Pandora AS Bundle

How Does Pandora AS Dominate the Jewelry Market?

From a small Danish shop to a global jewelry giant, Pandora A/S has redefined affordable luxury since its 1982 founding. Its innovative charm bracelets sparked a revolution, fostering deep customer connections and propelling the brand to international recognition. Today, Pandora's success story demands a closer look at its competitive positioning within the dynamic jewelry industry.

This Pandora AS SWOT Analysis will delve into the specifics of Pandora AS's competitive landscape, exploring its market share in 2024, and examining its key competitors. We'll dissect Pandora AS's business strategy, providing a thorough Pandora AS market analysis to understand its brand positioning and how it competes globally. Furthermore, we will conduct a detailed Pandora AS competitor comparison to understand the company's financial performance and growth strategies within the Danish jewelry market.

Where Does Pandora AS’ Stand in the Current Market?

Pandora holds a strong market position within the global jewelry industry, especially in the affordable luxury segment. The company is consistently ranked among the top jewelry brands worldwide by sales volume and brand recognition. Its primary product lines, including charm bracelets, rings, necklaces, and earrings, cater to a broad customer base seeking high-quality jewelry at accessible price points.

Geographically, Pandora has a significant global presence, with strongholds in Europe, North America, and the Asia-Pacific region. It operates through a vast network of concept stores, shop-in-shops, and online platforms. The company's strategic shift beyond charm bracelets to diversify its offerings has helped it capture new market segments, enhancing its overall Pandora AS market analysis.

Pandora's 2023 financial results showed robust performance, with organic growth of 8% and a record revenue of DKK 28.1 billion. This indicates continued strength and scale within the industry. The focus on digital transformation, including investments in e-commerce and digital marketing, has been a key aspect of its evolving market position, boosting customer engagement and sales. Pandora is also exploring opportunities in emerging markets to solidify its global footprint.

While precise global market share figures for 2024-2025 are still emerging, Pandora consistently ranks among the top jewelry brands worldwide. The company’s strong brand recognition and sales volume contribute to its leading position. This is crucial for understanding the Pandora AS competitive landscape.

Pandora has diversified its product offerings beyond charm bracelets to include rings, necklaces, and earrings. This diversification strategy helps mitigate reliance on a single product line. It also allows the company to appeal to a wider demographic and capture new market segments, supporting its Pandora AS business strategy.

Pandora has a significant global presence, with strongholds in Europe, North America, and the Asia-Pacific region. The company operates through a vast network of concept stores, shop-in-shops, and online platforms. This extensive retail presence is key to its market reach.

In 2023, Pandora reported organic growth of 8% and record revenue of DKK 28.1 billion. This financial performance demonstrates the company's strength and scale compared to many industry averages. This data is vital for Pandora AS financial performance evaluation.

Pandora's market position is characterized by its strong brand recognition, diverse product range, and global presence. The company’s focus on affordable luxury and digital transformation further strengthens its position. The company's ability to adapt and innovate is crucial for long-term success. For a deeper dive, consider reading this article about Pandora AS by [insert link here].

- Strong brand recognition and global presence.

- Diverse product range catering to a broad customer base.

- Focus on digital transformation to enhance customer engagement.

- Strategic expansion into emerging markets.

