Nirma Ltd. Bundle

How does Nirma Ltd. stack up in today's market?

From a backyard detergent venture to a national conglomerate, Nirma Ltd. has redefined affordability in the Indian consumer goods sector. Its journey, marked by disruptive pricing and a keen understanding of the Indian consumer, is a testament to its enduring market presence. But how does Nirma Ltd. SWOT Analysis shape its strategy in a constantly evolving market?

This deep dive into the Nirma Company's competitive landscape provides a comprehensive market analysis, exploring its key competitors and strategic positioning. Understanding Nirma Ltd.'s business strategy requires a close examination of its product portfolio review, financial performance, and the challenges and opportunities it faces in the FMCG industry. We'll dissect its competitive advantages, distribution network, and marketing strategies to offer actionable insights for investors and business strategists alike, including a look at recent acquisitions and future growth prospects.

Where Does Nirma Ltd.’ Stand in the Current Market?

Nirma Ltd. maintains a significant market position, especially in its traditional consumer product segments and expanding in chemicals and cement. The company is a key player in the Indian detergent and soap markets, known for its value-for-money offerings. This market position is supported by a strong geographic presence across India, reaching both urban and rural households. The company's product portfolio includes detergents, soaps, soda ash, and linear alkyl benzene (LAB), along with recent ventures in cement.

The company's strategic shift involves maintaining its core focus on consumer goods affordability while expanding into chemicals and cement. This diversification helps mitigate risks and tap into various growth drivers. For instance, the acquisition of Lafarge India's cement assets in 2016 for approximately $1.4 billion significantly boosted its presence in the cement sector. This strategic move reflects a proactive approach to market expansion and robust financial health. For a deeper dive into the business model, consider exploring the Revenue Streams & Business Model of Nirma Ltd..

While specific market share figures for 2024-2025 are proprietary, Nirma Ltd. has historically been a dominant force in its core markets. The company continually seeks to strengthen its position in newer sectors through strategic investments and operational efficiencies, ensuring its competitive edge. The company's focus on affordability and widespread distribution network are key factors in its sustained market presence.

Nirma Ltd. holds a substantial market share in the Indian detergent and soap market. While precise figures for 2024-2025 are not available, historical data indicates a strong presence. The company's value-for-money strategy has been a key driver of its market share, catering to a broad customer base across different income levels.

Nirma Ltd. has a robust distribution network across India, ensuring its products reach both urban and rural households. This extensive reach is a significant competitive advantage, allowing the company to maintain a strong presence in diverse markets. The distribution network supports the company's ability to deliver products efficiently.

Nirma Ltd. has diversified into chemicals and cement to mitigate risks and explore new growth opportunities. The acquisition of Lafarge India's cement assets in 2016 was a strategic move to strengthen its position in the cement sector. This diversification strategy reflects the company's proactive approach to market expansion.

Nirma Ltd. demonstrates robust financial health, supporting its strategic investments and market expansion. The company's financial performance allows it to pursue growth opportunities in various sectors. These strategic investments are crucial for maintaining and enhancing its competitive position in the market.

Nirma Ltd. benefits from several competitive advantages that contribute to its market position. These include a strong brand reputation, a wide distribution network, and a focus on value-for-money products. The company's strategic diversification into chemicals and cement further enhances its competitive edge.

- Strong brand recognition and customer loyalty.

- Extensive distribution network across India.

- Value-for-money pricing strategy.

- Diversification into chemicals and cement.

Nirma Ltd. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Nirma Ltd.?

The competitive landscape for Nirma Ltd. is multifaceted, spanning consumer products, chemicals, and cement. Understanding its key competitors is crucial for a thorough market analysis and assessing its business strategy. This analysis helps in evaluating Nirma Ltd.'s position and potential for future growth.

Nirma Company faces significant competition across its diverse business segments. In the consumer products sector, it competes with established multinational corporations and strong domestic players. The chemicals and cement segments also present competitive environments, requiring strategic adaptation to maintain and grow market share.

