Morgan Stanley Bundle

Can Morgan Stanley Maintain Its Momentum?

Founded in the wake of the Great Depression, Morgan Stanley has consistently evolved to meet the ever-changing demands of the financial world. From its inception as an investment banking pioneer to its current status as a global financial services leader, the company's journey is a testament to its strategic adaptability. Today, we delve into the Morgan Stanley SWOT Analysis, exploring its growth strategy and future prospects.

Morgan Stanley's success story, marked by record revenues and substantial client assets, highlights the effectiveness of its strategic planning. Understanding Morgan Stanley's future prospects requires a deep dive into its expansion plans, innovation strategy, and how it navigates the financial services market. This analysis will also explore the company's competitive advantages and its approach to risk management, providing valuable insights for investors and business strategists alike.

How Is Morgan Stanley Expanding Its Reach?

The growth strategy of Morgan Stanley is primarily driven by its expansion initiatives, especially in wealth management and through strategic mergers and acquisitions. This approach aims to diversify revenue streams and broaden its customer base. A key focus has been on expanding the wealth management division, which has seen significant growth in assets and revenue.

The firm's strategic moves, including acquisitions and the incorporation of new channels, are designed to generate new client relationships and deepen existing ones. This multi-channel strategy allows for a comprehensive suite of services, including investing, banking, lending, and planning. The company is also positioning itself to capitalize on anticipated increases in merger and acquisition activity globally.

Morgan Stanley's expansion strategy is a key component of its overall business plan. The company continues to adapt and evolve in the dynamic financial services market. For a deeper understanding of the competitive environment, consider reading about the Competitors Landscape of Morgan Stanley.

The wealth management division is a cornerstone of Morgan Stanley's growth. Total client assets in this division surpassed $7.5 trillion in Q3 2024. In 2024, Wealth Management generated $28.4 billion in revenues, an 8% year-over-year increase.

Strategic acquisitions have been crucial to Morgan Stanley's expansion. Notable acquisitions include Solium Capital (Shareworks), ETRADE, and Eaton Vance. The firm has completed 63 acquisitions, averaging nearly 3 acquisitions annually over the past three years.

Morgan Stanley is expanding its reach through new channels, including workplace access and self-directed investing. This multi-channel approach aims to generate new client relationships and deepen existing ones. This strategy allows the firm to offer a comprehensive suite of products and services.

The firm anticipates a rebound in merger and acquisition activity globally. An expected 50% increase in deal volumes is predicted for 2024 compared to 2023. Morgan Stanley was a top M&A financial adviser in the construction sector by value in 2024, advising on $41 billion worth of deals.

Morgan Stanley's expansion plans are focused on wealth management, strategic acquisitions, and multi-channel distribution. The firm aims to add $1 trillion in net new assets every three years. These strategies are central to Morgan Stanley's future prospects.

- Wealth Management: Focus on growing client assets and revenue.

- Strategic Acquisitions: Integrating new businesses to enhance capabilities.

- Multi-Channel Distribution: Reaching clients through various platforms.

- M&A Growth: Capitalizing on increased deal volumes.

