Nippon Paint Holdings Bundle

How Does Nippon Paint Stay Ahead in the Global Paint Race?

The paint and coatings industry is a dynamic arena, constantly reshaped by technological innovation and shifting consumer preferences. Nippon Paint Holdings Company, a global leader, has navigated this landscape for over a century, evolving from a regional supplier to a worldwide powerhouse. Understanding the Nippon Paint Holdings SWOT Analysis is crucial to grasp its position.

This deep dive into the Nippon Paint competitive landscape will dissect its key rivals and explore its strategic initiatives. We'll conduct a thorough paint industry analysis, examining its market share and financial performance. Furthermore, we’ll investigate the company's growth strategies within the global paint market, including its regional presence and sustainability initiatives, providing actionable insights for investors and industry observers alike.

Where Does Nippon Paint Holdings’ Stand in the Current Market?

Nippon Paint Holdings holds a prominent position within the global paint and coatings industry. As of early 2024, it ranks among the top players worldwide. This places it in direct competition with industry giants like PPG, AkzoNobel, Sherwin-Williams, and RPM International. The company's diverse product range includes automotive coatings, industrial coatings, architectural coatings, and marine coatings, catering to both professional and consumer markets.

The company's strategic focus involves expanding its global footprint through international expansion and acquisitions. This strategy allows it to diversify its geographic presence and tap into new customer segments. Its financial performance reflects its strong market standing, with consistent revenue growth and profitability, as highlighted in the Growth Strategy of Nippon Paint Holdings.

Nippon Paint's market position is particularly robust in key Asian markets, including Japan, China, and Southeast Asia. While its presence in some Western markets may be less dominant compared to local competitors, its strategic partnerships and localized production facilities continue to bolster its global reach. This positions the company well to capitalize on the evolving dynamics of the paint industry.

Nippon Paint is consistently ranked among the top five paint and coatings companies globally. The company has a significant market share in Asia, particularly in Japan, China, and Southeast Asia. Its strong presence in these regions contributes significantly to its overall market position.

The company offers a wide range of products, including automotive, industrial, architectural, and marine coatings. These products serve both professional and consumer markets. This diversified portfolio allows Nippon Paint to cater to various customer needs and market segments.

Nippon Paint has expanded its operations beyond its traditional Asian strongholds through strategic acquisitions and international expansion. This has broadened its geographic footprint and allowed it to penetrate new customer segments. The company's global presence is a key factor in its competitive advantage.

Nippon Paint Holdings reported strong financial results in its fiscal year ending December 31, 2023. This financial performance underscores its scale and competitive position within the industry. The company's financial health supports its continued growth and expansion strategies.

Nippon Paint's competitive advantages include its strong presence in key Asian markets, a diversified product portfolio, and a strategic focus on international expansion. The company's financial performance and strategic acquisitions further strengthen its position. These factors contribute to its ability to compete effectively in the global paint market.

- Strong presence in key Asian markets.

- Diversified product portfolio.

- Strategic international expansion and acquisitions.

- Consistent financial performance.

- Strong position in the automotive OEM coatings sector.

