QuinStreet Bundle

Can QuinStreet Conquer the Future of Digital Marketing?

QuinStreet, a veteran in the digital marketing arena since 1999, has built a bridge connecting service providers with eager customers. From its Foster City, California roots, the company has evolved into a significant player, leveraging cutting-edge technology and data-driven strategies. This approach has allowed QuinStreet to establish a strong foothold in competitive sectors like financial services and education.

To understand the trajectory of this marketing powerhouse, we delve into QuinStreet's strategic roadmap. This exploration will dissect its QuinStreet SWOT Analysis, expansion plans, and technological innovations, offering a comprehensive market analysis of its current standing. We will also assess the QuinStreet company’s financial performance and potential hurdles, providing insights into its long-term viability and the QuinStreet future prospects.

How Is QuinStreet Expanding Its Reach?

The QuinStreet growth strategy is heavily focused on expansion initiatives. These initiatives aim to penetrate existing markets more deeply and diversify into new product categories. The company continually assesses opportunities to leverage its technology and platforms to meet emerging consumer needs. This approach is crucial for sustaining growth in the digital landscape.

A key aspect of QuinStreet's strategy involves strategic partnerships and potential mergers and acquisitions. These moves are designed to accelerate market entry and consolidate positions in mature markets. The goal is to access new customer segments and diversify revenue streams. While specific timelines are not always public, the company's history, including acquisitions like Insure.com, demonstrates a commitment to this strategy.

The ongoing development of product pipelines is also vital. This includes optimizing user experience and lead quality. These efforts are designed to attract and retain both consumers and service providers. This, in turn, facilitates sustained expansion. The company's focus on innovation and adaptation is critical in the dynamic online marketing industry.

QuinStreet aims to deepen its presence within existing high-value verticals. This involves refining its current offerings and increasing its reach within established markets. The company uses data analytics to understand consumer behavior and tailor its strategies accordingly. This approach allows for more effective customer acquisition and retention.

The company actively seeks to diversify its offerings by entering new product categories. This strategy reduces reliance on any single market segment. By expanding into new areas, QuinStreet aims to mitigate risks and capture new revenue streams. This approach supports long-term growth and stability.

QuinStreet explores strategic partnerships to enhance its market presence. These collaborations can provide access to new customer bases and technologies. Partnerships often involve joint marketing efforts and shared resources. This strategy helps accelerate growth and expand market reach.

Mergers and acquisitions (M&A) are a key component of QuinStreet's growth strategy. M&A activities allow the company to quickly enter new markets or consolidate its position. Acquisitions can bring in new technologies, customer bases, and revenue streams. This approach supports long-term growth and market leadership.

QuinStreet's future prospects are tied to its ability to execute its expansion initiatives effectively. The company's focus on technology, partnerships, and acquisitions is crucial. These strategies are designed to drive revenue growth and increase market share. Understanding the company's strategies is important for investors looking to understand Owners & Shareholders of QuinStreet.

- Technology: Leveraging proprietary technology for lead generation and platform development.

- Partnerships: Forming strategic alliances to expand market reach and access new resources.

- Acquisitions: Acquiring companies to enter new markets and consolidate existing ones.

- Product Development: Continuously improving product offerings to enhance user experience and lead quality.

