Principal Financial Group Bundle

Can Principal Financial Group Thrive in Today's Financial Arena?

The financial services industry is in constant flux, demanding adaptability and foresight from its key players. Principal Financial Group, a global giant, has a rich history dating back to 1879, evolving from a life insurance provider to a multifaceted financial powerhouse. Understanding the Principal Financial Group SWOT Analysis is crucial to navigating this complex landscape.

This exploration of the Principal Financial Group's competitive landscape will dissect its market position, analyze its key rivals, and highlight its competitive advantages. We'll delve into the company's financial performance, including a comparison with its Principal competitors, and assess its strategic responses to industry trends. This market analysis will provide actionable insights into Principal Financial Group's strengths and weaknesses, helping investors, analysts, and business strategists understand its potential for future growth and its ability to overcome market challenges within the financial services industry.

Where Does Principal Financial Group’ Stand in the Current Market?

Principal Financial Group holds a significant position in the financial services industry, providing a wide array of products and services. These include retirement plans, insurance solutions, and investment products. The company's operations span globally, with a strong presence in the United States, Asia, and Latin America. Principal Financial Group operates through four main segments: Retirement and Income Solutions (RIS), Principal Global Investors, Principal International, and Benefits & Protection.

In the competitive landscape, understanding the company's market position is crucial. The financial services industry is dynamic, and Principal's ability to maintain and enhance its position is key. Market analysis reveals the company's strengths and weaknesses, helping stakeholders make informed decisions. A look at the Marketing Strategy of Principal Financial Group can offer additional insights into its approach.

Principal's financial performance and strategic initiatives reflect its market standing. The company's focus on capturing more revenue from retirement customers and investing in technology are vital for future growth. Analyzing Principal Financial Group's competitive advantages and market challenges provides a comprehensive understanding of its position.

Principal Financial Group's total assets under management (AUM) reached $718 billion in Q1 2025, surpassing analyst estimates. Its total assets under administration (AUA) stood at $1.7 trillion. This scale highlights its robust market presence within the financial services industry. These figures underscore the company's significant footprint in the market.

The Retirement and Income Solutions (RIS) segment showed strong performance, with a 9% increase in recurring deposits to $13.8 billion in Q1 2025. The small and mid-sized business (SMB) market within RIS saw a 12% growth in recurring deposits. The Principal Retirement Trust (PRT) generated $0.8 billion in sales, driving growth in the retirement sector.

Principal maintained a non-GAAP operating return on equity (ROE) of 14% in Q1 2025, aligning with its long-term target range. The company held a strong capital position with $1.75 billion in excess and available capital as of Q1 2025. These figures demonstrate Principal's financial stability and commitment to shareholder value.

Principal is actively working to enhance its market position through strategic initiatives. These include focusing on capturing more revenue from retirement customers and investing in technology. While experiencing net outflows in certain segments, the rate of outflows has decreased, with anticipated improvement in net flows in the latter half of 2024.

Principal Financial Group's market position is characterized by its strong financial performance and strategic initiatives. The company's focus on retirement solutions and its global presence contribute to its competitive advantages. The company's consistent dividend increases, including a 7% increase in its Q2 2025 dividend to $0.76 per share, further signal confidence in its financial stability.

- Strong AUM and AUA figures indicate a significant market presence.

- Robust performance in the Retirement and Income Solutions segment.

- Consistent dividend increases demonstrate financial stability.

- Strategic initiatives aimed at capturing more revenue and investing in technology.

