NextEra Energy Bundle

How Does NextEra Energy Dominate the Energy Sector?

NextEra Energy has become a powerhouse in the clean energy sector, revolutionizing electricity generation, transmission, and distribution. Its focus on renewable energy, particularly wind and solar, has established it as a leader in the global shift towards sustainable energy. NextEra Energy's strategic investments have set new industry standards.

To truly understand NextEra Energy's success, we must dissect its NextEra Energy SWOT Analysis and the intricacies of its competitive environment. This deep dive into the NextEra Energy competitive landscape will explore its market position, identify key NextEra Energy competitors, and analyze its core advantages. We'll also examine industry trends and future challenges, providing a comprehensive NextEra Energy market analysis to inform your investment decisions in the renewable energy market.

Where Does NextEra Energy’ Stand in the Current Market?

NextEra Energy holds a strong market position within the U.S. energy sector. Its operations are primarily divided into two key segments: Florida Power & Light Company (FPL) and NextEra Energy Resources (NEER). FPL is the largest rate-regulated electric utility in Florida, serving over 5.8 million customer accounts and more than 12 million people. NEER is a global leader in renewable energy generation, particularly from wind and solar sources.

The company's primary focus is on electricity generation, transmission, and distribution, with a major emphasis on clean energy. NextEra Energy's geographic presence spans across the U.S. and Canada for NEER, while FPL's operations are concentrated in Florida. NextEra Energy has invested heavily in modernizing its infrastructure and expanding its renewable energy portfolio. This strategic shift has allowed the company to capture a significant share in the renewable energy market, distinguishing itself from traditional utilities.

NextEra Energy's financial health is robust. As of early 2024, its market capitalization exceeded $150 billion, reflecting its strong performance and investor confidence. The regulated utility segment provides stability, while the competitive energy segment offers growth potential in the expanding renewable energy sector. For further insights, explore the Revenue Streams & Business Model of NextEra Energy.

NextEra Energy is a major player in the energy industry. FPL serves a large customer base in Florida. NEER has a substantial generating capacity, with approximately 30 GW from wind and solar as of early 2024.

NextEra Energy's focus on renewable energy gives it a competitive edge. Its investments in clean energy and infrastructure modernization are key. The company's financial strength and market capitalization also contribute to its advantages.

NextEra Energy continues to expand its renewable energy portfolio. It has a capital plan of approximately $32 billion for 2024-2025. The company's strategic investments support its growth in the renewable energy market.

NextEra Energy's financial performance is strong, with a market capitalization exceeding $150 billion in early 2024. The company benefits from the stability of its regulated utility segment and the growth potential of its competitive energy segment.

NextEra Energy's focus on renewable energy sets it apart. The company has a significant presence in the renewable energy market, particularly in wind and solar power. Its strategic investments and financial strength support its competitive position.

- Leading renewable energy generator.

- Strong financial performance and market capitalization.

- Significant investments in clean energy and infrastructure.

- Dominant position in the Florida utility market.

NextEra Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging NextEra Energy?

Understanding the NextEra Energy competitive landscape requires examining its diverse business segments. The company operates in both regulated utility and competitive energy generation sectors, each with distinct sets of rivals. The dynamics of the energy industry analysis are crucial for assessing its position.

In the regulated utility space, the primary focus is on Florida Power & Light (FPL), which primarily competes with other investor-owned utilities within Florida. However, direct competition for customers is limited due to the monopolistic nature of utility service territories. NextEra Energy's operational efficiency and customer service are often benchmarked against peers.

The competitive energy generation sector, particularly through NextEra Energy Resources (NEER), faces intense competition. This includes other large independent power producers, renewable energy developers, and integrated utilities expanding their renewable portfolios. This sector is highly dynamic, with companies continually vying for market share and project opportunities.

In the regulated utility segment, NextEra Energy's main focus is Florida Power & Light (FPL). FPL primarily competes with other investor-owned utilities within Florida. Although direct customer competition is limited, operational efficiency and customer service are key differentiators.

NextEra Energy Resources (NEER) faces significant competition in the competitive energy generation sector. Key rivals include independent power producers, renewable energy developers, and utilities expanding their renewable portfolios. The renewable energy market is highly competitive.

Key competitors in the renewable energy sector include Duke Energy, Berkshire Hathaway Energy, and AES Corporation. Ørsted and other developers focused on large-scale wind, solar, and battery storage projects are also significant. These companies compete through project development and competitive power purchase agreements.

The market for new renewable energy projects is highly competitive. Companies compete for land, interconnection rights, and financing. Sustainability has led to new entrants and strategic alliances, intensifying the competitive landscape. The renewable energy market is experiencing rapid growth.

