R.R. Donnelley & Sons Bundle

Can R.R. Donnelley & Sons Company Thrive in the Digital Age?

In a world increasingly dominated by digital communication, how does a company rooted in print navigate the future? R.R. Donnelley & Sons Company (RRD), a legacy player in the R.R. Donnelley & Sons SWOT Analysis, is actively reshaping its growth strategy to stay ahead. This comprehensive analysis dives into RRD's strategic initiatives, exploring its evolution from a printing pioneer to a multifaceted provider of marketing and business communication services.

This exploration of R.R. Donnelley & Sons Company analysis will examine the company's financial performance, market share in 2024, and its response to evolving printing industry trends. We'll also dissect RRD's expansion plans and acquisitions, assessing its long-term goals and investment potential within the competitive business services market. Understanding the impact of digital transformation on RRD is crucial to evaluating its future prospects.

How Is R.R. Donnelley & Sons Expanding Its Reach?

The R.R. Donnelley growth strategy is centered on expanding its market presence and diversifying its service offerings. This involves entering new markets, both geographically and in terms of product categories, especially in the evolving printing industry trends. The company is actively investing in digital and creative solutions to meet the increasing demand for integrated marketing communications. This approach is designed to capitalize on emerging opportunities and stay ahead of industry changes.

RRD future prospects include strategic partnerships and potential mergers and acquisitions to access new customers and diversify revenue streams. For example, the company is expanding its supply chain management solutions to address clients' complex logistical needs, offering end-to-end services. International expansion remains a key component of RRD's strategy, with a focus on replicating successful service models in new regions. While specific timelines for acquisitions or major international market entries are subject to ongoing negotiations, RRD consistently evaluates opportunities aligned with its strategic growth objectives.

The company's focus on data analytics and personalization enhances the effectiveness of its direct mail capabilities, even as digital channels grow. The company's ability to adapt to changing market dynamics is a key factor in its R.R. Donnelley & Sons Company analysis.

RRD aims to replicate its successful service models in new regions. The company is actively seeking opportunities for international growth, focusing on markets where it can leverage its existing expertise and infrastructure. This expansion is a key part of its long-term strategy to diversify its revenue streams and reduce its reliance on any single geographic market.

Recognizing the increasing demand for integrated marketing communications, RRD continues to invest in its digital and creative solutions. This includes enhancing its capabilities in areas such as data analytics, personalization, and digital marketing. These investments are designed to help clients enhance their marketing efforts and reach their target audiences more effectively.

To access new customers and diversify revenue streams, RRD is engaged in strategic partnerships and potential mergers and acquisitions. These initiatives are designed to help the company stay ahead of industry changes and capitalize on emerging opportunities. The company carefully evaluates potential acquisitions that align with its strategic growth objectives.

RRD is expanding its supply chain management solutions to address the complex logistical needs of its clients. This involves offering end-to-end services, from procurement to fulfillment. By providing comprehensive supply chain solutions, RRD aims to increase its value proposition and attract clients seeking integrated services.

RRD's expansion strategies include geographic expansion, digital and creative solutions, strategic partnerships, and supply chain management expansion. These initiatives are designed to drive growth and enhance the company's market position. The company's strategic focus is on adapting to business services market changes and meeting evolving customer needs.

- Geographic expansion into new markets.

- Investment in digital and creative solutions.

- Strategic partnerships and potential acquisitions.

- Expansion of supply chain management services.

For more insights into the company's core values and mission, you can read Mission, Vision & Core Values of R.R. Donnelley & Sons. The company's ability to adapt to changing market dynamics is a key factor in its RRD competitive landscape analysis and R.R. Donnelley & Sons Company financial outlook.

R.R. Donnelley & Sons SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does R.R. Donnelley & Sons Invest in Innovation?