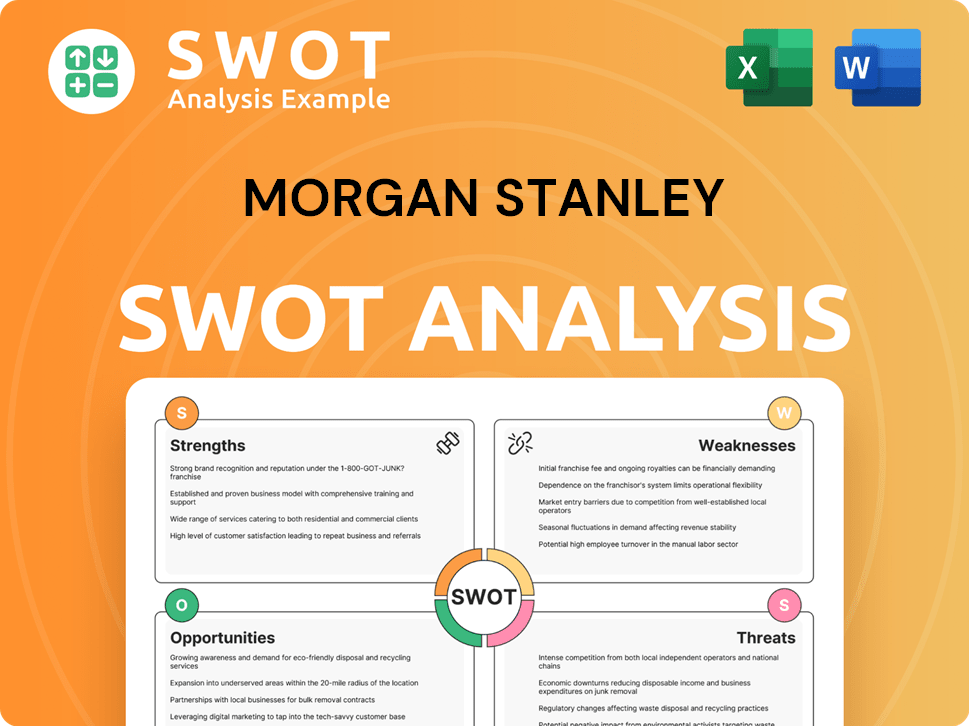

Morgan Stanley SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Morgan Stanley Invest in Innovation?

The firm actively uses technology and innovation to drive growth and enhance its service offerings. This includes a strong emphasis on digital transformation and the application of cutting-edge technologies, particularly Artificial Intelligence (AI). This approach supports the firm's strategic planning and market share analysis.

Morgan Stanley's investment in technology and AI is aimed at improving financial advisor productivity. This allows advisors to focus more on client relationship management and acquisition. Technology supports client service and centralized portfolio management. The firm's digital transformation strategy is key to its long-term success.

This strategy has contributed to a high client retention rate. The firm retained 99% of clients with assets over $1 million. The firm's focus on innovation is a key part of its competitive advantages in the financial services market.

Morgan Stanley's 2025 outlook highlights a shift towards 'Agentic AI.' This emphasizes task automation, efficiency, and market share. Agentic AI enables software programs to take autonomous actions and adapt without explicit human instruction.

Agentic AI has potential applications in areas like autonomous vehicles, healthcare assistants, and cybersecurity. The firm expects significant productivity gains as companies transition from reactive chatbot phases to proactive task-fulfillment with AI.

In 2025, technology companies are focusing on building AI platforms that cater to enterprise customers' needs. These platforms aim for optimized performance, profitability, and security. This is a key aspect of the firm's global market outlook.

This involves partnerships across the AI ecosystem, including chip companies, hyperscalers, large language models, data, and software companies. These collaborations are vital for driving innovation in investment banking trends.

The firm recognizes the importance of custom silicon designed for specific AI tasks. Custom silicon offers higher efficiency and performance compared to general-purpose GPUs. This is a key factor in Morgan Stanley's future investment opportunities.

Morgan Stanley's investment themes for 2025 include the future of energy. The firm recognizes the increasing power demand from generative AI. This demand is estimated to increase at an annual average of 70% through 2027 due to data center expansion.

The firm's focus on technology and innovation is a key part of its Revenue Streams & Business Model of Morgan Stanley. This includes strategic planning to ensure long-term growth and adaptability in the financial services market. The firm's digital transformation strategy and its investments in AI are crucial for its future prospects.