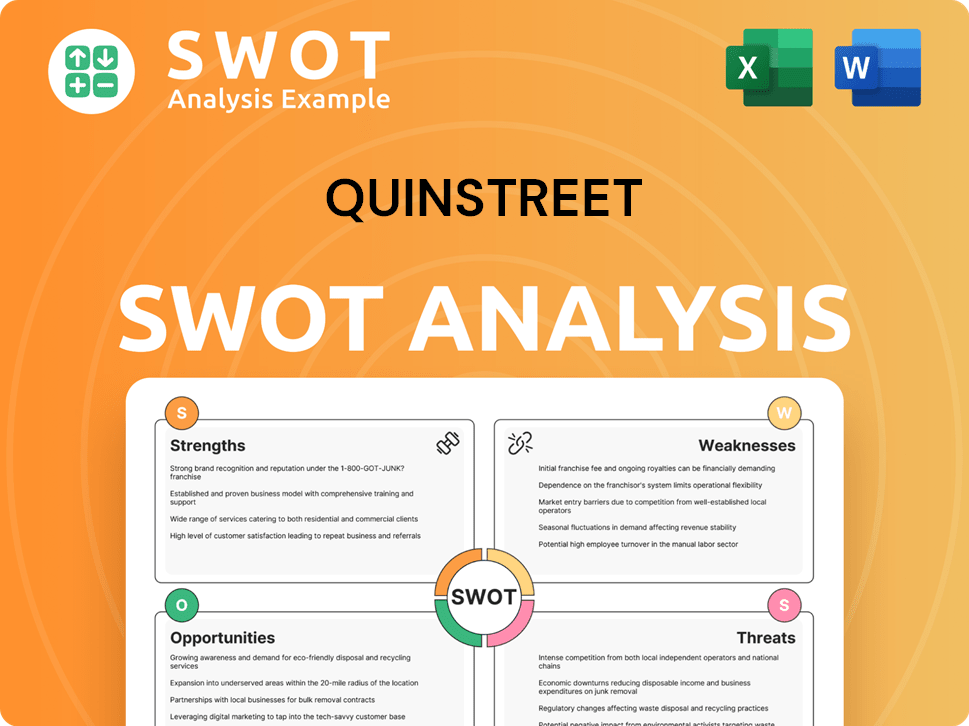

QuinStreet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does QuinStreet Invest in Innovation?

The QuinStreet growth strategy heavily relies on innovation and technology. The company consistently invests in research and development to enhance its proprietary platforms. This approach is central to its ability to generate high-quality leads and connect consumers with service providers efficiently.

A core element of QuinStreet's strategy is the continuous refinement of its data analytics capabilities. This allows for more precise targeting and optimization of marketing campaigns. Advanced machine learning models predict consumer intent and optimize bid strategies in real-time, directly contributing to increased conversion rates and revenue growth.

The company's commitment to digital transformation is evident in its ongoing efforts to automate various aspects of its marketing and operational processes. This leads to improved efficiency and scalability, solidifying its position as an industry leader. The focus on technological innovation directly supports its growth objectives by improving the effectiveness of its core offerings.

QuinStreet utilizes advanced data analytics to understand consumer behavior. Machine learning models are employed to optimize marketing campaigns in real-time.

The company's strength lies in its proprietary technology stack. This includes the platforms and algorithms that drive lead generation.

Automation plays a key role in improving efficiency and scalability. This includes automating marketing and operational processes.

QuinStreet adapts quickly to market shifts. The company integrates new digital marketing channels effectively.

Continuous technological innovation is a key driver for growth. This helps improve core offerings and launch new solutions.

Technological advancements help maintain QuinStreet's position as an industry leader. This strengthens its competitive advantage.

The company's focus on technology and innovation is crucial for its QuinStreet future prospects. The company's ability to adapt and integrate new technologies is a key factor in its long-term success. For more insights, consider reading a Brief History of QuinStreet.

The company uses several strategies to drive growth, including data analytics, machine learning, and automation. These approaches enhance the efficiency of their operations and improve outcomes.

- Investing in R&D to improve proprietary platforms.

- Using advanced machine learning models to predict consumer intent.

- Automating marketing and operational processes.

- Adapting quickly to market changes and integrating new channels.