The company, R.R. Donnelley & Sons Company, prioritizes innovation and technology as key drivers of its R.R. Donnelley growth strategy. This commitment is evident through significant investments in research and development, aimed at enhancing service offerings and improving operational efficiencies. These efforts are crucial for navigating the evolving printing industry trends and maintaining a competitive edge in the business services market.

RRD's approach includes both internal development of proprietary platforms and collaborations with external innovators. This dual strategy allows the company to integrate cutting-edge technologies effectively. The focus on digital transformation, automation, and data analytics is designed to improve customer experience and streamline workflows. This is vital for adapting to the future of print and digital communication RRD.

A core element of RRD's strategy involves actively exploring and implementing advanced technologies. This includes leveraging artificial intelligence (AI) for personalized marketing and predictive analytics, alongside the Internet of Things (IoT) to optimize supply chain logistics. These initiatives are part of R.R. Donnelley & Sons Company strategic initiatives.

RRD's digital transformation strategy focuses on automating workflows and improving data analytics capabilities. This includes enhancing customer experience through digital channels. These efforts are essential for RRD future prospects.

The company employs AI for personalized marketing campaigns and predictive analytics, aiming to improve targeting and enhance customer engagement. This enables more efficient use of resources and better outcomes. This is part of the RRD competitive landscape analysis.

RRD utilizes the Internet of Things (IoT) to optimize supply chain logistics, improving efficiency and reducing costs. This technology helps in real-time tracking and management of resources. This can influence R.R. Donnelley & Sons Company revenue streams.

Sustainability is a key part of RRD's innovation strategy, with a focus on eco-friendly printing processes and supply chain solutions. This reflects a commitment to environmental responsibility and aligns with current market demands. This helps with RRD sustainability and environmental impact.

The development of new products and platforms is a direct result of RRD's investment in technology and innovation. These offerings aim to provide more sophisticated and efficient services. This strategy impacts RRD expansion plans and acquisitions.

These technological advancements directly contribute to RRD's growth objectives by enabling the company to offer more sophisticated and efficient services. This, in turn, increases client value and market share. This is key to the R.R. Donnelley & Sons Company analysis.

These innovations support RRD's growth objectives by enabling more sophisticated and efficient services. This strategy is designed to increase client value and market share. For more details on how RRD approaches its marketing efforts, you can read the Marketing Strategy of R.R. Donnelley & Sons.

RRD invests in several key technological areas to drive growth and efficiency. These investments are critical for adapting to changing market dynamics and maintaining a competitive edge.

- AI and Machine Learning: Used for predictive analytics and personalized marketing.

- IoT: Implemented to optimize supply chain logistics and improve operational efficiency.

- Digital Transformation: Focuses on automating workflows and enhancing customer experience.

- Sustainability Technologies: Eco-friendly printing processes and supply chain solutions.

R.R. Donnelley & Sons PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is R.R. Donnelley & Sons’s Growth Forecast?

The financial outlook for R.R. Donnelley & Sons Company (RRD) is shaped by strategic investments and a focus on operational efficiency. The company's strategic direction indicates a commitment to sustained financial performance, even though specific detailed revenue targets and profit margin projections for 2025 are not always publicly disclosed in forward-looking statements. RRD's financial ambitions are aligned with its historical performance, which has shown resilience in adapting to market shifts, reflecting the company's ability to navigate the evolving business services market.

RRD's financial strategy to support growth includes prudent capital allocation and a focus on improving cash flow. While specific funding rounds or major capital raises in 2024-2025 were not prominently featured in general news, the company continuously evaluates its financial structure to support its expansion and innovation initiatives. This disciplined approach aims to enhance shareholder value through a combination of organic expansion and strategic acquisitions, all while maintaining a strong financial foundation. The company's ability to adapt to printing industry trends is a key factor.

The company's strategic initiatives are geared towards long-term value creation, focusing on both organic growth and potential strategic acquisitions. RRD's financial outlook is influenced by its ability to maintain a competitive edge and capitalize on opportunities within the print and digital communication sectors. The company's financial health is closely tied to its ability to manage costs, optimize its portfolio, and respond to market dynamics, influencing its RRD future prospects.

