Rajesh Exports Bundle

Can Rajesh Exports Maintain Its Golden Edge?

Rajesh Exports Limited (REL) is a heavyweight in the global gold market, but how does it stack up against its rivals? Founded in 1989, REL has built a vertically integrated model, controlling everything from refining to retail. This approach has allowed them to become a major refiner and manufacturer of gold and diamond jewelry.

Understanding the Rajesh Exports SWOT Analysis is crucial for investors and strategists alike. This deep dive into the Rajesh Exports Competitive Landscape will explore the company's position within the Gold Market and Jewelry Industry. We'll conduct a thorough Competitive Analysis Rajesh Exports, identifying its key Rajesh Exports Rivals and assessing its long-term Rajesh Exports business strategy to understand its future prospects.

Where Does Rajesh Exports’ Stand in the Current Market?

The company, a prominent player in the global gold industry, focuses on gold refining and jewelry manufacturing. It caters to a diverse customer base through wholesale and retail channels, with a significant presence in India, one of the world's largest gold-consuming markets, and also serves international markets. The company's core operations revolve around the production and sale of gold and diamond jewelry, establishing a strong foothold in the jewelry industry.

REL's value proposition lies in its integrated business model, encompassing refining, manufacturing, and distribution. This approach ensures control over the entire value chain, from sourcing raw materials to delivering finished products. The company's strategic acquisitions, such as Valcambi, have bolstered its refining capacity and global reach, strengthening its competitive edge in the gold market. This integrated model allows for greater efficiency and responsiveness to market demands.

The company's financial health reflects its robust position in the market. Owners & Shareholders of Rajesh Exports can review the company's financial performance. The company has consistently demonstrated strong financial performance, underpinning its scale and market influence. Its ownership of Valcambi gives it a substantial competitive advantage in sourcing and processing gold.

While specific recent market share data for 2024-2025 isn't available in public domain search results, the company has historically been a leading player in the gold refining and jewelry manufacturing sectors. The company's large refining capacity and extensive manufacturing capabilities have contributed to its significant market presence. The company's strong market position is supported by its substantial refining capacity and extensive manufacturing capabilities.

The company has a substantial presence in India, a major gold-consuming market. It also serves international markets. The company's global presence is enhanced through its refining operations and distribution networks, ensuring a wide reach for its products. The company strategically expands its operations to maintain a strong global presence.

The company's competitive advantages include its ownership of Valcambi, which significantly boosts its refining capacity and global reach. Its integrated business model, covering refining, manufacturing, and distribution, ensures control over the value chain. The company's financial strength and consistent performance further solidify its competitive edge in the Gold Market.

Key strategies involve expanding operations through acquisitions, such as the acquisition of Valcambi. The company focuses on strengthening its position in the upstream segment of the gold value chain. The company's strategic moves are aimed at enhancing its market position and profitability.

The company's competitive landscape includes other major players in the gold refining and jewelry manufacturing industries. The company's rivals compete on factors such as refining capacity, manufacturing capabilities, and distribution networks. The company's ability to maintain its market position depends on its strategic initiatives and financial performance.

- The company's strong financial performance supports its competitive position.

- Its integrated business model provides a competitive advantage.

- Strategic acquisitions, like Valcambi, enhance its global reach.

- The company's focus on the gold market and jewelry industry is key.

