R.R. Donnelley & Sons Bundle

How Does RR Donnelley Thrive in Today's Market?

R.R. Donnelley (RR Donnelley), a titan in business communications, recently expanded its capabilities with the acquisition of Williams Lea in January 2025. This strategic move underscores its commitment to providing comprehensive business support and productivity solutions to a global clientele. With a history stretching back over 150 years, Donnelley continues to evolve, adapting to the dynamic needs of the marketing and business landscape.

With over 35,000 employees worldwide and a vast network serving 92% of the Fortune 100, understanding RR Donnelley's operational strategies is key. The company's impressive portfolio includes marketing, packaging, print, and supply chain solutions, all geared towards optimizing customer engagement. For a deeper dive into its strengths and weaknesses, consider the R.R. Donnelley & Sons SWOT Analysis to gain valuable insights into this printing company's future.

What Are the Key Operations Driving R.R. Donnelley & Sons’s Success?

R.R. Donnelley (RR Donnelley) creates value through a diverse range of services, including marketing, packaging, print, and supply chain solutions. They serve a wide variety of clients across sectors such as healthcare, financial services, retail, and publishing. Their core offerings include commercial printing, direct mail, supply chain management, digital and creative solutions, and business process outsourcing.

Operational processes at RR Donnelley are multifaceted, integrating manufacturing, sourcing, technology development, logistics, sales channels, and customer service. For example, in supply chain management, they provide end-to-end solutions encompassing procurement, manufacturing, warehousing, distribution, and inventory management. The company is strategically investing in technology and innovation, such as digital printing presses and robotic automation, to enhance efficiency. This includes integrating digital elements like QR codes and AI for enriched offerings.

RR Donnelley's focus on technology extends to advanced printing technologies, data analytics, and marketing automation tools, which improve efficiency, reduce costs, and boost customer satisfaction. Their supply chain capabilities are further highlighted by their 'Future-Ready Supply Chain Report' from Q3 2024, which indicates that 93% of supply chain leaders are confident in their supply chain's resilience, with 97% planning to re-engineer their supply chains within the next two years.

RR Donnelley provides a wide array of services. This includes commercial printing, direct mail, supply chain management, digital and creative solutions, and business process outsourcing.

Their operations integrate manufacturing, sourcing, technology development, logistics, sales channels, and customer service. They are investing in digital printing presses and robotic automation to boost efficiency.

The company focuses on advanced printing technologies, data analytics, and marketing automation tools. They integrate digital elements like QR codes and AI to enrich their offerings and improve customer satisfaction.

RR Donnelley offers end-to-end supply chain solutions, including procurement, manufacturing, warehousing, distribution, and inventory management. Their 'Future-Ready Supply Chain Report' highlights their capabilities.

RR Donnelley leverages its expertise in data-driven marketing, variable data printing, and digital integrations to capitalize on the increasing demand for personalized communications. Their global network, creative execution, and proprietary technologies enable them to influence engagement across the entire customer journey. To learn more about their marketing strategies, check out this article: Marketing Strategy of R.R. Donnelley & Sons.

- Data-driven marketing and personalized communications.

- Global network and proprietary technologies.

- Client-centric approach tailored to industry needs.

- Focus on customer journey engagement.

