QuinStreet Bundle

Can QuinStreet Maintain Its Edge in a Crowded Market?

In the fast-paced world of digital marketing, understanding the competitive landscape is crucial for success. QuinStreet, a prominent player since 1999, has established itself by connecting consumers with service providers. This analysis dives deep into the QuinStreet SWOT Analysis, examining its rivals and the strategies that define its position in the market.

This exploration of the QuinStreet competitive landscape will provide a detailed QuinStreet market analysis, examining its key competitors and the dynamics shaping the QuinStreet industry. We'll dissect QuinStreet's business model and its recent performance, offering insights into its strengths and weaknesses relative to its rivals. The goal is to equip you with a clear understanding of QuinStreet's position and future prospects in the lead generation space.

Where Does QuinStreet’ Stand in the Current Market?

The company's core operations revolve around performance-based marketing, primarily connecting consumers with service providers through online marketplaces. This model focuses on generating leads and driving conversions for businesses, with the company earning revenue based on the results achieved. Key verticals include insurance, loans, credit cards, education, and home improvement, reflecting a diverse portfolio designed to capture various market opportunities.

The value proposition of the company lies in its ability to deliver qualified leads and customers to businesses, optimizing their marketing spend by only charging for actual performance. This approach allows businesses to focus on their core competencies while the company handles the lead generation process. Its sophisticated matching algorithms and extensive publisher network provide a competitive advantage, particularly in the insurance and financial services sectors.

The company's market position is notably strong, especially in the financial services and home services sectors. While specific market share data for the exact niche is not always available in broad industry reports, the company's consistent revenue and strategic moves indicate a significant presence. For the fiscal year 2023, the company reported total revenue of $370.4 million, demonstrating its scale compared to many online marketing firms.

The company primarily operates within the United States, serving a wide range of clients, from large national brands to smaller, specialized service providers. A key focus is on higher-value customer acquisitions and expansion into more resilient sectors, particularly financial services.

The company's financial health, as demonstrated by its revenue and profitability, suggests a robust scale compared to the industry average for online marketing firms. The company's ability to generate consistent revenue is a key indicator of its market strength.

The company exhibits a strong position in the insurance and financial services lead generation markets. Its sophisticated matching algorithms and extensive publisher network provide a competitive edge. The company's strategic approach to lead generation sets it apart.

The company's primary geographic focus is the United States. Its operations are concentrated within the U.S. market, serving a diverse customer base. This focused approach allows for deep market penetration.

The company's strengths include its strong position in the insurance and financial services lead generation markets and its technology platform. Its weaknesses might include dependence on specific sectors and vulnerability to economic fluctuations.

- Strengths: Strong market position, sophisticated technology, and a focus on performance-based marketing.

- Weaknesses: Dependence on specific sectors, potential for increased competition, and sensitivity to economic downturns.

- Opportunities: Expansion into new markets, strategic partnerships, and innovation in lead generation technologies.

- Threats: Increased competition, changes in consumer behavior, and regulatory changes.

The competitive landscape for the company includes various players in the lead generation and online marketing space. Understanding the Brief History of QuinStreet can provide additional context to its market position. Key competitors vary depending on the specific vertical, but generally include other performance marketing companies, lead aggregators, and digital marketing agencies. The company's ability to maintain its market position depends on its ability to adapt to changing market dynamics and innovate within the lead generation space. The firm's focus on financial services and home services provides a degree of stability, but the competitive landscape requires constant monitoring and strategic adjustments.

