Rajesh Exports Bundle

Can Rajesh Exports Reclaim Its Golden Touch?

Rajesh Exports, a titan in the global gold market, has seen its fortunes fluctuate. Founded in 1989, the company's journey from a Bangalore startup to a global player processing a significant portion of the world's gold is a testament to its ambition. But can Rajesh Exports navigate recent challenges and realize its ambitious Rajesh Exports SWOT Analysis, aiming to be the world's largest jewelry manufacturer?

This deep dive into Rajesh Exports explores its Growth Strategy and Future Prospects, examining its integrated business model, market position, and strategic initiatives. We'll analyze the Company Analysis and Market Trends shaping its path, from expansion plans in India to its global market strategy. Understanding the Rajesh Exports journey offers valuable insights for investors and business strategists alike, providing a crucial perspective on Rajesh Exports investment opportunities and the evolving landscape of the gold industry.

How Is Rajesh Exports Expanding Its Reach?

The growth strategy of Rajesh Exports involves aggressive expansion initiatives designed to enhance its market presence and diversify its business operations. The company, a prominent player in the gold and diamond jewelry sector, is strategically venturing into new sectors like electric vehicles (EVs) and semiconductors. This multifaceted approach aims to tap into new customer segments, diversify revenue streams, and adapt to evolving industry trends.

As of 2024, Rajesh Exports operates a significant retail footprint, with over 80 outlets worldwide. The company is focused on expanding its presence in India and internationally. Simultaneously, Rajesh Exports is increasing its exports to over 60 countries, with plans to penetrate new territories and boost global sales. This dual approach of retail expansion and export growth is central to its overall business development strategy.

The company's future prospects are significantly influenced by its strategic investments in emerging sectors. Rajesh Exports plans to invest approximately ₹50,000 crore (around $6 billion) over the next seven years to enter the electric vehicle (EV) market. This move includes establishing a 5 GWh lithium-ion cell factory in Karnataka, supported by India's ₹181 billion Production-Linked Incentive (PLI) program for domestic battery manufacturing.

Rajesh Exports is focused on growing its retail presence. The company operates over 80 outlets globally, with a strong focus on India. The aim is to open more showrooms and develop an e-commerce platform to enhance its retail footprint. This expansion is designed to increase market share and improve customer reach.

The company is actively expanding its exports to international markets. Rajesh Exports currently exports to over 60 countries. The strategy includes penetrating new territories to enhance global sales and diversify revenue sources. This will help in achieving long-term sustainable growth.

Rajesh Exports is making a strategic move into the electric vehicle (EV) market. The company plans to invest approximately ₹50,000 crore over the next seven years. This investment includes setting up a 5 GWh lithium-ion cell factory in Karnataka, supported by government incentives. This move is expected to diversify revenue streams.

The company is also investing in semiconductor display fabrication facilities. Rajesh Exports intends to invest around ₹24,000 crore under the Semicon India scheme. This strategic move aims to access new customer bases and stay ahead of evolving industry landscapes. This investment is a key part of their future outlook.

Despite ambitious plans, Rajesh Exports has faced some challenges. Reports in May 2025 indicated that the company, along with other beneficiaries, sought a one-year extension from the government for the ACC PLI battery scheme. This was due to missed milestones and supply chain delays. These delays highlight the complexities involved in large-scale manufacturing projects.

- Supply chain disruptions have impacted project timelines.

- Missed milestones led to requests for extensions.

- The company is working to mitigate these challenges.

- These delays could affect the overall growth trajectory.

The strategic initiatives of Rajesh Exports, including retail expansion, export growth, and investments in the EV and semiconductor sectors, are designed to drive future growth. This diversification strategy aims to enhance the company's market share and revenue streams. Understanding the Owners & Shareholders of Rajesh Exports is crucial for investors assessing the company's long-term potential.

