Nippon Paint Holdings Bundle

How Does Nippon Paint Holdings Thrive in the Global Paint Market?

Nippon Paint Holdings, a titan in the Nippon Paint Holdings SWOT Analysis, isn't just a paint company; it's a global force. With a history stretching back to 1881, this Japanese paint manufacturer has consistently demonstrated its prowess, achieving record-breaking financial results in 2024. Its impressive performance begs the question: what strategies and operational mechanisms fuel its success in the competitive paint industry?

This exploration of Nippon Paint Holdings delves into its core operations, revealing how this global paint market leader generates revenue and maintains its competitive edge. From its diverse product portfolio, spanning automotive and architectural coatings, to its strategic market positioning, we'll uncover the key drivers behind its sustained profitability. Understanding the intricacies of Nippon Paint's business model is crucial for anyone looking to gain insights into the global paint market and the strategies employed by industry leaders.

What Are the Key Operations Driving Nippon Paint Holdings’s Success?

Nippon Paint Holdings creates value by developing, manufacturing, and selling a wide range of paints and coatings. They serve various customer segments, including automotive, industrial, architectural, and marine applications. Their core offerings include decorative paints, automotive coatings, and industrial coatings, with decorative paints being a major revenue driver.

The paint company also provides application services and technical support to its customers. Operational processes involve manufacturing, sourcing, technology development, logistics, and sales. Nippon Paint emphasizes local production, especially for architectural paints, which boosts operational efficiency. They actively invest in research and development, allocating roughly JPY 14.4 billion in 2022 for product innovations, such as eco-friendly paints and advanced coatings.

A key aspect of Nippon Paint Holdings is its 'Asset Assembler' business model. This model enables autonomous and decentralized management across its global partner companies. This approach allows flexibility and responsiveness to regional market needs. The company expands its distribution networks by partnering with regional paint and putty manufacturers, increasing access to remote markets. This operational strategy, combined with product innovation and strategic acquisitions, helps Nippon Paint differentiate itself and offer tailored solutions. For more information on their target market, you can read this article: Target Market of Nippon Paint Holdings.

Nippon Paint Holdings offers a diverse range of products. These include decorative paints, automotive coatings, and industrial coatings. Decorative paints are a significant contributor to the company's revenue, reflecting a strong focus on architectural applications.

Operations encompass manufacturing, sourcing, technology development, logistics, and sales. The company emphasizes local production to enhance efficiency. Global logistics challenges impact raw material costs, influencing the supply chain.

Nippon Paint provides tailored solutions and differentiated products. They offer application services and technical support. This approach translates into customer benefits and market differentiation, creating a strong value proposition.

The 'Asset Assembler' model allows for decentralized management. This model enables flexibility and responsiveness to regional market needs. Partnerships with regional manufacturers expand distribution networks, especially in the global paint market.

Nippon Paint Holdings focuses on product innovation and strategic acquisitions. They allocate significant resources to research and development. This includes eco-friendly paints and advanced coatings, reflecting a commitment to sustainability.

- Investment in R&D: Approximately JPY 14.4 billion in 2022.

- Emphasis on local production for efficiency.

- Strategic acquisitions, such as DuluxGroup, to expand market presence.

- Focus on eco-friendly paints and advanced coatings.

