Rajesh Exports Bundle

How Does Rajesh Exports Shine in the Gold Market?

Rajesh Exports Limited, a titan in the global gold and jewelry arena, has built an empire from the ground up. From refining raw gold to dazzling retail displays, this company has mastered the entire value chain. With a significant presence in the Indian gold market and beyond, Rajesh Exports' story is one of remarkable growth and strategic prowess.

This deep dive into Rajesh Exports SWOT Analysis will unravel the intricacies of its operations, revealing how this gold manufacturer has become a global leader. We'll explore the Rajesh Exports business model, examining its revenue streams and competitive advantages within the dynamic gold jewelry sector. Understanding Rajesh Exports operations is key to appreciating its success, from sourcing to retail, and its influence on the Indian gold market.

What Are the Key Operations Driving Rajesh Exports’s Success?

The core operations of Rajesh Exports revolve around a vertically integrated business model, which is a key factor in its operational efficiency. This model allows the company to manage every stage of production, from acquiring raw materials to delivering finished products to consumers. This comprehensive control is a significant aspect of the company's strategy within the Growth Strategy of Rajesh Exports.

The company's main offerings include a wide range of gold products, such as medallions, bullion, and various types of jewelry, including handmade, casting, and machine-made pieces. They also offer studded jewelry, catering to a global customer base. This diverse product range is supported by extensive operational processes designed for efficiency and quality.

Rajesh Exports, a leading gold manufacturer, sources gold globally and refines it in its state-of-the-art facilities. The company's focus on innovation and efficiency is evident in its manufacturing processes and supply chain management.

Rajesh Exports has a substantial manufacturing capacity. Its facility in Bangalore, India, is one of the world's largest gold jewelry manufacturing facilities. This facility can process up to 250 tons of jewelry annually.

The company's total installed capacity for refining precious metals is 2,400 tons per annum. This capacity is crucial for maintaining the high purity of gold used in its products.

Rajesh Exports focuses on supply chain efficiency to minimize wastage. The company aims to keep wastage below 0.25%, which is significantly lower than the industry average of 3%. This efficiency contributes to cost-effectiveness.

The company has a strong retail presence through its branded jewelry chain, SHUBH Jewelers. As of recent reports, SHUBH Jewelers has over 80 outlets across India. This retail network enhances the company's market reach.

Rajesh Exports offers a compelling value proposition through its vertically integrated model. This approach ensures superior quality control and cost-effective operations.

- Customized Jewelry Solutions: Offering a wide array of designs to meet diverse customer preferences.

- Superior Quality: Maintaining high standards in gold refining and jewelry manufacturing.

- Competitive Pricing: Providing value to customers through efficient operations and supply chain management.

Rajesh Exports SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Rajesh Exports Make Money?

Understanding the revenue streams and monetization strategies of a company like Rajesh Exports provides insights into its financial health and operational efficiency. Rajesh Exports, a major player in the gold industry, employs a multifaceted approach to generate revenue and maintain profitability. This includes diverse sales channels and value-added services.

The company's primary revenue source is the sale of gold bullion and gold jewelry. It utilizes both wholesale and retail channels to reach a broad customer base. Moreover, Rajesh Exports provides refining services, enhancing its revenue streams and market presence. This integrated strategy supports its financial performance in the competitive Indian gold market.

Rajesh Exports' revenue model is designed for sustainability and growth, focusing on a combination of product sales, refining services, and strategic market positioning. The company has a strong presence in the gold market, which is reflected in its financial performance. This approach allows it to adapt to market changes and maintain a competitive edge.

In the fiscal year ending March 2024, Rajesh Exports reported a total revenue of INR 55,000 crore, a 15% increase from the previous fiscal year. Gold jewelry sales contributed approximately INR 45,000 crore to the total revenue in FY 2024. The company's net profit for FY 2024 was INR 2,500 crore, with a growth margin of 4.5%. For the quarter ended December 2024, consolidated net sales were Rs. 9,663 crore and a profit after tax of Rs. 355 crore. However, the Q2 FY25 results, declared on November 14, 2024, showed a profit of ₹45.56 crore on a total revenue of ₹66,923.67 crore, indicating a 0.55% year-on-year profit increase despite a 75.81% year-on-year revenue increase. The net profit decreased from ₹1,432 crore in FY23 to ₹336 crore in FY24, a fall of 76.54%. The net profit margin also dropped from 0.42% in FY23 to 0.11% in FY24.

