Principal Financial Group Bundle

How Does Principal Financial Group Thrive in a Competitive Market?

Principal Financial Group's success hinges on its robust sales and marketing strategy, a crucial element in the financial services industry. Their sustained focus on 'retirement readiness' and financial well-being has allowed them to differentiate themselves, especially with an aging global population. This strategic emphasis has shaped their trajectory, solidifying their position as a trusted financial partner and driving growth.

Founded in 1879, Principal Financial Group has evolved from a niche insurance provider to a global leader. This transformation highlights the adaptability of their sales and marketing approach, a key component of their overall Principal Financial Group SWOT Analysis. Understanding the intricacies of their sales strategy and marketing strategy is crucial for appreciating their enduring success. The company's ability to navigate the complex financial landscape and effectively deliver its products and services to a diverse customer base is a testament to its strategic foresight and innovative marketing tactics. Examining Principal Financial sales and marketing efforts provides valuable insights for anyone interested in financial services marketing.

How Does Principal Financial Group Reach Its Customers?

The sales and marketing strategy of Principal Financial Group relies on a multi-channel approach to reach its diverse customer base. This strategy combines direct sales efforts with a robust network of intermediaries and digital platforms. The aim is to provide a comprehensive customer experience and expand market penetration across various segments.

Principal Financial Group's sales strategy is designed to cater to a wide array of clients, from individuals to businesses and institutional investors. The company's marketing strategy focuses on building strong client relationships and offering tailored financial solutions. This approach is supported by continuous investment in digital capabilities to ensure a seamless customer experience.

The company's sales strategy includes direct sales teams, such as financial advisors and consultants, who work directly with clients. This allows for personalized financial planning and the development of customized solutions. For instance, dedicated sales professionals often consult with employers to set up and manage retirement plans. This direct approach is crucial for building strong client relationships and understanding specific financial needs.

Principal Financial Group employs financial advisors and consultants who work directly with clients. These professionals provide personalized financial planning and tailored solutions. This direct interaction helps build strong client relationships.

Principal Financial Group leverages a network of independent financial advisors and brokers. This wholesale distribution model expands the company's reach. Partnerships are key to expanding market penetration in specific segments.

The company utilizes its website and digital platforms for sales and customer service. Clients can access information and manage accounts online. Digital channels are increasingly important for customer engagement.

Principal Financial Group aims for a seamless customer experience across all channels. This includes in-person, phone, and online interactions. Enhanced digital adoption is a key strategic shift.

In addition to direct sales, Principal Financial Group utilizes intermediaries and partner relationships. This includes independent financial advisors, brokers, and consultants who recommend the company's products to their clients. Digital platforms are also increasingly important sales channels, allowing clients to access information and manage their accounts online. The evolution of these channels reflects a strategic shift towards enhanced digital adoption and omnichannel integration. For further insights into the company's structure, you can read more about the Owners & Shareholders of Principal Financial Group.

Principal Financial Group's sales strategy includes direct sales, intermediaries, and digital platforms. The company focuses on building strong client relationships through personalized financial planning. Digital capabilities are continuously enhanced to provide a seamless customer experience.

- Direct Sales: Financial advisors and consultants.

- Intermediaries: Independent financial advisors and brokers.

- Digital Platforms: Website and online portals for sales and service.

- Omnichannel Approach: Seamless customer experience across all channels.

