Nirma Ltd. Bundle

Can Nirma Ltd. Sustain Its Growth Trajectory?

Founded in 1969, Nirma Ltd. disrupted the Indian market with affordable detergents, challenging established players. This strategic move propelled Nirma from a small-scale operation to a diversified conglomerate. Today, Nirma's Nirma Ltd. SWOT Analysis reveals the company's current standing.

This deep dive into Nirma Company analysis explores its evolution, examining its expansion into chemicals and cement, and the impact of strategic acquisitions. We'll dissect Nirma Ltd. growth strategy, including its expansion plans in India and its approach to maintaining its market share. Furthermore, we'll analyze Nirma Ltd. future prospects considering its diverse product portfolio and the competitive landscape, including Nirma Ltd. competitors and their strategies.

How Is Nirma Ltd. Expanding Its Reach?

The Nirma Ltd. growth strategy centers on aggressive expansion across its diverse business segments. This approach includes strengthening its presence in existing markets and exploring new geographies, especially in rural and semi-urban areas. The company leverages its robust distribution network and strong brand recognition to achieve this.

Nirma Company analysis reveals a focus on diversifying its product portfolio. This involves introducing new product categories within personal care and home care. The goal is to capture a larger share of the evolving consumer market. Simultaneously, in the chemicals business, Nirma is expanding its production capacities and product range.

A significant part of Nirma's expansion strategy involves strategic mergers and acquisitions. These initiatives are aimed at accessing new customer bases, diversifying revenue streams, and staying ahead of industry changes by building a more resilient and diversified business portfolio. The company's approach demonstrates a proactive stance in adapting to market dynamics.

Nirma focuses on deepening its market penetration in existing markets. It is also exploring new geographies, particularly in rural and semi-urban areas. This expansion is supported by its strong distribution network and brand recognition. This strategy aims to increase its Nirma market share.

The company is actively exploring new product categories within personal care and home care. This diversification is designed to capture a larger share of the evolving consumer market. This strategy enhances the Nirma product portfolio and caters to changing consumer preferences.

Nirma is expanding its production capacities and product range in the chemicals business. This expansion is intended to meet the growing industrial demand, both domestically and internationally. The focus is on strengthening its position in the chemicals sector.

Strategic mergers and acquisitions are a key component of Nirma's expansion strategy. The acquisition of Lafarge India's cement assets in 2016 for an enterprise value of USD 1.4 billion marked a significant entry into the cement sector. More recently, the acquisition of a 75% stake in Glenmark Life Sciences for approximately INR 5,651.5 crore in October 2023, signals a strategic move into the active pharmaceutical ingredients (API) segment.

Nirma's expansion initiatives are designed to drive Nirma Ltd. future prospects. These strategies include both organic growth and strategic acquisitions. The company aims to diversify its revenue streams and build a more resilient business portfolio. For a deeper understanding of their target market, consider reading about the Target Market of Nirma Ltd.

- Deepening market penetration in existing consumer goods markets.

- Exploring new product categories in personal and home care.

- Expanding production capacities and product range in the chemicals business.

- Strategic mergers and acquisitions to enter new sectors and diversify revenue.

Nirma Ltd. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nirma Ltd. Invest in Innovation?

The growth strategy of Nirma Ltd. heavily relies on innovation and technology across its various operations. This approach is crucial for enhancing product offerings, improving efficiency, and meeting evolving consumer demands. The company's commitment to staying competitive involves continuous investment in research and development and the adoption of advanced technologies across different sectors.

Nirma's strategy includes developing sustainable and environmentally friendly products, which aligns with global trends in responsible consumption. In the chemicals and cement sectors, the focus is on process innovation, automation, and advanced manufacturing technologies to optimize production and improve product quality. The company's efforts in digital transformation are aimed at enhancing supply chain management and gaining deeper market insights.

The acquisition of companies like Glenmark Life Sciences has significantly strengthened Nirma's R&D capabilities and technological expertise, particularly in the pharmaceutical intermediates space. This strategic move supports the company's innovative edge and contributes to its overall growth. The integration of new technologies and the expansion of R&D efforts are key to maintaining a competitive advantage.

