QuinStreet Bundle

Who Does QuinStreet Serve in the Digital Landscape?

Delving into QuinStreet SWOT Analysis is just the start; understanding its customer demographics and target market is crucial for grasping its strategic positioning. In an era dominated by performance-driven marketing, QuinStreet's ability to connect businesses with consumers hinges on a deep understanding of its audience. This exploration will reveal the core of QuinStreet's success: its ability to adapt and thrive in the ever-evolving digital environment.

This analysis provides a comprehensive market analysis of QuinStreet's customer base, focusing on its target market and consumer profile. We'll examine the company's audience segmentation strategies, including demographic data of QuinStreet users, to determine the ideal customer profile. Furthermore, we'll explore how QuinStreet identifies its target market, considering factors like geographic location, income, and interests, to understand its market reach and demographics.

Who Are QuinStreet’s Main Customers?

Understanding the Growth Strategy of QuinStreet requires a close look at its primary customer segments. QuinStreet operates in both the B2C and B2B sectors, focusing on customer acquisition for clients in high-value markets. The company's main customer groups are concentrated within the financial services and home services industries.

The customer demographics for QuinStreet are largely defined by the industries it serves. This includes a broad range of consumers and businesses seeking financial products, insurance, and home services. The company's target market is therefore segmented by the specific needs and characteristics of these industries.

A key aspect of QuinStreet's market analysis involves understanding the revenue distribution across its client verticals. This segmentation helps to identify the most profitable areas and adapt strategies accordingly.

The financial services client vertical is the largest revenue source for QuinStreet. In the third quarter of fiscal year 2025, it accounted for 74% of net revenue. This is a significant increase from 58% in the same period of 2023, indicating a shift in revenue concentration towards financial services.

The home services client vertical is another significant segment. It represented 24% of net revenue in the third quarter of fiscal year 2025. This sector provides a substantial portion of QuinStreet's overall revenue.

Other revenue streams, including performance marketing agency and technology services, contributed a smaller portion of net revenue. These segments accounted for 2% and 1% of net revenue in the same period, respectively.

Within financial services, auto insurance has been a significant growth driver. Revenue in this area increased by 165% year-over-year in the third quarter of fiscal year 2025. This highlights the company's focus on high-growth areas.

QuinStreet's client portfolio, as of 2024, includes the education sector (42.3%), financial services (33.7%), and technology (24%). This demonstrates a diverse reach beyond its primary revenue drivers and provides insights into its consumer profile.

- The target market analysis reveals a strong emphasis on financial services and home services.

- The company's audience segmentation strategy focuses on these high-value, information-intensive markets.

- Auto insurance is a major growth area within financial services.

- QuinStreet's client base also includes education and technology sectors.

