Nippon Paint Holdings Bundle

Who Really Owns Nippon Paint Holdings?

Understanding the ownership structure of a global leader like Nippon Paint Holdings is crucial for investors and strategists alike. Recent shifts in its corporate structure, including a significant consolidation in December 2024, have reshaped its landscape. This Nippon Paint Holdings SWOT Analysis will help you to understand the company's strengths and weaknesses.

As a leading paint manufacturer and a prominent Japanese company, Nippon Paint's ownership reveals insights into its strategic direction and future prospects. This analysis explores the evolution of Nippon Paint ownership, from its founding to its current status as a global paint company. We'll examine key stakeholders, including the Wuthelam Group and Nipsea International, and the impact of these relationships on the company's performance and market share.

Who Founded Nippon Paint Holdings?

The story of Nippon Paint Holdings begins with its founder, Jujiro Motegi, who established the business in 1881. Initially known as Komyosha, Motegi's vision was to manufacture paints within Japan, reducing reliance on imports. His efforts culminated in the successful development of the first Japanese-made paints in 1880.

The company's evolution continued with its incorporation as Nippon Paint Manufacturing in 1898, with Hatsutaro Tasaka becoming the first president. The name changed to Nippon Paint Co., Ltd. in 1927, marking further development in its corporate identity. This early period set the foundation for the company's growth and its role as a significant paint manufacturer.

A critical turning point in the company's history involved a strategic partnership with the Wuthelam Group. This collaboration, starting in 1962, involved Wuthelam becoming Nippon Paint's Asian sales agent. The partnership led to the establishment of a joint venture in Singapore.

Founded in 1881 by Jujiro Motegi under the name Komyosha.

Developed the first Japanese-made paints in 1880.

Incorporated as Nippon Paint Manufacturing in 1898.

Hatsutaro Tasaka became the first president.

Renamed Nippon Paint Co., Ltd. in 1927.

Collaboration with Wuthelam Group began in 1962.

The joint venture in Singapore, known as the Nipsea Management Group, saw Nippon Paint holding a 40 percent stake. This strategic move was crucial for expanding the paint company's presence across Asia. Through various joint ventures, the company secured a leading market position in the region. The early ownership structure and strategic partnerships were pivotal in shaping the company's growth trajectory, establishing it as a major player in the global paint industry. The Wuthelam Group's involvement significantly influenced Nippon Paint's expansion and market dominance in Asia.

- Jujiro Motegi founded the company in 1881.

- The Wuthelam Group partnership began in 1962.

- Nippon Paint held a 40% stake in the Nipsea Management Group.

- The company's focus was on producing paints within Japan.

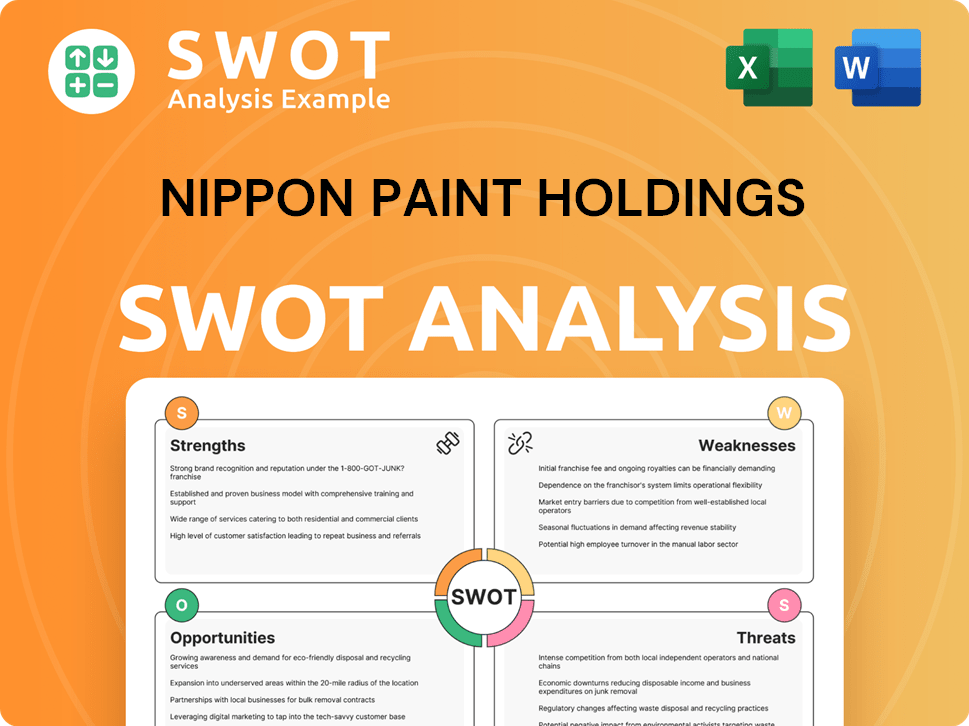

Nippon Paint Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Nippon Paint Holdings’s Ownership Changed Over Time?