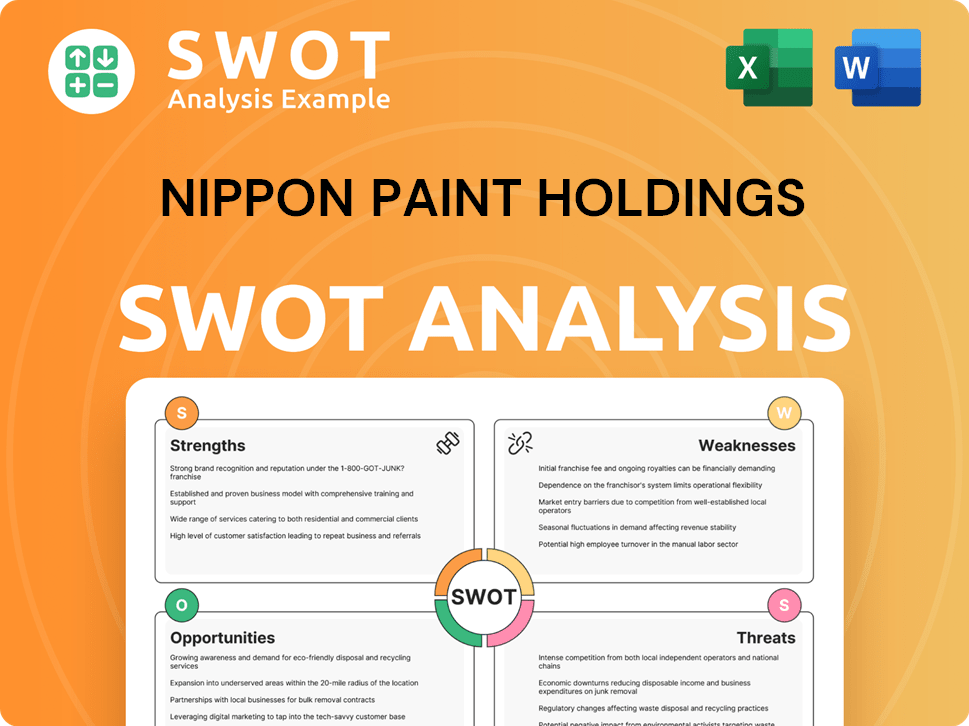

Nippon Paint Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Nippon Paint Holdings?

The Nippon Paint competitive landscape is shaped by a global market with both established multinational corporations and agile regional players. This dynamic environment requires continuous adaptation and strategic innovation. Understanding the key competitors and their strategies is crucial for assessing Nippon Paint market analysis and its future prospects.

Paint industry analysis reveals that competition is fierce, with rivals employing varied strategies to gain market share. These strategies include global expansion, technological advancements, and direct-to-consumer models. The ability to navigate these challenges will be critical for Nippon Paint to maintain and grow its market position.

Nippon Paint competitors include major players like PPG Industries, AkzoNobel, Sherwin-Williams, and RPM International. These companies compete across various segments, including automotive, industrial, and architectural coatings. Their strategies and market positions directly impact Nippon Paint's performance and strategic decisions.

PPG Industries is a major competitor, particularly in North America and Europe. It has a strong presence in automotive and industrial coatings. PPG's global scale and product portfolio pose a significant challenge to Nippon Paint.

AkzoNobel is a Dutch multinational with strong brand recognition in decorative and performance coatings. It has a significant footprint in Europe and emerging markets. Nippon Paint vs. AkzoNobel comparison highlights their similar global reach.

Sherwin-Williams dominates the North American architectural coatings market. Its extensive store network and brand loyalty impact Nippon Paint's consumer-facing businesses. Nippon Paint vs. Sherwin-Williams comparison shows their different market strengths.

RPM International competes in specialized coatings and sealants. It often uses niche brands and innovative solutions to gain market share. While smaller, RPM's focus can be a significant challenge.

Regional players like Asian Paints in India and local manufacturers also pose challenges. They often compete on price and localized distribution networks. This impacts Nippon Paint's regional presence.

Emerging players leverage digital platforms and sustainable product innovations. This disruption requires Nippon Paint to adapt its strategies. The paint company overview must include these new entrants.

Competitors like PPG and AkzoNobel emphasize global scale and technological innovation. Sherwin-Williams leverages its direct-to-consumer model. High-profile 'battles' often involve large infrastructure projects and supply contracts. Nippon Paint growth strategies must consider these factors.

- Global Expansion: Companies are expanding their presence in emerging markets.

- Technological Innovation: Investing in R&D for advanced coatings.

- Sustainability: Developing eco-friendly products.

- Mergers and Acquisitions: Reshaping the competitive landscape.

