Nippon Paint Holdings Bundle

How is Nippon Paint Holdings Painting its Future?

From its inception in 1881, Nippon Paint Holdings has transformed from a local Japanese paint provider into a global coatings leader. This journey reflects a strategic commitment to expansion and innovation, shaping its evolution into a multinational powerhouse. Today, the company's diverse operations span automotive, industrial, architectural, and marine applications, serving both professional and consumer markets worldwide. Understanding Nippon Paint's growth strategy is key to appreciating its enduring success.

To truly understand the company's trajectory, explore the Nippon Paint Holdings SWOT Analysis. Nippon Paint Holdings' future prospects are bright, driven by strategic market entries and technological advancements. The company's ability to adapt and innovate within the global coatings market is a testament to its robust growth strategy. This analysis will delve into the core pillars driving Nippon Paint's continued success, exploring its expansion strategies in Asia and beyond.

How Is Nippon Paint Holdings Expanding Its Reach?

The expansion initiatives of Nippon Paint Holdings are central to its Nippon Paint Growth Strategy and long-term success. These initiatives are designed to capitalize on emerging market opportunities and strengthen the company's position in the Global Coatings Market. The strategy involves a multi-faceted approach, including geographical expansion, product diversification, and strategic acquisitions, all aimed at driving sustainable revenue growth and enhancing shareholder value.

A key driver of Nippon Paint's expansion is its focus on high-growth regions, particularly in Asia. The company recognizes the significant potential in countries like China, India, and Indonesia, where rapid urbanization and infrastructure development are fueling demand for paints and coatings. This strategic focus is supported by investments in local manufacturing facilities, distribution networks, and marketing efforts designed to capture a larger share of these burgeoning markets. The company's expansion strategy is also influenced by the need to adapt to evolving industry trends and customer preferences, ensuring that Nippon Paint remains a leader in the global coatings market.

The company's approach to expansion is also influenced by the need to adapt to evolving industry trends and customer preferences, ensuring that Nippon Paint remains a leader in the global coatings market. Nippon Paint's growth strategy is not just about expanding its footprint; it's about becoming a more versatile and competitive player in the global market. This includes a commitment to innovation, sustainability, and customer-centric solutions, all of which are essential for long-term success. For more insights, you can explore the Competitors Landscape of Nippon Paint Holdings.

Nippon Paint is actively expanding its presence in key emerging markets, particularly in Asia. This includes strengthening its market share in China, India, and Indonesia. These markets are experiencing significant growth due to urbanization and infrastructure development, which drive demand for architectural and industrial coatings.

The company is diversifying its product portfolio to include high-growth segments such as automotive coatings. Nippon Paint aims to capitalize on the increasing production of electric vehicles and the demand for sustainable coating solutions. This diversification strategy helps to mitigate risks and tap into new revenue streams.

Strategic M&A activities are a vital part of Nippon Paint's expansion strategy. The acquisition of DuluxGroup in 2019 is a prime example of gaining market share and accessing new customer bases. The company focuses on M&A targets that offer synergistic benefits and align with its long-term growth objectives.

Nippon Paint is expanding its service offerings to include coating application and maintenance services. This move provides more comprehensive solutions to customers. This approach helps to build stronger customer relationships and create additional revenue streams.

Nippon Paint's expansion strategy is multifaceted, encompassing geographical expansion, product diversification, and strategic acquisitions. These initiatives are designed to drive sustainable revenue growth and enhance market share. The company's success is closely tied to its ability to adapt to changing market dynamics and customer needs.

- Geographical Expansion: Focus on emerging markets like China, India, and Indonesia.

- Product Diversification: Entering high-growth segments such as automotive coatings.

- Strategic M&A: Acquiring companies to gain market share and new customer bases.

- Service Expansion: Offering coating application and maintenance services.