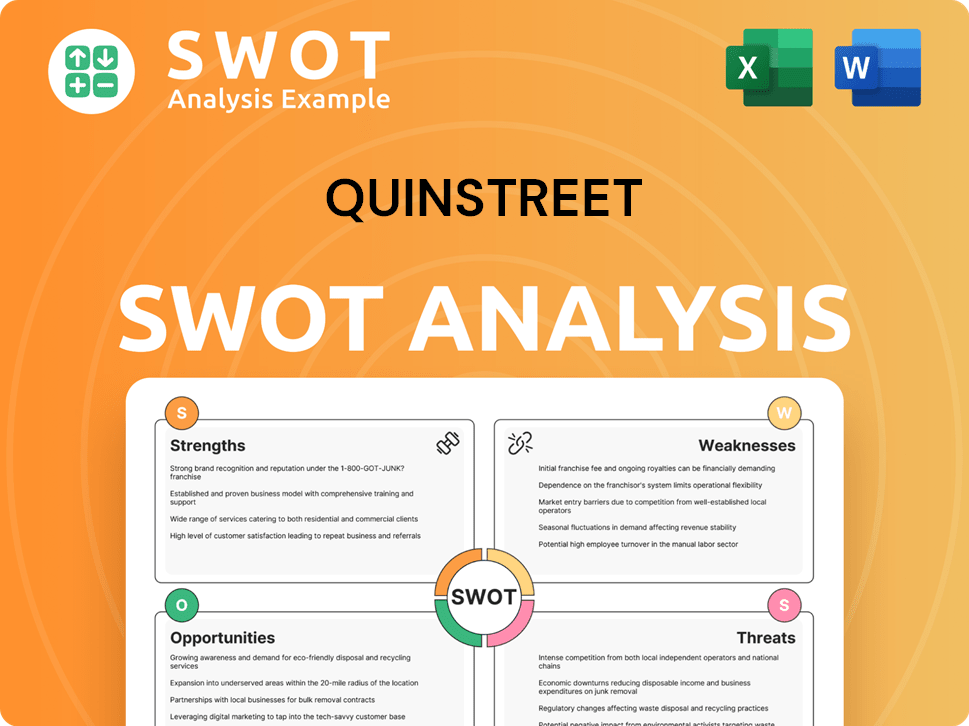

QuinStreet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging QuinStreet?

The Revenue Streams & Business Model of QuinStreet operates within a dynamic digital marketing environment, facing both direct and indirect competition. Understanding the QuinStreet competitive landscape is crucial for assessing its market position and growth potential. This analysis involves evaluating both direct rivals, such as performance-based marketing companies, and indirect competitors, including large advertising platforms.

The QuinStreet industry is characterized by rapid changes, influenced by technological advancements and evolving consumer behavior. Market analysis reveals that the competitive environment is shaped by factors like lead quality, conversion rates, and specialization in specific vertical markets. The company's success hinges on its ability to outperform competitors through superior strategies and innovative approaches.

QuinStreet's market analysis shows a complex interplay of direct and indirect competitors. Direct competitors often include lead generation firms and performance-based marketing companies that focus on similar sectors. Indirect competitors, such as Google and Meta, offer broad advertising platforms. The competitive landscape also includes traditional advertising agencies and media companies.

Direct competitors are companies that offer similar services, such as lead generation and performance-based marketing. These firms often specialize in specific industries, competing directly for market share. The competitive dynamics involve factors like lead quality and conversion rates.

In the financial services sector, EverQuote and SelectQuote are prominent players. In education, EducationDynamics is a key competitor. These companies directly compete with QuinStreet for customers and market share.

Indirect competitors include advertising platforms and traditional media companies. These entities compete by offering alternative ways for businesses to acquire customers. They often have broader reach and sophisticated targeting capabilities.

Google and Meta are major players in the advertising space, offering extensive reach and targeting options. Traditional advertising agencies also compete for marketing budgets. These competitors impact QuinStreet's market share.

QuinStreet's business model often involves outperforming competitors through superior lead quality and conversion rates. A deeper understanding of specific vertical markets is also key. The company focuses on providing value to clients.

The market is influenced by mergers and acquisitions, which can consolidate market power. New players continually emerge, often through niche specialization or innovative technology. These factors shape the competitive environment.

The QuinStreet competitive landscape is shaped by several key factors. These include lead quality, conversion rates, and specialization in specific vertical markets. The ability to adapt to market changes is also crucial for success. Understanding these factors is essential for effective market analysis.

