Owens & Minor Bundle

How Does Owens & Minor Stack Up in the Healthcare Supply Chain Arena?

In the complex world of healthcare, efficient supply chain management is crucial, and Owens & Minor is a key player. Founded in 1882, this company has evolved from a wholesale grocery business to a global healthcare logistics provider. This transformation highlights its adaptability in meeting the changing needs of the healthcare sector.

This analysis will dissect the Owens & Minor SWOT Analysis, exploring the

Where Does Owens & Minor’ Stand in the Current Market?

Owens & Minor holds a significant market position within the healthcare logistics industry. It acts as a vital link between manufacturers and healthcare providers globally. The company consistently ranks among the top-tier distributors of medical and surgical products. Its primary product lines include a vast array of medical supplies, equipment, and related supply chain services.

The company's core operations revolve around the distribution of medical supplies and equipment. They also offer comprehensive supply chain solutions. These solutions include inventory management, sterile kitting, and custom logistics. Owens & Minor serves a diverse customer base. This includes hospitals, integrated healthcare delivery networks, clinics, and government agencies.

Owens & Minor has strategically shifted its positioning to become a more comprehensive solutions provider. This move goes beyond traditional distribution. It offers value-added services that optimize the entire healthcare supply chain. This includes digital transformation initiatives aimed at enhancing efficiency and visibility within the supply chain. For more insights, you can explore the Brief History of Owens & Minor.

While specific market share figures for 2024-2025 are proprietary, Owens & Minor remains a top player. The company is consistently ranked among the leading distributors of medical and surgical products. This strong position reflects its extensive distribution network and established customer relationships, especially in the acute care sector.

Owens & Minor boasts a substantial global footprint. It has operations across North America, Europe, and Asia. This widespread presence allows the company to serve a diverse customer base. Their ability to operate globally is a key factor in their competitive advantage.

Owens & Minor reported net revenue of $10.5 billion for the full year 2023. This demonstrates its scale and robust financial health within the industry. The company's performance reflects its strong presence in both the Products & Healthcare Services segment and the Patient-Direct segment. The Patient-Direct segment, particularly the Byram Healthcare unit, shows significant growth.

The company has evolved into a comprehensive solutions provider. They offer value-added services that optimize the entire healthcare supply chain. This includes a greater emphasis on digital transformation initiatives. These initiatives aim at enhancing efficiency and visibility within the supply chain.

Owens & Minor's market position is strengthened by its extensive distribution network. They have strong relationships with customers, particularly in the acute care sector. The company's focus on value-added services and digital transformation further enhances its competitive edge.

- Extensive distribution network.

- Strong customer relationships, especially in acute care.

- Focus on value-added services and digital transformation.

- Global operations across North America, Europe, and Asia.

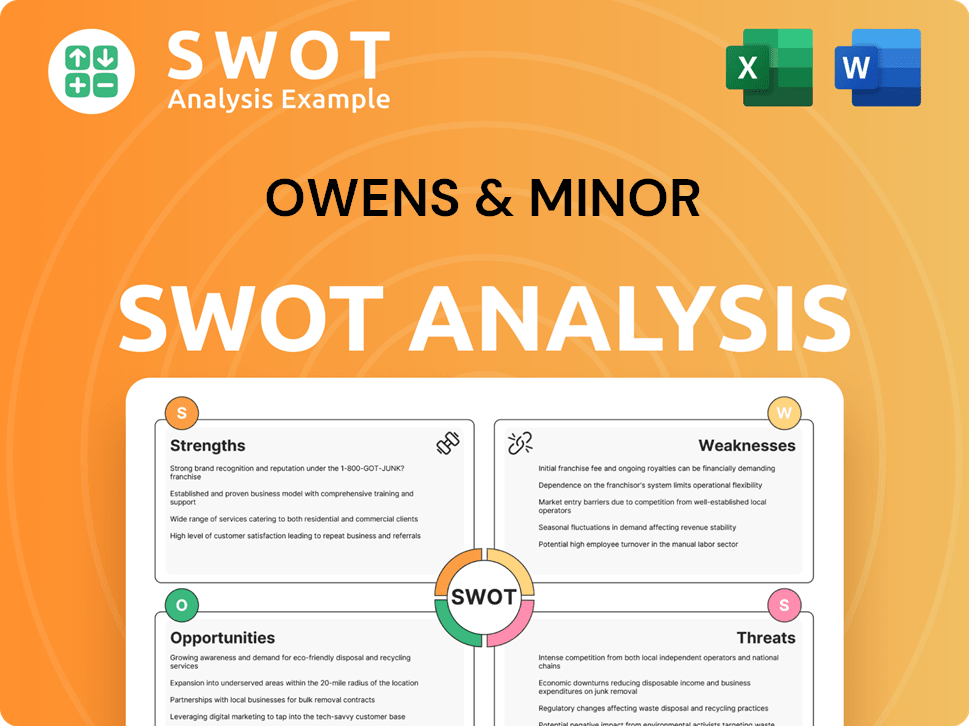

Owens & Minor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Owens & Minor?