Nirma Ltd., as detailed in the Brief History of Nirma Ltd., operates in several key sectors, each with its unique competitive dynamics. This includes detergents and soaps, chemicals, and cement. The company's ability to navigate these competitive landscapes directly impacts its financial performance and market position.

In the detergents and soaps market, Nirma Ltd. primarily competes with multinational giants and domestic players. These competitors include Hindustan Unilever Limited (HUL) and Procter & Gamble (P&G), which have extensive product portfolios and strong brand equity.

HUL's Surf Excel and Wheel brands are direct competitors to Nirma's detergent offerings. P&G's Ariel also holds a significant market share. Rohit Surfactants Private Limited (RSPL), with its Ghadi brand, is another major competitor, especially in the value-for-money segment.

These competitors utilize extensive distribution networks and marketing strategies. Nirma Ltd. must compete on pricing, product quality, and distribution to maintain its market share. Price wars and promotional activities are common in this segment.

In the chemicals segment, Nirma Ltd. competes with both domestic and international players. These include Tata Chemicals and DCW Limited, along with other global chemical manufacturers. Competition is based on production capacity, technological advancements, and cost efficiencies.

The cement sector sees Nirma Ltd. competing with major players like UltraTech Cement, Ambuja Cement, and ACC Limited. These companies have large production capacities and extensive distribution networks. Competition is often regional, focusing on pricing and logistical efficiency.

The competitive landscape is dynamic, with potential shifts due to emerging players or new alliances. Continuous strategic adaptation is essential for Nirma Ltd. to maintain its market position and achieve future growth prospects.

Nirma Ltd. leverages its brand recognition, extensive distribution network, and product portfolio to compete effectively. Understanding the competitive landscape is critical for Nirma Ltd. to assess its strengths and weaknesses. Market analysis reveals the importance of adapting to changing consumer preferences and market dynamics.

- Strong Brand Equity: Established brand recognition in the detergents and soaps market.

- Extensive Distribution Network: Wide reach across various regions, ensuring product availability.

- Product Portfolio: A diverse range of products catering to different consumer segments.

- Cost Efficiency: Competitive pricing strategies, particularly in value-for-money segments.

- Adaptability: Ability to adjust to changing market demands and consumer preferences.

