Morgan Stanley Bundle

How Does Morgan Stanley Stack Up in Today's Financial Arena?

In an era of relentless innovation and fierce competition within the financial services industry, understanding the Morgan Stanley SWOT Analysis is more critical than ever. The Morgan Stanley SWOT Analysis unveils the intricate dynamics of the investment banking rivals. This analysis is essential for investors, financial professionals, and business strategists alike.

This exploration delves into the Morgan Stanley competitive landscape, examining its key competitors and dissecting its strategic positioning within the global financial market. We'll explore Morgan Stanley competitors, their market share, and how Morgan Stanley is adapting to market changes. A thorough Competitive analysis Morgan Stanley will reveal the firm's strengths, weaknesses, and opportunities for future growth, crucial for anyone seeking to understand the financial services industry.

Where Does Morgan Stanley’ Stand in the Current Market?

Morgan Stanley maintains a strong market position across its key segments, reflecting its significant scale and diversified offerings. The firm's robust performance is evident in its wealth management division, which reported client assets of $6.9 trillion as of March 31, 2024. This solidifies its position as a leading player in the financial services industry, driving substantial revenue and stability.

In investment banking, Morgan Stanley consistently ranks among the top global advisors for mergers and acquisitions (M&A), equity underwriting, and debt underwriting. For instance, in the first quarter of 2024, Morgan Stanley advised on several high-profile M&A transactions, demonstrating its continued strength in this highly competitive area. The Institutional Securities segment, encompassing investment banking and sales & trading, generated net revenues of $7.0 billion in the first quarter of 2024.

Geographically, Morgan Stanley has a strong global footprint, with significant operations in North America, Europe, and Asia. The company serves a diverse client base, including corporations, governments, institutions, and individuals. Over time, Morgan Stanley has strategically shifted its positioning, notably with its increased focus on wealth management, which provides a more stable revenue stream compared to the cyclical nature of investment banking. This strategic pivot has enhanced the firm's overall financial health and resilience. For more insights into their strategic approach, consider reading about the Growth Strategy of Morgan Stanley.

Morgan Stanley's market share analysis reveals its strong standing in key areas. The firm's competitive advantages include a diversified business model and a global presence. Understanding its position within the financial services industry is crucial for assessing its long-term prospects.

Identifying Morgan Stanley's top competitors is essential for a thorough competitive analysis. Key investment banking rivals include Goldman Sachs and others. Comparing their performance against industry benchmarks provides valuable insights.

Morgan Stanley's competitive landscape is shaped by its diverse business segments and global reach. The firm's performance against industry benchmarks shows its resilience and strategic focus.

- The Institutional Securities segment generated $7.0 billion in net revenues in Q1 2024.

- Wealth management client assets reached $6.9 trillion as of March 31, 2024.

- The company reported net revenues of $15.1 billion for the first quarter of 2024.

- Net income applicable to common shareholders was $2.8 billion as of March 31, 2024.