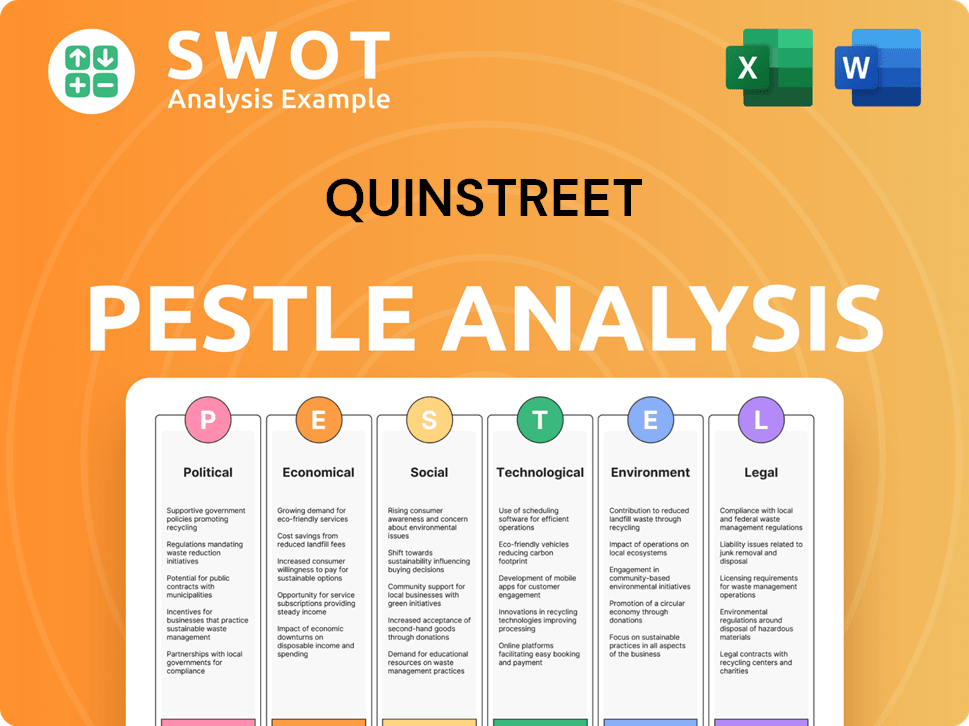

QuinStreet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is QuinStreet’s Growth Forecast?

The financial outlook for the company emphasizes sustainable growth and profitability, supported by its strong market position and technological capabilities. For the fiscal year ending June 30, 2024, the company projected total revenue to be between $500 million and $520 million. This indicates a strategic effort to balance revenue growth with healthy profit margins. The company's ability to capitalize on growing demand within its key verticals, such as financial services and home services, underpins its financial ambitions, leveraging its performance marketing expertise.

The company's financial strategy prioritizes organic growth supplemented by opportunistic acquisitions that align with its long-term objectives. The financial narrative for the company centers on leveraging its proprietary technology and market leadership to drive consistent revenue growth and expand its profitability in the competitive digital marketing landscape. The company's recent financial results and performance review show a commitment to enhancing its technology platform and supporting strategic expansion initiatives.

Historically, the company has demonstrated resilience in varying market conditions, adapting its strategies to maintain financial stability. The company's balance sheet reflects a disciplined approach to capital allocation, with investments primarily directed towards enhancing its technology platform and supporting strategic expansion initiatives. While specific funding rounds or major capital raises are not frequently disclosed given its public company status, the company's financial strategy prioritizes organic growth supplemented by opportunistic acquisitions that align with its long-term objectives.

The company's revenue projections for the fiscal year ending June 30, 2024, are set to be in the range of $500 million to $520 million. This forecast highlights the company's focus on maintaining a steady financial trajectory. Understanding these projections is key to assessing the company's Competitors Landscape of QuinStreet and its position within the market.

The company anticipates an adjusted EBITDA margin of 8% to 10% for the fiscal year ending June 30, 2024. This margin reflects the company's ability to manage costs and maintain profitability. This financial performance is crucial for understanding the company's financial performance and its ability to sustain growth.

