Nirma Ltd. Bundle

How Does Nirma Ltd. Thrive in the Indian Market?

From a humble beginning, Nirma Ltd. has become a household name, disrupting the market with its value-driven approach. Founded by Karsanbhai Patel in 1969, the Nirma company revolutionized the detergent industry, challenging established giants. Today, Nirma's diverse portfolio and strong market presence make it a compelling subject for analysis.

This article will dissect the operational strategies of Nirma, exploring its journey from a small-scale operation to a diversified conglomerate. We'll investigate its core business, Nirma Ltd. SWOT Analysis, and financial performance, offering insights into its competitive advantages and future prospects. Understanding the Nirma business model is key for anyone looking to understand its sustained success in the dynamic Indian market, including its manufacturing processes and product distribution.

What Are the Key Operations Driving Nirma Ltd.’s Success?

The core operations of Nirma Ltd. revolve around creating and delivering value through a diverse portfolio. This includes consumer products, industrial chemicals, and, more recently, pharmaceuticals and cement. The company's strategy is built on strong backward integration, which is a key differentiator in its operational approach. This allows Nirma company to maintain cost leadership and efficiency across its operations.

Nirma's value proposition is centered on providing affordable, high-quality products to a broad consumer base, particularly in the value-for-money segment. This approach is supported by an extensive distribution network that reaches over 2 million retail outlets across urban and rural India. The acquisition of Glenmark Life Sciences Limited (now Alivus Lifesciences) in March 2024 further strengthened its portfolio, adding high-margin active pharmaceutical ingredients (APIs).

Nirma's commitment to cost leadership is evident in its manufacturing processes. For example, the company manufactures essential raw materials like soda ash and linear alkyl benzene (LAB) for its detergent and soap production. This integrated approach, along with captive salt production facilities and power plants, ensures a steady supply of critical inputs, contributing to its competitive pricing strategy. To understand more about the company's ownership, you can read about the Owners & Shareholders of Nirma Ltd.

Nirma products include detergents, soaps, and edible salt. These products are primarily targeted at price-sensitive consumers in the economy segment. The company's focus is on providing affordable, high-quality options to a wide consumer base.

Nirma is a leading producer of soda ash and caustic soda. The industrial chemicals segment benefits from economies of scale and integrated operations, contributing to the company's overall revenue and market position.

The acquisition of Alivus Lifesciences (formerly Glenmark Life Sciences Limited) in March 2024 diversified Nirma's operations into active pharmaceutical ingredients (APIs). This strategic move adds stability and higher-margin products to its portfolio.

Nirma's supply chain is optimized for efficient distribution, reaching over 2 million retail outlets across urban and rural areas in India. This extensive network, supported by over 1,000 distributors, enables effective market penetration.

Nirma's operational strengths lie in its cost leadership, backward integration, and efficient manufacturing processes. These factors enable the company to offer competitive prices while maintaining product quality. This approach has allowed Nirma business to establish a strong presence in the Indian market.

- Backward Integration: Manufacturing essential raw materials like soda ash and LAB.

- Efficient Manufacturing: Optimized processes to reduce costs.

- Extensive Distribution Network: Reaching over 2 million retail outlets.

- Strategic Acquisitions: Expanding into high-margin sectors like pharmaceuticals.

Nirma Ltd. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nirma Ltd. Make Money?

The revenue streams and monetization strategies of Nirma Ltd. are multifaceted, focusing on diverse product lines and market segments. The company leverages a value-based pricing approach, offering competitive prices to capture a broad consumer base. This strategy is supported by efficient operations and a diversified product portfolio.

Nirma's revenue generation is primarily driven by sales across consumer products, industrial chemicals, and pharmaceuticals. The company's strategic focus on cost-effectiveness and market penetration allows it to maintain a strong competitive position. Geographical diversification of manufacturing capacities further enhances its resilience.

