Pandora AS Bundle

How Does Pandora AS Thrive in the Jewelry Market?

Pandora, a global jewelry powerhouse, isn't just about beautiful bracelets; it's a story of impressive financial performance and strategic innovation. With a remarkable 13% organic revenue growth in 2024, reaching approximately USD 4.42 billion, and a strong EBIT, Pandora has proven its resilience. But how does this leading jewelry company actually work, and what drives its consistent success?

This deep dive into Pandora AS SWOT Analysis will explore the intricate workings of the Pandora company, from its design and manufacturing processes to its extensive global retail network. We'll uncover the secrets behind Pandora's enduring appeal, examining its business model, operational strategies, and commitment to sustainability. Understanding How Pandora works is key to appreciating its position in the market and its future potential.

What Are the Key Operations Driving Pandora AS’s Success?

The core operations of the Pandora company are centered around a vertically integrated business model. This structure gives the company control over every stage, from product creation to direct sales, allowing for a consistent brand experience. The company designs, manufactures, and markets hand-finished jewelry, with a focus on customizable charm bracelets, rings, necklaces, and earrings, catering to a wide customer base seeking accessible luxury and personalized expression.

The company's operations primarily involve crafting jewelry in its facilities, with 92% of its jewelry produced in Thailand. The company employs around 37,000 people globally. A key aspect of its operations is a strong emphasis on sustainable sourcing, using 100% recycled silver and gold as of mid-2024, achieving its 2025 target ahead of schedule. This commitment, combined with the exclusive use of lab-grown diamonds, differentiates the company in the market.

The company's value proposition is built on offering accessible luxury through personalized jewelry, creating an emotional connection with consumers. The company's 'Phoenix Strategy,' launched in 2021, aims to reposition the company as a full jewelry brand. This strategy focuses on enhancing brand desirability, expanding the product range, and driving digital transformation. The new e-commerce platform, which underwent successful testing in Q4 2024, is being rolled out globally in 2025 to improve brand desirability.

The company's primary manufacturing takes place in Thailand, where the majority of its jewelry is produced. The company uses a variety of materials, including silver, gold, copper, cubic zirconia, and lab-grown diamonds. Silver accounted for 67% of total purchased materials in 2024.

The company has an extensive distribution network, selling products in over 100 countries through 6,800 points of sale, including over 2,700 concept stores. The company-owned stores continue to outperform partner stores. The company plans to expand its network with 400-500 net openings from 2024-2026.

The company is committed to sustainability, using 100% recycled silver and gold. The exclusive use of lab-grown diamonds also contributes to a lower carbon footprint. These initiatives are part of the company's broader efforts to reduce its environmental impact and appeal to environmentally conscious consumers.

The company leverages strong brand awareness and emotional connections through storytelling and personal expression. The 'Phoenix Strategy' focuses on enhancing brand desirability and expanding product offerings. The new e-commerce platform is being rolled out globally to enhance brand desirability and improve the customer experience.

The company's supply chain involves working with 98 direct product suppliers with over 113 factories, primarily in Thailand. The company is focused on expanding its retail network. Network expansion contributed 6% to revenue growth in Q2 2024.

- Expansion includes opening new concept stores and Pandora-owned shop-in-shops.

- The company's focus on expanding its network with targeted net openings demonstrates its growth strategy.

- The company’s supply chain management is critical to its operations, ensuring a steady flow of materials.

- The company's commitment to sustainable practices is a key differentiator.

For further insights into the company's history and development, you can explore Brief History of Pandora AS.

