R.R. Donnelley & Sons Bundle

Navigating the Digital Age: Who Competes with R.R. Donnelley?

In a world increasingly dominated by digital platforms, how does a company rooted in traditional printing, like R.R. Donnelley & Sons, maintain its competitive edge? Founded in 1864, RRD has continuously adapted, evolving from a printing house to a comprehensive marketing and business communications provider. This evolution is key to understanding its position in today's market.

This exploration of the R.R. Donnelley & Sons SWOT Analysis will dissect the company's competitive landscape, examining its rivals and strategies. We will delve into the Donnelley market analysis to understand its position within the printing industry and the broader print and marketing services sector. Understanding the RRD competitors is crucial to grasping its business strategy and future prospects.

Where Does R.R. Donnelley & Sons’ Stand in the Current Market?

RRD, within the marketing and business communications sector, maintains a significant market position. While specific market share data for 2024-2025 is not publicly available in financial reports, the company's comprehensive service offerings are well-recognized. These services encompass commercial printing, direct mail, supply chain management, digital and creative solutions, and business communications.

The company's primary services cater to a wide range of industries, including financial services, healthcare, retail, and manufacturing. This diverse customer base ranges from small businesses to large enterprises. RRD's global presence, with facilities across North America, South America, Asia, and Europe, enables it to serve a worldwide clientele. The company's ability to adapt and evolve has been crucial in maintaining its competitive edge within the dynamic Marketing Strategy of R.R. Donnelley & Sons.

Historically, RRD has adapted its positioning to respond to market shifts. It has strategically diversified its offerings beyond traditional printing, embracing digital transformation to provide integrated solutions that meet the evolving demands of marketing and business communications. This includes expanding into areas like digital asset management, multi-channel marketing, and business process outsourcing. While detailed financial health comparisons against industry averages for the most recent period are not explicitly published, RRD's consistent revenue generation and strategic investments in technology and services indicate its scale and commitment to maintaining a competitive edge. RRD maintains a particularly strong position in North America for its integrated print and digital marketing solutions.

RRD's core operations involve commercial printing, direct mail services, and supply chain management. They also provide digital and creative solutions and business communications services. These services are tailored to meet the diverse needs of its clients.

The value proposition of RRD lies in its ability to offer integrated solutions. This includes print and digital marketing services, which help businesses streamline their communications. They provide a comprehensive suite of services to meet evolving market demands.

RRD has a substantial global presence, with facilities across North America, South America, Asia, and Europe. This widespread presence allows RRD to serve a diverse, global clientele effectively. Their geographic reach is a key factor in their market position.

RRD focuses on several key industries, including financial services, healthcare, retail, and manufacturing. They serve a broad customer base, from small businesses to large enterprises. This focus allows RRD to tailor its services to specific industry needs.

RRD's competitive advantages include its comprehensive service offerings and a global presence. They integrate print and digital marketing solutions. The company has a strong position in North America, offering integrated print and digital marketing solutions.

- Comprehensive Service Suite: Offers a wide range of services, including commercial printing and digital solutions.

- Global Footprint: Operates facilities across North America, South America, Asia, and Europe.

- Adaptability: Has adapted to market shifts by embracing digital transformation.

- Industry Focus: Serves key industries such as financial services, healthcare, and retail.

