Nirma Ltd. Bundle

Who Truly Owns Nirma Ltd. Today?

Understanding the ownership structure of a company is vital for investors and strategists alike. A company's ownership can significantly influence its strategic direction and market performance. Nirma Limited, a major Indian conglomerate, presents a compelling case study in this regard.

Founded by Karsanbhai Patel in 1969, Nirma's journey from a detergent producer to a diversified group is a story of entrepreneurial vision and strategic expansion. Exploring the Nirma Ltd. SWOT Analysis reveals critical insights into its competitive positioning. This deep dive into Nirma ownership will uncover the key players and their influence within this privately held company, providing crucial context for anyone interested in the Nirma company.

Who Founded Nirma Ltd.?

The story of Nirma Ltd. begins in 1969 with Karsanbhai Patel, the Nirma founder. He started the company in a small room, manufacturing detergent powder. His vision was to provide affordable, high-quality products, which quickly gained popularity, changing the detergent market landscape.

Initially, Nirma operated as a one-man venture. Karsanbhai Patel owned and controlled the company. He managed all aspects, from production to distribution, showcasing his hands-on entrepreneurial spirit. This direct involvement was crucial in Nirma's early success.

Karsanbhai Patel's initial investment was a modest ₹15,000. He sold the detergent packets door-to-door on his bicycle, pricing them at ₹3.50 per kg. This was significantly lower than competitors like Hindustan Unilever's Surf, which was priced at ₹13 per kg. This value-for-money approach was a key factor in Nirma's rapid growth.

Karsanbhai Patel was the sole founder and initial owner of Nirma Ltd. He started the company with a small investment and managed all aspects of the business in its early stages.

The early business model focused on providing affordable products. Patel sold detergent directly to consumers, offering a lower price than competitors. This direct approach helped Nirma gain a strong market presence.

Nirma disrupted the established detergent industry by offering a more affordable product. This strategy allowed Nirma to quickly gain market share and become a household name.

Karsanbhai Patel's initial investment was ₹15,000. This modest investment demonstrates the humble beginnings of the Nirma company.

Nirma's detergent was priced at ₹3.50 per kg, significantly lower than competitors. This pricing strategy made Nirma accessible to a wider range of consumers.

Karsanbhai Patel personally handled the distribution of Nirma products. This hands-on approach ensured direct contact with customers and efficient market penetration.

Understanding the early ownership structure of Nirma company provides insights into its foundational values and business strategies. Karsanbhai Patel's sole ownership in the initial years reflects his commitment and control over the company's direction. For further insights, explore the Target Market of Nirma Ltd.

- Karsanbhai Patel's initial investment of ₹15,000 highlights the company's humble beginnings.

- The low pricing strategy of ₹3.50 per kg was crucial for market penetration.

- The early ownership structure was entirely founder-driven, with Karsanbhai Patel at the helm.

- Nirma's success story began with a focus on affordability and direct customer engagement.

Nirma Ltd. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Nirma Ltd.’s Ownership Changed Over Time?

The Brief History of Nirma Ltd. reveals a company built on family ownership. Nirma Ltd., established in 1980, has largely remained under the control of its founding family. While the parent company is unlisted, its cement unit, Nuvoco Vistas Corporation, went public in August 2021. As of 2022, the promoter holding in Nirma Ltd. was at 100.00%, underscoring its privately held status.

Key acquisitions have shaped Nirma's expansion and impacted its ownership structure. In 2007, Nirma acquired Searles Valley Minerals Inc. In 2016, it acquired Lafarge India's cement assets for $1.4 billion. Further acquisitions include Emami Cement in February 2020 for ₹5,500 crore (US$742.24 million), and in March 2024, a 75% stake in Glenmark Life Sciences Limited (now Alivus Life Sciences) for ₹5,652 crore (US$680 million). The Glenmark acquisition was financed through a combination of non-convertible debentures and bank borrowings.

| Event | Date | Impact on Ownership |

|---|---|---|

| Incorporation of Nirma Ltd. | February 25, 1980 | Foundation of the privately held company |

| Acquisition of Searles Valley Minerals Inc. | November 2007 | Expansion of Nirma's business portfolio |

| Acquisition of Lafarge India's cement assets | 2016 | Strengthened presence in the cement sector |

| Nuvoco Vistas Corporation IPO | August 2021 | Partial public listing of a Nirma subsidiary |

| Acquisition of Emami Cement | February 2020 | Further expansion in the cement industry |

| Acquisition of Glenmark Life Sciences (Alivus Life Sciences) | March 2024 | Diversification into the pharmaceutical sector |

The major stakeholders in Nirma Ltd. are primarily the Patel family. Karsanbhai Patel, the Nirma founder, has transitioned from day-to-day operations, with his sons, Rakesh K. Patel and Hiren K. Patel, holding key leadership roles. This family-centric control allows for a focus on long-term strategies, influencing the company's direction and governance. This structure is a key aspect of Nirma company ownership.