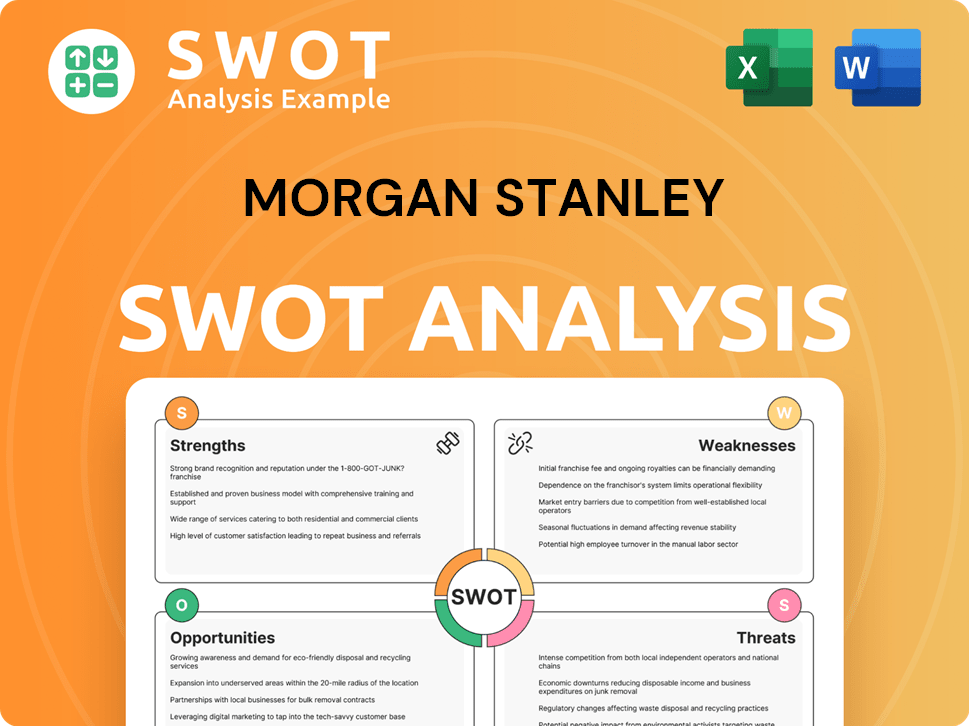

Morgan Stanley SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Morgan Stanley?

The competitive landscape for Morgan Stanley is complex, encompassing various segments within the financial services industry. A comprehensive Growth Strategy of Morgan Stanley reveals the firm's positioning and the challenges it faces. The firm competes with a diverse range of institutions, from global investment banks to wealth management firms and fintech disruptors, all vying for market share and client assets.

Understanding the competitive dynamics is crucial for assessing Morgan Stanley's strategic positioning and future prospects. The firm's ability to maintain and grow its market share depends on its ability to innovate, adapt to changing market conditions, and effectively compete against its rivals. Key competitors vary depending on the business line, including investment banking, wealth management, and investment management.

Morgan Stanley's competitive landscape is shaped by a variety of factors, including market trends, technological advancements, and regulatory changes. The firm's success hinges on its ability to navigate these challenges and capitalize on emerging opportunities. A detailed competitive analysis helps identify the firm's strengths and weaknesses in relation to its peers.

In investment banking, Morgan Stanley faces intense competition from major players. These firms compete for mandates in M&A advisory, equity capital markets, and debt capital markets. The competition is fierce, particularly in high-profile deals.

Morgan Stanley's wealth management arm competes with wirehouses and independent advisory firms. The competition is increasingly focused on technology, personalized advice, and fee structures. The acquisition of ETRADE expanded its reach in the self-directed segment.

In investment management, Morgan Stanley competes with large asset managers. These firms offer a wide range of investment products, including mutual funds and ETFs. The rise of passive investing and lower-cost solutions intensifies competition.

Emerging fintech players disrupt the traditional competitive landscape across all segments. These firms offer innovative digital solutions, pushing established firms to accelerate their technological advancements. Digital transformation is a key focus.

Morgan Stanley competes with firms such as Goldman Sachs, JPMorgan Chase, and others for M&A advisory mandates. The competition is intense, with firms constantly vying for high-profile deals. Boutique investment banks also pose a challenge.

Morgan Stanley's competitive strategy involves a multi-faceted approach. This includes expanding its technology, personalized advice, and fee structures. The firm's acquisition of ETRADE was a strategic move to expand its reach.

Morgan Stanley's key competitors vary by business segment, reflecting the firm's diversified operations. The firm's ability to maintain and grow its market share depends on its ability to innovate, adapt to changing market conditions, and effectively compete against its rivals. The competitive landscape is constantly evolving, with new players and technologies emerging.

- Investment Banking: Goldman Sachs, JPMorgan Chase, Bank of America Merrill Lynch, Citigroup, Lazard, and Evercore.

- Wealth Management: Merrill Lynch (Bank of America), UBS, Wells Fargo Advisors, Charles Schwab, and Fidelity.

- Investment Management: BlackRock, Vanguard, and State Street.

- Fintech Competitors: Various fintech companies offering digital solutions across all segments.

- Market Share Analysis: Analyzing market share is crucial to understanding the competitive dynamics. For example, in 2024, Goldman Sachs and JPMorgan Chase have consistently held significant market share in global M&A advisory, often exceeding 15% each, while Morgan Stanley typically ranks among the top three.