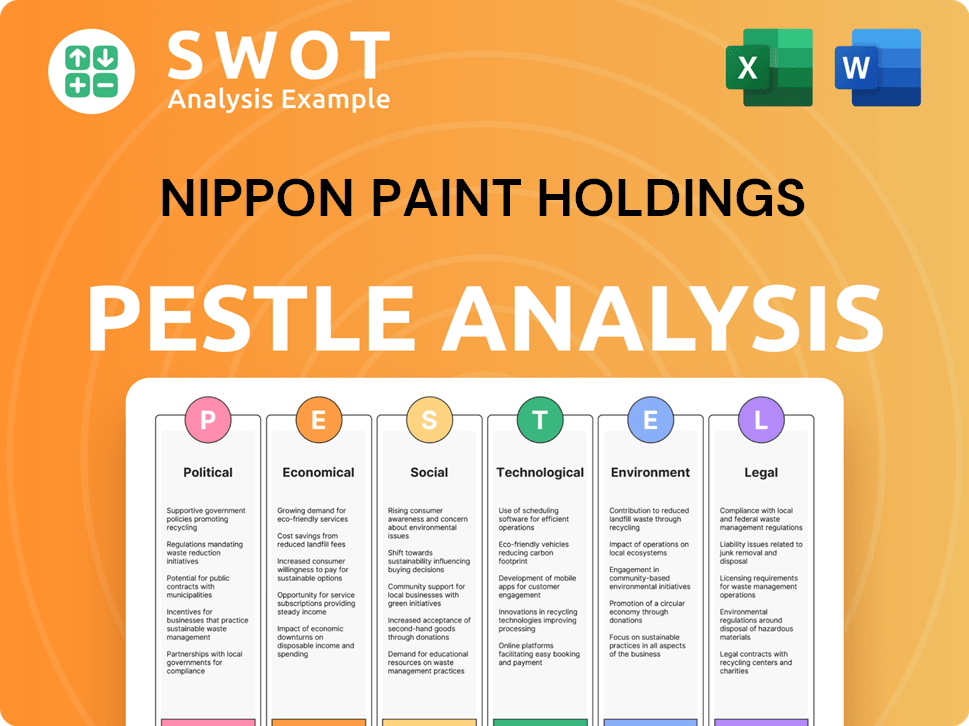

Nippon Paint Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Nippon Paint Holdings a Competitive Edge Over Its Rivals?

Examining the competitive landscape of Nippon Paint Holdings requires a deep dive into its core strengths. The company has cultivated several key advantages that differentiate it from its rivals in the global paint and coatings market. This includes its substantial investment in research and development, which has led to innovative product formulations and proprietary technologies. These strengths are crucial for understanding its position in the paint industry analysis.

The company's strong brand equity and customer loyalty, particularly in Asian markets, also play a significant role. Decades of consistent product quality and effective marketing have built trust among consumers and industrial clients. This loyalty is reinforced by its extensive distribution networks, ensuring wide product availability and strong relationships with distributors. Understanding these aspects is essential for a comprehensive paint company overview.

Furthermore, Nippon Paint benefits from economies of scale in manufacturing and procurement, leading to cost efficiencies. Its global supply chain supports timely delivery and consistent product quality, though it is subject to external disruptions. The company's strong talent pool, including experienced chemists, engineers, and sales professionals, contributes to its ability to innovate and maintain strong customer relationships. For more information about the company's strategies, consider reading about the Target Market of Nippon Paint Holdings.

Nippon Paint consistently invests in research and development, focusing on eco-friendly coatings, high-performance industrial coatings, and advanced materials. This commitment has led to the development of low-VOC and water-based paints, addressing environmental regulations and consumer preferences. The company's R&D spending is a key factor in its ability to compete in the global paint market.

Nippon Paint has built strong brand equity, particularly in Asian markets, through consistent product quality and effective marketing. This has cultivated deep trust among consumers and industrial clients. The company's extensive distribution networks further reinforce this loyalty, ensuring wide product availability and strong relationships with distributors.

Nippon Paint benefits from economies of scale in manufacturing and procurement, leading to cost efficiencies that can be passed on to customers or reinvested into innovation. Its global supply chain, while subject to external disruptions, supports timely delivery and consistent product quality. These efficiencies are critical for maintaining a competitive edge.