Nirma invests in R&D to improve product formulations and introduce new variants. This includes developing more sustainable and environmentally friendly products. The goal is to meet changing consumer preferences and maintain market relevance.

The company focuses on process innovation, automation, and advanced manufacturing. These strategies aim to optimize production, reduce costs, and improve product quality. This leads to increased efficiency and better product offerings.

Nirma explores digital transformation to enhance supply chain management. It also seeks to improve operational efficiency and gain deeper insights into market trends. This helps in making data-driven decisions.

While specific details on AI or IoT implementations are not extensively publicized, modernization suggests increasing integration of such technologies. This is done to drive efficiency and boost competitiveness. The company aims to stay ahead of the curve.

This acquisition brings in specialized R&D capabilities and technological expertise. It strengthens Nirma's innovative edge, particularly in the pharmaceutical intermediates space. This expands the company's portfolio and capabilities.

Nirma's sustained focus on R&D and technological upgrades is crucial. This has been instrumental in maintaining its competitive edge in various sectors. Continuous improvement is a key strategy.

Nirma's approach to innovation and technology is central to its Revenue Streams & Business Model of Nirma Ltd. and future prospects. The company's investments in R&D, digital transformation, and strategic acquisitions demonstrate a commitment to staying competitive and meeting evolving market demands. This focus is critical for driving Nirma Ltd.'s growth and maintaining its position in the market. The company's ability to adapt and innovate will be key to its long-term success.

Nirma's technological strategies include continuous R&D, digital transformation, and strategic acquisitions. These initiatives are designed to enhance product offerings, improve operational efficiency, and gain market insights. The company is focused on sustainable practices and advanced manufacturing.

- Research and Development: Continuous investment in R&D to improve product formulations and introduce new variants.

- Digital Transformation: Implementation of digital initiatives to enhance supply chain management and improve operational efficiency.

- Process Innovation: Adoption of advanced manufacturing technologies to optimize production and reduce costs.

- Strategic Acquisitions: Acquiring companies with specialized R&D capabilities and technological expertise to strengthen its innovative edge.

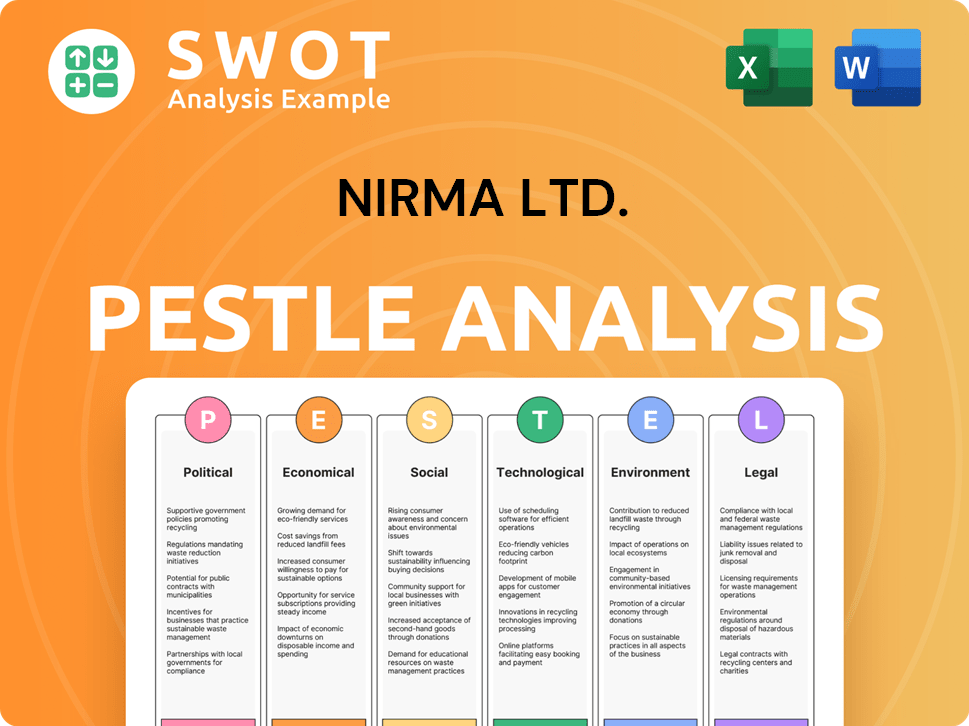

Nirma Ltd. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Nirma Ltd.’s Growth Forecast?

