NextEra Energy Bundle

Can NextEra Energy Continue Dominating the Renewable Energy Sector?

From its humble beginnings in 1925 as Florida Power & Light Company, NextEra Energy has transformed into a global powerhouse in the clean energy market. Today, it's the world's largest electric utility holding company, valued at over $170 billion. This journey showcases an impressive NextEra Energy SWOT Analysis and a strategic vision for a sustainable future.

NextEra Energy's remarkable ascent underscores the importance of its growth strategy, particularly in the rapidly evolving renewable energy landscape. Its future prospects hinge on continued expansion, technological innovation, and sound financial planning. This analysis delves into NextEra Energy's long-term growth strategy, exploring its commitment to sustainable energy and its potential impact on climate change.

How Is NextEra Energy Expanding Its Reach?

NextEra Energy is aggressively pursuing expansion, especially in the renewable energy sector. This strategy aims to strengthen its market position and diversify revenue streams. The company is focused on significantly increasing its renewable energy portfolio, driven by growing demand for clean energy and a commitment to zero-carbon emissions by 2045.

The company's expansion strategy focuses heavily on solar and battery storage investments. This includes substantial investments by Florida Power & Light (FPL), a subsidiary, to increase solar energy's share of its generation mix. NextEra Energy Resources (NEER) is also a key driver, adding new projects to its backlog and forming partnerships to accelerate renewable energy development.

These initiatives are part of a broader plan to capitalize on the growing demand for sustainable energy solutions. The company's approach includes both organic growth through project development and strategic partnerships to expand its geographic footprint and project pipeline. This positions NextEra Energy for continued growth in the evolving energy landscape.

NextEra Energy aims to develop a renewable and energy storage portfolio of 81 GW by 2027. This is more than double its 38 GW portfolio as of September 2024. This expansion is driven by strong U.S. economic demand for clean energy.

FPL plans to increase solar's share to 35% by 2034, requiring over 17 GW of solar generation and 7.6 GW of battery storage. In 2024, FPL commissioned 2.2 GW of new solar capacity. NextEra Energy plans to invest approximately $12 billion in solar energy between 2024 and 2027.

In the first quarter of 2025, NEER added approximately 3.2 GW of new renewables and storage projects to its backlog. The total backlog is approximately 28 GW. The company signed agreements for up to 10.5 GW of projects by 2030.

The Amite Solar Energy Center, a 100 MW solar project in Louisiana, began operations in March 2025. A partnership with Entergy aims to create up to 4.5 GW of new solar generation and energy storage projects. This demonstrates the company's commitment to Marketing Strategy of NextEra Energy.

NextEra Energy's expansion strategy is focused on significant investments in solar and battery storage, along with strategic partnerships and geographic diversification. These initiatives are designed to support the company's long-term growth and sustainability goals.

- Aggressive renewable energy portfolio growth, targeting 81 GW by 2027.

- Substantial investments in solar energy, with FPL leading the way.

- NEER's continued project origination and new partnerships.

- Geographic expansion, including projects in Louisiana and partnerships with other utilities.

NextEra Energy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does NextEra Energy Invest in Innovation?

The company's Growth Strategy hinges significantly on leveraging innovation and technology to drive its expansion, particularly within the burgeoning clean energy sector. This strategic focus includes substantial Research and Development (R&D) investments, in-house development initiatives, and collaborations with external innovators. This approach is designed to enhance its technological capabilities and maintain a competitive edge in the evolving energy market.

NextEra Energy actively pursues innovation through strategic investments in early-stage, cutting-edge companies. This is exemplified by the NextEra Energy Investments Seed Competition, which in 2024 awarded $3.5 million across five companies. This commitment to fostering innovation underscores its dedication to staying at the forefront of technological advancements in the energy sector.

The company's commitment to digital transformation and automation is evident in its use of smart grid technology, which helped avoid 2.7 million outages in 2024. This proactive approach not only enhances operational efficiency but also improves customer service and reliability. Furthermore, the company's strategic focus on emerging technologies such as AI, IoT, and sustainability initiatives demonstrates its forward-thinking approach to the future of energy.

NextEra Energy dedicates significant resources to research and development to stay ahead of technological advancements. These investments are crucial for developing new solutions and improving existing technologies.

The company fosters internal innovation through its own development teams. This allows for the creation of proprietary technologies and solutions tailored to its specific needs.

NextEra Energy actively partners with external innovators and technology providers. These collaborations help to accelerate the adoption of new technologies and expand its capabilities.

The company leverages smart grid technology to enhance grid reliability and efficiency. This technology helps to reduce outages and improve overall system performance.

NextEra Energy is exploring the use of Artificial Intelligence (AI) and the Internet of Things (IoT) to optimize operations and improve decision-making. These technologies can provide real-time data and insights.

The company is committed to sustainability and is investing in initiatives to reduce its environmental impact. This includes renewable energy projects and other eco-friendly practices.