- Competitive Advantages: Morgan Stanley's competitive advantages include its global reach, brand reputation, and comprehensive service offerings.

- Strategic Partnerships: Strategic partnerships and alliances can enhance Morgan Stanley's competitive position.

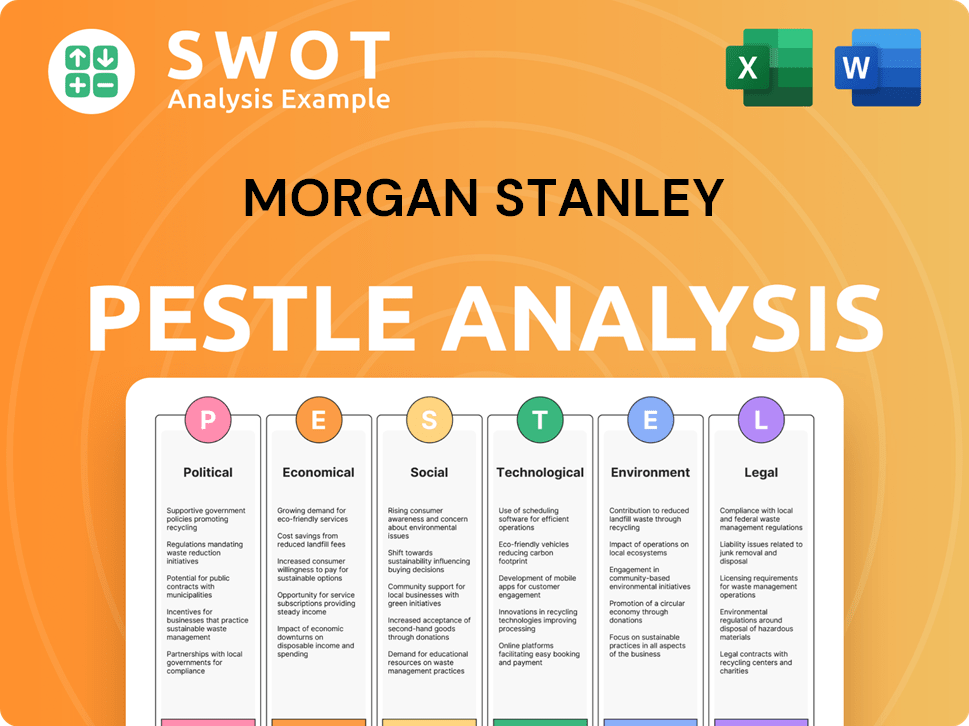

Morgan Stanley PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Morgan Stanley a Competitive Edge Over Its Rivals?

Understanding the Morgan Stanley competitive landscape requires a deep dive into its core strengths. The firm's robust brand reputation and extensive global network are significant advantages, especially in the financial services industry. These factors, combined with a highly skilled workforce, position the company favorably against its investment banking rivals. This analysis offers a look at the competitive advantages that have helped Morgan Stanley maintain its market position.

Morgan Stanley's competitive advantages are multifaceted, including a strong balance sheet and continuous investments in technology. The integration of digital capabilities, such as the acquisition of ETRADE, has enhanced its offerings. These strategic moves help the firm adapt to market changes and maintain its competitive edge. The firm's ability to take on large underwriting commitments and provide financing solutions further distinguishes it in the market.

The firm's sustained success is also linked to its strategic partnerships and alliances, which bolster its market share analysis. These collaborations are crucial for navigating the financial services industry's complexities and addressing challenges. For a detailed look at how Morgan Stanley generates revenue, consider reading Revenue Streams & Business Model of Morgan Stanley.

Morgan Stanley has built a strong brand over decades, becoming a trusted advisor in complex financial transactions. This reputation fosters client loyalty, especially among institutional clients and high-net-worth individuals. The firm's brand recognition is a key differentiator in the Morgan Stanley competitive landscape.

The firm's extensive global distribution network provides unparalleled access to capital markets. This network is crucial for its investment banking and wealth management operations. It enables Morgan Stanley to connect issuers with investors and provide comprehensive financial solutions globally.