NextEra Energy's competitive advantages include its large scale, financial strength, and experience in renewable energy development. The company's focus on operational efficiency and innovation also contributes to its competitive edge. These factors help it compete effectively in the market.

NextEra Energy continues to invest in renewable energy projects, including wind, solar, and battery storage. The company is also focused on expanding its utility infrastructure and improving customer service. These initiatives help it maintain its competitive position.

NextEra Energy's competitive landscape is shaped by its diverse business segments and the evolving energy industry analysis. Understanding the key players and their strategies is crucial for evaluating NextEra Energy's position. For a deeper dive into the company's history, consider reading the Brief History of NextEra Energy.

- Duke Energy: A major utility with significant renewable energy investments and a broad geographic footprint.

- Berkshire Hathaway Energy: Owns a diverse portfolio of energy businesses, including utilities and renewable energy assets.

- AES Corporation: A significant player in the renewable energy development space.

- Ørsted: A developer focused on large-scale wind, solar, and battery storage projects.

NextEra Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives NextEra Energy a Competitive Edge Over Its Rivals?

Analyzing the NextEra Energy competitive landscape reveals a company built on strategic foresight and operational excellence. Its dominance in the renewable energy sector, particularly in wind and solar power, provides a significant edge. The company's robust financial standing and strategic investments further solidify its competitive position in the energy industry.

NextEra Energy's success is also rooted in its regulated utility segment, Florida Power & Light (FPL). FPL's focus on providing low-cost, reliable, and clean energy contributes to stable cash flows. These financial resources are then strategically reinvested in the company's competitive energy business, fostering further expansion in renewable energy projects. This integrated approach gives it a competitive advantage over other utility company comparisons.

The company's commitment to innovation, including smart grid technologies and advanced energy storage solutions, further enhances its competitive edge. These elements, combined with significant capital requirements and regulatory complexities, create high barriers to entry for potential rivals, ensuring the sustainability of its competitive advantages. For a deeper dive into their marketing strategies, consider reading about the Marketing Strategy of NextEra Energy.

NextEra Energy Resources is the world's largest generator of renewable energy from the wind and sun. This leadership position provides a significant cost advantage due to economies of scale. Their expertise in managing large-scale projects allows for efficient execution and lower levelized cost of energy (LCOE).

Florida Power & Light (FPL) provides stable and predictable cash flows due to its regulated asset base. FPL is known for its low customer bills, high reliability, and clean energy mix. These cash flows are reinvested into the competitive energy business, supporting further growth in renewables.

NextEra Energy's strong financial position allows it to fund large-scale projects that many smaller competitors cannot. The company benefits from access to capital markets at favorable rates. This financial advantage supports its growth and innovation in the energy sector.

Investments in smart grid technologies and advanced energy storage solutions further solidify its competitive edge. Extensive transmission infrastructure and grid modernization efforts are crucial for integrating renewable energy sources effectively. These innovations enhance efficiency and reliability.

NextEra Energy's competitive advantages stem from its leadership in renewable energy, stable cash flows from regulated utilities, and strong financial standing. These factors enable the company to invest in large-scale projects and innovative technologies, creating high barriers to entry.

- Renewable Energy Leadership: World's largest generator of renewable energy from wind and sun.

- Regulated Utility Stability: FPL provides predictable cash flows and a clean energy mix.

- Financial Strength: Strong financial position and access to capital markets.

- Innovation: Investments in smart grid technologies and advanced energy storage.

NextEra Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping NextEra Energy’s Competitive Landscape?

The energy industry is undergoing a significant transformation, primarily driven by the global shift towards decarbonization and renewable energy sources. This trend presents both opportunities and challenges for companies like NextEra Energy, which is a key player in the NextEra Energy competitive landscape. The increasing demand for clean energy solutions, fueled by environmental concerns and supportive government policies, positions NextEra Energy favorably. However, it also faces increased competition and regulatory changes.

Analyzing the NextEra Energy market analysis reveals a dynamic environment influenced by technological advancements, fluctuating commodity prices, and geopolitical factors. The company's ability to adapt to these changes, manage risks, and capitalize on emerging opportunities will be crucial for its long-term success. Understanding the NextEra Energy competitors and their strategies is essential for navigating the evolving energy landscape.

The energy sector is experiencing a rapid transition towards renewable energy, driven by environmental concerns and policy support. The cost of renewable technologies, such as solar and wind, has decreased significantly, making them more competitive. Grid modernization and the integration of energy storage solutions are becoming increasingly important to manage the intermittency of renewables.