The ownership of Nippon Paint Holdings has seen significant shifts, particularly with the increased involvement of the Wuthelam Group. In August 2020, the Wuthelam Group, based in Singapore, boosted its stake in Nippon Paint to nearly 60% (58.7%) by exchanging its stake in their Singapore joint venture. This strategic move, valued at $12.18 billion, aimed to establish a dominant paints and coatings entity in Asia. This transaction concluded in January 2021, resulting in Nippon Paint Holdings acquiring approximately 100% ownership of these Asian businesses and the Wuthelam Group's stake in the Indonesian business.

As of December 31, 2024, Nipsea International Limited serves as the primary parent company of Nippon Paint Holdings, holding 55.06% of its voting rights. This became the sole parent company on December 23, 2024, following a share transfer to six Singaporean individuals within Nipsea International Limited. While April Goh holds 37.50% of Nipsea International, Goh Hup Jin holds significant voting rights, amounting to 90.91%, despite not owning shares in Nipsea International. The Wuthelam Group, formerly a direct parent, now functions as an asset management company focused on investment activities. You can also learn more about the company's origins by reading Brief History of Nippon Paint Holdings.

| Shareholder | Percentage of Shares (as of Dec 31, 2024) | Notes |

|---|---|---|

| Nipsea International Limited | 55.06% | Primary parent company |

| The Master Trust Bank of Japan, Ltd. (Trust Account) | Data not available | Major shareholder |

| Fraser (HK) Limited | Data not available | Major shareholder |

Other major shareholders as of December 31, 2024, include The Master Trust Bank of Japan, Ltd. (Trust Account), Fraser (HK) Limited, and various financial institutions. Financial institutions held 10.60% (251,337,865 shares), and financial instruments business operators held 0.79% (18,836,969 shares) of the company's shares as of December 31, 2024. The total number of issued shares was 2,370,512,215 as of December 31, 2024, and 2,348,673,000 as of June 2025.

The Wuthelam Group's strategic moves significantly reshaped Nippon Paint ownership.

- Nipsea International Limited is the primary parent company.

- Financial institutions hold a significant portion of shares.

- Goh Hup Jin has substantial voting rights.

- The total number of issued shares was 2,370,512,215 as of December 31, 2024.

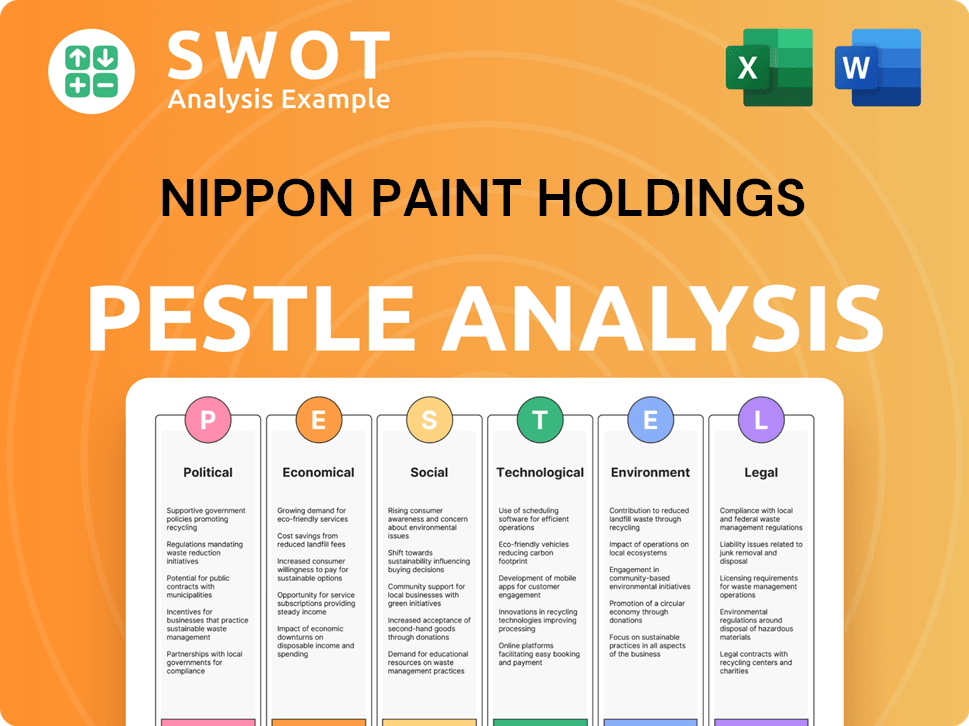

Nippon Paint Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Nippon Paint Holdings’s Board?