Morgan Stanley benefits from a deep pool of highly skilled talent, particularly in its investment banking and wealth management divisions. The expertise of its bankers, traders, and financial advisors is a critical differentiator. This allows the firm to execute complex transactions and provide sophisticated advice.

Proprietary technologies, especially in trading platforms and wealth management tools, contribute to its advantage. The integration of digital capabilities has enhanced Morgan Stanley's technological offerings. This provides a more seamless and accessible experience for clients.

Morgan Stanley's strong balance sheet and capital position enable it to take on large underwriting commitments and provide financing solutions. The firm's robust financial performance, as evidenced by its latest earnings reports, underscores its stability. This financial strength is a key factor in its competitive strategy analysis.

- Capital Adequacy: Morgan Stanley consistently maintains capital ratios well above regulatory requirements, providing a buffer against market volatility.

- Revenue Generation: The firm's diversified revenue streams, including investment banking, wealth management, and sales and trading, contribute to its financial resilience.

- Strategic Investments: Morgan Stanley continues to invest in technology and talent to maintain its edge.

- Market Position: The firm's global market share compared to rivals demonstrates its ability to compete effectively.

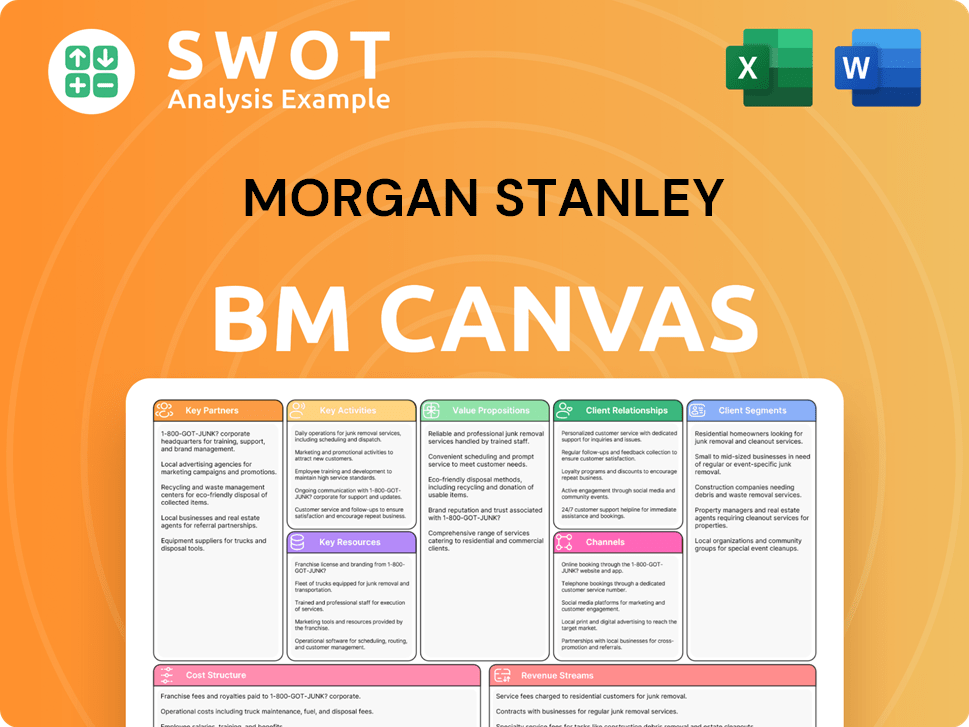

Morgan Stanley Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Morgan Stanley’s Competitive Landscape?

The financial services industry is undergoing significant transformation, driven by technological advancements, evolving regulatory landscapes, and shifts in global economic conditions. These factors are creating both challenges and opportunities for firms like Morgan Stanley. Understanding the Marketing Strategy of Morgan Stanley requires a deep dive into its competitive environment, market position, and strategic initiatives.

The competitive landscape for Morgan Stanley is dynamic, with established players and emerging fintech companies vying for market share. The firm's ability to adapt to these changes will be crucial for its continued success. The firm's success hinges on navigating these complexities and capitalizing on emerging opportunities to maintain its leadership position in the financial services industry.