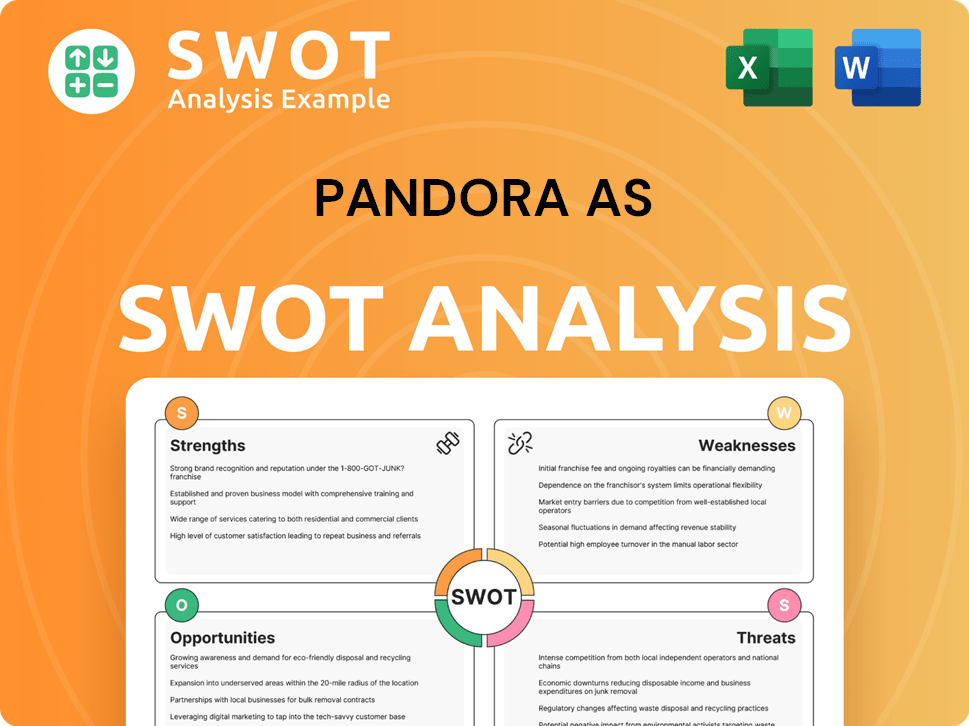

Pandora AS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Pandora AS Make Money?

The Pandora AS company generates revenue primarily through the sale of its hand-finished jewelry. This includes customizable charm bracelets, rings, necklaces, and earrings. Its revenue streams are diversified across various channels, including concept stores, shop-in-shop systems, and e-commerce platforms.

The Pandora company has demonstrated strong financial performance. In fiscal year 2024, revenue reached DKK 31.7 billion (approximately USD 4.42 billion), marking a 13% organic growth. This growth was driven by a 7% like-for-like sales increase and a 5% expansion of its retail network. The gross margin strengthened to 79.8% in 2024.

As of Q4 2024, online sales drove significant growth with a 20% revenue increase, representing 27% of total revenue. In Q1 2025, sales reached DKK 7,347 million, up from DKK 6,834 million in Q1 2024, with organic growth at 7%. The gross margin continued to strengthen to 80.4% in Q1 2025. To learn more about the company's strategic direction, you can explore the Growth Strategy of Pandora AS.

The Pandora business model centers around its 'affordable luxury' positioning. The company is expanding its 'Fuel with more' segment, which includes a wider range of full jewelry assortments and lab-grown diamonds. This segment drove 22% growth in 2024 and 12% like-for-like growth in Q1 2025.

- The introduction of lab-grown diamonds, with entry-level prices around $300, aims to democratize luxury.

- By 2024, the company planned to increase the availability of lab-grown diamonds tenfold.

- Strategic partnerships with major franchises like Disney and Marvel expand its appeal.

- Pandora is rolling out a new e-commerce platform globally in 2025 to enhance digital sales.

- The company is also adjusting prices in response to rising silver values.