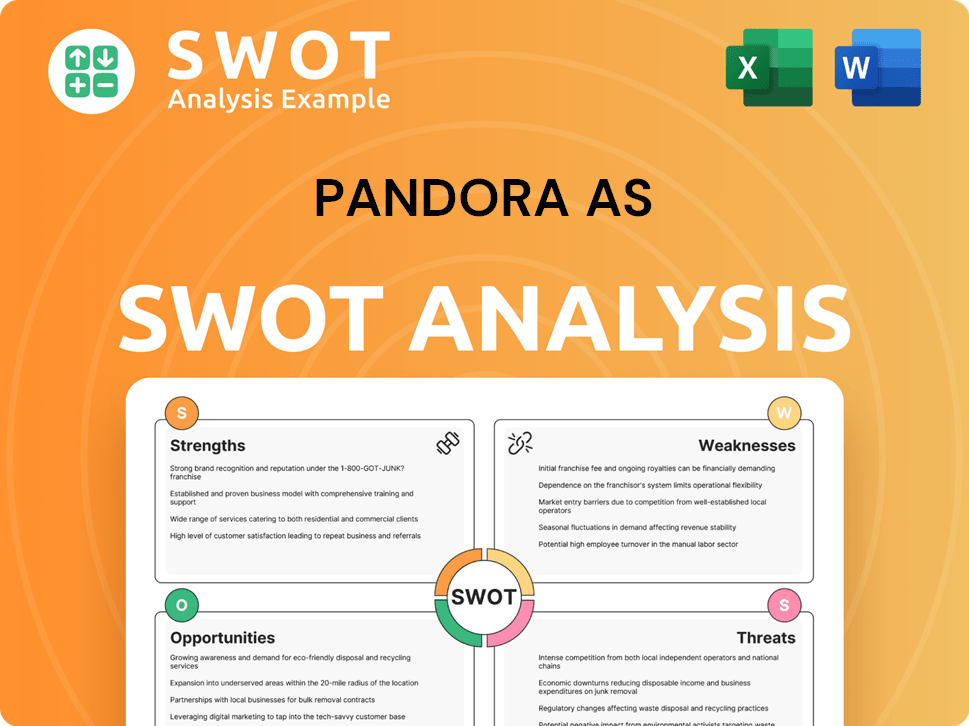

Pandora AS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Pandora AS?

Understanding the Growth Strategy of Pandora AS requires a close look at its competitive environment. The company operates within a dynamic jewelry market, facing competition from various players, each vying for market share and consumer preference. This analysis focuses on identifying key competitors and understanding how they impact the company's strategic positioning.

The competitive landscape of Pandora AS is shaped by both direct and indirect rivals. The company's success depends on its ability to differentiate itself and maintain a strong brand presence in a crowded marketplace. This analysis will delve into the main competitors, their strategies, and how they challenge Pandora AS.

The jewelry industry is highly competitive, with numerous companies vying for consumer attention and sales. The primary competitors include established luxury brands, fashion jewelry retailers, and online platforms. The competitive landscape is constantly evolving, with new entrants and changing consumer preferences influencing market dynamics. The company needs to adapt to these changes to maintain its market position and achieve sustainable growth.

Direct competitors offer similar products and target the same customer segments. These rivals often compete on design, price, and brand recognition.

Tiffany & Co. is a major player in the luxury jewelry market. It competes with the company in the premium segment, offering high-end designs and a strong brand legacy. However, its price point is significantly higher, differentiating its target market.

Swarovski competes more directly in terms of accessible fashion jewelry. It leverages its distinct materials and brand recognition. The company's focus on crystal jewelry provides a unique selling proposition.

Regional jewelers, often specializing in custom designs or specific niches, present localized competition. They compete particularly in brick-and-mortar sales, offering personalized services and unique products.

Indirect competitors offer different product categories but still compete for consumer spending. These rivals can impact the company's market share through alternative offerings.

Fashion accessories brands, including those selling costume jewelry, offer alternative options. These brands often compete on price and trendiness, targeting a broader audience.

The Pandora AS competitive landscape is shaped by various factors, including market share battles and the rise of online retail. Understanding these dynamics is crucial for the company's strategic planning.

- Market Share Battles: Competitors often vie for market share in specific product categories, such as rings or necklaces. This competition drives marketing campaigns and new product launches.

- Consolidation in the Luxury Goods Sector: Acquisitions, such as LVMH's purchase of Tiffany & Co., create larger, more formidable entities. These entities possess extensive resources and diverse brand portfolios.

- Online Retail and DTC Brands: The rise of online-only jewelry retailers and direct-to-consumer (DTC) brands poses a challenge. These players often have lower overheads and can quickly respond to consumer trends.

- Social Media and Influencer Marketing: Emerging players leverage social media and influencer marketing to disrupt the traditional competitive landscape. This strategy is particularly effective among younger demographics.