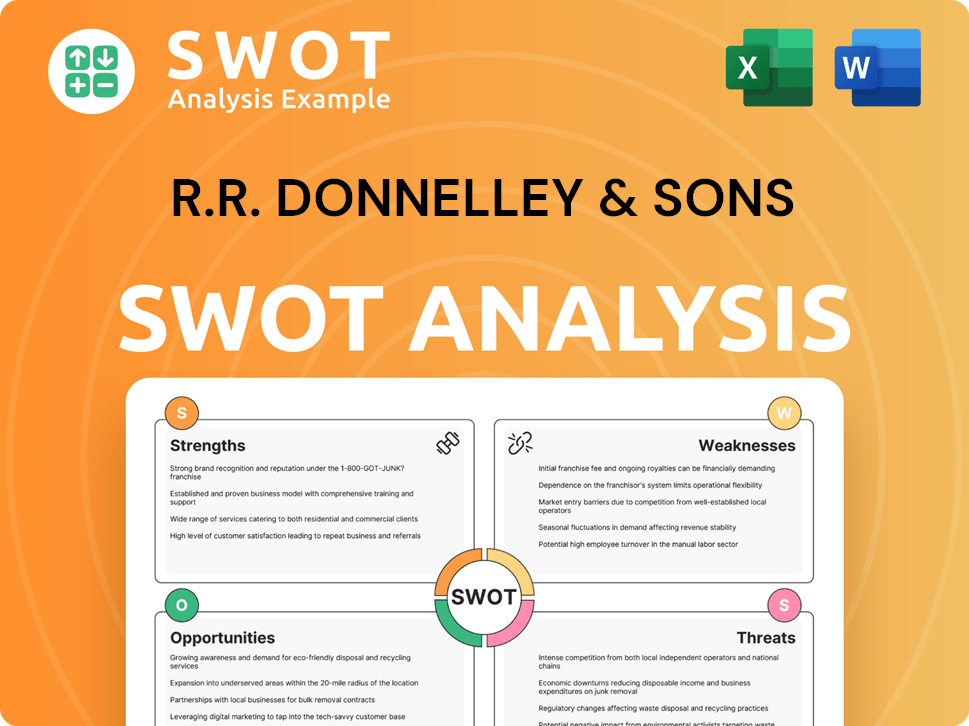

R.R. Donnelley & Sons SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging R.R. Donnelley & Sons?

The R.R. Donnelley competitive landscape is shaped by a diverse set of rivals across its various service offerings. Understanding these competitors is crucial for a thorough Donnelley market analysis and assessing its strategic positioning. The company faces competition in traditional printing, marketing solutions, and digital communication services.

RRD competitors span from large printing companies to digital marketing agencies, creating a complex competitive environment. The company must continually adapt its Donnelley & Sons business strategy to stay competitive. Analyzing these competitors helps in identifying R.R. Donnelley's competitive advantages in the printing sector and potential threats.

In the commercial printing and direct mail sectors, printing industry rivals such as Quad/Graphics and Transcontinental Inc. pose significant competition. These companies compete directly with RRD in providing print and marketing services, leveraging their scale and extensive client bases. Understanding the strategies of these firms is vital for RRD's market performance.

Quad/Graphics is a major player in the printing industry, directly competing with RRD in commercial printing and marketing solutions. This rivalry is particularly intense in the direct mail segment. Quad/Graphics often leverages its large scale and diverse client base to gain a competitive edge.

Transcontinental Inc. is a significant competitor, especially strong in Canada, offering printing, flexible packaging, and media solutions. This company directly competes with RRD in print-related services. It is essential to consider Transcontinental's strategies when evaluating the competitive landscape.

Accenture Song offers comprehensive digital marketing, customer experience, and technology consulting services. This creates competition with RRD's digital and creative solutions. The company’s focus on digital transformation presents a challenge to traditional print services.

Deloitte Digital provides digital marketing and technology consulting services, creating competition in the marketing and business communications space. This firm's services can overlap with RRD's digital and creative solutions. Deloitte's consulting expertise adds to the competitive pressure.

Global logistics providers compete with RRD in supply chain management and logistics. These companies offer extensive networks and services. The competition is particularly strong in the distribution of printed materials and marketing collateral.

Specialized supply chain solution companies also compete with RRD in supply chain management and logistics. These companies offer tailored solutions. They pose a direct challenge to RRD's logistics services.

In the broader marketing and business communications arena, RRD faces competition from digital marketing agencies, IT service providers, and specialized digital communication firms. Companies like Accenture Song and Deloitte Digital offer comprehensive digital marketing and technology consulting services. In the supply chain management and logistics sector, RRD competes with global logistics providers and specialized supply chain solution companies. Emerging players in niche digital communication and automation platforms also pose a competitive challenge.

The printing and marketing services competitive landscape is dynamic, with mergers and alliances reshaping the industry. RRD must remain agile to address these changes. Understanding the strengths and weaknesses of competitors is crucial for strategic planning.

- Market Consolidation: Mergers and acquisitions among smaller printing companies alter the competitive balance.