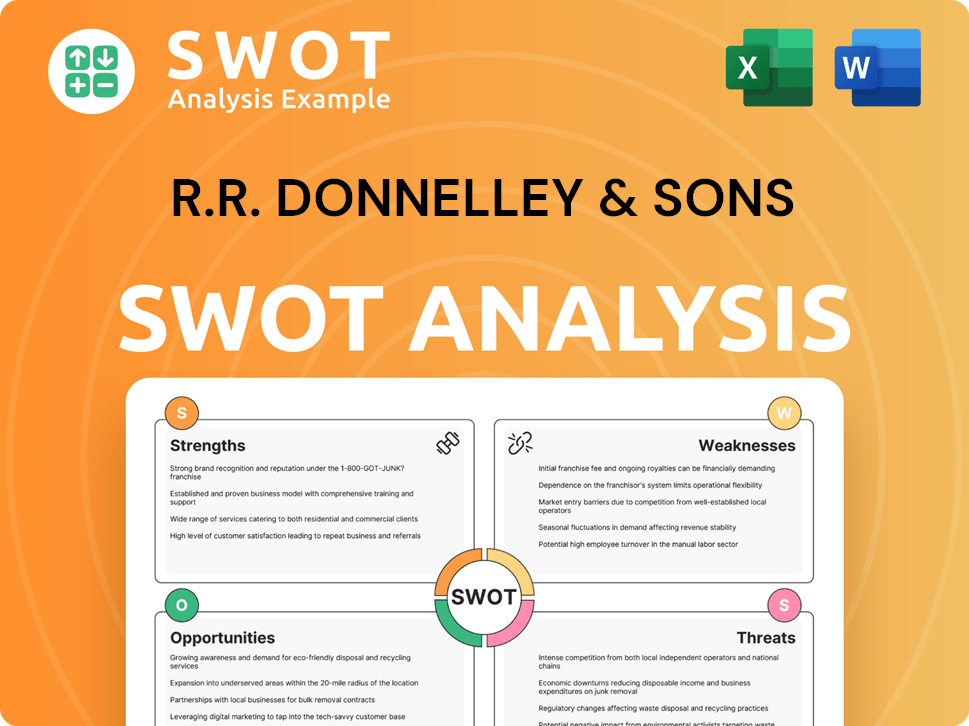

R.R. Donnelley & Sons SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does R.R. Donnelley & Sons Make Money?

R.R. Donnelley (RR Donnelley) generates revenue through a diverse array of services. These services cater to the needs of its clients in marketing, packaging, print, and supply chain solutions. This approach allows the company to serve a broad customer base.

The company's revenue streams include commercial print, direct mail, packaging, labels, statement printing, supply chain management, forms, business process outsourcing, and digital and creative solutions. RR Donnelley adapts its strategies to align with the evolving market demands, especially the growth in digital marketing and e-commerce.

While specific contributions of each revenue stream to the total revenue for 2024-2025 are not publicly detailed, RR Donnelley's overall revenue is projected to be $5.29 billion in 2025, slightly up from $5.24 billion in 2024. In 2024, the operational print and marketing segment accounted for approximately 50% of RR Donnelley's pro forma revenue.

RR Donnelley focuses on capitalizing on the growth in digital marketing and e-commerce. The digital advertising market is projected to reach $786.2 billion in 2024. The e-commerce packaging market is expected to reach $87.4 billion by 2025, offering significant opportunities for RR Donnelley. Data-driven solutions revenue grew by 12% in the first quarter of 2024.

- Variable data printing is projected to reach $6.5 billion by 2025.

- RR Donnelley is expanding its label production capacity.

- Revenue in the U.S. e-commerce market is expected to grow by 51% between 2024 and 2029.

- The acquisition of Williams Lea is expected to strengthen its Digital, Creative, and Business Support Services segment.

