Philips Bundle

Can Philips Maintain Its Healthcare Tech Dominance?

Philips, a name synonymous with innovation, has dramatically reshaped itself to become a healthcare technology powerhouse. But in the fast-paced world of medical devices and digital health, who are its key rivals, and how does Philips stack up? This article dives deep into the Philips SWOT Analysis to dissect the competitive landscape and uncover the strategies driving its success.

Understanding the Philips competitive landscape is crucial for investors and strategists alike. A comprehensive Philips market analysis reveals the company's position relative to its Philips competitors, assessing its strengths and weaknesses. This exploration of the Philips industry also examines its Philips business strategy, including recent acquisitions, partnerships, and its response to evolving market dynamics. Analyzing Philips key competitors in medical devices and its market share in healthcare technology provides a clear picture of its competitive advantages and disadvantages, shaping its future outlook and competitive landscape.

Where Does Philips’ Stand in the Current Market?

The company, now primarily focused on health technology, holds a significant market position in the industry. In 2024, the company reported sales of €18.2 billion, showcasing its substantial scale within the sector. The company's strategic shift towards healthcare has allowed it to concentrate on high-growth areas like connected care and precision diagnosis.

The company's primary product lines include diagnostic imaging systems, patient monitoring solutions, and healthcare informatics. It has a global footprint, with significant revenue streams from North America, Western Europe, and growth markets in Asia. The company serves a diverse customer base, including hospitals and clinics.

While specific market share figures vary by segment, the company is generally considered among the top global players in its core areas. For instance, it maintains a strong presence in diagnostic imaging, competing with industry giants. It continues to invest in research and development to maintain its competitive edge and expand its offerings in digital health and artificial intelligence.

The company holds a strong position in the health technology market, particularly in medical imaging and patient monitoring. While exact market share varies, it is a top global player in its core areas. It competes with major industry players, maintaining a significant presence in diagnostic imaging.

The company's main offerings include diagnostic imaging systems (MRI, CT, X-ray, ultrasound), patient monitoring solutions, sleep and respiratory care devices, and healthcare informatics. These products cater to hospitals, clinics, and individual consumers globally. The company's focus is on innovation in digital health and AI.

The company has a global presence, with significant revenue from North America, Western Europe, and growth markets in Asia. This diverse geographic footprint supports its overall market position and resilience. The company's global strategy is key to its competitive advantage.

The company has strategically shifted its focus to health technology, divesting from consumer electronics and lighting businesses. This pivot allows it to concentrate on high-growth areas like connected care and precision diagnosis. The company continues to invest in R&D to maintain its competitive edge.

The company's competitive landscape is shaped by its focus on health technology and its strategic investments in R&D. The company faces challenges in certain segments, such as the recall of some sleep and respiratory care devices. To understand the company's target audience, consider reading about the Target Market of Philips.

- Strong market position in medical imaging and patient monitoring.

- Strategic shift towards health technology, divesting from other sectors.

- Global presence with significant revenue from key regions.

- Continuous investment in research and development.