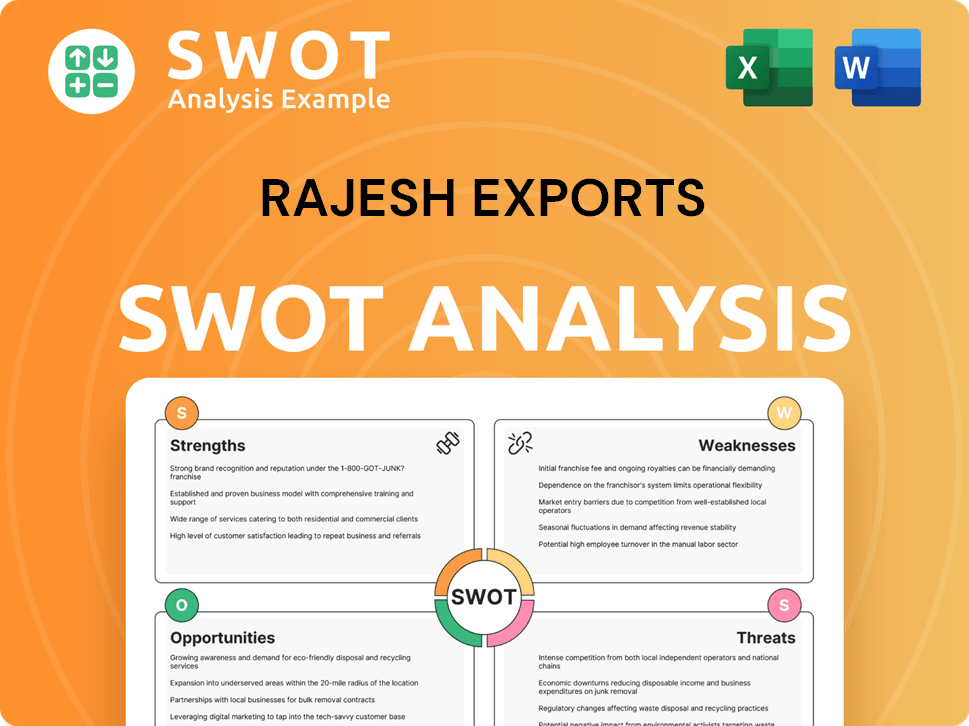

Rajesh Exports SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Rajesh Exports?

The Rajesh Exports Competitive Landscape is shaped by its position in the gold value chain, which includes refining, manufacturing, and retail. Understanding the competitive dynamics across these segments is crucial for a comprehensive Rajesh Exports Analysis. The company faces competition from both global and domestic players, each with distinct strengths and strategies.

Competitive Analysis Rajesh Exports reveals a complex interplay of factors influencing its market position. These factors include refining capacity, brand recognition, retail network, design innovation, and pricing strategies. The company's ability to navigate this landscape will determine its future growth and sustainability in the Gold Market and Jewelry Industry.

Rajesh Exports Rivals include a mix of international and domestic companies, each competing for market share in different segments of the gold industry. These competitors challenge REL on various fronts, from refining capabilities to retail presence and brand reputation. The competitive environment is constantly evolving due to mergers, acquisitions, and shifts in consumer preferences.

In the refining segment, REL competes with global players like Metalor Technologies, Rand Refinery, and Argor-Heraeus. These companies have established reputations and significant refining capacities. They often possess extensive global networks, which provide them with a competitive edge.

In the jewelry manufacturing segment, REL faces competition from both organized and unorganized players. Organized players include major brands like Titan Company Limited (Tanishq), Malabar Gold & Diamonds, Joyalukkas, and Kalyan Jewellers. Unorganized players are numerous and often operate on a smaller scale.

Retail competition comes from established jewelry chains and emerging online retailers. Traditional retail chains compete on brand recognition, design innovation, and extensive retail networks. Online retailers disrupt traditional channels by offering competitive pricing and wider product selections.

Key competitive factors include refining capacity, global network, brand recognition, design innovation, retail network, and pricing strategies. REL's ability to compete effectively depends on its performance in these areas. The company's Rajesh Exports business strategy must address these factors.

Mergers and alliances within the industry can significantly impact market shares and competitive dynamics. Such strategic moves can alter the competitive landscape and influence the Rajesh Exports market share analysis. These changes require continuous monitoring and adaptation.

Emerging online jewelry retailers pose a growing challenge by disrupting traditional distribution channels and offering competitive pricing. These online platforms often leverage digital marketing and e-commerce to reach a wider customer base. They are becoming an increasingly significant part of the Jewelry Industry.

REL's competitive advantages include its large-scale refining capacity and global presence. The company's key strategies involve expanding its retail network and enhancing its brand presence. Understanding these strategies is crucial for assessing the company's investment potential.

- Refining Capacity: REL's substantial refining capabilities allow it to process large volumes of gold, which is a significant advantage.

- Global Presence: REL's international operations and supply chain contribute to its ability to serve global markets.