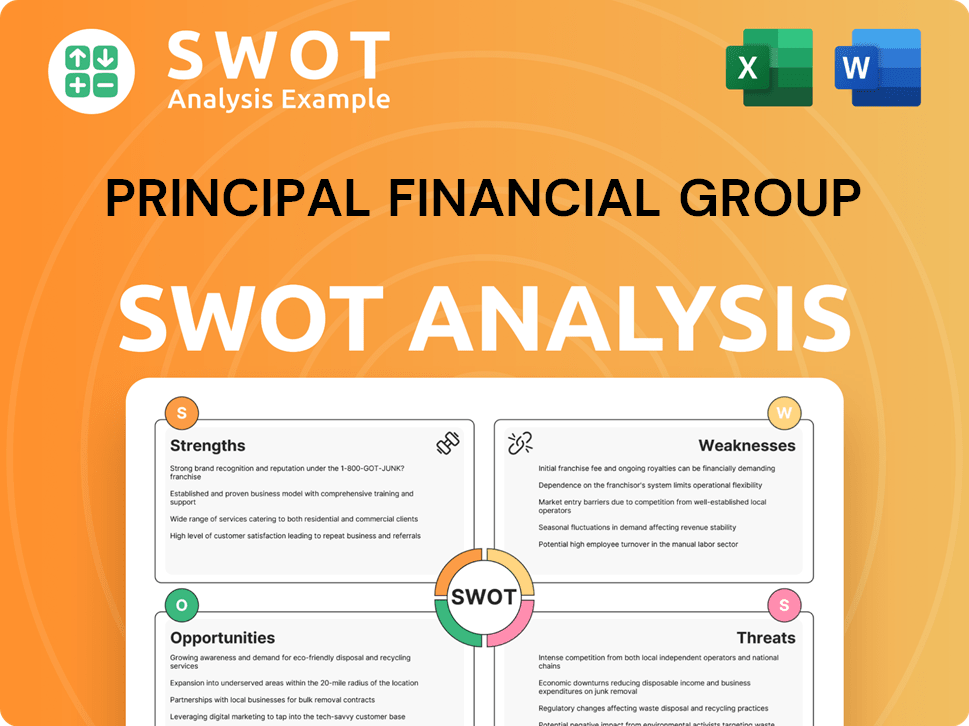

Principal Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Principal Financial Group?

The Brief History of Principal Financial Group reveals that it operates within a highly competitive financial services industry. The competitive landscape includes both direct and indirect rivals, all vying for market share in retirement planning, asset management, and insurance services. Understanding the key players and their strategies is crucial for assessing Principal Financial Group's position and potential.

The competition is multifaceted, encompassing large institutional players, niche firms, and emerging technology-driven companies. These entities challenge Principal Financial Group through various means, including pricing, innovation, and technological advancements. The ongoing shifts in the market, such as the increasing use of data analytics and AI, further intensify the competitive environment.

The competitive pressures affect Principal's business lines, particularly in retirement, asset management, and insurance. Strategic alliances and mergers within the industry can also significantly alter the competitive dynamics. For instance, Principal's collaboration with BCT Group in Hong Kong, announced in January 2025, aims to strengthen BCT's position in the MPF market and expand its pension distribution network.

Principal Financial Group faces competition from a range of companies, including large institutional players and niche firms. These competitors challenge Principal across various product lines and distribution channels.

Direct competitors include major insurance companies and financial service providers. These companies offer similar products and services, competing directly for the same customer base.

Indirect competitors include firms specializing in specific products or customer segments. These companies may not offer a full suite of services but can still impact Principal's market share in certain areas.

Companies compete on various factors, including brand recognition, distribution networks, and pricing. Innovation and technological advancements also play a crucial role in gaining a competitive edge.

Changes in the market, such as the increasing use of technology, continue to reshape the competitive landscape. Strategic partnerships and mergers can also significantly alter the competitive environment.

Principal's strategic relationship with BCT Group in Hong Kong, announced in January 2025, is an example of how companies are forming alliances to strengthen their market positions and expand their distribution networks.

The primary competitors of Principal Financial Group include large institutional players like MetLife, Prudential Financial, and AIG. These firms have extensive distribution networks and brand recognition, directly challenging Principal's market share. The competitive environment also includes niche firms and emerging players, who challenge through various means, including price, innovation, and technology.

- MetLife: A major player in the insurance and employee benefits market, MetLife competes with Principal in retirement plans, group life, and disability insurance.

- Prudential Financial: Prudential offers a similar range of products and services, competing with Principal in retirement, asset management, and insurance.