The financial outlook for Nirma Ltd. appears robust, supported by its diversified business model and strategic initiatives. The company's revenue streams are bolstered by its strong presence in consumer products, chemicals, and cement sectors. This diversification contributes to Nirma's financial resilience, allowing it to navigate market fluctuations more effectively. Understanding the Marketing Strategy of Nirma Ltd. provides additional insights into how the company positions itself within these various markets.

In the financial year 2023, Nirma Limited reported a consolidated net profit of INR 1,180 crore. The consolidated revenue from operations reached INR 13,858 crore. These figures highlight the company's financial strength and its ability to generate significant revenue and profit. The acquisition of Glenmark Life Sciences in October 2023 is expected to further enhance Nirma's financial performance.

Nirma's financial strategy emphasizes maintaining healthy profit margins, optimizing capital allocation, and ensuring a strong balance sheet to support future expansion. While specific forward-looking revenue targets and detailed profit margin projections for 2024-2025 are not readily available in the public domain, analysts generally view Nirma's diversified portfolio and strategic acquisitions as positive indicators for sustained financial performance. The company's consistent focus on value-for-money products and operational efficiency is expected to continue underpinning its financial resilience and growth trajectory.

The acquisition of Glenmark Life Sciences is a key strategic move, expected to contribute significantly to future revenue and profitability. Glenmark Life Sciences reported a 17% year-on-year increase in revenue from operations for the quarter ending December 31, 2023, reaching INR 604.6 crore. This acquisition adds a high-growth segment to Nirma's portfolio.

Nirma's revenue growth is driven by its diversified product portfolio and strong market presence in consumer goods, chemicals, and cement. The company's focus on value-for-money products and operational efficiency further supports its revenue generation capabilities. The company's expansion plans in India are also a key factor.

Nirma's financial performance is characterized by consistent profitability and revenue growth. The consolidated net profit of INR 1,180 crore and revenue from operations of INR 13,858 crore in 2023 demonstrate strong financial health. The company’s focus on maintaining healthy profit margins is crucial.

Nirma competes effectively in the FMCG market through its brand positioning strategy and a focus on value. While specific market share figures vary, Nirma maintains a significant presence. The company's competitors and their strategies influence its market dynamics.

The strategic acquisition of Glenmark Life Sciences presents future investment opportunities. Nirma's strong financial position and focus on expansion suggest potential for further investments. The company's ability to identify and capitalize on growth opportunities is key.

Nirma faces challenges such as market competition and economic fluctuations. However, opportunities exist in expanding its product portfolio and geographic reach. Sustainability initiatives and consumer behavior analysis also play a role.

Nirma Ltd. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Nirma Ltd.’s Growth?

The future trajectory of Nirma Ltd. and its Nirma Ltd. growth strategy is subject to several potential risks and obstacles. These challenges span across its diverse business segments, from consumer products to chemicals and cement. Understanding and mitigating these risks are crucial for the company to achieve its Nirma Ltd. future prospects.

Intense competition and market dynamics pose significant hurdles for the company. Furthermore, regulatory changes and supply chain vulnerabilities add layers of complexity to Nirma's operational environment. The company must proactively address these challenges to maintain its market position and drive sustainable growth.

The company faces intense market competition, particularly in the consumer products sector. This competition comes from established multinational corporations and a growing number of regional players. The chemicals and cement industries are also influenced by cyclical demand, raw material price fluctuations, and environmental regulations.

Nirma competes with major multinational corporations and a rising number of regional competitors. This necessitates continuous innovation and aggressive marketing to maintain and grow its Nirma market share. The FMCG market is highly competitive, requiring constant adaptation.

The chemicals and cement industries are subject to cyclical demand, which can significantly impact profitability. Fluctuations in raw material prices, such as those for limestone and various chemical compounds, also affect operational costs. These factors require careful management and strategic planning.