For the fiscal year ending March 31, 2024, Nirma Ltd. reported a consolidated revenue from operations of approximately ₹10,403 crore. This financial performance reflects the company's robust business model and strategic market positioning.

Nirma's revenue streams are diverse, encompassing consumer products, industrial chemicals, and pharmaceuticals. Consumer products, including detergents, soaps, and cosmetics, are a major contributor. Industrial chemicals, such as soda ash and caustic soda, also provide significant revenue.

The consumer products segment, which includes a wide array of items, is a major revenue driver for the Nirma company. This segment is crucial for the company's overall financial performance. The success of these products is a key factor in Nirma's market position.

The chemicals segment, including soda ash and caustic soda, is another significant revenue source. This segment contributes substantially to the overall revenue of Nirma Ltd. The chemicals business is a key part of Nirma's diversified operations.

The pharmaceuticals segment, recently expanded through acquisitions, is an emerging revenue stream. This segment is expected to contribute to future growth. The addition of pharmaceuticals diversifies Nirma's portfolio.

Nirma's monetization strategy is centered on value-based pricing and cost efficiency. The company offers competitive prices to attract a broad consumer base. This strategy helps maintain a strong market share.

Nirma employs a segmented pricing strategy, with a focus on both economy and premium offerings. The company adjusts pricing based on competitor moves. This approach helps maintain competitiveness.

In FY24, consumer products contributed approximately ₹6,500 crore to revenue, while the chemicals segment generated around ₹2,000 crore. The pharmaceuticals segment, through Glenmark Life Sciences, added approximately ₹500 crore. Nirma's strategies include value-based pricing and cost-effective operations.

- Value-Based Pricing: Offering competitive prices to attract a wide consumer base, particularly in the economy segment.

- Low-Cost Production: Maintaining a low-cost production model through efficient supply chain management and economies of scale.

- Market Segmentation: Diversifying product ranges to include premium offerings, catering to different market segments.

- Geographical Diversification: Operating capacities in India and the USA, enhancing resilience to market fluctuations.

To understand the company's target market, you can read more about it in the Target Market of Nirma Ltd. article.

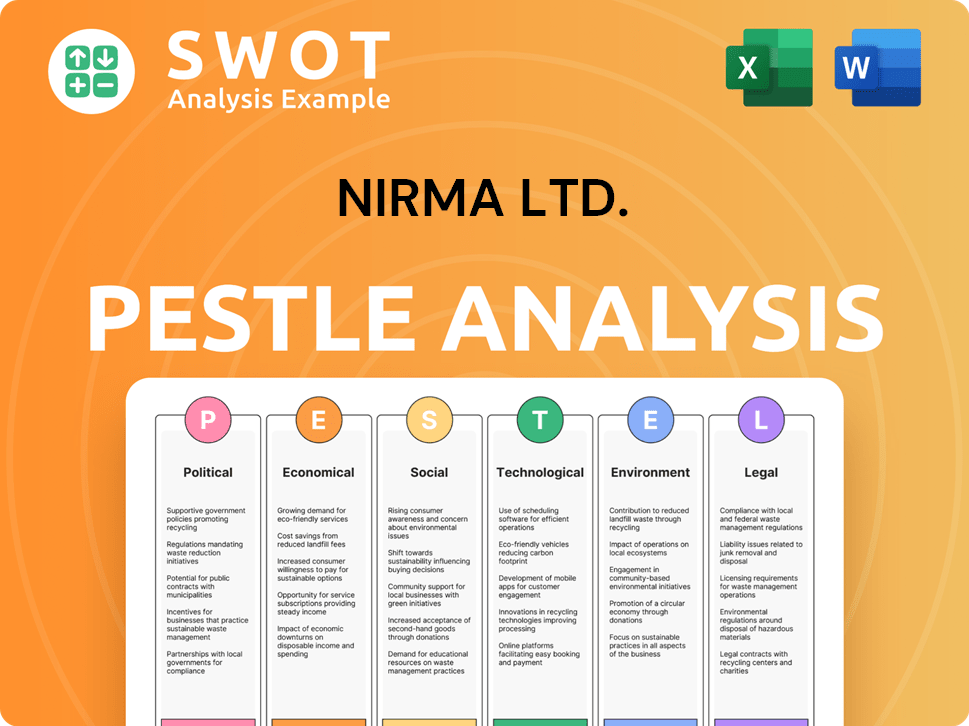

Nirma Ltd. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Nirma Ltd.’s Business Model?