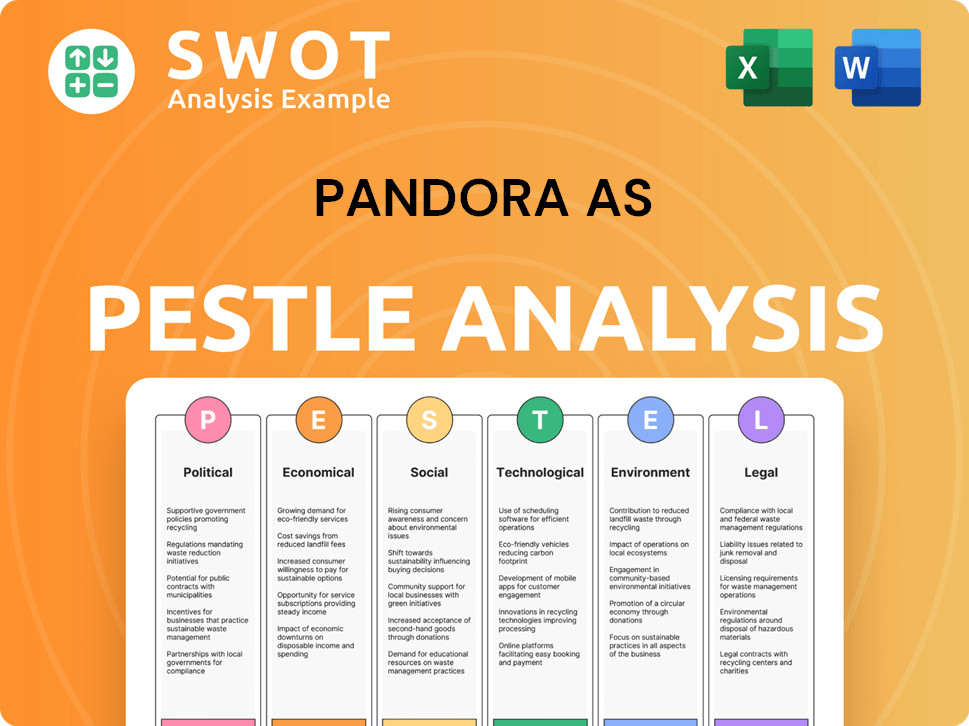

Pandora AS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Pandora AS’s Business Model?

The evolution of the company, marked by strategic initiatives and operational adjustments, showcases its adaptability and commitment to sustainable practices. The 'Phoenix Strategy,' launched in 2021 and entering its second phase (2024-2026), is central to its growth plan, aiming to transform the company into a full jewelry brand. This strategy includes elevating brand appeal, expanding product lines, and enhancing digital and omnichannel capabilities.

Key operational milestones include the shift to using 100% recycled silver and gold for all new jewelry by mid-2024, ahead of the original 2025 target. This move is projected to reduce carbon dioxide emissions by approximately 58,000 tons annually. Furthermore, the company's exclusive use of lab-grown diamonds, produced with renewable energy, underscores its dedication to sustainability. These efforts are part of a broader focus on responsible business practices.

The company's expansion strategy involves continuous investment in its retail network, with plans to open 400-500 net new stores between 2024 and 2026. The introduction of the 'Evoke 2.0' store format, rolled out in all new stores from 2024, emphasizes personalized experiences and gifting zones. These strategic moves are designed to strengthen the company's market position and enhance customer engagement.

The company's transition to crafting all new jewelry with 100% recycled silver and gold by mid-2024, a year ahead of its original 2025 target, is a significant milestone. The company also exclusively offers lab-grown diamonds, produced using renewable energy sources. These initiatives highlight the company's commitment to sustainability and responsible practices.

The 'Phoenix Strategy' launched in 2021, with its second phase (2024-2026), focuses on accelerating growth and repositioning the company as a full jewelry brand. The company is expanding its retail network, with plans to open 400-500 net new stores between 2024 and 2026. A new e-commerce platform is being rolled out globally in 2025.

The company's global brand awareness, strong emotional connection with consumers, and vertically integrated business model provide a competitive advantage. The ability to offer 'affordable luxury' and personalization resonates with consumers. The company's consistent organic growth, including 13% in 2024 and 7% in Q1 2025, demonstrates its adaptability.

The company continues to invest in its retail network, expanding its network by 5% in 2024. The introduction of the 'Evoke 2.0' store format, implemented in all new stores from 2024, focuses on personalized experiences. Strategic partnerships, such as with Australian Fashion Week, enhance brand visibility.