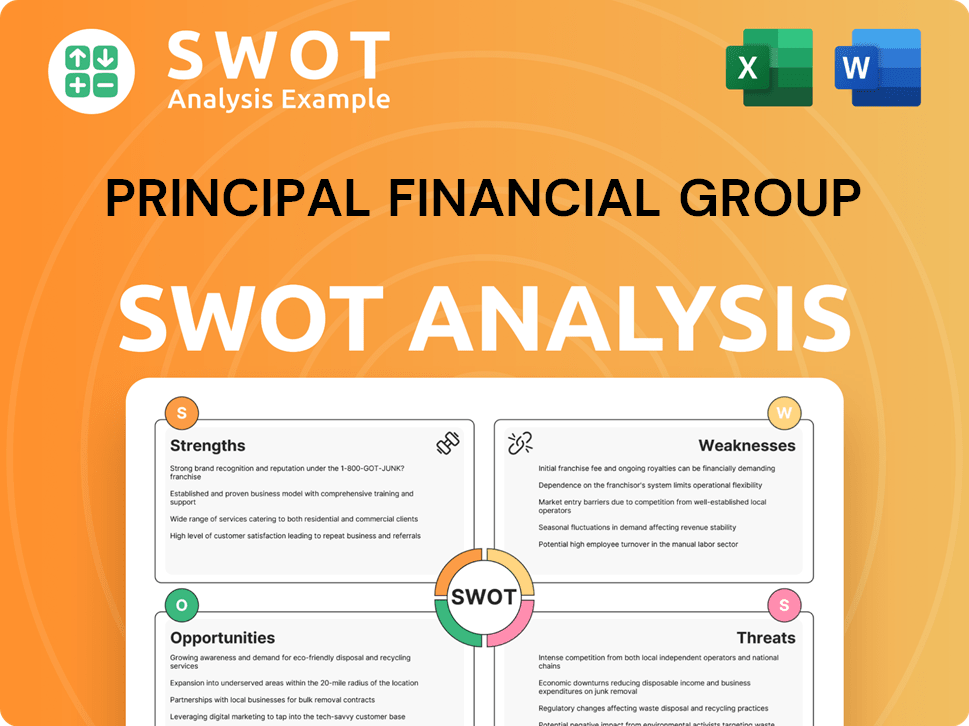

Principal Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Principal Financial Group Use?

The marketing tactics employed by Principal Financial Group are designed to boost brand awareness, generate leads, and drive sales across its diverse financial products and services. Their approach combines digital and traditional methods, focusing on customer engagement and personalized communication. A key element of their strategy is content marketing, which positions them as a thought leader in the financial industry.

Principal Financial Group's marketing strategy leverages digital platforms extensively. This includes content marketing, SEO, and paid advertising. Email marketing is also a key tactic for nurturing leads and communicating with existing clients. They also use traditional media to reinforce brand presence, which may include print advertisements.

Data-driven marketing is sophisticated at Principal Financial Group, utilizing customer segmentation to tailor marketing messages and product offerings. Personalization is increasingly important, with efforts aimed at providing relevant information based on a client's financial goals and life stage. Their marketing mix has evolved with a greater emphasis on digital engagement and personalized communication, reflecting broader industry trends.

Digital marketing is a cornerstone of Principal Financial Group's strategy. This includes content marketing, SEO, and paid advertising campaigns across various digital platforms. Email marketing is also a key tactic for nurturing leads and communicating with existing clients.

Principal Financial Group frequently publishes articles, whitepapers, and webinars on topics such as retirement planning, investment strategies, and financial wellness. This content serves to educate potential clients and establish Principal as a thought leader. SEO ensures this content is discoverable.

Beyond digital, Principal utilizes traditional media channels to reinforce its brand presence. This can include print advertisements in financial publications and, to a lesser extent, potentially radio or television spots, particularly for broader brand awareness campaigns.

Principal's approach to data-driven marketing is sophisticated, utilizing customer segmentation to tailor marketing messages and product offerings to specific client needs. Personalization is increasingly important, with marketing efforts aimed at providing relevant information.

Principal invests in robust CRM systems, marketing automation platforms, and data analytics tools to track campaign performance, optimize spending, and gain deeper insights into customer behavior. The marketing mix has evolved with a greater emphasis on digital engagement.

Personalization is a key aspect of their marketing efforts, with a focus on providing relevant information and solutions based on a client's financial goals and life stage. This approach enhances customer engagement and satisfaction.

The marketing strategy of Principal Financial Group incorporates various elements to reach its target audience and achieve its sales goals. This approach includes a blend of digital and traditional marketing tactics, all geared towards building strong customer relationships and driving business growth. For more insights, see Target Market of Principal Financial Group.

- Content Marketing: Publishing articles, whitepapers, and webinars to educate and establish thought leadership.

- SEO: Ensuring content is discoverable through search engine optimization.

- Paid Advertising: Utilizing digital platforms to target specific demographics and interests.

