Morgan Stanley Bundle

How Does Morgan Stanley Thrive in the Financial World?

Morgan Stanley, a leading financial services firm, consistently demonstrates its influence in the financial sector. Its recent financial performance, with a reported net revenue of $15.1 billion for Q1 2024, highlights its ability to navigate complex market conditions. This financial powerhouse excels in investment banking, wealth management, and investment management, serving a diverse global clientele.

The Morgan Stanley SWOT Analysis provides a deeper understanding of this company's strengths and weaknesses. Understanding Morgan Stanley's company operations is vital for investors and industry observers alike. This analysis will explore the firm's operational processes and revenue streams, offering insights into its sustained profitability and global impact. Delving into "How does Morgan Stanley make money" and its strategic initiatives will provide a comprehensive view of this financial giant.

What Are the Key Operations Driving Morgan Stanley’s Success?

As a leading financial services firm, Morgan Stanley operates through three main business segments. These segments are Institutional Securities, Wealth Management, and Investment Management. Each segment contributes to the firm's overall value proposition by offering specialized services to diverse client groups.

The firm's operational structure is designed to facilitate cross-selling opportunities and provide a holistic client experience. This integrated approach leverages the strengths of each segment to deliver customized financial solutions. This structure allows the firm to maintain a competitive edge in the financial market.

Morgan Stanley's core operations focus on providing comprehensive financial services. These services are delivered through three primary business segments, each with distinct operational processes and value propositions. The firm's global presence and technological infrastructure enable it to offer sophisticated financial solutions.

This segment offers financial advisory and capital-raising services. It includes mergers and acquisitions (M&A) advisory, underwriting of equity and debt offerings, and sales and trading activities. Operational processes involve extensive research, deal origination, and client relationship management.

Wealth Management provides financial planning and advisory services to individual investors. This includes brokerage services, financial planning, and retirement solutions. Operations center around personalized client engagement and digital platforms.

This segment offers asset management products and services to institutional and retail investors. It provides a broad range of investment strategies, including equity and fixed income. Operations involve investment research, portfolio construction, and risk monitoring.

The integrated approach enables cross-selling and a holistic client experience. This allows the company to offer customized financial solutions. This integrated model enhances customer benefits and market differentiation.

In 2024, Morgan Stanley's net revenues were approximately $54.1 billion. Wealth Management contributed significantly to this figure. The firm's focus on client service and risk management has solidified its competitive position.

- Institutional Securities: Focuses on investment banking and sales and trading.

- Wealth Management: Provides financial planning and advisory services.

- Investment Management: Offers asset management products.

- Global Presence: Operates in multiple countries, enhancing its service capabilities.

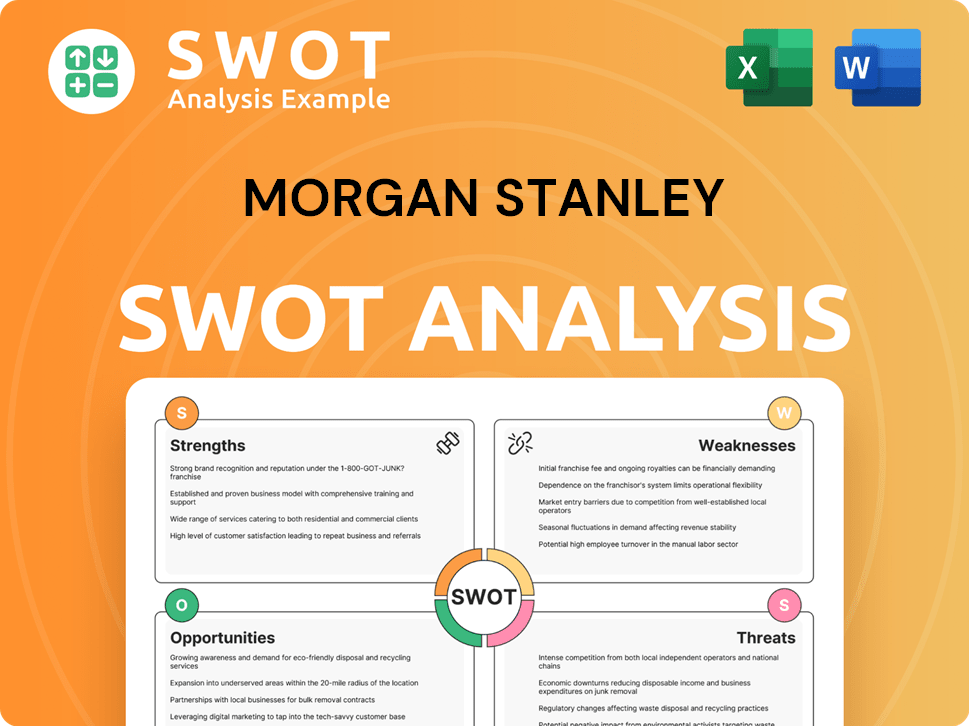

Morgan Stanley SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Morgan Stanley Make Money?