- Pricing Strategies: Competitors use various pricing strategies to attract customers. The company must balance value and profitability to remain competitive.

- Product Innovation: The introduction of new designs and materials is critical. The company must continuously innovate to stay ahead of the competition.

- Retail Presence: The company's retail presence, including both physical stores and online platforms, is a key factor. A strong retail presence enhances brand visibility and accessibility.

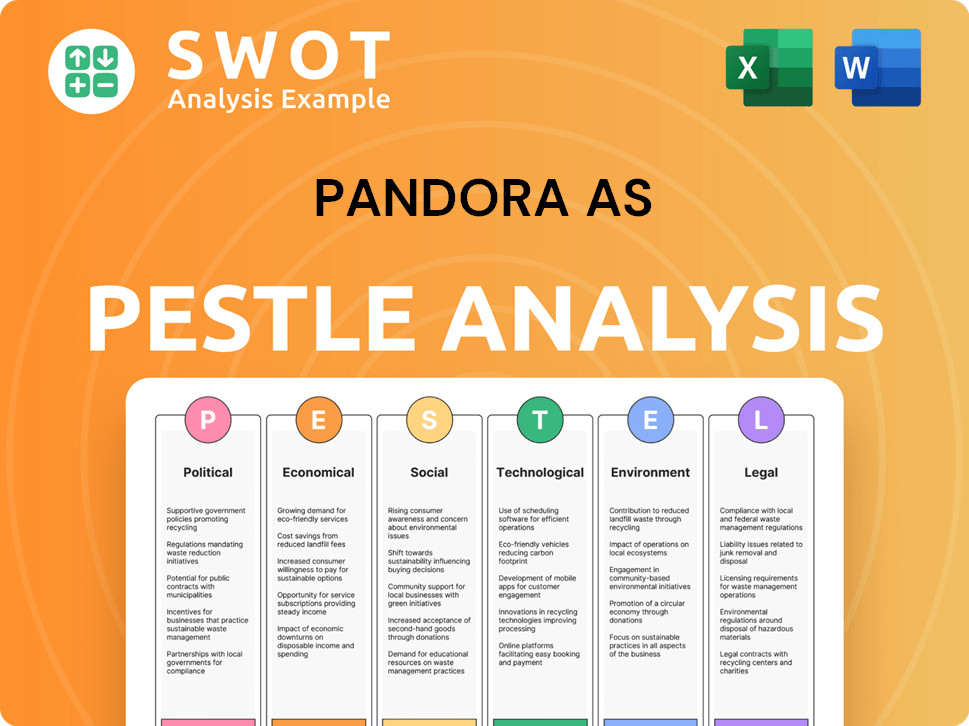

Pandora AS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Pandora AS a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Pandora AS requires a deep dive into its core strengths. The company's success is built on a foundation of strong brand recognition, a vast global retail network, and a unique product design that resonates with consumers. This combination allows it to maintain a significant presence in the global jewelry market. The Brief History of Pandora AS highlights the evolution of these advantages.

Pandora's strategic moves, including its focus on customizable jewelry and the charm bracelet system, have created a loyal customer base. This customer loyalty drives repeat purchases and strengthens the brand's market position. By offering high-quality, affordable jewelry, Pandora has carved out a niche that differentiates it from both luxury brands and mass-produced costume jewelry. This strategic approach is key to its competitive edge.

Its vertically integrated manufacturing facilities and robust supply chain management contribute to its profitability. These factors enable Pandora to control production costs and maintain quality, further solidifying its competitive advantage. In 2024, Pandora's revenue reached approximately DKK 28.1 billion, demonstrating its financial strength and market success. This financial performance is a testament to its effective business strategy.

Pandora's strong brand equity is a significant competitive advantage. Its global recognition is supported by consistent branding across its retail network. This consistency builds trust and encourages customer loyalty, driving sales and market share. The brand's association with affordable luxury and self-expression resonates with a broad consumer base.

Pandora's extensive global retail network ensures broad accessibility. The company operates concept stores and shop-in-shops worldwide, providing a consistent brand experience. This widespread presence allows Pandora to reach a diverse customer base and maintain a strong market presence. The retail network is crucial for driving sales and brand visibility.