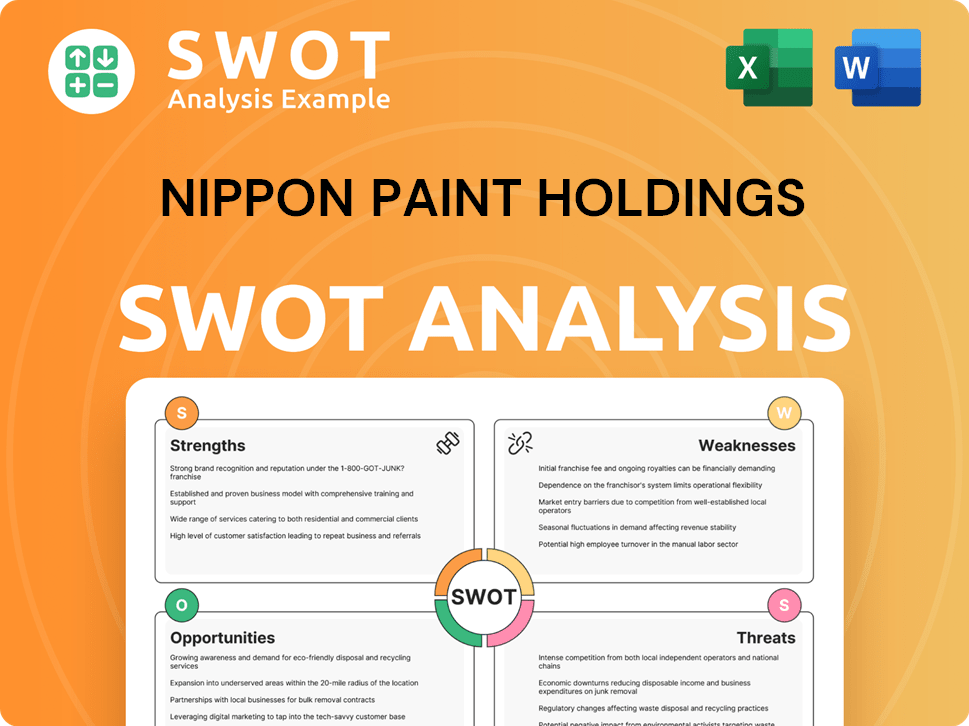

Nippon Paint Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nippon Paint Holdings Invest in Innovation?

Nippon Paint Holdings places a strong emphasis on innovation and technology to drive sustained growth and maintain its competitive edge. This approach is crucial in the dynamic Paint Industry Analysis and the evolving Global Coatings Market. The company's commitment to research and development (R&D) is a cornerstone of its strategy, focusing on creating advanced coating solutions that meet changing customer needs and adhere to environmental regulations. This is a key element of their Nippon Paint Growth Strategy.

A major focus of innovation is the development of sustainable and environmentally friendly products. This includes low-VOC (volatile organic compound) paints and coatings that offer improved durability and performance. This direction aligns with global trends favoring greener building materials and manufacturing processes. These efforts are central to understanding Nippon Paint Future Prospects.

To accelerate technological advancements, the company utilizes both internal development capabilities and collaborations with external innovators. These collaborations include partnerships with universities and research institutions. For example, the firm has been exploring the application of cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT) in its manufacturing processes and product development. This includes optimizing production efficiency, improving quality control, and developing smart coatings with advanced functionalities. This is a key element of their Nippon Paint Holdings strategy.

Nippon Paint Holdings consistently invests in R&D to support innovation. While specific figures for 2024-2025 were not available at the time of this writing, past reports indicate significant allocations to R&D. These investments are critical for maintaining a competitive edge and driving Nippon Paint Holdings Company innovation in coatings.

The company is actively developing and promoting sustainable products, including low-VOC paints. The demand for such products is increasing globally. This focus on sustainability directly addresses market trends and enhances Nippon Paint Holdings Company sustainability initiatives.

Nippon Paint Holdings integrates AI and IoT in its manufacturing and product development. This integration aims to improve efficiency, quality control, and the functionality of coatings. This is part of their Nippon Paint Holdings Company digital transformation.

Collaborations with universities and research institutions help accelerate technological advancements. These partnerships are essential for accessing specialized expertise and staying at the forefront of innovation. These are examples of Nippon Paint Holdings Company strategic partnerships.

Continuous introduction of new products and solutions expands the product portfolio. This expansion meets the increasing demand for specialized and sustainable coating solutions. This strategy supports Nippon Paint Holdings Company revenue growth drivers.

The company adapts to market trends by focusing on sustainable products and advanced technologies. This adaptation is crucial in the Japanese Paint Market and the broader global market. This approach helps in Nippon Paint expansion strategies in Asia.

The focus on innovation and technology directly contributes to Nippon Paint's growth objectives. New products and technical capabilities expand the product portfolio and enhance product performance. This approach helps the company meet the increasing demand for specialized and sustainable coating solutions. For more information on the business model, see Revenue Streams & Business Model of Nippon Paint Holdings.