- Retail Expansion: Expanding the retail network helps REL reach more consumers directly and increase its market share.

- Brand Building: Enhancing brand recognition and reputation is essential for attracting customers and gaining a competitive edge.

- Growth Strategy of Rajesh Exports: Further insights into the company's strategic direction.

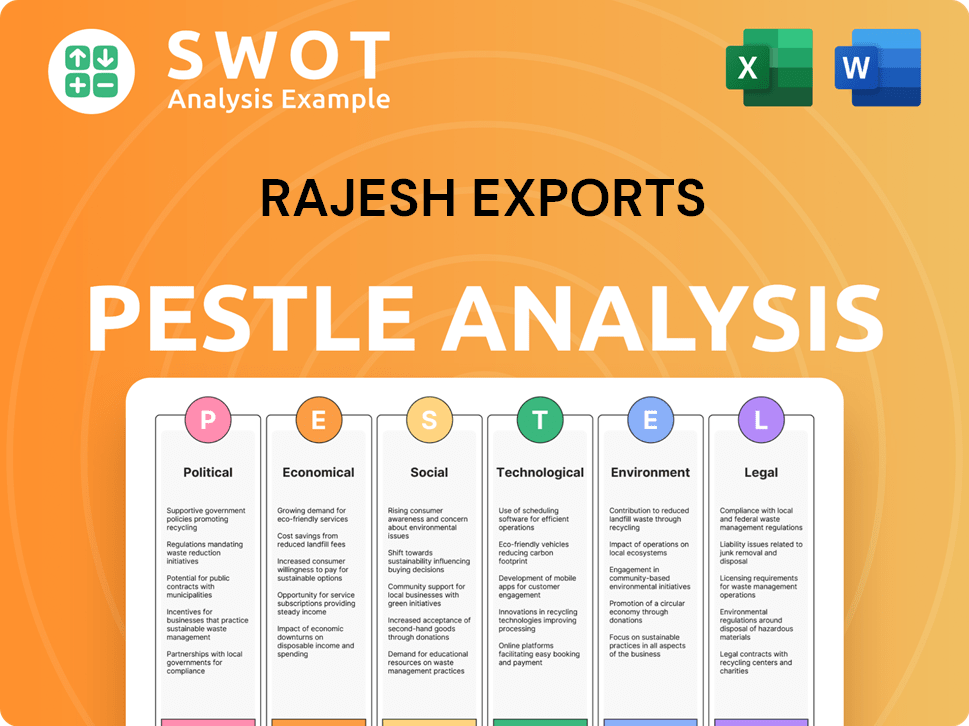

Rajesh Exports PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Rajesh Exports a Competitive Edge Over Its Rivals?

The competitive landscape of Rajesh Exports is shaped by its distinct advantages in the gold and jewelry market. A key element of its strategy is vertical integration, which provides a significant edge over competitors. This approach, combined with its extensive manufacturing capabilities, allows it to maintain a strong market position. For a deeper understanding of the company's marketing approach, consider exploring the Marketing Strategy of Rajesh Exports.

The company's strategic moves, particularly the acquisition of Valcambi, have significantly enhanced its capabilities. This, along with its established presence in the industry, has allowed it to build strong relationships with suppliers and customers. These factors collectively contribute to its ability to compete effectively in the global market. The company's focus on both wholesale and retail markets further strengthens its position.

Rajesh Exports' competitive edge is rooted in its comprehensive control over the value chain, from refining to manufacturing and retailing. This integrated model enables economies of scale, optimizes the supply chain, and offers competitive pricing. The company's ability to efficiently produce a wide variety of gold and diamond jewelry designs in large volumes is another key advantage.

Rajesh Exports' vertical integration, including its refining capabilities through Valcambi, allows for better control over the supply chain. This integration helps in reducing costs and enhancing efficiency. This strategic advantage is crucial in the competitive gold market.

The company's extensive manufacturing infrastructure enables it to produce a wide range of jewelry designs efficiently. This capability allows Rajesh Exports to cater to diverse market demands. The ability to handle large volumes is a key competitive advantage.