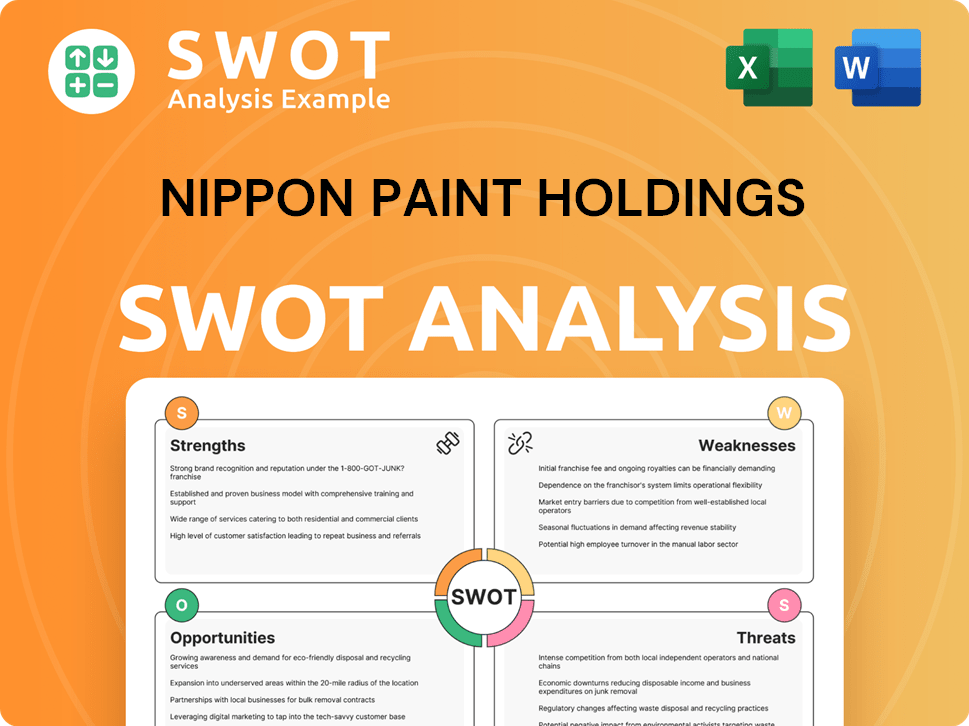

Nippon Paint Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nippon Paint Holdings Make Money?

Nippon Paint Holdings, a prominent paint company, generates revenue through a diverse range of products and services within the paint industry. Its primary revenue streams include decorative paints, automotive coatings, industrial coatings, fine chemicals, and other paint-related businesses. The company's business model is designed to capitalize on various segments of the global paint market.

The company's revenue streams are diversified across several key areas, including decorative paints, automotive coatings, and industrial coatings. This diversification helps to mitigate risks and ensures a stable revenue base. A look into the Marketing Strategy of Nippon Paint Holdings reveals further insights into how the company leverages its product portfolio.

For the fiscal year 2024, decorative paints accounted for the largest portion of total net sales, representing 64%. Automotive coatings contributed 12%, while industrial coatings made up 6%. Fine chemicals contributed 1%, other paints 6%, and other adjacencies business accounted for 11% of total net sales. In the three months ended March 31, 2025, consolidated revenue increased by 5.6% to ¥405,724 million.

Nippon Paint Holdings employs several strategies to monetize its operations and expand its global presence. These strategies include geographic expansion, strategic acquisitions, and price adjustments.

- Geographic Expansion: The company focuses on expanding into emerging markets, particularly in Southeast Asia. Markets like Malaysia and Vietnam have shown substantial growth, contributing over 25% of total sales in 2022.

- Price Adjustments and Volume Increases: Nippon Paint utilizes price adjustments and increases sales volumes, especially in its decorative segment, to boost revenue.

- Strategic Acquisitions: The acquisition of DuluxGroup in 2021 for approximately JPY 117 billion has strengthened its market position and diversified its revenue sources. The recent acquisition of AOC LLC in March 2025 is expected to significantly contribute to the company's operating profit from the second quarter of fiscal year 2025.