- Enhanced Product Performance: Innovation leads to coatings with improved durability and functionality, meeting customer needs.

- Market Expansion: New product lines and technologies enable Nippon Paint to enter new markets and segments.

- Competitive Advantage: Continuous innovation helps maintain a strong competitive position in the global coatings market.

- Sustainability: The development of eco-friendly products aligns with global environmental regulations and consumer preferences.

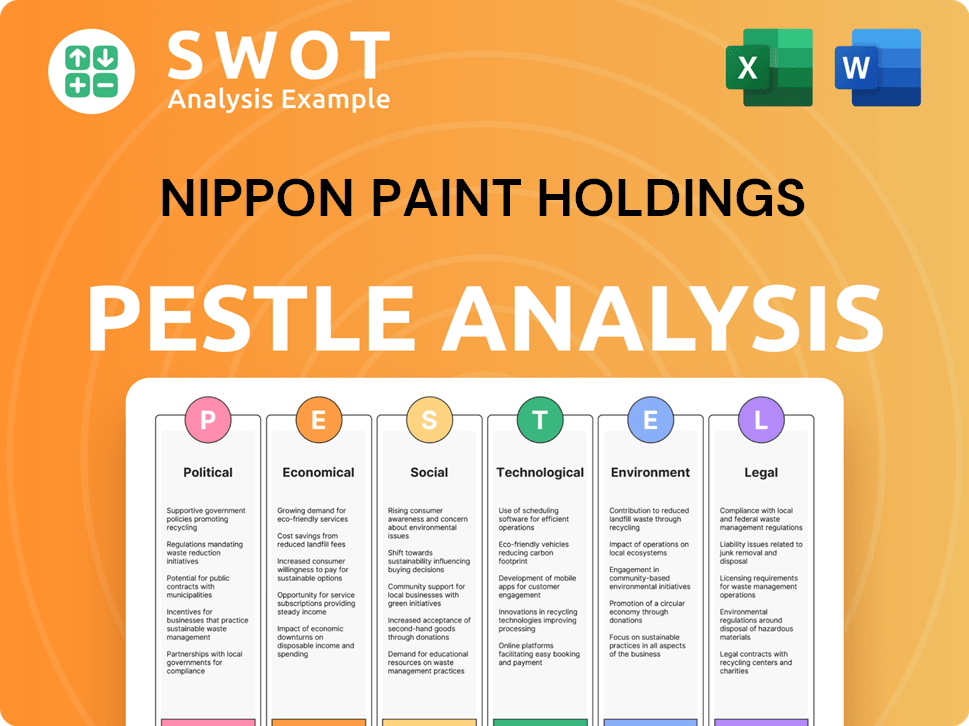

Nippon Paint Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Nippon Paint Holdings’s Growth Forecast?

The financial outlook for Nippon Paint Holdings Company is notably positive, underpinned by strategic initiatives aimed at sustained growth. The company anticipates a robust performance, particularly in key markets across Asia and other regions. This optimistic view is supported by projected revenue increases and a focus on operational efficiency, positioning the company for continued success in the global coatings market.

For the fiscal year ending December 31, 2024, Nippon Paint Holdings projects a revenue of JPY 1,510.0 billion, reflecting a 5.6% year-on-year increase. This growth is expected to be driven by the Decorative Paints and Industrial Coatings segments. The company's financial strategy emphasizes sustainable growth, allowing it to capitalize on market opportunities and navigate potential economic headwinds.

Nippon Paint's financial strategy is designed to ensure sustainable growth, allowing it to capitalize on market opportunities and navigate potential economic headwinds. The company's financial narrative is one of cautious optimism, balancing ambitious growth targets with prudent financial management to maximize shareholder value. The company is focused on expansion strategies in Asia and other international markets.

Nippon Paint Holdings anticipates a revenue of JPY 1,510.0 billion for the fiscal year ending December 31, 2024. This represents a 5.6% increase compared to the previous year. The growth is primarily driven by the Decorative Paints and Industrial Coatings segments, with a strong focus on the Asia-Pacific region.

The company forecasts an operating profit of JPY 155.0 billion for the fiscal year ending December 31, 2024. This projection indicates healthy profit margins, despite ongoing cost pressures in the paint industry. This reflects the company's focus on operational efficiency and strategic cost management.

Nippon Paint is committed to investing in research and development, mergers and acquisitions, and market expansion. These investments are crucial for sustaining long-term growth and maintaining a competitive edge in the global coatings market. The company's disciplined approach to capital allocation supports these future investments.

