Pandora AS Bundle

Can Pandora's Phoenix Strategy Continue to Soar?

From its humble beginnings in Copenhagen, Denmark, Pandora has become a global jewelry powerhouse. But how has this Danish jewelry company evolved, and what drives its continued success in a competitive market? This exploration delves into the Pandora AS SWOT Analysis to understand its growth strategy and uncover its future prospects.

Pandora's 'Phoenix strategy' is transforming the brand, as evidenced by strong organic revenue growth in 2024 and early 2025. This strategic shift is crucial for understanding Pandora's future, including its expansion plans and revenue forecast. We will analyze Pandora's market share and digital transformation strategy to assess the company's long-term potential within the jewelry market analysis.

How Is Pandora AS Expanding Its Reach?

The Pandora growth strategy is built around significant expansion initiatives, primarily focusing on entering new markets, developing its retail network, and diversifying its product offerings. These efforts are all part of the company's 'Phoenix strategy,' designed to drive sustained growth and increase its market share within the jewelry industry. This strategic direction is crucial for the Pandora AS company to maintain its competitive edge and capitalize on emerging opportunities in the global market.

A core element of this Pandora growth strategy involves targeting emerging consumer markets, particularly in India and China. The company aims to leverage the rising demand for high-quality, personalized luxury goods in these regions. Despite facing challenges in China, including a -21% growth in 2024, Pandora remains committed to the market, although it plans to adjust its presence by closing at least 50 stores in 2025.

To further enhance its retail presence, Pandora plans to open between 225 and 275 new stores and 175 to 225 shop-in-shop locations from 2024 to 2026. The company has identified approximately 7,000 potential locations within its existing operating regions. All new stores from 2024 onwards will feature the 'Evoke 2.0' format, designed to offer personalized experiences and dedicated gifting zones. In Q1 2025, Pandora added 7 shop-in-shops and closed 17 stores, bringing its total store count to 2,271, with 30% being Pandora-operated.

Pandora is actively targeting emerging markets like India and China to capitalize on the increasing demand for luxury goods. Despite challenges in China, the company remains committed, planning to close at least 50 stores in 2025. This strategic focus is part of the broader Pandora future prospects.

The company plans to open between 225 and 275 new stores and 175 to 225 shop-in-shop locations from 2024 to 2026. All new stores will feature the 'Evoke 2.0' format, offering personalized experiences. In Q1 2025, Pandora added 7 shop-in-shops and closed 17 stores.

Pandora is rolling out its new e-commerce platform globally throughout 2025, following successful testing in Italy and Canada in Q4 2024. This platform aims to enhance the brand's desirability and improve the online customer experience. This initiative is part of the Pandora AS company's digital transformation strategy.

The new 'Evoke 2.0' store format will be implemented in all new stores from 2024 onwards. This format is designed to offer personalized experiences and dedicated gifting zones. This strategic move reflects the company's commitment to adapting to changing consumer preferences.

The company's expansion initiatives also include a global rollout of its new e-commerce platform throughout 2025, following successful testing in Q4 2024 in Italy and Canada. This new platform aims to significantly elevate the brand's desirability and enhance the online customer experience. For more details on how Pandora generates revenue, you can refer to Revenue Streams & Business Model of Pandora AS.

Pandora's expansion strategy is multifaceted, focusing on market entry, retail network development, and digital transformation. These initiatives are designed to drive growth and enhance the brand's presence in key markets.

- Strategic focus on emerging markets like India and China.

- Aggressive retail expansion with new store openings and shop-in-shop locations.

- Global rollout of a new e-commerce platform to enhance online customer experience.

- Implementation of the 'Evoke 2.0' store format for personalized experiences.