- Email Marketing: Nurturing leads and communicating with clients through personalized updates.

- Traditional Media: Using print advertisements and other traditional channels to reinforce brand presence.

- Data-Driven Marketing: Employing customer segmentation to tailor marketing messages and product offerings.

- Personalization: Providing relevant information and solutions based on client financial goals.

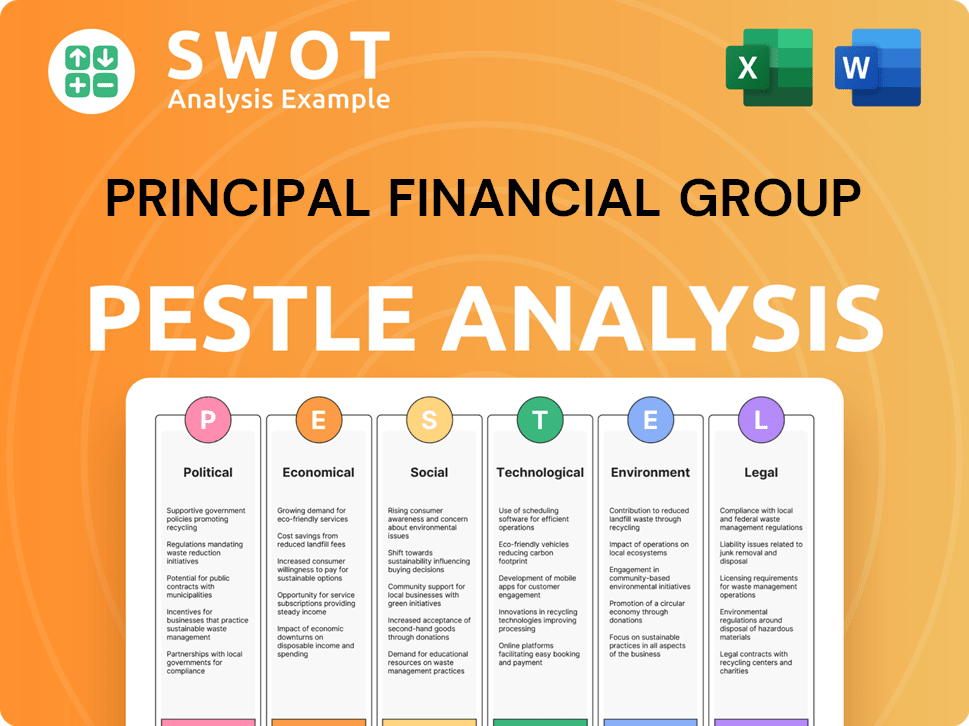

Principal Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Principal Financial Group Positioned in the Market?

The brand positioning of Principal Financial Group centers on being a trusted partner in financial well-being. This strategy emphasizes security, expertise, and a long-term commitment to clients' financial goals. The core message consistently communicates how the company helps individuals and businesses 'build, protect, and manage their financial well-being,' encompassing its comprehensive services from retirement plans to investment products and insurance solutions. This approach reinforces a sense of reliability and support across all client touchpoints.

Visually, Principal's brand identity often incorporates elements of stability and growth, using a professional and approachable color palette. The tone of voice is typically informative, empathetic, and empowering, aiming to demystify complex financial concepts. This approach aims to make financial planning accessible to a broad audience. The company's consistent industry recognition and long-standing client relationships are indicators of positive brand perception.

Principal Financial Group's brand positioning is a key element of its overall sales and marketing strategy. The company focuses on a holistic approach to financial solutions, catering to a wide spectrum of clients. This strategy includes a focus on client education and personalized guidance. The goal is to differentiate itself by offering a broad range of services.

The sales strategy emphasizes building long-term relationships with clients. Principal Financial Group's sales teams focus on understanding individual client needs. This approach is supported by a comprehensive suite of financial products and services.

The marketing strategy is built on consistent messaging and a unified brand identity. Digital marketing plays a significant role in reaching target audiences. The company uses content marketing to educate and engage potential clients.

Principal Financial Group targets a diverse audience, including individuals and businesses. The company focuses on those seeking retirement planning, investment products, and insurance solutions. This includes both individual investors and corporate clients.

