R.R. Donnelley & Sons Bundle

Who Really Owns R.R. Donnelley & Sons?

Unraveling the R.R. Donnelley & Sons SWOT Analysis reveals more than just market strategies; it unveils the core of its ownership. Understanding who owns RRD is crucial for anyone seeking to grasp its future trajectory in the marketing and business communications sector. From its humble beginnings in 1864 to its current global presence, the Donnelley company's ownership has seen significant transformations.

The acquisition by Chatham Asset Management in 2022 marked a pivotal shift, fundamentally altering the R.R. Donnelley ownership landscape. This exploration delves into the evolution of RR Donnelley owner, examining the influence of key investors and the implications of its privatization. Discovering who controls R.R. Donnelley now provides critical insights into its strategic direction and market positioning, making it essential knowledge for investors and industry observers alike.

Who Founded R.R. Donnelley & Sons?

R.R. Donnelley & Sons Company, a name synonymous with printing and communications, was founded in 1864 by Richard Robert Donnelley. The initial focus of the company was on delivering high-quality printing services, setting the stage for its future growth and influence in the industry. Understanding the early ownership structure is key to grasping the company's foundational principles.

The early days of the Donnelley company saw Richard Robert Donnelley at the helm, primarily controlling the business. Details of the exact equity splits or initial shareholding percentages from the company's founding are not easily found in public records. However, it is clear that Richard Robert Donnelley held the primary ownership and control as the founder. This centralized control was typical for businesses of that era, reflecting the founder's direct involvement in all aspects of the company.

The company's initial growth was fueled by Donnelley's entrepreneurial vision and dedication to craftsmanship. Early financial backing likely came from personal capital and possibly small loans or investments from close associates. There is no widely publicized information about significant early angel investors or friends and family acquiring substantial stakes during the initial phase that would have diluted Donnelley's control. The early ownership structure was largely centralized around the founder, reflecting his direct involvement in the company's operations and strategic direction.

Richard Robert Donnelley, the founder, held primary ownership. This centralized control was common for businesses of that time.

Funding likely came from personal capital and small investments from close associates, not large outside investors.

Early agreements, such as vesting schedules, would have been private and are not publicly documented.

The founder's vision, centered on quality printing and customer service, was directly reflected in the concentrated control.

The company's early growth was fueled by Donnelley's entrepreneurial vision and dedication to craftsmanship.

The early ownership structure was largely centralized around the founder.

Understanding the early ownership of R.R. Donnelley provides insight into the company's foundational principles and its evolution. The founder's control and vision were central to the company's initial success. For a deeper dive into the company's strategic direction, consider reading about the Growth Strategy of R.R. Donnelley & Sons.

- Richard Robert Donnelley's centralized control shaped the company's early operations.

- Early funding came from personal capital and close associates, not external investors.

- The focus on quality printing and customer service was a direct result of the founder's vision.

- The early ownership structure reflected the founder's direct involvement.

