RWS Holdings Bundle

How Does RWS Holdings Navigate a Changing Market?

The language services and intellectual property (IP) sectors are experiencing a seismic shift, largely due to the rise of artificial intelligence. This transformation presents both hurdles and opportunities for industry leaders. RWS Holdings SWOT Analysis can help you understand the company's position.

This exploration delves into the RWS Holdings competitive landscape, examining its key RWS Holdings competitors and strategic positioning within the RWS Holdings industry. We'll dissect RWS Holdings market analysis, including its RWS Holdings financial performance, RWS Holdings business strategy, and the factors influencing its future outlook. Understanding these elements is crucial for anyone seeking insights into this dynamic market.

Where Does RWS Holdings’ Stand in the Current Market?

RWS Holdings' core operations revolve around language services and intellectual property (IP) services, making it a key player in the RWS Holdings industry. The company offers localization services, translating and adapting content, and IP Services, providing patent translations and filing services. This dual focus allows RWS to serve a diverse global clientele, ensuring consistent brand messaging across various platforms.

The value proposition of RWS lies in its ability to provide high-quality, specialized services that cater to the complex needs of global businesses. By offering both language and IP solutions, RWS helps clients navigate the challenges of international expansion and intellectual property protection. This integrated approach, combined with its extensive global presence, positions RWS as a strategic partner for companies seeking to succeed in the global marketplace.

RWS Holdings maintains a strong market position within the language services and IP industries. In FY 2024, the company generated revenues of £718.2 million. Its AI-related products and services accounted for a quarter of Group revenues, highlighting its investment in technology. RWS is considered the second-largest translation and localization firm by revenue in the broader language services market, which was estimated at USD 71.7 billion in 2024 and is projected to grow to USD 75.7 billion in 2025.

RWS operates through two primary segments: localization services and IP Services. Localization services involve the translation and adaptation of content for global markets, ensuring brand consistency. IP Services offer high-quality patent translations, filing services, and IP search services. These segments cater to a diverse customer base, including top global brands and leading pharmaceutical companies.

RWS serves a diverse customer base, including over 84 of the top 100 global brands, 19 of the top 20 pharmaceutical companies, and 18 of the top 20 patent filers worldwide. No single client accounts for more than 10% of the Group's revenue, with the top 10 clients generating 30% of total revenue. This diversification helps mitigate risks associated with client concentration, contributing to RWS Holdings' market share analysis.

RWS has a strong global presence, with over 50% of its revenue generated in the U.S. The company's strategic acquisitions, such as Propylon and ST Comms, have further strengthened its offerings and geographic reach, particularly in the African market. This global footprint supports RWS Holdings' growth strategies and competitive advantages.

While RWS experienced a 2% decline in total revenue in FY24, it returned to growth in the second half, with organic constant currency (OCC) revenue growing 2% in the second half of FY24, bringing the full year in line with the prior year. Adjusted profit before tax declined to £106.7 million in FY24, reflecting investments in growth and transformation. The company’s focus on innovation and strategic acquisitions, as highlighted in Brief History of RWS Holdings, positions it for future growth.

- Revenue for FY24 was £718.2 million.

- AI-related products and services accounted for a quarter of Group revenues.

- Adjusted profit before tax declined to £106.7 million in FY24.

- Organic constant currency (OCC) revenue grew 2% in the second half of FY24.

RWS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging RWS Holdings?

The competitive landscape for RWS Holdings is multifaceted, encompassing both the language services and intellectual property sectors. The company faces competition from a variety of players, ranging from large, established firms to emerging companies specializing in data-for-AI solutions. Understanding the competitive dynamics is crucial for evaluating RWS Holdings' market position and strategic initiatives. A thorough Growth Strategy of RWS Holdings reveals how the company navigates this complex environment.

RWS Holdings' market analysis indicates a competitive environment driven by factors such as pricing, technological innovation, and the breadth of service offerings. The industry is also influenced by mergers and acquisitions, as companies seek to consolidate their market share and expand their capabilities. This competitive pressure necessitates a focus on differentiation and strategic positioning.

In the language services market, RWS Holdings faces competition from direct rivals like TransPerfect, Lionbridge, and Welocalize. TransPerfect is the largest firm in terms of revenue, with RWS being the second largest. These companies compete across various fronts, including price, technological innovation, and breadth of service offerings.

The language services industry is highly competitive, with several key players vying for market share. These competitors offer a range of services, including translation, localization, and interpretation. The competitive landscape is dynamic, with companies constantly innovating and expanding their service offerings.

- TransPerfect: The largest language services firm by revenue.

- Lionbridge: A major competitor with a global presence.

- Welocalize: Known for its comprehensive language solutions.