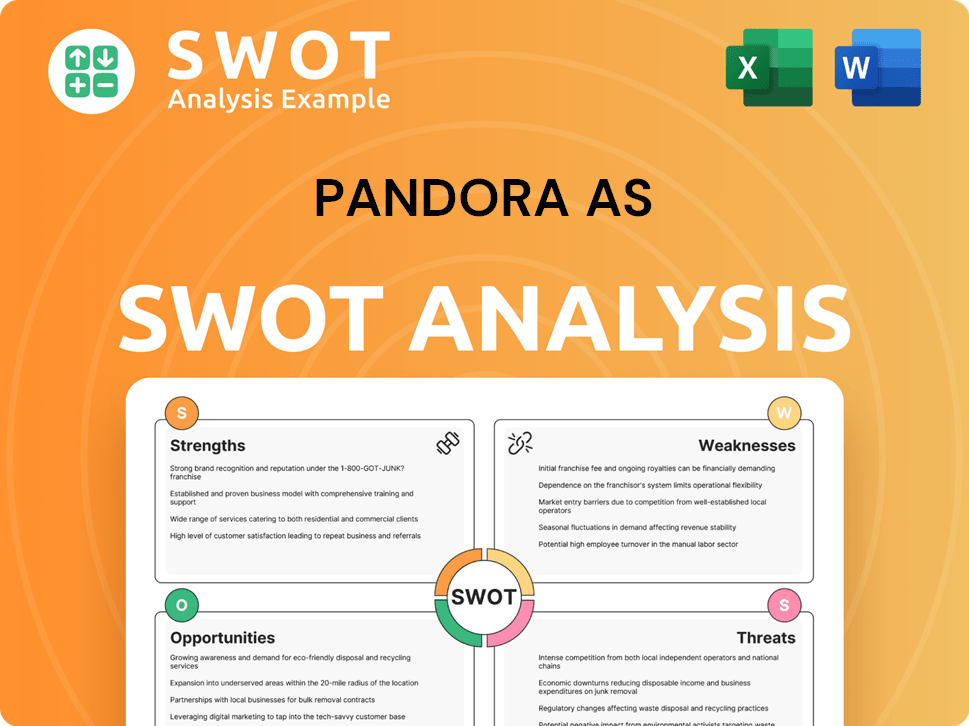

Pandora AS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Pandora AS Invest in Innovation?

The Pandora AS company is strategically leveraging innovation and technology to drive its sustained growth. This approach is particularly evident in its commitment to sustainability and digital transformation. These initiatives are crucial components of the overall Pandora growth strategy, shaping its Pandora future prospects.

One of the key aspects of Pandora's innovation strategy involves its early adoption of 100% recycled gold and silver in jewelry crafting. This move, achieved by mid-2024, a year ahead of its original target, underscores its dedication to sustainable practices. The company's focus on digital transformation further enhances its online presence and customer engagement.

The successful testing of a new e-commerce platform in Q4 2024, with a global rollout planned for 2025, is a significant technological initiative. This platform is designed to provide a more engaging online experience, contributing to overall brand desirability. Ongoing investments in digital initiatives and brand marketing, such as the 'BE LOVE' campaign launched in February 2025, are aimed at transforming the perception of Pandora into a full jewelry brand and driving growth across its collections.

By mid-2024, Pandora achieved its goal of using 100% recycled gold and silver. This initiative is projected to reduce carbon dioxide emissions by 58,000 metric tons annually, equivalent to taking 6,000 cars off the road. This demonstrates a strong commitment to environmental responsibility, a key factor in the Pandora AS company's strategy.

A new e-commerce platform was successfully tested in Q4 2024, with a global rollout planned for 2025. This platform aims to enhance the online shopping experience. The company is investing heavily in digital initiatives and brand marketing to drive growth.

Online sales saw an 18% like-for-like (LFL) growth in Q1 2025. This strong performance highlights the success of Pandora's digital strategy. The company is focusing on improving customer engagement and online presence.

Pandora exclusively offers lab-grown diamonds produced using renewable energy sources. This further demonstrates its commitment to a low-carbon future. This aligns with the growing consumer preference for sustainable products.

The 'BE LOVE' campaign, launched in February 2025, aims to transform the perception of Pandora into a full jewelry brand. This campaign is part of a broader effort to drive growth across its collections. These marketing strategies are crucial for the Pandora growth strategy.

The adoption of recycled materials and lab-grown diamonds showcases Pandora's commitment to product innovation. These initiatives are designed to meet evolving consumer preferences. This focus on innovation is key to its Pandora future prospects.

The Pandora AS company's innovation and technology strategy focuses on sustainability and digital transformation. This includes the use of recycled materials, lab-grown diamonds, and a new e-commerce platform. These efforts are designed to enhance customer engagement and drive growth in the jewelry market analysis.