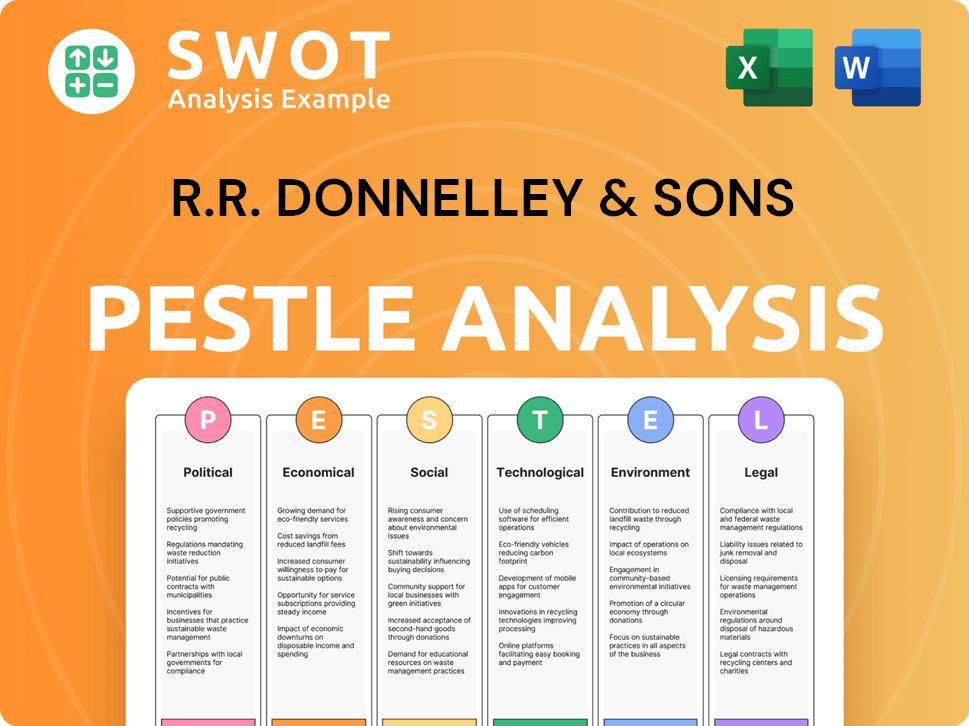

R.R. Donnelley & Sons PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped R.R. Donnelley & Sons’s Business Model?

R.R. Donnelley (RR Donnelley) has undergone significant strategic shifts, particularly in 2024 and early 2025, to adapt to evolving market dynamics. These moves highlight the company's commitment to expanding its digital capabilities and enhancing its service offerings within the business communications sector. The acquisitions and innovations underscore its efforts to maintain a competitive edge in a changing industry.

Key milestones include the acquisition of Williams Lea, finalized in January 2025, which is set to bolster its digital and creative services. Another important move was the acquisition of digital and print marketing businesses from Vericast Corp. in 2024. Furthermore, the launch of Iridio℠ in April 2025, a unified marketing solutions platform, demonstrates its focus on streamlining marketing execution and delivering integrated campaigns.

These strategic initiatives are aimed at strengthening the company's position in the market and driving growth in key areas. By focusing on digital solutions and integrated services, RR Donnelley is positioning itself to meet the evolving needs of its clients and capitalize on new opportunities. For more insights, check out the Growth Strategy of R.R. Donnelley & Sons.

The acquisition of Williams Lea in early 2025 is a significant move to expand digital marketing capabilities. The purchase of digital and print marketing assets from Vericast Corp. in 2024 further strengthens its marketing creative execution. These acquisitions are part of a broader strategy to enhance its service offerings and market reach.

RR Donnelley is investing heavily in digital printing and automation to improve efficiency. Digital printing adoption is projected to grow by 6-8% annually through 2025. Automation initiatives are targeting a 10-15% reduction in labor costs by the end of 2024, showcasing a commitment to technological advancement.

The company faces challenges from secular pressures in traditional print and external factors like postage increases. RR Donnelley is responding by focusing on growth in labels, packaging, and digital services. A survey in 2024 revealed that 97% of supply chain leaders plan to re-engineer their supply chains.

RR Donnelley's competitive advantages include its established reputation, diverse service offerings, and global presence. The ability to provide integrated print and digital campaigns is a key differentiator. Leveraging AI and automation across operations streamlines processes and reduces expenses.

RR Donnelley continues to invest in technology to enhance its operational capabilities and service offerings. The company is focusing on integrating digital elements and leveraging AI and automation to streamline processes and reduce costs. These investments are crucial for maintaining a competitive edge in the market.

- Digital printing presses and robotic automation are key areas of investment.

- The launch of Iridio℠ in April 2025 streamlines marketing execution.

- Integrated print and digital campaigns capture a larger market share.

- AI and automation are used to tailor solutions and reduce expenses.

