Owens & Minor Bundle

How Does Owens & Minor Thrive in Healthcare Logistics?

Owens & Minor Company, a vital player in the global healthcare landscape, connects manufacturers with healthcare providers, acting as the essential backbone of the medical supply chain. In an industry where precision and reliability are critical, especially considering the recent global health events, understanding how OMN operates is more important than ever. Their expansive network and advanced logistics solutions ensure hospitals and clinics receive the essential products needed for patient care, making them an indispensable partner.

Owens & Minor's significant influence is highlighted by its substantial market presence and its continuous adaptation to the evolving demands of the healthcare sector. As of early 2025, the company continues to demonstrate its scale and industry standing, offering a comprehensive suite of services including distribution, inventory management, and specialized healthcare supply chain solutions. For investors, understanding Owens & Minor SWOT Analysis can provide valuable insights into their strategic positioning and future prospects within the medical products distribution market. This in-depth examination will explore their core operations, value proposition, and revenue streams.

What Are the Key Operations Driving Owens & Minor’s Success?

The Owens & Minor Company (OMN) creates value by acting as a crucial link in the healthcare supply chain. They ensure the efficient movement of medical products from manufacturers to healthcare providers. Their core offerings include distribution services, inventory management, and healthcare supply chain consulting.

OMN serves a diverse customer base, including hospitals, healthcare networks, government agencies, and alternate care sites. Their operations are complex, relying on a vast network of distribution centers and advanced technology. This allows them to optimize delivery times and reduce costs.

Their operational backbone includes warehousing, order fulfillment, and transportation management systems. They manage relationships with thousands of medical device and pharmaceutical manufacturers globally. Technology is central to their operations, with significant investments in data analytics, automation, and digital platforms to enhance supply chain visibility and efficiency.

OMN provides comprehensive distribution services, ensuring medical products reach healthcare providers efficiently. This includes managing a vast network of distribution centers and optimizing delivery routes. Their services are critical for the timely delivery of essential medical supplies.

They offer sophisticated inventory management solutions, helping healthcare providers optimize their stock levels. This reduces waste and ensures that the right products are available when needed. They use advanced forecasting tools and digital platforms for efficient inventory control.

OMN provides healthcare supply chain consulting and optimization services. They help healthcare providers streamline their supply chains, reduce costs, and improve efficiency. This includes analyzing and improving logistics processes.

Their sales channels are primarily direct, with dedicated sales teams building relationships with healthcare organizations. Robust customer service operations support these efforts. OMN focuses on building strong relationships with its clients.

OMN's deep expertise in healthcare logistics and ability to manage high-volume environments translate into significant benefits for customers. This includes reduced operational costs and improved inventory turns. They also enhance patient safety through reliable product availability.

- Reduced operational costs for healthcare providers.

- Improved inventory turns and efficiency.

- Enhanced patient safety through reliable product availability.

- Ability for healthcare providers to focus on patient care.

The company's supply chain is known for its resilience and adaptability, developed through years of experience and strategic partnerships. For more details on the competitive landscape, you can check out the Competitors Landscape of Owens & Minor. In 2024, the healthcare supply chain market was valued at approximately $119 billion, reflecting the significant scale of the industry in which OMN operates.

Owens & Minor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Owens & Minor Make Money?

The Owens & Minor Company (OMN) generates revenue through a multifaceted approach centered on healthcare logistics and supply chain services. Their primary revenue streams are categorized into product sales and service fees. This dual-pronged strategy allows them to capture value from both the physical distribution of medical supplies and the provision of value-added services that optimize healthcare operations.

Product sales, stemming from the distribution of medical and surgical products, historically constitute the largest portion of their revenue. Service fees, encompassing inventory management, logistics consulting, and other value-added services, represent a growing segment, reflecting a strategic shift towards more comprehensive supply chain solutions.