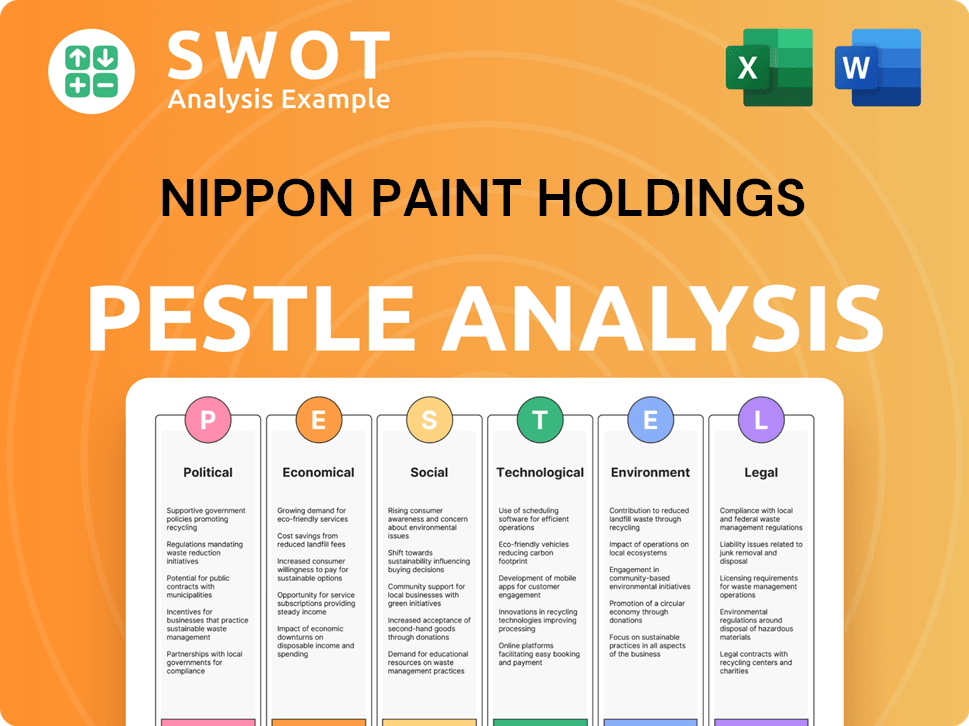

Nippon Paint Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Nippon Paint Holdings’s Business Model?

The strategic journey of Nippon Paint Holdings has been marked by significant milestones and strategic moves. These actions have been pivotal in shaping its operational framework and financial outcomes. A key move was the acquisition of DuluxGroup in 2021, which expanded its market reach and product offerings. More recently, in March 2025, the company completed the acquisition of LSF11 A5 TopCo LLC, including AOC LLC, a specialty formulator, which further diversified its business.

Nippon Paint has adeptly navigated various operational and market challenges, such as global logistics disruptions and rising raw material costs. The company's focus on cost management and operational efficiency is evident in its improved gross profit margin. Furthermore, Nippon Paint has adapted to changing market demands, particularly the increasing need for eco-friendly paint solutions, by launching new products in this segment. This has contributed to growth in decorative paint sales.

The company's competitive advantages are rooted in its 'Asset Assembler' business model, which facilitates effective asset management and integration. This model, combined with autonomous and decentralized management, supports the growth of partner companies while leveraging low funding costs available in Japan. Nippon Paint's brand strength, especially in Asia and the Pacific, where it often holds a leading market position, and its continuous investment in research and development, further enhance its competitive edge. The company's long-term restricted stock compensation plan also aligns leadership with sustained corporate success.

Nippon Paint's acquisition of DuluxGroup in 2021 for approximately JPY 117 billion was a major strategic move. This expanded its market presence and product lines significantly. The recent acquisition of LSF11 A5 TopCo LLC, including AOC LLC, in March 2025, further diversified its business into specialty solutions.

The company has focused on expanding its global footprint and diversifying its product portfolio. The 'Asset Assembler' business model enables efficient asset management. Continuous investment in research and development supports product innovation and competitive differentiation within the paint industry.

Nippon Paint benefits from its strong brand presence and pricing power, especially in the Asia-Pacific region. The company's commitment to sustainability, reflected in its eco-friendly product launches, is another key advantage. The long-term restricted stock compensation plan aligns executive incentives with sustained corporate success. Check out Nippon Paint Holdings' Growth Strategy to learn more.

Despite challenges, Nippon Paint has shown resilience, increasing its gross profit margin from 34.0% in 2018 to 36.0% in 2022. Decorative paint sales grew by 18% in 2022, indicating strong market demand. The company invested JPY 14.4 billion in research and development in 2022, supporting innovation.