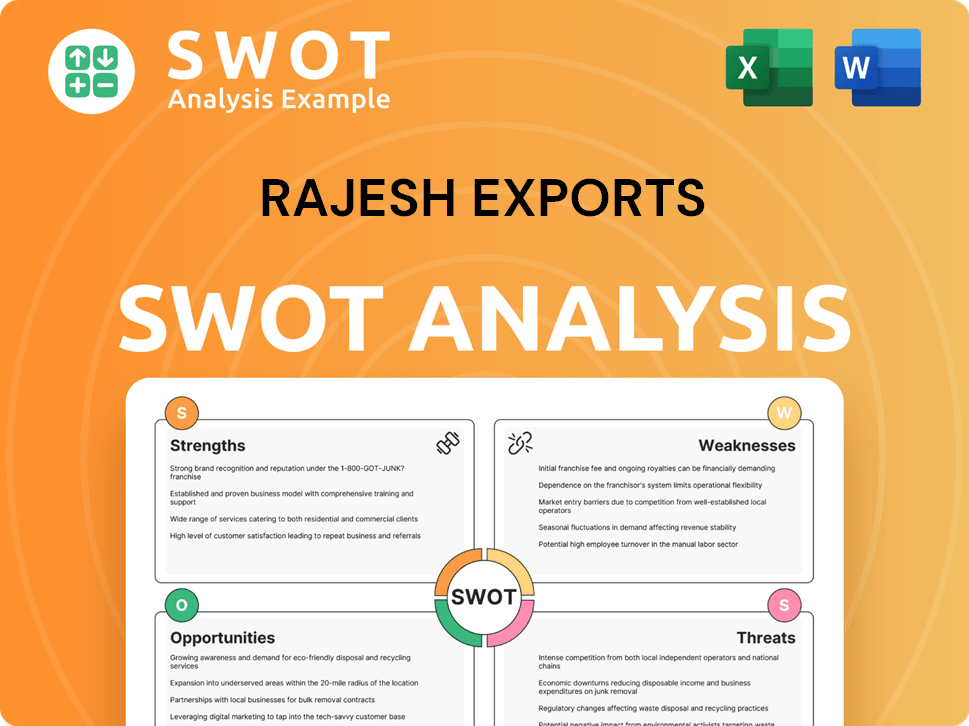

Rajesh Exports SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Rajesh Exports Invest in Innovation?

The innovation and technology strategy of Rajesh Exports is a critical component of its overall growth strategy, enabling it to stay competitive in the dynamic gold and diamond market. By focusing on research and development (R&D) and integrating advanced technologies, the company aims to enhance its product offerings, improve manufacturing processes, and ensure sustainable practices. This approach is essential for navigating market trends and achieving long-term success.

Rajesh Exports' commitment to innovation is evident in its significant investment in R&D. This commitment not only drives the creation of new product lines but also enhances operational efficiency. The company's strategic investments in technology and sustainable practices are designed to meet evolving consumer preferences and maintain a strong market position. To understand the company's foundational principles, you can refer to Mission, Vision & Core Values of Rajesh Exports.

The company allocates a reported 10% of its annual revenue towards R&D initiatives, demonstrating a strong commitment to innovation. In fiscal year 2023, this investment amounted to ₹200 crores. This financial commitment supports the development of new product lines and the integration of advanced technologies. This investment is a key driver for its future prospects.

Rajesh Exports utilizes artificial intelligence (AI) in its design processes. This integration has led to a reported 20% reduction in production time. This efficiency gain allows for faster product development and improved responsiveness to market demands.

The company operates world-class R&D facilities in Switzerland and India. These facilities are dedicated to developing new designs and innovative manufacturing processes for gold products. This global presence supports its expansion plans in India and other markets.

Sustainability is a core part of Rajesh Exports' operational philosophy. The company focuses on minimizing environmental impact and promoting social responsibility. This focus aligns with market trends towards ethical and sustainable business practices.

In 2023, Rajesh Exports achieved a 50% reduction in carbon emissions compared to 2020 levels. This significant reduction demonstrates the company's commitment to environmental sustainability. This is a key factor in its future outlook for 2024 and beyond.

The company aims for 100% recyclable material usage in all packaging by 2025. This goal underscores its dedication to minimizing waste and promoting a circular economy. This initiative supports its strategic initiatives.