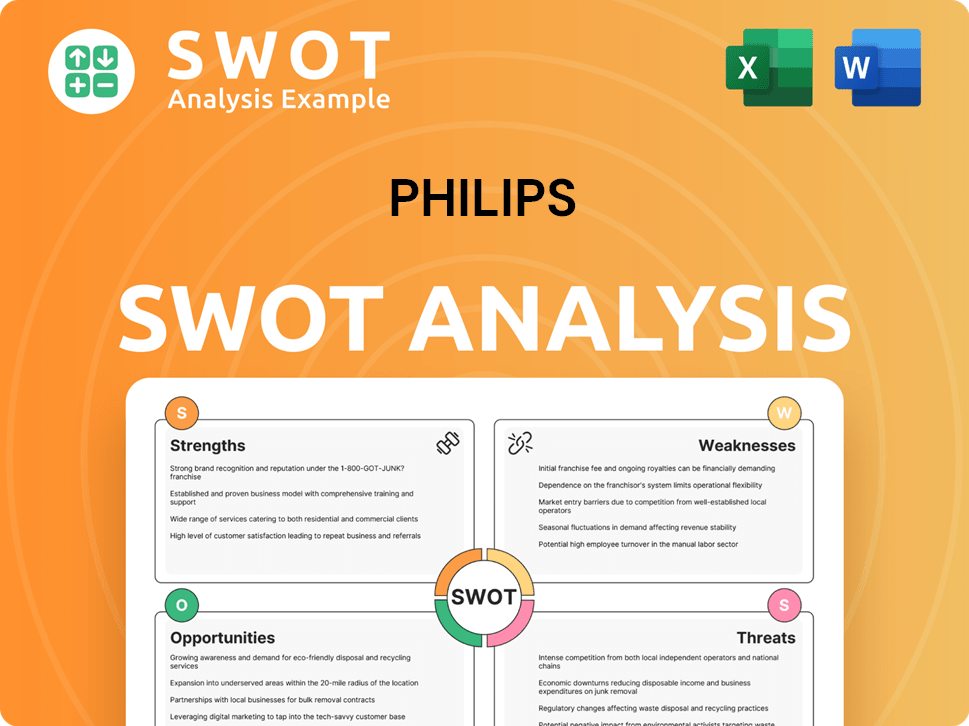

Philips SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Philips?

The competitive landscape for the company is multifaceted, encompassing a range of direct and indirect rivals across its diverse health technology sectors. This analysis is crucial for understanding the company's strategic positioning and market dynamics. A thorough examination of its key competitors is essential for evaluating its market share, identifying potential threats, and recognizing opportunities for growth and innovation. For a deeper dive into the financial aspects, consider exploring the Revenue Streams & Business Model of Philips.

The company faces competition from major global players in diagnostic imaging and patient monitoring, as well as specialized companies in sleep and respiratory care. The competitive dynamics are also influenced by emerging players and technological advancements, such as AI integration in diagnostics. Understanding these competitive forces is vital for the company's strategic planning and maintaining its market position.

The company competes in a dynamic market, particularly in the healthcare technology sector. The competitive environment is shaped by technological advancements, market trends, and the strategic moves of key players. This analysis provides insights into the competitive landscape, helping to understand the challenges and opportunities the company faces.

Siemens Healthineers, GE HealthCare, and Canon Medical Systems are the primary direct competitors in diagnostic imaging. These companies offer comprehensive portfolios and often compete on innovation and integrated solutions. They pose significant challenges due to their global presence and diverse offerings.

Siemens Healthineers is a major competitor, providing a broad range of medical imaging, laboratory diagnostics, and advanced therapies. They compete directly with the company, often focusing on integrated solutions and technological advancements. In 2023, Siemens Healthineers reported a revenue of approximately €21.7 billion.

GE HealthCare is another key competitor, offering a wide array of medical technologies, pharmaceuticals, and digital solutions. They leverage their extensive global presence and diverse offerings to compete in the market. GE HealthCare's revenue for 2023 was around $19.4 billion.

Canon Medical Systems focuses on imaging technologies and competes directly in CT, MRI, and ultrasound markets. They often emphasize image quality and advanced features to gain a competitive edge. Canon Medical Systems' market share in specific imaging segments is significant, though precise revenue figures are often consolidated within Canon's broader financial reports.

ResMed is a significant competitor in sleep and respiratory care, offering a strong portfolio of devices and digital health solutions. They pose a direct challenge to the company in this specialized market segment. ResMed's revenue for fiscal year 2024 was approximately $4.2 billion.

Numerous agile tech companies and software providers pose indirect competition in healthcare informatics and digital health. Emerging players and start-ups, particularly in digital health and telemedicine, are continually disrupting the traditional competitive landscape. These newer entrants often focus on niche markets or leverage disruptive technologies to gain traction.

The company's competitive landscape is shaped by technological advancements, market trends, and strategic moves by key players. Understanding these dynamics is crucial for maintaining market share and driving innovation. Mergers and acquisitions, such as those by larger healthcare providers or technology firms, can alter competitive dynamics.

- Technological Advancements: AI integration in diagnostics and other innovations are key competitive battlegrounds.