Nippon Paint's competitive edge is bolstered by several key factors that drive its success in the global paint market. These advantages enable the company to maintain a strong position and drive future growth.

- 'Asset Assembler' Business Model: This model allows for efficient management and integration of assets, supporting partner company growth.

- Strong Brand Presence: Particularly in Asia and the Pacific, where Nippon Paint often holds a number one market position.

- Continuous R&D Investment: With JPY 14.4 billion allocated in 2022, supporting product innovation and differentiation.

- Sustainability Initiatives: Launching eco-friendly products to meet growing market demand.

- Long-Term Executive Incentives: The restricted stock compensation plan aligns leadership with long-term corporate success.

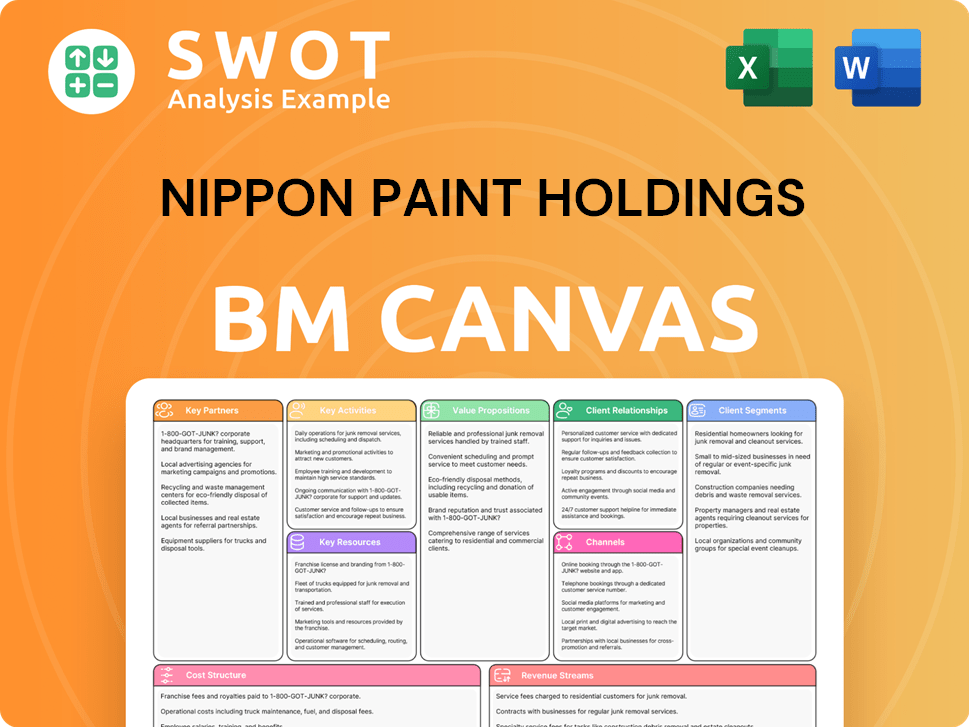

Nippon Paint Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Nippon Paint Holdings Positioning Itself for Continued Success?

Nippon Paint Holdings holds a strong position in the global paint industry. It operates in over 50 countries, often ranking among the top three in market share, especially in China, Australia, and other Asian countries. The company's success is built on a robust business model and strategic global presence.

However, Nippon Paint, like any paint company, faces its share of challenges. These include intense competition from major players and the volatility of raw material costs. Also, fluctuations in foreign exchange rates and the integration of new acquisitions can pose additional risks. To learn more about their growth strategy, see Growth Strategy of Nippon Paint Holdings.

Nippon Paint is a major player in the global paint market, with a strong presence in Asia and Australia. The company's decorative paint sales from China account for about 30% of midcycle group sales, Australia 20%, and the rest of Asia about 15%. This global paint market presence allows for diversified revenue streams.

The paint industry is highly competitive, facing challenges like fluctuating input prices and supply chain issues. Operational risks include supply chain challenges leading to increased raw material costs, as seen in Q2 2023 with a 15% increase in cost of goods sold. Financial risks include foreign exchange fluctuations, with Nippon Paint reporting a foreign exchange loss of approximately ¥1.5 billion in 2022.