The company's strong talent pool, including experienced chemists, engineers, and sales professionals, contributes to its ability to innovate and maintain strong customer relationships. Nippon Paint focuses on operational excellence to enhance its offerings and overall efficiency. This focus is essential for long-term success in the paint industry.

Nippon Paint's competitive advantages are multifaceted, including robust R&D, strong brand recognition, and operational efficiencies. These advantages are crucial for its continued success in the global paint market. The company's focus on sustainability and digital transformation further enhances its offerings and operational efficiencies.

- Extensive R&D leading to innovative products.

- Strong brand equity and customer loyalty, especially in Asia.

- Economies of scale and cost efficiencies.

- A talented workforce driving innovation and customer relationships.

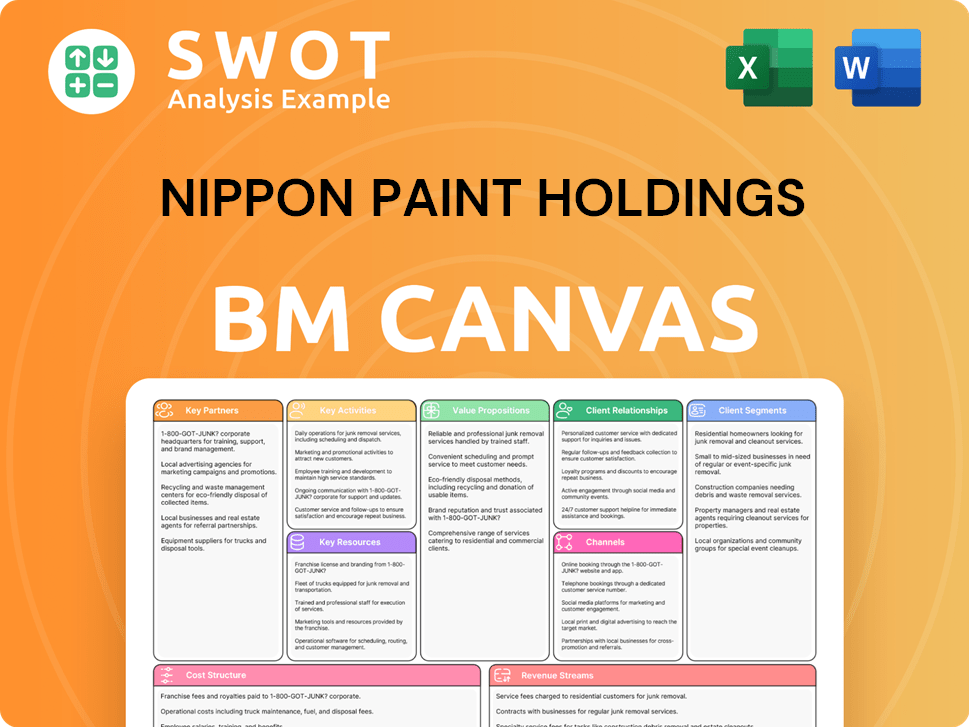

Nippon Paint Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Nippon Paint Holdings’s Competitive Landscape?

The Nippon Paint competitive landscape is significantly influenced by evolving industry trends, upcoming challenges, and potential growth opportunities. A thorough paint industry analysis reveals that the company must adapt to maintain and enhance its market position. The Nippon Paint market analysis indicates a dynamic environment where strategic decisions will be crucial for sustained success.

The paint and coatings sector is experiencing notable transformations. These include technological advancements, stringent environmental regulations, and shifting consumer preferences. The Nippon Paint competitors and the company itself are continuously adjusting to these factors. This necessitates a proactive approach to innovation, sustainability, and market expansion to navigate the complexities of the global paint market.

Technological advancements are driving innovation in coatings, including smart coatings and bio-based materials. Environmental regulations are becoming stricter, pushing for sustainable and eco-friendly products. Consumer demand is increasingly focused on health, durability, and environmental impact, influencing purchasing decisions.