The Owens & Minor competitive landscape is shaped by a dynamic healthcare logistics and distribution market. This sector is characterized by both direct and indirect challenges from a variety of established and emerging players. Understanding the competitive dynamics is crucial for stakeholders conducting an Owens & Minor market analysis.

The company faces competition from various players, each with unique strengths and strategies. Competition is fierce, with companies vying for market share and customer loyalty. This competitive environment impacts Owens & Minor's strategic decisions and financial performance.

Owens & Minor competitors include major healthcare distributors, manufacturers, and specialized providers. These companies compete on various fronts, including pricing, product offerings, and service capabilities. The competitive landscape is constantly evolving due to mergers, acquisitions, and technological advancements.

Cardinal Health and McKesson Corporation are key direct competitors. These large-scale healthcare distributors offer extensive product portfolios and services.

Medline Industries, Inc. and Henry Schein, Inc. are also significant competitors. Medline manufactures and distributes a wide range of medical supplies. Henry Schein has a strong presence in the dental and animal health markets.

These competitors often engage in aggressive bidding for distribution contracts. They focus on building strong customer relationships and offering competitive pricing. Competition is particularly intense for large integrated delivery networks (IDNs).

Byram Healthcare, a unit of Owens & Minor, competes in the patient-direct segment. It faces competition from home healthcare providers and direct-to-consumer medical supply companies.

Mergers and acquisitions and technological advancements continually reshape the market. New entrants leveraging advanced logistics technologies also pose a threat. These factors drive all players to innovate.

The healthcare supply chain is subject to constant change. Companies must adapt to new regulations and market demands. Owens & Minor must navigate these trends to maintain its market position.

The Owens & Minor competitive landscape presents both challenges and opportunities. The company must differentiate itself through innovation and customer service. Strategic partnerships and acquisitions can also be leveraged to gain market share. For a deeper understanding, consider reading an article about the company's financial performance Owens & Minor's financial performance.

- Competitive Pricing: The need to offer competitive pricing to win contracts.

- Supply Chain Efficiency: Improving supply chain efficiency to reduce costs.

- Technological Integration: Leveraging technology to enhance services.

- Customer Relationships: Building strong relationships with healthcare providers.

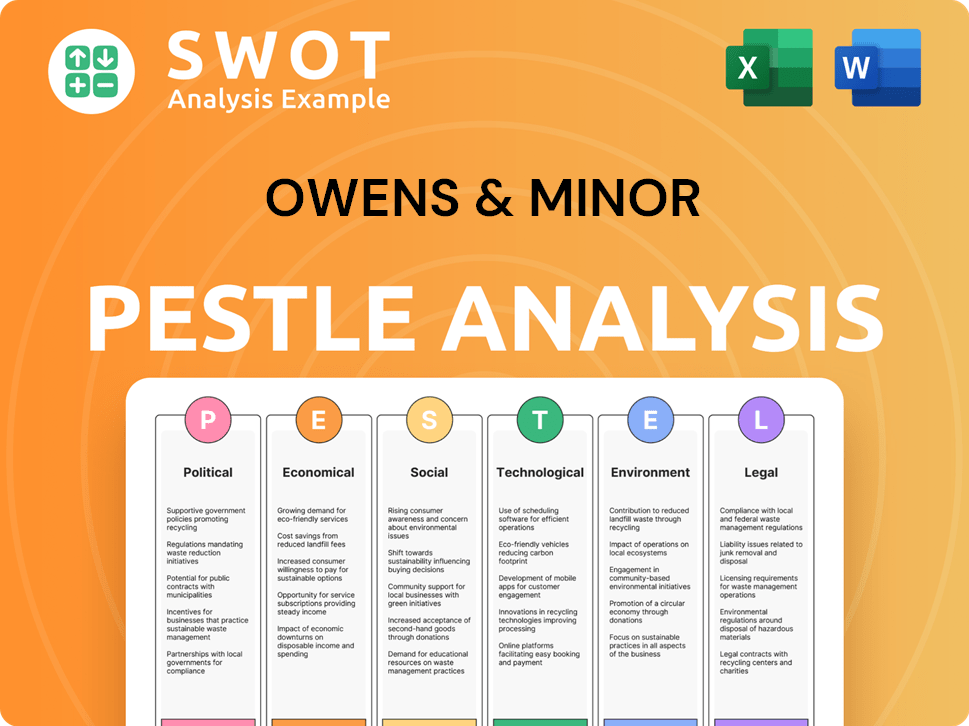

Owens & Minor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Owens & Minor a Competitive Edge Over Its Rivals?