- Early adoption of 100% recycled gold and silver by mid-2024.

- Successful testing of a new e-commerce platform with a global rollout in 2025.

- 18% like-for-like (LFL) growth in online sales in Q1 2025.

- Focus on lab-grown diamonds produced using renewable energy.

- Ongoing marketing campaigns to transform brand perception.

For a deeper understanding of the target market, consider reading about the Target Market of Pandora AS.

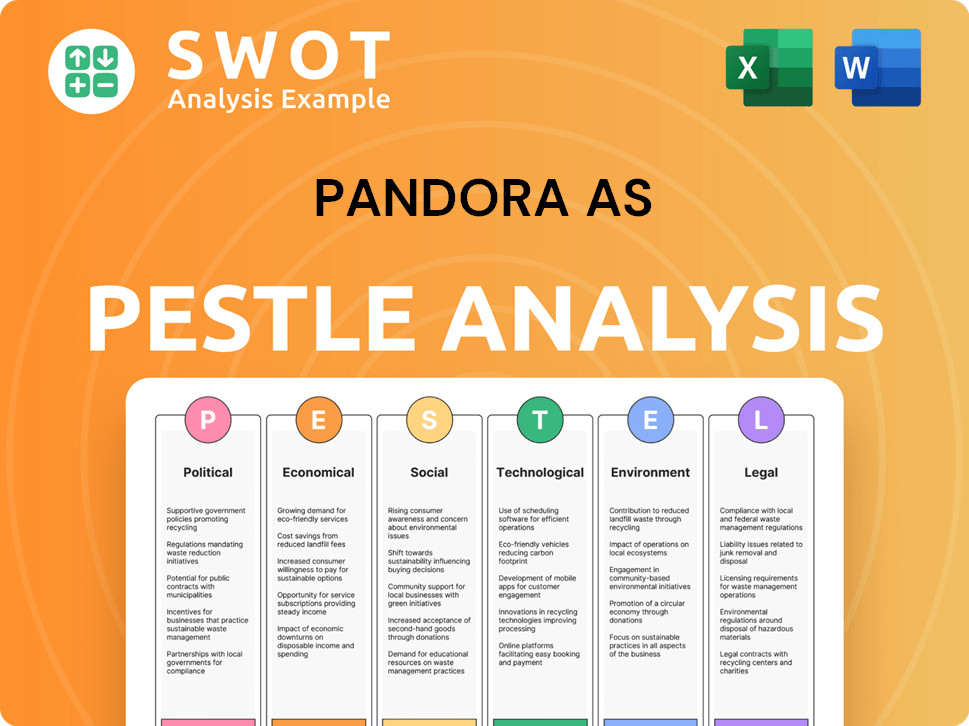

Pandora AS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Pandora AS’s Growth Forecast?

The financial outlook for the company demonstrates a commitment to sustained, profitable growth. This is largely due to the implementation of its Phoenix strategy. This strategy has been instrumental in driving strong performance in recent years and is expected to continue shaping the company's financial trajectory. Understanding the company's financial performance is crucial for a comprehensive Pandora AS company analysis.

For the fiscal year 2024, the company reported a robust 13% organic revenue growth, exceeding initial forecasts. Revenue reached DKK 31.7 billion, with earnings before interest and taxes (EBIT) climbing to DKK 8.0 billion. The gross margin improved to 79.8%, and the EBIT margin reached 25.2%. These figures reflect the company's strong operational efficiency and successful market strategies. The company's financial performance is a key aspect of the Pandora growth strategy.

Looking ahead, the company maintains its guidance for 7-8% organic growth in 2025. However, the EBIT margin guidance for 2025 has been adjusted to 'around 24%' (previously 'around 24.5%'), primarily due to foreign exchange headwinds and potential impacts from US tariffs. Despite these adjustments, the company's Q1 2025 results showed strong performance, with sales of DKK 7,347 million, a gross margin of 80.4%, and an EBIT margin of 22.3%, contributing to a 19% EPS growth. These strong numbers are a testament to the company's resilience and ability to adapt to market challenges. For more insights into the company's core values and mission, you can read about the Mission, Vision & Core Values of Pandora AS.