The company's long-term financial goals include strengthening its balance sheet and maintaining a disciplined approach to capital allocation to support future investments. Nippon Paint aims for continued revenue growth and profitability, driven by its expansion initiatives and technological advancements. These advancements are key to the company's future prospects.

Nippon Paint Holdings Company's financial strategy focuses on sustainable growth and value creation. The company is committed to prudent financial management and strategic investments to achieve its long-term goals. The company's performance is a testament to its strategic focus and operational excellence.

- Emphasis on revenue growth through market expansion and innovation.

- Disciplined capital allocation to support R&D, M&A, and market expansion.

- Focus on operational efficiency and cost management to maintain profitability.

- Strategic partnerships to enhance market presence and technological capabilities.

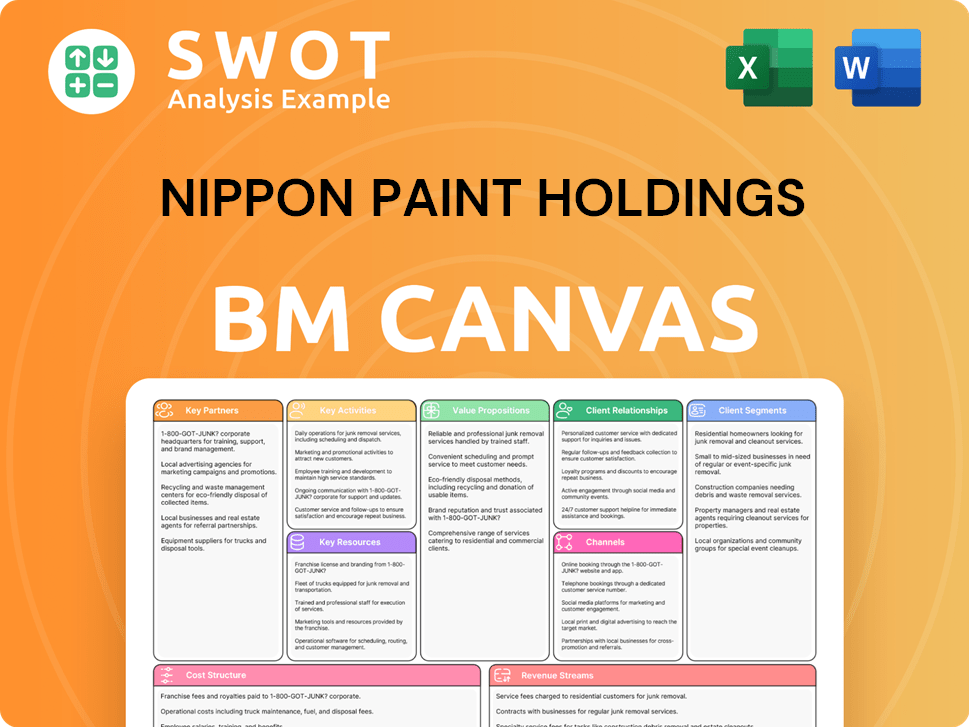

Nippon Paint Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Nippon Paint Holdings’s Growth?

The future of Nippon Paint Holdings faces potential headwinds, despite its ambitious growth plans. The company must navigate a complex landscape of market competition, regulatory changes, and supply chain vulnerabilities. These factors, along with internal constraints and emerging risks, could influence its trajectory.

Market competition in the paint and coatings sector remains intense, potentially squeezing profit margins. Regulatory shifts, especially concerning environmental standards, require continuous adaptation and investment. Furthermore, fluctuations in raw material prices and availability pose a constant challenge to production costs.

Technological advancements and internal resource limitations also present risks. The ability to innovate and manage rapid global expansion is crucial. Moreover, external factors like geopolitical instability and economic downturns could significantly impact the company's performance, demanding constant vigilance and strategic agility.

The global coatings market is highly competitive, with numerous players vying for market share. This intense competition can lead to pricing pressures and impact profit margins. The Marketing Strategy of Nippon Paint Holdings must continuously adapt to stay ahead.

Regulatory changes, particularly those related to environmental protection and product safety, pose a significant challenge. Stricter regulations on VOC emissions and the use of certain chemicals could necessitate significant R&D investments and adjustments to manufacturing processes. Compliance costs are a constant factor.