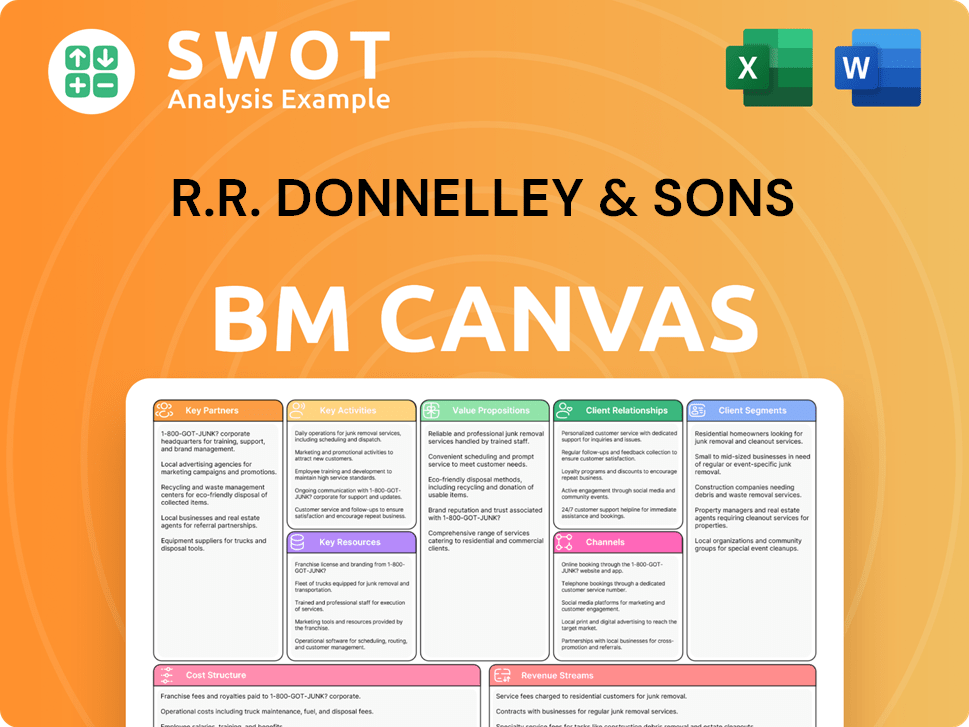

R.R. Donnelley & Sons Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is R.R. Donnelley & Sons Positioning Itself for Continued Success?

R.R. Donnelley & Sons (RR Donnelley) holds a strong position in the global market as a provider of marketing, packaging, print, and supply chain solutions. Operating across 26 countries and serving approximately 17,000 clients, including a substantial portion of the Fortune 100, RR Donnelley leverages its client-focused approach to differentiate itself in the competitive landscape. Recent strategic acquisitions, such as Williams Lea and assets from Vericast, are aimed at boosting its market position in digital and business support services.

However, RR Donnelley faces several risks. The operational print and marketing segment, which accounted for about 50% of its pro forma revenue in 2024, is exposed to secular pressures and external factors like postage increases. High operational costs, including fluctuating raw material prices, and potential integration difficulties from acquisitions also pose challenges. Understanding these factors is crucial for evaluating RR Donnelley's future prospects.

RR Donnelley is a significant player in the printing company and business communications sectors. Its diverse client base and global presence offer a competitive edge. The company's ability to tailor solutions to specific industry needs is a key differentiator, enhancing its market share and customer loyalty. RR Donnelley's strategic acquisitions aim to strengthen its position in digital and business support services, reflecting its adaptation to evolving market demands.

The company faces risks from secular pressures in the print and marketing segment. High operational costs, including raw material price fluctuations, impact profitability. Integration challenges from acquisitions can strain resources. External factors, such as postage increases, also pose financial challenges. These elements require strategic mitigation to safeguard RR Donnelley's financial performance.

RR Donnelley is focused on several strategic initiatives to expand revenue generation. The company is accelerating its digital transformation to reduce reliance on print services. It is also streamlining operational structures to drive efficiencies. Sustainability initiatives, like expanding its greenhouse gas emissions reduction plan, will also enhance its brand appeal.