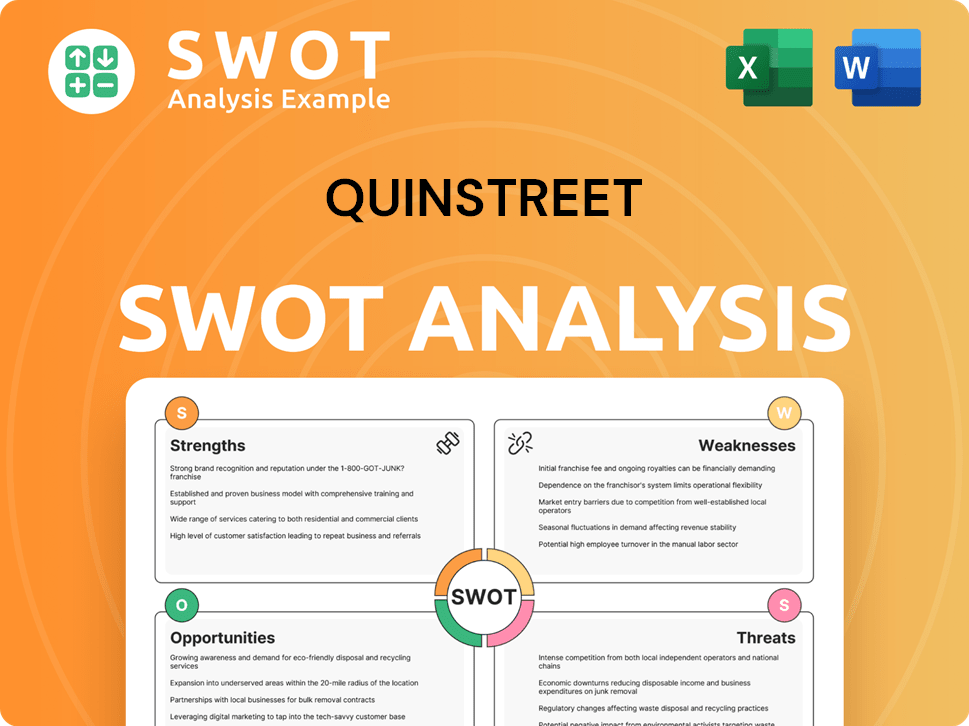

QuinStreet SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do QuinStreet’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and this is especially true for companies like QuinStreet. Their ability to effectively serve both consumers and businesses hinges on a deep understanding of what drives their respective behaviors. This involves recognizing the distinct motivations and requirements that shape their interactions with the platform.

For consumers, the focus is on making informed decisions, often in complex areas like financial services and home services. They seek tools and information to compare options and find the best solutions. For businesses, the primary goal is efficient and cost-effective customer acquisition, seeking measurable results from their marketing efforts.

The company addresses these needs by offering a streamlined process for comparing brands and leveraging its technology to generate high-intent digital traffic. By tailoring product features and marketing efforts to specific client needs, the company ensures it meets the demands of both consumers and businesses effectively. This customer-centric approach is key to QuinStreet's strategy.

Consumers use the company's platforms to research and compare products and services. They seek information to make informed decisions, focusing on areas like financial services and home services. This behavior is driven by the need to find the best deals and solutions.

Businesses use the platform to acquire new customers efficiently and cost-effectively. They seek measurable online marketing results, such as qualified leads and new customers. The company helps businesses overcome the challenges of customer acquisition.

The company tailors its product features and marketing efforts to specific client needs within its verticals. This allows clients to access targeted media and segment consumers effectively. This approach ensures that both consumers and businesses receive relevant and valuable services.

Feedback and market trends, such as increased demand in the auto insurance sector, directly influence the company's product development. This responsiveness to market dynamics ensures the company remains relevant and competitive. The company adapts to changing consumer and business needs.

The company offers a streamlined process for consumers to compare brands and make informed decisions. This ease of use is a key factor in attracting and retaining consumers. The platforms are designed to simplify complex purchasing decisions.

The company leverages its technology and marketing strategies to generate high-intent digital traffic. This ensures that businesses receive qualified leads and potential customers. This focus on quality traffic is crucial for business success.

The company's success hinges on its ability to understand and cater to the diverse needs of its customers. This involves a dual approach: providing consumers with tools for informed decision-making and offering businesses efficient customer acquisition solutions. This strategic focus has allowed the company to adapt to market changes and maintain a competitive edge.

- Consumer Focus: Providing platforms that offer research, comparison, and selection tools, particularly in complex areas like financial services and home services.

- Business Focus: Offering efficient and cost-effective customer acquisition solutions, focusing on generating qualified leads and new customers through targeted marketing efforts.

- Technology and Data: Leveraging proprietary technology and data analytics to understand customer behavior, optimize marketing campaigns, and deliver personalized experiences.

- Market Responsiveness: Adapting to market trends and customer feedback, such as increased demand in the auto insurance sector, to refine product development and strategic focus.

- Strategic Partnerships: Collaborating with various providers and businesses to expand service offerings and reach a wider audience.