The company's success is driven by a robust business model that emphasizes both product innovation and market expansion, as detailed in Growth Strategy of Pandora AS. This strategy includes a focus on sustainable practices and enhancing customer engagement through personalized experiences.

- The company's vertically integrated model ensures control over product development and distribution.

- The 'Phoenix Strategy' is central to the company's growth, focusing on brand elevation and product diversification.

- The company's ability to adapt to market challenges, such as macroeconomic uncertainties, is demonstrated through its consistent organic growth.

- Strategic partnerships and investments in retail expansion further enhance brand visibility and market reach.

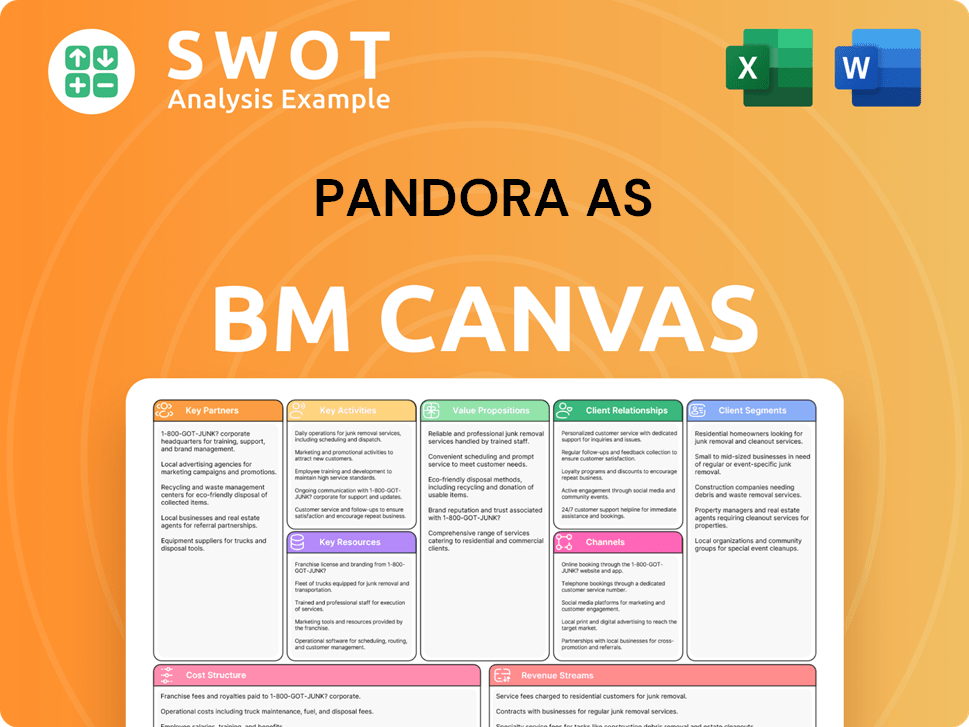

Pandora AS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Pandora AS Positioning Itself for Continued Success?

The Pandora AS company is a leading player in the global jewelry market, recognized as the world's largest jewelry brand by volume. In 2024, the company demonstrated strong performance, achieving DKK 31.7 billion (EUR 4.2 billion) in revenue and a 13% organic growth. This growth is supported by its extensive global presence, with over 6,800 points of sale across more than 100 countries, including over 2,700 concept stores.

Despite its strong position, the Pandora company faces several risks, including regulatory changes, competition, and shifts in consumer preferences. The company is also mindful of potential impacts from US tariffs and fluctuations in commodity prices and foreign exchange rates. However, Pandora has shown its capability to manage these risks through pricing and operational efficiencies.

Pandora maintains a strong market position as the largest jewelry brand globally by volume. Its unaided brand awareness is high, and it fosters strong customer loyalty. The company's market share in the US, its largest market, is in the low single-digit levels, indicating growth potential.