The journey of Nirma Ltd. is marked by significant strategic moves and key milestones that have shaped its operational and financial performance. A pivotal early milestone was its disruptive entry into the Indian detergent market in 1969. Nirma company offered a high-quality product at a fraction of the price of established multinational brands. This helped it quickly gain market leadership in the mid-priced detergents sector.

The company expanded its product line to include soaps, detergent cakes, and personal care items, diversifying its consumer offerings. This strategic diversification has been a key factor in its sustained growth and market presence. Nirma's business has consistently adapted to changing market dynamics.

In March 2024, Nirma made a major strategic move by acquiring a 75% stake in Glenmark Life Sciences Limited (GLS) for approximately INR 56.5 billion. This acquisition, funded by a mix of Non-Convertible Debentures (NCDs) worth INR 35 billion and cash balances, marks Nirma's entry into the high-margin pharmaceutical business. It is expected to enhance its consolidated scale and profitability from FY25 onwards. Another notable acquisition was Searles Valley Minerals Inc. in the USA in fiscal 2008, expanding its industrial chemicals business and global reach. Nirma has also aggressively expanded in the cement sector, aiming to increase its production capacity to over 30 million tons per annum by 2025.

Disruptive entry into the Indian detergent market in 1969, offering high-quality products at lower prices. Expanded product line to include soaps, detergent cakes, and personal care products. Acquired Searles Valley Minerals Inc. in 2008 to expand industrial chemicals business.

Acquisition of a 75% stake in Glenmark Life Sciences Limited (GLS) in March 2024 for approximately INR 56.5 billion. This move diversified the company into the pharmaceutical sector. Aggressive expansion in the cement sector, targeting over 30 million tons per annum production capacity by 2025.

Strong brand recognition built on a legacy of value and quality in the Indian market. Backward integration in chemical businesses ensures control over raw material costs. Extensive distribution network reaching both urban and rural areas.

Nirma has consistently shown strong financial performance, driven by its strategic moves and market leadership. The acquisition of GLS is expected to boost profitability from FY25. The company continues to invest in research and development, with approximately ₹150 million spent in 2024.

Nirma's competitive advantages include strong brand recognition, backward integration in chemical businesses, and an extensive distribution network. These factors contribute to its cost leadership and market reach. The company faces challenges such as commodity price volatility and evolving consumer preferences, which it addresses through product innovation and strategic marketing.

- Brand Recognition: Strong brand equity built over decades.

- Backward Integration: Control over raw material costs.

- Distribution Network: Extensive reach across India.

- R&D Investment: Approximately ₹150 million in 2024, for product innovation.

Nirma Ltd. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Nirma Ltd. Positioning Itself for Continued Success?

Analyzing the industry position, risks, and future outlook for the Nirma company reveals a complex landscape. Nirma Ltd. holds a strong position in its core markets, particularly in soda ash and the soaps and detergents (S&D) sector. However, the company faces various challenges, including commodity price volatility and intense competition.

The future of Nirma business is shaped by strategic initiatives, including acquisitions and operational improvements. The company aims for growth while navigating the dynamic market environment. Understanding these factors is critical for assessing Nirma's long-term prospects.

Nirma Ltd. is a leading player in the domestic soda ash and S&D businesses. In 2023, Nirma's estimated market share in the Indian detergent powder market was around 12.5%. Strategic acquisitions have diversified its revenue and geographical presence, enhancing its resilience.