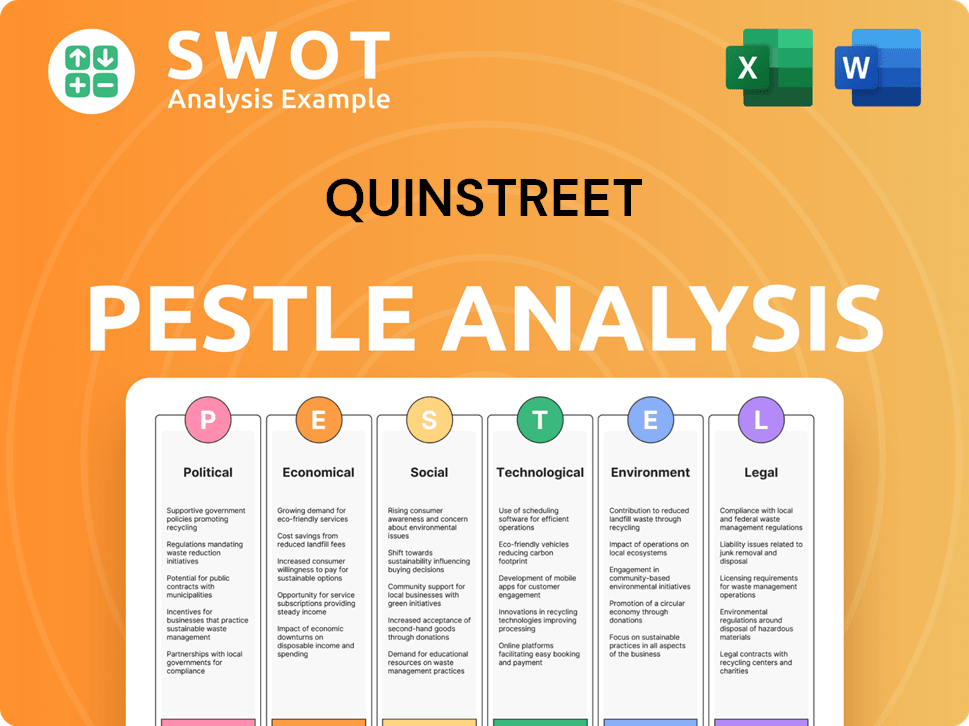

QuinStreet PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does QuinStreet operate?

The geographical market presence of the company is heavily concentrated in the United States. A significant portion of its revenue is derived from sales within the U.S. market, making it the primary focus of its operations. This strong U.S. presence is a key characteristic of its market strategy.

For the three months ending March 31, 2025, the company's U.S. net revenue was $266.2 million. Over a longer period, the nine months ending March 31, 2025, saw U.S. net revenue reach $822.2 million. International revenue is considerably smaller, highlighting the dominance of the U.S. market in its financial performance.

The company's digital distribution strategy emphasizes North American markets, with 98.6% market coverage. Within North America, the United States is the primary market, with Canada as a secondary focus. The company's digital presence penetration within the North American region is 92.4%. While the company's core operations are in North America, its technology platform allows it to adapt its services to foreign clients' preferences and customs, although international revenue remains a smaller portion of the business.

The United States is the primary geographical market for the company, generating the vast majority of its revenue. This strong focus on the U.S. market is evident in its financial results. The company's strategic decisions and resource allocation are heavily influenced by its performance within the U.S.

International revenue represents a smaller portion of the company's overall revenue. While the company has a digital platform that can adapt to foreign markets, its primary focus remains on North America. The company's international revenue for the three months ended March 31, 2025, was $3.7 million.

The company's digital distribution strategy places a strong emphasis on the North American market. The company has a significant market presence in the region. This strategic focus is reflected in its market coverage and penetration rates.

The company has a high level of market penetration within North America, with 92.4% digital presence penetration. The company's North American market coverage is 98.6%. This indicates a strong presence and reach within the target market.

The company's ongoing efforts to expand into new insurance and financial services categories, as well as broadening offerings in home services and personal loans, suggest a continued focus on expanding within existing and related markets. This strategic direction aims to leverage its current market position and customer base. For more insights into the company's growth strategy, consider reading about the Growth Strategy of QuinStreet.

- Expansion into new service categories.

- Focus on home services and personal loans.