Rajesh Exports has invested over ₹150 crores in sustainable mining practices. This investment ensures that 80% of its gold supply comes from responsibly mined sources. This practice is crucial for maintaining its competitive landscape.

The company's innovation and technology strategy is supported by several key initiatives designed to drive growth and maintain a competitive edge. These initiatives are critical for its business development and long-term success in the gold market.

- Continuous investment in R&D to develop new product lines and improve manufacturing processes.

- Integration of AI and other advanced technologies to enhance efficiency and reduce production time.

- Expansion of sustainable practices, including reducing carbon emissions and using recyclable materials.

- Investment in responsibly mined gold sources to ensure ethical sourcing and sustainability.

- Focus on global market strategy to expand its reach and capture new opportunities.

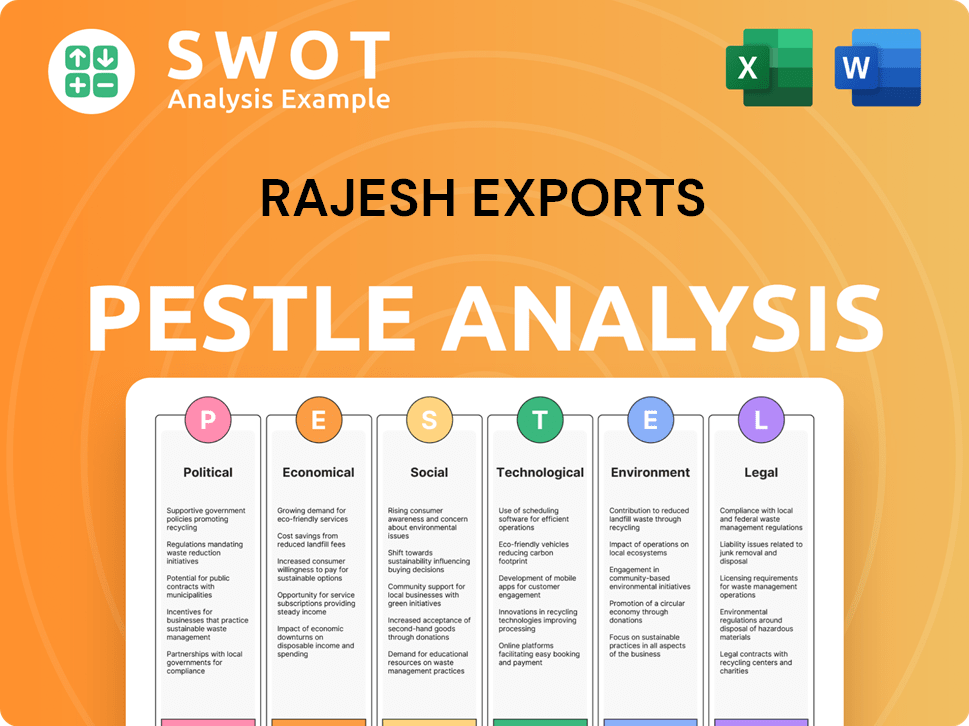

Rajesh Exports PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Rajesh Exports’s Growth Forecast?

The financial outlook for Rajesh Exports reflects a mixed performance, with both challenges and opportunities. Understanding the Rajesh Exports financial performance is crucial for assessing its Growth Strategy and evaluating its Future Prospects. This Company Analysis reveals key trends and potential areas for Business Development.

The company's revenue for the fiscal year ending March 2024 was INR 2,80,676.34 crore (approximately $34.06 billion USD), representing a 17.37% decrease compared to the previous year. However, recent quarterly results show a significant increase in revenue, indicating a potential turnaround. This Market Trends analysis provides insights into the company's current position and future trajectory.

The net profit for FY24 decreased substantially by 76.57%, dropping to INR 335.53 crore from INR 1,432.28 crore in FY23. Operating and net profit margins also declined. Despite these challenges, the most recent quarterly results, specifically for the quarter ended December 2024, show a substantial year-on-year increase in revenue, pointing to a possible recovery. For a broader perspective, it's useful to consider the Competitors Landscape of Rajesh Exports.