Volatility in raw material prices poses a significant risk to profitability. Increased competition from new entrants, especially in emerging markets, is intensifying market pressures. Digital transformation is essential for operations and customer engagement, requiring substantial investment and strategic focus.

Emerging markets, particularly in Southeast Asia and Africa, offer significant growth potential. Innovations in specialized industrial coatings and protective coatings for renewable energy infrastructure are promising. Strategic partnerships and acquisitions can strengthen market position and technological capabilities.

Focus on sustainable innovation to meet environmental regulations and consumer demands. Targeted market expansion in high-growth regions. Operational efficiency improvements to manage costs and enhance competitiveness. Strategic partnerships and acquisitions to enhance market position.

Nippon Paint’s response to these trends and challenges will determine its future success. The company's strategies must focus on both mitigating risks and capitalizing on opportunities. This includes a strong emphasis on sustainability, innovation, and strategic market expansion to maintain a competitive edge in the global paint market.

- Sustainability Initiatives: Develop and promote eco-friendly products to meet regulatory requirements and consumer preferences.

- Market Expansion: Focus on growth in emerging markets such as Southeast Asia and Africa, where urbanization and infrastructure development are driving demand.

- Product Innovation: Invest in research and development to create specialized coatings for various industrial applications.

- Strategic Partnerships: Form alliances to enhance market presence and technological capabilities.

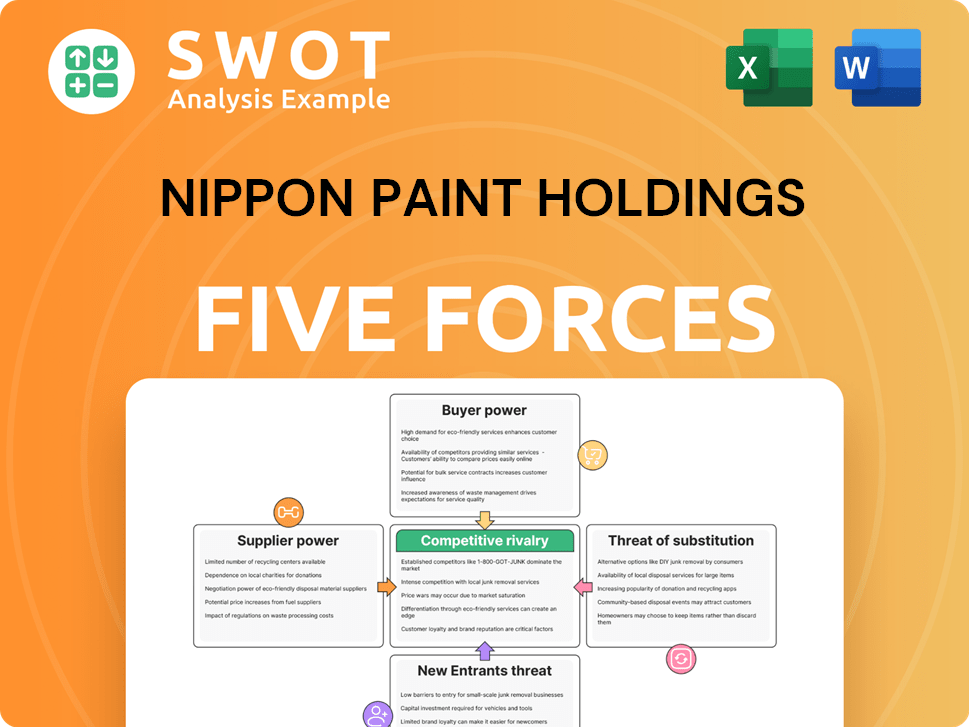

Nippon Paint Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nippon Paint Holdings Company?

- What is Growth Strategy and Future Prospects of Nippon Paint Holdings Company?

- How Does Nippon Paint Holdings Company Work?

- What is Sales and Marketing Strategy of Nippon Paint Holdings Company?

- What is Brief History of Nippon Paint Holdings Company?

- Who Owns Nippon Paint Holdings Company?

- What is Customer Demographics and Target Market of Nippon Paint Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.