The unique product design, particularly the charm bracelet system, is a key differentiator. Pandora's hand-finished jewelry offers perceived value that exceeds its price point. This design encourages continuous engagement and collection, fostering customer loyalty. This innovative approach drives repeat purchases and strengthens its market position.

Pandora's supply chain and manufacturing capabilities offer significant advantages. The company benefits from economies of scale in sourcing and manufacturing. Its vertically integrated facilities provide greater control over production, quality, and cost. This streamlined process enhances profitability and ensures product quality.

Pandora's competitive advantages are multifaceted, including strong brand recognition, an extensive retail network, unique product design, and efficient supply chain management. These factors contribute to its success in the jewelry industry. The company's focus on customer engagement and product innovation further strengthens its market position.

- Strong brand equity and global recognition.

- Extensive retail network with consistent branding.

- Unique product design, particularly the charm bracelet system.

- Efficient supply chain and vertically integrated manufacturing.

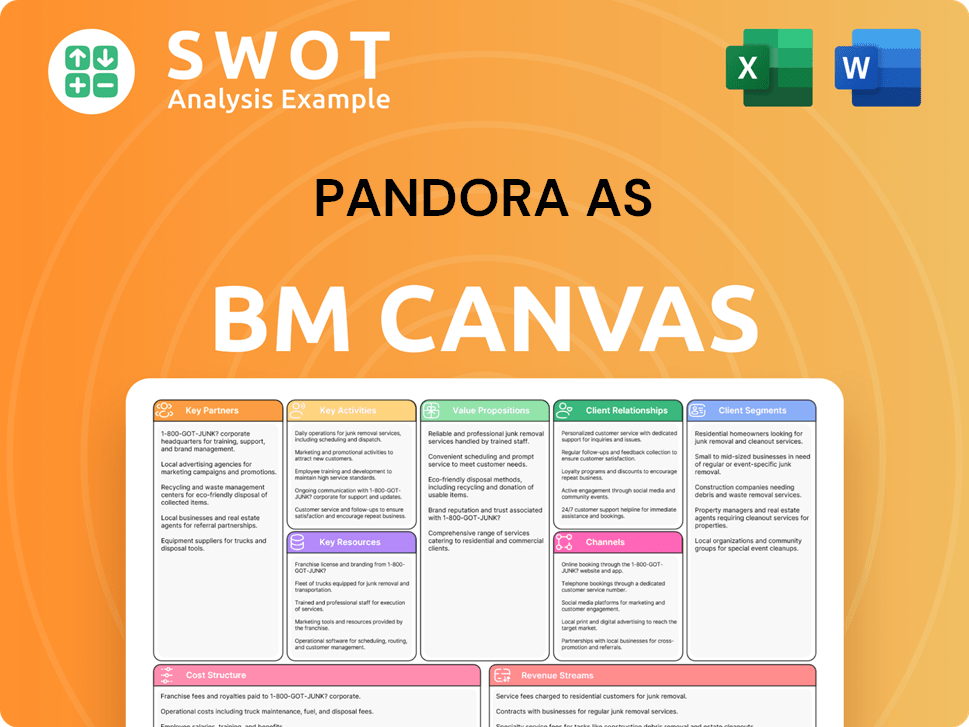

Pandora AS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Pandora AS’s Competitive Landscape?

The jewelry industry is currently undergoing significant shifts, impacting companies like Pandora. Key trends include the rise of e-commerce, the demand for sustainable products, and the ongoing need for personalization. Understanding the Pandora AS competitive landscape requires a close look at these industry dynamics and how they influence Pandora AS market analysis.

For Pandora AS business strategy, it's crucial to address challenges such as increased competition from online retailers and changing consumer tastes. Simultaneously, there are opportunities to leverage digital platforms, expand sustainable practices, and target emerging markets. This dual perspective is essential for navigating the Danish jewelry market and beyond.

E-commerce continues to reshape how jewelry is sold, with online sales growing significantly. Consumers are increasingly seeking sustainable and ethically sourced products. Personalization and customization remain strong drivers of consumer choice, influencing Pandora AS brand positioning.