- Rajesh Exports' business model includes multiple revenue streams.

- They focus on selling gold bullion and a wide range of gold jewelry.

- The company uses both wholesale and retail channels to distribute its products.

- Refining services are also a key part of their revenue generation.

Rajesh Exports' monetization strategies include ultimate luxury, add-on sales, cross-selling, bundling, and acting as a solution provider. The company also uses direct selling and make-and-distribute models. Their low-cost strategy helps them to maintain competitiveness. For those interested in the company's ownership structure, further details can be found in this article about Owners & Shareholders of Rajesh Exports.

Rajesh Exports PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Rajesh Exports’s Business Model?

Rajesh Exports, established in 1989, has evolved into a significant player in the global gold market. The company's journey has been marked by strategic acquisitions and expansions, transforming it into a vertically integrated entity. Understanding the Marketing Strategy of Rajesh Exports provides insights into its growth and market positioning.

A pivotal move for Rajesh Exports was the 2015 acquisition of Valcambi SA, the world's largest gold refinery, for USD 400 million. This acquisition significantly boosted its refining capacity. The company has also established a retail presence through SHUBH Jewellers, expanding its reach across India.

However, Rajesh Exports has faced challenges, including scrutiny over tax evasion allegations and a decline in its stock price. Despite these hurdles, the company maintains several competitive advantages, including its vertically integrated model and large manufacturing capacity.

Rajesh Exports' key milestones include its establishment in 1989 and the acquisition of Valcambi SA in 2015. The company has expanded its refining capacity and retail presence through SHUBH Jewellers. These strategic moves have shaped the company's operations and market position.

The acquisition of Valcambi SA was a crucial strategic move, enhancing Rajesh Exports' refining capabilities. Establishing retail showrooms under the SHUBH Jewellers brand was another significant step. These moves aimed to create a vertically integrated business model.

Rajesh Exports' competitive edge lies in its vertical integration, spanning refining, manufacturing, and retailing. The company is recognized as the world's lowest-cost gold jewelry producer. Its large manufacturing capacity and extensive design database also contribute to its competitive advantage.

The company has faced operational challenges, including scrutiny over tax evasion allegations. The decline in stock price, down about 80% since February 2023, and the closure of several SHUBH Jewellers stores have also impacted the company. The net profit decreased by 76.54% from FY23 to FY24.

Rajesh Exports is adapting to new trends and threats by exploring diversification into new sectors. The company plans to invest approximately ₹50,000 crore (around $6 billion) over the next seven years to enter the electric vehicle (EV) market. It is also investing around ₹24,000 crore (approximately $3 billion) in setting up semiconductor display fabrication facilities.

- The company's vertical integration provides a significant edge in cost control and supply chain efficiency.

- Rajesh Exports is recognized as the world's lowest-cost gold jewelry producer.

- The company's large manufacturing capacity enables it to meet global demand.

- Rajesh Exports has one of the world's largest active jewelry design databases.

Rajesh Exports Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Rajesh Exports Positioning Itself for Continued Success?

The industry position, risks, and future outlook of Rajesh Exports are critical elements to consider. As the world's largest gold company, Rajesh Exports holds a dominant position in the global gold market. Its fully integrated business model, spanning refining to retail, gives it a unique advantage. However, the company faces significant challenges and uncertainties that could impact its future performance.

Understanding these aspects is crucial for anyone interested in the company, whether as an investor, a competitor, or simply an observer of the gold industry. This analysis will delve into the current standing of Rajesh Exports, the risks it faces, and its strategic plans for the future, providing a comprehensive view of its potential.