The company focuses on key verticals such as financial services and home services, where it leverages its performance marketing expertise. These areas are crucial for the company's QuinStreet growth strategy. The company's ability to excel in these sectors will significantly impact its future prospects.

The company's capital allocation strategy prioritizes investments in its technology platform and supports strategic expansion initiatives. This approach is designed to enhance its competitive edge and foster sustainable growth. These strategic investments are essential for the company's QuinStreet future prospects.

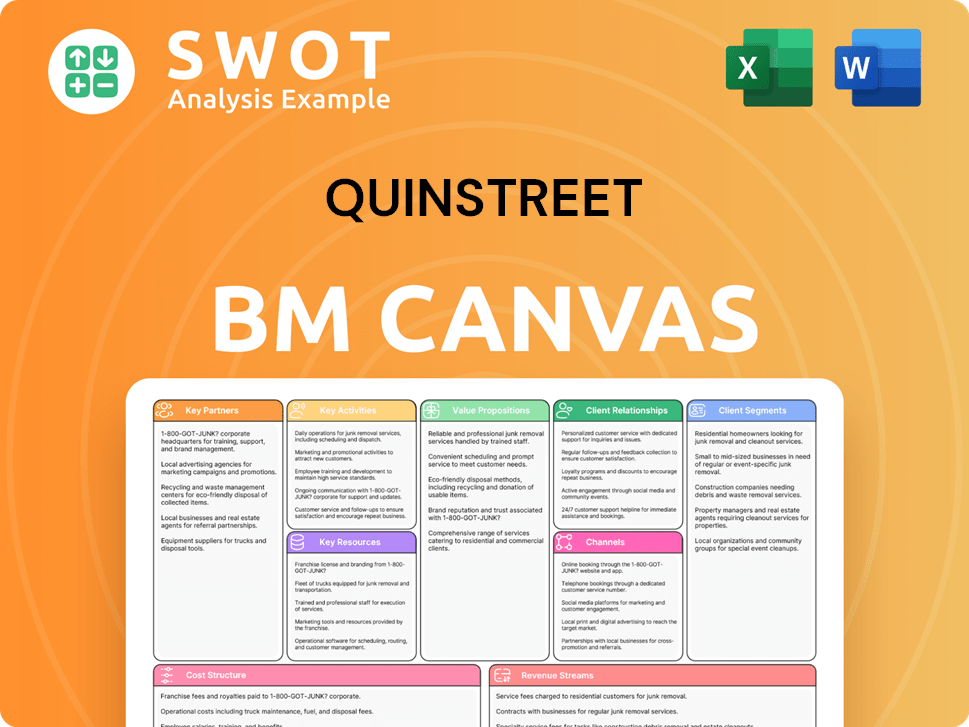

QuinStreet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow QuinStreet’s Growth?

The growth strategy of the company faces several risks and obstacles inherent in the dynamic digital marketing industry. Intense competition, regulatory changes, and technological disruptions are primary challenges. Navigating these issues is crucial for the company's future prospects and sustained financial performance.

One significant challenge is the competitive landscape. The online advertising and lead generation markets are crowded, which can impact pricing, client acquisition, and retention. Furthermore, compliance with evolving data privacy regulations poses a considerable risk, potentially increasing operational costs and limiting data utilization. Understanding the Marketing Strategy of QuinStreet is essential for investors.

Technological advancements, particularly in AI and marketing automation, could render existing methodologies less effective if the company fails to innovate. Reliance on a concentrated base of large service providers for revenue also creates vulnerability. The company addresses these risks through continuous investment in proprietary technology, diversification of its client base, and proactive regulatory monitoring.

The company operates in a highly competitive market. Numerous players compete for market share in online advertising and lead generation, impacting pricing and client retention. This competitive pressure necessitates continuous innovation and strategic adaptation.

Changes in data privacy and online advertising regulations pose a significant risk. New regulations could lead to higher operational costs and limit data utilization, affecting the effectiveness of targeted marketing strategies. Compliance is crucial for sustaining operations.

