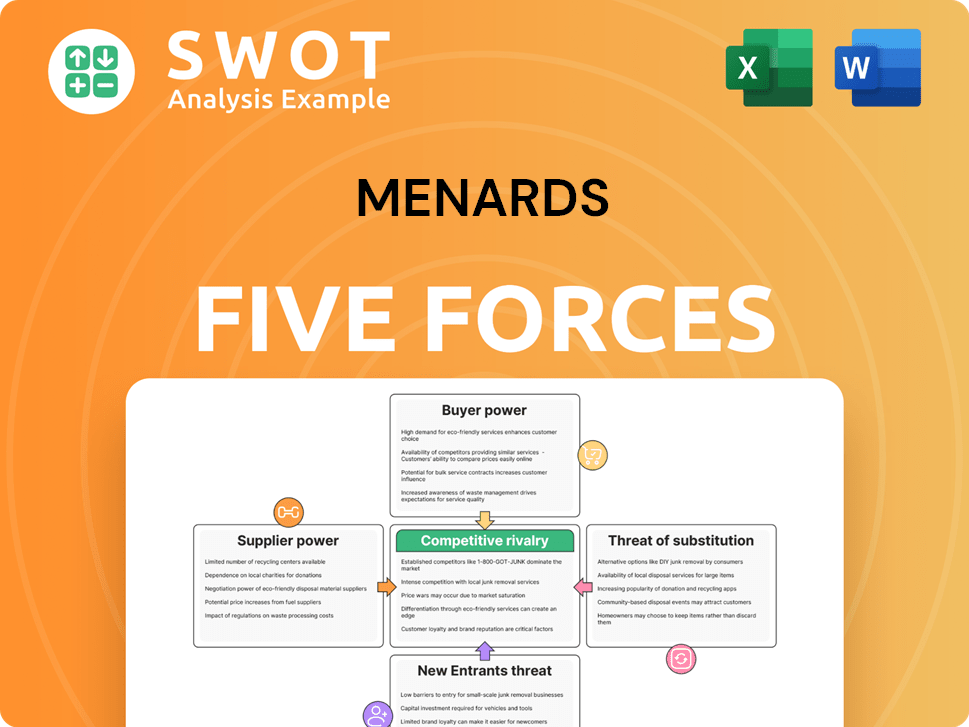

Menards Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Menards Company?

- What is Competitive Landscape of Menards Company?

- How Does Menards Company Work?

- What is Sales and Marketing Strategy of Menards Company?

- What is Brief History of Menards Company?

- Who Owns Menards Company?

- What is Customer Demographics and Target Market of Menards Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.