The company's 'Real Zero' plan aims to eliminate carbon emissions from its operations by 2045 without increasing costs for customers. This ambitious goal is supported by substantial investments in renewable energy and a forward-thinking approach to technologies like green hydrogen. As of March 2024, the company has a vast 37 GW fleet of wind, solar, and storage projects, coupled with a pipeline of approximately 300 GW of renewable projects. This scale is crucial for optimizing cost-effectiveness and generating valuable insights for technological advancements. You can learn more about the company's target market in this article: Target Market of NextEra Energy.

The company is at the forefront of technological advancements in the renewable energy sector. Its focus on innovation is designed to drive efficiency, reduce costs, and improve the performance of its assets.

- Wind Energy: NextEra Energy Resources has pioneered technologies that have transformed the wind energy industry.

- Solar Energy: The company continues to invest in solar technology, optimizing efficiency and reducing costs.

- Energy Storage: Investments in battery storage solutions are crucial for grid stability and the integration of renewable energy sources.

- Green Hydrogen: The company is exploring green hydrogen as a key component of its long-term sustainability strategy.

NextEra Energy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is NextEra Energy’s Growth Forecast?

The financial outlook for NextEra Energy is robust, underpinned by consistent growth projections and substantial investment plans. The company's performance in 2024 and early 2025 demonstrates its strong financial health and strategic execution within the Renewable Energy sector.

For the full year 2024, NextEra Energy reported adjusted earnings of $7.063 billion, or $3.43 per share, reflecting an 8.2% year-over-year increase in adjusted earnings per share. The company's first-quarter 2025 results further illustrate this positive trend, with adjusted earnings reaching $2.038 billion, or $0.99 per share, marking a nearly 9% year-over-year increase.

NextEra Energy's commitment to Sustainable Energy and strategic investments position it well for continued expansion and financial success. The company’s focus on Growth Strategy and operational efficiency is evident in its financial forecasts and capital allocation strategies.

NextEra Energy anticipates adjusted earnings per share to be in the range of $3.45 to $3.70 for 2025. This projection indicates continued financial growth and stability, driven by strategic investments and operational efficiencies.

The expected range for 2026 adjusted earnings per share is $3.63 to $4.00. This further demonstrates the company's confidence in its long-term growth strategy and its ability to capitalize on market opportunities.

For 2027, the anticipated adjusted earnings per share range is $3.85 to $4.32. This reflects NextEra Energy’s sustained commitment to growth and its strategic investments in renewable energy infrastructure.

NextEra Energy aims to grow its dividends per share by approximately 10% annually through at least 2026, based on a 2024 starting point. This commitment to dividend growth underscores the company's financial strength and its dedication to shareholder value.

Capital expenditures for the first quarter of 2025 totaled approximately $2.4 billion, with full-year investments projected between $8 billion and $8.8 billion. NextEra Energy plans to invest roughly $120 billion in America's energy infrastructure over the next four years through 2028. This investment will target grid modernization, renewables expansion in high-demand states like Texas, and strategic investments in gas-fired generation to ensure grid stability. For more details on the company's revenue streams and business model, you can read the article Revenue Streams & Business Model of NextEra Energy.

Capital expenditures in Q1 2025 were approximately $2.4 billion. The planned investment of $120 billion through 2028 will be crucial for expanding its renewable energy portfolio and modernizing infrastructure.

The company's funding plan from 2024-2027 includes equity units of $5 billion to $7 billion and asset recycling of $5 billion to $6 billion. These financial strategies support its long-term growth objectives.

NextEra Energy's investment in renewables will focus on grid modernization and expansion, particularly in states with high energy demand. This strategic focus is critical for its Future Prospects.

Strategic investments in gas-fired generation are planned to ensure grid stability. This balanced approach supports the reliable delivery of energy while transitioning to renewables.

NextEra Energy aims to grow its dividends per share by approximately 10% annually through at least 2026. This commitment to shareholder value is a key component of its financial strategy.

The company's long-term financial expectations include adjusted earnings per share targets for 2025, 2026, and 2027, demonstrating a clear and consistent NextEra Energy growth trajectory.

NextEra Energy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow NextEra Energy’s Growth?

The path of NextEra Energy's growth strategy is not without its challenges. Several potential risks and obstacles could affect the Energy Company's future prospects. These challenges range from market competition and regulatory uncertainties to supply chain vulnerabilities and technological disruptions.

Market dynamics and policy changes present significant hurdles. The company must navigate a competitive landscape and adapt to regulatory shifts to maintain its leading position. Addressing these risks is crucial for sustaining its growth trajectory in the Renewable Energy sector.

Internal and external factors can also impact NextEra Energy's performance. These include workforce challenges, supply chain issues, and the need to stay ahead of technological advancements. These factors require careful management to ensure that NextEra Energy achieves its long-term goals and continues its contributions to Sustainable Energy.