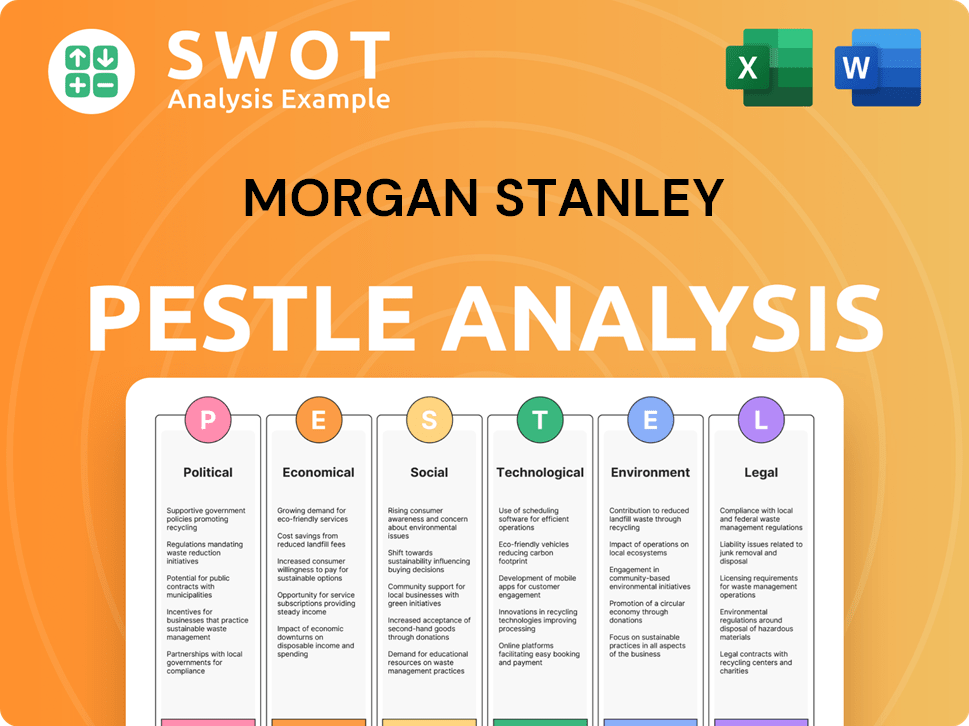

Morgan Stanley PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Morgan Stanley’s Growth Forecast?

The financial outlook for Morgan Stanley suggests continued strong performance in 2024 and 2025. The firm demonstrated robust financial health in 2024, with record net revenues and significant growth in net income and earnings per share. This positive trajectory is expected to continue, driven by strategic initiatives and favorable market conditions.

Morgan Stanley's commitment to strategic planning and its ability to adapt to market dynamics are key factors in its projected growth. The company's diverse business segments, including wealth management and institutional securities, are poised to contribute to its overall financial success. This strategic positioning supports the firm's ambitious growth targets and enhances its competitive advantages within the financial services market.

The firm's impressive financial results underscore its resilience and strategic prowess. The company's ability to capitalize on investment banking trends and navigate the complexities of the financial services market is evident in its recent performance. This strong foundation positions Morgan Stanley favorably for future investment opportunities and continued market share analysis.

In 2024, Morgan Stanley reported record net revenues of $61.8 billion, a 14% increase year-over-year. Net income reached $13.4 billion, up 47% from 2023. Earnings per diluted share (EPS) for 2024 reached $7.95, and the return on tangible common equity (ROTCE) was 18.8%.

Morgan Stanley Research forecasts global economic growth of 3.0% in 2025. Analysts project an average EPS of around $8.69 for 2025. The pretax profit margin for Q1 2025 grew to 31%.

Net revenues in wealth management reached a record $7.5 billion in Q4 2024, a 13% increase from 2023. Fee-based client assets increased to $2.35 trillion. Fee-based asset flows increased to $123 billion from $109 billion in 2023.

Institutional Securities achieved net revenues of $28.1 billion in 2024, a 22% increase compared to 2023. Investment banking revenues surged by 56% in Q3 2024, reaching $1.46 billion.

Morgan Stanley's revenue growth drivers include strong performance in wealth management and institutional securities. The firm's strategic focus on fee-based asset flows and investment banking activities contributes to its financial performance review.

- Increased Investment Banking Activity: A surge in investment banking revenues, driven by corporate deal-making.

- Wealth Management Expansion: Growth in fee-based client assets and net revenues in the wealth management division.

- Global Economic Growth: Benefiting from the projected global economic growth of 3.0% in 2025.