As of May 14, 2025, the Board of Directors of Nippon Paint Holdings includes key figures such as Yuichiro Wakatsuki and Wee Siew Kim, who serve as Director, Representative Executive Officer & Co-President. Other board members include Goh Hup Jin, Hisashi Hara, Andrew Larke, Lim Hwee Hua, Masataka Mitsuhashi, Toshio Morohoshi, and Masayoshi Nakamura. Goh Hup Jin also holds a directorship at Nipsea International Limited, the parent company. This composition reflects the company's governance structure and the influence of its major stakeholders.

The board's structure emphasizes independent oversight. Independent Directors constitute a majority, holding 66.7% of the seats. With six out of the nine board members being independent, this structure is designed to ensure impartial decision-making and protect the interests of all shareholders. This setup is crucial for maintaining transparency and accountability within the company, especially in transactions involving the majority shareholder.

| Board Member | Title | Additional Information |

|---|---|---|

| Yuichiro Wakatsuki | Director, Representative Executive Officer & Co-President | |

| Wee Siew Kim | Director, Representative Executive Officer & Co-President | |

| Goh Hup Jin | Director | Also a director of Nipsea International Limited |

| Hisashi Hara | Director | |

| Andrew Larke | Director | |

| Lim Hwee Hua | Director | |

| Masataka Mitsuhashi | Director | |

| Toshio Morohoshi | Director | |

| Masayoshi Nakamura | Director |

Nippon Paint Holdings operates under a one-share-one-vote system, ensuring that all shareholders have equal voting rights. The company utilizes a unit share system, where one unit equals 100 shares, providing a clear structure for voting. This approach, combined with the presence of independent directors, safeguards minority shareholders' interests, particularly in transactions with the majority shareholder. For more details on the company's financial operations, consider reading about the Revenue Streams & Business Model of Nippon Paint Holdings.

The board structure of Nippon Paint Holdings prioritizes independent oversight and shareholder protection.

- Independent directors hold a majority of board seats, ensuring unbiased decision-making.

- The one-share-one-vote system and unit share system promote fair voting rights.

- The company emphasizes autonomous management while maintaining strong corporate governance.

- The board encourages risk-taking by management while maintaining oversight.

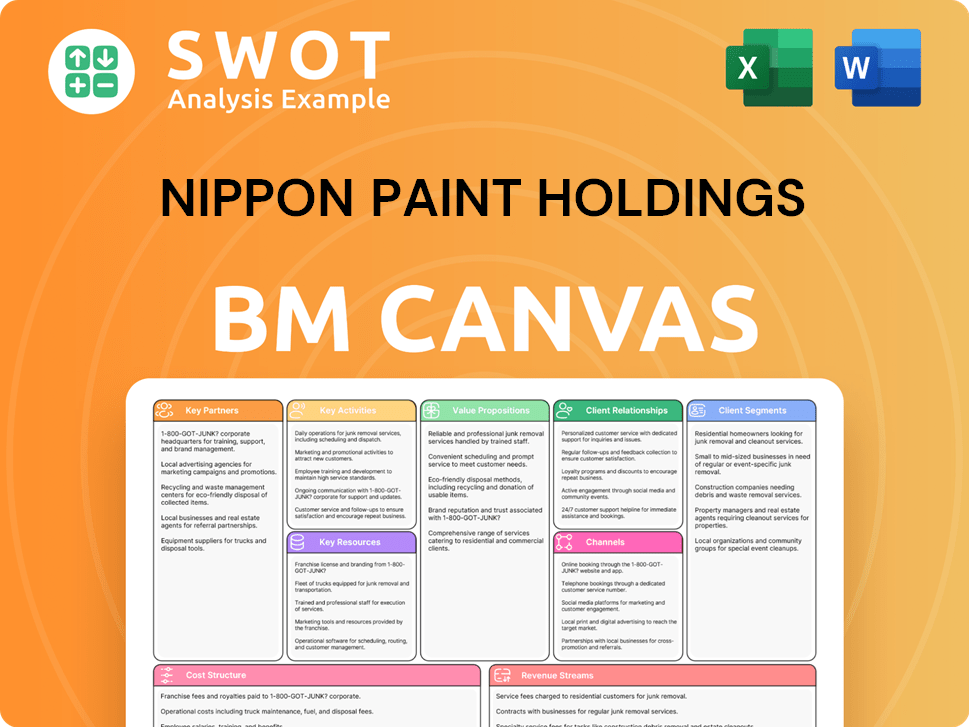

Nippon Paint Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Nippon Paint Holdings’s Ownership Landscape?