The rise of AI capabilities is reshaping the language services industry. Companies like Centific, Summa Linguae, Scale.ai, Appen, and Uber's Scaled Solutions are competing in the data-for-AI space. RWS Holdings, with its TrainAI brand, also participates in this segment, providing data-for-AI technology and services.

The data-for-AI market is experiencing significant growth, attracting various competitors. These companies offer specialized services and technologies to support AI development. The competition is intense, with companies focusing on innovation and market expansion.

- Centific: A player in the data-for-AI space.

- Summa Linguae: Offers data solutions for AI.

- Scale.ai: Focused on data labeling and AI development.

In the intellectual property services market, RWS Holdings faces competition from firms like Dennemeyer, Wilson Sonsini Goodrich & Rosati, Marathon Patent Group, and Madderns. These competitors offer a range of IP-related services, including patent prosecution, litigation, and IP management. The competitive dynamics are also influenced by mergers and alliances within the industry, as companies seek to consolidate market share and enhance their capabilities.

The intellectual property services market is characterized by specialized firms offering a range of services. These companies compete on expertise, service quality, and global reach. The competitive landscape is shaped by the increasing importance of intellectual property in the modern economy.

- Dennemeyer: Provides IP management and related services.

- Wilson Sonsini Goodrich & Rosati: A law firm with IP expertise.

- Marathon Patent Group: Involved in patent monetization.

RWS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives RWS Holdings a Competitive Edge Over Its Rivals?

Understanding the RWS Holdings competitive landscape involves recognizing its key strengths and strategic positioning within the language, content management, and intellectual property services sectors. The company has cultivated several competitive advantages that set it apart from its rivals. A deep dive into these advantages reveals a company focused on innovation, global reach, and client satisfaction. Analyzing RWS Holdings market analysis provides insights into its strategic moves and competitive edge.

RWS Holdings's success is underpinned by its proprietary technology and a strong global presence. The company's strategic acquisitions and focus on operational efficiencies further enhance its market position. Examining the company's financial performance and business strategy reveals a commitment to sustainable growth and client-centric solutions. For more insights, consider exploring the Marketing Strategy of RWS Holdings.

The company's ability to integrate AI into its services is a key differentiator. With over 45 AI patents and innovative solutions like Language Weaver and Evolve, RWS Holdings leads in AI-driven language services. This focus on technology, combined with its global reach and client retention rates, positions it well in the industry. A closer look at its RWS Holdings competitive advantages is essential for understanding its market position.

RWS Holdings leverages proprietary technology, including over 45 AI patents. Its AI-centered machine translation solution, Language Weaver, and the recently launched linguistic AI solution, Evolve, highlight its tech-driven approach. AI-related products now constitute a quarter of RWS's group revenues, showcasing successful integration and client adoption of these advanced solutions.

With over 60 locations across five continents, RWS Holdings serves a vast client base, including over 80 of the world's top 100 brands. This extensive network supports efficient service delivery and provides access to a wide talent pool. The company's global scale is a significant advantage in the RWS Holdings competitive landscape.

RWS Holdings boasts strong client retention and satisfaction, with a 95% repeat revenue in services and an improved Net Promoter Score (NPS) of +48 in FY24. Its deep domain expertise, particularly in specialized areas like life sciences and intellectual property, provides a competitive edge. This high level of client satisfaction is crucial for RWS Holdings's financial performance.

The company has expanded its capabilities through acquisitions like Corporate Translations and SDL. This diversification allows RWS Holdings to offer a comprehensive suite of services beyond its original patent translation heritage. These acquisitions contribute to RWS Holdings's growth strategies and market position.

RWS Holdings benefits from a combination of technological innovation, global presence, and high client satisfaction. The company's focus on AI and its extensive network of locations provide a strong foundation for growth. Its repeat revenue of 95% and an NPS of +48 in FY24 highlight its client-centric approach. Strategic acquisitions and operational efficiencies further strengthen its position in the RWS Holdings industry.

- Proprietary technology with over 45 AI patents, including Language Weaver and Evolve.

- Global presence with over 60 locations across five continents.

- Strong client retention with 95% repeat revenue and an improved NPS of +48 in FY24.

- Deep domain expertise, particularly in life sciences and intellectual property.

- Strategic acquisitions, such as Corporate Translations and SDL, expanding service offerings.

RWS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping RWS Holdings’s Competitive Landscape?

The language services and intellectual property sectors are currently experiencing significant transformations, largely driven by the integration of artificial intelligence. The Target Market of RWS Holdings is adapting to these changes, aiming to balance technological advancements with the essential role of human expertise to maintain quality and trust. The industry's future hinges on navigating these shifts while responding to the evolving needs of clients.