- Digital Transformation: The shift towards digital communication challenges traditional print services.

- Technology Integration: Partnerships between marketing agencies and technology providers create new competitive pressures.

- Supply Chain Efficiency: Competition in supply chain management requires continuous improvement.

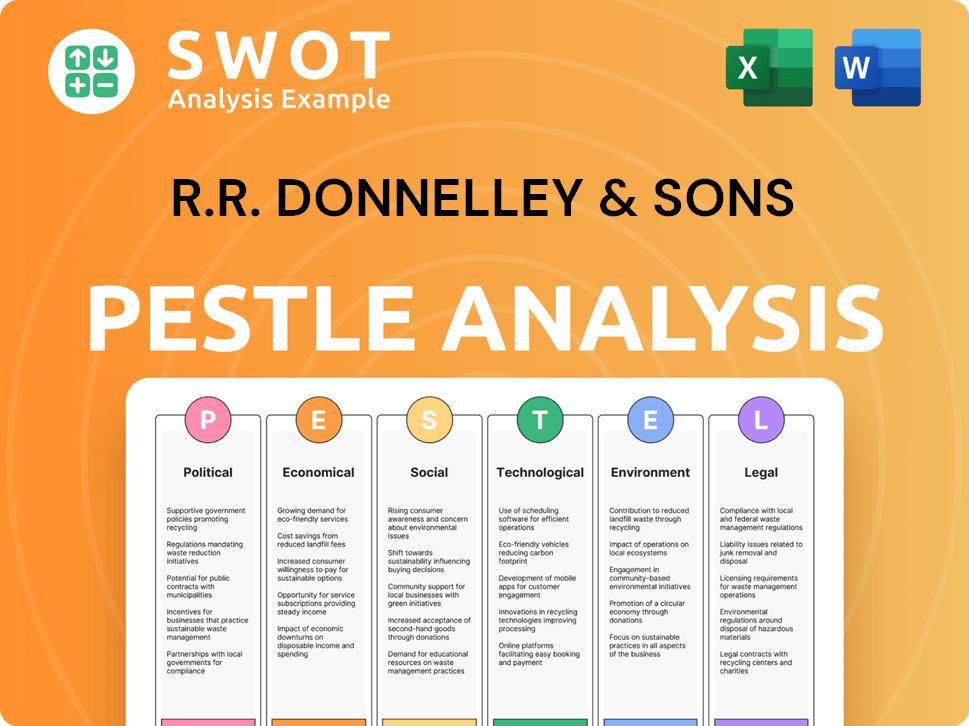

R.R. Donnelley & Sons PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives R.R. Donnelley & Sons a Competitive Edge Over Its Rivals?

Understanding the R.R. Donnelley competitive landscape requires a deep dive into its core strengths. The company, often referred to as RRD, has carved out a significant position in the print and marketing services sector. Its ability to offer a comprehensive suite of services, from commercial printing to digital solutions, sets it apart from many printing industry rivals. This broad approach allows RRD to serve diverse client needs, making it a key player in the Donnelley market analysis.

RRD's strategic moves, including acquisitions and organic growth, have enabled it to build a 'one-stop shop' solution. This strategy simplifies vendor management for clients and often leads to cost efficiencies. The company's focus on regulated industries, such as financial services and healthcare, further strengthens its market position. This expertise creates strong customer loyalty and trust, acting as a significant barrier against new entrants. To understand the company's target audience, you can read more about it in this article: Target Market of R.R. Donnelley & Sons.

The competitive edge of RRD is also supported by its robust distribution network and continuous investment in digital capabilities. These investments ensure its services remain relevant in an increasingly digital world. By focusing on these areas, RRD aims to maintain its position in the printing and marketing services competitive landscape.

RRD provides a wide array of services, from commercial printing and direct mail to digital solutions and supply chain management. This comprehensive offering allows them to serve complex client needs across various channels. The broad service range simplifies vendor management for clients, often leading to cost efficiencies. This positions RRD as a leader among RRD competitors.

RRD has deep expertise in regulated industries, such as financial services and healthcare. This specialized knowledge is a significant barrier to entry for many competitors. Their ability to manage sensitive data and adhere to stringent compliance requirements builds strong customer loyalty and trust. This is a key aspect of their Donnelley & Sons business strategy.