Revenue for FY24 was INR 2,80,676.34 crore, a 17.37% decrease. Net profit for FY24 was INR 335.53 crore, a 76.57% decrease. Operating profit margin for FY24 was 0.1%, down from 0.5% in FY23.

For the quarter ended December 2024, revenue increased by 47.59% year-on-year to ₹96,651.89 crore. Net profit for the same quarter was ₹35.50 crore, a 185.6% jump year-on-year. Net profit margin for Q3 FY2024-2025 was 0.04%.

Share price forecasts for 2025 range between ₹180 and ₹221. This is supported by stable performance in gold refining and exports. The company's long-term goals include global leadership in the gold and diamond marketplace.

Target production capacity of over 200 tons of gold annually. The company aims to achieve global leadership in the gold and diamond market. Continued high delivery volumes are expected to support these goals.

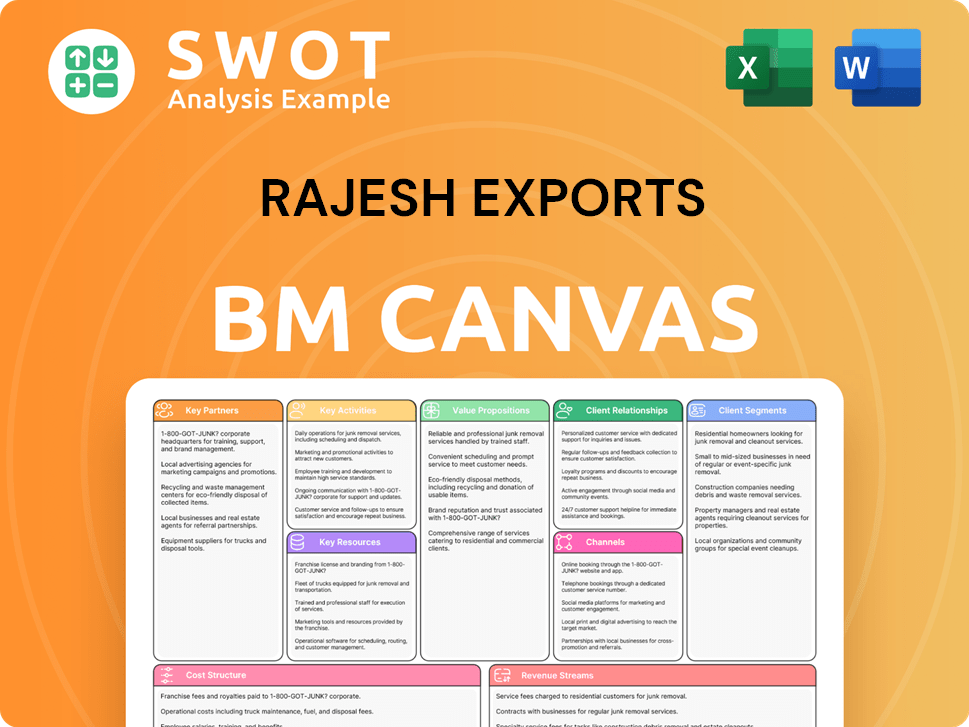

Rajesh Exports Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Rajesh Exports’s Growth?

The Rajesh Exports faces several significant risks that could impact its Growth Strategy and Future Prospects. These challenges range from external market factors to internal operational issues, all of which require careful management to ensure sustained success. Understanding these potential pitfalls is crucial for evaluating the company's long-term viability and investment potential.

One of the primary concerns is the volatility of gold prices, which directly affects the company's profitability. Additionally, supply chain vulnerabilities and corporate governance issues present considerable hurdles. The company's ability to navigate these risks will be critical for achieving its Business Development goals and maintaining a competitive edge in the market.

The company's stock price has declined approximately 80% since February 2023, highlighting the impact of these challenges. A comprehensive Company Analysis reveals several areas needing strategic attention.

Sharp fluctuations in gold prices can significantly impact the company's margins. Regulatory changes, such as import duties, also pose a risk. For example, a reduction in customs duty on gold from 15% to 6% could boost demand, but adverse changes could harm the company.