The competitive landscape for RWS Holdings is shaped by both opportunities and challenges. While AI offers efficiency gains, the company must also address price pressures, potential budget constraints from clients, and operational adjustments. The company's strategic moves, such as investments in AI-driven solutions and acquisitions, are designed to capitalize on market trends and maintain its competitive edge. The industry is expected to grow significantly, presenting avenues for expansion and diversification.

The language services market is projected to reach USD 75.7 billion in 2025, with a compound annual growth rate (CAGR) of 5.98% from 2025 to 2033, reaching US$131.75 billion by 2033. Key drivers include globalization, digital transformation, and e-commerce expansion. Technological advancements, particularly in generative AI and neural machine translation, are offering rapid and cost-effective solutions.

Ongoing price pressure in the language services market remains a concern. Potential impacts from reduced client budgets and longer decision-making cycles pose challenges. Operational friction and short-term costs associated with transitioning clients to new automated delivery models are also factors. Weaker performance in the life sciences segment of its Regulated Industries arm has also been noted.

The increasing demand for multimedia localization, hyper-localization, and accessibility in content presents growth opportunities. Investments in AI-led solutions like TrainAI and Evolve are expected to drive future revenue growth. Strategic partnerships and acquisitions can further diversify the company's portfolio and market reach.

A strong balance sheet and a focus on cost efficiency are key strengths. Commitment to responsible AI implementation positions the company well. The ability to adapt services and ensure compliance with evolving legal frameworks is crucial. RWS's focus on innovation and strategic acquisitions supports its competitive advantage.

The company’s market position is influenced by industry trends and competitive dynamics. Key business segments include language services, intellectual property support, and regulated industries. Recent acquisitions, such as Great Big Events, are aimed at expanding market reach. The company's financial performance is closely tied to its ability to navigate challenges and capitalize on opportunities.

- RWS Holdings competitive landscape is shaped by the integration of AI and the growing demand for localization.

- RWS Holdings industry is experiencing growth driven by globalization and digital transformation.

- RWS Holdings financial performance is influenced by its ability to adapt to market changes and manage costs.

- RWS Holdings business strategy includes investments in AI and strategic acquisitions to drive growth.

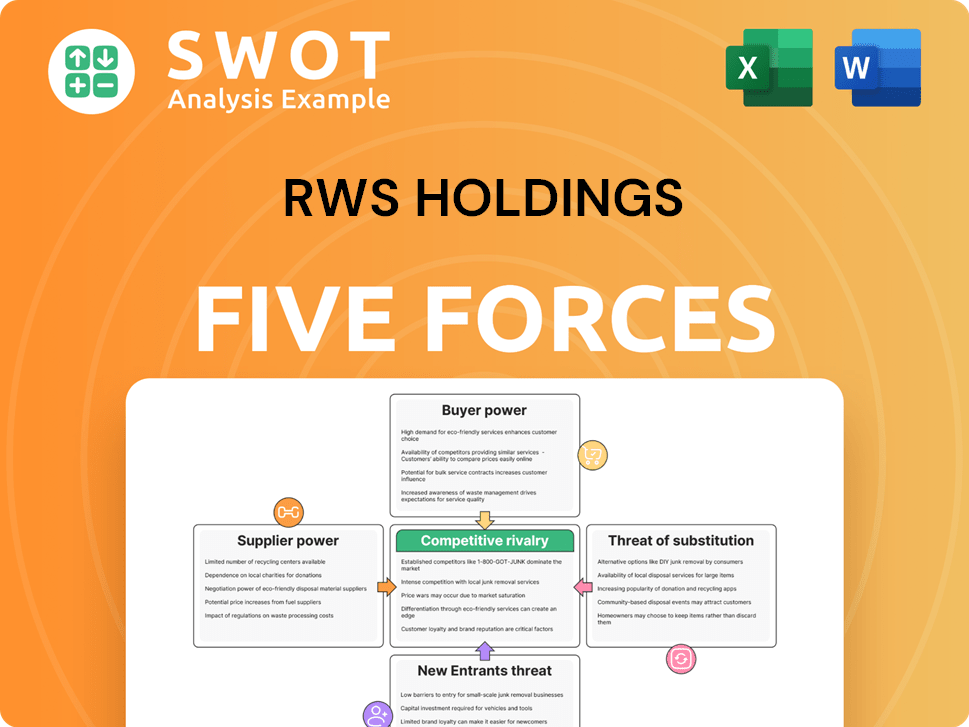

RWS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of RWS Holdings Company?

- What is Growth Strategy and Future Prospects of RWS Holdings Company?

- How Does RWS Holdings Company Work?

- What is Sales and Marketing Strategy of RWS Holdings Company?

- What is Brief History of RWS Holdings Company?

- Who Owns RWS Holdings Company?

- What is Customer Demographics and Target Market of RWS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.