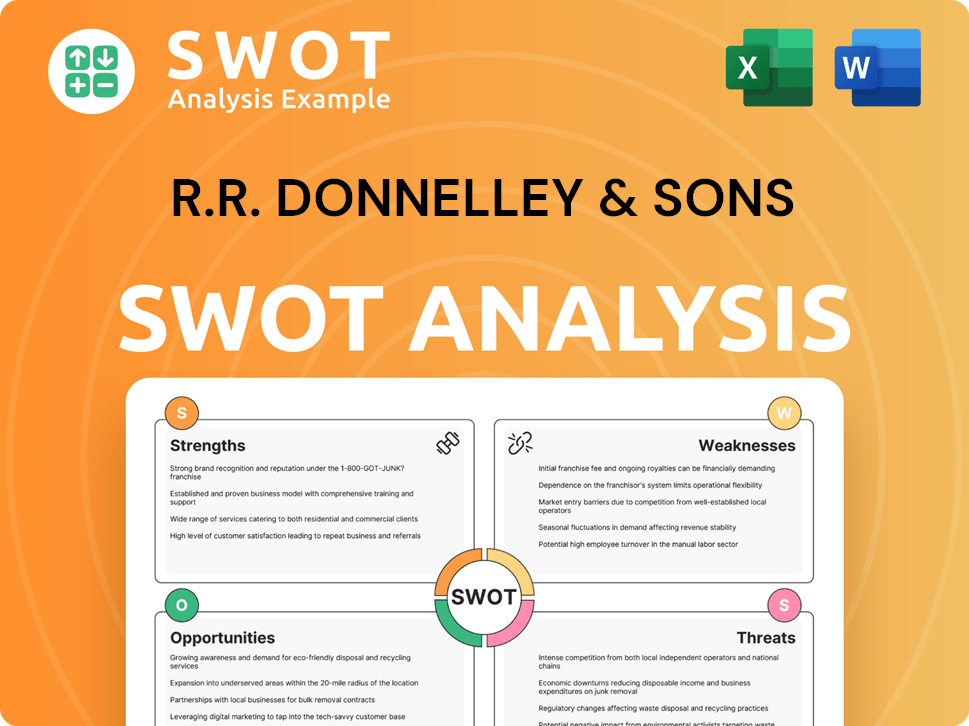

R.R. Donnelley & Sons SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has R.R. Donnelley & Sons’s Ownership Changed Over Time?

The ownership structure of the Donnelley company has seen a significant transformation over time. Historically, as part of its history, R.R. Donnelley & Sons Company was a publicly traded entity on the New York Stock Exchange. This meant that its ownership was dispersed among a variety of shareholders, including institutional investors, mutual funds, and individual investors. The company's public status allowed for a degree of transparency and regulatory oversight, typical of publicly listed corporations.

A pivotal change occurred in February 2022 when Chatham Asset Management, LLC, acquired R.R. Donnelley. This acquisition marked a shift from public to private ownership, fundamentally changing the company's ownership structure. Prior to this, major shareholders included institutional investors such as Vanguard Group Inc., BlackRock Inc., and Dimensional Fund Advisors LP. The move to take RRD private allowed for a different strategic approach, potentially focusing on long-term goals without the immediate pressures of quarterly earnings reports.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | Historical | Company listed on the New York Stock Exchange, ownership dispersed among public shareholders. |

| Acquisition by Chatham Asset Management | February 2022 | RRD transitioned from a publicly traded company to a privately held entity, with Chatham Asset Management becoming the sole owner. |

| Prior to 2022 | End of 2021 | Top institutional holders included Vanguard Group Inc., BlackRock Inc., and Dimensional Fund Advisors LP. |

Chatham Asset Management, a credit-focused hedge fund, had been a significant bondholder of RRD before the acquisition. Their decision to acquire the company reflected a strategic interest in RRD's business and a desire to take it private. This shift has implications for RRD's strategy and governance, potentially enabling more agile decision-making and a focus on long-term strategic planning. As of early 2024, Chatham Asset Management remains the sole owner of RRD, influencing its direction and operational strategies.

The current owner of RRD is Chatham Asset Management, a private equity firm. This follows the company's privatization in February 2022.

- R.R. Donnelley was previously a publicly traded company.

- The acquisition by Chatham Asset Management changed the company's ownership structure.

- The shift to private ownership allows for different strategic approaches.

- Understanding the ownership is key to understanding the company's direction.