Rajesh Exports is the world's largest gold company and a significant player in the Indian gold market. It refines approximately 35% of the world's gold. The company operates over 80 retail outlets, primarily in India, under the SHUBH Jewelers brand. This extensive network and refining capacity give Rajesh Exports a strong competitive advantage in the gold industry.

Rajesh Exports faces several risks. Gold price volatility can severely affect profit margins. Regulatory changes, such as alterations in gold import duties, pose a threat. Economic slowdowns could weaken demand, particularly in international markets. The company has also encountered scrutiny regarding corporate governance and financial transparency. The stock price has declined significantly, down about 80% since February 2023, reflecting investor concerns.

Rajesh Exports is focusing on strengthening its direct connection with retail consumers. This strategy includes expanding its retail presence by opening more showrooms and developing an e-commerce platform. The company is also diversifying into high-growth sectors, such as the electric vehicle (EV) market, with plans for a lithium-ion cell factory and semiconductor display fabrication facilities. The success of these ventures is crucial for the company's future financial performance.

Rajesh Exports aims to move up the value chain by manufacturing jewelry and investment bars for direct retail. This involves expanding its retail network and enhancing its online presence. Diversification into the EV market and semiconductor fabrication is another key strategic move. These initiatives are designed to boost revenue and mitigate risks associated with the gold market. To learn more about the company's strategic moves, you can read the Growth Strategy of Rajesh Exports.

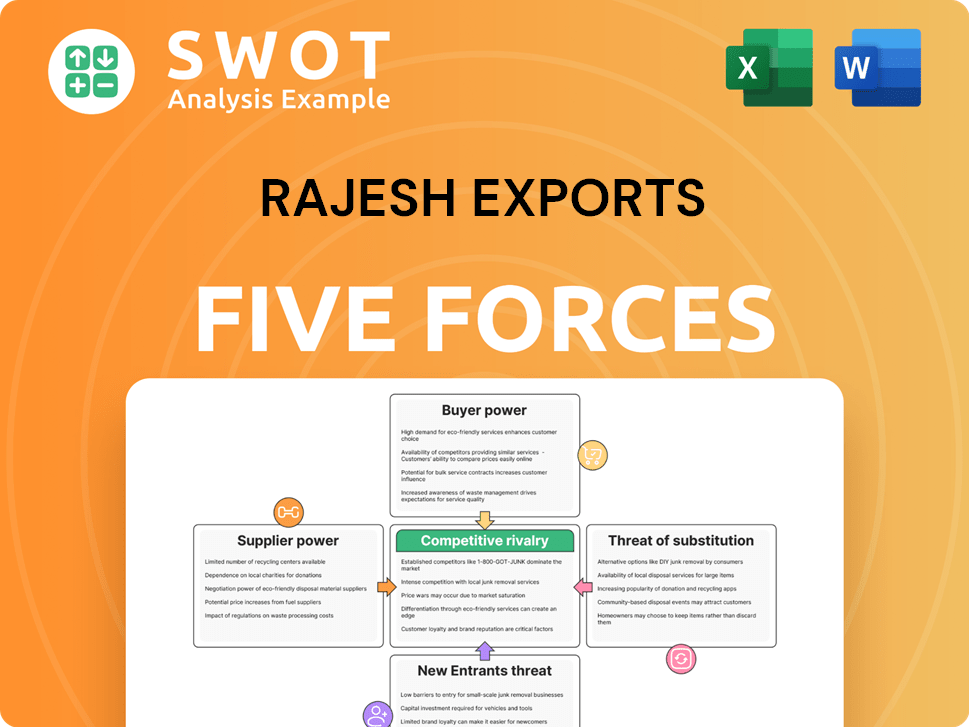

Rajesh Exports Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rajesh Exports Company?

- What is Competitive Landscape of Rajesh Exports Company?

- What is Growth Strategy and Future Prospects of Rajesh Exports Company?

- What is Sales and Marketing Strategy of Rajesh Exports Company?

- What is Brief History of Rajesh Exports Company?

- Who Owns Rajesh Exports Company?

- What is Customer Demographics and Target Market of Rajesh Exports Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.