The competitive advantages of Owens & Minor are primarily rooted in its robust distribution network and comprehensive supply chain solutions within the healthcare sector. These strengths enable the company to maintain a strong market position. An in-depth Growth Strategy of Owens & Minor reveals how the company has consistently adapted to meet industry changes.

Owens & Minor's extensive global distribution network is a key differentiator, ensuring efficient delivery of critical medical supplies. This infrastructure, combined with advanced inventory management, allows for high service reliability. Furthermore, the company’s long-standing relationships with manufacturers and healthcare providers foster strong customer loyalty. The company's focus on digital transformation and data analytics also enhances its competitive edge.

The company's competitive landscape is influenced by its ability to offer integrated supply chain solutions, including services like sterile kitting and custom logistics. This integrated approach helps healthcare systems optimize their operations, reduce costs, and improve efficiency. Owens & Minor’s investments in technology provide better demand forecasting and real-time visibility across the supply chain. These advantages have allowed Owens & Minor to maintain a strong market position.

Owens & Minor's vast distribution network is a core competitive advantage. It spans globally, ensuring the efficient delivery of medical supplies. This extensive infrastructure supports the company's ability to provide reliable and responsive services.

The company offers comprehensive supply chain solutions, including sterile kitting and custom logistics. These services help healthcare systems optimize operations. This integrated approach enhances efficiency and reduces costs for clients.

Owens & Minor invests in digital transformation, including data analytics. This provides better demand forecasting and inventory optimization. Real-time visibility across the supply chain is also a key benefit.

Strong, long-standing relationships with manufacturers and healthcare providers are crucial. These relationships foster customer loyalty and trust. Consistent performance is a key factor in maintaining these relationships.

Owens & Minor's competitive advantages include a robust distribution network, comprehensive supply chain solutions, and strong customer relationships. The company’s focus on technology and data analytics further enhances its market position. These factors contribute to its ability to meet the evolving needs of the healthcare industry.

- Extensive Distribution Network: Global reach and efficient delivery.

- Comprehensive Supply Chain Solutions: Integrated services that optimize operations.

- Strong Customer Relationships: Long-standing partnerships with manufacturers and providers.

- Technology and Data Analytics: Enhanced demand forecasting and supply chain visibility.

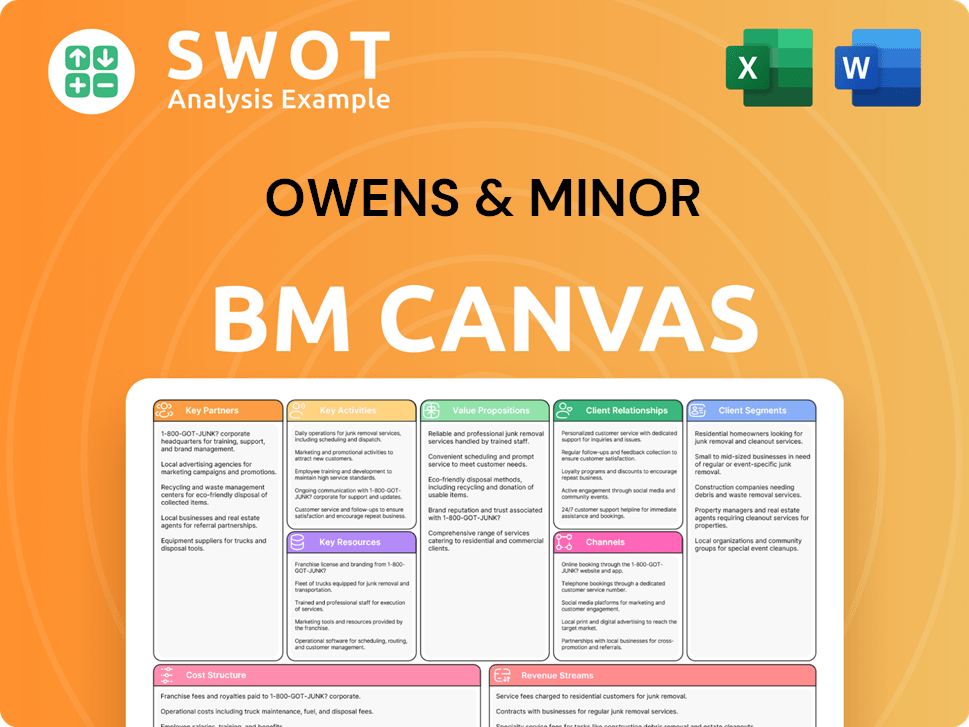

Owens & Minor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Owens & Minor’s Competitive Landscape?