- Market Share Shifts: Product recalls and new market entries significantly impact market share.

- Mergers and Alliances: Acquisitions and partnerships can create new integrated solutions and consolidate market power.

- Regulatory Impact: Regulations influence the competitive landscape, affecting product approvals and market access.

- Competitive Pricing: Pricing strategies are crucial for maintaining or gaining market share.

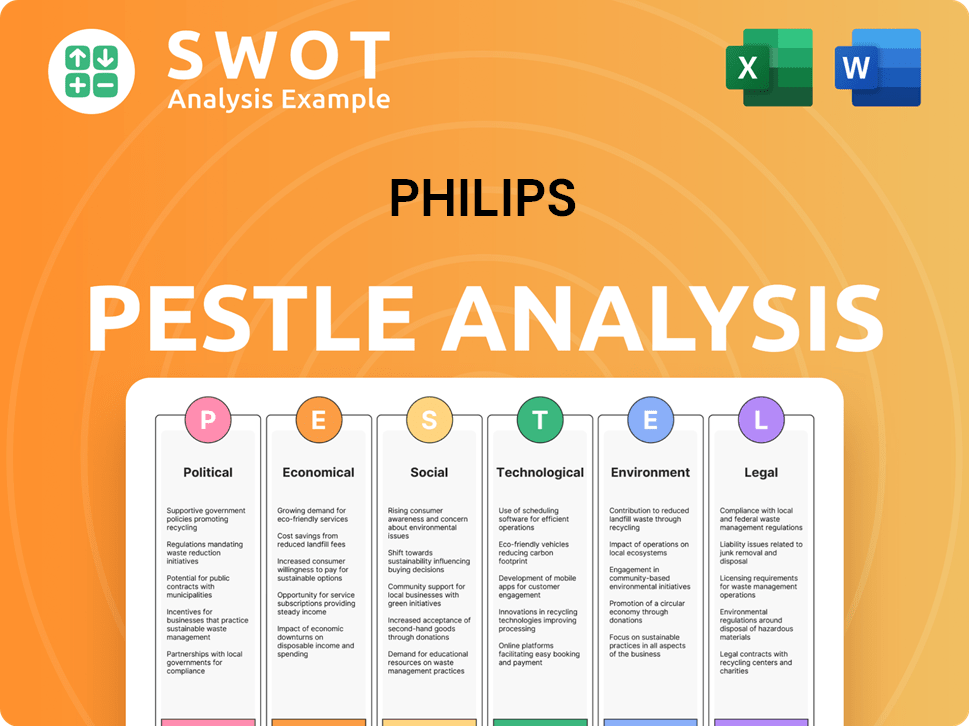

Philips PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Philips a Competitive Edge Over Its Rivals?

The competitive landscape for Philips is shaped by its strengths in health technology, brand recognition, and strategic focus. Understanding these elements is crucial for assessing its market position. Philips's ability to innovate and adapt to market changes is essential for maintaining its competitive edge. A comprehensive analysis of its advantages and disadvantages provides insight into its future prospects.

Key milestones and strategic moves significantly influence Philips's competitive position. The company has consistently invested in research and development (R&D), with expenditures reaching €1.8 billion in 2024. This investment supports its proprietary technologies, particularly in medical imaging and patient monitoring. Strategic partnerships and acquisitions further enhance its capabilities and market reach. These initiatives are crucial for navigating the evolving healthcare technology sector.

Philips's competitive edge is reinforced by its global presence and brand reputation. The company's extensive distribution network and service infrastructure ensure its products and solutions are widely available. This, combined with its focus on integrated solutions, allows it to offer a holistic value proposition. While facing challenges like product recalls, Philips's brand strength and technological prowess remain central to its sustained competitive position.

Philips's substantial R&D investments, totaling €1.8 billion in 2024, drive innovation in medical imaging, patient monitoring, and connected care solutions. This includes advanced algorithms, sensor technologies, and healthcare informatics platforms. These technological advancements are key to maintaining its competitive advantage and addressing the evolving needs of healthcare providers.