- Lead Quality: Providing high-quality leads is essential for attracting and retaining clients.

- Conversion Rates: Improving conversion rates is a key metric for assessing performance.

- Vertical Market Specialization: Focusing on specific industries allows for deeper market understanding.

- Technological Innovation: Utilizing AI and other technologies to improve lead qualification.

- Customer Acquisition Cost: Managing customer acquisition costs is critical for profitability.

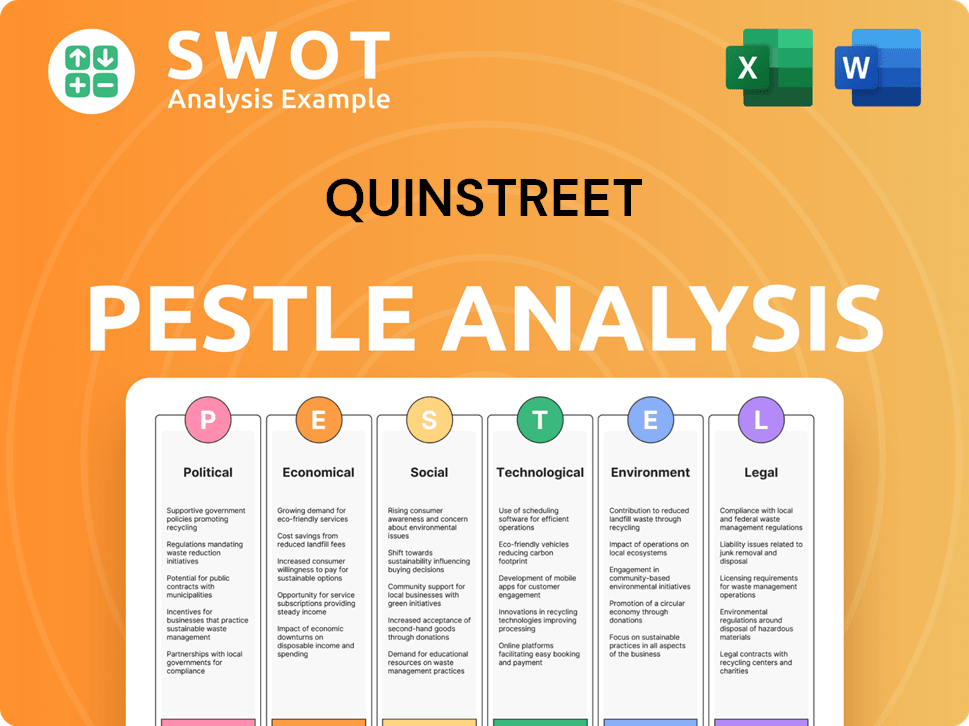

QuinStreet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives QuinStreet a Competitive Edge Over Its Rivals?

Analyzing the QuinStreet competitive landscape reveals key advantages. The company leverages its proprietary technology, sophisticated algorithms, and machine learning to optimize lead generation and customer matching processes. This focus on technology ensures high-quality leads and improves the return on investment for clients.

A significant strength for QuinStreet is its extensive data assets, accumulated over two decades. This data provides insights into consumer behavior, market trends, and advertiser performance, allowing for continuous refinement of targeting and matching capabilities. This data-driven approach is a key differentiator in the QuinStreet industry. Furthermore, strong relationships with publishers and advertisers create a robust ecosystem, enhancing reach and effectiveness.

QuinStreet's business model emphasizes performance-based pricing, aligning its success with that of its clients. This approach, combined with its technological and data advantages, positions the company well within the lead generation market. Understanding the QuinStreet competitors and their strategies is crucial for sustained success.

QuinStreet's core advantage lies in its proprietary technology. Sophisticated algorithms and machine learning optimize lead generation and customer matching, ensuring high-quality leads. This technology enables efficient connections between consumers and service providers, boosting conversion rates.