Supply chain vulnerabilities, including fluctuations in raw material prices and availability, are a considerable risk. The company is exposed to global commodity markets for key inputs. Disruptions in these markets can directly affect production costs and profitability. The impact of raw material costs is a key concern.

Technological disruption, while also an opportunity, could become a risk if competitors introduce groundbreaking innovations. Nippon Paint must invest in innovation in coatings and stay ahead of the curve. Digital transformation is also a factor.

Internal resource constraints, such as the availability of skilled labor or the capacity to manage rapid global expansion, could hinder growth. The company must ensure it has the resources to meet its ambitious goals. Expansion strategies in Asia are particularly important.

Emerging risks, such as geopolitical instability or unforeseen global economic downturns, could also shape its future trajectory. Continuous vigilance and adaptability are essential to navigate these uncertainties. Market trends analysis is crucial for long-term growth forecast.

In 2024, the global coatings market was valued at approximately $160 billion. The competitive landscape includes major players like AkzoNobel, Sherwin-Williams, and PPG Industries, alongside numerous regional competitors. Nippon Paint's market share worldwide is a key factor.

Raw material costs, including titanium dioxide and various resins, significantly impact the profitability of paint manufacturers. In 2024, the price of titanium dioxide fluctuated significantly, affecting production costs. Supply chain disruptions, particularly in Asia, have also been a concern.

Environmental regulations, such as those related to VOC emissions, are becoming increasingly stringent. The European Union's REACH regulations and similar standards in the United States and China require significant investment in R&D and product reformulation. Sustainability initiatives are also important.

Innovations in coatings, such as the development of self-healing paints and coatings with enhanced durability and environmental performance, are driving market trends. Digital technologies are also transforming the industry, with companies investing in smart manufacturing and data analytics. Nippon Paint's innovation in coatings is crucial.

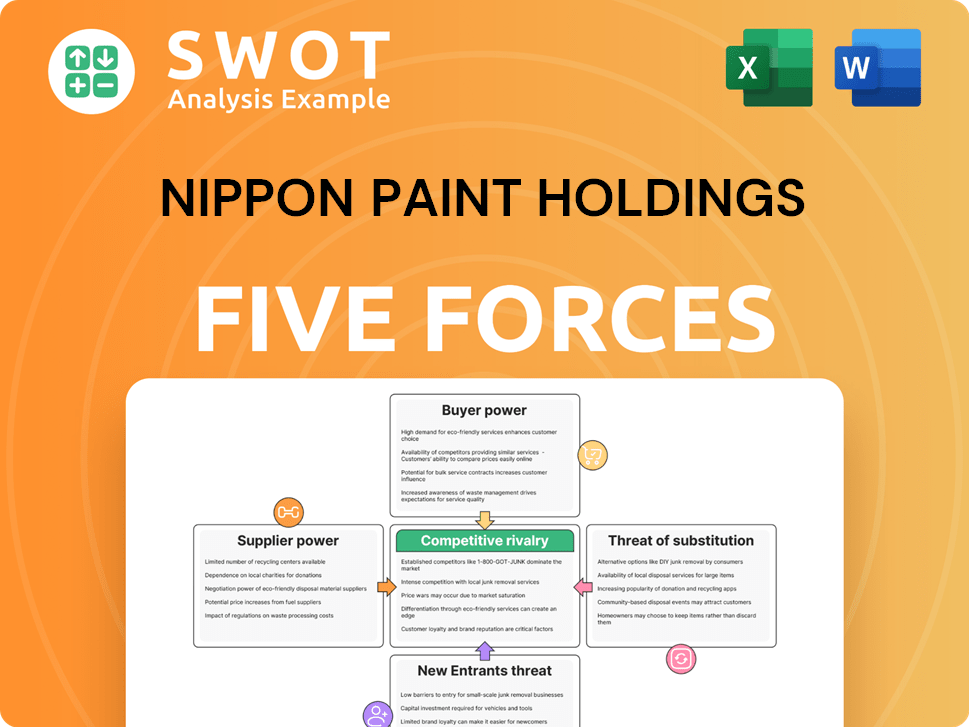

Nippon Paint Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nippon Paint Holdings Company?

- What is Competitive Landscape of Nippon Paint Holdings Company?

- How Does Nippon Paint Holdings Company Work?

- What is Sales and Marketing Strategy of Nippon Paint Holdings Company?

- What is Brief History of Nippon Paint Holdings Company?

- Who Owns Nippon Paint Holdings Company?

- What is Customer Demographics and Target Market of Nippon Paint Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.