The company faces risks from regulatory changes, new competitors, and shifts in consumer preferences. Currency fluctuations and commodity price changes also pose challenges. Pandora is preparing for potential impacts from US tariffs and actively manages these risks through pricing and operational strategies.

Pandora's 'Phoenix Strategy' aims for 7-9% annual organic revenue growth from 2023-2026. The company targets an EBIT margin of 26-27% by 2026, with mid-to-high teens growth in earnings per share (EPS) annually. Revenue is expected to reach DKK 34-36 billion by 2026.

Key initiatives include investments in brand desirability, expanding product assortments, and strengthening digital capabilities. A global rollout of its new e-commerce platform is planned for 2025. The company is also expanding its retail network, with 400-500 targeted net openings from 2024-2026.

Pandora is committed to its sustainability roadmap, aiming to reduce greenhouse gas emissions by half by 2030 and achieve net-zero by 2040. This involves using 100% recycled silver and gold and exclusively offering lab-grown diamonds. The company's leadership focuses on sustainable and profitable growth, solidifying its position in the accessible jewelry segment.

- Focus on accessible jewelry with a strong gifting proposition.

- Expansion of product assortments beyond charms.

- Strengthening digital and omnichannel capabilities.

- Commitment to sustainability through recycled materials and lab-grown diamonds.

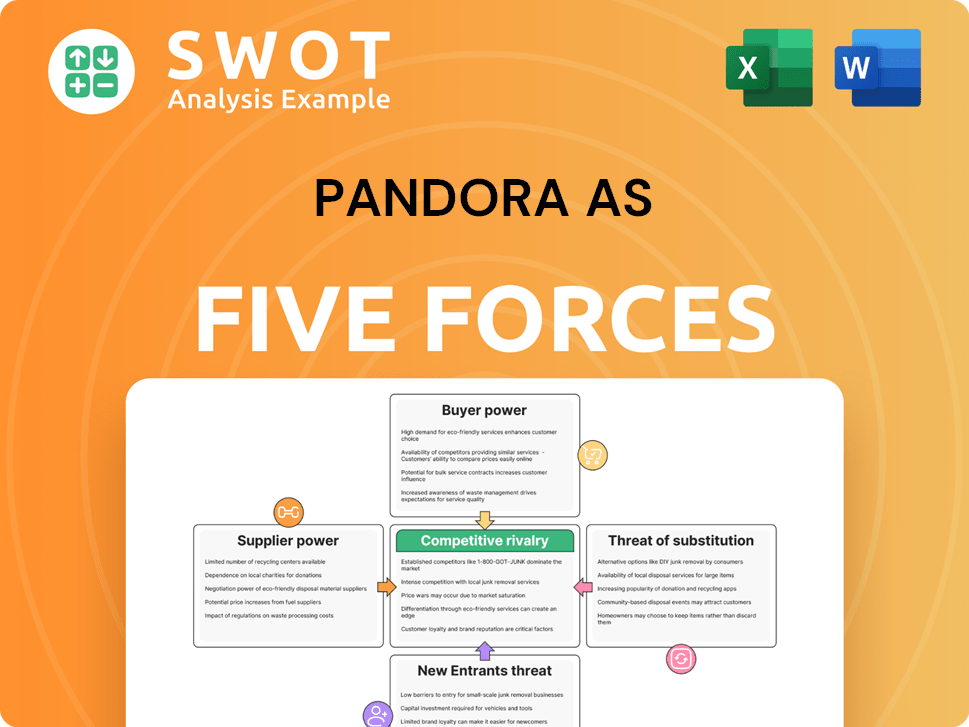

Pandora AS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pandora AS Company?

- What is Competitive Landscape of Pandora AS Company?

- What is Growth Strategy and Future Prospects of Pandora AS Company?

- What is Sales and Marketing Strategy of Pandora AS Company?

- What is Brief History of Pandora AS Company?

- Who Owns Pandora AS Company?

- What is Customer Demographics and Target Market of Pandora AS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.