- AIG: AIG competes in the insurance and retirement markets, particularly in the areas of annuities and life insurance.

- Niche Firms: Boutique firms specializing in specific financial products or customer segments also pose a competitive challenge.

- Emerging Players: Companies leveraging technology and data analytics to offer personalized solutions are gaining a competitive edge.

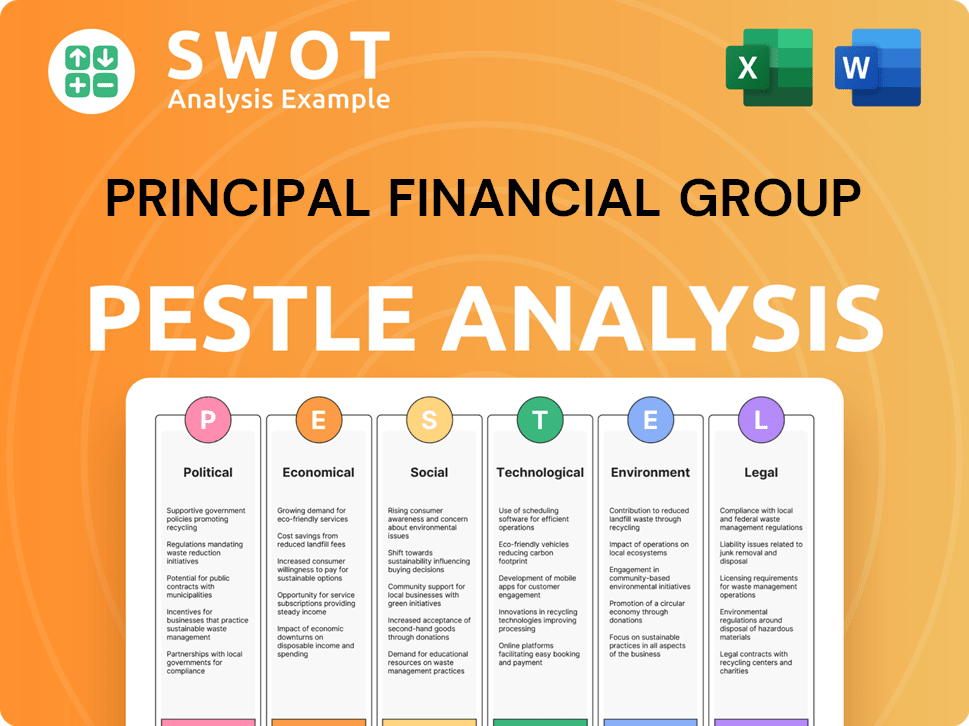

Principal Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Principal Financial Group a Competitive Edge Over Its Rivals?

Principal Financial Group's competitive landscape is shaped by its strategic moves and core strengths. The company has consistently adapted to market changes, focusing on innovation and customer-centric strategies. These efforts have helped it maintain a strong position within the financial services industry. For a deeper look at the company's ownership structure, you can explore Owners & Shareholders of Principal Financial Group.

A key milestone for Principal has been its expansion of product offerings and global presence. This has allowed it to cater to a diverse customer base, from individuals to large institutions. Principal's commitment to technology and customer service further enhances its competitive edge. The company's ability to evolve with industry trends is crucial for its continued success.

Principal Financial Group's competitive advantages are multifaceted, setting it apart from its rivals. Its diverse product portfolio, including retirement savings, investment, and insurance, caters to a wide range of customer needs. The company's strong brand reputation and global footprint contribute to its sustainability.

Principal's diverse product offerings, including retirement plans, investments, and insurance, allow it to serve a broad customer base. This comprehensive approach provides a competitive edge by meeting various financial needs. This diversification helps the company to navigate different market conditions effectively.

Principal operates globally, with a strong presence in the United States, Asia, and Latin America. This global footprint, combined with a solid financial track record, builds customer and investor confidence. This widespread presence allows Principal to tap into diverse markets and opportunities.

Principal invests in cutting-edge technology to streamline processes and enhance customer experience. Their AI assistant, 'Paige,' is an example of their commitment to digital transformation. This focus on technology enables Principal to offer personalized financial products and services.