RRD's financial performance is a critical indicator of its growth strategy. The company's ability to maintain and improve profitability is essential for its long-term success. Key metrics such as revenue, operating income, and cash flow are closely monitored to assess the company's financial health and its ability to meet its financial goals. This includes the impact of digital transformation on RRD.

Analyzing RRD's market share in 2024 provides insights into its competitive position. The company's market share reflects its ability to attract and retain customers in a competitive market. Factors such as industry trends, customer preferences, and the company's strategic initiatives influence its market share. This also includes the RRD competitive landscape analysis.

RRD's strategic initiatives are designed to drive growth and enhance shareholder value. These initiatives may include investments in technology, strategic acquisitions, and efforts to expand its service offerings. The company's strategic initiatives are crucial for adapting to changing market conditions and maintaining a competitive advantage. This also includes the RRD expansion plans and acquisitions.

The financial outlook for RRD is influenced by its ability to execute its strategic plans and adapt to market changes. Factors such as economic conditions, industry trends, and the company's operational performance impact its financial outlook. The company's financial outlook is a key consideration for investors and stakeholders. This also includes the R.R. Donnelley & Sons Company stock forecast.

RRD faces various challenges and opportunities in the market. Understanding these factors is essential for assessing the company's future prospects. The company must navigate challenges such as changing customer preferences and technological advancements. This also includes how R.R. Donnelley adapts to changing markets.

- Adapting to Digital Transformation: The shift towards digital communication presents both challenges and opportunities.

- Competitive Pressures: The company faces competition from other players in the market.

- Market Dynamics: Economic conditions and industry trends influence RRD's performance.

- Innovation: Investing in new technologies and services is crucial for growth.

R.R. Donnelley & Sons Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow R.R. Donnelley & Sons’s Growth?

The path of R.R. Donnelley & Sons Company (RRD) towards achieving its R.R. Donnelley growth strategy is fraught with potential risks and obstacles. The dynamic nature of the printing industry trends and the business services market requires constant adaptation. Navigating these challenges is crucial for RRD's RRD future prospects and overall success.

One of the primary challenges is the intense competition within the marketing and business communications sector. The rapid evolution of technology necessitates continuous investment in innovation to maintain a competitive edge and avoid obsolescence. Furthermore, regulatory changes, particularly concerning data privacy and environmental standards, pose additional burdens.

Supply chain disruptions, whether due to raw material shortages or transportation issues, could significantly impact RRD's capacity to deliver services efficiently. Internal challenges, such as managing a complex global operation and attracting and retaining skilled talent, also present ongoing hurdles. These factors could influence the R.R. Donnelley & Sons Company analysis and its ability to meet its R.R. Donnelley & Sons Company long term goals.

The RRD competitive landscape analysis is characterized by numerous players vying for market share. This intense competition can pressure pricing and margins, impacting Financial performance RRD. To counter this, RRD must continuously innovate and differentiate its service offerings.

The rapid pace of technological change presents a constant need for innovation. Impact of digital transformation on RRD requires substantial investment in new technologies and digital solutions. Failure to adapt quickly can lead to a loss of market share.

Changes in regulations, especially concerning data privacy and environmental standards, can increase compliance costs. These regulations might impact RRD sustainability and environmental impact efforts. Staying compliant requires ongoing monitoring and adaptation.

Disruptions in the supply chain, such as raw material shortages or transportation issues, can hinder operations. Optimizing the global supply chain is crucial to mitigate these risks. This directly affects RRD's ability to fulfill orders and maintain customer satisfaction.

Attracting and retaining skilled talent is an ongoing challenge in a competitive job market. A skilled workforce is essential for innovation and operational efficiency. How R.R. Donnelley adapts to changing markets depends on its ability to maintain a strong team.