Technological advancements are reshaping financial services. Artificial intelligence, blockchain, and data analytics are key. Regulatory changes, including cybersecurity and data privacy, are increasing. The global economic environment, marked by inflation and geopolitical tensions, is also a factor.

Managing the cyclical nature of investment banking is crucial. Maintaining growth in wealth management amidst increasing competition is a challenge. The threat from fintech companies offering specialized services requires strategic responses. Economic uncertainties and geopolitical risks add complexity.

The growth of global wealth, particularly in emerging markets, offers significant opportunities. Demand for sustainable investing and ESG products is rising. Strategic partnerships and acquisitions can expand market reach. Digital transformation and client-centric models are key.

Focus on technology-driven, client-centric models is essential. Continued emphasis on diversified revenue streams is important for resilience. Adapting to market changes and leveraging strengths in wealth management and investment banking is crucial. Strategic agility is key.

Morgan Stanley's strategic initiatives are focused on enhancing its market position. These include significant investments in technology and digital platforms to improve client experiences and operational efficiency. The firm is also expanding its wealth management services and global reach.

- Investing in AI and data analytics to improve trading strategies and client prospecting.

- Expanding wealth management services to capture a larger share of the growing global wealth market.

- Forming strategic partnerships and making acquisitions to broaden market reach and capabilities.

- Developing and offering sustainable investing and ESG products to meet growing client demand.

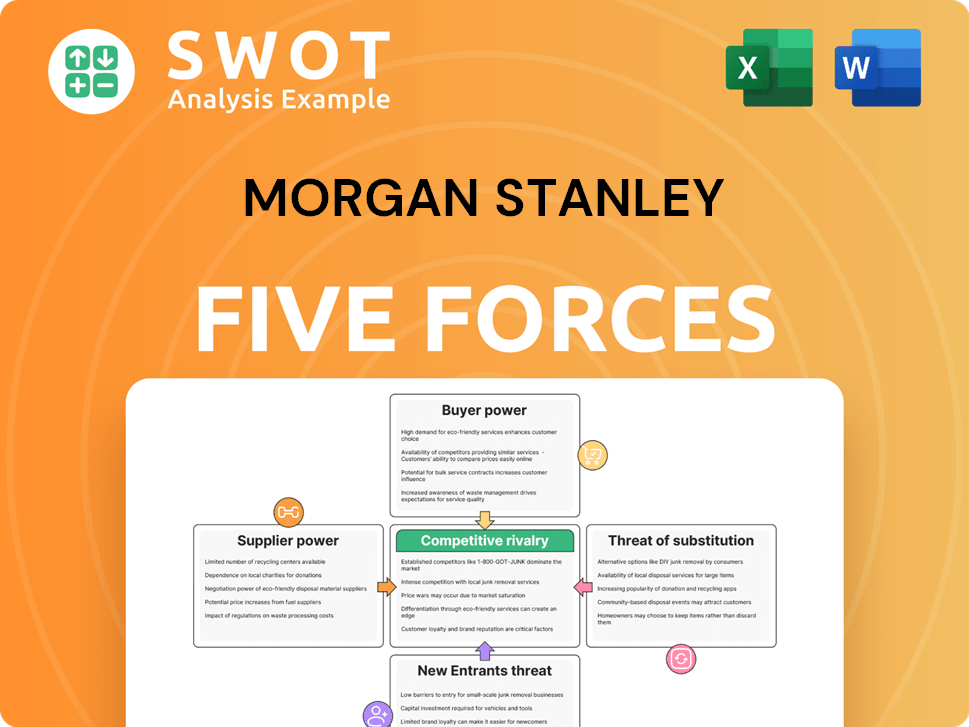

Morgan Stanley Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Morgan Stanley Company?

- What is Growth Strategy and Future Prospects of Morgan Stanley Company?

- How Does Morgan Stanley Company Work?

- What is Sales and Marketing Strategy of Morgan Stanley Company?

- What is Brief History of Morgan Stanley Company?

- Who Owns Morgan Stanley Company?

- What is Customer Demographics and Target Market of Morgan Stanley Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.