The company is targeting an EBIT margin of 26-27% by 2026, although current expectations lean towards the lower end of this range. This indicates a focus on long-term profitability and operational excellence. The company also initiated a new DKK 4.0 billion share buyback program in early February 2025, which reflects confidence in its financial health and commitment to shareholder value.

- 2024 Revenue: DKK 31.7 billion

- 2024 Organic Revenue Growth: 13%

- 2024 EBIT: DKK 8.0 billion

- 2024 Gross Margin: 79.8%

- 2024 EBIT Margin: 25.2%

- 2025 Organic Growth Guidance: 7-8%

- 2025 EBIT Margin Guidance: Around 24%

- Q1 2025 Sales: DKK 7,347 million

- Q1 2025 Gross Margin: 80.4%

- Q1 2025 EBIT Margin: 22.3%

- Q1 2025 EPS Growth: 19%

- Target EBIT Margin by 2026: 26-27%

- Share Buyback Program: DKK 4.0 billion (initiated February 2025)

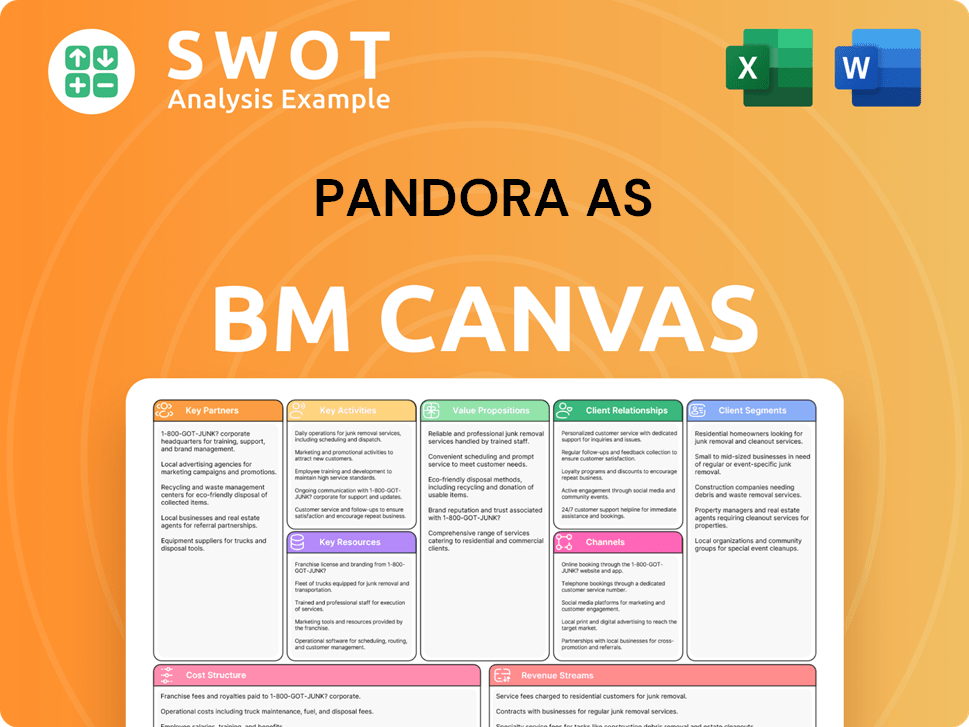

Pandora AS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Pandora AS’s Growth?

The Pandora AS company faces several risks that could impact its Pandora growth strategy and Pandora future prospects. These challenges include market competition, regulatory changes, and macroeconomic uncertainties. The company is actively monitoring these factors to maintain its growth trajectory.

A significant concern is the potential impact of US tariffs on goods from Thailand, where Pandora manufactures its products. Sluggish demand in key European markets, such as Germany, France, and Italy, also poses a challenge due to economic difficulties and intense promotional activity. The company is proactively managing these risks.

The company acknowledges 'elevated macro uncertainty' and anticipates slower growth in Europe. These issues require strategic adjustments to navigate the competitive landscape and maintain financial performance. Pandora is implementing measures to mitigate these risks and capitalize on opportunities.

If former US President Donald Trump reinstates tariffs, Pandora estimates a potential impact of DKK 500 million in 2025 and DKK 900 million annually thereafter. This is a significant financial challenge that the company is actively addressing.