Delays in setting up the lithium-ion cell factory have led to the company seeking a one-year extension for the PLI battery scheme. These delays highlight the risks associated with dependence on suppliers and the complexity of large-scale projects. Effective Market Trends analysis is crucial.

Instances of missed filings and errors in documents submitted to exchanges have raised concerns. These issues have contributed to a significant decline in the stock price. Addressing these concerns is vital for restoring investor confidence.

Negative cash flow in recent years and a meager operating profit margin are concerning. The high material cost of 99% and the decrease in net profit by 76.54% in FY24 compared to FY23 indicate financial strain. The company's profitability score is 43/100.

The company's ability to manage gold price volatility, secure supply chains, and improve operational efficiencies is crucial. Streamlining operations and enhancing financial management are essential. The Rajesh Exports must focus on these areas to mitigate risks.

Understanding the Rajesh Exports competitive landscape is essential for developing effective strategies. The company needs to assess its position relative to its competitors and identify areas for differentiation. This includes evaluating market share and growth opportunities.

Rajesh Exports should focus on diversifying its revenue streams to reduce dependence on gold. Improving supply chain management and enhancing transparency in corporate governance are also critical. The company should also explore Rajesh Exports expansion plans India.

A thorough market analysis is essential to identify opportunities and threats. Understanding Rajesh Exports market share and growth potential is crucial for strategic planning. This involves assessing Rajesh Exports global market strategy and adapting to changing market dynamics. Consider reading about the Marketing Strategy of Rajesh Exports.

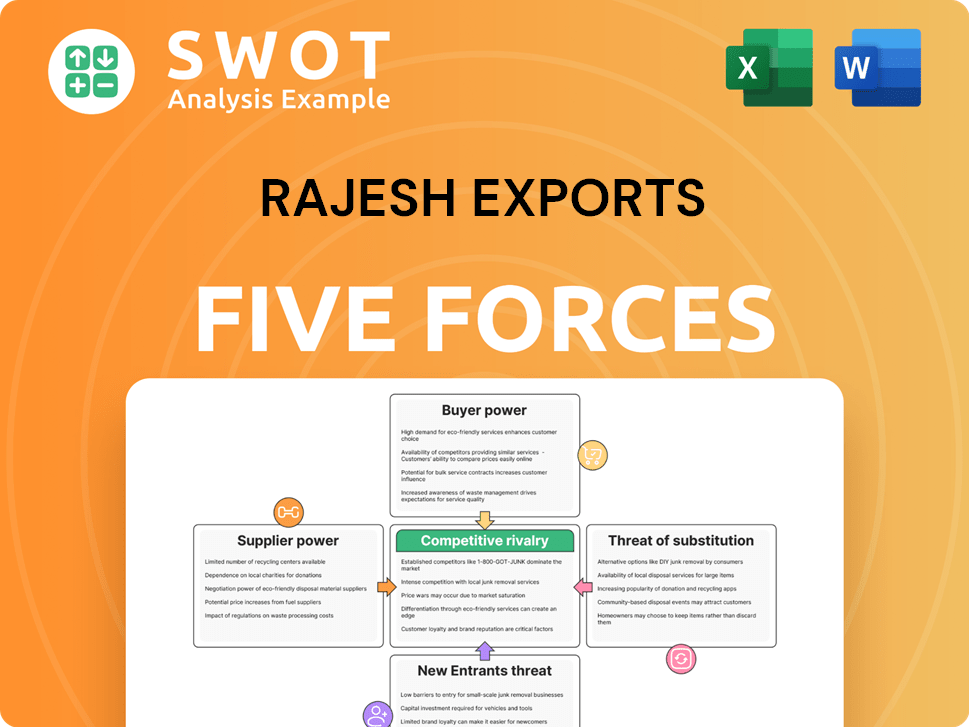

Rajesh Exports Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rajesh Exports Company?

- What is Competitive Landscape of Rajesh Exports Company?

- How Does Rajesh Exports Company Work?

- What is Sales and Marketing Strategy of Rajesh Exports Company?

- What is Brief History of Rajesh Exports Company?

- Who Owns Rajesh Exports Company?

- What is Customer Demographics and Target Market of Rajesh Exports Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.