The company focuses on expanding its service-based revenue streams, which includes inventory management solutions and global solutions. This approach diversifies its monetization strategies and fosters stronger, recurring revenue relationships with customers.

The revenue model of Owens & Minor is primarily driven by two key areas: product sales and service fees. Product sales are the largest contributor, representing the distribution of medical and surgical products. Service fees include inventory management, logistics consulting, and other value-added services. This diversification enhances their financial stability.

- Product Sales: Revenue generated from the distribution of medical and surgical products. This includes a wide array of items purchased from manufacturers and sold to healthcare providers.

- Service Fees: Revenue from various services, including inventory management, logistics consulting, kitting, and sterilization services. These services aim to improve the efficiency and effectiveness of healthcare supply chains.

- Monetization Strategies: The company uses tiered pricing for different service levels and cross-selling to maximize customer value. They also focus on expanding service-based revenue streams to provide integrated supply chain solutions.

- Market Position: The company plays a crucial role in the healthcare industry by ensuring the timely and efficient delivery of medical supplies. For more insights, see Marketing Strategy of Owens & Minor.

Owens & Minor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Owens & Minor’s Business Model?

The operational and financial journey of the Owens & Minor Company (OMN) has been shaped by significant milestones and strategic moves. A key aspect has been the expansion of its global reach and capabilities, especially through acquisitions. These acquisitions have allowed the company to broaden its product portfolio, strengthen market presence, and improve its technological infrastructure, thus establishing its position as a global leader in healthcare logistics.

Owens & Minor has consistently invested in automation and digital transformation within its distribution centers. This has optimized efficiency and throughput, demonstrating its commitment to technological leadership. The company's ability to adapt to operational challenges, such as global supply chain disruptions, has further solidified its reputation as a reliable partner in the healthcare supply chain. Its proactive communication and strategic inventory management have been critical.

The company's competitive advantages are multifaceted. Its extensive global distribution network and logistical expertise provide significant economies of scale and a vast reach. Deep relationships with manufacturers and healthcare providers, built over decades, foster strong customer loyalty. Ongoing investment in data analytics and supply chain technology provides a critical edge, enabling more efficient operations, better inventory management, and enhanced visibility across the supply chain. To learn more about their target market, read this article: Target Market of Owens & Minor.

Owens & Minor has strategically acquired companies to expand its service offerings and geographic footprint. These acquisitions have been instrumental in enhancing its capabilities in medical products distribution and healthcare logistics. The company continues to seek opportunities for strategic growth through acquisitions.

Owens & Minor has invested heavily in technology to improve its supply chain solutions. This includes automation in distribution centers, data analytics for better inventory management, and enhanced visibility across the supply chain. These advancements have improved operational efficiency and customer service.

Owens & Minor has demonstrated resilience in the face of supply chain disruptions. The company has leveraged its extensive network and industry relationships to mitigate impacts. Its proactive communication and strategic inventory management have been critical in navigating these challenges.

The company maintains deep relationships with both manufacturers and healthcare providers. These long-standing partnerships foster strong customer loyalty and preferred supplier status. These relationships are crucial for its success in the healthcare supply chain.

Owens & Minor's competitive advantages include its extensive global distribution network, logistical expertise, and deep relationships with manufacturers and healthcare providers. The company's investment in data analytics and supply chain technology provides a critical edge. It continues to adapt to new trends, expanding its service offerings to meet evolving market needs.

- Extensive global distribution network and logistical expertise.

- Deep relationships with manufacturers and healthcare providers.

- Ongoing investment in data analytics and supply chain technology.

- Adaptation to new market trends, such as home healthcare.

Owens & Minor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Owens & Minor Positioning Itself for Continued Success?

The Owens & Minor Company (OMN) holds a significant position in the healthcare logistics sector. As a leading global provider, it specializes in the distribution of medical and surgical supplies. OMN's operations are deeply embedded within its clients' supply chains, fostering strong customer loyalty.