Pandora is preparing for various scenarios related to these tariffs. Mitigating measures include considering further price increases and rerouting product shipments directly to Canada and Latin America by 2026. These actions aim to reduce the financial impact.

Economic challenges and promotional environments in Europe are expected to slow growth in key markets. This requires a flexible approach to adapt to changing consumer behavior and market dynamics. The company must navigate these challenges effectively.

Pandora is making ongoing strategic adjustments under its Phoenix strategy. These adjustments are aimed at maintaining a consistent growth trajectory and tapping into vast untapped opportunities. This strategic approach is critical.

The company is actively working on supply chain management to minimize the impact of external factors. This includes exploring alternative shipping routes and optimizing production processes. Effective supply chain management is essential.

The Danish jewelry company faces intense competition in the jewelry market analysis. The company’s ability to differentiate its brand and products is crucial for maintaining market share. A strong brand is vital.

To understand the company's history and development, you can read more in the Brief History of Pandora AS. These risk factors are closely monitored and managed by Pandora to ensure long-term success in the jewelry market. The company's proactive approach is key to navigating these uncertainties.

Pandora's financial performance is closely tied to its ability to manage these risks effectively. The company's revenue forecast and Pandora's market share analysis are critical for evaluating its success. These factors influence the company's overall strategy.

Pandora's expansion plans in the next 5 years include international market expansion, which could be affected by these risks. The company must adapt its Pandora's international market expansion strategies to account for these challenges. Expansion strategies are crucial.

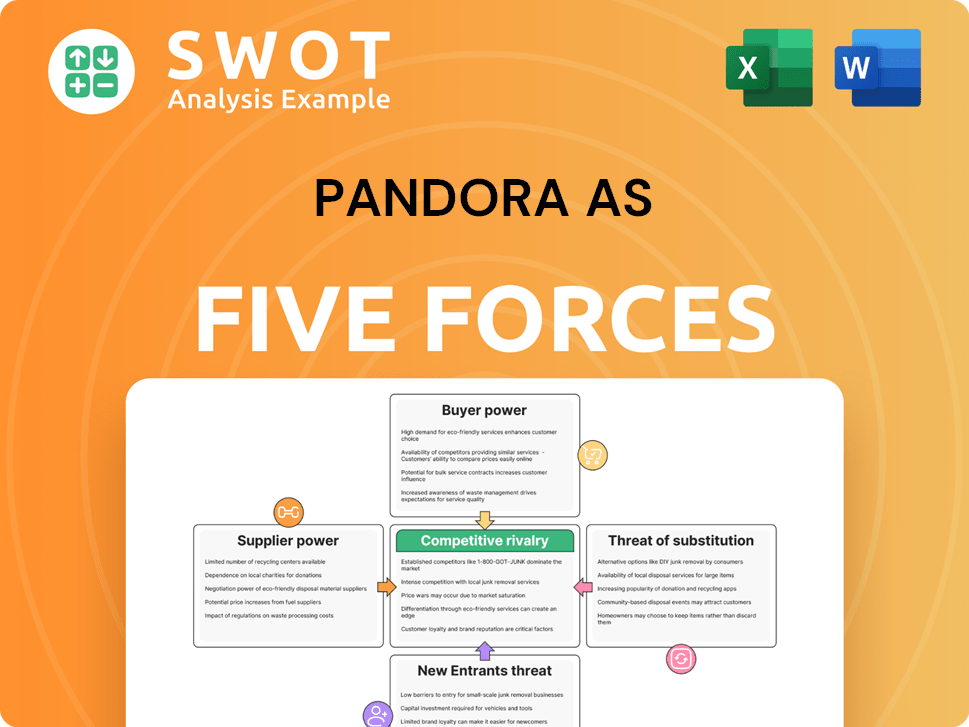

Pandora AS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pandora AS Company?

- What is Competitive Landscape of Pandora AS Company?

- How Does Pandora AS Company Work?

- What is Sales and Marketing Strategy of Pandora AS Company?

- What is Brief History of Pandora AS Company?

- Who Owns Pandora AS Company?

- What is Customer Demographics and Target Market of Pandora AS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.