Principal emphasizes customer service and relationship management to build long-lasting client relationships. This customer-centric approach helps foster loyalty and trust. These strong relationships are a key factor in the company's success and market position.

Principal's competitive advantages are sustained through continuous investment in technology, diversification of offerings, and a strong focus on customer relationships. These strategies help the company maintain its market position despite industry changes. However, Principal faces ongoing threats from imitation and rapid industry shifts.

- Diverse Product Range: Offers a wide array of financial products, including retirement plans, investments, and insurance.

- Global Presence: Operates in multiple countries, expanding its reach and customer base.

- Technological Innovation: Leverages technology to enhance customer experience and streamline processes.

- Customer-Centric Approach: Focuses on building strong relationships with clients through excellent service.

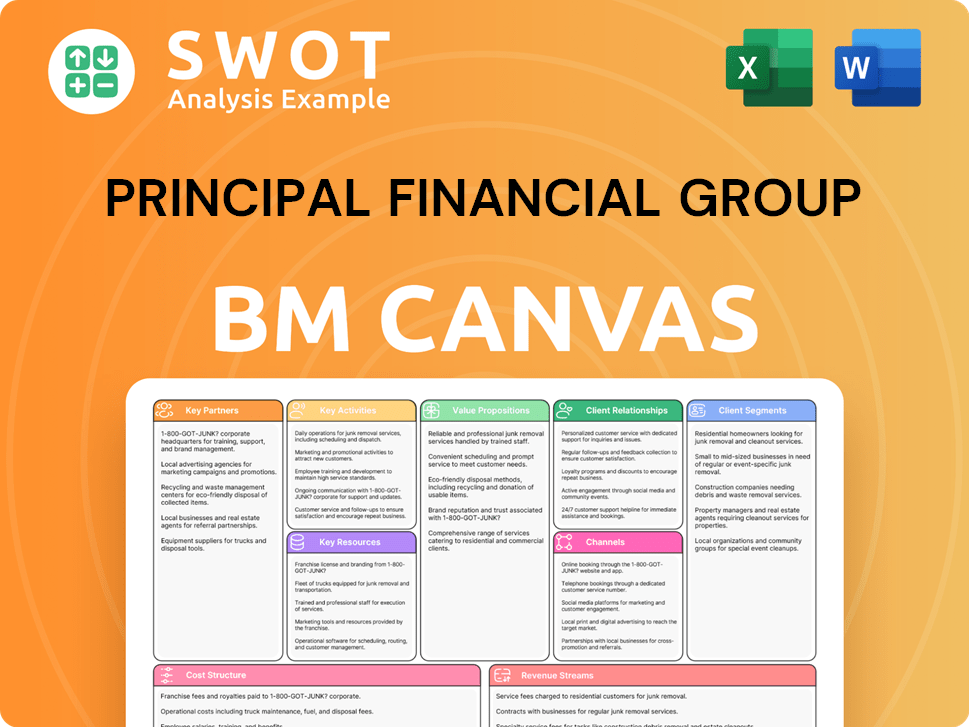

Principal Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Principal Financial Group’s Competitive Landscape?

The financial services industry, in which Principal Financial Group operates, is undergoing significant transformations. These changes are driven by digital advancements, regulatory shifts, and global economic fluctuations. Understanding these trends is crucial for assessing the company's competitive landscape and future prospects. This analysis will delve into the key industry trends, challenges, and opportunities facing Principal Financial Group, providing a comprehensive market analysis.

The competitive landscape for Principal Financial Group involves navigating a complex environment. The company must adapt to evolving customer preferences, regulatory pressures, and global economic uncertainties. The future outlook for Principal depends on its ability to leverage opportunities while mitigating risks. This includes strategic initiatives such as digital transformation, international expansion, and product diversification to maintain and enhance its market position. For a deeper dive into its strategic approach, you can explore the Growth Strategy of Principal Financial Group.