Philips has a long-standing reputation for quality and reliability, fostering strong customer loyalty among healthcare providers. This trust is supported by a comprehensive global distribution network and robust service infrastructure. The company's brand recognition is a significant asset in the competitive healthcare technology market, influencing purchasing decisions and customer retention.

Philips focuses on providing integrated solutions that combine hardware, software, and services, offering a holistic value proposition. This approach differentiates it from competitors that may offer more fragmented solutions. By integrating various components, Philips aims to improve healthcare outcomes and enhance operational efficiency for its customers.

The company benefits from economies of scale due to its global operations and large production volumes. This allows for cost efficiencies in manufacturing and procurement, potentially leading to competitive pricing or higher profit margins. These efficiencies are crucial for sustaining profitability and competitiveness in the health technology sector.

Philips leverages several key advantages to maintain its position in the market. These advantages include a strong portfolio of proprietary technologies, a well-established brand, and a global distribution network. The company's focus on integrated solutions and its ability to achieve economies of scale further strengthen its competitive position.

- Proprietary Technologies and Intellectual Property: Advanced algorithms, sensor technologies, and healthcare informatics platforms.

- Brand Equity and Reputation: Decades of building customer loyalty and trust, especially among healthcare providers.

- Global Distribution Network and Service Infrastructure: Ensuring widespread availability and support for its products.

- Economies of Scale: Cost efficiencies in manufacturing and procurement due to global operations.

- Integrated Solutions: Combining hardware, software, and services for a holistic value proposition.

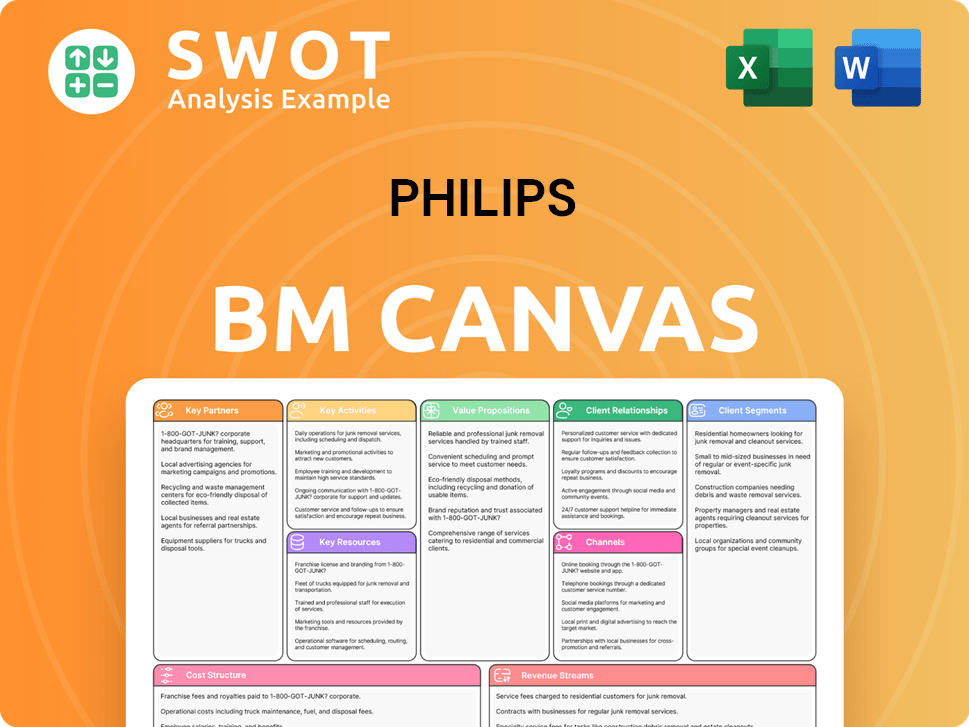

Philips Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Philips’s Competitive Landscape?

The health technology industry is experiencing rapid changes, with digital health solutions, artificial intelligence (AI), and personalized medicine taking center stage. These shifts create both challenges and opportunities for companies like the one formerly known as the Royal Dutch Electronics company. A Brief History of Philips shows its evolution, highlighting its need to adapt to these dynamic market forces.