The financial services firm, Morgan Stanley, generates revenue through diverse streams, primarily from its three core segments. These segments include Institutional Securities, Wealth Management, and Investment Management. Understanding the revenue streams and monetization strategies provides insight into how the company operations drive financial performance.

In the first quarter of 2024, the firm demonstrated its ability to generate substantial revenue across its business lines. The firm's approach to revenue generation is multifaceted, leveraging its strong brand, extensive client relationships, and comprehensive product offerings.

Morgan Stanley employs cross-selling strategies, where clients engaged with one segment are offered services from another, maximizing client lifetime value and overall revenue generation. For more details, explore the Growth Strategy of Morgan Stanley.

The Institutional Securities segment, Wealth Management segment, and Investment Management segment are the primary drivers of revenue for Morgan Stanley. Each segment utilizes specific strategies to generate income, contributing to the overall financial success of the financial services firm.

- Institutional Securities: This segment brought in $7.0 billion in net revenues in Q1 2024. Key revenue sources include investment banking (advisory and underwriting fees) and sales and trading (equities and fixed income).

- Wealth Management: Net revenues for this segment were $6.8 billion in Q1 2024. Revenue is primarily generated through asset-based fees, transaction fees from brokerage activities, net interest income, and other service fees. The integration of ETRADE has expanded its reach.

- Investment Management: This segment generated $1.4 billion in net revenues in Q1 2024. Revenue comes from investment advisory and administration fees, typically asset-based, and performance-based fees.

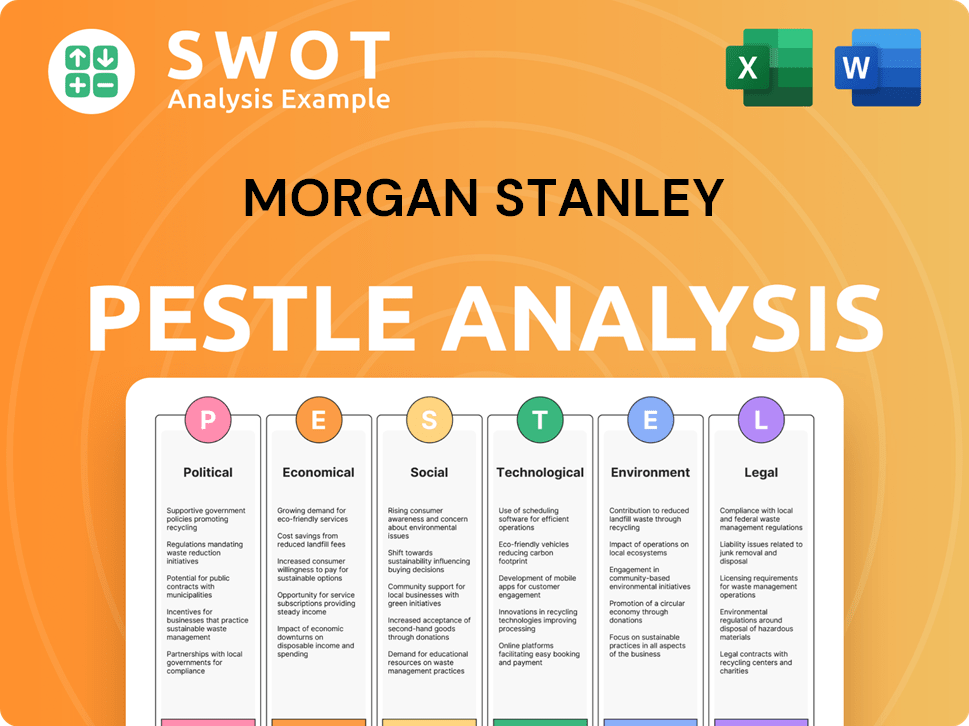

Morgan Stanley PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Morgan Stanley’s Business Model?

The operational and financial journey of Morgan Stanley, a prominent financial services firm, has been shaped by key milestones and strategic decisions. The firm's evolution includes significant acquisitions and adaptations to market dynamics. These moves have solidified its position in the competitive landscape of investment banking and wealth management.

A crucial strategic move was the acquisition of ETRADE in 2020. This significantly boosted its Wealth Management segment by incorporating a substantial self-directed investing platform and attracting a younger client base. Another key acquisition was Eaton Vance in 2021, which strengthened its Investment Management capabilities, particularly in ESG investing and custom solutions. These strategic expansions reflect the firm's responsiveness to evolving client preferences and the increasing importance of digital channels.