RRD's robust distribution network and supply chain strengths are crucial advantages, enabling efficient and timely delivery of printed materials and managed communications globally. They leverage advanced technology and operational efficiencies to streamline production and optimize delivery. This ensures they can compete effectively in the printing industry rivals.

RRD's ongoing investment in digital capabilities, including data analytics, personalization, and multi-channel delivery platforms, ensures its services remain relevant. They are evolving their traditional strengths to meet modern demands. This commitment to digital transformation is vital for maintaining a competitive edge in the R.R. Donnelley competitive landscape.

RRD's competitive advantages include its extensive scale, comprehensive service offerings, and deep industry expertise. They also have a robust distribution network and continuous investments in digital capabilities. These strengths allow RRD to differentiate itself from competitors and maintain a strong market position, especially in the digital printing market.

- Extensive Service Portfolio: Offers a wide range of services, simplifying vendor management.

- Industry Expertise: Deep knowledge of regulated industries like finance and healthcare.

- Robust Distribution: Efficient and timely delivery globally.

- Digital Capabilities: Continuous investments in digital solutions and platforms.

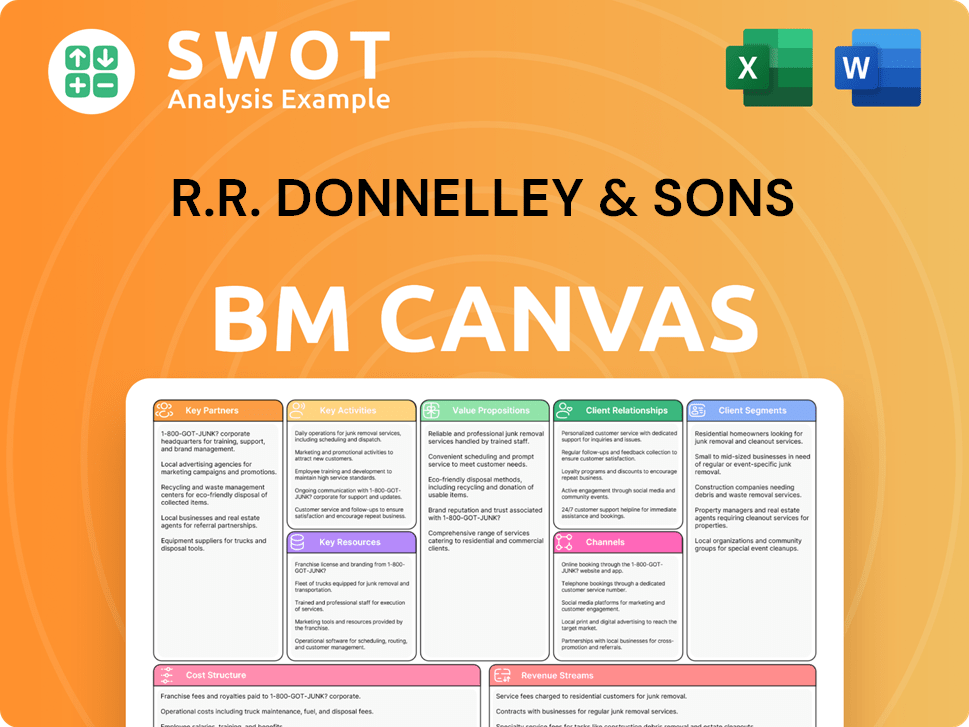

R.R. Donnelley & Sons Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping R.R. Donnelley & Sons’s Competitive Landscape?

The marketing and business communications sector is undergoing significant shifts, creating both challenges and opportunities for RRD. The Growth Strategy of R.R. Donnelley & Sons must navigate these changes to maintain a competitive edge. The industry's future depends on adapting to digital transformation, managing regulatory changes, and responding to global economic dynamics.

For RRD, this means balancing its traditional print operations with the rapid expansion of its digital services. The competitive landscape, including RRD competitors, is evolving, with digital-native agencies and tech firms gaining market share. RRD's ability to strategically invest in high-growth areas while divesting from less profitable segments will be crucial for its success. The printing industry rivals are also adapting to changing market demands.