However, OMN faces various risks, including regulatory changes, competition, and economic downturns. Supply chain volatility also poses a challenge. Despite these risks, OMN focuses on strategic initiatives to sustain revenue generation. This includes investments in advanced analytics and expansion into new markets.

OMN is a major player in the healthcare supply chain. It is recognized for its extensive distribution network. The company's reach extends globally, providing services in North America, Europe, and Asia.

Regulatory changes are a potential risk for OMN. Competition from other logistics firms and technology companies is also a concern. Economic fluctuations and supply chain disruptions can further impact operations.

OMN is focused on expanding its market reach and operational efficiency. The company invests in advanced analytics and automation. Partnerships with manufacturers and healthcare providers are also key.

OMN is committed to customer-centric solutions. It aims to leverage its network to meet healthcare industry needs. This positions the company for continued growth and profitability.

In recent financial reports, OMN has shown resilience. The company's revenue streams are diversified. OMN continues to adapt to the evolving healthcare landscape.

- In 2024, OMN's revenue was approximately $9.8 billion.

- The company serves over 1,500 hospitals and healthcare systems.

- OMN's distribution network includes over 45 distribution centers.

- The company's market capitalization is around $600 million as of early 2024.

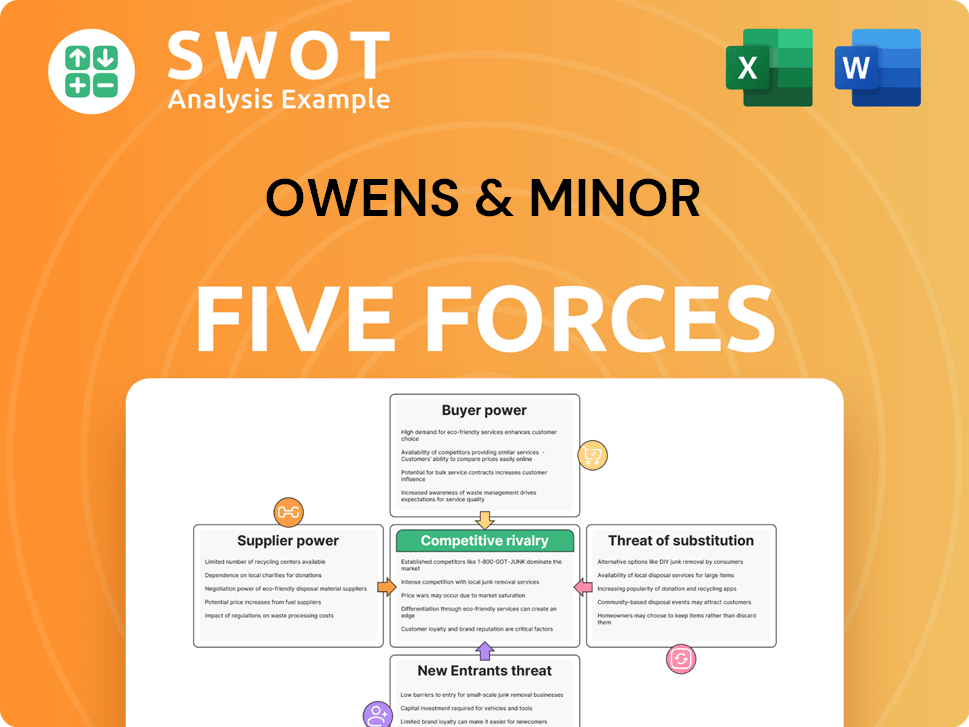

Owens & Minor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Owens & Minor Company?

- What is Competitive Landscape of Owens & Minor Company?

- What is Growth Strategy and Future Prospects of Owens & Minor Company?

- What is Sales and Marketing Strategy of Owens & Minor Company?

- What is Brief History of Owens & Minor Company?

- Who Owns Owens & Minor Company?

- What is Customer Demographics and Target Market of Owens & Minor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.