Digital transformation is a key trend, with customers increasingly using online and mobile financial services. Regulatory changes, including consumer protection and data privacy, are also significant. Global economic shifts, such as market volatility, impact investment product performance. Principal must adapt to these changes to maintain its competitive edge.

Staying compliant with evolving regulations poses a challenge for Principal. Global economic shifts, including market volatility, can impact investment performance. Potential economic downturns and risks in the commercial real estate market could affect investment income. Geopolitical uncertainties may also influence growth.

The growing demand for pension risk transfer solutions presents a key growth area for Principal. Expansion into retirement planning and financial security offers market expansion opportunities. International expansion, particularly in emerging markets, is a key strategy. Product diversification and strategic partnerships can also drive growth.

Principal aims for 9%-12% EPS growth and a 14%-16% return on equity. Strategies include deeper market penetration in the small and mid-sized business (SMB) segment. Active management of portfolios and a focus on high-growth markets are key. The company is focusing on global asset management.

Principal's strategies include digital transformation, international expansion, and product diversification. The company is focusing on deeper market penetration, particularly within the SMB segment. Active portfolio management and strategic capital allocation are also key.

- Digital Solutions: Investing in digital platforms and AI to enhance customer experience.

- International Expansion: Targeting growth in Asia and Latin America.

- Product Diversification: Expanding offerings beyond traditional retirement and insurance.

- Strategic Partnerships: Collaborating with other financial institutions and technology companies.

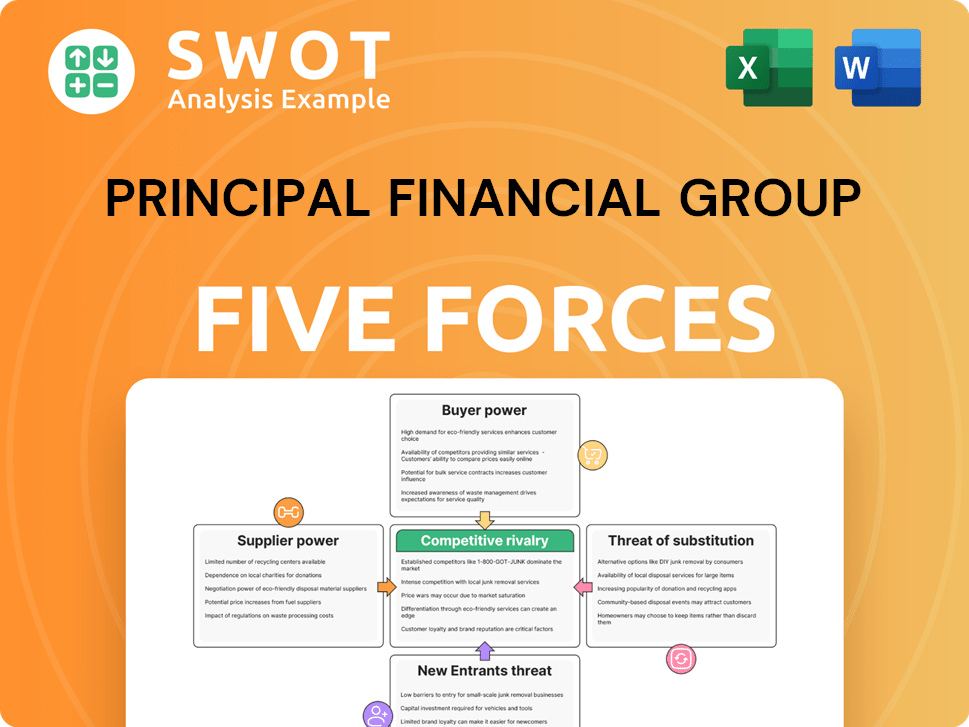

Principal Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Principal Financial Group Company?

- What is Growth Strategy and Future Prospects of Principal Financial Group Company?

- How Does Principal Financial Group Company Work?

- What is Sales and Marketing Strategy of Principal Financial Group Company?

- What is Brief History of Principal Financial Group Company?

- Who Owns Principal Financial Group Company?

- What is Customer Demographics and Target Market of Principal Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.