Increased competition in the renewable energy market could put pressure on project margins. Regulatory changes, particularly concerning grid infrastructure and carbon emissions, can impact operational costs and investment strategies. The need for substantial investment in energy storage and grid flexibility presents technological and financial challenges. Geopolitical instability and supply chain disruptions can affect the availability and cost of critical materials.

Emerging technologies like green hydrogen and advanced energy storage offer significant growth potential. Strategic partnerships and acquisitions in these areas could unlock new revenue streams and strengthen market position. Expanding into new geographic markets with high renewable energy potential represents another avenue for growth. Focus on sustainable growth and commitment to a clean energy future will drive competitive advantage.

NextEra Energy benefits from its strong financial health, diversified business model, and continued investment in innovation. Its leadership in wind, solar, and battery storage positions it well to capitalize on the growing demand for clean energy. The company's focus on sustainable growth and commitment to a clean energy future are expected to drive its competitive position forward. For more insights, consider reading about the Target Market of NextEra Energy.

In 2024, the renewable energy market is experiencing rapid growth, with solar and wind energy projects becoming increasingly cost-competitive. NextEra Energy's investment in renewable energy infrastructure is substantial, reflecting a strategic focus on sustainable growth. The company's strong financial performance, as compared to its competitors, is a key factor in its ability to navigate industry challenges.

- Renewable Energy Growth: The global renewable energy market is projected to continue its growth trajectory, with significant investments in solar and wind projects.

- NextEra Energy Investments: NextEra Energy continues to invest heavily in renewable energy projects, including solar, wind, and energy storage, to expand its portfolio.

- Financial Performance: The company's financial performance is robust, with strong revenue and earnings, allowing it to maintain a competitive edge in the market.

- Market Share: NextEra Energy holds a significant market share in the renewable energy sector, positioning it as a leader in the industry.

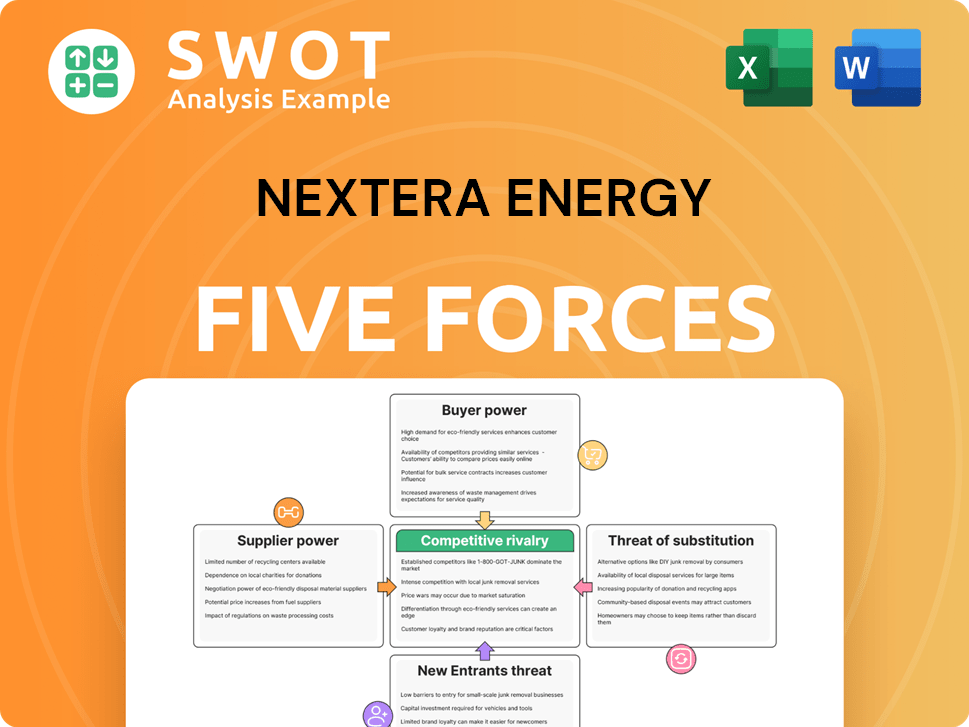

NextEra Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NextEra Energy Company?

- What is Growth Strategy and Future Prospects of NextEra Energy Company?

- How Does NextEra Energy Company Work?

- What is Sales and Marketing Strategy of NextEra Energy Company?

- What is Brief History of NextEra Energy Company?

- Who Owns NextEra Energy Company?

- What is Customer Demographics and Target Market of NextEra Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.