Principal differentiates itself through its comprehensive offerings and global reach. The company provides a wide range of services, from retirement plans to employee benefits. This breadth of service, combined with client education, sets it apart.

Principal Financial Group utilizes digital marketing to reach its target audience. This includes search engine optimization (SEO) and social media marketing. The company also invests in content marketing to educate and engage potential clients, driving lead generation.

Customer acquisition involves a multi-channel approach. The company uses digital advertising, content marketing, and strategic partnerships. The focus is on building trust and providing valuable information to potential clients.

The sales team is structured to support both individual and institutional clients. Teams are often specialized by product or client segment. This structure allows for personalized service and expertise in specific areas.

Marketing budget allocation is strategically distributed across various channels. Digital marketing, including SEO and social media, receives significant investment. The budget also supports content creation and brand-building initiatives.

Lead generation tactics include content marketing, webinars, and online advertising. The company uses data analytics to optimize lead generation efforts. These tactics aim to attract and nurture potential clients.

Social media marketing is used to engage with potential clients and share valuable content. The company uses platforms like LinkedIn, Facebook, and Twitter. Social media campaigns are designed to build brand awareness and generate leads.

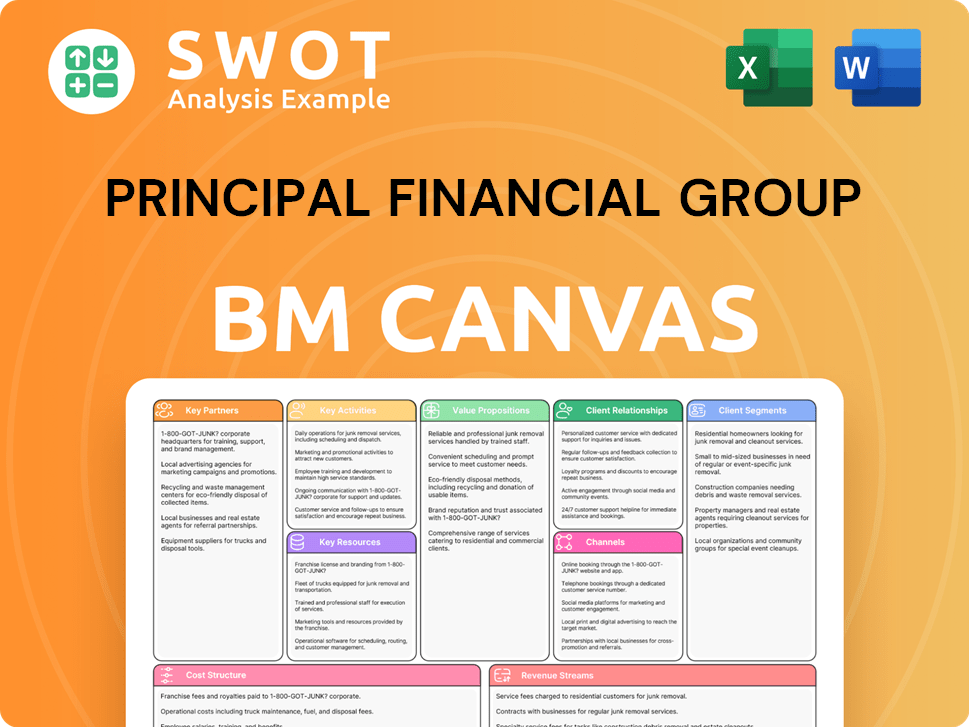

Principal Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Principal Financial Group’s Most Notable Campaigns?

The sales and marketing strategy of Principal Financial Group (PFG) centers on campaigns designed to reinforce its brand and drive business growth. These campaigns often highlight themes like retirement readiness and financial security. A core objective is to educate the market about the importance of long-term financial planning and to showcase its comprehensive solutions.

Principal's campaigns typically use a mix of digital channels, including targeted online advertisements, social media content, and email marketing, along with traditional methods. The creative concept often features relatable individuals or small businesses achieving their financial goals with Principal's support. This approach helps build trust and demonstrate the practical benefits of their financial products and services.