The healthcare logistics sector is currently experiencing a transformation driven by technological advancements, regulatory changes, and shifts in consumer preferences. These factors significantly influence the Owens & Minor competitive landscape, presenting both opportunities and challenges for the company. A thorough Owens & Minor market analysis is crucial to understanding its position and future prospects.

Owens & Minor's ability to navigate these trends will be critical to maintaining its market position. Understanding the Owens & Minor competitors and their strategies is essential for formulating effective responses to competitive pressures and capitalizing on growth opportunities. The company's success hinges on its capacity to adapt, innovate, and strategically deploy capital to meet the evolving demands of the healthcare industry.

Technological advancements, such as AI and automation, are reshaping the healthcare supply chain. Regulatory changes, including stricter compliance rules, impact supply chain practices. Consumer demand for home healthcare and personalized medicine is increasing, influencing distribution strategies.

Intensified competition from new logistics providers poses a threat. Healthcare providers internalizing supply chain functions presents a challenge. Economic shifts, like inflation and supply chain disruptions, require robust risk management.

Emerging markets offer significant growth potential for medical device distribution. Expansion of value-added services to manage costs and improve patient outcomes is a key opportunity. Product innovations, particularly in specialized medical devices and pharmaceuticals, drive new distribution needs.

Owens & Minor is investing in technology to enhance capabilities and expand its geographic reach. The company focuses on optimizing its operational footprint and leveraging its global scale. Strategic capital deployment is crucial for capitalizing on market dynamics. For more information about the company's approach, see Growth Strategy of Owens & Minor.

The healthcare logistics market is projected to continue growing, with specific segments experiencing accelerated expansion. Owens & Minor needs to closely monitor industry consolidation and the emergence of new competitors. Adapting to evolving regulatory landscapes, such as those impacting medical device traceability, is crucial.

- Focus on technological integration, including AI-driven solutions for supply chain optimization.

- Expand value-added services to meet the changing needs of healthcare providers.

- Strengthen risk management strategies to address economic uncertainties and supply chain disruptions.

- Explore strategic partnerships and acquisitions to enhance market presence and capabilities.

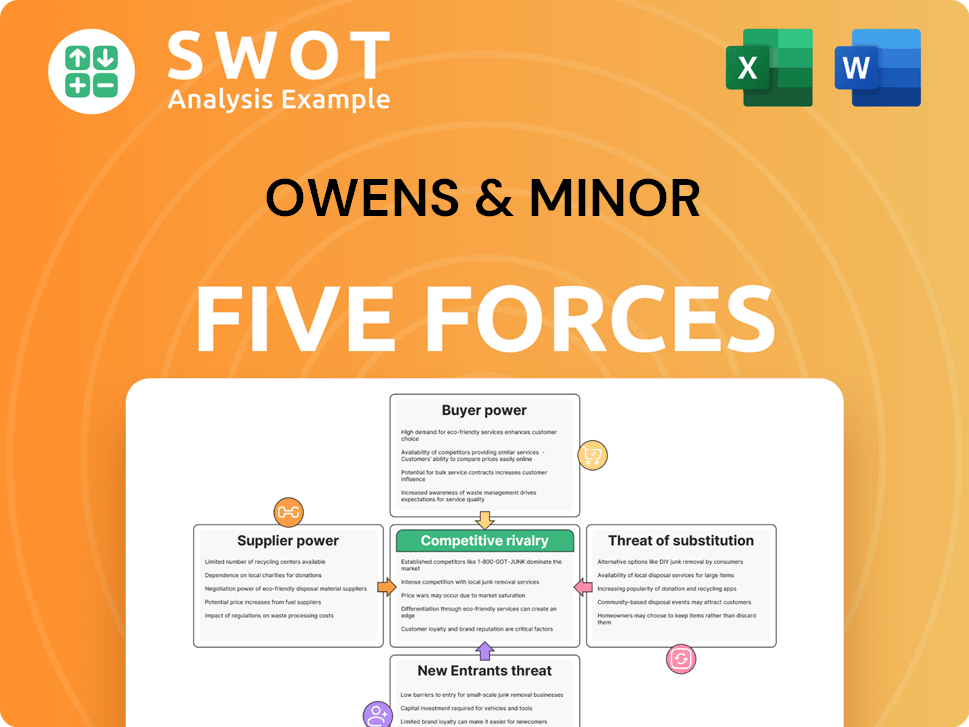

Owens & Minor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Owens & Minor Company?

- What is Growth Strategy and Future Prospects of Owens & Minor Company?

- How Does Owens & Minor Company Work?

- What is Sales and Marketing Strategy of Owens & Minor Company?

- What is Brief History of Owens & Minor Company?

- Who Owns Owens & Minor Company?

- What is Customer Demographics and Target Market of Owens & Minor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.