The company has navigated various market challenges, including global financial crises and regulatory shifts. During the 2008 financial crisis, Morgan Stanley transitioned from a pure investment bank to a bank holding company, a strategic pivot that provided access to more stable funding sources and enhanced regulatory oversight. This adaptability has been crucial for maintaining its competitive edge in the ever-changing financial industry.

The acquisition of ETRADE in 2020 expanded its wealth management services. The purchase of Eaton Vance in 2021 enhanced investment management capabilities. These acquisitions demonstrate Morgan Stanley's commitment to growth and adapting to market trends.

Transitioning to a bank holding company during the 2008 financial crisis. Focusing on digital platforms and wealth management tools. Continuous adaptation to sustainable investing and digitalization.

Strong brand recognition and reputation in investment banking. Advanced technology in trading platforms and wealth management tools. Economies of scale from global operations and extensive client base.

Integrated ecosystem fostering collaboration across segments. Focus on client stickiness and network effects. Continuous development of new products and technological infrastructure.

Morgan Stanley's competitive advantages include a strong brand, technological leadership, and economies of scale. The firm focuses on integrated services and continuous adaptation to market trends, such as sustainable investing and digitalization. The company's strategic moves have been pivotal in shaping its current position in the financial services industry.

- Brand Recognition: Strong reputation in investment banking.

- Technology: Advanced trading platforms and wealth management tools.

- Global Presence: Economies of scale and broad market reach.

- Integrated Ecosystem: Collaboration and client stickiness.

The firm's integrated approach, where different segments collaborate, enhances client relationships and creates a powerful network effect. Morgan Stanley continuously adapts to emerging trends, such as the growing demand for sustainable investing and the ongoing digitalization of financial services, by developing new products and enhancing its technological infrastructure. For more details on the company's history, you can read a Brief History of Morgan Stanley. These strategic moves and inherent strengths sustain its business model in a highly competitive industry. In 2024, the company's net revenues were approximately $54.1 billion, demonstrating its robust financial performance and market position. The firm continues to focus on innovation and client service to maintain its competitive edge.

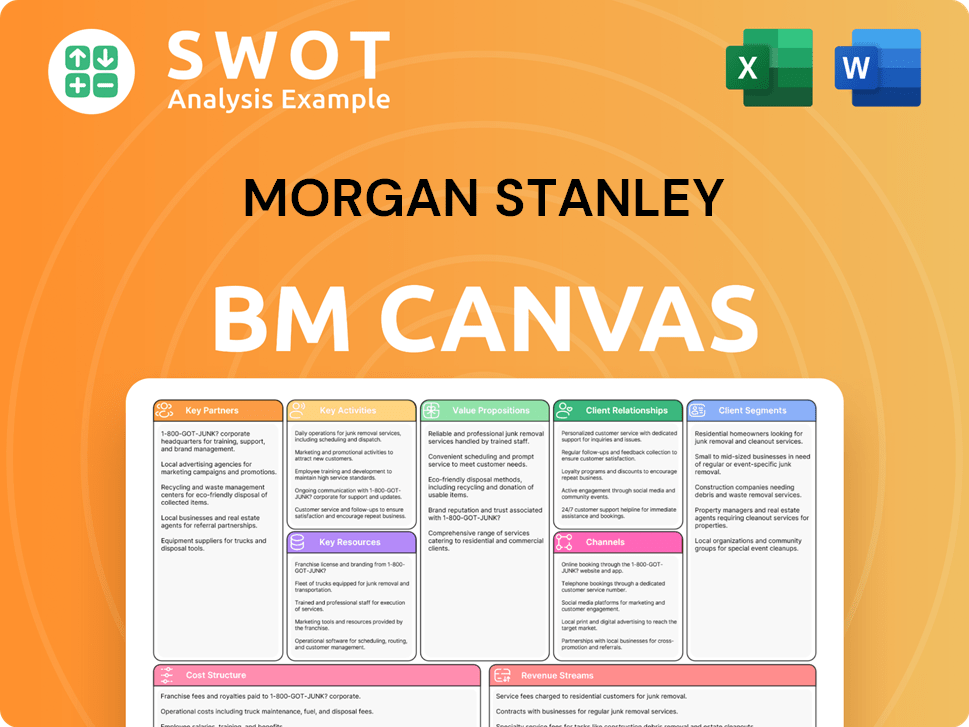

Morgan Stanley Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Morgan Stanley Positioning Itself for Continued Success?