Nippon Paint is focused on sustained growth through strategic initiatives and innovation. The company's fiscal year 2025 guidance projects revenue to reach a record high of JPY 1,740 billion, marking a 6.2% increase. The company aims to expand its market share by strengthening its sales network, particularly in Tier 3–6 cities in China, and diversifying income streams through infrastructure and government projects.

The company's 'asset assembler' business model is seen as a key competitive advantage that will support its future growth and profitability. Nippon Paint is committed to sustainable EPS compounding through both organic and inorganic growth, targeting a medium-term consolidated CAGR of 8-9% in revenue and 10-12% in EPS for organic growth based on its 2023 business portfolio. Innovation remains a priority, with continued investment in eco-friendly and advanced coatings.

Nippon Paint aims to expand its market share by strengthening its sales network, especially in smaller Chinese cities. The company is also diversifying its income through infrastructure and government projects. These strategies are designed to support sustained growth in the global paint market.

- Expansion in Tier 3–6 cities in China.

- Diversification through infrastructure and government projects.

- Continued investment in eco-friendly and advanced coatings.

- Focus on organic and inorganic growth to increase revenue and EPS.

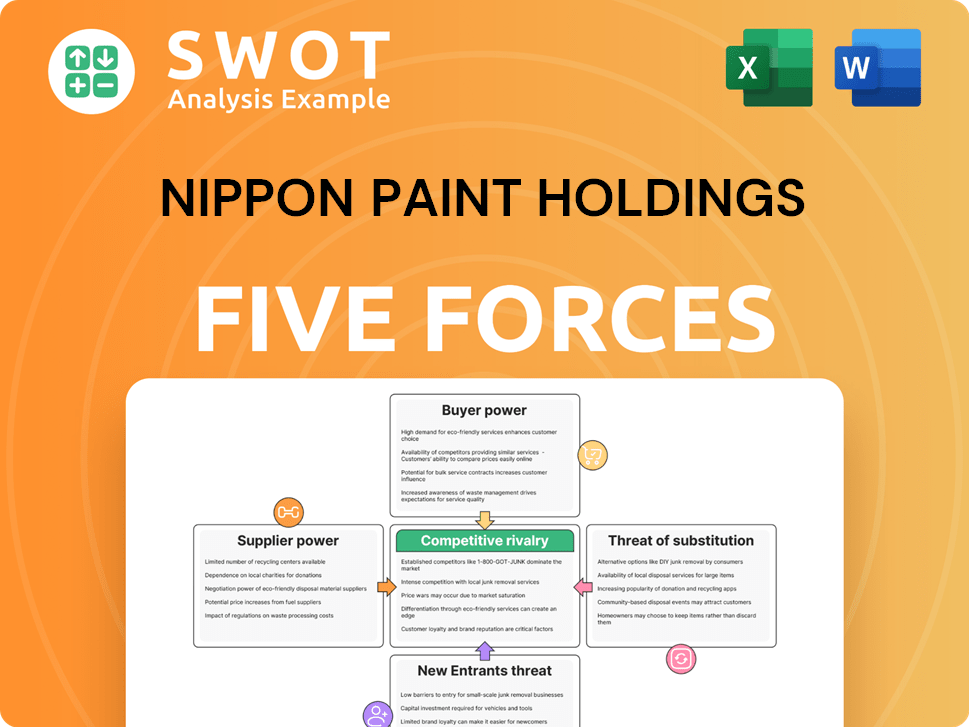

Nippon Paint Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nippon Paint Holdings Company?

- What is Competitive Landscape of Nippon Paint Holdings Company?

- What is Growth Strategy and Future Prospects of Nippon Paint Holdings Company?

- What is Sales and Marketing Strategy of Nippon Paint Holdings Company?

- What is Brief History of Nippon Paint Holdings Company?

- Who Owns Nippon Paint Holdings Company?

- What is Customer Demographics and Target Market of Nippon Paint Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.