QuinStreet has accumulated significant data over two decades. This data provides insights into consumer behavior, market trends, and advertiser performance. This data-driven approach allows for continuous refinement of targeting and matching capabilities, giving it a competitive edge.

QuinStreet has cultivated strong relationships with a wide network of publishers and advertisers. This robust ecosystem enhances reach and effectiveness. These relationships are crucial for maintaining a strong presence in the lead generation market.

QuinStreet uses performance-based pricing models. This aligns its success with that of its clients, creating a mutually beneficial relationship. This strategy incentivizes QuinStreet to deliver high-quality leads and maximize client ROI.

QuinStreet gains a competitive edge through its proprietary technology, extensive data, and strong industry relationships. These factors enable the company to deliver high-quality leads and achieve strong performance. Analyzing the Growth Strategy of QuinStreet further clarifies these advantages.

- Proprietary technology and algorithms for lead generation.

- Vast data assets accumulated over two decades.

- Strong relationships with publishers and advertisers.

- Performance-based pricing models.

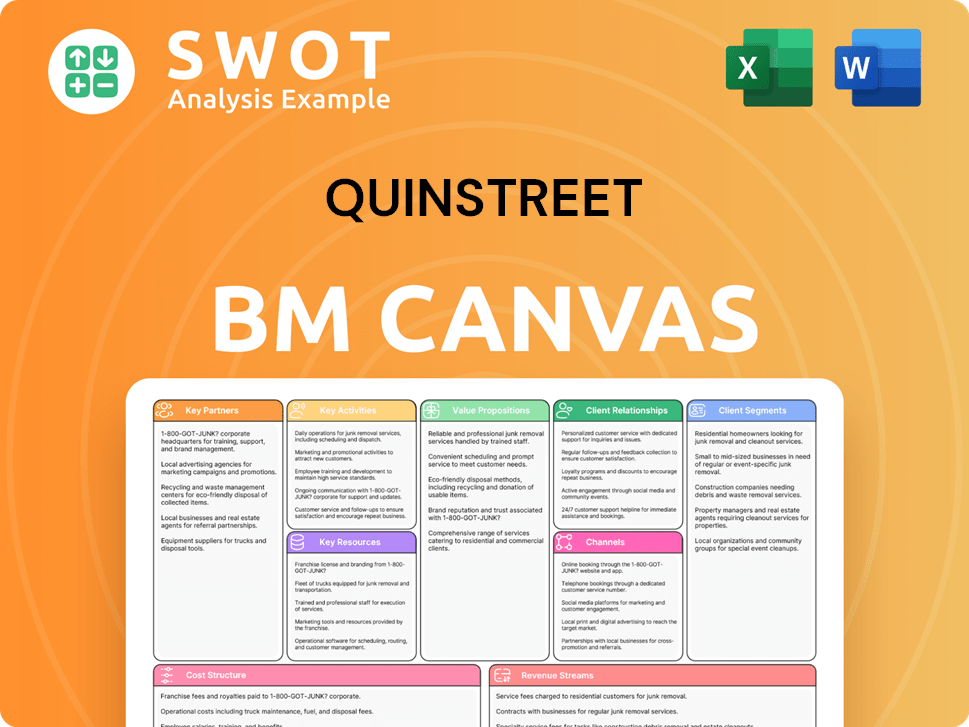

QuinStreet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping QuinStreet’s Competitive Landscape?

The Marketing Strategy of QuinStreet is significantly influenced by the evolving industry trends, future challenges, and opportunities within the performance marketing and lead generation sectors. Understanding the competitive landscape, including key players and market dynamics, is crucial for assessing the company's position and potential for growth. This analysis considers the interplay of technological advancements, regulatory changes, and shifts in consumer behavior that shape QuinStreet's strategic outlook.

QuinStreet's competitive landscape is dynamic, with varying degrees of competition across different verticals. While the company has established itself in several key areas, factors such as technological innovation and regulatory compliance pose ongoing challenges. The future outlook for QuinStreet involves adapting to changes, leveraging its strengths, and exploring new opportunities to maintain and enhance its market position.