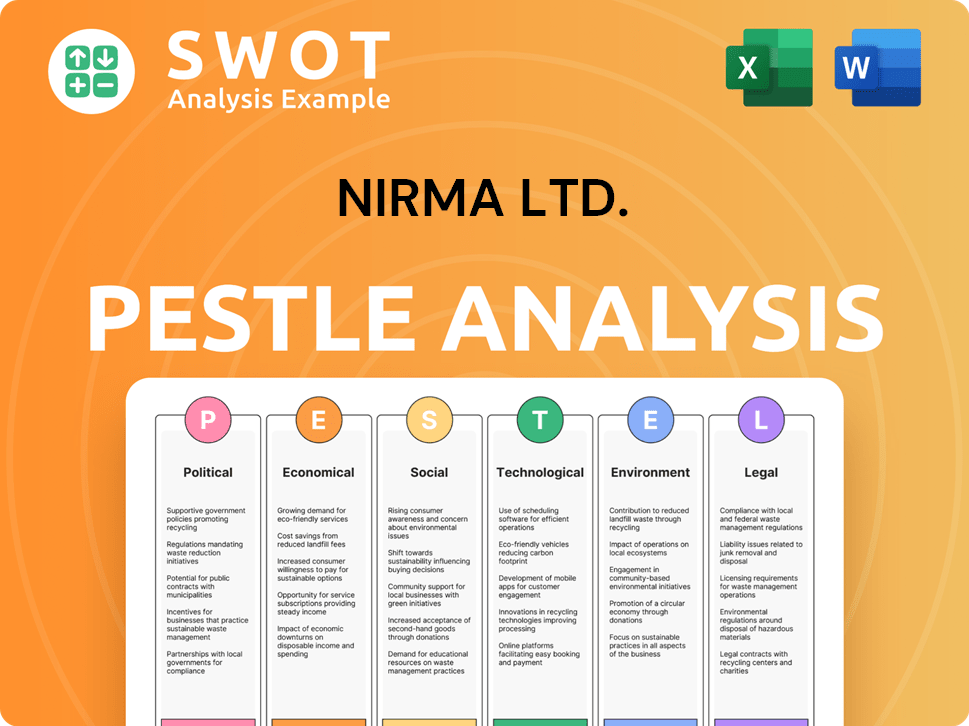

Nirma Ltd. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Nirma Ltd. a Competitive Edge Over Its Rivals?

The competitive advantages of Nirma Ltd. stem from its foundational strategy of providing value-for-money products. This approach has evolved into a multi-faceted strategy that leverages cost leadership, a vast distribution network, and strategic diversification. This has allowed the company to maintain a strong position in the market, particularly in price-sensitive segments.

Nirma Company has historically differentiated itself by offering products at significantly lower prices than competitors. This is achieved through backward integration and efficient manufacturing processes. This cost advantage allows Nirma to maintain competitive pricing while ensuring profitability, a crucial factor in the Indian consumer market. The company's ability to control costs and offer affordable products has been a key driver of its success.

Another significant advantage for Nirma Ltd. is its robust and extensive distribution network, especially in rural and semi-urban areas. This deep market penetration, built over decades, ensures that Nirma's products are widely available and accessible. This gives it a significant edge over competitors who may have a stronger urban focus. The company's strong brand equity, built on trust and affordability, also fosters significant customer loyalty.

Nirma's ability to offer products at lower prices is a key competitive advantage. This is achieved through backward integration and efficient manufacturing. This allows the company to maintain competitive pricing while ensuring profitability, which is crucial in the price-sensitive Indian market.

Nirma has a robust distribution network, especially in rural and semi-urban areas. This deep market penetration ensures wide product availability. This gives Nirma an edge over competitors with a stronger urban focus, ensuring products reach a broad consumer base.

Nirma has built a strong brand equity based on trust and affordability. This fosters significant customer loyalty, particularly among its target demographic. The brand's reputation for value and reliability has been a key factor in its sustained market presence.

Nirma's diversification into cement and chemicals leverages its expertise in large-scale manufacturing. This creates synergies and reduces overall business risk. This strategic move enhances the company's resilience and growth potential in diverse sectors.

Nirma Ltd.'s competitive advantages are multifaceted, including cost leadership, an extensive distribution network, and strategic diversification. These factors have enabled the company to maintain a strong position in the market. The company's focus on value-for-money products has resonated with consumers.

- Cost Leadership: Nirma's ability to offer products at lower prices through backward integration and efficient manufacturing processes.

- Extensive Distribution: A robust distribution network, especially in rural and semi-urban areas, ensuring wide product availability.

- Strong Brand Equity: Building trust and affordability, fostering significant customer loyalty.

- Strategic Diversification: Expanding into cement and chemicals to leverage manufacturing expertise and reduce risk.

Nirma Ltd. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Nirma Ltd.’s Competitive Landscape?

The competitive landscape of Nirma Ltd. is shaped by evolving industry trends, regulatory changes, and shifts in consumer preferences. These factors present both challenges and opportunities for the company. Understanding these dynamics is crucial for analyzing Nirma's strategic positioning and future prospects. For detailed insights into Nirma's target audience, refer to the Target Market of Nirma Ltd. analysis.

Nirma faces potential disruptions from direct-to-consumer brands and increased digital penetration, intensifying competition. New market entrants and changing consumer demands for eco-friendly products also pose challenges. However, significant growth opportunities exist in emerging markets and through product innovation and strategic partnerships. The company's ability to adapt and innovate will be key to its long-term success.

Technological advancements are driving innovation in manufacturing processes and product development. Regulatory changes, particularly regarding environmental protection and consumer safety, are increasingly impactful. Consumer preferences are shifting towards more sustainable and premium products.