Rajesh Exports' global presence allows it to tap into diverse markets and customer bases. This broad reach helps in diversifying revenue streams and mitigating risks. This global presence is a crucial aspect of its competitive strategy.

The company's long-standing presence in the industry has fostered strong relationships with suppliers and customers. These relationships provide a stable foundation for business operations. These connections are vital for sustained success.

Rajesh Exports' competitive advantages are multifaceted, including its vertical integration, extensive manufacturing infrastructure, and global reach. The ownership of Valcambi, one of the world's largest gold refineries, is a significant strategic asset. The company's ability to manage its supply chain effectively is crucial in the volatile gold market.

- Vertical Integration: Control over the entire value chain from refining to retail.

- Manufacturing Capacity: Ability to produce a wide variety of jewelry designs efficiently.

- Global Presence: Access to diverse markets and customer bases worldwide.

- Strong Relationships: Established connections with suppliers and customers.

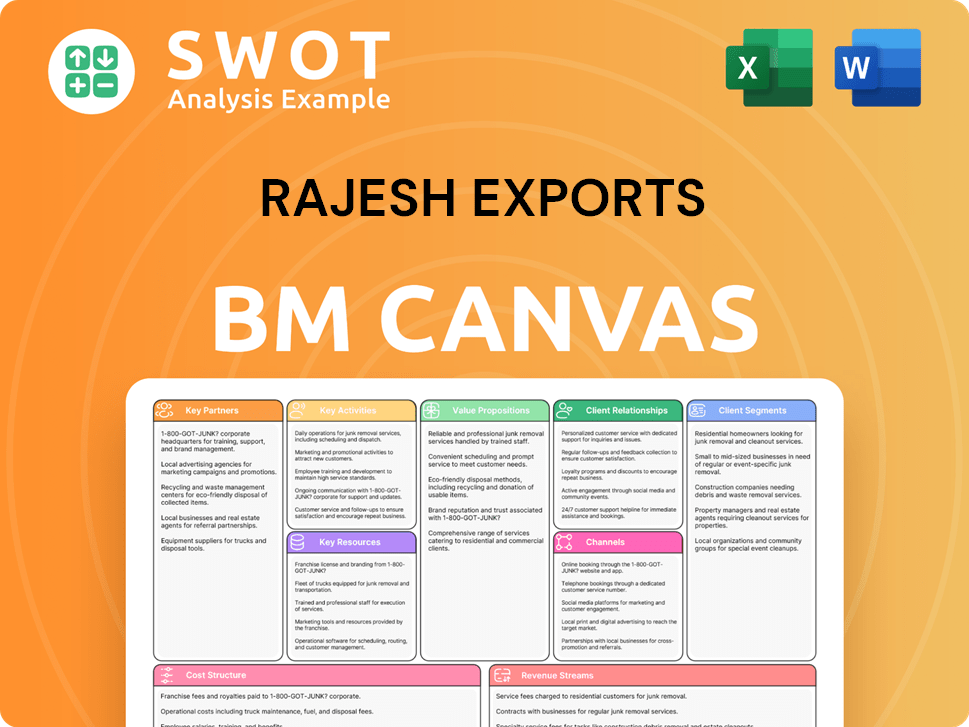

Rajesh Exports Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Rajesh Exports’s Competitive Landscape?

The gold industry is currently experiencing significant shifts, influenced by fluctuating gold prices, evolving consumer preferences, and technological advancements. The Target Market of Rajesh Exports needs to adapt to these dynamic conditions to maintain its competitive edge. This analysis of the Rajesh Exports Competitive Landscape examines key trends, potential challenges, and future opportunities.

Understanding the competitive landscape of Rajesh Exports involves assessing industry trends, identifying potential risks, and forecasting future prospects. The company's position is influenced by its integrated business model, encompassing sourcing, manufacturing, and retail. The future outlook depends on its ability to navigate market volatility, meet evolving consumer demands, and leverage technological innovations.

The Gold Market is influenced by fluctuating gold prices, increasing demand for responsibly sourced gold, and the growth of e-commerce in jewelry retail. Technological advancements in manufacturing, such as 3D printing, are also impacting the industry. Regulatory changes and shifting consumer preferences towards contemporary designs and sustainability are also prominent.