Technological advancements, especially in AI and machine learning, are reshaping performance marketing. Regulatory changes, particularly regarding data privacy, demand constant adaptation. Consumer preferences are shifting towards personalized experiences and seamless digital interactions.

Increased regulatory scrutiny could increase compliance costs. New market entrants with advanced AI capabilities could disrupt traditional lead generation models. Economic downturns might reduce demand in specific verticals.

Further enhancement of AI and machine learning capabilities can improve matching and personalization. Expansion into emerging markets and new vertical segments represents growth potential. Deepening relationships with existing clients and strategic partnerships can broaden reach.

QuinStreet is likely to evolve towards a more data-intensive and AI-driven approach. The focus should be on resilience through diversification and continuous technological innovation. The company should leverage its data assets to develop new product offerings.

The competitive landscape for QuinStreet involves adapting to technological advancements and regulatory changes. The company's ability to leverage AI and machine learning is critical. Diversification and innovation are key strategies for maintaining a competitive edge.

- Data Privacy: Compliance with regulations like CCPA and potential federal laws.

- Technology: Investing in AI and machine learning to improve targeting and personalization.

- Market Expansion: Exploring new verticals and geographical markets for growth.

- Client Relationships: Strengthening ties with existing clients to increase value.

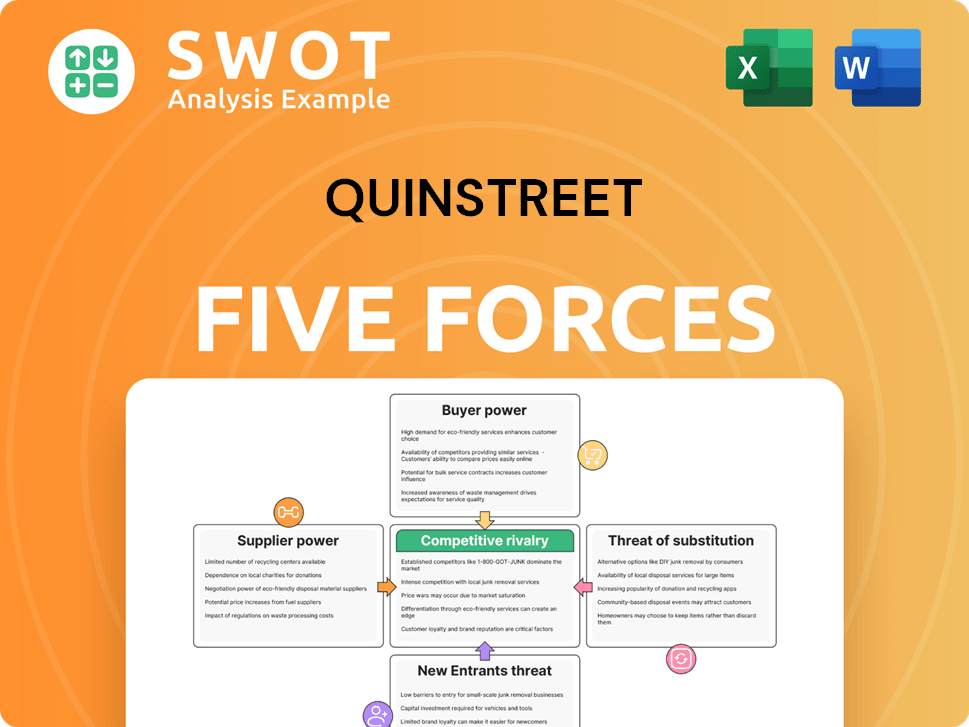

QuinStreet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QuinStreet Company?

- What is Growth Strategy and Future Prospects of QuinStreet Company?

- How Does QuinStreet Company Work?

- What is Sales and Marketing Strategy of QuinStreet Company?

- What is Brief History of QuinStreet Company?

- Who Owns QuinStreet Company?

- What is Customer Demographics and Target Market of QuinStreet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.