The success of these campaigns is measured by sales lift, increased engagement, website traffic, and lead generation. The company also engages with financial experts and thought leaders to bolster its credibility. For more insights into the broader financial landscape, you can explore the Revenue Streams & Business Model of Principal Financial Group.

The sales strategy emphasizes building relationships and providing tailored financial solutions. This approach is particularly important in the B2B sector. Principal Financial sales teams focus on understanding the unique needs of businesses and individuals.

The marketing strategy integrates digital and traditional channels to reach a wide audience. Digital marketing includes targeted ads, social media, and content marketing. Traditional methods involve industry publications and events.

Key campaign themes often revolve around retirement planning and financial security. These campaigns aim to educate potential clients about the importance of long-term financial planning. The goal is to position the company as a trusted advisor.

Digital marketing tactics include search engine optimization (SEO), pay-per-click (PPC) advertising, and social media engagement. These tactics help drive traffic and generate leads. The company also uses email marketing to nurture prospects.

Principal Financial Group uses several KPIs to measure the effectiveness of its sales and marketing efforts. These metrics help the company refine its strategies and improve results. Key metrics include sales growth, customer acquisition cost, and website traffic.

- Sales Growth: Measures the increase in revenue from sales.

- Customer Acquisition Cost (CAC): The cost to acquire a new customer.

- Website Traffic: The number of visitors to the company's website.

- Lead Generation: The number of potential customers generated through marketing efforts.

- Customer Retention Rate: The percentage of customers who stay with the company.

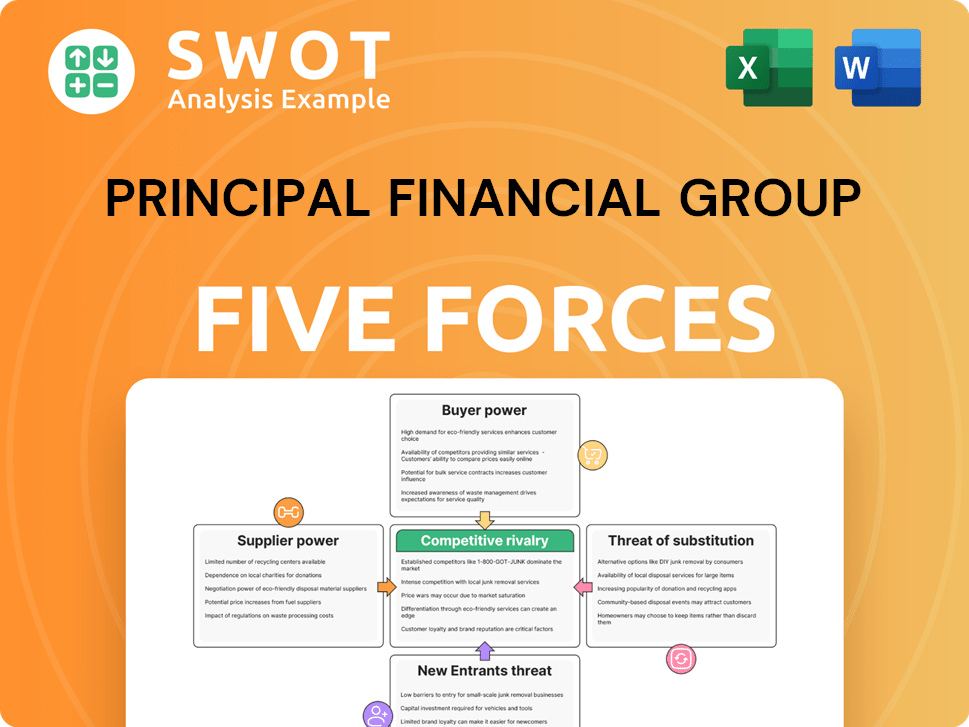

Principal Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Principal Financial Group Company?

- What is Competitive Landscape of Principal Financial Group Company?

- What is Growth Strategy and Future Prospects of Principal Financial Group Company?

- How Does Principal Financial Group Company Work?

- What is Brief History of Principal Financial Group Company?

- Who Owns Principal Financial Group Company?

- What is Customer Demographics and Target Market of Principal Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.