Maintaining innovation and relevance in a competitive market is a key challenge. The rise of lab-grown diamonds and alternative materials presents potential disruption. Competition from online retailers and direct-to-consumer brands with lower costs poses a threat. Global economic shifts can impact consumer spending.

Leveraging digital platforms for enhanced online sales and customer engagement is a significant opportunity. Expanding sustainable practices can strengthen brand image. Growth potential exists in emerging markets, especially in Asia. Product innovations and strategic partnerships can unlock new avenues for growth.

Pandora's future will likely be shaped by digital integration and sustainability efforts. Continued focus on product innovation and brand storytelling is essential. Adapting to changing consumer preferences and market dynamics is crucial for long-term success. For deeper insights, consider reading about the Marketing Strategy of Pandora AS.

Pandora needs to effectively manage its Pandora AS competitor comparison and adapt to market changes. The company must balance traditional retail with a robust online presence, as indicated by the growth in e-commerce. Sustainability efforts and innovative product offerings are critical for maintaining a competitive edge.

- Enhance Pandora AS online sales strategy and digital marketing to reach a wider audience.

- Develop and promote sustainable and ethically sourced products to meet consumer demand.

- Explore strategic partnerships to expand market reach and brand visibility.

- Innovate the Pandora AS product range analysis to attract new customer segments.

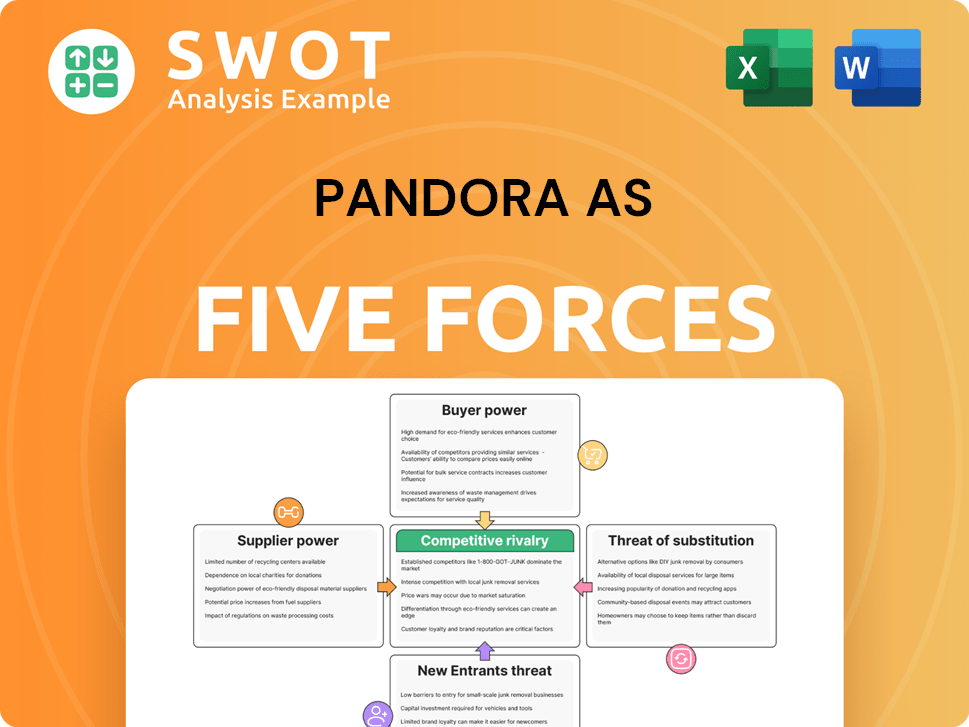

Pandora AS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pandora AS Company?

- What is Growth Strategy and Future Prospects of Pandora AS Company?

- How Does Pandora AS Company Work?

- What is Sales and Marketing Strategy of Pandora AS Company?

- What is Brief History of Pandora AS Company?

- Who Owns Pandora AS Company?

- What is Customer Demographics and Target Market of Pandora AS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.