Nirma Ltd. is primarily owned and controlled by the Patel family, the Nirma founder. This private ownership structure allows the company to focus on long-term goals.

- The company's cement unit, Nuvoco Vistas Corporation, is listed.

- Key acquisitions have expanded Nirma's business segments.

- Rakesh K. Patel and Hiren K. Patel hold leadership positions.

- The company's strategic decisions are strongly influenced by family control.

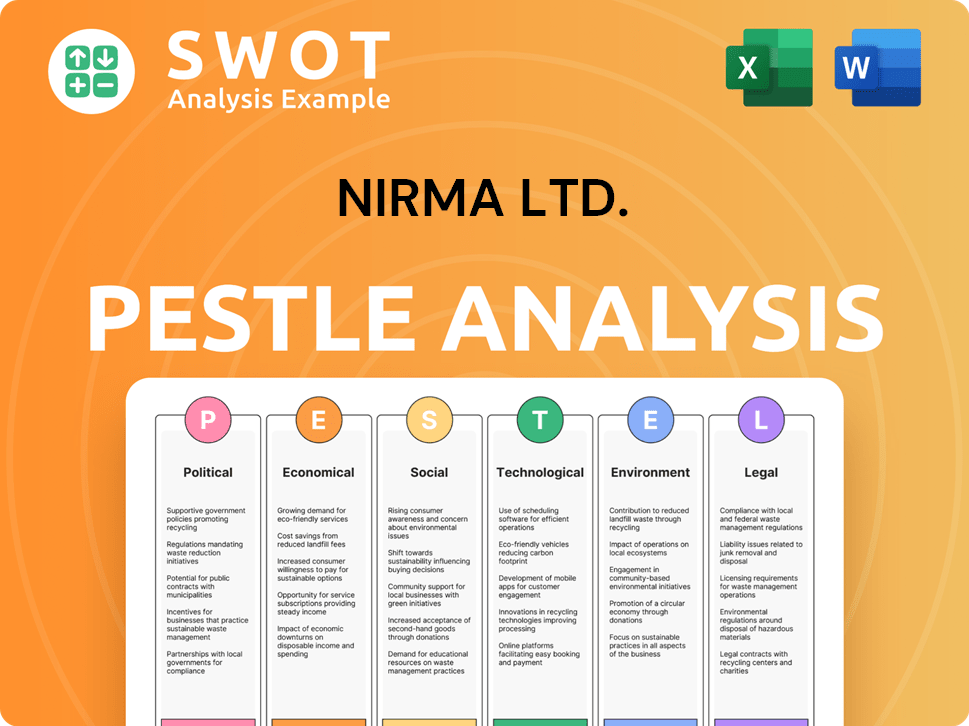

Nirma Ltd. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Nirma Ltd.’s Board?

The ownership and control of Nirma Ltd. are primarily vested in the founding family. As of September 23, 2024, the company's Board of Directors comprises eight members, reflecting the concentrated ownership structure. This structure ensures that strategic decisions are made with a unified vision, typical for a privately held company.

The key figures on the board include Karsanbhai Khodidas Patel, the Chairman, and his sons, Rakesh K. Patel (Vice Chairman) and Hiren K. Patel (Managing Director). Other directors include Pankaj Ramanbhai Patel, Kaushikbhai Nandubhai Patel (Independent Director), Tejalben Amitkumar Mehta (Independent Director), and Shaileshbhai Valjibhai Sonara (Director, Environment & Safety). Manan Shah serves as the Chief Financial Officer and Paresh Sheth as the Company Secretary.

| Director | Position | As of |

|---|---|---|

| Karsanbhai Khodidas Patel | Chairman | September 23, 2024 |

| Rakesh K. Patel | Vice Chairman | September 23, 2024 |

| Hiren K. Patel | Managing Director | September 23, 2024 |

| Pankaj Ramanbhai Patel | Director | September 23, 2024 |

| Kaushikbhai Nandubhai Patel | Independent Director | September 23, 2024 |

| Tejalben Amitkumar Mehta | Independent Director | September 23, 2024 |

| Shaileshbhai Valjibhai Sonara | Director, Environment & Safety | September 23, 2024 |

| Manan Shah | Chief Financial Officer | September 23, 2024 |

| Paresh Sheth | Company Secretary | September 23, 2024 |

Given the private status of Nirma Ltd. and the Patel family's complete ownership as of 2022, the voting power is firmly within the family's control. This structure allows for streamlined decision-making and strategic direction. To learn more about the company's strategic initiatives, you can read about the Growth Strategy of Nirma Ltd.

Nirma Ltd. is a privately held company, with the founding Patel family holding complete ownership.

- The Board of Directors is primarily composed of family members.

- The concentrated ownership structure ensures unified decision-making.

- There are no external proxy battles or activist investor campaigns.

- The family's control extends to strategic decisions, investments, and expansions.