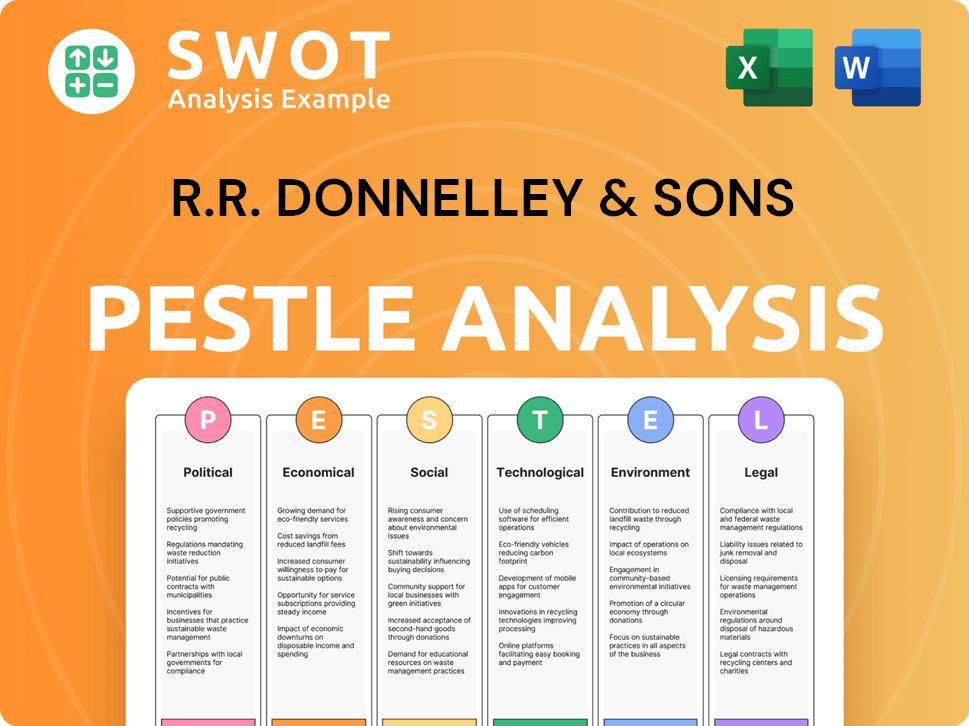

R.R. Donnelley & Sons PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on R.R. Donnelley & Sons’s Board?

Since the acquisition by Chatham Asset Management, LLC, the structure of the Board of Directors for R.R. Donnelley & Sons (RRD) has shifted. The current board is primarily composed of representatives from Chatham Asset Management, reflecting the new ownership. Key executives from RRD also serve on the board, ensuring alignment between the company's operations and the strategic goals set by its owner. The specifics of the board's composition are not as readily available as they would be for a publicly traded company, but the focus is on direct alignment with Chatham's objectives.

Understanding the Brief History of R.R. Donnelley & Sons helps to clarify the changes in ownership and governance. The shift to private ownership means that the board now operates under the ultimate authority of Chatham Asset Management. This structure streamlines decision-making, as Chatham, as the sole owner, directs the company's governance and strategic direction. This is a common arrangement in private equity acquisitions, where the focus is on maximizing value under the direct control of the ownership group.

| Aspect | Details | Impact |

|---|---|---|

| Ownership Structure | Chatham Asset Management, LLC | Direct control over all aspects of the company. |

| Board Composition | Representatives from Chatham Asset Management and key RRD executives. | Ensures alignment with Chatham's strategic objectives. |

| Voting Power | Chatham Asset Management holds 100% of the voting power. | Eliminates proxy battles and activist investor campaigns. |

In the context of R.R. Donnelley ownership, the transition to private ownership by Chatham Asset Management has fundamentally altered the dynamics of the board and voting power. Chatham, as the sole owner, holds all the decision-making authority, streamlining the governance process. This structure typically results in a more focused approach to strategic initiatives, with the board's actions directly reflecting the goals of the private equity owner. This is a significant change from the previous public company structure, where shareholders had a more direct influence.

The board is now primarily composed of Chatham Asset Management representatives and key RRD executives.

- Chatham Asset Management has 100% voting power.

- Decision-making is streamlined under private ownership.

- The board's actions reflect the goals of the private equity owner.

- No proxy battles or activist investor campaigns exist.