Rapid advancements in AI and other marketing technologies present an ongoing concern. If the company fails to innovate at a comparable pace, existing platforms could become less effective. Staying ahead of technological trends is vital for long-term growth.

Reliance on a concentrated base of large service providers can create vulnerability. If key clients reduce their marketing spend or switch to alternative solutions, it could negatively impact revenue. Diversifying the client base mitigates this risk.

Economic downturns can affect marketing budgets. During economic uncertainty, clients may reduce their marketing spending, impacting revenue and profitability. The company needs to adapt its strategies to navigate economic fluctuations.

Data security breaches can damage the company's reputation and lead to financial losses. Protecting sensitive client data is crucial. Robust security measures and proactive risk management are essential to prevent breaches.

The company mitigates these risks through continuous investment in its proprietary technology, aiming to maintain a competitive edge. Diversifying its client base across various industries reduces reliance on any single client or sector. Actively monitoring the regulatory landscape ensures compliance and allows for proactive adjustments.

The company employs robust risk management frameworks to assess and prepare for potential market shifts and operational challenges. This includes identifying potential risks, assessing their impact, and developing strategies to minimize their effects. This proactive approach supports agility and resilience in the growth trajectory.

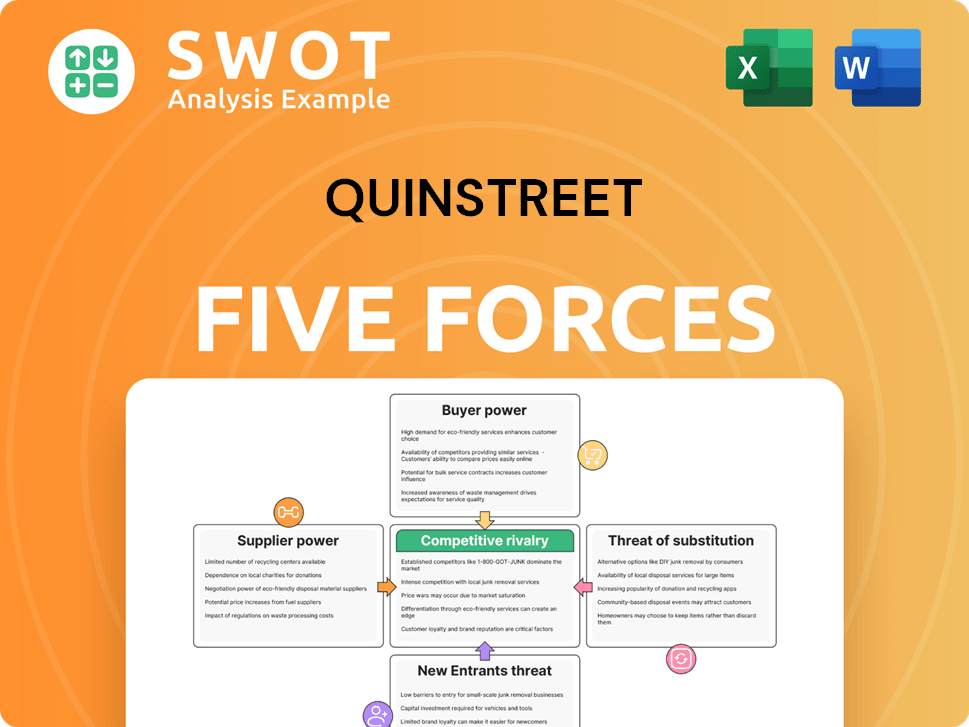

QuinStreet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QuinStreet Company?

- What is Competitive Landscape of QuinStreet Company?

- How Does QuinStreet Company Work?

- What is Sales and Marketing Strategy of QuinStreet Company?

- What is Brief History of QuinStreet Company?

- Who Owns QuinStreet Company?

- What is Customer Demographics and Target Market of QuinStreet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.