- Leveraging current market position.

- Strategic growth within existing and related markets.

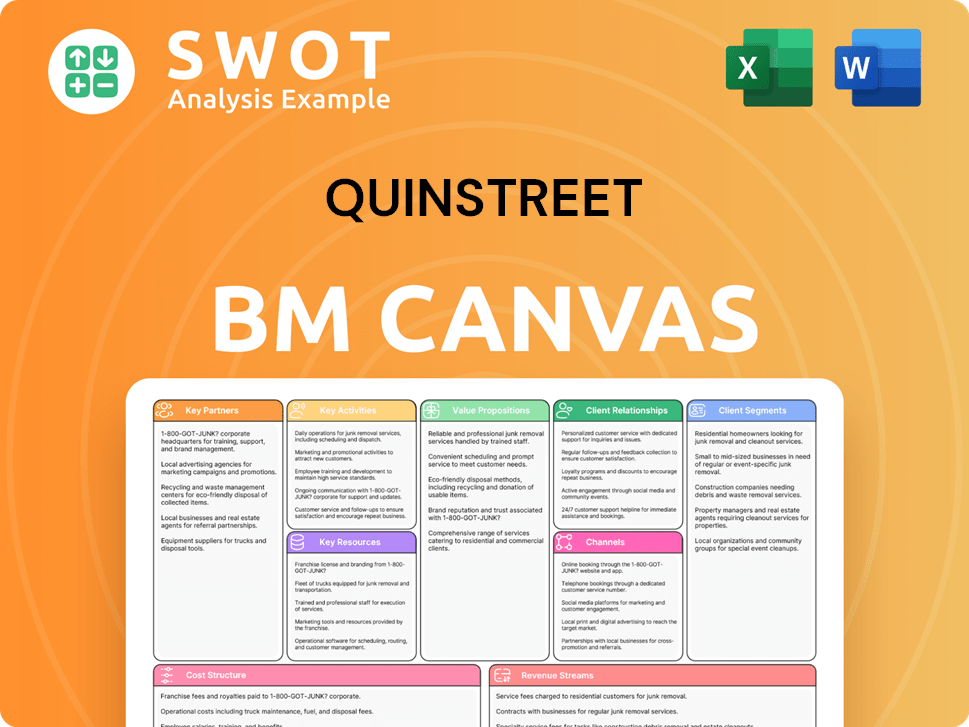

QuinStreet Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does QuinStreet Win & Keep Customers?

Customer acquisition and retention are critical components of [Company Name]'s business strategy. The company leverages its proprietary technology and a performance-based marketing model to attract and retain customers. Its approach focuses on delivering measurable results and building long-term relationships with clients seeking leads.

The company utilizes the QuinStreet Media Platform (QMP) to connect clients with high-intent digital traffic. This platform enables customer acquisition through various channels, including search engine marketing (SEM), search engine optimization (SEO), social media, mobile, email, and call centers. This multi-channel approach allows for reaching a broad audience within the target market.

The company's strategy includes a focus on optimizing media efficiencies and client results, especially in auto insurance. The company also prioritizes compliance with data privacy and security regulations, which is vital for maintaining client trust and long-term relationships. Furthermore, the company invested in data analytics and machine learning technologies to enhance marketing optimization.

The company uses its QuinStreet Media Platform (QMP) to acquire customers. Clients gain access to high-intent digital traffic from various channels. These channels include SEM, SEO, social media, mobile, email, and call centers.

The company's marketing model is performance-based, meaning clients pay for results. This model ensures cost-effectiveness and aligns incentives. The marketing efficiency ratio in 2023 was 0.42, indicating strong cost management.

The average cost per lead (CPL) varies based on the marketing channel. For targeted advertising, the CPL is approximately $37.50. Digital marketing leads cost around $42 each.

The company invests in data analytics and machine learning. In 2023, the company spent $24.3 million on these technologies. This enhances marketing optimization and improves client outcomes.

For customer retention, the company focuses on delivering measurable results and building long-term relationships. The average client retention rate is 4.2 years. The firm provides continuous optimization support and real-time performance tracking. Personalized marketing consultation and dedicated account management are also key.