RR Donnelley plans to host an Investor Day on March 11, 2025, to provide updates on strategic goals. The company is leveraging data analytics for personalized marketing. Investments in technology, including AI for supply chain optimization, are expected to enhance agility. These initiatives are designed to drive growth and adapt to market changes.

RR Donnelley is focused on digital transformation and operational efficiency. This includes leveraging data analytics and AI. The company is also committed to sustainability, aiming for a 25% reduction in greenhouse gas emissions over 10 years. These strategies aim to enhance client relationships and improve responsiveness.

- Digital Transformation: Reducing reliance on traditional print services.

- Operational Efficiency: Streamlining structures to drive efficiencies.

- Sustainability: Expanding emissions reduction plans to enhance brand appeal.

- Technology Investments: Leveraging AI for supply chain optimization.

For more in-depth information on the company's ownership structure and financial performance, you can explore the details provided in Owners & Shareholders of R.R. Donnelley & Sons. This resource provides a comprehensive overview of RR Donnelley's financial standing and strategic direction.

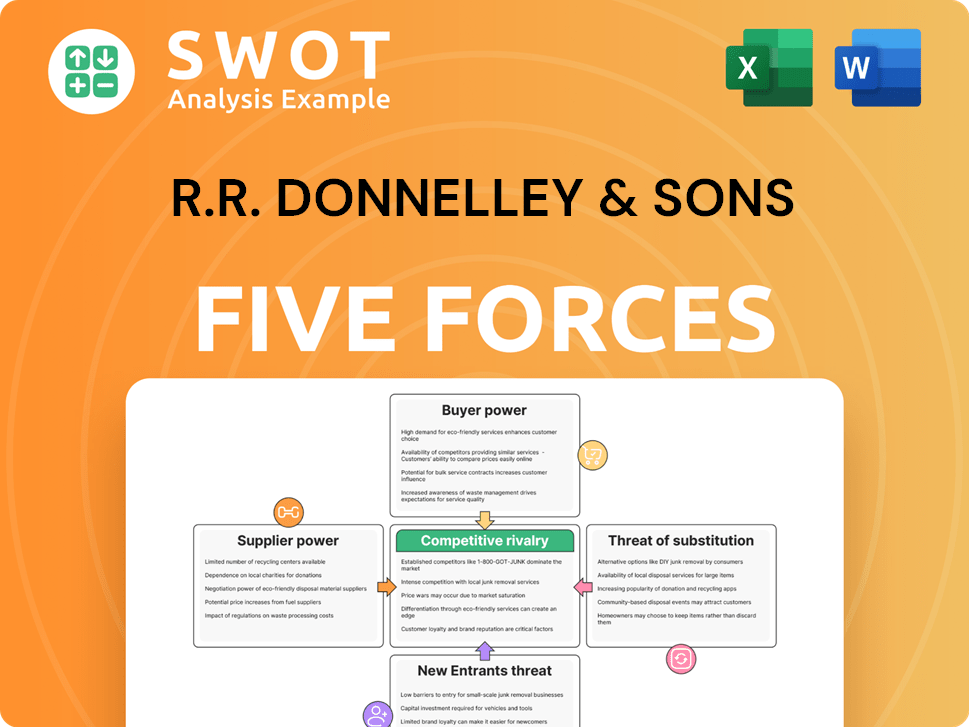

R.R. Donnelley & Sons Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of R.R. Donnelley & Sons Company?

- What is Competitive Landscape of R.R. Donnelley & Sons Company?

- What is Growth Strategy and Future Prospects of R.R. Donnelley & Sons Company?

- What is Sales and Marketing Strategy of R.R. Donnelley & Sons Company?

- What is Brief History of R.R. Donnelley & Sons Company?

- Who Owns R.R. Donnelley & Sons Company?

- What is Customer Demographics and Target Market of R.R. Donnelley & Sons Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.