NextEra Energy faces intense competition in the rapidly evolving energy market. Competitors continuously innovate, requiring the company to maintain a strong competitive edge to preserve its market share. Staying ahead of the competition is essential for NextEra Energy's Growth Strategy.

Changes in federal or state policies can significantly impact NextEra Energy's projects. Renewable energy incentives, tariffs, and permitting frameworks are subject to change. The company must adapt to regulatory shifts to ensure the economic viability of its projects.

Supply chain vulnerabilities and rising costs pose financial risks. The costs of building gas-fired plants have increased significantly. These issues could impact the company's near-term development expectations and affect its financial performance.

Technological advancements can disrupt the energy sector. NextEra Energy must adapt quickly to new technologies. Failure to do so could allow competitors to gain an advantage.

Workforce challenges and other internal constraints can affect project execution. These constraints could impact operational efficiency and potentially slow down NextEra Energy's Growth Strategy.

NextEra Energy diversifies its energy portfolio to mitigate risks. It incorporates carbon footprint and climate-related risks into planning. Risk management frameworks and continuous learning help improve decision-making. To learn more about the company, read the Brief History of NextEra Energy.

NextEra Energy invests in a diverse range of energy sources, including wind, solar, battery storage, and natural gas. This diversification helps reduce the company's reliance on a single energy source or technology, mitigating risks. The company's strategic investments in Renewable Energy sources are a key part of its Future Prospects.

NextEra Energy integrates its carbon footprint and potential climate-related risks into its planning processes. This includes evaluating different options based on system economics, demand forecasts, fuel prices, and climate policies. The company's proactive approach to risk management is crucial for its long-term success.

Investment decisions undergo thorough reviews by subject matter experts from nearly 20 functional areas. This due diligence assesses commercial, financial, and operational feasibility. This detailed review process helps to minimize risks and improve the likelihood of successful project outcomes for NextEra Energy.

NextEra Energy maintains processes to learn from unforeseen challenges. This continuous learning approach allows the company to improve future capital allocation decisions. By adapting and learning, NextEra Energy strengthens its ability to achieve its Sustainable Energy goals.

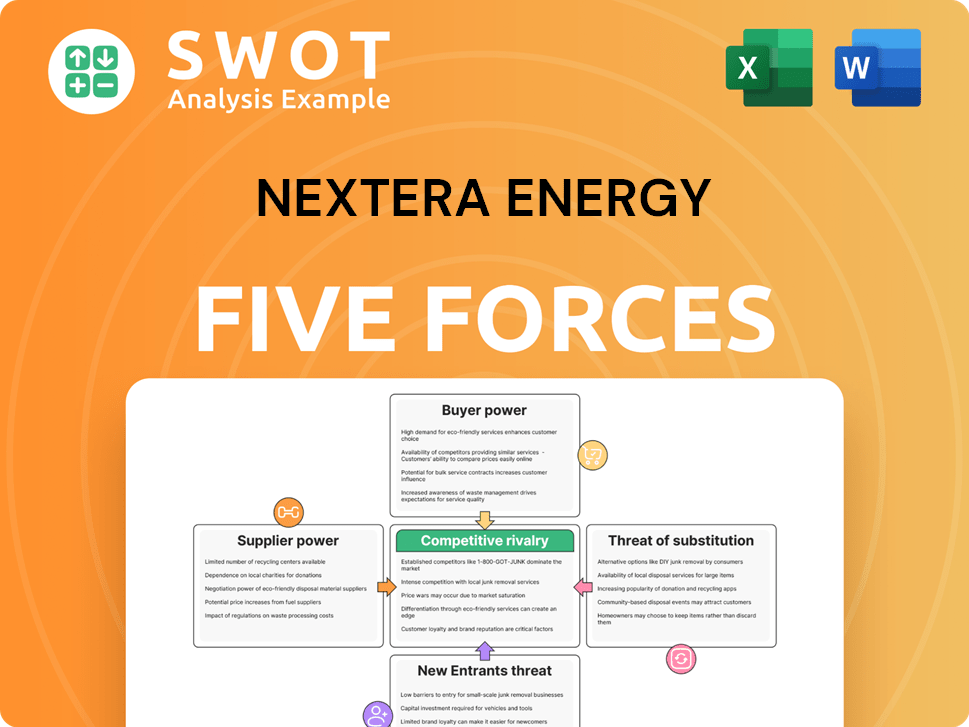

NextEra Energy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NextEra Energy Company?

- What is Competitive Landscape of NextEra Energy Company?

- How Does NextEra Energy Company Work?

- What is Sales and Marketing Strategy of NextEra Energy Company?

- What is Brief History of NextEra Energy Company?

- Who Owns NextEra Energy Company?

- What is Customer Demographics and Target Market of NextEra Energy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.