- Strategic Initiatives: The firm's ability to adapt and capitalize on market trends.

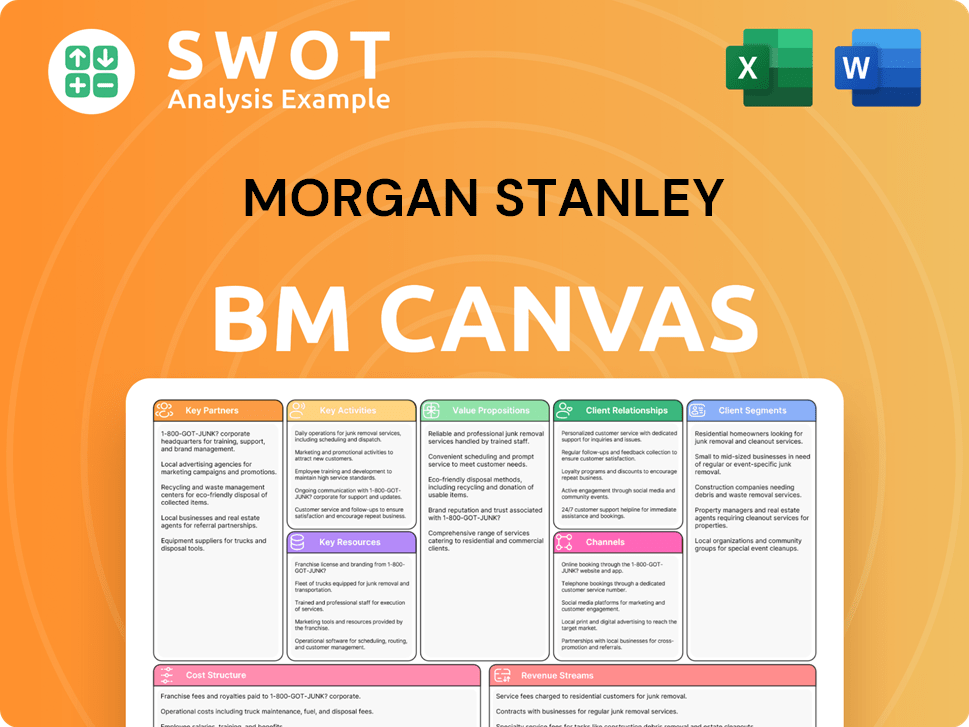

Morgan Stanley Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Morgan Stanley’s Growth?

The financial services sector presents several potential risks and obstacles for institutions like Morgan Stanley. The company's Morgan Stanley Growth Strategy and future prospects are intricately linked to its ability to navigate these challenges effectively. A thorough Morgan Stanley Company Analysis reveals the complexities of maintaining a competitive edge in a rapidly evolving market.

Key among these are market competition, regulatory changes, and technological disruption. These factors can directly impact the company's financial performance and strategic initiatives. Additionally, internal resource constraints and geopolitical uncertainties add further layers of complexity to Morgan Stanley's expansion plans.

Market competition is a significant hurdle. Major players continuously vie for market share across investment banking, wealth management, and asset management. The financial services market is intensely competitive. Regulatory changes also pose a significant obstacle. For instance, proposed Basel III regulatory capital rules could potentially increase risk-weighted assets by up to 20% at Morgan Stanley, despite the firm being well-capitalized.

Regulatory investigations into client screening practices in the wealth management division raise concerns about potential money laundering activities. These investigations can lead to financial penalties and reputational damage. Strategic Planning Morgan Stanley must include robust compliance measures to mitigate these risks effectively.

Rapid technological advancements necessitate continuous investment and adaptation. Cyber threats pose a constant risk. Morgan Stanley's digital transformation strategy is crucial for maintaining competitiveness and ensuring security. The firm is actively investing in AI and digital transformation.

Geopolitical tensions and policy changes can lead to economic instability. New tariff and immigration policies could cause inflation. The firm's CIO and Chief US Equity Strategist, Mike Wilson, noted in December 2024 that economic risks are swirling around some proposed policies, particularly those related to tariffs, which could lead to a surge in inflation.