The rise of direct-to-consumer brands and increased digital penetration can intensify competition. New market entrants, particularly agile startups, could challenge established players. Declining demand for traditional detergent formats poses a threat.

Significant growth opportunities lie in emerging markets, especially in underserved rural areas. Product innovations, such as eco-friendly detergents, can open new revenue streams. Strategic partnerships in technology or distribution could bolster Nirma's competitive edge.

Nirma's competitive position is evolving towards a more diversified and technologically integrated entity. The company is deploying strategies focused on sustainable growth, operational efficiency, and targeted innovation to remain resilient. Market analysis reveals a need for constant adaptation.

Nirma must balance its value-for-money positioning with the growing demand for premium and sustainable products. The company needs to invest in research and development to create eco-friendly detergents and other innovative products. Strategic partnerships and digital marketing are vital for reaching consumers effectively.

- Market Analysis: Continuous monitoring of consumer trends and competitor strategies.

- Product Innovation: Developing new products to meet changing consumer demands.

- Distribution Network: Optimizing the distribution network to reach both urban and rural markets.

- Sustainability: Implementing sustainable practices in manufacturing and product development.

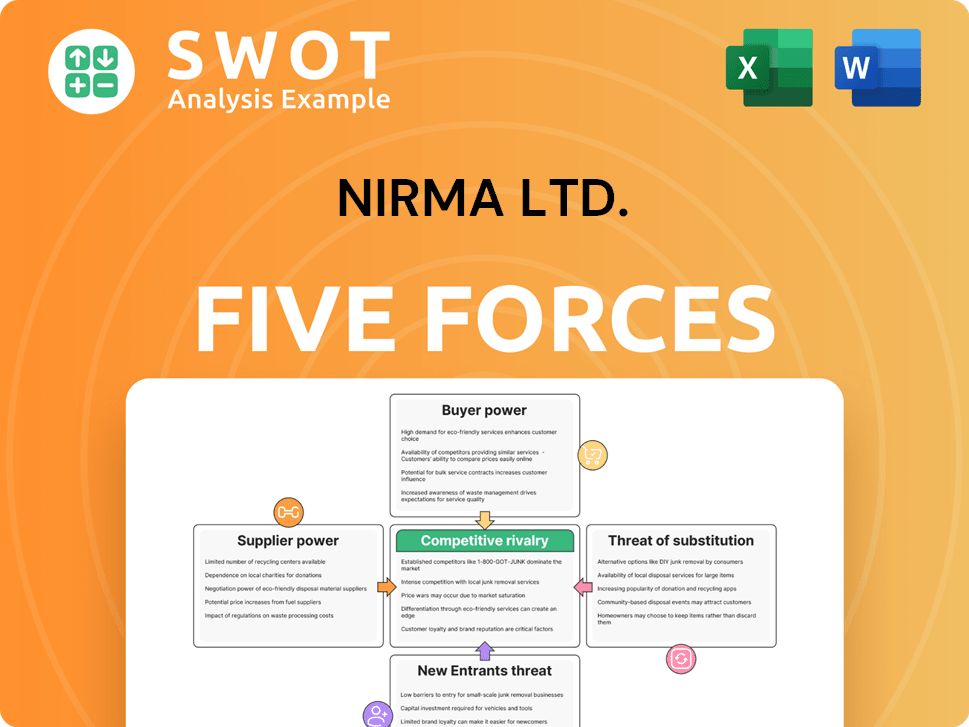

Nirma Ltd. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nirma Ltd. Company?

- What is Growth Strategy and Future Prospects of Nirma Ltd. Company?

- How Does Nirma Ltd. Company Work?

- What is Sales and Marketing Strategy of Nirma Ltd. Company?

- What is Brief History of Nirma Ltd. Company?

- Who Owns Nirma Ltd. Company?

- What is Customer Demographics and Target Market of Nirma Ltd. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.