As a leading financial services firm, Morgan Stanley holds a prominent position in the global market. Its company operations span investment banking, wealth management, and asset management, competing with other major financial institutions. The firm's strong client relationships and global reach contribute to its sustained market leadership.

Morgan Stanley's performance is closely tied to the stock market and overall economic conditions. The company faces risks from regulatory changes, intense competition, and technological disruption. Adapting to these challenges and maintaining a focus on client needs are crucial for continued success. The firm's strategic initiatives include expanding wealth management and leveraging technology.

Morgan Stanley consistently ranks among the top firms in Investment banking, particularly in M&A advisory and equity underwriting. It benefits from a loyal client base, especially in wealth management. Its global presence allows it to serve a diverse international client base.

Regulatory changes, such as increased capital requirements, can impact profitability. Competition from established players and fintech firms poses a continuous challenge. Economic downturns and market volatility can significantly impact trading revenues. Technological disruption is another risk.

Morgan Stanley aims to grow its wealth management assets and leverage its institutional expertise. The firm focuses on diversification and innovation to sustain profitability. The company's commitment to client-centricity and technology is key to its future.

The company is further integrating its acquired businesses and expanding its global wealth management footprint. They are investing in technological enhancements to improve efficiency and client experience. Leadership focuses on sustainable growth and leveraging technology.

In 2024, Morgan Stanley reported strong financial results, driven by its wealth management and investment banking divisions. The firm's revenue for the year was approximately $54.1 billion, with net income attributable to Morgan Stanley of $10.1 billion. Wealth management contributed significantly to the revenue, with assets under management (AUM) reaching over $6.7 trillion.

- Investment banking revenues were approximately $6.8 billion, reflecting a strong performance in M&A advisory.

- The firm's return on equity (ROE) remained competitive, demonstrating efficient use of shareholder equity.

- Morgan Stanley continues to invest in technology and strategic acquisitions to enhance its market position.

- The company's global presence, with offices in major financial centers, supports its diverse client base.

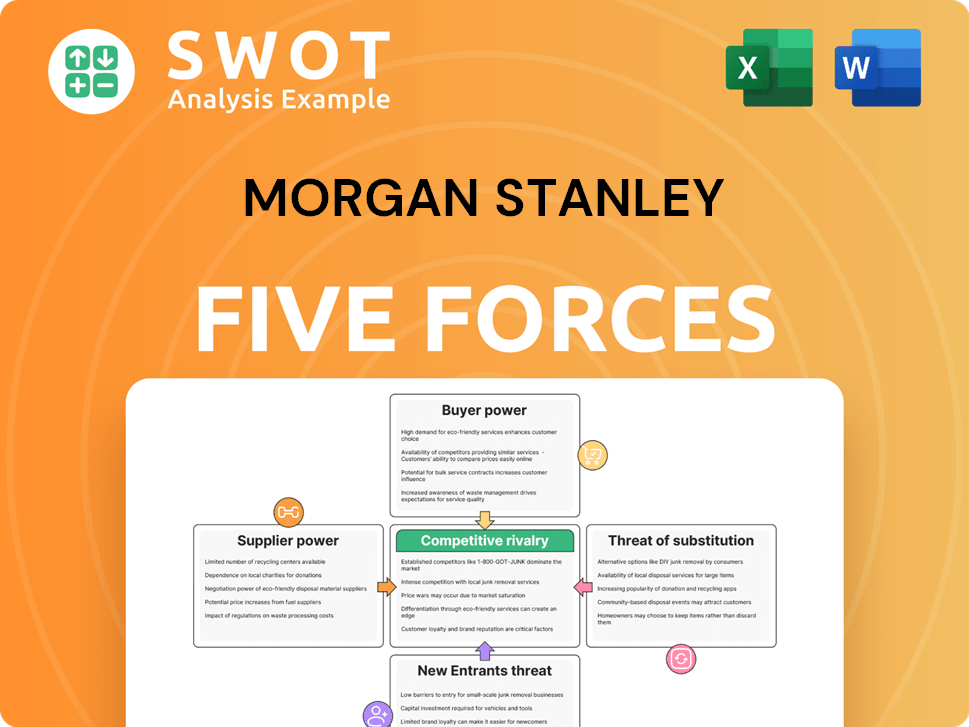

Morgan Stanley Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Morgan Stanley Company?

- What is Competitive Landscape of Morgan Stanley Company?

- What is Growth Strategy and Future Prospects of Morgan Stanley Company?

- What is Sales and Marketing Strategy of Morgan Stanley Company?

- What is Brief History of Morgan Stanley Company?

- Who Owns Morgan Stanley Company?

- What is Customer Demographics and Target Market of Morgan Stanley Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.