Attracting and retaining top talent is a constant challenge in a competitive industry. The need for continuous investment in human capital and technology is paramount. Morgan Stanley's career prospects are tied to its ability to foster a strong and innovative workforce.

Integrating acquisitions presents operational complexities. While the acquisitions of E-Trade and Eaton Vance have strong strategic rationale, integrating two relatively large organizations simultaneously presents operational complexities. Morgan Stanley's mergers and acquisitions activity requires careful management to ensure successful integration and avoid disruptions.

The company acknowledges and prepares for risks through diversification of its business model. Robust risk management frameworks and scenario planning are essential. Owners & Shareholders of Morgan Stanley should be aware of the company's approach to mitigating these risks.

Investment Banking Trends are constantly evolving, requiring Morgan Stanley to adapt its strategies. The rise of fintech and digital platforms is reshaping the landscape. The company's ability to innovate and offer cutting-edge financial solutions is critical for maintaining its market position. Morgan Stanley's market share analysis shows its position in the industry.

A Financial Performance Review should include factors such as revenue growth, profitability, and operational efficiency. Morgan Stanley's revenue growth drivers include a diversified business model. The firm's recent financial results will reveal its success in addressing these challenges.

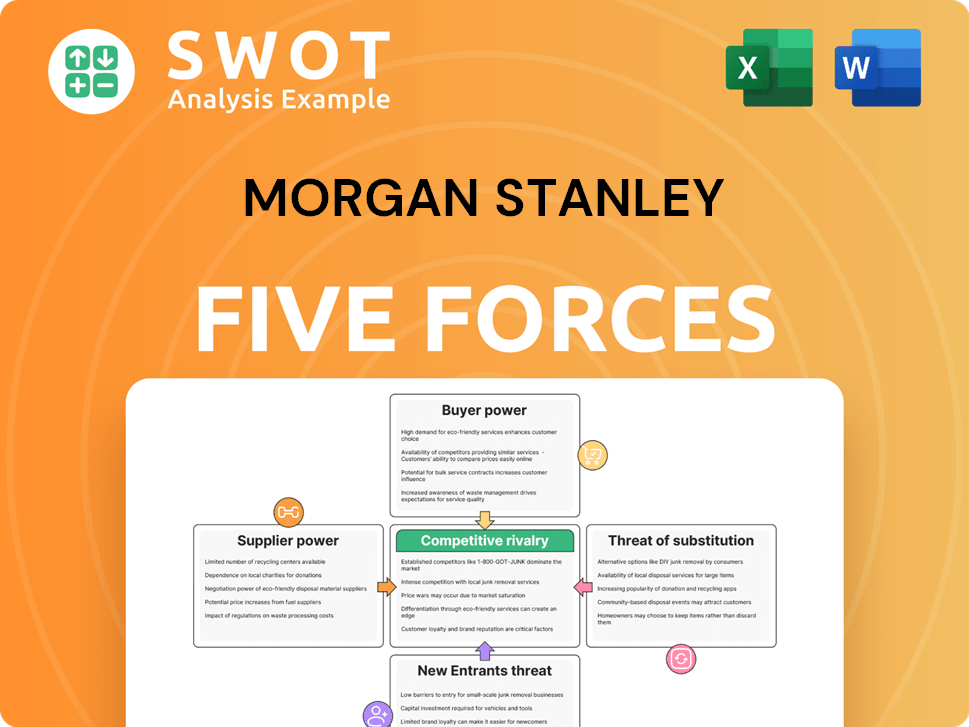

Morgan Stanley Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Morgan Stanley Company?

- What is Competitive Landscape of Morgan Stanley Company?

- How Does Morgan Stanley Company Work?

- What is Sales and Marketing Strategy of Morgan Stanley Company?

- What is Brief History of Morgan Stanley Company?

- Who Owns Morgan Stanley Company?

- What is Customer Demographics and Target Market of Morgan Stanley Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.