Recent developments at Nippon Paint Holdings have seen shifts in both executive leadership and ownership structure. Effective January 1, 2025, the company announced changes in its senior management, including new roles within the Japan Segment to improve technical capabilities, marketing, and sales. These changes, including the establishment of Japan Group CTO and Japan Group CCO positions in 2024, and new CSCO and CAO roles, reflect a strategic focus on operational efficiency and specialization within the organization. Furthermore, the acquisition of AOC, a global specialty formulator, was completed on March 3, 2025, making it a subsidiary and expected to boost earnings per share from the first year, demonstrating a commitment to growth through strategic acquisitions.

A significant change in the ownership structure occurred on December 23, 2024, when Nipsea International Limited became the sole parent company of Nippon Paint Holdings, streamlining the previous multi-parent structure. This consolidation highlights the influence of key individuals like Goh Hup Jin, who holds significant voting rights within Nipsea International Limited. The company's strategic focus remains on mergers and acquisitions to drive profit growth, with share buybacks not currently under consideration as of April 2024. These strategic moves and ownership adjustments are part of the company's broader strategy, as detailed in the Growth Strategy of Nippon Paint Holdings, aimed at maximizing shareholder value.

The ownership landscape also includes the presence of various institutional investors and investment funds among its major shareholders, reflecting industry trends towards increased institutional ownership. Nippon Paint Holdings continues to operate under its 'Asset Assembler' model, which focuses on low-risk, sustainable EPS compounding by integrating robust businesses. This strategy is intended to deliver consistent returns and long-term value creation for shareholders, highlighting the company's commitment to financial stability and growth within the paint manufacturer industry.

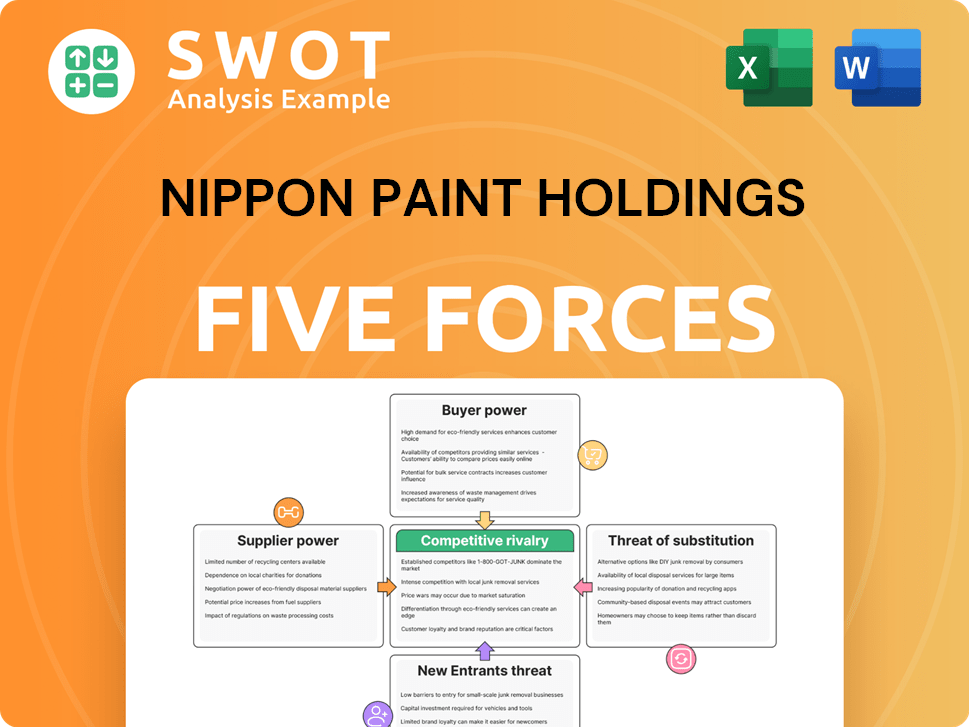

Nippon Paint Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nippon Paint Holdings Company?

- What is Competitive Landscape of Nippon Paint Holdings Company?

- What is Growth Strategy and Future Prospects of Nippon Paint Holdings Company?

- How Does Nippon Paint Holdings Company Work?

- What is Sales and Marketing Strategy of Nippon Paint Holdings Company?

- What is Brief History of Nippon Paint Holdings Company?

- What is Customer Demographics and Target Market of Nippon Paint Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.