Nirma Ltd. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Nirma Ltd.’s Ownership Landscape?

Over the past few years, Nirma Ltd. has been strategically expanding, especially in the pharmaceutical sector. A key move was acquiring a 75% stake in Glenmark Life Sciences Limited (GLS), now known as Alivus Life Sciences, from Glenmark Pharmaceuticals Ltd. The acquisition, finalized in March 2024, was valued at ₹5,652 crore (US$680 million) and was financed through a combination of NCDs and other borrowings. This acquisition is expected to diversify the company's business profile and boost revenue growth.

For the fiscal year ending March 31, 2024, Nirma's consolidated revenue reached ₹10,700 crore. While the company's operating performance moderated in fiscal year 2024, consolidated margins are anticipated to improve in the future. This is supported by the recovery in domestic business and the high-margin product mix of Alivus Life Sciences. Additionally, Nirma recognized a non-cash impairment loss of ₹2,688.5 crore for its investments in Niyogi Enterprises Pvt Ltd in the first half of fiscal year 2025.

| Metric | Value | Year |

|---|---|---|

| Consolidated Revenue | ₹10,700 crore | FY2024 |

| Acquisition Value (Alivus Life Sciences) | ₹5,652 crore (US$680 million) | March 2024 |

| Impairment Loss | ₹2,688.5 crore | H1 FY2025 |

As an unlisted public company, the ownership trends of Nirma differ from those of publicly traded entities. The family continues to maintain strong control, which is a consistent trend. While there are no public statements about future public listings for Nirma Limited itself, its cement unit, Nuvoco Vistas, was listed in August 2021. The company’s liquidity position is expected to remain adequate, supported by healthy cash accruals and access to capital markets.

Nirma Ltd. is privately held, with the founding family maintaining significant control. Understanding the current ownership structure is key to grasping the company's strategic direction.

The company’s ownership is primarily concentrated within the family. This structure impacts decision-making and long-term strategy.

The acquisition of Alivus Life Sciences is a major move, diversifying Nirma’s portfolio and influencing future financial performance. This strategic shift is important.

Nirma's financial health, including revenue and margins, is expected to improve. The company's liquidity position is expected to remain adequate, supported by healthy cash accruals and access to capital markets.

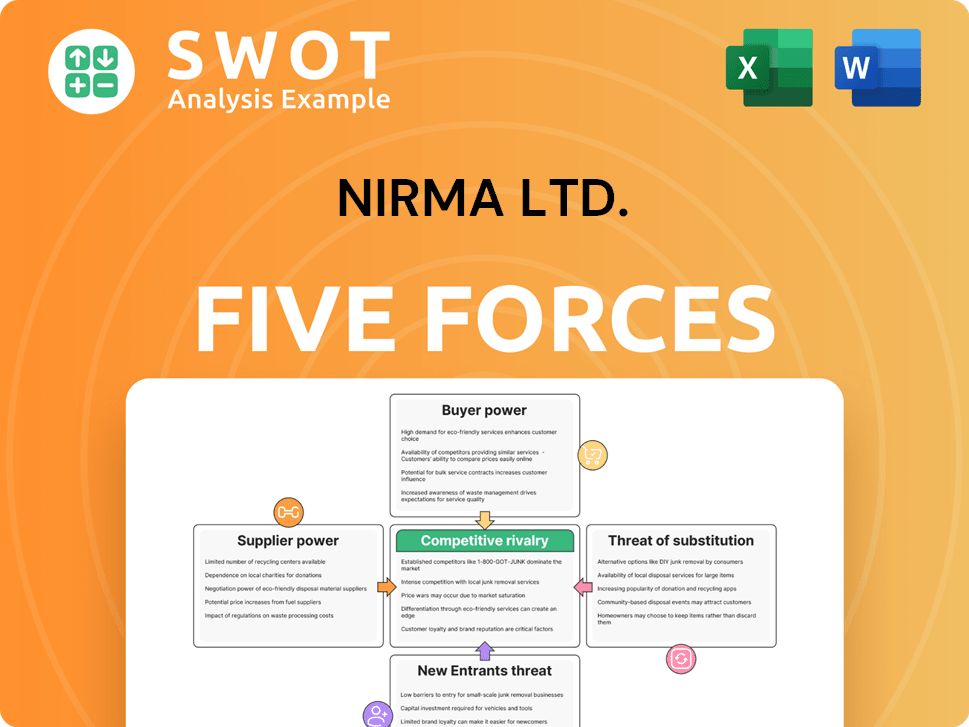

Nirma Ltd. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nirma Ltd. Company?

- What is Competitive Landscape of Nirma Ltd. Company?

- What is Growth Strategy and Future Prospects of Nirma Ltd. Company?

- How Does Nirma Ltd. Company Work?

- What is Sales and Marketing Strategy of Nirma Ltd. Company?

- What is Brief History of Nirma Ltd. Company?

- What is Customer Demographics and Target Market of Nirma Ltd. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.