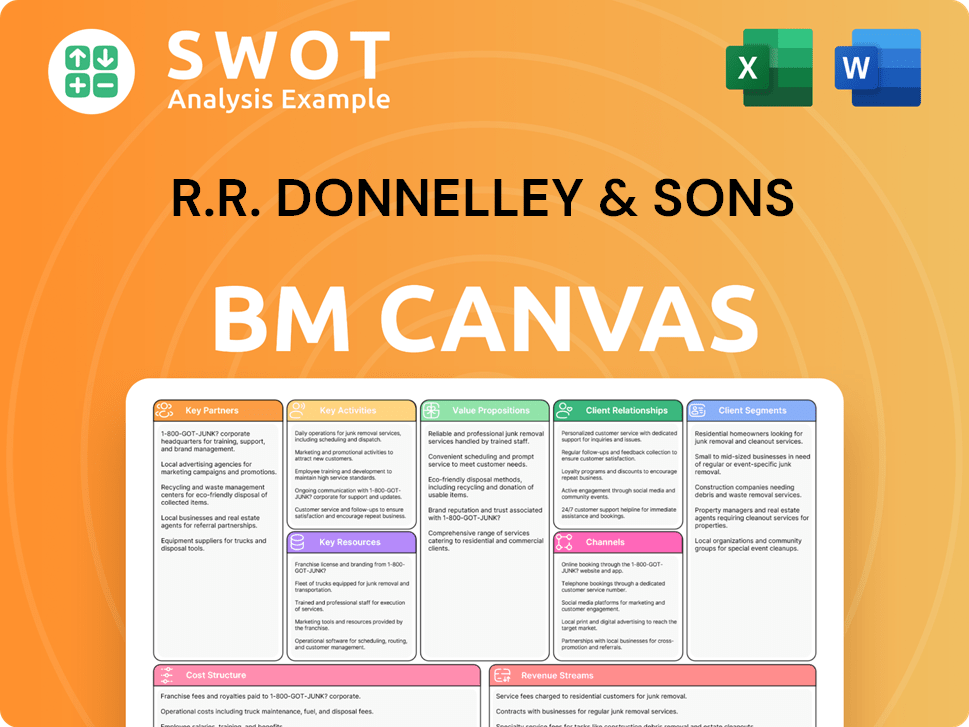

R.R. Donnelley & Sons Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped R.R. Donnelley & Sons’s Ownership Landscape?

The most significant recent development in the ownership of R.R. Donnelley & Sons Company (RRD) is its acquisition by Chatham Asset Management, LLC, which concluded in February 2022. This transaction resulted in RRD transitioning from a publicly traded entity to a privately held one. Before the acquisition, the company faced challenges common in the print and marketing services sector, including the need to adapt to digital transformation and evolving client needs. This change in ownership structure fundamentally altered the company's trajectory.

The privatization of RRD by Chatham Asset Management aligns with a broader industry trend where private equity firms acquire publicly traded companies. The goal often involves restructuring, improving operations, and boosting long-term value, free from the immediate pressures of public markets. Chatham, already a significant bondholder, demonstrated confidence in RRD's underlying assets and future prospects. This move allowed RRD to potentially focus on long-term investments and strategic pivots without the quarterly scrutiny of public shareholders. Understanding the Growth Strategy of R.R. Donnelley & Sons can provide further insights into the company's strategic direction under its new ownership.

| Key Event | Date | Details |

|---|---|---|

| Acquisition by Chatham Asset Management | February 2022 | RRD transitioned from a public to a private company. |

| Focus Shift | Post-2022 | Emphasis on long-term investments and strategic initiatives. |

| Ownership Structure | Present | Controlled by Chatham Asset Management. |

Future ownership changes or succession plans within RRD are now under the purview of Chatham Asset Management. Any public statements regarding RRD's future are likely to originate from Chatham Asset Management or RRD's leadership, focusing on strategic initiatives and operational performance rather than stock market performance or shareholder relations. This shift offers the potential for RRD to concentrate on long-term investments and strategic shifts without the short-term pressures of public markets. As of late 2024, the company remains privately held, with Chatham Asset Management as the controlling entity.

Chatham Asset Management, LLC, acquired RRD in February 2022. This acquisition made RRD a privately held company. The change reflects a strategic shift in ownership.

RRD is now privately owned, allowing for a focus on long-term strategies. This structure enables operational optimization. The shift allows for more flexible decision-making.

Founded in 1864, R.R. Donnelley has a long history in printing. The company adapted to digital changes. The recent acquisition marks a new chapter.

Chatham Asset Management is the current owner. They aim to restructure and optimize operations. This ownership change impacts future strategies.

R.R. Donnelley & Sons Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of R.R. Donnelley & Sons Company?

- What is Competitive Landscape of R.R. Donnelley & Sons Company?

- What is Growth Strategy and Future Prospects of R.R. Donnelley & Sons Company?

- How Does R.R. Donnelley & Sons Company Work?

- What is Sales and Marketing Strategy of R.R. Donnelley & Sons Company?

- What is Brief History of R.R. Donnelley & Sons Company?

- What is Customer Demographics and Target Market of R.R. Donnelley & Sons Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.