Regulatory changes, particularly concerning environmental norms and product safety standards, can lead to increased compliance costs. These changes may necessitate significant investments in new technologies and processes. Adapting to these regulations is crucial for sustained operations.

Supply chain disruptions, including those related to raw material availability and transportation, pose ongoing operational risks. These disruptions can impact production schedules and increase costs. Nirma's historical approach to cost efficiency and backward integration is a key factor in mitigating such risks.

Emerging risks include technological disruption, particularly in manufacturing processes and distribution channels. The company must adapt to these changes to remain competitive. This includes adopting new technologies to improve efficiency and reduce costs.

The integration of newly acquired businesses, such as Glenmark Life Sciences, presents integration risks. These risks relate to cultural alignment, operational synergies, and talent retention. Successful integration is critical for realizing the full potential of these acquisitions.

Nirma's focus on cost efficiency and backward integration helps mitigate some supply chain risks. The company's diversified portfolio strategy also reduces reliance on any single sector. The company's management uses robust internal controls and strategic planning to maintain its competitive edge and achieve sustained growth. For more information on the company's values, consider reading about the Mission, Vision & Core Values of Nirma Ltd.

Increasing consumer demand for sustainable products requires Nirma to adapt its Nirma product portfolio and operational practices. This includes investing in research and development to create eco-friendly products and implementing sustainable manufacturing processes. The company's ability to adapt to changing consumer preferences is crucial for its long-term success.

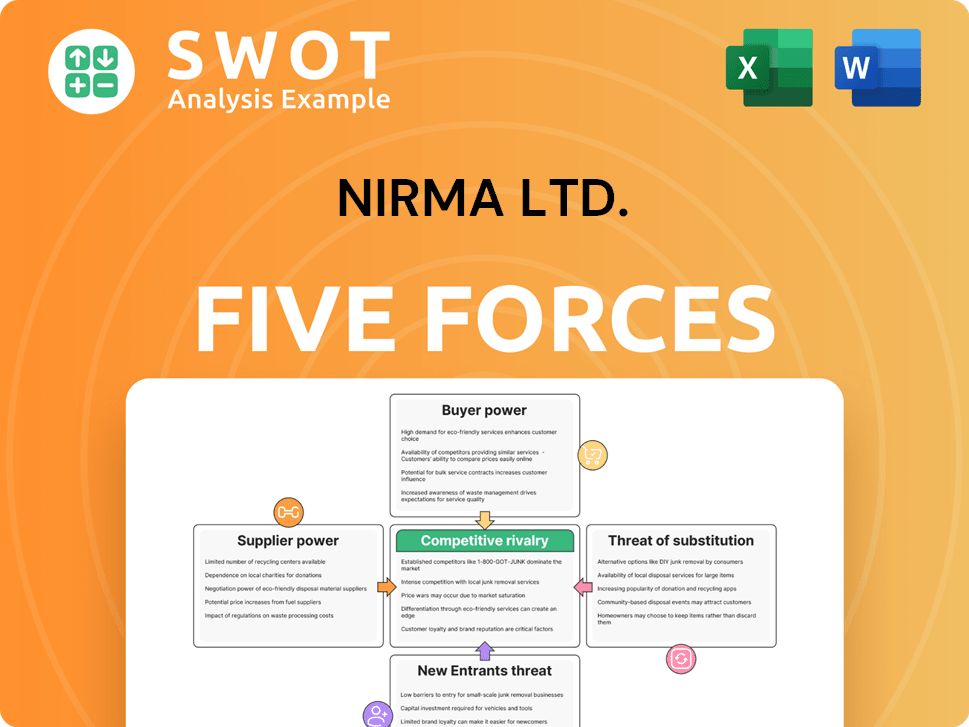

Nirma Ltd. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nirma Ltd. Company?

- What is Competitive Landscape of Nirma Ltd. Company?

- How Does Nirma Ltd. Company Work?

- What is Sales and Marketing Strategy of Nirma Ltd. Company?

- What is Brief History of Nirma Ltd. Company?

- Who Owns Nirma Ltd. Company?

- What is Customer Demographics and Target Market of Nirma Ltd. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.