Economic downturns can reduce demand for printing and marketing services. Economic fluctuations can impact R.R. Donnelley & Sons Company financial outlook. Diversification of services helps to mitigate the impact of economic cycles.

RRD addresses these risks through a multi-faceted approach, including diversifying its service offerings to reduce reliance on any single revenue stream. The company employs robust risk management frameworks and engages in scenario planning to anticipate and prepare for potential disruptions. For example, RRD has focused on optimizing its global supply chain to mitigate potential disruptions.

RRD's risk management frameworks are crucial in identifying, assessing, and mitigating potential threats. These frameworks include detailed contingency plans to address various scenarios. Proactive risk management helps protect the company's financial performance and reputation.

RRD's long history demonstrates its ability to adapt and navigate challenging market conditions. This includes continuous innovation in Growth strategy for print and packaging and digital solutions. Adaptability is key to addressing emerging risks effectively.

The Future of print and digital communication RRD is constantly evolving, requiring RRD to stay agile. This involves understanding changing customer needs and preferences. Market analysis and customer feedback are essential tools.

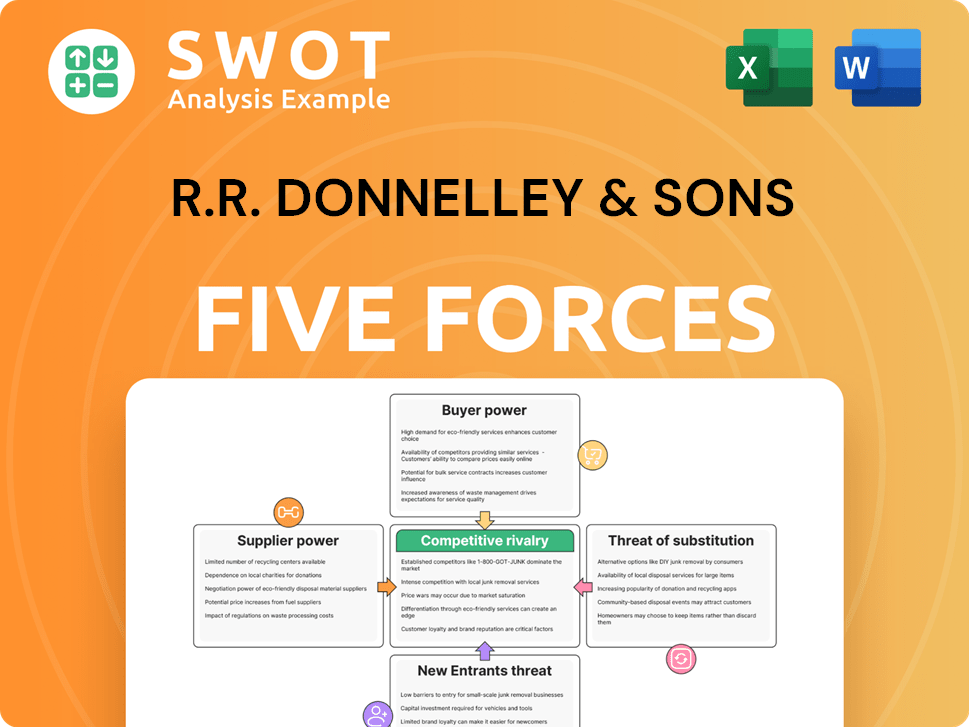

R.R. Donnelley & Sons Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of R.R. Donnelley & Sons Company?

- What is Competitive Landscape of R.R. Donnelley & Sons Company?

- How Does R.R. Donnelley & Sons Company Work?

- What is Sales and Marketing Strategy of R.R. Donnelley & Sons Company?

- What is Brief History of R.R. Donnelley & Sons Company?

- Who Owns R.R. Donnelley & Sons Company?

- What is Customer Demographics and Target Market of R.R. Donnelley & Sons Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.