Regulatory scrutiny, economic pressures, and new competitors pose significant risks. However, growth opportunities exist in emerging markets, an aging global population, and through product innovation. The company’s future hinges on its ability to navigate these trends, innovate, and form strategic partnerships.

Digital health, AI, and personalized medicine are key trends in the health tech sector. These advancements are changing how healthcare is delivered and managed. Companies are investing heavily in these areas to stay competitive and meet evolving patient needs.

Regulatory changes, economic pressures, and the entry of new competitors pose challenges. Stricter regulations on medical devices and data privacy require significant investments. Economic factors like inflation and supply chain disruptions also impact operations.

Emerging markets, an aging population, and product innovation offer growth opportunities. Expanding into developing countries with growing healthcare needs is promising. Innovations in imaging and AI-powered diagnostics create new revenue streams.

Strategic actions include divesting non-core assets, investing in R&D, and focusing on high-growth segments. Partnerships with healthcare providers and research institutions are also key. These moves aim to strengthen the company's competitive position.

The health technology market is highly competitive, with companies vying for market share in various segments. Competition is driven by innovation, pricing, and strategic partnerships. The company's ability to adapt and innovate will be crucial for maintaining its market position.

- The global medical devices market is projected to reach $671.4 billion by 2024.

- Digital health market is expected to grow significantly, with AI in healthcare projected to reach $61.7 billion by 2027.

- The company is focusing on expanding its presence in emerging markets, where healthcare spending is increasing.

- Strategic partnerships are becoming increasingly important for market expansion and access to new technologies.

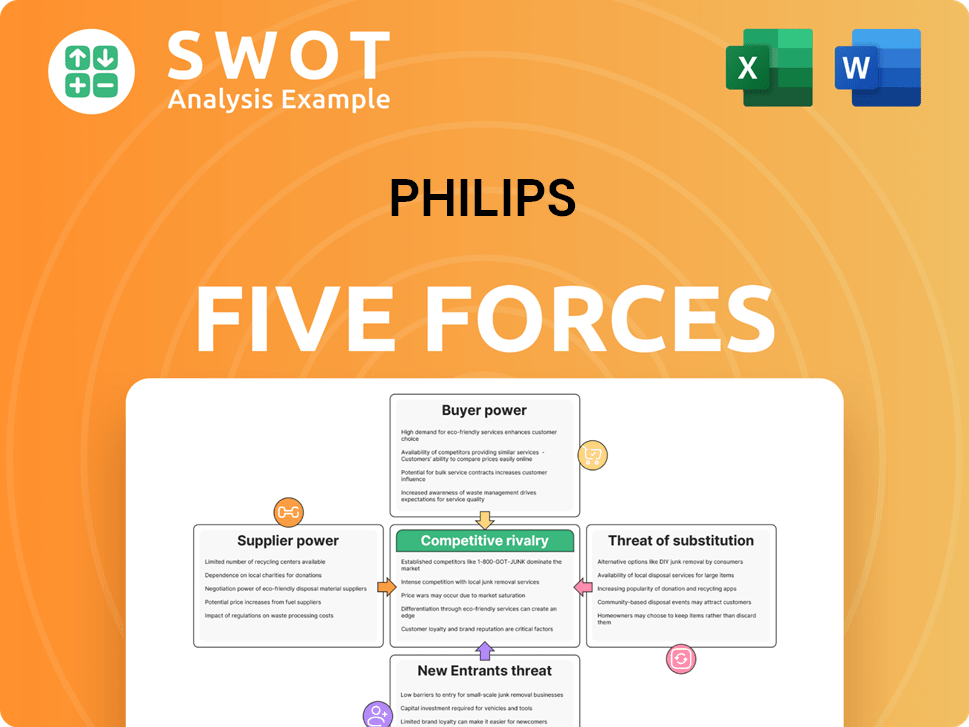

Philips Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Philips Company?

- What is Growth Strategy and Future Prospects of Philips Company?

- How Does Philips Company Work?

- What is Sales and Marketing Strategy of Philips Company?

- What is Brief History of Philips Company?

- Who Owns Philips Company?

- What is Customer Demographics and Target Market of Philips Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.