The company emphasizes building long-term client relationships. The average client retention rate is 4.2 years, which indicates customer loyalty. This focus helps to ensure repeat business.

The company provides dedicated account management for its clients. There are 76 enterprise client account managers. Each manager oversees an average of 23 clients.

Continuous optimization support is provided to clients. Real-time performance tracking and reporting are also offered. These services contribute to client satisfaction and retention.

The company prioritizes compliance with data privacy and security regulations. This includes TCPA, TSR, CCPA, and UDAP. Compliance is crucial for maintaining client trust.

The company focuses on optimizing media efficiencies and client results. This is particularly true in the auto insurance sector. There is also a focus on higher-margin opportunities.

Ongoing productivity improvements are a key focus across the business. This helps improve efficiency and client outcomes. The company seeks to enhance overall performance.

The company's customer acquisition and retention strategies are multifaceted and data-driven. This approach includes a performance-based marketing model and a focus on long-term client relationships. For a deeper understanding, consider reading the Marketing Strategy of QuinStreet.

- Leveraging the QuinStreet Media Platform (QMP) for lead generation.

- Utilizing data analytics and machine learning for marketing optimization.

- Providing dedicated account management and personalized consultation.

- Focusing on compliance with data privacy and security regulations.

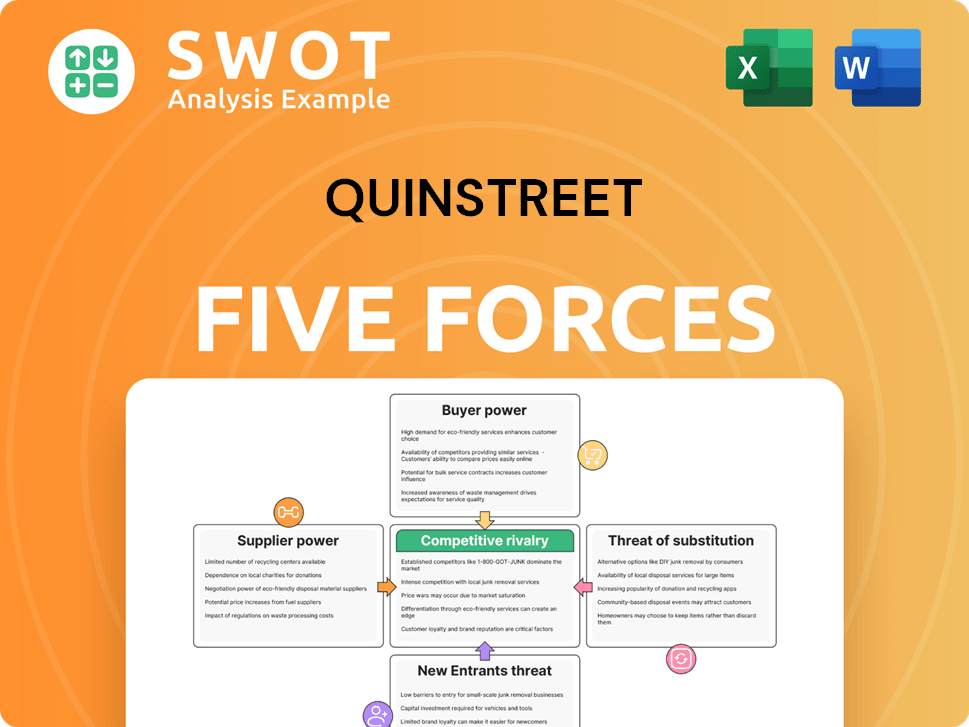

QuinStreet Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QuinStreet Company?

- What is Competitive Landscape of QuinStreet Company?

- What is Growth Strategy and Future Prospects of QuinStreet Company?

- How Does QuinStreet Company Work?

- What is Sales and Marketing Strategy of QuinStreet Company?

- What is Brief History of QuinStreet Company?

- Who Owns QuinStreet Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.