The primary trend is the accelerated shift towards digital communication. This is driven by evolving consumer preferences and technological advancements. Regulatory changes, particularly around data privacy, also impact the industry. Global economic shifts and supply chain disruptions continue to affect operational costs.

A key challenge is balancing legacy print operations with the growth of digital services. Increased competition from digital-native agencies and tech firms also threatens market share. Managing declining demand in traditional print segments is another significant hurdle. The competitive analysis of R.R. Donnelley's financial performance is crucial.

RRD can leverage its established client relationships and expertise to expand its digital offerings. Growth opportunities exist in emerging markets, which may still have a higher reliance on traditional print alongside growing digital adoption. Strategic partnerships and innovation in areas like AI can strengthen its position.

The company's future depends on strategically divesting from less profitable segments. Aggressive investment in and expansion of high-growth digital and integrated solutions is crucial. This includes adapting the Donnelley & Sons business strategy to the changing market.

RRD's success hinges on its ability to navigate the changing landscape of print and marketing services. Understanding the Donnelley market analysis and adapting to digital transformation are critical. The company must also address competitive threats while capitalizing on opportunities.

- Digital Transformation: Invest in digital platforms and data analytics.

- Strategic Partnerships: Collaborate with tech providers.

- Market Expansion: Explore growth in emerging markets.

- Innovation: Utilize AI for content optimization.

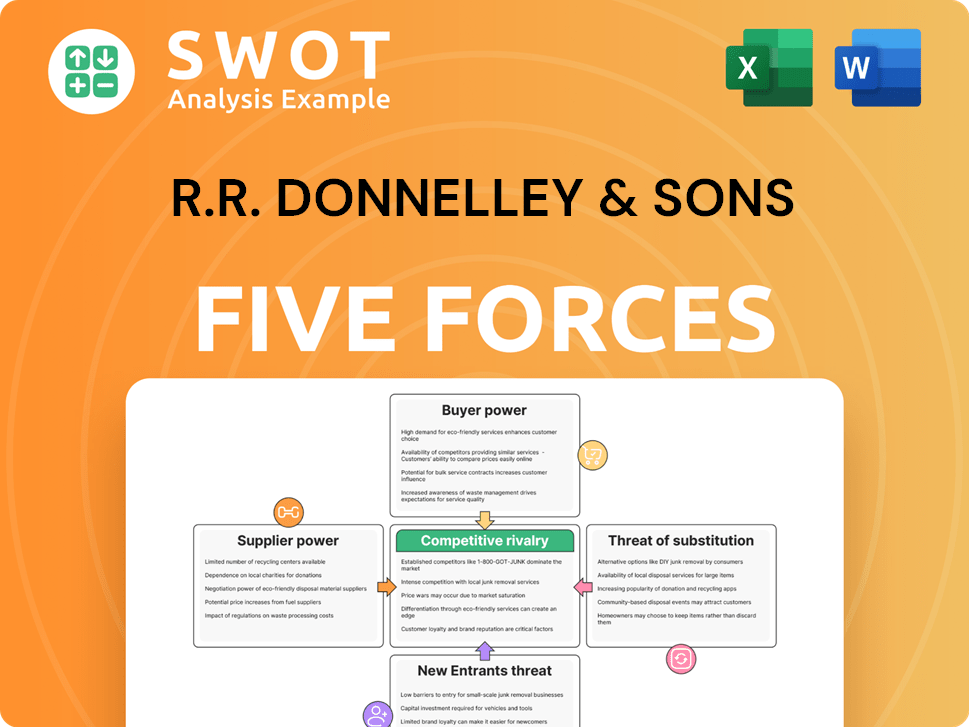

R.R. Donnelley & Sons Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of R.R. Donnelley & Sons Company?

- What is Growth Strategy and Future Prospects of R.R. Donnelley & Sons Company?

- How Does R.R. Donnelley & Sons Company Work?

- What is Sales and Marketing Strategy of R.R. Donnelley & Sons Company?

- What is Brief History of R.R. Donnelley & Sons Company?

- Who Owns R.R. Donnelley & Sons Company?

- What is Customer Demographics and Target Market of R.R. Donnelley & Sons Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.