Profitability is vulnerable to commodity price cycles, especially for industrial chemicals. Fluctuations in global prices and foreign exchange rates impact margins. Intense competition in the FMCG market and changing consumer preferences pose challenges to maintaining market share.

The acquisition of Glenmark Life Sciences is expected to drive growth and stabilize profitability. The company anticipates consolidated revenue growth of over 20% year-on-year in FY25, with EBITDA margins of 16-18%. Nirma is also focused on operational improvements and capacity expansion.

Nirma aims to increase its cement production capacity to over 30 million tons per annum by 2025. The company's commitment to research and development, with approximately ₹150 million in R&D spending in 2024, indicates a focus on innovation.

Nirma's performance is closely tied to its ability to navigate commodity price fluctuations and competitive pressures. The company's diversification efforts, particularly through acquisitions like Glenmark Life Sciences, are crucial for long-term stability. For a deeper understanding of the competitive environment, you can explore the Competitors Landscape of Nirma Ltd.

- Nirma's financial flexibility supports debt management and future growth.

- The company's focus on R&D is essential to adapt to evolving consumer demands and maintain its market position.

- Expansion in the cement business aligns with India's infrastructure growth.

- Operational improvements in overseas soda ash operations are a key focus area.

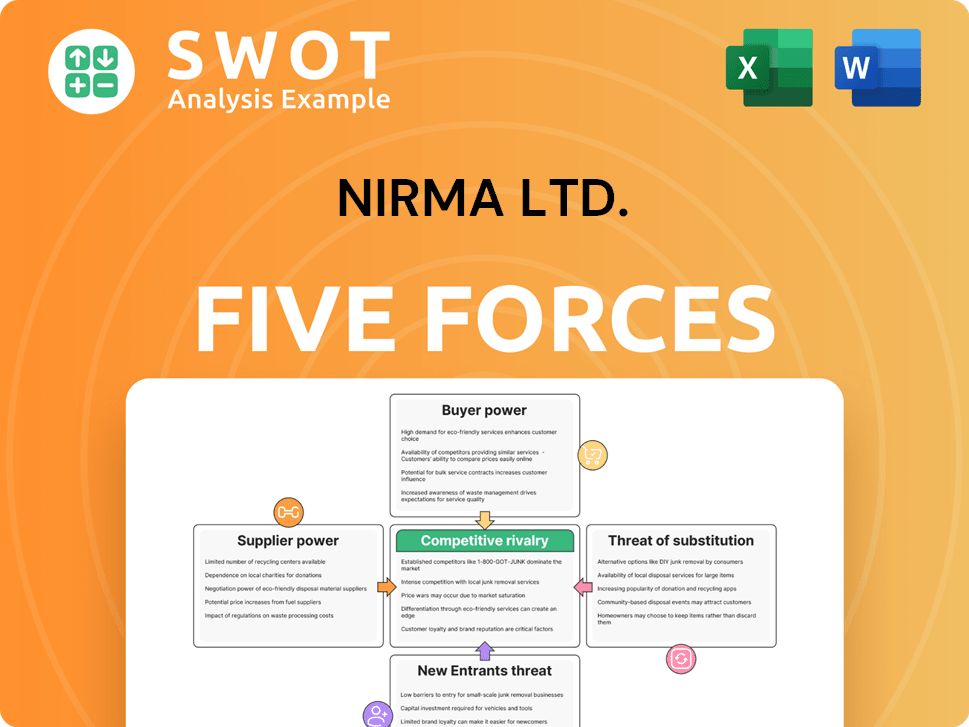

Nirma Ltd. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nirma Ltd. Company?

- What is Competitive Landscape of Nirma Ltd. Company?

- What is Growth Strategy and Future Prospects of Nirma Ltd. Company?

- What is Sales and Marketing Strategy of Nirma Ltd. Company?

- What is Brief History of Nirma Ltd. Company?

- Who Owns Nirma Ltd. Company?

- What is Customer Demographics and Target Market of Nirma Ltd. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.