Potential challenges include gold price volatility, which can affect profitability, and increased competition from online retailers. Ensuring compliance with ethical sourcing standards across the supply chain is also a significant hurdle. Adapting to changing consumer preferences and maintaining operational efficiency are also crucial.

Opportunities include leveraging the integrated value chain, especially refining capabilities, to meet the demand for responsibly sourced gold. Expanding into emerging markets, such as Asia and Africa, where gold demand is strong, presents growth avenues. Investing in advanced manufacturing technologies can enhance efficiency and innovation.

To stay competitive, Rajesh Exports should focus on leveraging its integrated value chain, investing in sustainable practices, and expanding its digital presence. Exploring strategic partnerships and adapting to evolving consumer demands are also vital. These strategies will help navigate market dynamics and capitalize on emerging opportunities.

To maintain its market position, Rajesh Exports should focus on several key strategies. These include optimizing its supply chain, enhancing its digital presence, and expanding into new markets. Investment in sustainable practices and technological upgrades will also be crucial for long-term success.

- Supply Chain Optimization: Enhancing traceability and ensuring ethical sourcing to meet consumer demands and regulatory requirements.

- Digital Expansion: Strengthening online sales channels and improving customer engagement through digital platforms.

- Market Diversification: Expanding into high-growth markets in Asia and Africa to capitalize on rising gold demand.

- Technological Investment: Embracing advanced manufacturing technologies to improve efficiency and product innovation.

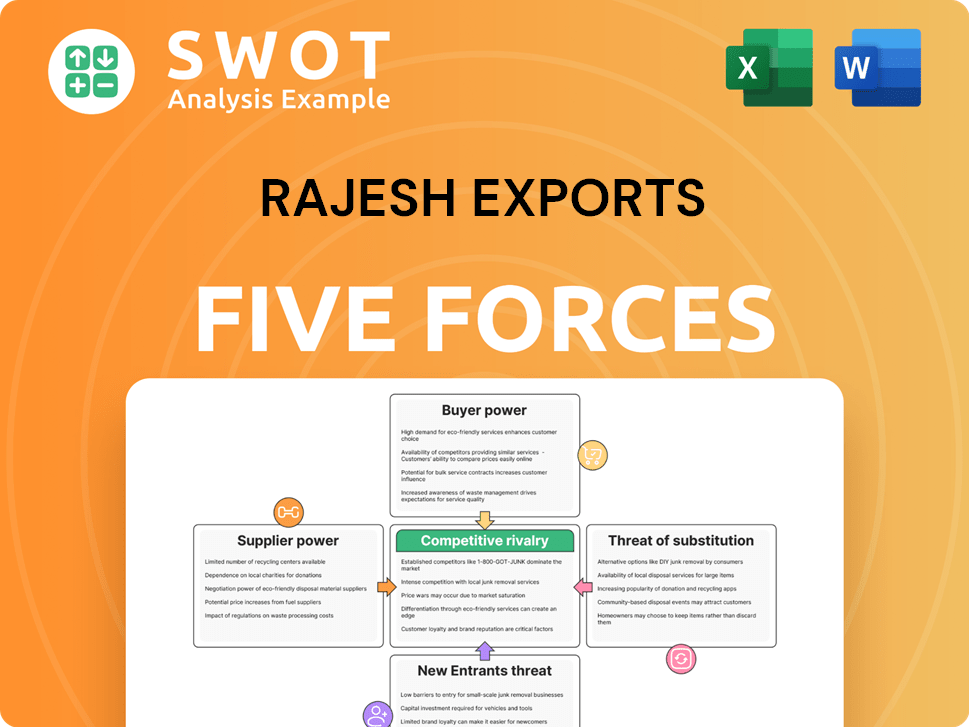

Rajesh Exports Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rajesh Exports Company?

- What is Growth Strategy and Future Prospects of Rajesh Exports Company?

- How Does Rajesh Exports Company Work?

- What is Sales and Marketing Strategy of Rajesh Exports Company?

- What is Brief History of Rajesh Exports Company?

- Who Owns Rajesh Exports Company?

- What is Customer Demographics and Target Market of Rajesh Exports Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.